Coinbase Card Review | Key Features And Fees

The Coinbase card offers a simple rewards earning structure, no annual fee, and fee-free transactions for cryptocurrency spending. Each cardholder has a different spending limit, and since the card is linked to your Coinbase account online, you can use it anywhere Visa is accepted.

Coinbase is a safe and friendly platform for buying and selling different cryptocurrencies, and the launch of the Coinbase card makes this operation faster. With the crypto debit card, Coinbase users can exchange their virtual currency for fiat money to spend both online and in physical locations across the globe that accept Visa cards. The Coinbase debit card is perfect for those new to cryptocurrency because of its simplicity of use and seamless integration with the Coinbase app.

Read on to discover more about the Coinbase debit and credit card as TU experts explore the key features, fees, benefits, and how to get a Coinbase card.

-

Is the Coinbase card worth it?

Yes. The Coinbase card is worth it, considering how easy it is to convert crypto into fiat currency. Again, the zero charges for purchases made using this card make it a top option.

-

How do I get my Coinbase card?

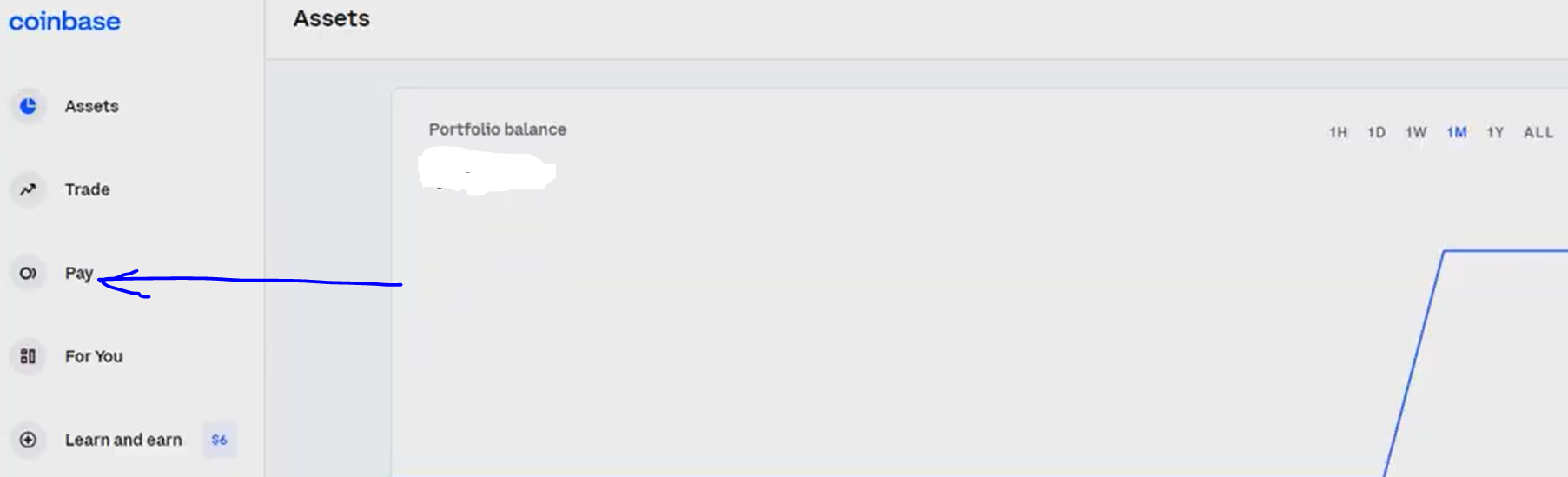

Coinbase card by logging into the Coinbase platform, clicking on the pay option, and selecting “Join the Waitlist” to make your order.

-

Is a Coinbase card free?

Yes. Applying for a Coinbase card is free.

-

Can I use my Coinbase card internationally?

Yes, you can use your Coinbase card anywhere in the world that accepts Visa. It works exactly like a regular debit card and lets you spend your cryptocurrency balance in your Coinbase account.

