6 Best International Brokers To Trade In Global Markets

Best International Broker To Trade In Global Markets — SaxoBank

Top International Brokers:

-

Saxo Bank - Best for Stocks and Forex Traders

-

eToro - Best international broker for beginners

-

Degiro - Best for the EU

-

Interactive Brokers - Best Overall Stock Broker

-

TradeStation - Best in User Friendliness

Nowadays, it’s important to be smart with your money. If you have extra cash, investing it is always a good idea. This allows it to grow and even double in value, instead of collecting dust in your bank account somewhere.

In today’s article, we’ll be discussing an opportunity that not too many new traders are aware of - the global market - which allows you to grow your portfolio in only a short time.

We’ll help you identify the international stock broker that matches your needs by evaluating six candidates based on their international market access, worldwide network, trading assets, web and mobile applications, and functionality.

-

What documents are needed for account opening with international brokers?

Basic KYC documents like passport/ID proof, address proof, income proof, bank statement, sometimes questionnaire. Requirements vary by broker and country.

-

Can US citizens trade via foreign brokers?

Yes, but comply with FATCA. Brokers must share account info with the IRS if a US citizen/green card holder uses them.

-

Which country has the lowest broker fees?

Brokers based in the EU like Degiro and Europe generally have lower fees compared to US due to regulations

-

Can I trade US stocks being an international trader?

Yes, all top brokers reviewed in the article provide access to the US market. But taxes may apply depending on the country of residence.

