Understanding Altcoin Season 2024: Indicators, Causes, and Timing

Altcoin season is when altcoins outperform Bitcoin, offering high returns but with increased volatility:

-

Triggered by market trends, investor FOMO, and global economic shifts.

-

Key 2024 trends: Web3 gaming, AI, Layer 2s, DePIN.

-

Pros include portfolio diversification and innovation exposure.

-

Cons involve market speculation and liquidity issues.

-

Monitoring tools and staying informed on crypto news is essential for leveraging altcoin seasons.

As the clock has ticked into 2024, the whispers amongst traders and investors grow louder - could this be the year of the altcoin? The buzz is tangible, the speculation is rife, and the potential for profit is enticing. But to navigate these waters with acumen, one must first understand the phenomenon at the heart of the chatter: altcoin season.

-

When is the next altcoin season?

The next altcoin season is not scheduled and cannot be predicted with certainty; it's best anticipated by monitoring market trends and staying informed about emerging crypto sectors.

-

What causes altcoin season?

Altcoin season typically leads investors to seek higher returns in alternative cryptocurrencies. This shift is often driven by a mix of factors, including advancements in altcoin projects, speculative trading, and a general market sentiment that encourages the diversification of investment portfolios into risky assets.

-

What is the altcoin cycle signal?

The altcoin cycle signal is typically indicated by a significant and sustained increase in altcoin prices and market share relative to Bitcoin.

-

What is the difference between altcoin season and BTC season?

Altcoin season is characterized by a majority of altcoins outperforming Bitcoin, while BTC season sees Bitcoin leading the market with dominant price gains and investor attention.

What is altcoin season?

In the simplest of terms, altcoin season is a period within the cryptocurrency market cycle where alternative coins - or altcoins - experience a significant surge in value, often outpacing the market leader, Bitcoin.

Bitcoin's share of all cryptos started at 100% but has been below 40%

Unlike Bitcoin’s monolithic presence, altcoin season is a period of opportunity and increased volatility. It usually comes after a period of Bitcoin dominance, as depicted in the graph showing Bitcoin's market cap percentage fluctuating over time. This period is distinct from the broader, more steady market phases where Bitcoin retains the lion's share of the market cap.

Historically speaking, crypto bull cycles start with capital pouring into Bitcoin first, then Ethereum, which is only then followed by the rest of the cryptocurrencies.

As a side note, Ethereum is technically an altcoin, but more recently, many have stopped putting Ethereum in the same basket as all other altcoins due to its huge market cap.

The start of an altcoin season can be forecast by some key indicators. Sharp increases in trading volume, social media buzz, the decrease in Bitcoin dominance and significant price movements across multiple altcoins are telltale signs.

These indicators are markedly different from the usual ebb and flow of the markets. They are the drumbeats of a coming change, a rhythm that quickens and intensifies, breaking the norm of market fluctuations and heralding the onset of a season where altcoins take center stage.

As we stand on the cusp of what may be the next altcoin parade, it’s imperative to recognize these signals amidst the market's cacophony.

Historically, altcoin seasons have yielded stories of sudden wealth and unexpected market players rising to prominence. Take, for instance, the legendary surge of Ethereum in 2017 or the meteoric rise of coins like Litecoin and Ripple, which saw investors multiplying their stakes in a matter of weeks.

These instances serve not only as lore but as case studies of what happens when market sentiment, technological breakthroughs, and investor FOMO converge to fuel the altcoin engines.

But is 2024 aligning itself to be yet another chapter in this saga of altcoin dominance? The whispers in the market suggest a resounding "seems like it".