What is a Coinbase card?

The Coinbase Card functions as a debit card that allows users to make purchases wherever Visa is accepted, spanning across locations in the UK and the EU. It can be linked to an online Coinbase account. Coinbase converts the cryptocurrency in your wallet into fiat money—either US dollars or the local currency of the country you are using—when you use the card to make a purchase. For example, when you want to make a withdrawal, all of your cryptocurrency will be automatically converted to US dollars. Additionally, cryptocurrency can be withdrawn as cash, depending on your local currency, from ATMs worldwide.

What you need to know about the Coinbase card

The Coinbase Card is a credit card issued by Coinbase; the European version is issued by Paysafe Financial Services Limited, a company authorized by the UK Financial Conduct Authority to issue credit cards and electronic money following the Electronic Money Regulations 2011 FRN: 900015. With over 42 million merchants worldwide accepting VISA cards, holders can use the card at any point of payment that accepts VISA. With Mastercard and Visa being the most widely used credit cards worldwide, this is undoubtedly a huge benefit.

-

Supported Cryptocurrencies

Currently, Coinbase offers over 248 cryptocurrencies, which is also the number of cryptocurrencies supported by the Coinbase card. Cryptocurrencies on Coinbase include BTC, DOGE, ETH, MATIC, LTC, SHIB, XRP, USDT, ADA, SOL, DOT, AAVE, USDC, 1INCH, ABT, etc.

Real-Time Conversion

Using the Coinbase debit card, you can instantly convert your

cryptocurrency and withdraw funds in your local currency. Your wallet balance is automatically converted at the current exchange rate.

Coinbase Account Integration

The Coinbase credit and debit cards work with Apple Pay

and Google Pay and are connected to your Coinbase wallet and account. Android users can now add the Coinbase Visa Card directly to their Google Pay wallets.

Card Types

You can use Visa and MasterCard debit cards to make purchases on Coinbase. The Coinbase Card is

accepted at over 42 million merchant locations worldwide, wherever Visa® debit cards are accepted.

Global Acceptance

With services like Apple Pay and Google Pay, Coinbase cardholders can make cryptocurrency payments at

millions of physical and virtual retailers worldwide.

Fees

The Coinbase Card by MetaBank has no annual fees. Coinbase removed most transaction fees in 2022 to reduce barriers to card use. But note that the card's fine print says that "other fees may be associated with the card."

| Coinbase card fee terms | Fees |

|---|---|

|

Annual fees |

None |

|

Transaction Fees |

None |

|

Card purchase |

$0 |

|

Monthly fee |

$0 |

|

Coinbase wallet currency conversion |

2.49% |

|

ATM balance inquiry |

$0 |

|

International transactions |

$0 |

|

International ATM withdrawal and balance inquiry |

$0 |

Additionally, Coinbase offers a simple cryptocurrency rewards program that lets you earn points for purchases—but not for ATM withdrawals. The rewards available vary from 1 to 4 percent.

The IRS categorizes cryptocurrencies as "property" for tax purposes. Consequently, each sale of cryptocurrency using your card is treated akin to a real estate transaction and is subject to taxation. You are required to report any gains or losses from using the card on your tax return. However, if your transactions with USDC match those in USD, you may not be obligated to pay taxes on the profits or losses from using your card.

KYC Verification

KYC verification is among the criteria that qualify a user to obtain a Coinbase debit card. You have

to complete the advanced verification process, which involves identity verification. Users are required to submit ID photos, personal data, and a facial analysis (selfie) to validate their identity.

Is Coinbase Card available worldwide?

Although Coinbase Card is actively seeking to reach additional markets, at this time, citizens and permanent residents of the following nations can use the card:

-

United Kingdom

-

US (excluding Hawaii)

-

Cyprus

-

Denmark

-

Estonia

-

Finland

-

France

-

Slovenia

-

Spain

-

Sweden

-

Norway

-

Poland

-

Portugal

-

Austria

-

Belgium

-

Bulgaria

-

Croatia

-

Greece

-

Hungary

-

Iceland

-

Ireland

-

Italy

-

Latvia

-

Liechtenstein

-

Lithuania

-

Luxembourg

-

Netherlands

-

Romania

-

Slovakia

How to get a Coinbase card

Applying for a Coinbase card is simple; you only have to ensure you have verified your ID or you will be stopped halfway through to verify your address and agree to legal disclosures. Below are steps on how to get a Coinbase debit/credit card.

