FSA | Financial Regulator Of Seychelles

The Seychelles Financial Services Authority (FSA) is a government regulator that inspects license applicants and superficially oversees their operation. The FSA has mild registration conditions and considers private investors’ complaints pro forma.

In most cases, a regulator is a government organization that grants licenses to financial market participants, ensures that they abide by local and international laws, and settles disputes between legal entities and their clients.

For a broker, holding a license means:

-

The necessity to disclose information. Before issuing a license, the regulator checks the broker’s founding documents and financial statements and confirms the sufficiency of registered capital. In some cases, the regulator may require the broker’s executives to confirm their qualifications and disclose the company’s organizational structure and risk management system.

-

The possibility to legally render services to non-residents on the condition that the laws of their respective countries are observed.

Potential traders primarily want to make sure that the broker is not fraudulent and will not obstruct money withdrawal. A license testifies that the broker’s founding documents were checked, its financial statements are inspected annually, and the broker goes through independent audits. The broker’s reliability is determined by its regulator’s trustworthiness.

This review explores the FSA’s functions, procedure for confirming licenses on the website, and procedure for filing complaints, as well as reviews and an expert’s opinion of this regulator.

Description and functions of the FSA Seychelles

The Seychelles Financial Services Authority is a government regulator that supervises financial sectors related to asset management and confidential management, as well as insurance and gambling sectors. The Authority’s licensees are brokers, dealers, market makers, and investment funds.

The FSA’s mission and objectives in the Forex market

-

Create favorable conditions for the growth and development of the Seychelles financial services industry in accordance with the national economic development strategy and in strict compliance with local and international standards.

-

Uphold the jurisdiction’s investment attractiveness.

-

Keep a licensee database and inform market participants.

Seychelles is an offshore jurisdiction that attracts brokers with mild license acquisition requirements and simplified taxation. The FSA is an auxiliary body in the Seychelles regulatory system headed by the Central Bank.

To obtain an FSA license, a broker has to

-

Open an office in Seychelles.

-

Have registered capital of 150,000-250,000 Seychelles rupees (up to $20,000), depending on license type.

-

Open a bank account in Seychelles.

The FSA is lenient to licensees. The Authority’s website does not mention client account segregation or mandatory external audits. If a license is canceled for some reason, the broker can renew it after paying a fine.

Official website of the FSA Seychelles and available information

The FSA website provides general information. Here, you can find local laws; statutory acts that regulate local and international economic relations; and general recommendations and advice to investors. The website is of no use if you want to find blacklisted brokers or confirm a broker’s license.

Overview of the FSA website:

-

Main and additional menus at the top. In the additional menu, you can see the regulator’s contact info and read the news. The news section is rarely updated. On average, the website posts 3-6 articles per year.

-

Regulatory Updates. Alerts, notices, surveys, etc.

-

Quick Links to license application forms; rules for the preparation of license acquisition documents; licensing and registration fees; categories of regulated entities (capital markets, insurance, gambling, etc.); and frequently asked questions.

-

Information section. Complaint handling, publications, access to information, regulated entities, etc.

-

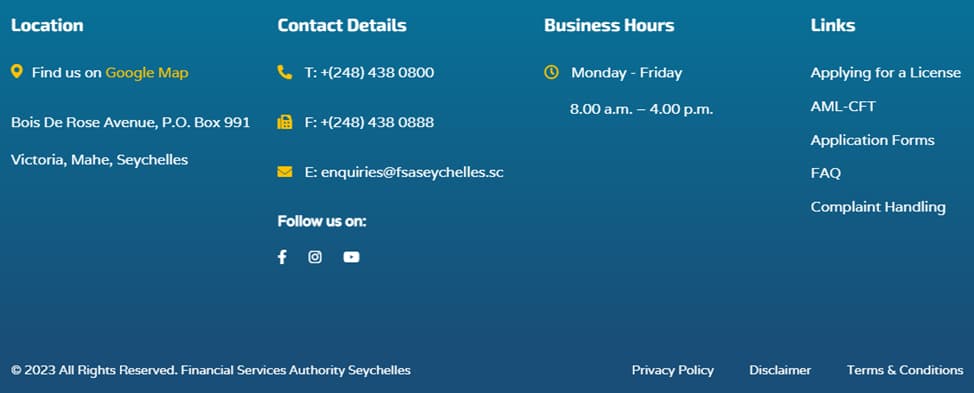

Footer. Contact details and social media profiles. “FAQ” and “Complaint Handling” are the sections that interest traders.

