City Index Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- WebTrader

- MetaTrader4

- Mobile application

- AT Pro Trading Platform

- FCA

- 1983

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- WebTrader

- MetaTrader4

- Mobile application

- AT Pro Trading Platform

- FCA

- 1983

Our Evaluation of City Index

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

City Index is a broker with higher-than-average risk and the TU Overall Score of 4.66 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by City Index clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Broker City Index is aimed at cooperation with seasoned traders who prefer active trading in various markets.

Brief Look at City Index

The City Index broker was founded in 1983 in London. This company allows its clients to engage in active trading and place bets on the spread. City Index is licensed and regulated by the UK’s FСA — UK Financial Services Authority (license number 113942). The broker has received tremendous awards numerous times, including "Best Loyalty Trading Program" (2019), "Best Trading Platform" (2019), and "Best CFD Provider" (2020) while providing financial services.

- a vast array of trading instruments;

- both floating and fixed spreads are available to users;

- MetaTrader 4 terminal is provided for trading, as well as a web terminal and mobile applications.

- the trading platform periodically malfunctions;

- shortage of deposit/withdrawal methods;

- a broker can reject an application regarding opening a trading account if the user does not have enough trading experience or his starting capital is not sufficient for trading.

TU Expert Advice

Financial expert and analyst at Traders Union

During its activity, the City Index broker has proved to be a reliable partner who regularly fulfills its obligations. The company offers clients only two types of accounts: real and demo, on which a trader can test his trading skills without the risk of losing capital. The site also contains all the necessary information on each of the trading assets.

City Index aims to cooperate with market participants who already have experience in trading. This is because CFD trading has its peculiarities, which are not easy for a beginner to understand, and the level of risk in such trading is much higher. The broker does not have investor-oriented programs. During its cooperation with the Traders Union, the company received complaints from customers, primarily related to its support service, which assists exclusively in English, and it’s not always comfortable for CIS traders.

All information related to trading instruments is available on the broker's home page. However, it should be noted that all data is presented only in English, some of the links on the site do not work, and there is no detailed description of trading conditions (such as leverage, stop-out level, and order execution method) on the site.

City Index Summary

| 💻 Trading platform: | MetaTrader 4, WebTrader, AT Pro Trading Platform, iOS, and Android applications |

|---|---|

| 📊 Accounts: | Real, demo |

| 💰 Account currency: | EUR, USD, GBP |

| 💵 Replenishment / Withdrawal: | Bank cards Visa / MasterCard, bank transfer |

| 🚀 Minimum deposit: | 100$ |

| ⚖️ Leverage: | Depending on the trading instrument |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating and fixed |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, commodities, metals, cryptocurrencies |

| 💹 Margin Call / Stop Out: | From 5% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Spread betting |

| 🎁 Contests and bonuses: | Yes |

Broker City is dedicated to providing services for experienced traders internationally. The company offers one type of real account, the minimum deposit amount is 100 EUR / USD / GBP. The size of the leverage, spread, and other trading conditions depend directly on the trading asset that the trader uses.

