Note:

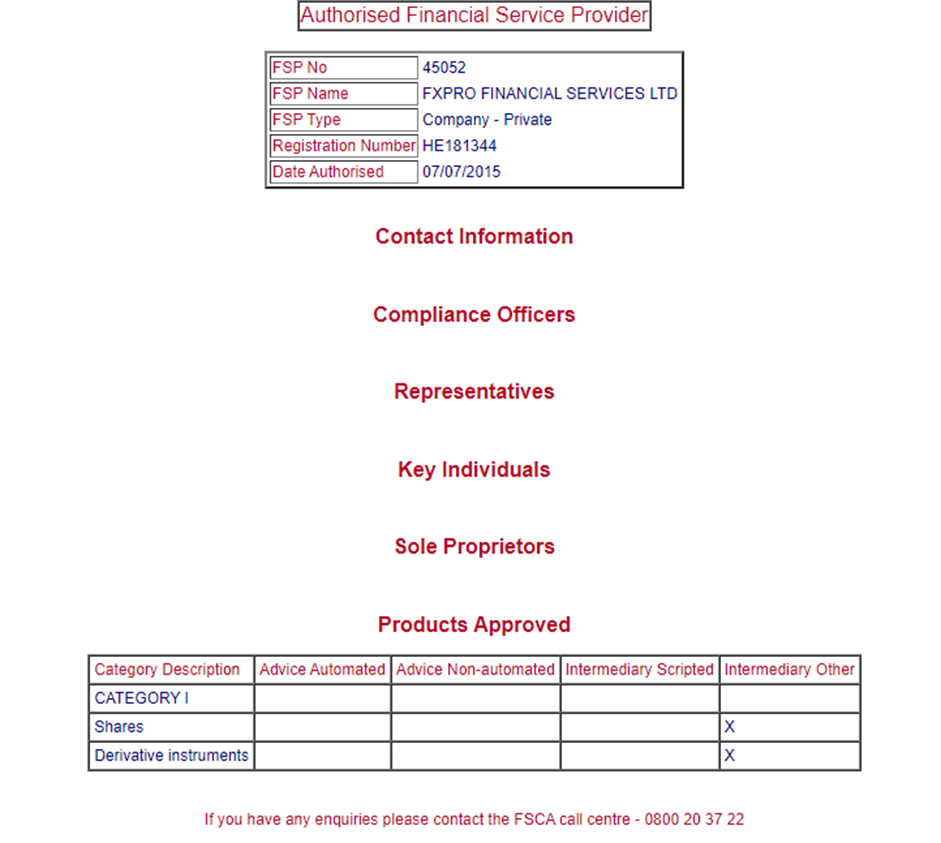

Note that, in this case, the broker is allowed to make transactions with derivatives. When you find a valid license, pay attention to the types of services it allows

The Financial Sector Conduct Authority (FSCA) supervises the financial sector of South Africa along with other government bodies. The regulator grants licenses and monitors licensees. Its objective is to create favorable conditions for the attraction of investors and investments to the country’s financial sector.

Almost every country has a financial regulator. It can be an independent government organization or a division of the National Bank entrusted with the licensing and control of the country’s non-banking sector. Every financial system participant registered as a legal entity must strictly observe its regulator’s requirements. Depending on its mandate, a regulator can audit a licensee, request statements of account activity, require the disclosure of the organizational structure, etc. A regulator’s objectives are to assist in resolving disputes, protect investors’ rights, and ensure that licensees abide by the law.

For a broker, holding a license means the following:

Access to providing separate types of services in the jurisdiction covered by the license

Access to the jurisdiction’s market. Some countries attract brokers with lenient legislation and the possibility to optimize taxes. Without a license, a broker cannot be registered

Prestige and reputation in international markets

For a trader, a license means that the broker was inspected by a regulator, is under constant supervision, and complies with local and international laws. Also, the trader can always count on the regulator’s help in settling disputes and other issues.

In this post, TU explores the FSCA’s functions, advantages, complaint submission procedure, and its operations. Also included is an expert’s opinion of this regulator.

