FCA | Review of the UK Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulatory and supervisory body in the UK. It cooperates with the Bank of England and other British regulatory bodies independently of the UK Government.The FCA regulates the operation of investment, banking, and financial companies, including Forex brokers.

A brokerage license is a legal permit issued to a broker by a regulatory authority to conduct financial operations in a specified jurisdiction. A regulator is usually an independent organization or government body, which is subordinated to the country's Central Bank or Finance Ministry. A regulator’s license means that the broker complies with equity adequacy standards, has a transparent organizational structure, and is regularly audited by the regulator and third-party auditing firms.

There are two main advantages for a broker having a license:

-

It provides an opportunity to operate legally and in compliance with the local law;

-

It also instills trust among traders. Clients are more likely to trust brokers with a license.

A license is a guarantee to traders that the company indeed operates within the legal framework and complies with local law. It also provides confidence in the security of their deposit.

This article thoroughly reviews the FCA, including its tasks, capacity, and advantages for brokers and traders.

Description and functions of the FCA

The Financial Conduct Authority (commonly referred to as the FCA) is a financial regulatory body in the UK. It was created on 1 April 2013 as a result of the reorganization of the Financial Services Authority (FSA UK). The regulator is a non-government organization that works closely with the Bank of England and HM Treasury. The FCA regulates the operation of investment, banking, and financial companies, including Forex brokers.

FCA’s tasks and purposes in the Forex market

-

Monitor and audit brokers;

-

Prevent actions and manipulations aimed at violating the interests of brokers and their clients;

-

Enforce the rules of fair competition;

-

Monitor advertising of financial services;

-

Settle disputes between market participants;

-

Take measures to remove risks that may affect the country’s financial system;

-

Counter money laundering and prevent insider trading;

-

Develop standards, regulations, and requirements for financial reporting and interaction between market participants that may negatively affect the reputation of the financial system.

Brokers without an FCA license cannot provide brokerage services in the UK. Licensed brokers regularly disclose financial and operational information and also pass independent audits.

To obtain an FCA license, a broker has to

-

Submit an application and pay a membership fee. Membership fees are paid by brokers annually. Among other things, the fees are used to form the insurance fund in the event of a broker’s bankruptcy;

-

Disclose information, including organizational and management structure;

-

Submit financial statements to the regulator on a quarterly basis;

-

Meet the minimum equity requirement. Depending on the type of activity, the minimum equity ranges from £125,000 to £1 million. The amount is periodically revised.

In an attempt to earn traders’ trust, many brokers registered in an offshore territory, open their subsidiaries in the UK. This model is simpler for brokers than full registration of their business in the country. An FCA license allows brokers to legally operate in most European countries, as provided by the Markets in Financial Instruments Directive (MiFID).

Official website | Available information

Overview of the FCA website:

-

About us. This section features general information about principles of operation of the regulatory authority such as regulatory documents, organizational structure, international standards, etc.;

-

Firms. This is a section for legal entities that are potential or current licensees;

-

Markets. This section provides information about regulated markets. Also, visitors can report abuse here.