Top 6 International Brokers

| Stock Broker | Award | Overall Rating |

|---|---|---|

|

Best Forex Trader |

5 out of 5 |

|

Best international broker for beginners |

5 out of 5 |

|

Best for the EU |

5 out of 5 |

|

Best Overall Stock Broker |

5 out of 5 |

|

Best in User Friendliness |

4.0 out of 5 |

|

Best in Customer Service |

4.0 out of 5 |

Saxo Bank - Best for Stocks and Forex Traders

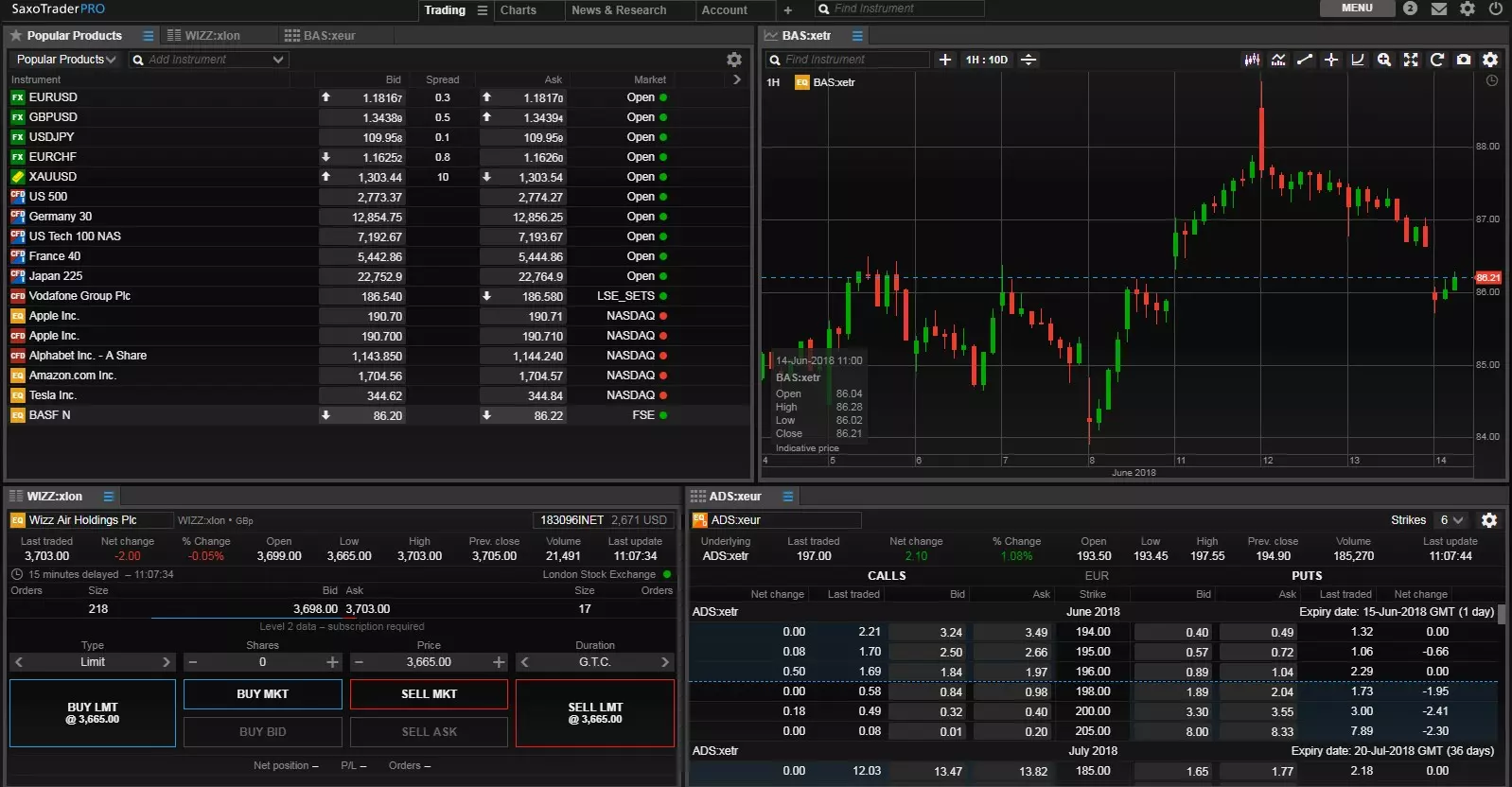

Saxo Bank platform

Another firm that was established in Europe is Saxo Bank, formerly known as Midas Fondsmæglerselskab. This was their name until 1992, right before receiving their banking license. Although ironically, they don’t offer any conventional banking products, instead operating purely as an online brokerage.

Even though they offer a pretty broad portfolio, Saxo Bank is one of the best platforms for forex trading. Since the foreign exchange market can be quite volatile, they lessen the risk by providing well-researched analyses and predictions based on key market trends.

Moreover, their fees are low, and boast of the highest currency pair ranking among international stock brokers.

Saxo Bank offers stock traders a highly competitive and well-rounded solution due to its powerful and customizable SaxoTraderGo online platform filled with technical analysis and research tools, access to numerous global exchanges allowing diversification among companies worldwide, ability to also trade other assets like ETFs, forex and futures from one integrated account.

eToro - best international broker for beginners

If you're looking for an advanced trading experience with access to over 3,000 different assets such as CFDs, Forex, and exchange-traded securities, then you should consider eToro. This broker is one of the world's largest trading platforms, with users in over 140 countries around the world. As of March 2022, they had 27 million users and 2.4 million funded accounts.

eToro is an excellent choice for investors looking for a comprehensive and secure trading platform. It offers the largest social trading platform in the industry, as well as top-notch mobile capabilities and security features. Cash assets are held in Federal Deposit Insurance Corp (FDIC)-insured bank accounts up to $250,000, and no fees for stock, ETF, and options trading.

eToro comes with robust regulatory compliance and multiple licenses, with authorization and regulation by the Financial Conduct Authority (FCA), Cyprus Securities Exchange Commission (CySEC), Australian Securities & Investments Commission (ASIC), Financial Services Authority Seychelles (FSAS), and Financial Crimes Enforcement Network (FinCEN), assuring traders that all operations are undertaken in accordance to applicable regulations. The broker is popular due to its expansive market offerings, including more than 50 top currency pairs and more than 70 crypto options.

| Number of supported countries | Supported international markets | International regulations |

