How to Identify and Trade a Liquidity Grab?

-

Liquidity Grabs involve Smart Money creating or attracting counter liquidity

-

Techniques include order book manipulation and fake breakouts

-

ICT SM Trades Indicator on TradingView can signal liquidity grabs

-

Liquidation grabs occur when professional traders buy during mass liquidations

Liquidity is a cornerstone in Forex trading, yet it often presents a complex challenge, particularly for professional traders dealing with substantial volumes. These market players, often referred to as “Smart Money,” face a unique predicament. Their large-scale trades necessitate equivalent counter liquidity, which isn't readily available, leading to significant hurdles in executing their strategies efficiently.

This article will explore the ingenious yet controversial technique known as a "liquidity grab," a strategy employed by these traders to navigate through these challenges. Understanding the mechanics and implications of liquidity grabs can help traders at all levels gain insight into the deeper workings of the market, helping them make more informed decisions and potentially safeguard their investments from market manipulations.

-

What is liquidity in trading?

Liquidity in trading refers to the ease with which assets can be bought or sold in the market without affecting their price.

-

What is Smart Money?

Smart Money is a term that describes the actions and financial transactions of individuals or entities that are considered to have insider knowledge or other advantages in the market. The Smart Money Concept is a methodology developed by identifying the transactions (and intentions) of these large professional market participants.

-

How does liquidity work?

Liquidity works as a facilitator for transactions in the markets, provided by the presence of buyers and sellers at consistent price levels, allowing for efficient trading.

-

How do traders provide liquidity?

Traders provide liquidity by placing buy or sell orders in a market, making it easier for transactions to occur without significant price changes.

What is the meaning of the liquidity grab?

A liquidity grab is a sophisticated strategy employed by professional traders to navigate the challenges of trading large volumes in markets like Forex and cryptocurrency. This tactic revolves around creating or attracting the necessary counter liquidity -the matching volume of opposing orders - essential for executing large trades without significant market impact.

Smart Money uses two primary methods for a liquidity grab:

-

Manipulation in order books: This serves to artificially inflate demand. This move is not aimed at actual acquisition but to manipulate the perception of other market participants

-

Fake breakouts: Here, professional traders keenly observe key support levels. When these levels are broken, it typically triggers a wave of sell orders from smaller traders

These liquidity grab strategies highlight the deep strategic planning and market understanding of professional traders. For regular traders, recognizing these tactics is crucial, not only to avoid potential pitfalls but also to develop a more nuanced understanding of market dynamics.

1 Trick 1. Manipulation in Order Book (DOM)

A technique often referred to as the Depth of Market (DOM) manipulation, this strategy starts with the placement of a conspicuously large buy order.

This order is not intended for execution but serves a more cunning purpose; to create a false impression of high demand for the asset.

The appearance of this large buy order in the order book can significantly influence market perception. It leads smaller traders, often swayed by the apparent increase in demand, to place their own buy orders. This reaction plays right into the hands of Smart Money.

They use the influx of these smaller buy orders as cover to build up a substantial short position. The rationale is simple yet effective. As smaller traders fill the order book with buy orders, Smart Money quietly accumulates a position that bets on the price falling.

Once the desired short position is established, the original large buy order, which was never meant to be executed, is removed from the book. This sudden removal often leads to a market correction. The price, which was artificially inflated by the perceived demand, starts to fall back to its normal levels.

This fall in price benefits the short positions that Smart Money has accumulated, allowing them to capitalize on the price movement they orchestrated.