The Financial Sector Conduct Authority was established in the Republic of South Africa in 1990. The regulator issues licenses and controls brokerage, investment, and insurance companies. Its mandate includes supervision over currency transactions and transactions with bills of exchange, bonds, stocks, and derivatives in the South African stock market. Recently, the regulator has been controlling all large issuers whose stocks are listed on Africa’s largest stock exchange, the JSE.

Issue licenses and ensure that regulated entities comply with the law. A license can permit the provision of all types of financial services or only a part thereof, e.g., currency transactions only, derivatives transactions only, etc. The FSCA website lists permitted activities for each licensee

Monitor licensees to ensure that clients are not deceived

Maintain the transparency of the financial sector and the attractiveness of the jurisdiction for international investors

Provide licensees with information support

The FSCA is almost entirely subordinate to the Ministry of Finance of South Africa and is part of the organizational structure of the country’s regulators alongside the ombudsman, the National Credit Regulator, the Reserve Bank, and separate departments responsible for overseeing separate sectors (retail trade, banking supervision, etc.). The regulator’s mandate is strictly limited. For example, the FSCA does not investigate cases of fraud.

Have its executives be personally present when signing and submitting the documents. Opening a physical office in South Africa is not necessary

Have a resident of South Africa on its management team

Open an account at a South African bank

Reserve funds in an account to be frozen as collateral

Have its executives take a regulation test to confirm their knowledge and competence

Submit financial statements in the form required by the regulator

The requirements are less strict than European regulators’, but, unlike offshore controlling bodies, the FSCA oversees its licensees responsibly.

The FSCA website has the following structure:

Upper menu with the sections About Us, Careers, Contact Us, and News. Here you can view the regulator’s organizational structure, mission, and annual reports. The News section contains warnings to licensees, interviews, media releases, electronic newsletters, current information, changes in legislation, etc

Main menu

The Footer partially repeats the upper and main menus. It also contains a Useful Links section and the Site Map

FSCA Review — Website sections

Structure of the main menu:

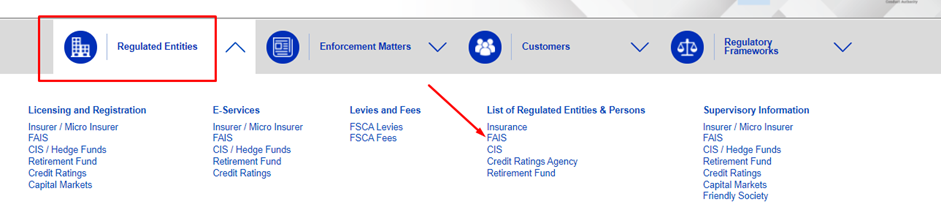

Regulated Entities is the largest section with a list of regulated entities, information about the licensing of separate categories of legal entities, fees, and much more

The Enforcement Matters section is about legal issues

Customers. Here you can file a complaint, visit an educational portal, find information about benefits for private clients, etc

Regulatory Framework. Directives, regulations, etc., are contained here

Sections that will interest traders:

Customers. Here you will find all information for clients, including a complaint submission form