-

Step 1: Log in to Coinbase personal area

-

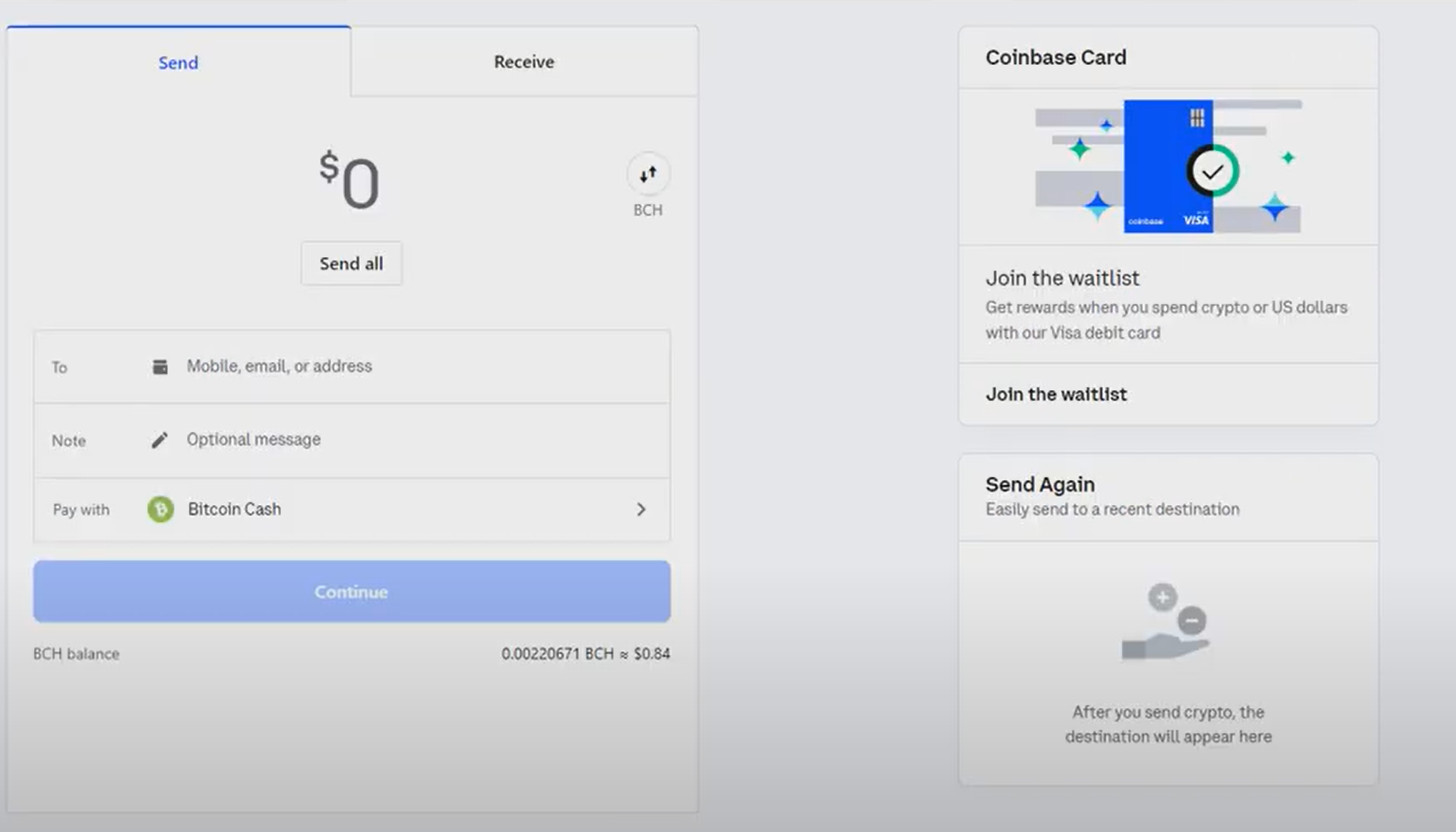

Step 2: Search for the Coinbase card by clicking the pay button or simply replacing “home” with the URL (https://card.coinbase.com/home) on your browser to “card.” (https://card.coinbase.com/card)

