How to buy/sell instruments at XTB

X-Trade Brokers (XTB) is one of the world’s biggest stock exchange-listed Forex and CFD trade brokers. XTB enables instant access to more than 2000 trading instruments. The trusted Broker is authorized and under the jurisdiction of FCA (UK), FSC (Belize), CNMV (Spain), and KNF (Poland). XTB has offices in over 13 countries, including the UK, Germany, Poland, France, Spain, and Chile.

This review of XTB business profile details will help beginners and seasoned traders learn about the features and tools that XTB has to offer, how to trade on XTB, and what it costs.

Largest Forex Brokers in the WorldTrading instruments available on XTB

XTB has a decent range of trading instruments. Traders can use the XTB platform to buy/ sell Forex, Indices, Commodities, Stock CFDs, ETF CFDs, and Cryptocurrencies CFDs. To give readers an idea of the instruments available with XTB, here is a glimpse of XTB’s trading services.

CFD Trading — Commodity, Cryptocurrency, Index.Forex

57 currency pairs to trade.

Lowest spread in the market.

Trading is available 24 hours, five days a week.

Leverage up to 30:1 (EU regulation) and 1:500 (Belize regulation).

Micro Lot trading is also available.

Indices

More than 20 indices from all over the globe.

Transparent rollovers that are directly visible on the chart.

Traders can go short or long.

Competitive spreads.

Indices instruments: UK100, US500, US2000, EU50, DE30, AUS200, AUT20, etc.

Commodities

Leverage up to 10:1.

Transparent rollovers that are directly visible on the chart.

24 hours trading is available.

Stock CFDs

XTB facilitates the trade of over 2100 equities.

The leverage ratio is up to 1:10.

Stock instruments include listings from Belgium, Czech, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States of America.

ETF CFDs

60 ETF CFDs to trade.

The leverage ratio is up to 1:10.

XTB protects its users from negative balances.

ETF instruments include SPY.US, URA.US, XLE.US, QQQ.US, GDXJ.US, etc.

Cryptocurrencies

XTB facilitates the trade of Crypto CFDs 24X7.

Low trading costs, spreads starting from just 0.22%.

Features of XTB trading platform

TBX boasts its award-winning xStation platform, designed to make trading easy for even greenhorn traders. TBX, like other leading brokers, assists trading on all platforms,

Web,

Smartphones,

And Desktops.

XTB’s features:

No minimum deposit is necessary to use the TBX platform.

Supports MetaTrader 4 for trading cryptocurrency CFDs.

XTB’s xStation platform suite offers a wide range of easy trading tools for even new traders.

Free analytics and education in trading.

Users can conveniently deposit money from electronic wallets and cards.

Withdrawal requests are processed within a day.

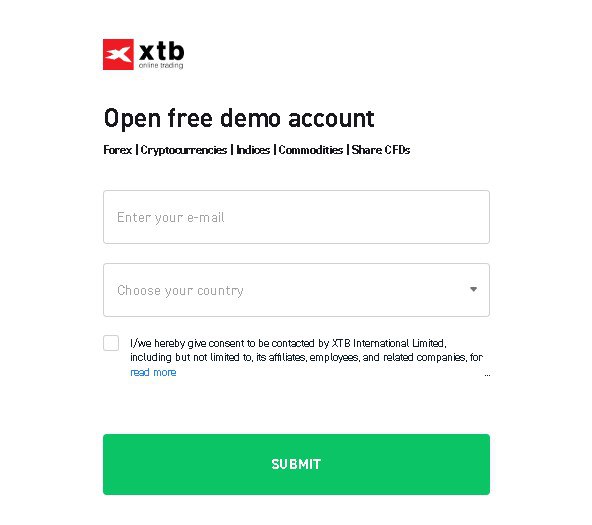

Users can use a demo account, which is available for a month.

Leverage for trading cryptocurrencies.

Quick responses from customer support through live chat, albeit live chats, are unavailable on weekends.

How much does it cost to trade on XTB?

Registering on XTB is free, but how much do users have to pay XTB to trade over a wide range of trading instruments? Let’s find out.

Title |

Charges |

|---|---|

Opening and closing of accounts. |

None |

Account maintenance. |

None |

E-Wallet funding. |

GBP – free of charge. |

Commission for withdrawal from the Cash Account for amounts lower than 50 USD. |

30 USD. |

Withdrawal commission. |

Bank cards & Safety Pay – 1.5% of the amount or 30 USD, whichever is more. Neteller- 1% of the amount or 30 USD, whichever is more. Skrill– 2% of the amount or 30 USD, whichever is more. |

Commission charged on Stock & ETF CFDs transactions. |

None |

Commission charged on Forex, Commodities, and Indices. |

None |

Commission is charged on Crypto CFDs transactions. |

4 USD. |

The spread on the Standard account is floating and the minimum spread is 0.9 pips. The spread on the Pro account is the market spread, and the minimum spread is 0.1 pips.

