What Is The Break-Even Price In Forex Trading?

The break-even point in trading is when your trade brings neither profit nor loss. As a rule, traders move the stop loss to the breakeven point when the trade starts to make profit.

Break-even point is an important concept in money management. Knowing the techniques described in this article will help you achieve the smoother capital growth curve that is characteristic of highly skilled forex traders.

What is the break-even point in trading?

When you open a trade on Forex (or any other financial market - stocks, cryptocurrencies or futures), the trade will immediately be unprofitable because of the difference between the ask and bid price and the commission that is automatically deducted from your account by the broker. Therefore, to reach the breakeven point, the price must go in the direction you expect it to go.

Example

Here is how to calculate a break-even point in trading:

-

Suppose you buy GBP/USD at 1.3050.

-

Next, you set an initial stop loss at 1.3010.

-

Then the price rises to 1.3090.

-

And then, you change the stop loss to 1.3050 (breakeven level).

-

If the price falls back to 1.3050, your trade neither makes a profit nor a loss (except for a small loss due to spread and brokerage commission).

It is a break-even trade. Your portfolio's value curve will point to the right, rather than down, if the price had moved lower to the level where you originally placed your stop loss.

How to use a break-even in trading?

To use a break-even in trading, you need to go through certain phases step by step. First, you need to calculate your break-even price. You are certainly aware of the price at which you entered the trade.

Then, you should work on managing your stop loss. A stop loss is a specific type of order traders or investors use to limit their potential losses in the stock market. Setting a stop-loss order is a common risk management technique in trading. A stop loss is the price level at which you are willing to exit a trade to limit your losses.

By placing your stop loss at or just above your break-even point (for long positions) or below it (for short positions), you ensure that if the price reaches the break-even point, you will at least exit the trade without losing money.

And then, when the price of the security approaches your break-even point, it's a good time to reevaluate your trade. Consider the current market conditions, news, and technical indicators, to determine whether the trade still has potential for profit. If the trade no longer seems favorable, consider closing it to minimize potential losses.

Move stop-loss when the position goes into profit

Let's say the price goes in your favor. A dilemma arises - at what moment to move the deal to breakeven? If you do it too early, the price fluctuation may close a promising trade that you may have been waiting for a long time.

It can be considered optimal to move a position to breakeven if the price has gone halfway towards take profit.

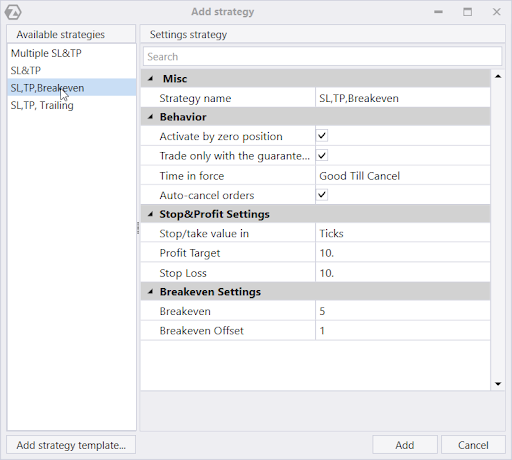

Source: ATAS Platform

For example, the picture above shows that take profit is equal to 10 ticks, and the trade is moved to breakeven when the price passes 5 ticks in the direction of take profit.

Move stop-loss to protect growing profits

Moving your stop-loss when a trading position goes into profit is known as trailing your stop-loss. It is primarily a risk management technique that permits you to take care of your gains as the price moves in your favor.

Here's how to do it:

-

Initial stop-loss. When you enter a trade, you should initially set a stop-loss order at a level that reflects your acceptable level of risk.

-

Monitor the trade. As the trade starts to move in your favor and generate profits, you can begin trailing your stop-loss. he idea is to adjust the stop-loss order to a level closer to your entry price but still allows room for minor price fluctuations, as mentioned before.

-

Determine trailing method. You can choose several trailing methods depending on your trading strategy and the conditions of the present market. These methods are usually divided into:

-

Percentage based

-

-

Moving averages or other indicator (Parabolic SAR, Super Trend, for example)

-

Moving stop-loss to protect growing profits starts with initiating the stop-loss first and then determining your profit target, which is the price level at which you want to secure your profits. It is followed by moving the stop-loss and trailing it, as mentioned earlier, depending upon various techniques present.

Also, don’t forget to regularly review your trading positions and adapt your stop-loss orders as the market evolves. Market conditions can change, and your strategy should adjust accordingly.

So, What is the break-even price in trading?

As of now, you have surely understood that the break-even price in trading is the price at which the gains and losses on a particular trade are equal. In other words, it's the price you neither profit nor incur a loss on that trade.

It's important to note that the break-even price does not consider factors like taxes, brokerage fees, financing costs (if applicable), and other expenses that may affect your overall profitability.

Knowing the break-even price can help you decide when to exit a trade to minimize losses or lock in profits. It's a critical element of risk management in trading and is often used in conjunction with stop-loss and take-profit orders to create a well-defined trading plan.

Best Forex brokers

FAQs

Does break-even mean no profit?

Actually, yes. Break-even is the point of balance when total revenue is equal to the total cost, thus making neither profit nor loss. A number below the point is a loss, whereas it's a profit above the point.

How do you break even in trading?

When opening a trade, set a stop loss. When (and if) the price passes a certain value of ticks in your favor, move the stop loss to the opening price of the trade.

What is a good break-even point?

A good break-even point aligns with your trading plan, risk management strategy, and financial objectives. It is a good idea to take the trade to breakeven if the price has passed 50% towards the take profit level.

Should commission fees be taken into account when calculating breakeven?

Yes, commission fees are a cost associated with sales; they must be included in your cost calculations to determine when you'll reach the breakeven point. Failure to consider these fees could result in an inaccurate break even analysis, which could affect your pricing and sales strategies.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Break-even point

The break-even point in trading is when your trade brings neither profit nor loss. As a rule, traders move the stop loss to the breakeven point when the trade starts to make profit.

-

4

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).