-

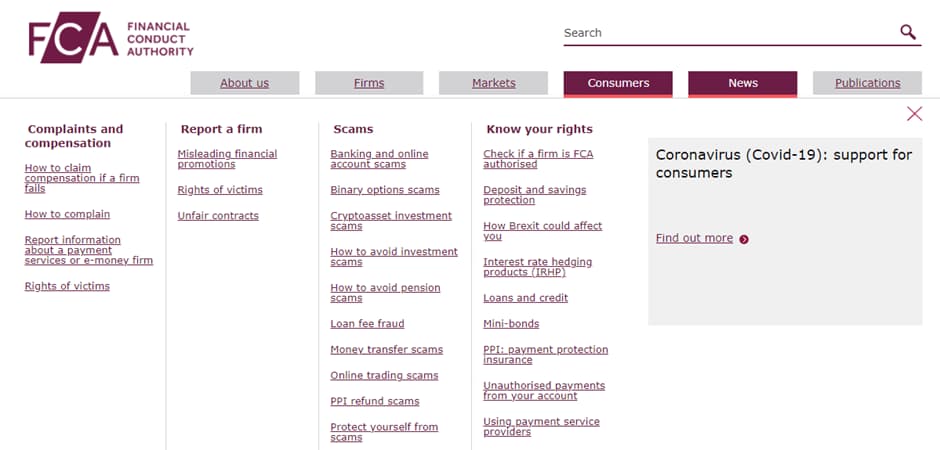

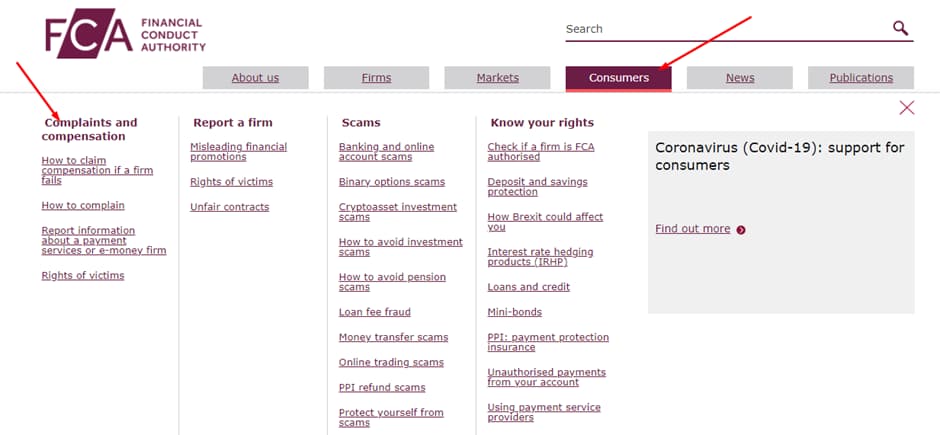

Consumers. In this section, clients can file a complaint against a broker or fill out a form to claim compensation. The Scams subsection features information about mechanisms of scams and fraud, and the Know Your Rights subsection explains principles of consumer rights protection.

-

News. This section features news releases, information bulletins, and statements;

-

Publications. This section features policies and guidance, corporate documents, etc.

Consumers | Main section for traders:

FCA Review — Sections of the website

The first subpart of the Consumer section provides information about how to file a complaint, which includes the sequence of actions, procedures and terms of consideration, etc. Traders can also file a claim for compensation in the event of the broker’s bankruptcy. Other subsections provide general information on various violations and consumer rights.

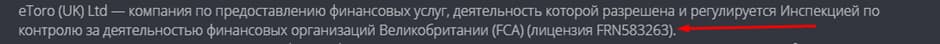

Below is an instruction on how to find a broker’s license on the FCA website.

How to confirm a broker’s license on the FCA website

-

1

Find the license number on the broker’s website either in the footer of the homepage, a section on regulation, in the About Us section, or in the FAQs section.

-

2

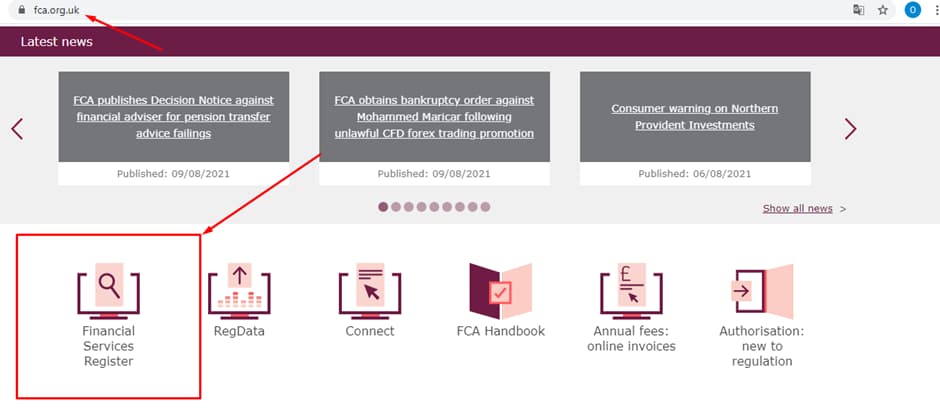

Open the regulator’s website.