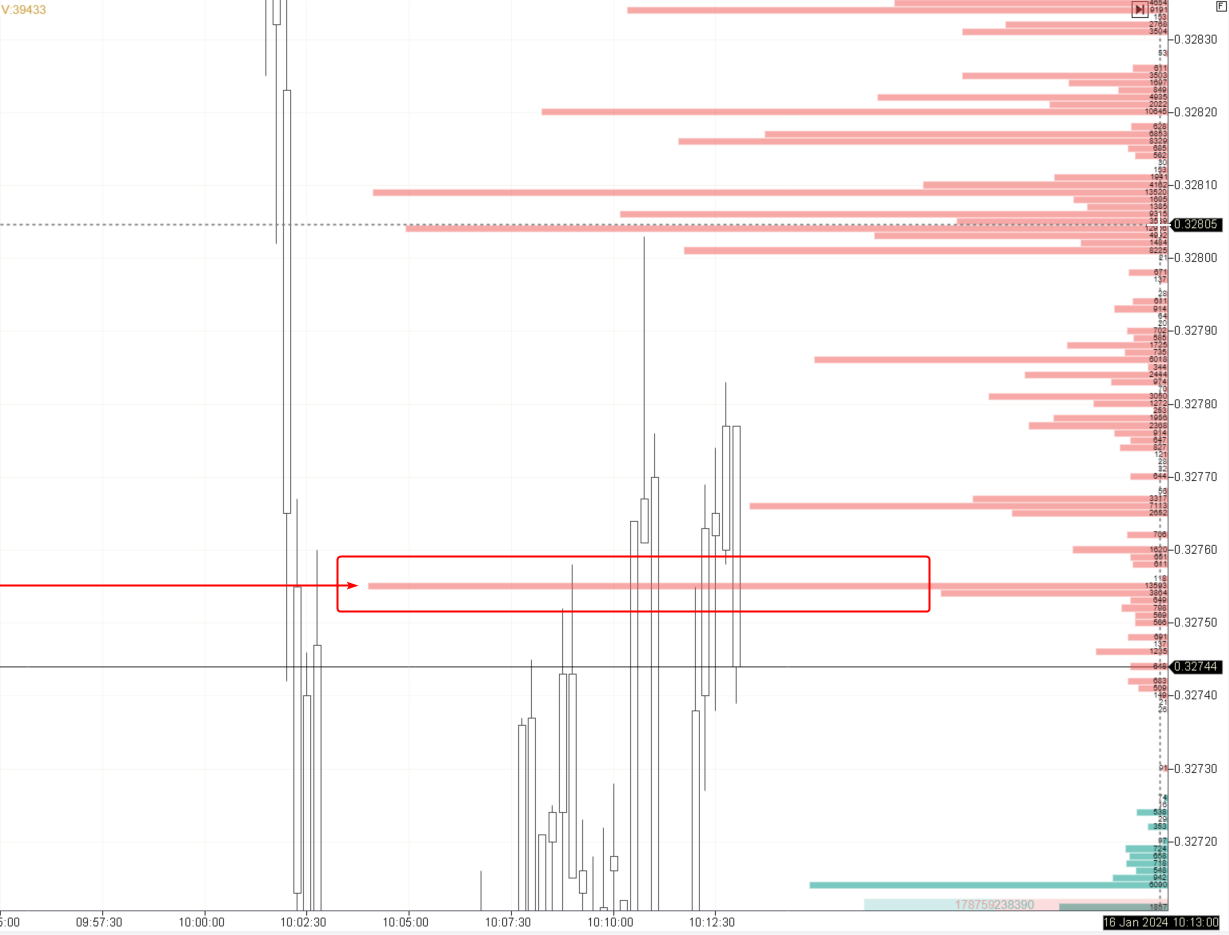

Large sell order near the current price

The example in the picture above (this is a screenshot from the cryptocurrency market) shows a large sell order. Only a professional trader can place a significant volume. In this case, this order can help the professional to motivate other market participants to open short positions and thereby strengthen the current downtrend.

2 Trick 2. Fake Breakouts

The second trick in the Smart Money playbook is the creation of fake breakouts. This tactic is employed, particularly when Smart Money is bullish on an asset. They closely monitor the asset's price movement, specifically watching for moments when it breaks down through key support levels.

In typical market scenarios, a breakdown of support levels can trigger a flurry of sell orders from smaller traders, as it is often interpreted as a bearish signal. Smart Money utilizes this reaction to their advantage. They position themselves to absorb the sell orders coming in from smaller market participants. This absorption is not random but a calculated move to accumulate long positions at lower prices.