FSA Website Sections

FSA Website

FSA Website

FSA Website

FSA Website Sections

For a broker, holding a license means:

-

About. The regulator’s mission, strategic development, organizational structure, services, and executives.

-

Legal Framework. General legislation of the jurisdiction’s financial sector.

-

Enforcement. Statutory acts that regulate the interaction between the Authority and its licensees.

-

Regulated Entities. Categories and lists.

-

Applying for a License.

-

AML-CFT. Anti-Money Laundering and Countering the Financing of Terrorism.

-

Media Corner. Reports, newsletters, regulatory updates, press releases, and FAQs.

The following sections may interest traders the most:

-

FAQ (footer). Answers to the most frequently asked questions about licenses, insurance, gambling sectors, databases, etc.

-

Complaint Handling (information section and footer). A complaint filing form.

-

Regulated Entities (main menu at the top and information section).

How to confirm a broker’s license on the FSA website

The FSA Seychelles is an offshore regulator that is more interested in protecting licensees than their clients. That is why the FSA website provides very few details about brokers.

To confirm a broker’s license on the FSA website, do the following:

-

1

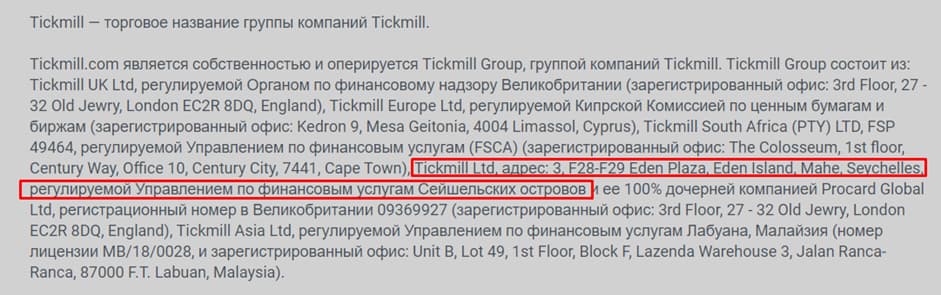

On the broker’s website, find information that the company is registered in the Authority’s jurisdiction. In most cases, this is indicated in the website’s footer. Pay attention to the name of the broker’s branch office registered in Seychelles. It may differ from the company’s primary name included in your client agreement/offer.

-

2

On the FSA website’s homepage, go to “Regulated Entities” and select “Capital Markets”.

-

3

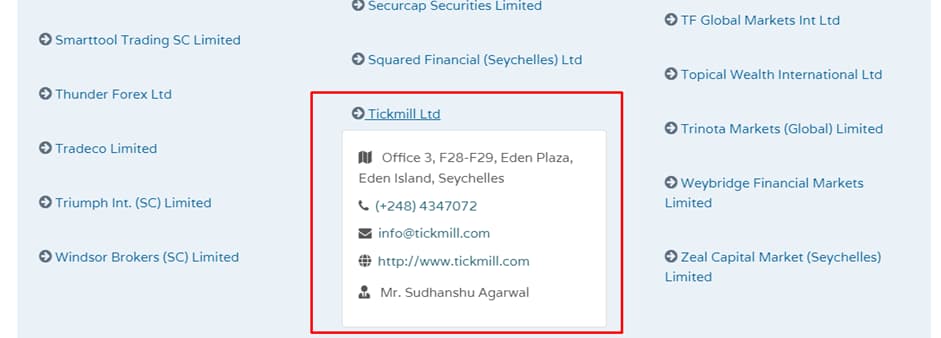

Find the broker alphabetically. In this case, the broker was found in the “Securities Dealer” tab.