-

3

Scroll down the homepage and click Financial Services Register.

-

4

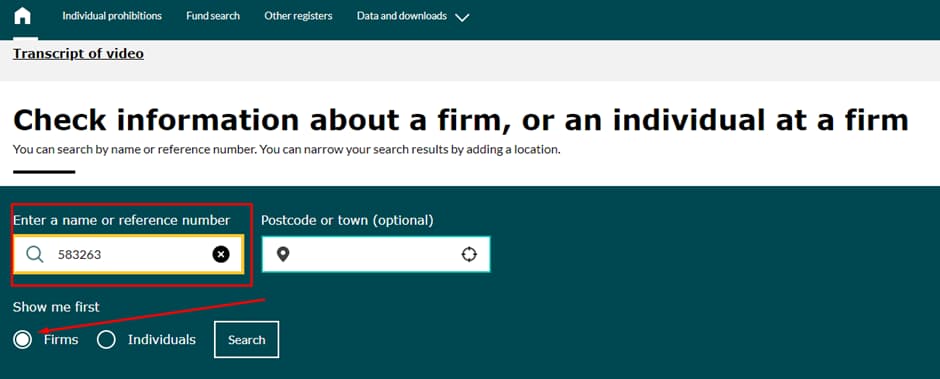

Enter the license number in the search box. Note that, in this case, the digits are sufficient. There is no need to include “FRN”. Also, choose “Firms” as we are searching for a legal entity.

-

5

Review the search results.

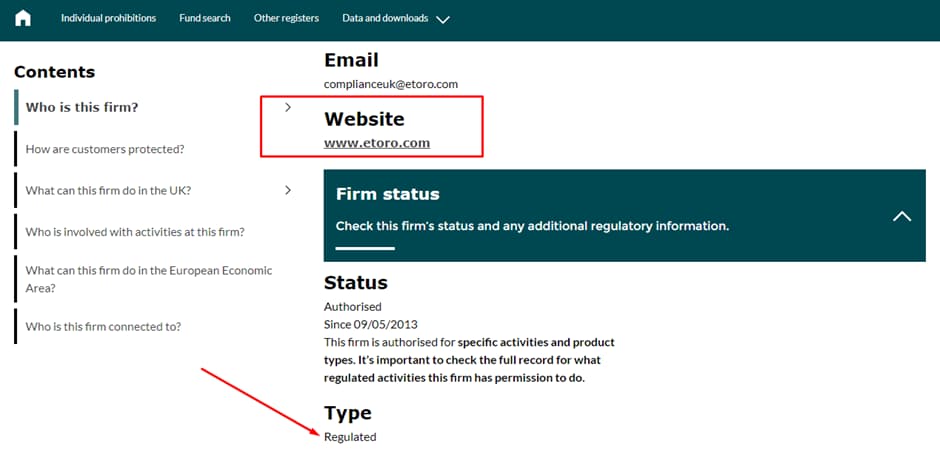

FCA Review — Broker’s license number

FCA Review — The list of registered and licensed brokers

FCA Review — Searching for a legal entity

FCA Review — Search results for a broker’s license

It is important that the license be valid. You can also compare the details provided by the FCA to the details on the broker’s website. This eliminates the risk of visiting phishing websites.

FCA’s basic requirements for brokers

Basic requirements to obtain a license:

-

Possess equity from £125,000 to £1 million, depending on the type of services offered. Maintain equity at a set level.

-

Pay annual membership fees that form the insurance fund.

-

Segregate client accounts.

-

Disclose information about related companies, subsidiaries, and the broker’s management team.

