MAS | Financial Regulator Of Singapore

MAS is the Central Bank of Singapore and also serves as a regulator. MAS oversees all markets, including the over-the-counter Forex and stock markets. The jurisdiction’s centralized regulatory system is strict and authoritarian, but thanks to it, Singapore is among the world’s top countries for doing business.

To render services legally, a broker must be licensed by a regulator of the country in which it is registered or has an office or legal address. A license means that the broker is supervised by the regulator, operates in compliance with local and international laws, and takes into account traders’ interests. Regulatory functions can be carried out by the central bank or a separate government or non-government agency that is controlled by the Ministry of Finance and cooperates with independent auditors. The regulator’s tasks are to coordinate the interaction between licensees and their clients, protect the national economy and make it more attractive, and protect investors’ rights.

For a broker, holding a license means:

-

Necessity to meet the regulator’s requirements and observe the law. In some cases, requirements make brokers set limits on trading conditions to reduce potential risks;

-

Free choice of marketing tools. Licensed brokers have the right to advertise their services;

-

Authority in the eyes of traders. A license testifies that the broker is overseen by a third, independent party, operates transparently, and does not aim to deceive its clients.

For a trader, a license is the possibility to seek help from a regulator that is interested in protecting investors. In most cases, a license entitles investors to full or partial loss reimbursement from a compensation fund if the broker becomes bankrupt.

In this post, TU explores MAS’ functions, mandate, and procedures for confirming licenses on the website and filing complaints, as well as reviews and an expert’s opinion of this regulator.

Description and functions of MAS

The Monetary Authority of Singapore (MAS) is the central bank that also acts as a financial regulator and is responsible for the country’s monetary policies and currency reserves. MAS’ regulatory functions consist of issuing several license types and controlling all economic sectors, including cryptocurrencies. The regulator’s powers and resources are practically unlimited.

MAS’ mission and objectives in the Forex market

-

Fulfill classic functions of a central bank, including the provision of services to the government;

-

Perform complete oversight of all market participants, such as commercial banks and brokers; trust, investment, and insurance companies; exchanges and digital platforms, etc;

-

Investigate reports of misconduct, regulatory breaches, or suspected fraud, and liquidate “bubbles” and pyramids.

Today, Singapore is number 4 in the global competitiveness ranking. In 2019, Central Banking recognized the Central Bank of Singapore as the best bank in the world. It is largely attributable to the elaborate monetary policy that ensures the stability of the country’s economy and demonstrates the effectiveness of Singapore’s regulatory system.

To obtain a MAS license, a broker needs

Up to $3.2 million registered capital. The amount is set individually.

-

A management team with at least 5 years of experience in the financial sector;

-

A physical office in Singapore;

-

To have at least two Singapore citizens on its board of directors;

-

A business plan and a risk management system;

-

To meet the criteria that are determined individually by the regulator, depending on the license type and the broker’s plans;

-

Employees that meet trustworthiness criteria.

In terms of strictness, MAS is comparable to U.S. regulators. The difference lies in centralization. While the U.S. market is controlled by several regulators that are assisted by private auditors and self-regulatory organizations, MAS fulfills all supervisory functions and uses many control mechanisms in Singapore. Other bodies, such as the Financial Industry Disputes Resolution Centre Ltd (FIDReC) or the Association of Banks in Singapore (ABS), have fewer powers.

Official website and available information

MAS is Singapore’s central bank. That is why, besides a section about regulation, the Authority’s website contains a lot of other information related to the country’s economy and monetary policies.

Overview of the website:

-

Upper main menu.

Upper main menu

-

Information sections. Media releases and the annual report; latest news; latest publications, and upcoming releases.

MAS Website Sections

MAS Website Sections

MAS Website Sections

-

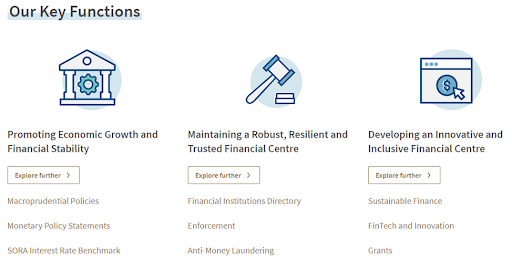

Key functions.