Coinbase official website

-

Step 3: On the new page, select Join the Waitlist, click again on Join the Waitlist, and the message will change to you are on the Waitlist

Coinbase official website

-

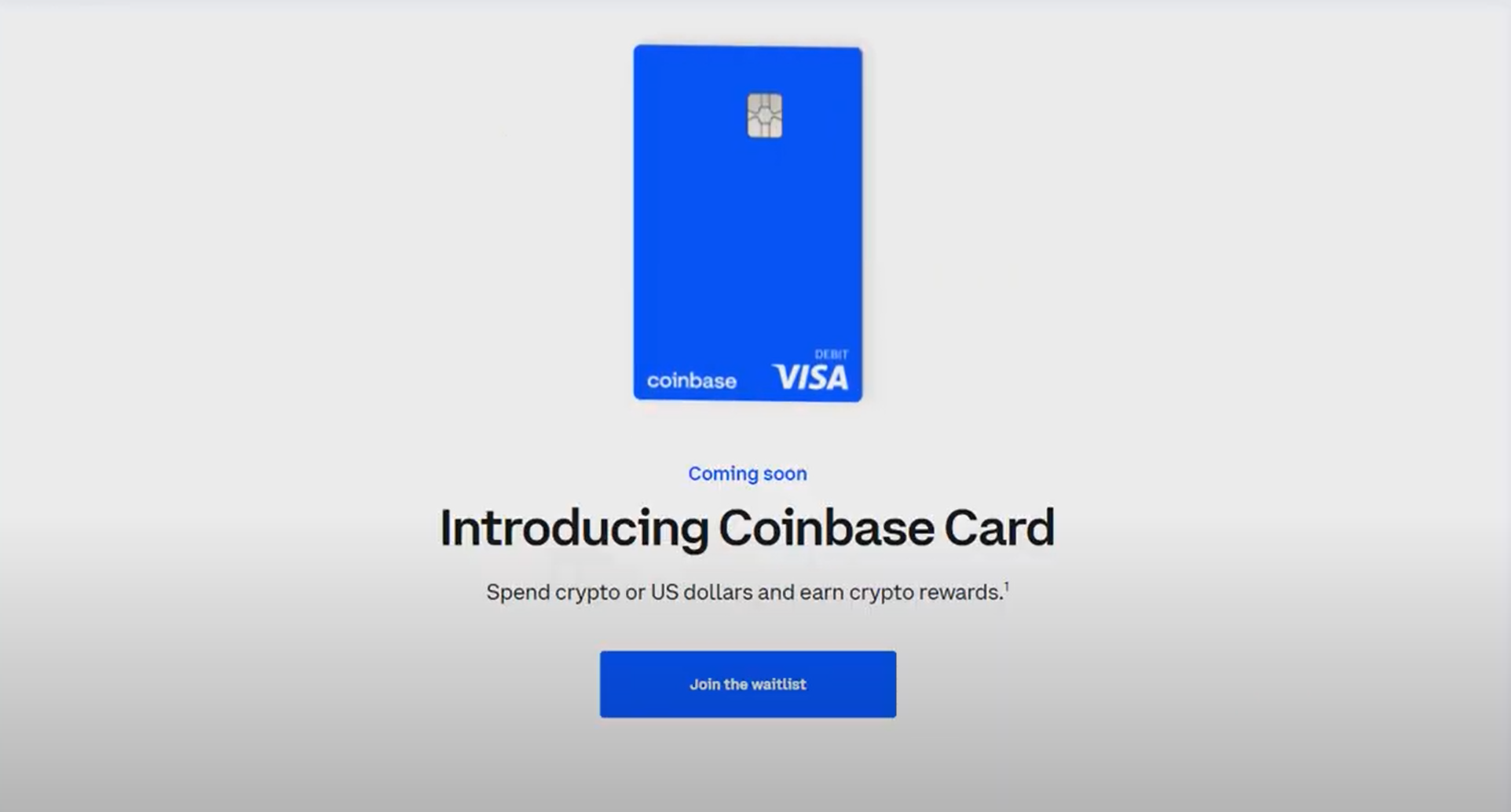

Step 4: The next prompt will present you with a screen telling you that your Coinbase card is coming soon

Coinbase official website

Coinbase official website

-

Step 5: You will receive your card when the card application is approved

Note:

You must create a PIN and validate your details to order a physical card using the Coinbase mobile app. After that, your card will arrive within two to three weeks. While you wait, you can begin using your virtual card within the application. Contact customer support if, after three weeks, you have not received your Coinbase Card or a notification regarding its expected arrival.

How Coinbase Card Works

You can use the Coinbase Card to transact with your cryptocurrency anywhere Visa is accepted. When you want to pay with your card or try taking out cash from an ATM, Coinbase converts the cryptocurrency in your wallet to fiat money, such as US dollars or the currency of your nation.

Coinbase's debit card is available in the US, the UK, and the EU (except for Hawaii). All you need is a working Coinbase account and to have completed the KYC process. Once your card is approved, you will gain access to the necessary information to make online purchases. Activate your physical card through the app or website by accessing your account. Navigate to the card section and follow the provided instructions to complete the activation process.

Coinbase card benefits

A few more enticing features that the Coinbase crypto debit card offers are as follows:

-

It is a Visa card and can be used virtually anywhere.

-

Every time you make a purchase, you can receive up to 4% in cryptocurrency rewards.

-

No transactions or annual fees

-

It accepts a large range of cryptocurrencies, and you can select the cryptocurrency that will be converted and used for transactions.

-

It integrates numerous security protocols that offer total protection for your cryptocurrency while you spend. Among the top security features are pin changes, card freezing, two-factor authentication, and more.