City Index Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

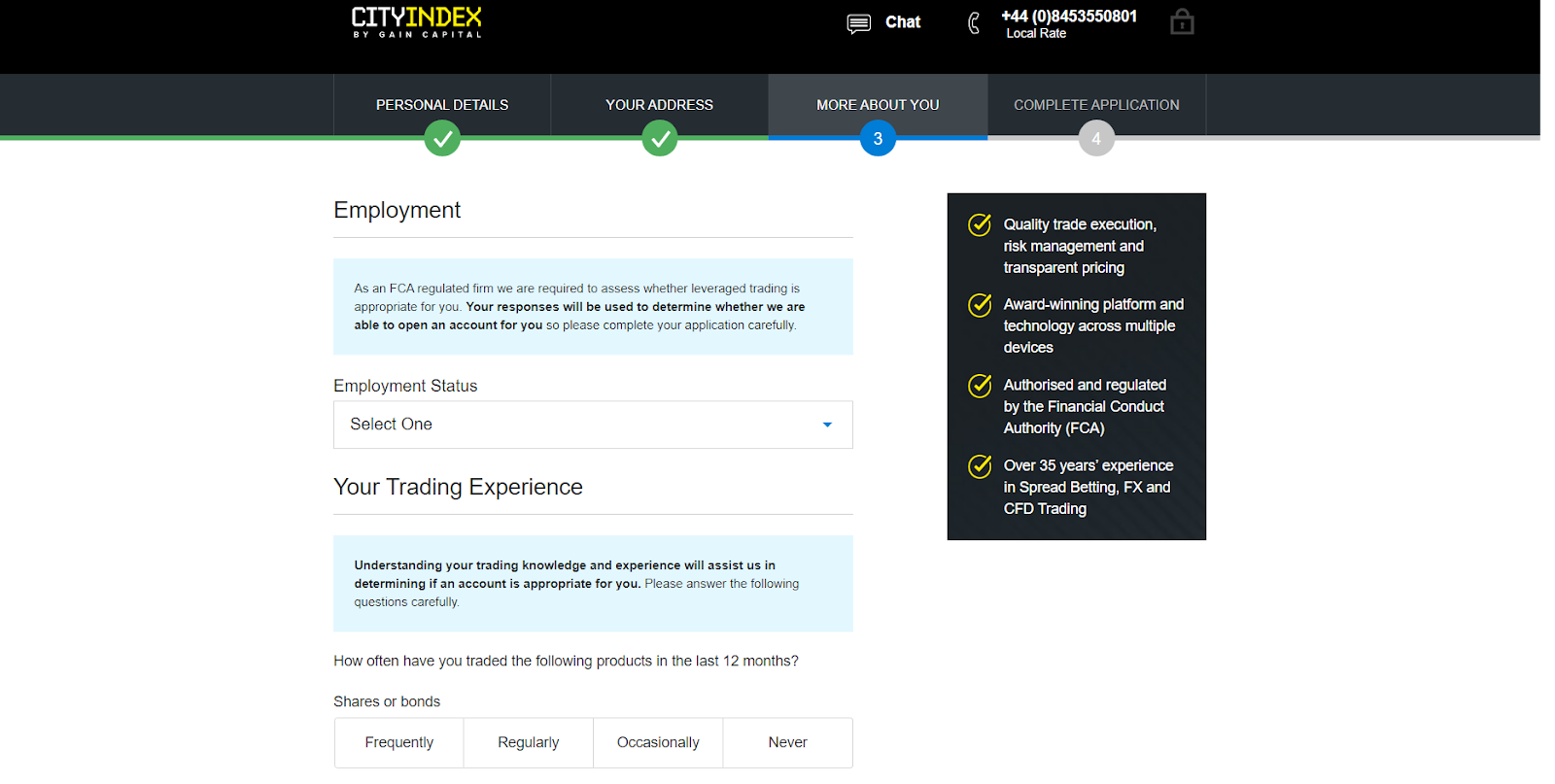

You need to stick to the following steps to start trading with City Index through the Traders Union rebate service:

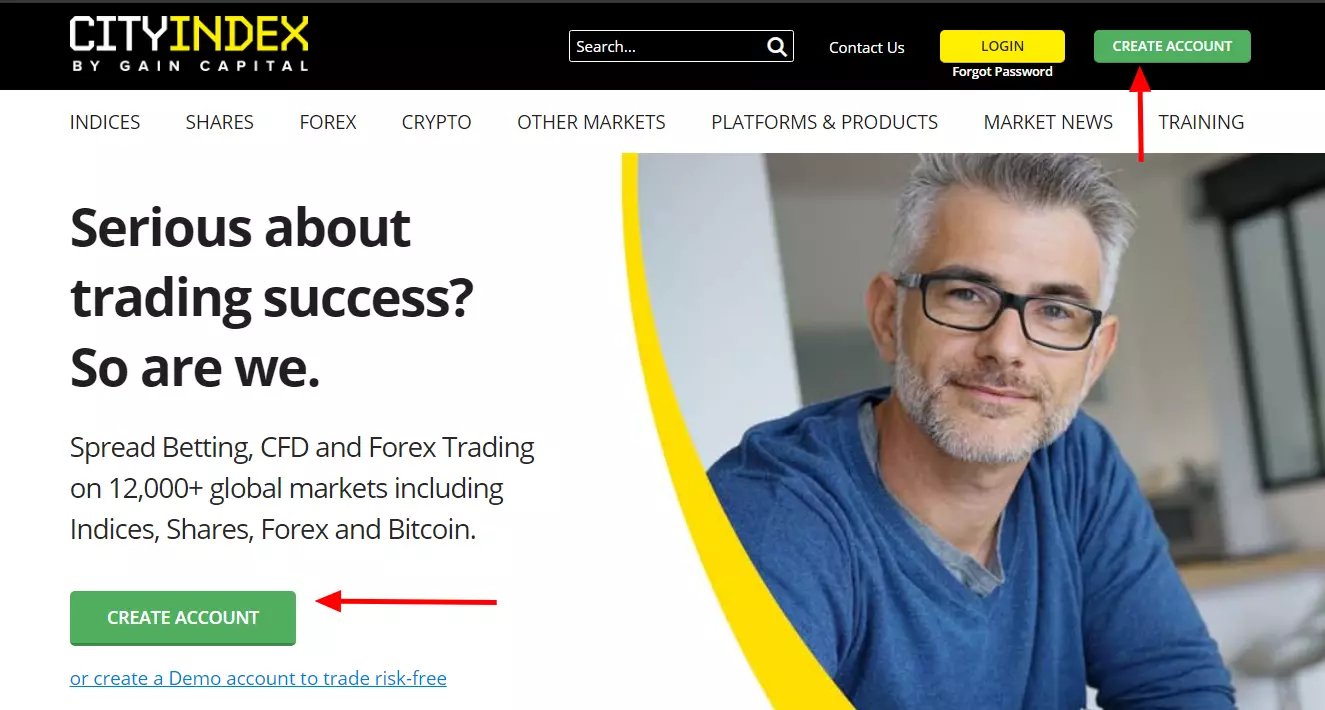

Open the Trades Union website, find City Index in the list of brokers, and follow the referral link to the broker's website. On the main page, click on the "Create account" button.