|---|---|---|

| 140 countries | USA 2 | FCA - UK |

| UK 1 | CySEC - Cyprus | |

| China 1 | FSAS - Seychelles | |

| Canada 1 | FinCEN - USA | |

| Europe 1 | ASIC - Australia |

👍 Pros

•Advanced copy trading platform

•Free US Stocks and ETFs trading

•Tight Forex spreads

•70+ supported crypto coins

•Communal experience

•Comprehensive educational resources

👎 Cons

•Inactivity fees

Degiro - Best for EU

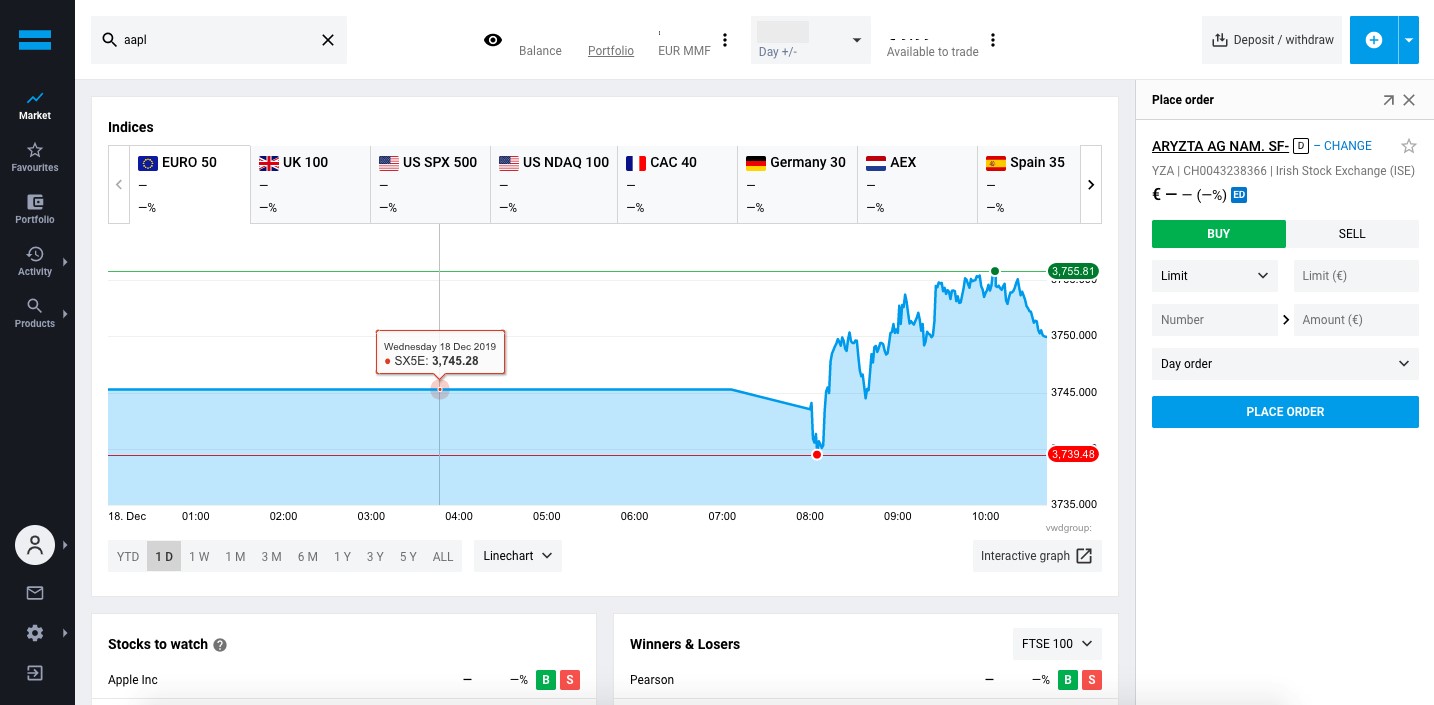

Degiro platform

Founded in 2008, DEGIRO has quickly grown to become one of the biggest brokers in Europe. What makes DEGIRO so sought-after amongst investors is their combination of a comprehensive and user-friendly platform with low trading fees. Currently, they boast over two million customers from 20 countries around the world, which speaks volumes about their quality services and competitive pricing structures.

DEGIRO is a reliable trading platform regulated by The Financial Conduct Authority (United Kingdom), Federal Financial Supervisory Authority (Germany), and the Financial Markets Authority (Netherlands). As the largest execution-only brokerage firm in the region, it provides nine base currencies and a selection of crypto trackers and ETFs. Note that DEGIRO does not provide direct crypto trading services but rather crypto trackers aimed at tracking blockchain-related indices - albeit indirectly - instead of cryptocurrencies themselves.

| Number of supported countries | Supported international markets | International regulations |

|---|---|---|

| 20 countries | USA 4 | FCA - UK |

| UK 2 | FFSA - Germany | |

| Europe 3 | FMA - Netherlands | |

| Australia 1 | ||

| Japan 1 | ||

| Canada 2 | ||

| others |

👍 Pros

•Extremely low fees

•Easy-to-use mobile app

👎 Cons

•Cryptocurrencies not available

•Not accessible in most countries

•Limited currencies

•Lack of US ETFs

Interactive Brokers - Best Overall

Interactive Brokers platform

Interactive Brokers is a one-stop shop for international investors, offering the ability to trade on 150 global markets in 26 currencies and four cryptocurrencies. From stocks and options to futures, bonds, currencies, and more, IB provides a comprehensive platform at an affordable cost - clients enjoy commission-free trading on US stocks and low commissions across other products.

What's more, Interactive Brokers doesn't impose any extra spreads or trading fees, making it an ideal choice for those seeking good value and superior services. This broker has over two million client accounts across 200 countries and territories.

Interactive Brokers is a well-regulated platform recognized by prominent financial organizations in the United States, including Financial Industry Regulatory Authority (FINRA) and US Securities and Exchange Commission (SEC). It's also a Securities Investor Protection Corporation (SIPC) member.

Interactive Brokers is also regulated by the Australian Securities and Investments Commission (ASIC), Financial Conduct Authority (FCA), Central Bank of Hungary, Investment Regulatory Organization of Canada(IIROC), Monetary Authority of Singapore, and the Hong Kong Securities and Futures Commission, making it one of the safest trading platforms available.

| Number of supported countries | Supported international markets | International regulations |