If an audit reveals violations, the FCA orders the broker to rectify them promptly. The regulator has the right to impose fines, revoke licenses, and initiate administrative or criminal proceedings.

FCA license | Pros and cons

An FCA license is respected more than licenses from other regulators that require less equity, may not establish an insurance fund, or are less strict regarding information disclosure. For example, for some offshore regulators, submitting a balance statement, as well as an income and expenses statement is sufficient. Naturally, traders trust such brokers a lot less.

Advantages of trading with an FCA-licensed broker

-

Segregation of clients’ accounts. Clients’ money is held at institutional banks separately from brokers' transaction accounts. If a broker goes bankrupt, its clients do not lose their deposits.

-

An insurance fund with up to £50,000 coverage for each account. The fund is formed from annual fees paid by brokers. In case of a broker’s bankruptcy, a trader is offered a choice: to transfer his account to another FCA-licensed broker or receive compensation from an insurance fund. If the deposit exceeds £50,000, it is partially compensated for.

-

Access to additional deposit insurance. Some FCA-licensed brokers can offer traders insurance coverage of up to £500,000 from Lloyd’s (an insurance market in London).

-

Reliability and security. The regulator’s task is to prevent unlawful manipulations on the part of brokers and protect traders’ interests. FCA-licensed brokers strictly follow the account segregation rules and have transparent offers, client agreements, and rates. They do not show signs of financial pyramids or provide traders with false information. Their marketing policies comply with the law.

Unlike offshore regulators, the FCA requires brokers to fully disclose their financial and management information. Licensees are mandatorily audited every year and inspections are mostly conducted by the “Big Four” accounting firms. FCA-licensed brokers cannot conceal their trading volumes or information on organizational structure. That is why for a trader, an FCA license primarily guarantees that:

-

A broker’s legal documentation is in order and complies with UK law.

-

A broker is not a financial pyramid. Trades are indeed routed to over-the-counter (OTC) markets.

-

A broker has enough equity to maintain its operation.

An FCA license represents a substantial likelihood of a broker’s reliability. It is not a guarantee, however.

Disadvantages of trading with an FCA-licensed broker

-

Limits on leverage. The regulator requires that maximum leverage for retail traders be 1:30. Leverage can only be increased if a client officially becomes a professional market participant. To obtain such a status, a trader has to fulfill several conditions that include annual trading volume, knowledge, etc.

-

No bonuses offered. The FCA considers bonuses to be equivalent to leverage and usable for marketing purposes as an additional persuasion method. Therefore, bonus programs are restricted.

The FCA classifies OTC trading as a game and brokers as betting agencies. That is why the regulation of Forex is maximally strict compared to other types of trading and investing. For brokers, it means several restrictions on trading conditions and advertising. For traders, it means risk minimization that limits possible income.

FCA’s jurisdiction

The FCA operates under the laws of the United Kingdom. Full access only applies to brokers with a British registration.

A complete FCA license gives UK residents the following advantages:

-

Access to operating in the legal framework. Legally operating companies have access to national registers and are entitled to get help and support from state bodies in cases of force majeure.

-

Recommendations from the regulator and auditors. These are available to any broker that is interested in upholding its status as a reliable and responsible partner. By following recommendations from inspection agencies, brokers can correct mistakes, optimize their internal structure, and improve the quality of their service.

-

Authoritativeness. Traders see FCA-licensed brokers as more reliable. A license attracts new clients.

According to MiFID, entities that are not registered in the UK can obtain FCA licenses as well. Such brokers become EEA-authorized (EEA: European Economic Area), but they must primarily observe the financial laws of their jurisdictions and only then meet the FCA requirements. Compared to British companies, non-British companies with FCA licenses have a lot of freedom. But a license confirms a broker’s status nonetheless.