Screenshots from broker’s website.

Screenshots from broker’s website.

Screenshots from broker’s website.

Here is all the available information about the broker:

FSA Website

Apparently, the broker’s presence on the list means that it holds a valid license. However, it is unknown which services the broker is permitted to render, whether the license has a number, when the license expires, etc. All a trader can do is compare the broker’s name and address to the details on its official website.

The regulator offers to contact it individually through a written request to get detailed information about a broker’s license.

FSA Website

FSA’s basic requirements for brokers

Basic requirements to obtain a license:

-

Provide necessary documents, including financial statements.

-

Confirm the availability of the minimum registered capital.

-

Comply with local laws.

The regulator only reacts to evident, serious violations and discloses information about licensees only on individual requests.

FSA license | Pros and cons

In terms of taxation, Seychelles is a very favorable jurisdiction for brokers. The regulator does not monitor money turnover or ask too many questions. Considering the lenient requirements for registered capital and information disclosure, any company can buy a license. So, the fact that a company is licensed hardly signifies that it’s reliable.

👍 Advantages of trading with an FSA-licensed broker

• Traders can learn about new fraud schemes from notices periodically published on the regulator’s website.

An FSA license is interesting for brokers, but cannot help traders much. Complaints are considered superficially and the Authority does not have leverage over offenders.

👎 Disadvantages of trading with an FSA-licensed broker

• An FSA license does not meet the European standards for financial supervision.

• No information about brokers or their licenses.

• No clear procedure for complaint consideration.

• No compensation fund.

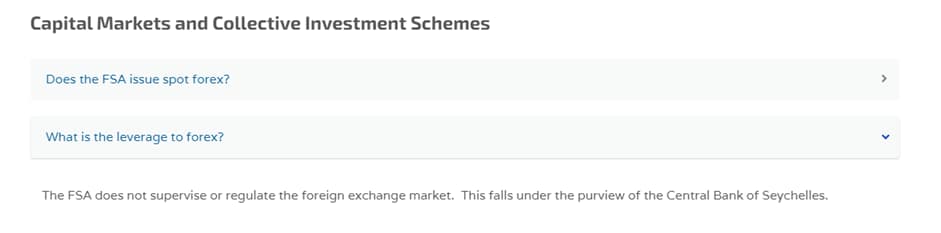

• Currency trading is not regulated.

For a trader, an FSA license only means that if a broker commits a serious violation, information about it will be posted on the Authority’s website. There is no use counting on any help from the regulator in considering claims for small financial losses or complaints about violations of the user agreement by a broker. The most you can do is file a completed complaint form with the FSA and the Fair Trading Commission (FTC). But practice shows that you will receive only a formal response at best.

FSA’s jurisdiction

The FSA Seychelles is an independent government regulator serving as an auxiliary supervisory body for the Central Bank of Seychelles. A license can be granted to almost any company. Entities can register remotely and obtain legal addresses in the jurisdiction. For both residents and non-residents of Seychelles, a license means practically nothing. Brokers can render services even without an FSA license if laws of non-residents’ countries are not violated. In particular, an FSA license is not accepted in the USA and a number of European countries.