|---|---|---|

| Over 200 countries | USA 57 | ASIC - Australia |

| Germany 10 | FCA - UK | |

| UK 9 | CBH - Hungary | |

| Canada 7 | MAS - Singapore | |

| Belgium 5 | HKSFC - Hong Kong | |

| Hong Kong 5 | IIROC - Canada | |

| Japan 5 | ||

| France 6 | ||

| Australia 4 | ||

| Mexico 2 | ||

| others |

👍 Pros

•Huge investment selection

•Great research tools

•Low trading fees

👎 Cons

•The website is difficult to navigate

•Complex account opening process

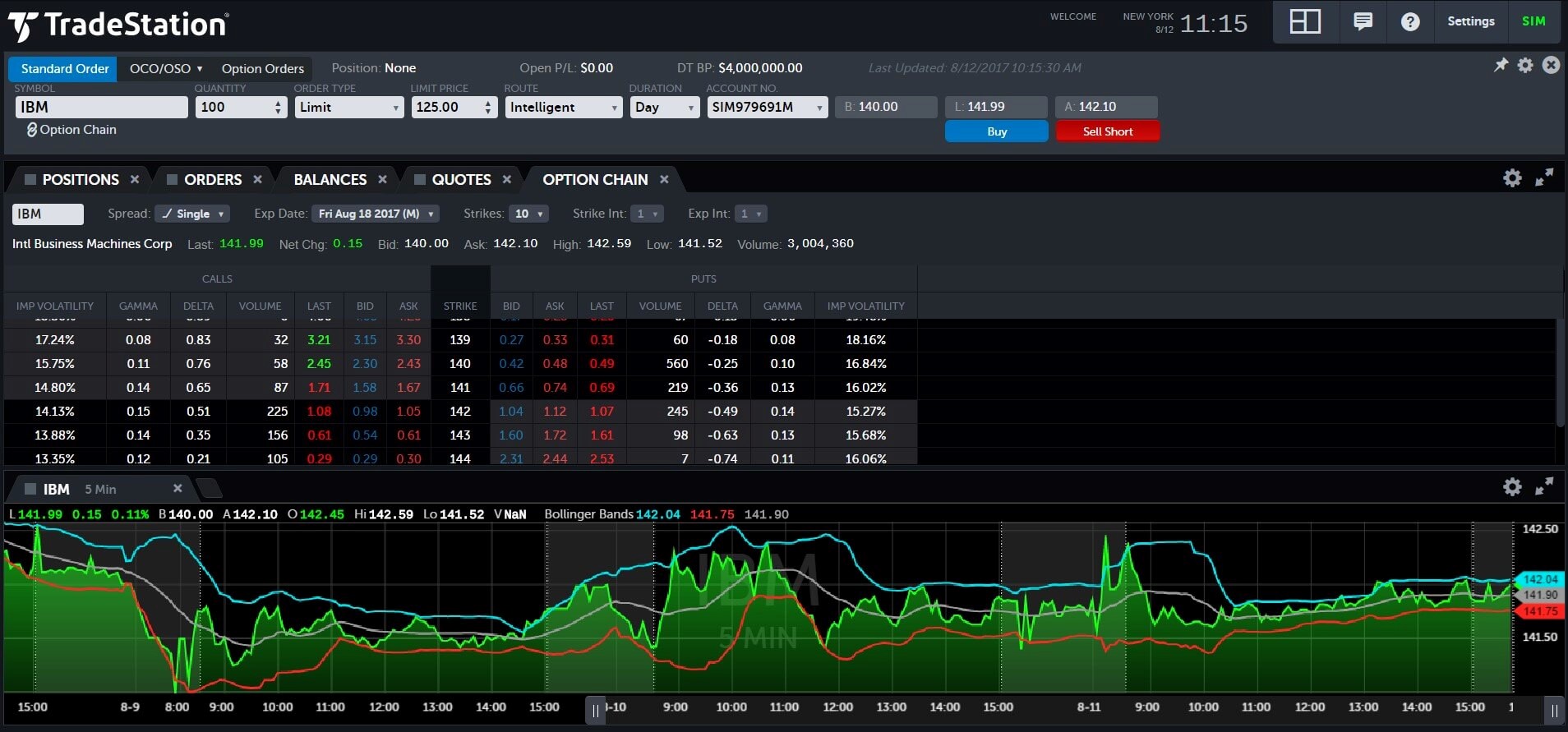

TradeStation - Best in User Friendliness

TradeStation platform

Trading stocks and other assets can be quite overwhelming, especially for newbies.

TradeStation, set up by brothers William and Rafael Cruz way back in 1982, was originally known as Omega Research. Their primary objective, even until today, is to provide beginners a simpler way to understand data through charts and test out their ideas before actually trading. In 2001, the company officially transitioned from a software company to an international brokerage, into who we know them today.

Besides that feature, TradeStation’s different mobile and web-based platforms look neat and are easy to understand. So even users without any prior experience can navigate through them fairly easily.

TD Ameritrade - Best in Customer Service

TD Ameritrade platform

This brokerage is probably the longest-tenured on our list. TD Ameritrade was originally founded as Ameritrade way back in 1971, before agreeing to handle the US-based operations of TD Waterhouse just fifteen years ago. Currently, the company handles assets valued at approximately 1.3-trillion dollars.

Like its American counterpart, Interactive Brokers LLC, TD Ameritrade also has a wide portfolio of products including stocks, futures, margin lending, mutual funds, and even the riskier options like forex and cryptocurrency. Unfortunately, their services are largely limited to the United States of America.

Serving a specified market, though, has allowed them to provide top-notch customer service. Their support team attends to inquiries very quickly, and are available round-the-clock, which is great news for beginners.

International Brokers - Key Takeaways

Now that we’ve learned a bit about each one, let’s dive into more information, shall we?

An international broker’s area of operations is important because it allows you to maximize the platform further. Whether or not you plan on expanding outside the United States is a key factor to consider, too. Whichever the case, here’s a comparison table of each one’s reach.

| Broker | Minimum Deposit | Regulated In | Total Number of Supported Countries | Total Number of Markets |

|---|---|---|---|---|

|

$1 |

Hong Kong, Australia, India, Japan, France, Italy, Denmark, Switzerland, and the United Kingdom |

180 countries |

21 global exchanges in 13 markets |

|

$10 |

USA, UK, Cyprus (EU), Australia, Seychelles, Gibraltar |

140+ countries |

20+ |

|

$0 |

Germany |

19 countries |

50 global exchanges across 30 countries |

|

$0 |

USA, Ireland, United Kingdom, Luxembourg, Hong Kong, Singapore, Japan, Canada, Australia, India, and Hungary |

200+ countries |

135 across 30+ countries |

|

$0 |

United States |

156 countries |

1 market |

|

$0 |

United States |

2 countries |

1 market |

If you’ll see, the top 6 international brokers are split right down the middle in terms of availability. On one hand, you can trade using Interactive Brokers, Degiro, and Saxo Bank in multiple markets outside the United States. Those platforms might be better suited for experienced individuals, or those looking to penetrate a particular region like Asia or Europe.