Submission and consideration of complaints

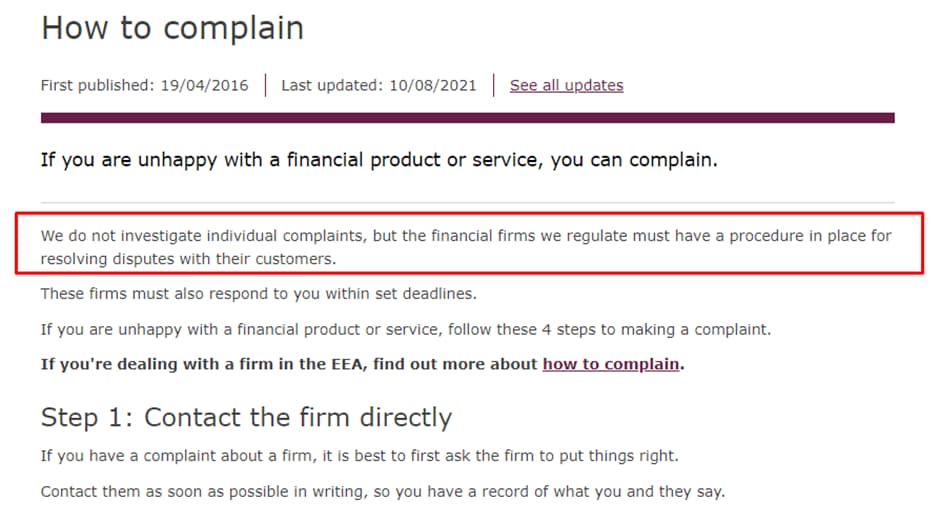

Theoretically, any trader can submit a complaint to the FCA; there are no limits on the amount of deposit. But practically, the regulator mainly considers collective complaints about large amounts of money. To reduce the flow of individual applications, the regulator clearly indicates on its website that individual complaints are not investigated:

FCA Review — Submission and consideration of complaints

Practice shows that, in some cases, individual applications can also be considered by the regulator.

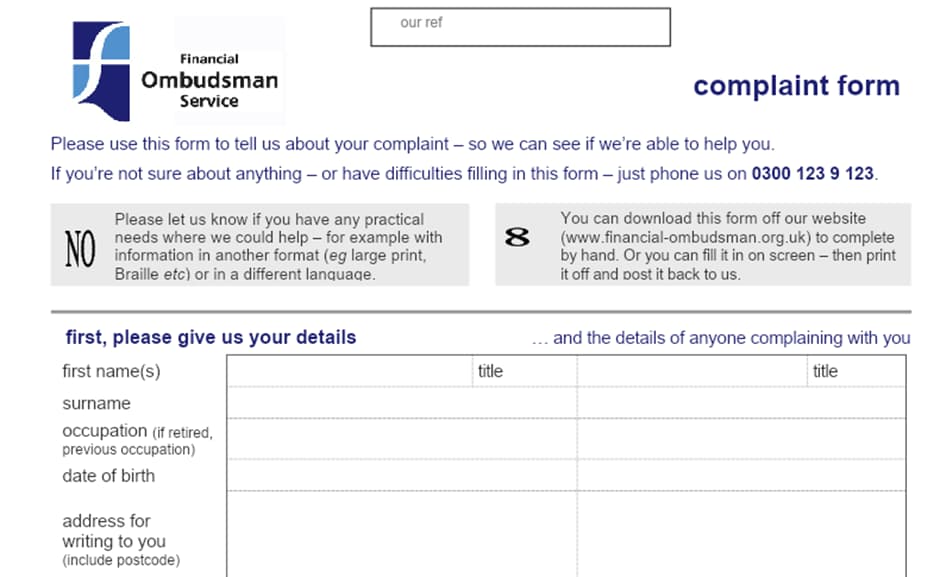

The term for lodging a collective complaint is up to 6 months of the violation. A complaint is simultaneously submitted to the Financial Ombudsman Service and a district court.

FCA Review — Term for lodging a collective complaint

When submitting a complaint, you need to:

-

Include complete details of the broker and your account. Provide proof that this is indeed your account with this broker. Account statements may be additionally requested.

