BVI FSC | Financial Regulator Of The British Virgin Islands

The British Virgin Islands Financial Services Commission (BVI FSC) is a state regulator that issues licenses to companies registered in the Islands and controls their operation. A license means that a broker meets certain basic requirements such as minimum registered capital and its financial statements are audited every year.

The financial systems of many countries include regulators. Although a regulator works closely with a country’s Central Bank and ombudsman and can be partially subordinate to government authorities, it is deemed to be an independent organization. This helps avoid conflicts of interest. A regulator’s tasks are to control the operation of its licensees and audit them, prevent violations of the law and clients’ rights, assist in the development of statutory acts, etc. A regulator’s license testifies that a broker is not a financial pyramid, operates transparently in compliance with the laws of its jurisdiction, and does not violate the rights of its clients.

A licensed broker must:

-

Disclose information about its operation, organizational structure, and management team, as well as go through audits.

-

Operate within the legal framework of its jurisdiction. Attempts to violate the law or use insider information can lead to a fine, license revocation, or criminal prosecution.

-

Meet requirements that ensure the fulfillment of the broker’s obligations to its clients.

For traders, a brokerage license is primarily a guarantee that they are not dealing with a fraudulent short-lived company, but with a regulated broker that abides by the law.

This post explores the BVI FSC’s functions, advantages, and complaint submission procedure, as well as provides reviews and an expert’s opinion of this regulator.

Description and functions of the BVI FSC

The British Virgin Islands Financial Services Commission was established in 2001. The regulator was initially created to counteract money laundering. Later, the BVI FSC assumed control of brokers, banks, and insurance and investment companies. The Commission is an independent organization and operates in the British legal framework, which is considered to be one of the strictest in the world. But at the same time, the BVI FSC has signs of an offshore regulator, e.g., superficial control of licensees and minimal requirements for information disclosure and registration.

Tasks and purposes of the BVI FSC in the Forex market

-

Grant licenses and keep a record of companies registered in the Islands.

-

Protect consumers’ rights.

-

Monitor licensees’ operations and help investigate financial crimes.

-

Take measures in relation to those who don’t fulfill requirements. The BVI FSC can issue warnings, impose fines, and initiate legal proceedings.

-

Uphold domestic and international trust in the financial system of the British Virgin Islands.

-

Participate in the consideration of draft bills that regulate the jurisdiction’s financial field and the interaction between all its participants.

-

Ensure education of financial services specialists.

The BVI FSC is an offshore regulator that serves as a backup for the National Bank. The jurisdiction covers approximately 25-30 thousand people. But minimal tax rates attract numerous companies. As of January 1, 2021, there were over 600 thousand companies registered in the British Virgin Islands, while the Commission only has a few dozen full-time employees. The BVI FSC can only put a stop to obvious violations and does not continuously conduct in-depth monitoring of its licensees.

To obtain a BVI FSC license, a broker has to

-

Confirm the availability of its registered capital. TU couldn’t find an exact minimum amount of registered capital on the regulator’s website or in open sources;

-

Open an account at a reliable bank. However, it’s unclear which banks or jurisdictions it means and whether it’s possible to open an account at a British bank, in particular;

-

Show transparency and confirm the efficiency of the risk management system. No details were readily available;

-

Provide an auditor’s report and then pass audits every year. The Commission does not perform full audits, unlike the FCA (the Financial Conduct Authority, UK or CySEC (the Cyprus Securities and Exchange Commission).

-

Provide a complete financial statement. After that, a broker only has to provide statements of its balance, income and expenses, and account activity if required.

Documents are reviewed in 20-30 days. A license issued by the BVI FSC is more like a formality. The Commission does not aim to strictly control every step of a broker. The fulfillment of basic requirements is sufficient. The rest of the information is considered to be a commercial secret and may not be shared with the regulator. The BVI FSC stops obvious violations of the law and performs superficial control.

Official website and available information

The Commission’s website has a simplified structure, but due to limited non-transparency, not all information is made publicly available. The website’s structure is as follows:

-

The main menu is at the top;

-

The central part has buttons for quick access to the most important information.

BVI FSC website section — Current information

-

The footer contains the regulator’s contacts and a map of the website.

BVI FSC website sections — Footer

-

About Us. This section describes the regulator’s divisions, mission, and functions, as well as offers useful links to the websites of other regulatory bodies;

-

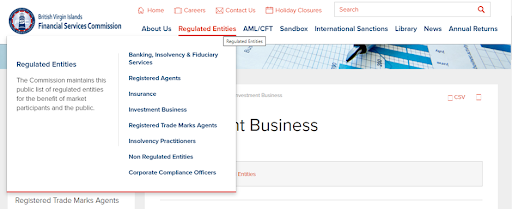

Regulated Entities. Here you can find information about legal entities registered by the Commission. Based on the type of their activity, the companies are divided into groups such as banks, insurance funds, etc. Brokers belong to investment companies;

-

AML/CFT (Anti-Money Laundering / Countering the Financing of Terrorism laws) is a section with various documents, including those describing risk management;

-

Sandbox contains regulatory documents on the interaction between “Sandbox” members who can test their financial products and services in this community;