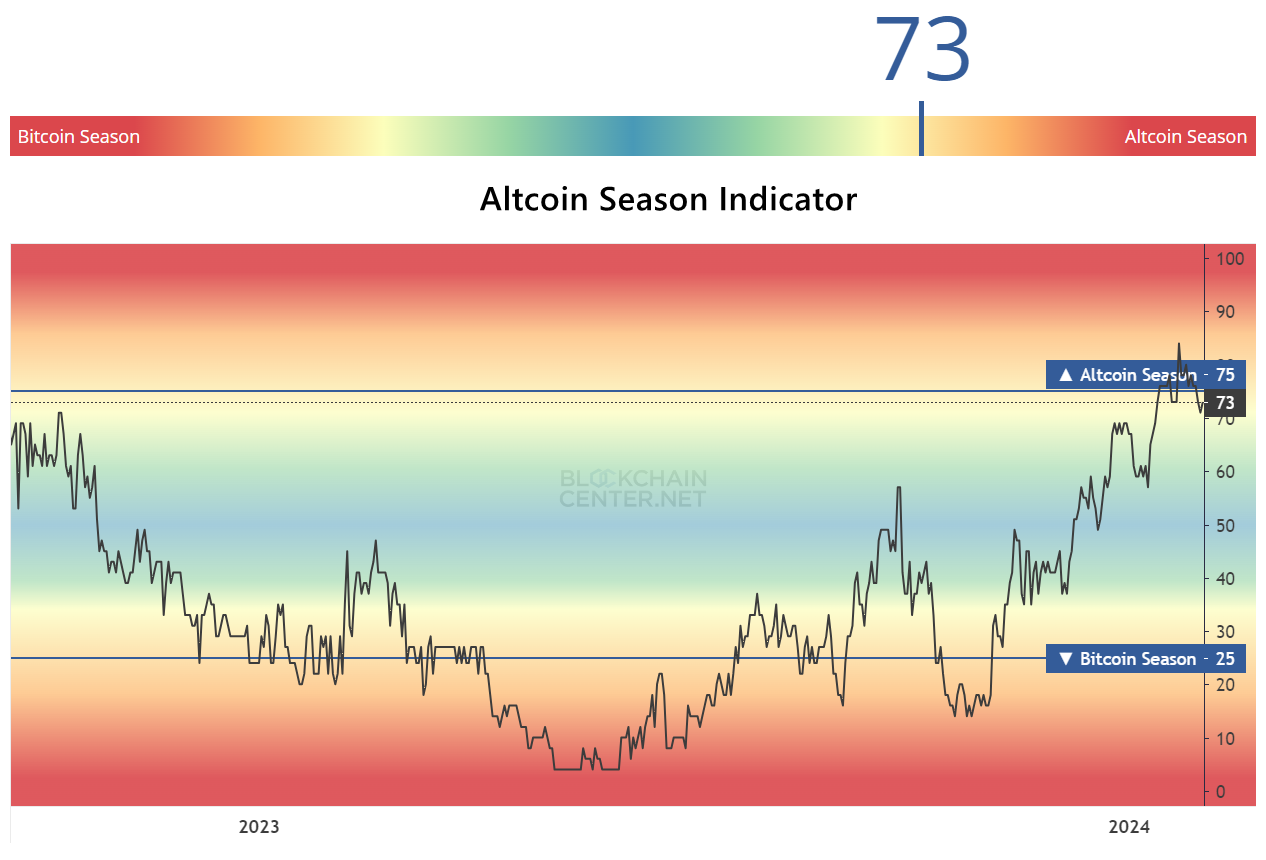

Altcoin Season

A specially designed altcoin season indicator can serve as an aid in determining whether the altcoin season has started or not. If the indicator values are above 75, then the altcoin season is on!

Best crypto exchanges

Causes behind altcoin season

The forces propelling the altcoin season are as diverse as the cryptocurrencies themselves. Market trends, investor psychology, and a myriad of global economic factors coalesce to create the perfect storm that is altcoin season.

Market trends often serve as the harbingers of an altcoin season. A noticeable shift occurs when traders begin diversifying their portfolios away from Bitcoin, seeking higher returns on less established coins. As Bitcoin's price consolidates after a bull run, investors' appetites for risk increase, and altcoins present the perfect playground for their speculative urges.

Investor behavior also plays a pivotal role. The cycle typically begins with seasoned traders, those adept at reading between the lines of market data, who move their capital into altcoins. As these coins start to rally, a broader investor FOMO (fear of missing out) takes hold, drawing in a wave of retail investors. This surge in buying pressure propels altcoin prices upwards, further fueling the season.