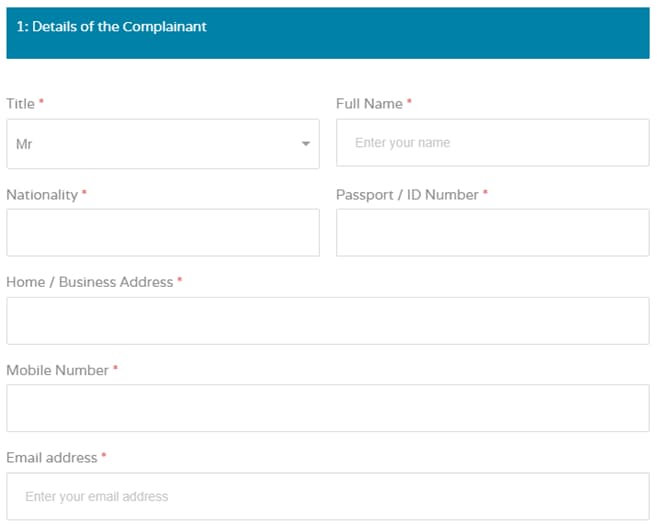

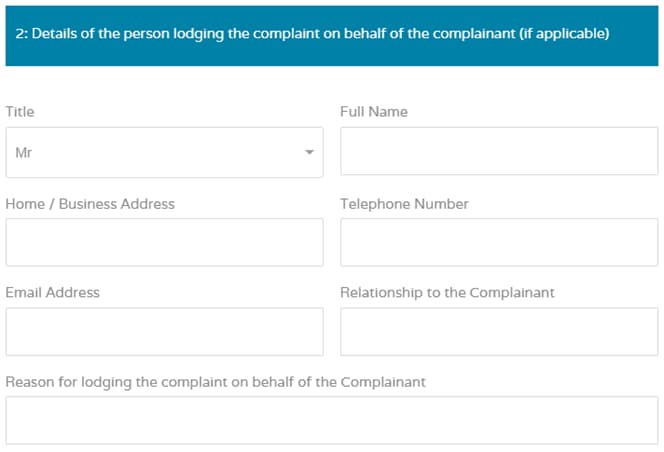

Submission and consideration of complaints

-

1

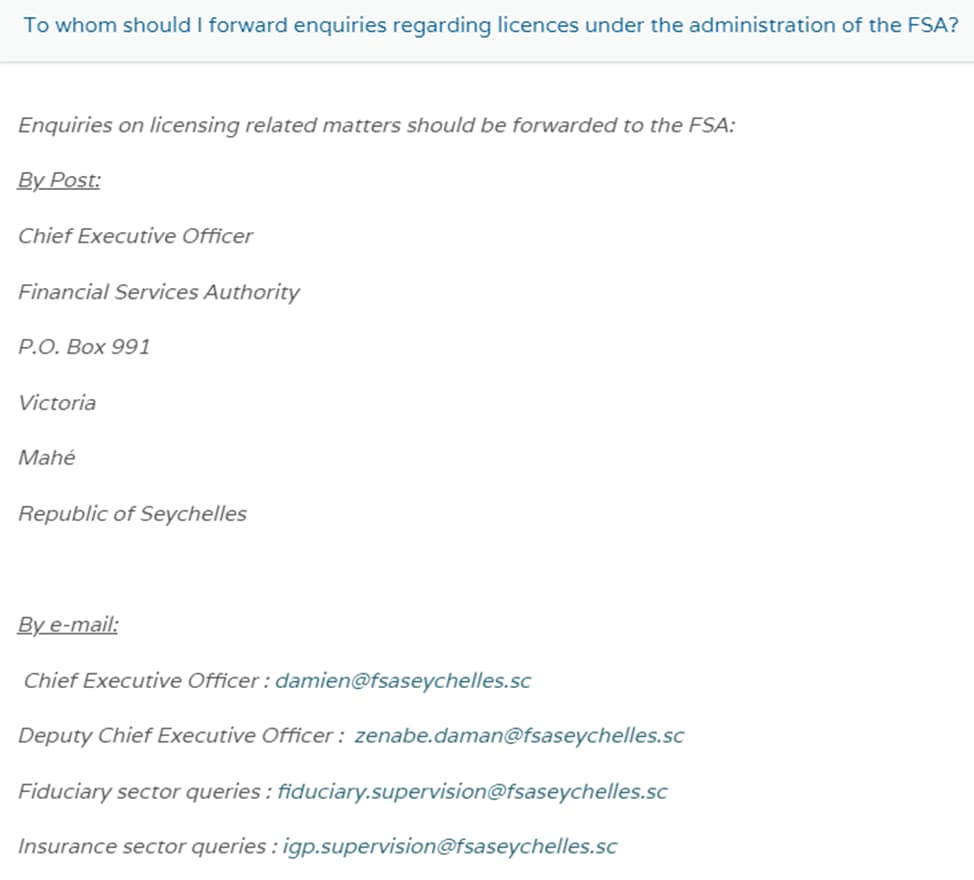

Go to “Complaint Handling” in the information section or footer.

