XTB (X-Trade Brokers) Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MetaTrader4

- xStation 5

- FSC

- FCA. CySEC

- 2002

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MetaTrader4

- xStation 5

- FSC

- FCA. CySEC

- 2002

Our Evaluation of XTB

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

XTB is a moderate-risk broker with the TU Overall Score of 5.17 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by XTB clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

XTB is a broker that focuses on the European segment of the market. The company is suitable for novice traders because the deposit in XTB starts from $1. A leverage of 1:500 will allow you to test almost any trading strategy without significant investments.

Brief Look at XTB

The X Trade Brokers (hereinafter “XTB”) is registered in Belize and provides a fairly extensive list of financial services to traders. The company was incorporated in 2002 and its financial regulator is the Belize International Financial Services Commission (FSC, 000302/438), CySEC (169/12), FCA (522157). The broker has offices in Spain, Poland, and the UK, where it is authorized and regulated by the National Financial Supervision Commissions. The XTB is focused on working primarily with European investors. It has several significant awards, including the Best Broker in Europe award by Global Banking & Finance Review and Best Financial Teacher by World Finance Exchange & Brokers.

- minimum deposit - $1;

- a wide range of trading instruments;

- branches in 12 countries.

- the demo account is only available for four weeks;

- all analytical materials provided by the broker are exclusively in English;

- no PAMM accounts;

- the broker is focused on European clients.

TU Expert Advice

Financial expert and analyst at Traders Union

The XTB broker (X Trade Brokers) has significant experience in the Forex market. The company has a solid reputation that allows it to open representative offices in many countries. Since the broker focuses on working with European investors, registration for citizens of other countries requires additional verification, including the obligation to provide financial data that disclose sources of income.

The XTB offers a fairly wide range of trading instruments and two trading platforms (MetaTrader 4 and xStation 5). As for disadvantages, there are no bonus programs or PAMM investment opportunities. Also, the broker limits the use of the demo account to only four weeks.

The broker's website is quite convenient. However, all technical and operational support as well educational materials are provided in English only.

- You prioritize regulated brokers as this broker is regulated by multiple reputable authorities, including the Financial Conduct Authority (FCA) in the UK, the Polish Financial Supervision Authority (KNF), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission (FSC) in Belize.

- You're in need of advanced trading features, as xStation 5, the platform offered by this broker, provides powerful charting tools, advanced order types, and algorithmic trading options. These features cater to traders who utilize complex trading strategies and require sophisticated tools to execute their trades effectively.

- You are located in a country that is not supported by this broker, such as the US and Canada, as you will not be able to open an account or trade with them. It's essential to ensure that your country of residence is supported by the broker before attempting to sign up or conduct any trading activities.

We checked the office of the XTB brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

Pikioni 10, Building: Highsight Rentals Ltd, 3075, Limassol, Cyprus

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office

-

XTB Summary

Your capital is at risk. Forex and CFDs are leveraged products and can result in losses that exceed your deposits. Please ensure you fully understand all of the risks.

| 💻 Trading platform: | MetaTrader 4 and xStation 5 |

|---|---|

| 📊 Accounts: | Standard, Swap Free |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, Skrill, Neteller, wire transfer, SafetyPay |

| 🚀 Minimum deposit: | no minimum deposit |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lot |

| 💱 Spread: | From 0.1 pips |

| 🔧 Instruments: | Currencies, stocks, indices, raw materials, CFDs, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 30%/30% |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Advisors can be used |

| 🎁 Contests and bonuses: | No |

The XTB broker has favorable trading conditions. The company has three account types: Standard, Pro, and Islamic. The minimum deposit for all account types is $1. The size of the spread depends on the specific trading instrument and the type of account. The maximum leverage is 1:500 and the minimum lot is 0.01. An additional commission is also provided for opening trades in cryptocurrency, stocks, and indices on Pro and Islamic accounts, from $3.5.

XTB profile detailsXTB Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Do you want to trade with XTB and receive compensation from Traders Union using the rebate service? Then you need to do the following:

Register on the Traders Union website, and then follow the affiliate link to the broker's website. Then click on the "Create Account" button.