Timing is what makes this strategy particularly effective. The breakdown of support levels creates a momentary panic or a bearish sentiment among less experienced traders. They rush to sell, fearing further price decline. Meanwhile, Smart Money, with a bullish outlook, gathers these sell orders, effectively grabbing the liquidity being shed in the market. This allows them to build their bullish positions discreetly and at more advantageous prices.

Once the market stabilizes or rebounds, which often happens after such temporary breakdowns, the price of the asset starts to climb again. This rise in price benefits the positions accumulated by Smart Money during the fake breakout phase, allowing them to profit from the temporary market turmoil they helped engineer.

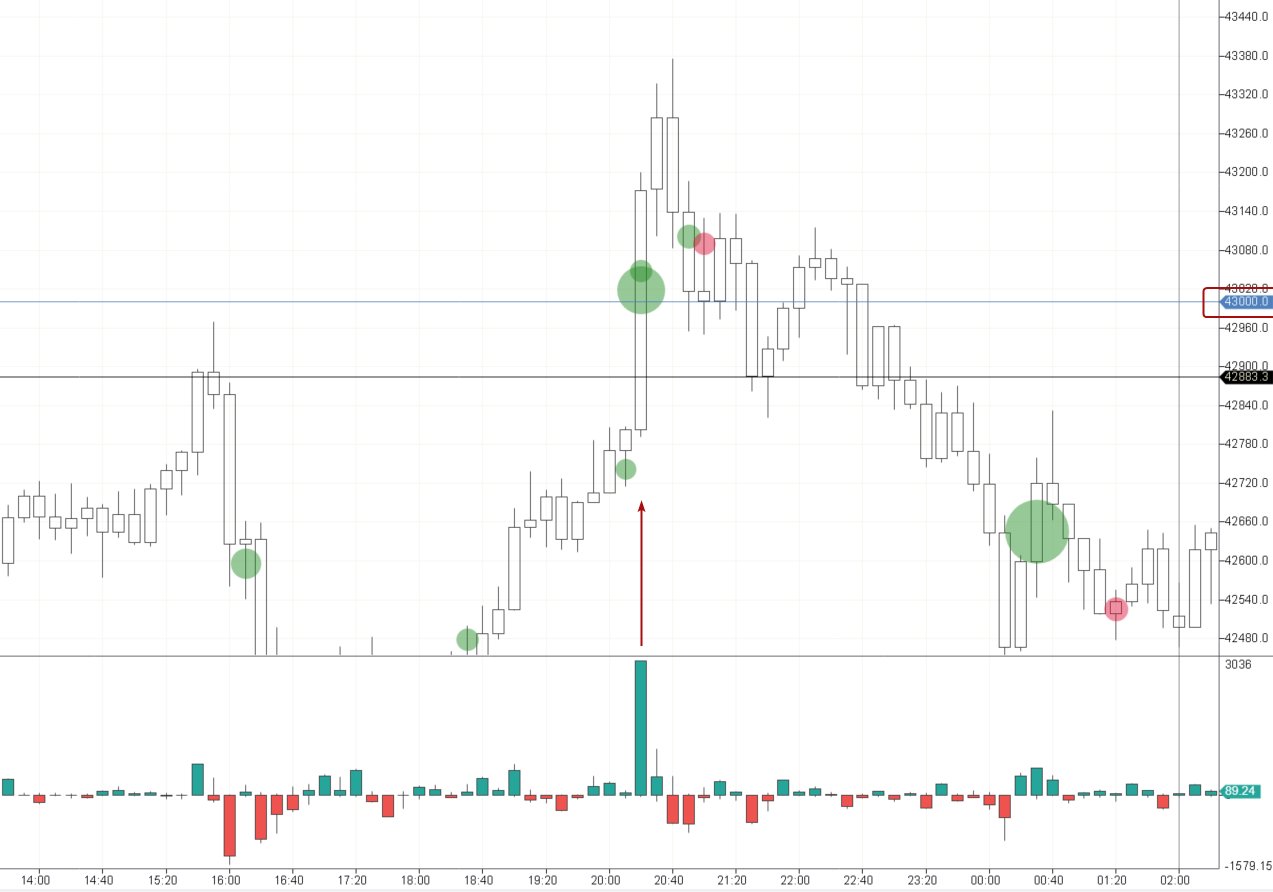

Fake breakout of the resistance

The example above (bitcoin market) shows buying activity on the breakdown of the psychological level of 43 thousand dollars per coin. The smart money can use this activity (and even help it) to fulfill their intentions of forming large short positions.

Best Forex brokers

What is the liquidity grab indicator in Tradingview?

Traders have at their disposal a plethora of tools and indicators to identify market trends and potential trade setups. One of those tools is the liquidity grab indicator, specifically designed to pinpoint the moments when Smart Money executes a liquidity grab.

On Tradingview, a popular charting platform used by traders worldwide, this functionality is encapsulated in an indicator known as the ICT SM Trades Indicator.

The ICT (Inner Circle Trader) SM Trades Indicator is crafted to reveal the subtle movements of Smart Money-those market players who move large volumes and can thus significantly influence price direction. The indicator illuminates areas where these traders are likely entering the market, often at the expense of smaller players.

It is particularly adept at identifying points where liquidity is being 'grabbed', i.e. where large players are likely absorbing the liquidity provided by retail traders' stop-losses or breakout entries.

Liquidity grab indicator in Tradingview

The image above showcases the ICT SM Trades Indicator in action on a USD/JPY chart. It highlights specific points with green diamonds where liquidity is suspected to have been grabbed just below a support line. These points are crucial for traders. They often precede a swift reversal as Smart Money has accumulated its desired positions and the market reacts to the sudden shift in supply and demand.

Traders use this indicator to steer clear of being caught in adverse movements initiated by these liquidity grabs and, if skilled enough, to align their trades with the direction of Smart Money.