FSCA Review — Website sections

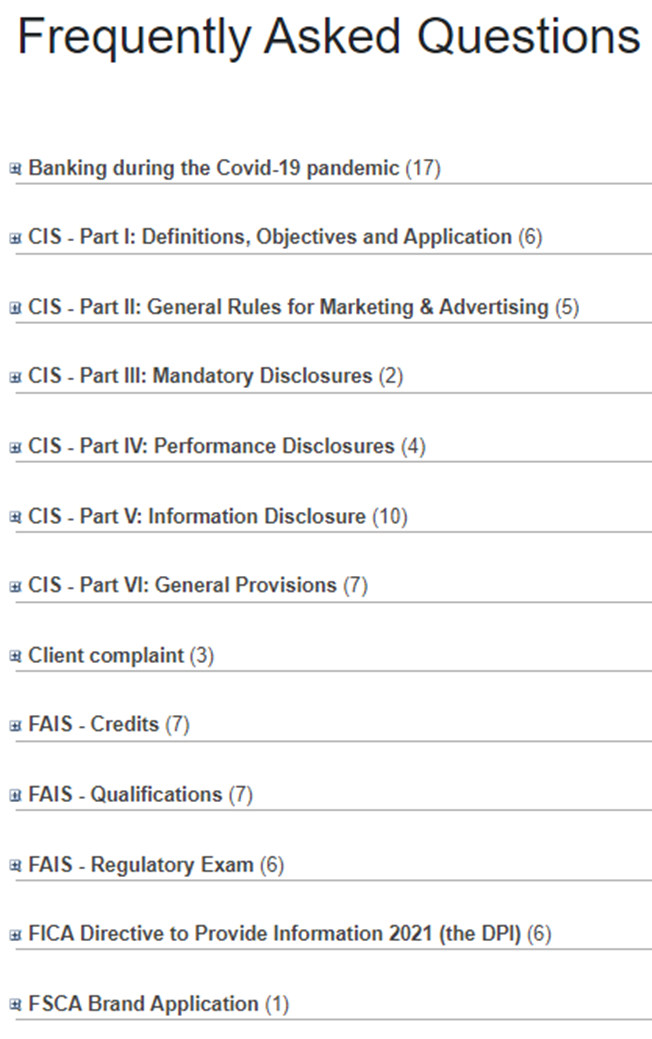

FAQs answers the most frequently asked questions and provides links to other controlling agencies in South Africa

FSCA Review — Website sections

News > Warnings & Alerts Here you can view the sanctions that have been applied by the regulator. A license may remain active, but a warning from the regulator should be a red flag for a trader

FSCA Review — Website sections

One of the FSCA’s advantages over offshore regulators is that it provides complete and transparent information. On the regulator’s website, you can find detailed information about a broker by its license number without registration.

To confirm a broker’s license on the FSCA website, do the following:

On the broker’s website, locate information about its licenses. In most cases, it’s in the footer of the website’s homepage. Otherwise, look for it in such sections as “About Us”, “For Traders”, etc. Or ask for a license number from the broker’s support service. Note that an FSCA license can be held by a separate division of the broker

Follow a link if it’s active (like in this case).