-

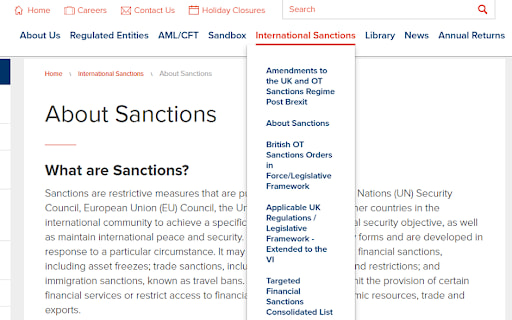

International Sanctions is a database of sanctions against legal entities and private individuals worldwide;

-

Library. Theoretical discussions, publications, laws, etc;

-

News. Current newsfeeds;

-

Annual Returns. A guide for brokers on how to submit annual documents for review.

Main sections of the upper menu:

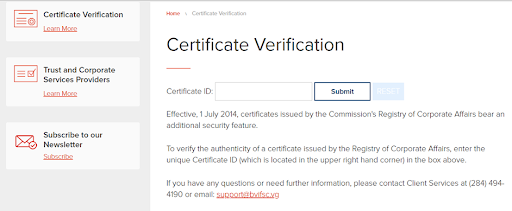

The main sections for traders are International Sanctions, Regulated Entities, and Certificate Verification.

In International Sanctions, you can find a list of sanctioned brokers.

BVI FSC website sections — Sanctioned brokers list

The Regulated Entities section features the regulator’s licensees.

BVI FSC website sections — Licensed brokers list

Certificate Verification is most likely for searching for valid licenses. But somehow, the Site Map doesn’t work. And to search for a license in the search box, you have to enter a certificate ID. But it’s unknown where to get a broker’s certificate ID if you only have a license number.

BVI FSC website sections — Searching for a brokerage license

How to confirm a broker’s license on the BVI FSC website

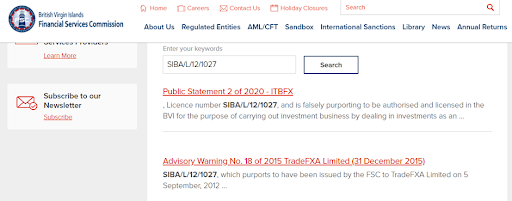

Searching for a license on the Commission’s website is complicated and inconvenient. Entering a license number in the search box on the homepage gives you nothing. You either get no information or links to publications from previous years where this license is mentioned.

BVI FSC Review — Brokerage license number

On their websites, some brokers create links to their licenses that take you to the “Regulated Entities/Investment Business” section of the Commission’s website. But license numbers are not there, either. An alternative option is to address the regulator directly.

How to confirm a broker’s license on the BVI FSC website:

-

1

On the broker’s website, find its license number and legal name in the British Virgin Islands jurisdiction;

BVI FSC Review — License details on a broker’s website

-

2

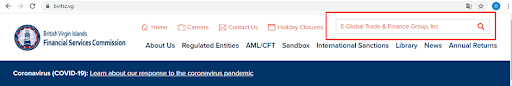

On the BVI FSC website’s homepage, enter the broker’s full name in the search box;

BVI FSC Review — Searching for a license

-

3

Analyze the search results.

BVI FSC Review — Scrutinize the search results

In this case, the regulator confirms that the broker is registered and holds a valid license, but the license number is not included. One way to finally make sure that the broker is indeed a licensee of the BVI FSC is to contact the regulator’s support service.

BVI FSC’s basic requirements for brokers

Basic requirements to obtain a license:

-

Comply with the requirements. Having obtained a license, a broker must keep its registered capital at a set level and meet liquidity requirements and other criteria;

-

Open an account at a reliable bank. The list of accredited banks is revised and may change;

-

Pass an external audit every year. A broker submits an auditor’s report to the Commission, based on which the BVI FSC prepares recommendations;

-

Disclose the risk management system;

-

Disclose information about the management team;

-

Get professional liability insurance.

All holders of BVI FSC licenses must meet the above requirements. A license guarantees that a broker has sufficient proprietary funds to provide brokerage services and fulfill clients’ financial demands.

BVI FSC license | Pros and cons

Many people take a BVI FSC license for granted. Due to low taxes, the British Virgin Islands are deemed one of the most attractive jurisdictions for registration. The Commission’s staff cannot constantly supervise the massive number of licensees. Therefore, its task comes down to superficial monitoring that identifies fraudulent companies and allows the regulator to ferret out obvious violations and take timely remedial action. The Commission also tries to promptly respond to traders’ complaints.

👍 Main advantages of trading with a BVI FSC-licensed broker

• Confirmation of the broker’s legal status. A license confirms that the broker has passed an independent investigation; that it indeed exists, and operates within the legal framework of its jurisdiction under the regulator’s control;

• Help in resolving disputes. The regulator considers individual complaints and tries to reply when it can. Sometimes this can be a strong argument in favor of the trader;

• Timely warnings. If periodic inspections reveal violations, the regulator can issue a written warning that will be published on the BVI FSC website. If the broker has a problem, traders will learn about it from the regulator’s publications before they encounter that problem themselves.