In fact, TradingView is a very user-friendly platform with many indicators. You can learn more about its useful features in the article: Tradingview Review 2024: Is it Worth Paying for Pro?

What is a liquidation grab?

A liquidation grab is a strategic move in the trading world where professional traders capitalize on the forced closure of positions, commonly seen in leveraged trading environments. This phenomenon occurs when the market price hits a point where leveraged positions, typically those of retail traders, are automatically closed or 'liquidated' due to insufficient margin to support the trade.

A liquidation grab

The chart demonstrates this concept in the context of Bitcoin trading. It shows a price graph with a sudden downward spike, representing a sharp decline in price, which would trigger a mass liquidation of long positions. Beneath the price chart, a significant spike in the liquidation volume is visible, indicating that a substantial number of buy positions have been forcefully closed.

Smart Money traders wait for these moments of high liquidation. They anticipate that the liquidation of bull positions will push prices down temporarily, allowing them to purchase assets at a lower price.

Once the wave of forced sell-offs subsides, these professional traders, who have increased their long positions through the acquisition of the liquidated assets, stand to gain from the subsequent price recovery. This strategy not only allows them to enhance their long portfolios but also to benefit from the volatility and panic selling caused by the mass liquidations.

Conclusion

The strategies of liquidity and liquidation grabs highlight the intricate tactics employed by professional traders to maneuver through the complex landscape of trading. While this article has shed light on two prominent methods, it's pivotal to acknowledge that the depths of market strategy are vast and varied.

Smart Money continuously devises new techniques to capitalize on market mechanics, often remaining a step ahead of the general trading populace. For the astute trader, awareness and continuous education are key to navigating these waters without falling prey to such maneuvers.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

5

Long position

A long position in Forex, represents a positive outlook on the future value of a currency pair. When a trader assumes a long position, they are essentially placing a bet that the base currency in the pair will appreciate in value compared to the quote currency.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.