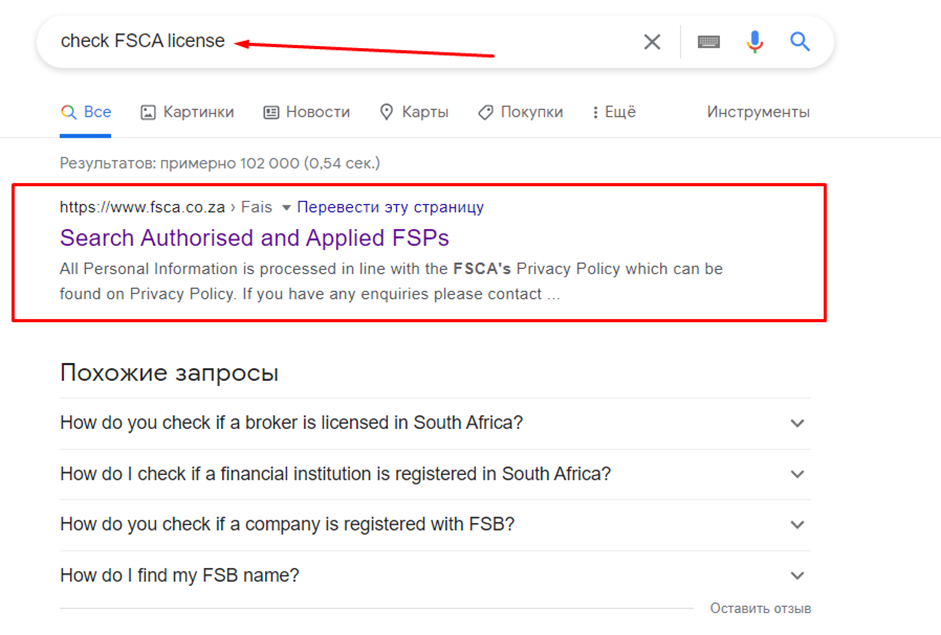

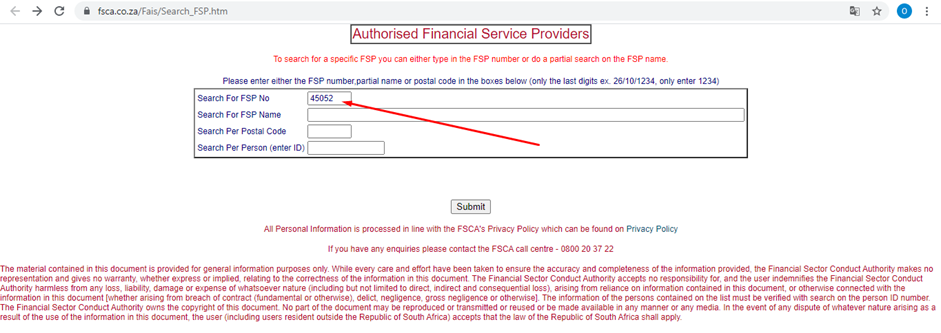

If you only see a license number, but there is no link, open a new tab in your browser and enter “check FSCA license” in the search bar. Perhaps, on the regulator’s website, you can also search for brokers by license numbers, but it’s done faster through a browser. When you enter the broker’s name or license number in the search box on the FSCA website, the search doesn’t work

Search for brokers by license numbers

Enter the license number in this window

Search for brokers by license numbers

Check the company’s name, permitted types of services, and other information

Search for brokers by license numbers

Note:

Note that, in this case, the broker is allowed to make transactions with derivatives. When you find a valid license, pay attention to the types of services it allows

Another way to find a license:

FSCA Review — Website sections

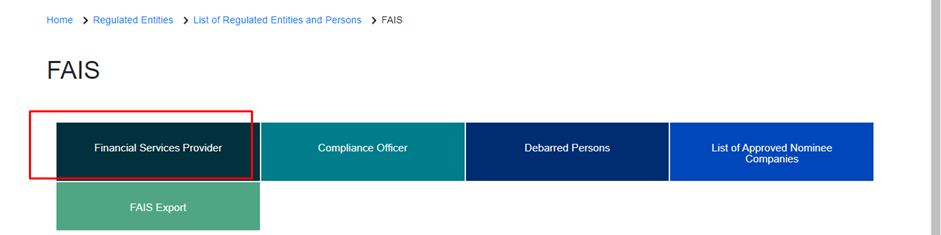

Follow the arrow on the screenshot. If necessary, select another item in this section. Next, select “Financial Services Provider”.

FSCA Review — Website sections

The first way of searching is more convenient, as it doesn’t require you to know the website’s structure.

Basic requirements to obtain a license:

Freeze a fixed amount in an account at a South African bank

Executives must pass a qualifications test

Provide financial statements on a regular basis

Avoid violating local and international laws

The requirements are relatively lenient because they don’t include full disclosure of business information. But within its mandate, the regulator tries to loosely monitor the broker’s activities.

Trust in an FSCA license is above average. The South African jurisdiction attracts companies with limited competition, transparency, and regulated financial services. South Africa is one of the 10 best countries for doing business in the global capital market. Acquisition of an FSCA license is mandatory. But unlike offshore regulators, there are real work examples and results proving that the FSCA performs effective supervision.

👍 Advantages of trading with an FSCA-licensed broker

• The FSCA and other controlling authorities help in settling conflict situations with brokers

• Possible problems with a broker can be seen early. The regulator has broader powers for control, and traders can see potential problems and risks in advance by monitoring the FSCA’s warnings on its website

A license is a guarantee that a broker operates in the legal framework, albeit in just one country. There are no other benefits for a trader. Brokers don’t need an FSCA license to render services to non-residents of South Africa on the condition that they observe the local legislation.

👎 Disadvantages of trading with an FSCA-licensed broker

• The regulator’s mandate is limited. The FSCA can hardly influence offenders without engaging other government bodies

• Complete absence of regulation or control of the cryptocurrency sector

• No compensation fund

The drawback for traders is that they can count on help only in cases of substantial and obvious violations. But even then, they cannot receive monetary compensation.

The FSCA is a financial regulator of South Africa, but obtaining a license does not require official registration in the country. Brokers that meet the FSCA’s requirements can obtain a license and don’t need to open a physical office in South Africa. FSCA-licensed brokers can operate in other countries as well on the condition that they abide by local legislation. The regulator’s main requirement for foreign brokers is to do legal business without fraudulent actions, such as money laundering.