Alternatively, TradeStation, TD Ameritrade, and Tastyworks covers only the US, which isn’t a big problem since it’s arguably the biggest market, anyway. Still, people from other countries (see the full list below) can sign up and trade assets.

In any case, the first step is always to identify what market - whether internationally or locally - you would like to prioritize. Identifying that should give a better idea of which among the firms mentioned above best fits your needs.

International Brokers - A Comparison Table

Let’s continue comparing each one based on the types of products they offer, fees, methods for deposit and withdrawal, and overall user-friendliness. Again, we hope this gives you a better idea of which one is a more seamless fit for you.

Products Comparison

Know what assets are available for trading on each platform. Each brokerage likewise has certain products it specializes in, so together, let’s see how they measure up with each other.

| Saxo Bank | eToro | Degiro | Interactive Brokers | Trade Station | TD Ameritrade | |

|---|---|---|---|---|---|---|

|

Stocks |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

ETFs |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Options |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Forex |

Yes |

Yes |

No |

Yes |

No |

Yes |

|

Bonds |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Mutual Funds |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Crypto |

Yes |

Yes |

No |

Yes |

Yes |

Yes |

|

CFDs |

Yes |

eToro crypto |

No |

Yes |

No |

Yes |

|

Passive Income Options |

Yes |

$5 |

Yes |

Yes |

Yes |

Yes |

Stocks, ETFs, and Options are perhaps the assets that are most commonly traded and easiest to understand. More people have a deeper knowledge of market trends and thus, can predict outcomes more accurately. Forex, Crypto, and CFDs - to name a few - are quite volatile. They may bring larger returns, but also pose a substantial amount of risk. It takes a real expert to analyze them properly.

For beginners, we would recommend focusing on the first set of products, at least to accumulate enough experience. It is only then that you can move on to more challenging endeavors.

Fees Comparison

In order to earn a profit, it’s normal for these firms to charge a small fee. This is used to maintain the system, conduct research, and serve as their commission. Since it comes off technically as an expense for users, brokerages make it a point to remain competitive, offering charges at a lower price than similar companies.

Here’s a quick comparison of each one.

| Saxo Bank | eToro | Degiro | Interactive Brokers | Trade Station | TD Ameritrade | |

|---|---|---|---|---|---|---|

US Stocks |

$10.0 per $2,000 trade |

Free |

$0.00 |

$1.0 per $2,000 trade |

$1.0 per $2,000 trade |

$0.00 |

UK Stocks |

$11.2 per $2,000 trade |

N/A |

$2.8 per $2,000 trade |

$4.2 per $2,000 trade |

N/A |

N/A |

German Stocks |

$12.0 per $2,000 trade |

N/A |

$5.8 per $2,000 trade |

$3.6 per $2,000 trade |

N/A |

N/A |

China Stocks |

N/A |

N/A |

N/A |

0.08% of trade value |

N/A |

N/A |

US Stock Options |

$3.0 per contract |

N/A |

$0.5 per contract |

$0.65 per contract |

$1.0 per contract |

$0.65 per contract |

Futures |

$4.0 per contract |

N/A |

$0.5 per contract |

$2.5 (US), $23.8 (UK) and $9.6 (Germany) |

$0.5 per contract |

$2.25 per contract |

Forex |

$7.8 (EUR), $5.7 (GBP), and $6.2 (AUD) |

from 1 pip |

N/A |

$10.5 (EUR), $8.3 (GBP), and $8.9 (AUD) |

N/A |

$0.00 |

Crypto |

0.10% |

1% |

N/A |

0.05% |

$50 per year |

$0.00 |

As you can see, the required fees vary from company to company, and also on the assets being traded. Saxo Bank is, by far, the firm that charges the most. Probably as a banking institution, they have to comply with more requirements, which increases their overall expenses.

In a similar way, the four North American-based companies impose only a small fee for US stocks and stock options. One reason for this is they mainly focus on the local markets. Interested clients will want to consider this, too, to maximize their earnings.

Deposits and Withdrawals

The ease of moving your money around, especially to maintain flexibility. As such, having a platform with several options will be convenient not only for the user, but also when keeping track of transactions. Once again, here is a head-to-head comparison of each of the top 6 international brokers.

| Saxo Bank | eToro | Degiro | Interactive Brokers | Trade Station | TD Ameritrade | |

|---|---|---|---|---|---|---|

Wire Transfer |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Debit & Credit Cards |

No |

Yes |

No |

YES for deposit, |

No |

No |

Paypal |

No |

Yes |

No |

No |

No |

No |

Other E-Wallets |

No |

Yes |

Yes |

No |

No |

No |

Crypto Currencies |

Yes |

eToro crypto |

No |

No |

No |

No |

Withdrawal Fees |

ACH is FREE, wire transfer is $35 for Non-USA and $25 for inside |

$5 |

$0.00 |

$0.00 |

Generally free, but they charge $25 for wire transfer withdrawals |

$45 for non-US traders, and $25 for those within the country |

Wire transfers, or transactions done through an official bank account, is the most common way to withdraw and deposit funds - and it’s not surprising. Since we’re dealing with money, security is the primary priority. Of the choices, this is certainly the safest to do business through.