MAS Website Sections

-

Related sites. In particular, the financial communication network Masnet.

MAS Website Sections

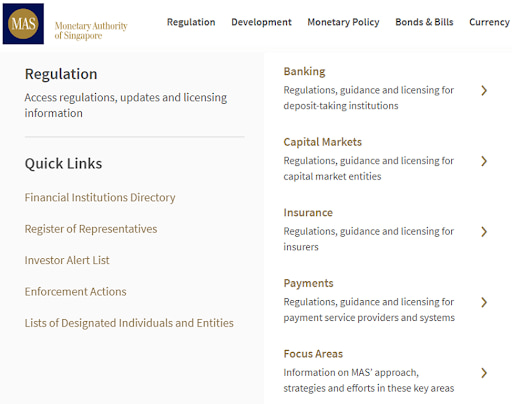

Structure of the “Regulation” section:

-

Regulation. Rules and information about the licensing of Singapore’s economic sectors, such as banking and insurance, capital markets, payment systems, etc.;

-

Quick Links. Financial institutions directory, investor alert list, etc.

MAS Website Sections

Traders are interested in the whole “Regulation” section and, particularly, the “Financial Institutions Directory” subsection, where they can find information about MAS-licensed entities and details of their licenses.

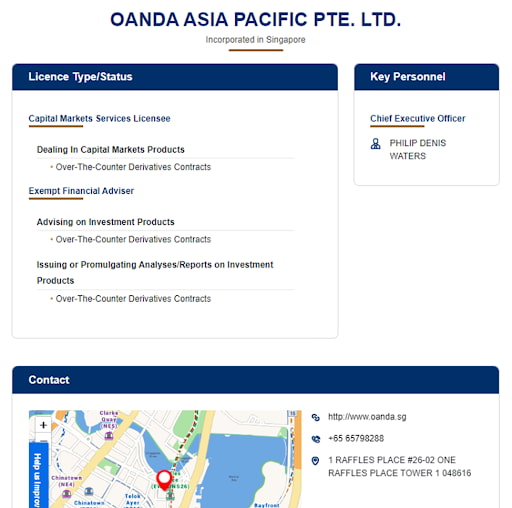

How to confirm a broker’s license on the MAS website

As mentioned, alongside information about brokers and regulation, MAS provides a lot of economic and financial content on its website. This complicates searching. If you enter a broker’s name in the search box on the MAS website’s homepage, you will get all publications that mention the broker, as well as search avenues, such as news, media releases, and other pages.

To confirm a broker’s license on the MAS website, do the following:

-

1

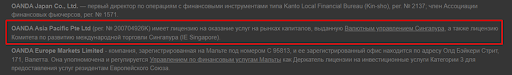

Go to the broker’s website and make sure it holds a MAS license. This information may be in the footer or other sections of the broker’s website, such as “About us” or “Regulation”;

Screenshots from broker’s website

-

2

Next, you have two options:

2.1Google “check MAS license” and follow the first link;

Confirmation of an MAS License — Via Google search

The link takes you to the regulator’s search form, where you will need to input the broker’s name or license number.

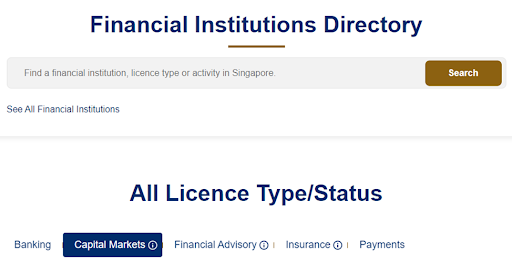

MAS Website Sections

2.2On the MAS website’s homepage, go to the “Regulation” section and select “Financial Institutions Directory”.

MAS Website Sections

-

3

Enter the broker’s name and compare the result to the details on the broker’s website.

MAS Website Sections

Note the license type. Brokers need a license of at least the “Capital Markets Services” type.