Cancellation of an FSCA license means that a broker cannot operate in South Africa, but it doesn’t have any effect on the broker’s right to keep rendering services in other countries. Therefore, the FSCA performs regulation in South Africa only.

The FSCA considers every individual complaint. The regulator cannot always help private traders due to its limited mandate, but every complaint can inform the regulator of violations in sufficient time to issue a public warning and draw the attention of other government bodies to an offender, thereby preventing potential problems.

1. Lodging a complaint directly with the FSCA:

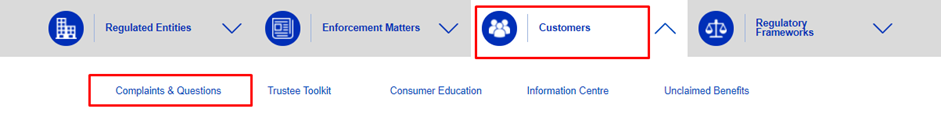

On the website’s homepage, select Customers > Complaints & Questions

FSCA Review — Website sections

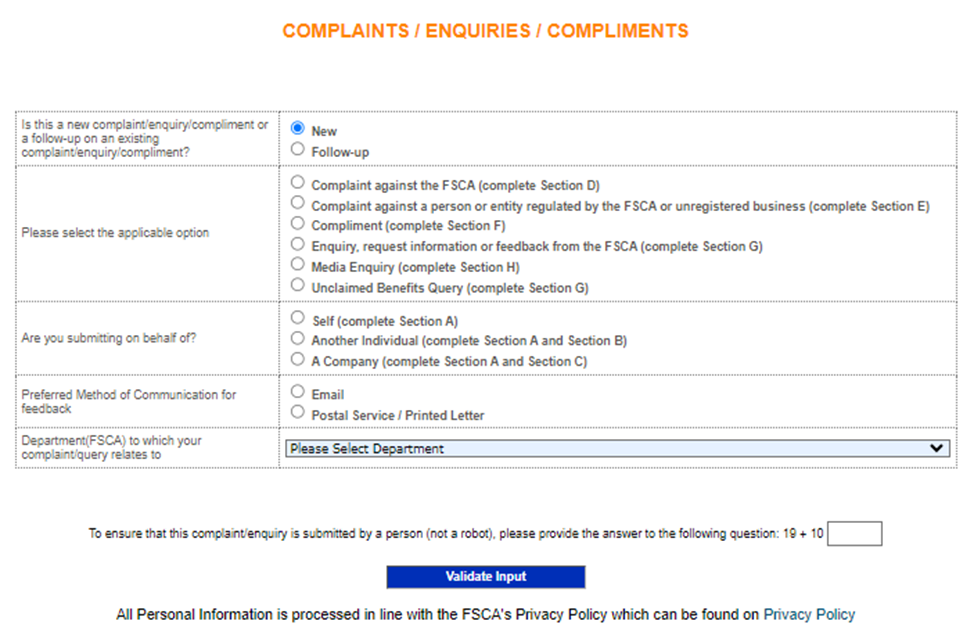

Select “Complaints/Enquiries/Compliments/Media Queries Form”

FSCA Review — Website sections

Complete the above form.