-

2

Complete the Complaint Handling Form.

Screenshots from broker’s website.

Screenshots from broker’s website.

Screenshots from broker’s website.

FSA-licensed brokers | How to check on a broker

This section provides relevant information about valid licenses and certificates held by brokers, including registration with compensation funds and self-regulatory organizations. Every month, Traders Union analysts view regulators’ websites and update the following information:

-

Valid licenses held by brokers and all their subsidiaries.

-

Types of activities permitted by licenses.

-

Violations, warnings, and fines.

-

Information that can have an impact on brokers’ reputation.

You don’t need to look through regulators’ websites every day. Save your time by getting relevant information about brokers’ licenses on the TU website.

Expert’s assessment

After getting familiar with the FSA Seychelles, you are left with more questions than answers. In theory, the Authority issues licenses for rendering three types of services:

-

International corporate services.

-

International confidential management services.

-

Services related to funds.

In practice, this invites many questions:

-

Why doesn’t the regulator’s website disclose public information about licensees?

-

Where is this license accepted? For example, brokers with a license from Malta or Cyprus can operate legally in Europe. Brokers with an FSA Seychelles license must abide by MiFID II (Markets in Financial Instruments Directive). But trading conditions offered to some brokers contravene the Directive.

The Seychelles jurisdiction attracts brokers with simplified taxation. Account segregation is not required and the minimum registered capital is up to 250,000 Seychelles rupees (almost $20,000). Although the FSA is a government regulator, it has no leverage over offenders. If a broker is liquidated, it can pay a fine and renew the license. Offenders are not blacklisted.

There is one more thing traders should know:

Screenshots from broker’s website.

Does the regulator count currency CFD trading as Forex and currency transactions? If it does, then what does an FSA license have to do with Forex brokers? If it doesn’t, then how can you explain the fact that Forex brokers offer access to trading specifically CFDs and not currencies? And who should license brokers in that case? A trader who is planning to cooperate with an FSA-licensed broker should ask the regulator all these questions.

Conclusion

An FSA Seychelles license makes no difference for a trader because the Authority does not consider complaints and only provides license details on individual requests. Also, FSA-licensed brokers should not be expected to follow the European rules for CFD trading. The only alternative is to trade with a broker that holds several licenses from different regulators.

About the author of this review

Oleg Tkachenko, author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 proprietary trading strategies. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is the FSA Seychelles?

The Seychelles Financial Services Authority (FSA) is a government regulator that inspects license applicants and superficially oversees their operation. The FSA has mild registration conditions and considers private investors’ complaints pro forma.

What do I get from trading with FSA-licensed Forex brokers?

For a trader, a Seychelles license doesn’t change anything. It is not adapted to the European requirements of MiFID II, the FSA has a mediocre approach to the regulation of currency transactions, and traders are advised to submit complaints to the FTC. Legal registration of brokers doesn’t mean anything either: the required registered capital is up to $20,000, revoked licenses can be reinstated, and there are no blacklists.

How to check if a broker holds an FSA Seychelles license?

Two options:

-

1

On the FSA website’s homepage, go to “Regulated Entities”, select “Capital Markets”, and look for the broker by category. If you find it, the license can be deemed active.

-

2

On the Traders Union website, open the broker’s card and view all active licenses held by the company and its subsidiaries.

The second option is advantageous in that TU analysts have already looked through all regulators’ websites, contacted their support teams if anything needed to be clarified, and updated information on the TU website. This way, you save time.

How to submit a complaint against a broker to the FSA?

-

1

Complete the complaint form in the “Complaint Handling” section of the regulator’s website. You can also write to the FTC.

-

2

Register on the TU website for free. Every TU member has the right to free legal assistance in resolving disputes with brokers.

The second option is better in terms of consideration time and results. The FSA Seychelles protects licensees’ interests and Traders Union protects traders’ interests.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.