Withdrawal fees are almost the same across the board, too. Only TradeStation charges, but only for wire transfers. If you don’t want to pay any fee, use the platform's ACH option instead. The trade-off, I guess, is that they’re the only one offering an option for payouts through Cryptocurrency. This includes Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple.

Trading Platforms

It’s not enough to have a web application anymore. Having a mobile and desktop program will allow users to access your platform across different gadgets, even simultaneously or when in transit. You’d be surprised how many traders multi-task, and this certainly helps them.

A clean and neat layout is just as important, too, especially for first-time users. This plays a pivotal role to encourage individuals to continue using it for longer periods. Otherwise, if things are too complicated, they end up just giving up completely.

| Saxo Bank | eToro | Degiro | Interactive Brokers | Trade Station | TD Ameritrade | |

|---|---|---|---|---|---|---|

Desktop |

Yes |

Yes |

No |

Yes |

Yes |

Yes |

Mobile |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Web |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Every international brokerage firm we reviewed has a presence on the top three locations, meaning on desktop, mobile, and web programs. It’s only Degiro that lacks one, but they make up for it by really improving the other two platforms being used.

But out of all the nominees, Saxo Bank is by far the best, meaning it’s well-constructed and easy to navigate around. The programs can even be translated to different languages, which is really good because it attracts traders from all over the world.

International Brokers Profile

After comparing and contrasting each brokerage firm using different metrics, we’ll be providing a brief profile, complete with our own analysis. This will include how effective they are in an international market, the countries and markets they serve, and what we would consider as their strengths and weaknesses.

Saxo Bank

Saxo Bank is another international broker with a rich backstory. Serving clients in approximately 120 different countries has contributed to their reputation as being a reliable trader of forex. One of the few, in fact, outside the United States.

👍 Pros

• Amazingly constructed web, desktop, and mobile applications

• Very detail research tools

• Diverse product portfolio

👎 Cons

• The fees are quite high

• Customer support can still be improved further

| Full List of Countries Supported | International Markets |

|---|---|

|

Currently, their website is said to serve approximately 156 countries globally. But a recent update says only the following can create an account via TradeStation. |

1. Hong Kong |

|

2. Australia |

|

|

3. Japan |

|

|

4. Singapore |

|

|

5. United Kingdom |

|

|

6. Denmark |

|

|

7. Italy |

|

|

8. France |

|

|

9. Switzerland |

eToro

eToro is one of the top international brokers offering a wide range of services for the U.S. and international clients in 140+ countries. One of the key benefits of the broker is the world’s largest social trading platform that allows users to study the experience of successful traders and automatically copy their trades.

eToro provides access to trading U.S. stocks and ETFs at zero fees, while in the Forex market, the broker offers narrow spreads and around 50 top currency pairs for trading. eToro is an excellent choice for those who like to trade cryptocurrencies, offering more than 70 of them.

eToro is a company licensed by many respectable regulatory authorities, including in the UK, Cyprus and Australia. In the U.S., the broker is regulated by the SEC and FINRA.

👍 Pros

• Advanced copy trading platform

• Free US Stocks and ETFs trading

• Tight Forex spreads

• 70+ supported cryptocoins

👎 Cons

• There is an inactivity fee

Degiro

If you’re looking to trade in markets across Europe, Degiro would be a viable option. They are currently the largest execution-only brokerage firm in the region, currently offering its services to nineteen different countries. Not a bad place to start for beginners.

👍 Pros

• Very strong presence in Europe

• One of the lowest fees available

• Free for US clients

👎 Cons

• They don’t offer trading for forex or cryptocurrency

| Full List of Countries Supported | International Markets |

|---|---|

1. Belgium |

1. Germany (3) |

2. France |

2. United Kingdom (2) |

3. Austria |

3. Italy (2) |

4. Netherlands |

4. Singapore (1) |

5. Italy |

5. United States (1) |

6. United Kingdom |

6. Canada (2) |

7. Portugal |

And others |

8. Poland |

|

9. Greece |

|

10. Norway |

|

11. Finland |

|

12. Ireland |

|

13. Switzerland |

|

14. Germany |

|

15. Czech Republic |

|

16. Spain |

|

17. Denmark |

|

18. Hungary |

|

19. Sweden |

Interactive Brokers

Although based in the United States, Interactive Brokers possess a wide network spanning several countries worldwide. During a period spanning nearly fifty years, they’ve built a strong reputation for being credible by typing up with various financial authorities. Among the aforementioned firms, they also boast of the most complete portfolio that investors can take advantage of.