Brokerage Fees Definition and ComparisonHow to start trading with XTB?

Traders require a trading account with XTB to use its platform. Opening an account is simple, but traders must undergo a complex verification procedure. It usually takes 10 minutes of patience to go through all the stages of registering a user account.

Click here to initiate the opening process for a real account.

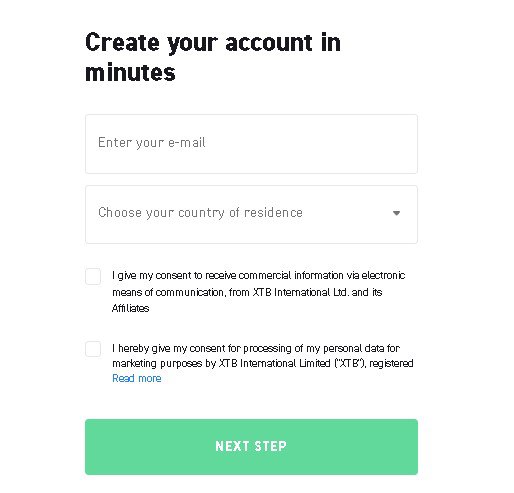

Enter the email id, choose the country the trader is a resident of, and give consent after reading the terms and conditions.

Image: Create an XTB account

Image: Open an XTB demo account

How to buy/sell using the XTB platform

XTB’s intuitive platform, xStation5, is designed so that traders find everything they require easily and quickly, regardless of their trading experience.

1. Logging in

The first step towards trading with XTB is to log into xStation5.

2. Choosing the market

Contracts for Difference (CFDs) are a top-rated leveraged product, meaning traders can gain a vast market exposure by depositing a smaller deposit. The XTB trading platform allows traders to trade CFDs on Forex, Commodities, Indices, Stocks, Cryptocurrencies, and ETFs. But, new traders should never forget that using leverage increases the volume of the potential profit and the magnitude of the possible loss. Most newbie traders trade in limited instruments, and rightfully so, as they have little experience and resources at hand.

3. Making the deposit

XTB does not have a minimum deposit policy. Each trader's expectations and risk-taking mindset establish their first deposit amount. It is generally accepted that a substantially more enormous amount of capital is required to attain more ambitious goals.

4. Analyzing the market

Traders must be precise when they should open a trade, as well as the parameters under which they are willing to close it, regardless of whether the trade is based on technical analysis or economic data.

The XTB trading platform provides various helpful tools and study materials for market analysis, saving the investor the time and effort of searching for further information on several other websites.

5. Open a trade.

Traders can open a trade using either Charts or Market Watch.

Charts

Trading using Chart is the easiest way to make the first trade with XTB. Enter the transaction amount and select whether you want to purchase or sell by clicking the green or red price buttons respectively.

Another way is to right-click anywhere in the analysis chart to open an order window and select a new order. The trader will find opened position’s information in the order panel.

Market Watch

Traders can use the click & trade panel after selecting an instrument. By clicking the green or red buttons, traders must enter the trade's size and whether they want to purchase or sell.

6. Managing trades

When the market advances in an unprofitable direction, the Stop Loss order lets traders limit their losses. In contrast, the Take Profit order automatically secures profit at a predetermined level. Both can be put in at any time after placing the order.

7. Closing the trade

Closing the trade is the most crucial part of trading because the trader needs to make the judgment at the right moment to close a trade that generates profit and brings loss. At XTB, closing is quick and straightforward. To close a trade from the XTB platform, hover the cursor above the chart and click on the “X” button. Or go to the Open Positions Tab, click on the Close option and choose whichever you want to close from the Close all, Close profitable, or Close losing options.

Best Trading PlatformsFAQs

Is XTB safe?

XTB is authorized by one tier-1, three tier-2, and one tier-3 regulator, which is considered very safe.

Is XTB a good broker that novice traders should start with?

XTB provides its users with comprehensive study content and research material. The broker bagged Best in Class for Research in 2024.

Is buying and selling on XTB available in India?

Since XTB is an FCA-regulated entity, it only accepts clients from the UK.

What is the minimum withdrawal limit on XTB?

There’s no minimum withdrawal limit on XTB. But, if the withdrawals are less than $50, then $30 per trade will be charged under bank commissions.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).