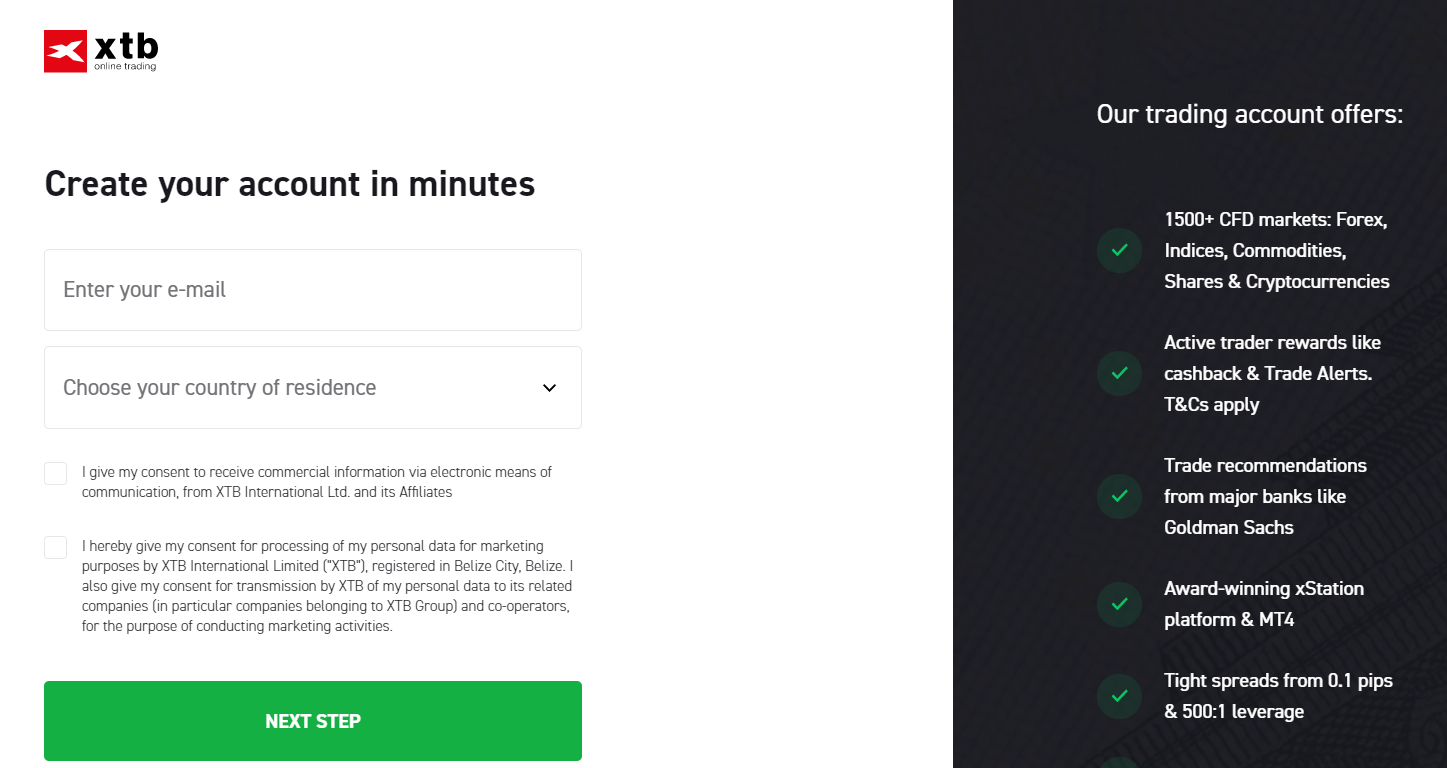

Complete your registration by providing your email address, your country of residence, and agreeing to the terms of the broker's services. The next stage of registration involves creating a password, as well as uploading information on sources of income and income tax return information.

The following useful functions will be available to you in your personal account:

XTB Login: overview of the members area

Also, other useful functions will be available in the Personal Account:

-

access to affiliate programs;

-

access to trading terminals and quotes;

-

technical support and help from a personal manager;

-

change of personal data.

Regulation and Safety

The financial regulator of X Trade Brokers is the Belize International Financial Services Commission (FSC). The broker's license number is 000302/438.

Also, X Trade Brokers is licensed by financial regulators in Spain, Poland, and Turkey.

Advantages

- Licensed by financial regulators in several countries

- There are representative offices in 12 countries

- The broker's regulations and rules for the provision of financial services are freely available on the official website.

Disadvantages

- Complaints are accepted only in English

- Complex and lengthy complaint procedure

- Claims that relate to compensation for personal injury damage are not considered

- Claims by traders with small losses are not considered

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $5 | 1.5% - when withdrawing money to a bank card (Visa, Mastercard), as well as when withdrawing to SafetyPay; 2% when withdrawing to Neteller and Skrill |

| Swap Free | From $7 | 1.5% - when withdrawing money to a bank card (Visa, Mastercard), as well as when withdrawing to SafetyPay; 2% when withdrawing to Neteller and Skrill |

The broker's commission for transferring trading positions to the next day (swap) is available for Standard and Pro account types. However, the Islamic account is a swap-free account. Below, is a table comparing brokers based on their trading commissions. Each broker is assigned a level from low to high, according to the results of the assessment for this parameter.

| Broker | Average commission | Level |

|---|---|---|

|

$4 | |

|

$1 | |

|

$8.5 |

Account Types

The XTB broker offers several types of accounts. The Standard account is more suitable for novice traders, while the Pro and Islamic accounts are designed for professionals. The main differences between the accounts are: the minimum spread size, additional commissions for contracts for cryptocurrency, stocks, and indices, as well as the existence of swaps.