-

It comes with an app that allows you to keep track of your spending.

-

No credit check is necessary.

-

Cardholders can diversify their holdings and acquire new assets with a rotating rewards structure. Rewards and earning rates for the Coinbase Card are subject to frequent fluctuations. Monthly upgrades to fresh rewards eliminate existing options.

Expert Opinion

The Coinbase Card enables users to make purchases wherever Visa is accepted, primarily in the US, UK, and EU. It is linked to an online Coinbase account, allowing purchases to be made using cryptocurrency holdings converted into fiat money. Additionally, depending on the local currency, the card allows for cash withdrawals from ATMs.

The Coinbase Card's convenience of use is one of its main advantages. Customers can apply for the card without paying an application fee or having their credit checked in most states in the United States and other places where Coinbase's platform services are accessible. I admire the function that makes the card convert with the current exchange rate; the card supports real-time conversion for over 248 cryptocurrencies.

Additionally, the Coinbase Card boasts no annual fees. This, coupled with its rewards program, provides users with a convenient means to utilize their cryptocurrency assets for everyday transactions, rendering it an attractive choice for those keen on integrating cryptocurrency into their day-to-day spending.

Conclusion: Should I Get a Coinbase Card?

The simplest and fastest way to spend cryptocurrency anywhere in the world is with the Coinbase Card, which lets you fund a Visa debit card with your Coinbase balance. This Visa debit card is powered by the balance in your Coinbase account, making cryptocurrency just as easily spendable as cash in your bank account. You can use contactless payment methods, enter your PIN, and withdraw cash from any ATM, which is accepted in millions of locations worldwide. The card offers standard security features like instant card freeze, two-step verification, and more to protect your funds.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).