A license from the BVI FSC gives traders confidence that they are dealing with a legitimate broker, not a phishing startup or a one-day company. On a separate request, a trader can compare the broker's details included on its website to the official information in the Commission's database.

👎 Main disadvantages of trading with a BVI FSC-licensed broker

• Superficial control. The Commission does not conduct in-depth inspections and mostly uses information from open sources;

• Brokers need not disclose information in full. The jurisdiction’s legislation does not oblige brokers to disclose full financial statements. The regulator does not check on brokers’ transactions or internal document circulation;

• Fewer powers outside of the jurisdiction. Although the BVI FSC and the FCA operate under UK laws, the FCA’s international powers are broader. This may be a negative aspect for a separate category of traders;

• No compensation fund in case a broker goes bankrupt.

For traders, a license from the BVI FSC is a reassuring factor. But in terms of checking and control, the Commission is inferior to European regulators. Therefore, a trader should not expect that the regulator will always take his side in a conflict of interest or will be able to prevent a potential problem.

BVI FSC’s jurisdiction

A license granted by the Commission only covers the British Virgin Islands. Although the Islands abide by British laws, brokers need an FCA license to operate in the UK. The BVI FSC does not require having an office in the jurisdiction; legal registration is sufficient. BVI FSC-licensed brokers provide the same services to both residents and non-residents on the condition that the law of a non-resident’s country is not violated. For example, BVI FSC-licensed brokers cannot operate in the USA and several Asian countries without licenses from local regulators.

Submission and consideration of complaints

Information on the BVI FSC website is mostly introductory. You can find theoretical and legal content that explains the interaction between participants in financial markets. However, there is no complaint submission form. Therefore, TU recommends writing complaints in a free form that includes the following information:

-

1

In the subject:

-

The word “complaint” and the name of the broker.

-

-

2

In the body:

-

Essence of the complaint with a date of every event and a reference to every clause of the agreement that was violated by the broker;

-

Screenshots proving that you deposited funds;

-

Screenshots confirming the violation;

-

Screenshots of your conversations with the broker;

-

Screenshots of the offer and client agreement.

-

Before you send the letter, enable read notification. Send a copy of the letter to the broker (sometimes this helps to settle the issue quicker).

BVI FSC-licensed brokers | How to check on a broker

To be able to operate in as many jurisdictions as possible and to attract as many clients as possible, brokers can acquire several licenses. It allows them to increase profits and confirms that they are reliable partners. Every month, TU’s analysts check if the licenses are still valid and monitor regulators’ websites for warnings or fines. All information is updated monthly in the brokers’ rating section.

Expert’s assessment

The BVI FSC is a typical offshore regulator that has all the merits and demerits common to that group. There are several reasons why this jurisdiction is one of the most popular for brokers: optimal taxation system, no strict controls, full information disclosure is not required, etc. Technically, there is a license, but, compared to the requirements of European regulators, it imposes almost no obligations.

A license of the BVI FSC is of little help to a trader. First, based on its non-disclosure principle, the Commission does not share information about its licensees. You cannot find even the brokers’ primary statements on the BVI FSC website. There is only information about sanctions and fines. Second, a compensation fund in case a broker becomes bankrupt is not available. Third, the regulator does not perform unscheduled inspections or online control of transactions.

Conclusion

A license from the BVI FSC is convenient for brokers as it almost doesn’t obligate them to anything. For traders, this is better than nothing, but they shouldn’t really count on the regulator’s help. Although the BVI FSC may wish to consider each trader’s complaint individually, it only has a few dozen full-time employees who can’t thoroughly investigate every complaint. But it’s worth admitting that even superficial control allows the BVI FSC to sift out many fraudulent startups.

FAQs

What is the BVI FSC?

The British Virgin Islands Financial Services Commission (BVI FSC) is a state regulator that issues licenses to companies registered in the Islands and controls their operation. A license means that a broker meets certain basic requirements such as minimum registered capital and its financial statements are audited every year.

What do I get from trading with BVI FSC-licensed Forex brokers?

-

1

Help in resolving disputes with brokers.

-

2

Free advice on legal issues and risk optimization.

-

3

A guarantee that a broker is an officially registered legal entity.

If a broker is on the regulator’s blacklist, you should not trade with it.

How to check if a broker holds a BVI FSC license?

Two options:

-

1

On the Commission’s website, enter the broker’s full legal name in the search box and analyze the results. The only information the BVI FSC makes publicly available is whether a license is valid or not. Its number and other details are not included.

-

2

Confirm the availability of a valid brokerage license on the Traders Union website. An advantage of this option is that TU provides information on all valid licenses, so you don't need to visit every regulator’s website.

How to submit a complaint to the BVI FSC against a broker?

-

1

Write a free-form letter to the regulator. Advantage: no strict requirements for the submission of complaints. Disadvantage: the regulator may consider the complaint for over a week and take the broker’s side.

-

2

Contact TU’s legal department.

Advantages:

-

Consultations are free for every TU member. Membership in TU is also free.

-

TU defends traders’ interests.

Disadvantages: none.

-

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

4

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).