Types of accounts:

The broker also has the opportunity to open a demo account, but only for four weeks. After that, the demo account is blocked.

XTB is a broker that focuses mostly on experienced traders.

Deposit and Withdrawal

-

The XTB broker provides a relatively fast withdrawal of funds.

-

The company charges a commission of 1.5% (but not less than $30) for bank transfers and transfers to SafetyPay, and 2% for withdrawals to Neteller and Skrill e-wallets.

-

There are five options for depositing and withdrawing funds: bank transfer, Visa or MasterCard, Skrill, Neteller, and SafetyPay.

-

Withdrawals to a bank card usually take about 1-3 business. Withdrawals to electronic wallets Skrill, Neteller, SafetyPay take about 3-5 working.

-

Withdrawals are only possible in US dollars.

Investment Options

The XTB broker focuses primarily on those traders who trade on their own. The company has no options for investing and using PAMM accounts or opportunities for trust management.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

XTB affiliate program:

-

The XTB affiliate program allows a client of the company to earn additional income by advertising the broker and attracting new clients. The amount of such income is up to 20% of the spread of the referred client.

-

The XTB cashback (rebates) program is primarily for traders who trade actively. The client has the opportunity to receive partial compensation of the spread, subject to the fulfillment of the monthly trading volume.

As you can see, the broker provides a couple of affiliate programs that allow traders to receive a part of the commission from the broker and create their own referral network. And for active traders, it is possible to convert a certain number of trading lots into a partial return of the spread.

Customer Support

In case of questions or problems during the workflow, a trader can contact the support service, which works around the clock, 5 days a week.

Advantages

- The FAQs section provides answers to the most common questions

- Availability of email support

- Availability of phone support

Disadvantages

- Support does not work on weekends

- No feedback form

- No online chat

- Support is provided in English only

- It takes about 3-4 days to receive a response

You can contact XTB support specialists in the following ways:

-

by phone, as indicated on the website;

-

by email;

-

in the company's offices.

Support is available both on the XTB broker's website and via your personal account, in the "Support" section.

Contacts

| Foundation date | 2002 |

|---|---|

| Registration address | 35 Barrack Road, 3rd Floor, Belize City, Belize, C.A. |

| Regulation |

FSC, FCA. CySEC

Licence number: 000302/46, 522157, 169/12 |

| Official site | xtb.com |

| Contacts |

+357 257 25356, +48 222 739 976

|

Education

In order to help the trader, the broker's website has many analytical tools and video training courses. These materials can be useful to all clients of the company. But it should be noted that all materials are presented in English only.

You can use a demo account to test trading systems, but such a demo account is only available for four weeks.

Comparison of XTB with other Brokers

| XTB | RoboForex | Pocket Option | Exness | Forex4you | XM Group | |

| Trading platform |

MT4, xStation 5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | MT4, MT5, MobileTrading, XM App |

| Min deposit | $1 | $10 | $5 | $10 | No | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:10 to 1:2000 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0.1 points | From 0.6 points |

| Level of margin call / stop out |

100% / 30% | 60% / 40% | 30% / 50% | No / 60% | 100% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | Yes | Yes |

Detailed Review of XTB (X-Trade Brokers)

The XTB broker is registered in Belize. It has been in the financial services market for over 15 years. The company has offices in twelve countries, and its activities reach traders worldwide. The broker's policy is aimed primarily at cooperation with European traders.

Here are a few numbers about the XTB broker that will help a trader to choose a reliable broker:

-

more than 15 years of experience in the foreign exchange market;

-

the minimum investment amount is $1;

-

representative offices in 12 countries.

The XTB is an acceptable broker that targets professional traders and the European market segment.

It provides standard financial services in the Forex market. The broker has a wide range of trading instruments but does not provide PAMM investment opportunities. All analytical and training materials are available in English only. It should also be noted that the broker offers its demo account for four weeks only.

The company has two trading platforms: MetaTrader 4 and xStation 5. Also, the broker has a mobile platform that allows traders to trade from anywhere in the world.

Useful services of XTB:

-

Market News - the trader has access to the most important news that affects the Forex market;

-

Academy of Trading - video courses for learning to trade and strategies;

-

trading calendar - displays the most important information about the economies of different countries.

Advantages:

two platforms are available;

there is an Islamic, swap-free account;

a minimum deposit of USD 1;

a wide range of trading instruments;

availability of a mobile platform;

several ways to deposit and withdraw funds.

The broker does not limit traders in choosing strategies in any way. Hedging and locking orders are allowed. Also, the broker does not set conditions regarding the minimum duration of the trade.

User Satisfaction