MAS’ basic requirements for brokers

Basic requirements to obtain a license:

-

Full disclosure of required information. The broker must have a physical office in Singapore and at least two Singapore citizens on its management team;

-

Maintain registered capital at a level that is set by the regulator upon granting a license. Registered capital requirements depend on the broker’s focus area(s) and risk level;

-

Provide information about strategic development plans, investor rights protection, etc.

MAS issues licenses of several types that determine the fields in which brokers are permitted to render services. The regulator’s mandate allows it to not only impose fines, but also initiate disciplinary, administrative, and criminal proceedings in Singapore.

MAS license | Pros and cons

MAS has practically unlimited powers to control brokers and enforce financial laws. Having access to national registers and accounts, the Authority can get any information about brokers. It primarily supervises branch offices of transnational companies, ensuring that they follow the anti-money laundering and counter-terrorism financing rules. In some cases, fines of $3-4 million were imposed on the largest investment banks.

Advantages of trading with a MAS-licensed broker

-

The broker is under constant, strict supervision. MAS approaches the regulation of licensees and their interaction with maximum responsibility.

-

You can be sure that the broker is reliable and fulfills its obligations.

A license from MAS is deemed to be the most trustworthy in Asia.

Disadvantages of trading with a MAS-licensed broker

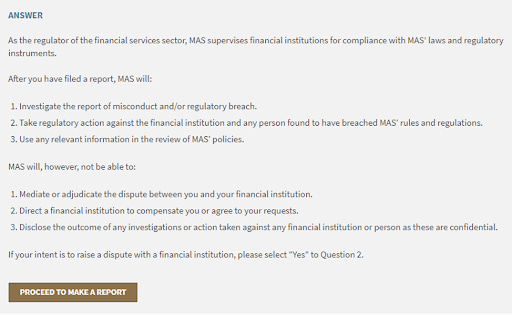

Although the Authority accepts reports of misconduct on the part of financial institutions, it does not mediate or adjudicate traders’ disputes with brokers. Instead, MAS advises harmed traders and investors to contact FIDReC.

MAS’ jurisdiction

A MAS license is permission to operate in Singapore. MAS-licensed brokers can render services to residents and non-residents of Singapore if that does not violate the laws of non-residents’ countries. In most cases, U.S. and European brokers open branch offices in Singapore to access the Asian financial market. In a number of Asian countries, MAS is the most reputable regulator.

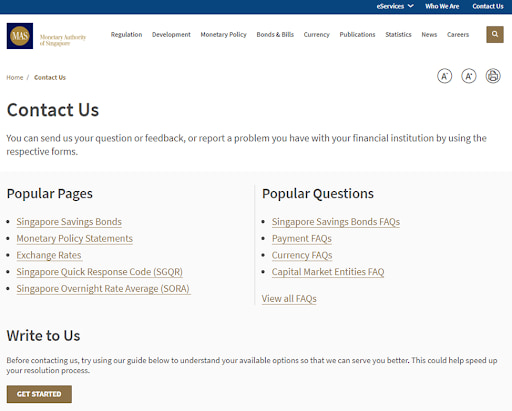

Submission and consideration of complaints

You cannot file a complaint against a broker directly with MAS, as the regulator does not resolve disputes between financial institutions and their clients. However, MAS requires its licensees to have a procedure for handling client complaints promptly and responding to complainants. Therefore, MAS recommends approaching the broker first. If that does not help, you can lodge a complaint with FIDReC. If the problem remains unresolved, MAS advises contacting the Singapore Mediation Center (SMC) or consulting a lawyer.

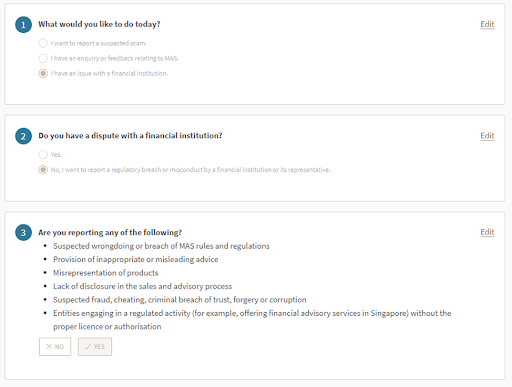

If you suspect a broker of fraud, you can notify MAS about it:

-

1

In the top right corner of the MAS website, go to “Contact Us” and click the “Get Started” button in the “Write to Us” section;

MAS Website Sections

-

2

Choose “I have an issue with a financial institution” for question 1, “No, I want to report a regulatory breach…” for question 2, and “Yes” for question 3;

MAS Website Sections

-

3

Read the “Answer” carefully to understand what a trader can expect after filing a report. Then, click “Proceed to make a report” and complete the form.