👍 Pros

• Great for users who are considering to trade assets globally

• Wide product offerings

• Affordable fees

• Very good track record

👎 Cons

• Limited options for deposit and withdrawal of funds

• Platforms can still be improve

| Full List of Countries Supported | International Markets |

|---|---|

1. Australia |

1. United States of America (56) |

2. Argentina |

2. Canada (7) |

3. Canada |

3. Mexico (2) |

4. China |

4. Austria (1) |

5. Jordan |

5. Belgium (5) |

6. Poland |

6. Germany (10) |

7. Russian Federation |

7. United Kingdom (9) |

8. South Africa |

8. Hong Kong (5) |

9. Spain |

9. Australia (4) |

10. United States of America |

10. Japan (5) |

Other countries |

Others |

TradeStation

This brokerage firm is valuable because it connects the entire world to the various trading markets in the United States of America. At present, TradeStation’s services are being enjoyed by about 156 countries worldwide.

A big reason for this is the convenience it provides. TradeStation is most known for their low fees and easy-to-navigate trading platform. They’re also the only company on our list that allows withdrawal via cryptocurrency. If you're an avid trader of that asset, you should be thrilled that there’s one less step when liquidating your earnings.

👍 Pros

• Relatively low trading fees

• Allows withdrawal via cryptocurrency

• Very user-friendly from opening an account to navigating the platform

👎 Cons

• Charge for every wire withdrawal

• No forex services

| Full List of Countries Supported | International Markets |

|---|---|

1. United Arab Emirates |

1. United States of America only |

2. Belgium |

|

3. Bahrain |

|

4. Indonesia |

|

5.Taiwan |

|

6. Panama |

|

7. British Virgin Islands |

|

8. Samoa |

|

9. New Zealand |

|

10. Croatia |

|

Among others - but those are only part of the 156 countries they currently serve. |

TD Ameritrade

Despite being the longest-running international brokerage in this group, TD Ameritrade has chosen to focus on growing their accounts in Canada and the United States only. Still, this has worked well for, growing to be one of the most trusted firms in their region.

They have done this by offering a wide range of products, while maintaining a high level of customer service. Their clients always feel appreciated when inquiries and concerns are addressed immediately.

👍 Pros

• Excellent customer service

• Do well in educating their users

• The trading platform is simple and easy to understand

👎 Cons

• Deposits and withdrawals are sometimes a challenge

• Limited only to North America

| Full List of Countries Supported | International Markets |

|---|---|

1. United States of America |

1. United States of America only |

2. Canada |

What is an International Broker?

These are firms or companies that allow assets to be traded across countries. They do this by tying up with local financial authorities, and creating a platform that links all sides together. Basically, facilitating transactions is their primary role.

How to Choose the Best International Broker

When bombarded with so many different choices, it can be quite overwhelming. One way of maintaining objectivity is by sticking to factors that the majority feel are crucial to consider. Here are some of our thoughts.

Find Firms in your Country - When beginning this search, it’s always wise to begin in your own backyard. Research local options in your town or municipality. Afterwards, do a quick background check to verify their credentials. You should have a general idea of which one is good, and which one isn’t.

Compare Trading Conditions - Commissions, fees, and markets covered are just some of the factors that could sway your decision. Make a comparison table (like what we did earlier) to properly evaluate how each one measures up from the other.

Open a Trading Account - Experience is always the wisest teacher. Try signing up on each platform to gauge how convenient and user-friendly they are. Some offer a trial period, anyway, so just think of it as a free taste before making a final decision.

Fund Account - As you fund the account, you’ll see how things work on a first-hand basis. From actual trading and studying, to withdrawal and deposit of earnings. Remember, going through each step shouldn’t be bringing you stress. So simply find the one that best matches your personality.

What is the Best Stock Broker for International Tradings?

After going through each option carefully and thoroughly, we can safely say that the best stock brokerage firm for international trading is Interactive Brokers. Not only do they provide a wide range of products, but also charge relatively less, and boast a strong track record of reliability.

Additionally, their market reach is by far the widest out of all the choices we discussed. Even if you’re living in a remote part of the world, you’ll be able to trade alongside the best investors in the world, thus broadening your experience and gathering valuable experience.

Can a Non-US Citizen Trade With the US Brokers?

Yes, non-US citizens can trade with US brokers, but not all US brokers accept clients from other countries. Most US brokers only support trading for US citizens or residents and a few other countries with whom they have established relationships and regulatory compliance.

However, some US brokers do offer international trading services, such as Interactive Brokers and eToro. These brokers have obtained regulatory approval in multiple countries, including the United States, and offer services to clients from various parts of the world.

Which Broker is Best for International Share Trading?

The best broker for international share trading depends on your specific needs and preferences. However, here are a few options that are well-suited for different types of traders:

eToro: Best for beginners

eToro is a great choice for beginners because it offers commission-free trading for US stocks and has a user-friendly platform with a large social trading network. Social trading allows beginners to learn from other experienced traders and even copy their trades, making it a good option for those who are just starting out in the world of trading.

Degiro: Best for EU residents

Degiro is a popular choice for EU residents because it offers low fees and a wide range of investment products, including stocks, bonds, options, and futures. They also have a user-friendly platform and are regulated by the Dutch Central Bank, providing a high level of security for investors.

Interactive Brokers: Best for professionals

Interactive Brokers is a great choice for professional traders because it offers access to a wide range of markets, including stocks, options, futures, and Forex, and has advanced trading tools and features. They also offer low fees and are regulated by multiple regulatory bodies, providing a high level of security for investors.

How to Open an International Brokerage Account?

Opening an international brokerage account can be a complex process that varies depending on the broker and your country. However, here is a general step-by-step guide on how to open an international brokerage account.