Global economic factors cannot be ignored, as they underpin the market's sentiment. For instance, regulatory changes in a major economy can trigger a shift towards altcoins that promise more privacy or different use cases.

Similarly, technological advancements or endorsements from influential figures can catalyze interest in specific altcoins or the sector as a whole.

A case in point can be found in the decentralized finance (DeFi) boom of 2020. As traditional financial systems grappled with low interest rates and economic uncertainty, DeFi platforms offered an alternative with high yield-generating protocols. This not only attracted investors but also highlighted the potential of Ethereum-based altcoins, setting off a ripple effect across the altcoin market.

When is the next altcoin season?

Pinpointing the exact start of the next altcoin season is virtually impossible. However, understanding market patterns and staying updated on industry trends can help investors better anticipate when the altcoin winds might change.

For beginners, the key to monitoring market conditions lies in utilizing a suite of tools and resources. Cryptocurrency price-tracking websites, market capitalization data, and social media sentiment analysis are essential. Additionally, subscribing to industry newsletters and following influential crypto analysts can provide insights and forecasts.

Looking ahead to 2024, the crypto market is abuzz, with a few specific trends expected to influence the next altcoin season:

-

Web3 gaming, with its integration of blockchain technology into interactive entertainment, is poised for growth. This sector's native tokens, particularly those offering unique in-game utilities or rewards, are likely to capture investors' attention.

-

AI (Artificial Intelligence) in the blockchain space is another frontier with significant potential. As AI and machine learning technologies mature, their integration with crypto projects, especially those that can harness AI for predictive analytics or automated trading, could drive investor interest.

-

Layer 2 solutions, which aim to solve the scalability issues of established blockchains like Ethereum, are also anticipated to rise. Tokens associated with these solutions may see increased demand as they contribute to a more efficient and cost-effective blockchain ecosystem.

-

DePIN (decentralized physical infrastructure) is emerging as a groundbreaking trend. Projects that decentralize and secure physical assets on the blockchain could revolutionize multiple industries, from logistics to real estate, potentially initiating their own mini altcoin seasons.

What should I do in the altcoins season?

The most important thing is to stay calm and collected and not let your emotions cloud your judgment. Navigating an altcoin season is a nuanced process that requires weighing the potential benefits against the inherent risks.

As the season unfolds, investors are often caught between the thrill of significant gains and the volatility that characterizes these periods. Here are some pros and cons to consider:

👍 Pros of altcoin season

• Diversification: altcoin season presents the opportunity to diversify one's portfolio beyond the more stable, but often slower-growing, Bitcoin. This diversification can lead to higher returns if timed correctly.

• High Return Potential: Many altcoins have smaller market caps than Bitcoin, which means they have the potential for a higher percentage gain. A well-selected altcoin portfolio can yield substantial profits during a season.

• Innovation Exposure: Investing in altcoins during their season can provide exposure to cutting-edge blockchain technologies and use cases, allowing investors to back projects with transformative potential.

👎 Cons of altcoin season

• Increased Volatility: With high potential returns come high risks. Altcoins can be incredibly volatile, with the possibility of sharp price drops, sometimes in mere hours or days.

• Market Speculation: Much of the price movement during altcoin season is driven by speculation rather than fundamental value, making investments more susceptible to hype and sudden sentiment shifts.

• Liquidity Concerns: Some altcoins may not have the same liquidity as Bitcoin, making it difficult to exit positions during rapid market movements without affecting the price significantly.

For further insights, read our article on How To Become A Successful Cryptocurrency Investor?

Conclusion

Understanding altcoin season is crucial for any investor, especially those just beginning their journey in the cryptocurrency market. It's a time of opportunity, innovation, and heightened risk.

The wise investor will approach this season with a blend of caution and curiosity, always striving to stay informed about market trends and the underlying value of potential investments. As we navigate through 2024, let’s embrace the learning curve that comes with these dynamic market phases, continually equipping ourselves with knowledge to make the most of the altcoin tides.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

5

Ethereum

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.