MAS Website Sections

MAS-licensed brokers | How to check on a broker

This section provides all the information about licenses held by brokers and their branch offices in various countries. Every month, TU analysts look through regulators’ websites and update the information. On TU’s website, you will learn about:

-

All valid licenses, their types, and authorized activities;

-

Penalties, warnings, and investigations in relation to brokers.

Traders Union values your time!

Expert’s assessment

MAS is Singapore's central bank that oversees the whole financial sector from commercial banks to over-the-counter brokers and companies that deal with cryptocurrencies. The unique feature of Singapore’s regulatory system is strict centralization which was established in 1971, when the jurisdiction had several regulators, each working in its own niche. Communication problems and separated duties led to the appearance of legislative and executive gaps that were manipulated by brokers. MAS eventually became the central bank and was entrusted with full control of Singapore’s financial system.

Compared to European regulators, MAS has several unusual functions:

-

Holds responsibility for gold and foreign currency reserves, money emission, and the monetary system;

-

Acts as a government financial agent and creditor;

-

Supervises payment systems.

Although MAS presents itself as a fully independent body with its own board of directors, it is subordinate to the Cabinet and led by the Vice-Prime Minister of Singapore.

Centralization is advantageous in that MAS has access to any information about brokers, including their account activity in any Singapore bank and international transactions. The downside lies in possible conflicts of interest. The Central Bank of Singapore is considered to be one of the best regulators in the world and therefore it is primarily interested in upholding the jurisdiction’s status and financial prestige. Requirements for brokers are as strict as possible. Everything is controlled, and breaches can lead to serious fines. By this criterion, Singapore is comparable to the USA. But the USA is the world’s largest economy that offers thousands of tradable assets. Singapore does not have such advantages and that is why few brokers want to obtain a license from this jurisdiction.

Conclusion

For traders, MAS is one of the best regulators, but it is inconvenient for brokers. This regulator does not adjudicate traders’ disputes with brokers but recommends approaching FIDReC. A MAS license confirms a broker’s reliability and transparency, but not many brokers hold such a license.

About the author of this review

Oleg Tkachenko, author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 trading systems. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is MAS?

MAS is the Central Bank of Singapore and also serves as a regulator. MAS oversees all markets, including the over-the-counter Forex and stock markets. The jurisdiction’s centralized regulatory system is strict and authoritarian, but thanks to it, Singapore is among the world’s top countries for doing business.

What do I get from trading with MAS-licensed Forex brokers?

-

1

You can be sure that these brokers are reliable. They operate in compliance with the laws of Singapore and are supervised by the independent regulator and auditors.

-

2

The client account segregation rule is observed.

For a trader, a MAS license is a guarantee of a broker’s reliability.

How to check if a broker holds a MAS license?

There are two options:

-

1

On the MAS website’s homepage, go to the “Regulation” section, select the “Financial Institutions Directory”, and search for the broker by its legal name.

-

2

Find information about the broker in its profile on the Traders Union website. The second option is advantageous in that the broker’s profile contains not only constantly updated information about all licenses, but also trading conditions, reviews, etc.

How to submit a complaint against a broker to MAS?

-

1

MAS accepts traders’ reports of violations by brokers but does not mediate disputes between companies and their clients. Traders who cannot settle their issues with brokers directly are advised to file complaints with the Financial Industry Disputes Resolution Centre Ltd (FIDReC).

-

2

Register with TU and refer to its legal department for help. Every TU member is entitled to free legal support that can help resolve issues with brokers faster and more effectively than regulators.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).