Research and Choose a Broker

Start by researching and comparing different international brokers to find one that meets your specific trading needs and requirements. Compare their fees, products, and regulatory compliance and ensure the broker has a good reputation.

Verify Your Identity and Residency

To open an international brokerage account, you'll need to verify your identity and residency. This usually involves providing a government-issued ID, proof of address, and sometimes a passport and tax ID number. The exact requirements may vary depending on the broker and your location.

Complete the Application

Once you have chosen a broker and verified your identity, you will need to complete the account application. This will usually involve providing personal and financial information, such as your employment status, income, and investment goals.

Complete any Necessary Regulatory Requirements

Depending on the broker and your home country's regulations, you may need to complete additional regulatory requirements. For example, some countries require permission from the banking regulator to transfer funds abroad, so you may need to get permission before opening your account.

Fund Your Account

After your account is approved, you'll need to fund it with the required minimum deposit. This usually involves transferring funds from your bank account, eWallet, or credit card to your brokerage account. Most international brokers offer a wide array of deposit methods and various currencies. Look for a broker that offers your currency and a convenient deposit and withdrawal method.

Start Trading

Once you fund your account, you can start trading in international markets. Keep in mind that different brokers may have different trading platforms, fees, and products, so familiarize yourself with the platform and the fees before making any trades.

How to invest internationally

Investing with international brokers allows you to access global markets and broaden your investment opportunities. Here are some steps to consider when investing with international brokers:

Research and select a reputable international broker. Look for brokers that are well-established, regulated by reputable authorities, and offer a range of investment products and services. Read reviews and compare fees, account requirements, and available markets

Understand regulatory and compliance requirements. Different countries may have varying regulations, so ensure that the broker complies with the rules and regulations of both your home country and the country where the broker is located

Open an investment account. Follow the broker's account opening process. This typically involves completing an application form, providing identification documents, and fulfilling any other requirements outlined by the broker. Some brokers may require a minimum deposit to open an account

Fund your account. International brokers usually offer multiple funding methods, such as wire transfers, credit/debit cards, or online payment systems. Be aware of any associated fees or currency conversion charges

Familiarize yourself with the trading platform. Understand its features, functionality, and tools available for research and analysis. Ensure that the platform is user-friendly and suits your investment needs

Conduct thorough research. Evaluate companies, sectors, and economic indicators relevant to your investment strategy. Leverage the research tools and resources provided by the international broker

Place trades and monitor investments. Monitor your investments regularly, review performance, and stay informed about market trends and news that may impact your holdings. Consider setting up alerts or notifications to stay updated on market movements

Manage risks and diversify. Diversify your portfolio across different countries, industries, and asset classes to spread risk. Be aware of currency risk and consider strategies to manage it, such as hedging techniques or currency-hedged investments

Stay informed and seek professional advice. Consider consulting with financial advisors or professionals who specialize in international investments to gain insights and guidance

Remember that investing with international brokers involves risks, including currency fluctuations, market volatility, and geopolitical factors. Stay informed, conduct due diligence, and make investment decisions based on your risk tolerance and investment objectives.

Advantages and disadvantages of cooperation with International Brokers

| Advantages | Disadvantages |

|---|---|

Access to global markets |

Regulatory complexities |

Expanded investment options |

Currency risk |

Expertise in international markets |

Time zone and trading hours challenges |

Currency diversification |

Language and communication barriers |

Potential for higher returns |

Additional costs and fees |

Geopolitical and economic risks |

Cooperating with international brokers can offer several advantages and disadvantages. Here are some key points to consider:

👍 Advantages:

• Access to global markets. International brokers provide access to a wide range of global markets. This can provide opportunities for diversification and potentially higher returns

• Expanded investment option. International brokers often offer a broader range of investment products, such as stocks, bonds, mutual funds, ETFs, commodities, and more

• Expertise in international markets. They can provide research, analysis, and insights on international investments, helping you make informed decisions

• Currency diversification. Investing internationally can provide exposure to different currencies, allowing you to diversify your currency holdings. This can be beneficial in managing currency risk and potentially benefiting from favorable exchange rate movements

• Potential for higher returns. Rapidly growing economies, emerging markets, and sectors that are thriving in specific regions may provide attractive investment prospects

👎 Disadvantages:

• Regulatory complexities. Regulations vary across jurisdictions, and you need to ensure that you understand and comply with all relevant laws and regulations

• Currency risk. Fluctuations in exchange rates can impact the value of your investments. Adverse currency movements can erode your returns or increase losses

• Language and communication barriers.

• Additional costs and fees such as currency conversion fees, international wire transfer fees, and broker-specific charges. Consider these expenses when evaluating the overall cost of investing internationally

• Geopolitical and economic risks Factors such as political instability, economic downturns, trade disputes, or regulatory changes can impact your investments

Summary

When faced with a dilemma like this, always look at your goals. This will help guide you when chartering through the challenges presented by each platform. Not to mention when deciding what assets to invest in, which markets to enter, and planning out your entire strategy.

Ultimately, the real best international broker is that company that aligns perfectly with your targets, and the firm that helps you achieve all your aspirations at a much quicker pace.

Just remember to remain objective, stick to the facts, and consider your current standing.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.