-

Describe your complaint in detail. Attach screenshots that confirm your complaint.

-

Attach your conversations with the support service that confirm the broker’s refusal to resolve the issue in your favor.

Detailed information on how to lodge a complaint can be found in the Consumers or Complaints section.

FCA Review — Information about the lodging of complaints

FCA-licensed brokers | How to verify licensure

Traders Union tries to make it as easy as possible for traders and investors to search for brokers with licenses from various regulators. This section includes a list of Forex brokers that have, in particular, an FCA-license. Note that a broker may have several licenses that allow it to provide services in various jurisdictions in compliance with local laws.

The logos of these particular brokers are tiled with links to their profiles:

Expert’s assessment

The FCA is the most reputable regulator in Europe. It’s comparable to the U.S. Securities and Exchange Commission (SEC), which is one of the best regulators in the world. An FCA license means that a broker fulfills the strict requirements of the regulator whose goal is to limit the risks and protect the interests of traders. The FCA regularly audits brokers’ financial statements, monitors the observance of the account segregation rules, and promptly responds to traders’ complaints.

Unlike many other regulators, the FCA has broader powers to apply sanctions to the brokers that commit violations. Besides fines, the Authority can impose restrictions on separate types of services provided by brokers and influence the format of brokers’ partnership with private clients and businesses. Revocation of an FCA license means a complete prohibition from providing brokerage services in the UK. The Authority is fully independent of the UK Government, which eliminates conflicts of interest. But the FCA cooperates closely with the Bank of England and other British organizations that regulate the financial sector.

Despite the reputation and the strict regulatory policy of the FCA, traders should primarily rely on themselves. A dramatic example is the bankruptcy of WorldSpreads, formerly one of the largest brokers in the UK. In March 2012, the broker had to admit that it did not have enough funds to cover its clients’ balances and that the reason was as a result of fraud. The bankruptcy could not be prevented by the FSA, which regulated the broker at that time, or Ernst & Young, one of the “Big Four'' accounting firms. Account segregation did not save the traders’ money, either. Traders should remember that a license guarantees a broker’s reliability only to some extent, but it does not fully protect everyone from all risks.

FAQs

What is the FCA?

The Financial Conduct Authority (FCA) is a financial regulatory and supervisory body in the United Kingdom that regulates the operation of investment, banking, and financial companies. It cooperates with the Bank of England and other British regulatory bodies independently of the UK Government. The FCA’s tasks are to improve and protect the stability of the financial system, prevent fraud, money laundering, manipulations and abuse, regulate the interaction between all entities in the financial system, and protect consumer rights.

What are the benefits of an FCA license?

-

For brokers, it is traders’ trust, to provide help from state authorities, and improve ratings.

-

For traders, it is the confidence that a broker is legitimate and not a financial pyramid; protection by the regulator; and compensation of deposits in case of a broker’s bankruptcy. Conditions apply.

Question

Elaborate method:

-

On the broker’s website, find the license number. It may be in the footer, FAQs, or other sections that describe the broker’s features.

-

On the FCA website, find a section that contains basic information about all the licensees. Presently, it’s in the Financial Services Register. But the website may be periodically updated and the names of the sections may change.

-

Enter the license number. If the license is not found, try other entering options. For example, omit the letters and only include the digits.

Easy method:

-

Go to the Traders Union website and find a detailed review of the FCA.

-

Find a list of FCA-licensed brokers in the review.

Every month, TU’s analysts check brokers for valid licenses and analyze regulators’ comments about their respective licensees. All information on every license held by brokers is regularly updated on TU’s website.

How to submit a complaint against a broker to the FCA

The regulator only considers collective complaints. The form can be found in the Consumers section of the FCA website. A complaint is simultaneously submitted to the Financial Ombudsman Service and a district court. All documents must be completed in English.

A simpler option is to contact TU’s legal department. Every TU member is entitled to free legal help in resolving issues with brokers that are partners of Traders Union.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.