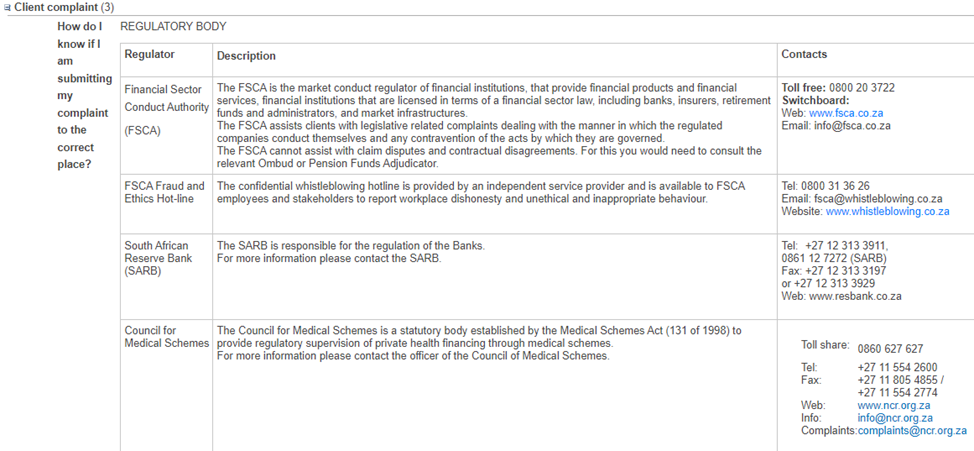

2. Lodging a complaint with other authorities. Additionally, you can send a complaint to other government authorities, depending on the specifics of your problem.

In the website’s footer, select “FAQ”

FSCA Review — Website sections

Open the “Client Complaint” list

FSCA Review — Website sections

Here you will find the organizations to which you can send your complaint.

Traders Union analysts are always ready to help you save time and give you as much useful information as possible. Every month, they visit regulators’ websites to check on the validity of licenses and monitor warnings. All information is updated on TU’s website. You don’t need to view regulators’ websites – all data is already updated in TU’s brokers’ ratings.

Cryptocurrencies are not formally regulated in South Africa. The South African Reserve Bank (SARB) issued a statement cautioning against the use of cryptocurrencies for payments, but trading on decentralized platforms, as well as cryptocurrency mining and holding, are permissible.

South Africa lacks specific cryptocurrency legislation. While consumer protection laws may offer some recourse, in case of a crypto exchange failure, traders may not receive compensation directly from the government or regulatory bodies.

There is no specialized taxation framework for cryptocurrencies in South Africa. However, cryptocurrency traders are still required to pay income tax, typically at rates similar to those for Forex traders, ranging from 18% to 45%.

The FSCA is a good local regulator that tries to uphold the jurisdiction’s reputation at a high level. Its purpose is to ensure the transparency and stability of the financial system. And judging by the results of its work and by the fact that, for many non-residents, South Africa remains an attractive country for registration, and the FSCA is successful in many aspects.

One of the FSCA’s problems is its limited mandate. One of the reviews in this post clearly describes the issue of supervision over cryptocurrency transactions and the whole cryptocurrency trading sector. The regulator is not empowered to control the cryptocurrency industry, and fraud has become a disaster here. In January 2021, the regulator managed to expose the cryptocurrency pyramid Mirror Trading International, but losses couldn’t be avoided – they amounted to about $700 million. The regulator has addressed the local legislative bodies several times, requesting to add cryptocurrencies to financial products, but to no avail so far. Potential cryptocurrency investors should take this aspect into account.

An FSCA license is the golden mean between strict and conservative regulators of Europe and offshore regulators. The FSCA controls its licensees but has almost no leverage over them, except for full or partial cancellation of a license. Traders are advised to follow the news on the regulator’s website – the FSCA reacts quickly even to the smallest violations of the local laws by brokers.

Oleg Tkachenko, Author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 proprietary trading strategies. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

The Financial Sector Conduct Authority (FSCA) supervises the financial sector of South Africa along with other government bodies. The regulator grants licenses and monitors licensees. Its objective is to create favorable conditions for the attraction of investors and investments to the country’s financial sector.

Confidence that a broker is a real legal entity that observes local and international laws

Access to information and advice regarding brokers. Warnings about brokers’ problems

Every client of an FSCA-licensed broker can count on the regulator’s help.

Two options:

In the Google search bar, enter “check FSCA license”. Follow the first or one of the first links to a license search form on the regulator’s website. Enter the license number in the form and see what types of services this license allows

On the Traders Union website, open the broker’s page and see a full list of its licenses. This option is more convenient, as it lets you check on the status of all licenses without opening every regulator’s website

On the homepage of the FSCA website, select Customers > Complaints & Questions. Fill out a registration form

Register on the Traders Union website and ask for help from TU’s lawyers. TU is a community of traders who aim to protect each other’s interests, unlike regulators that often take a broker’s side. The advantages are prompt consideration of complaints and help in preparing documents for regulators. This service is free

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).