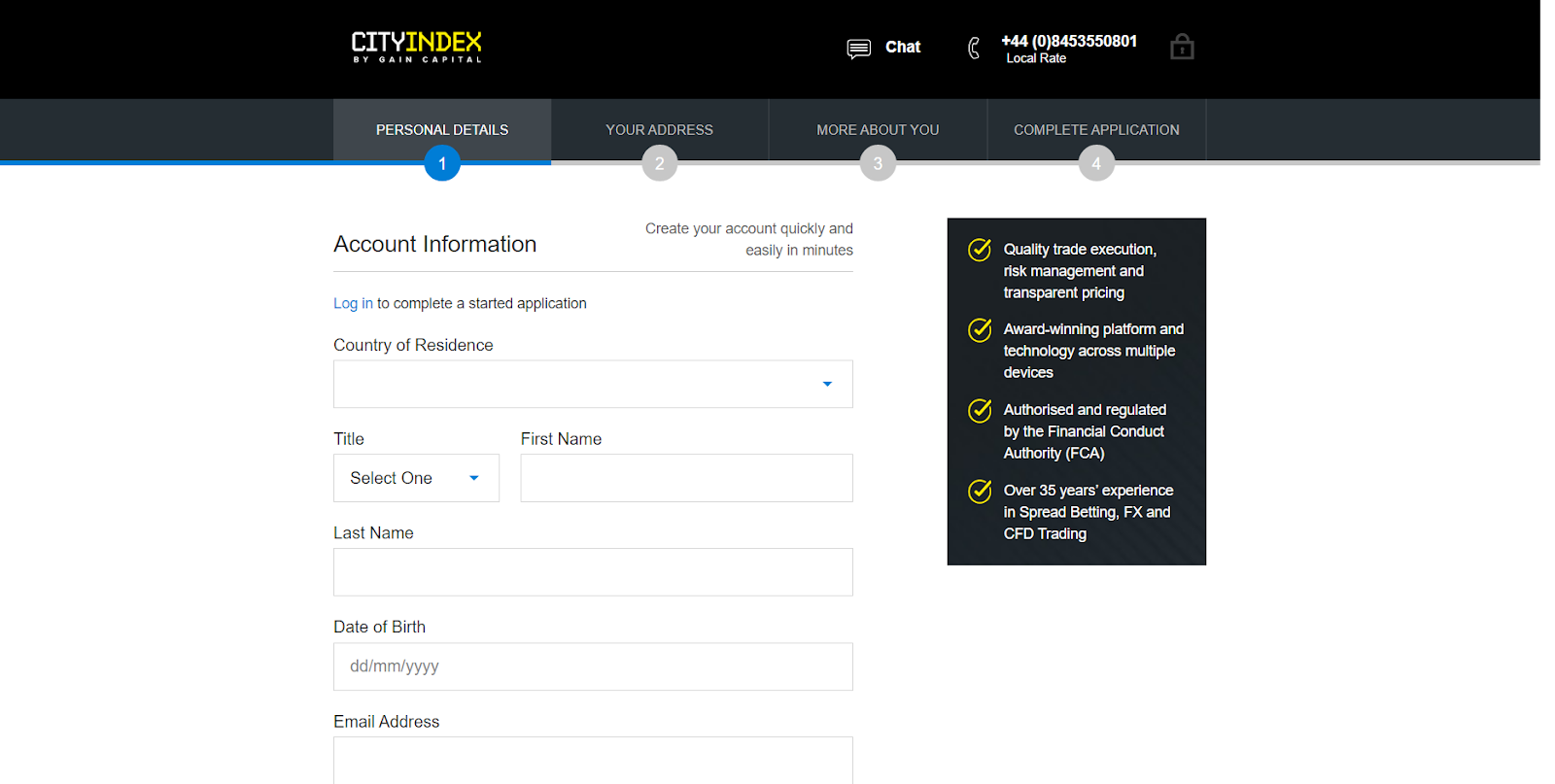

Fill out the form with your personal data, including country of residence, marital status, name, surname, date of birth, email address, mobile phone number, account name, password, and instruments that interest you (CFDs or spread bets, etc.).

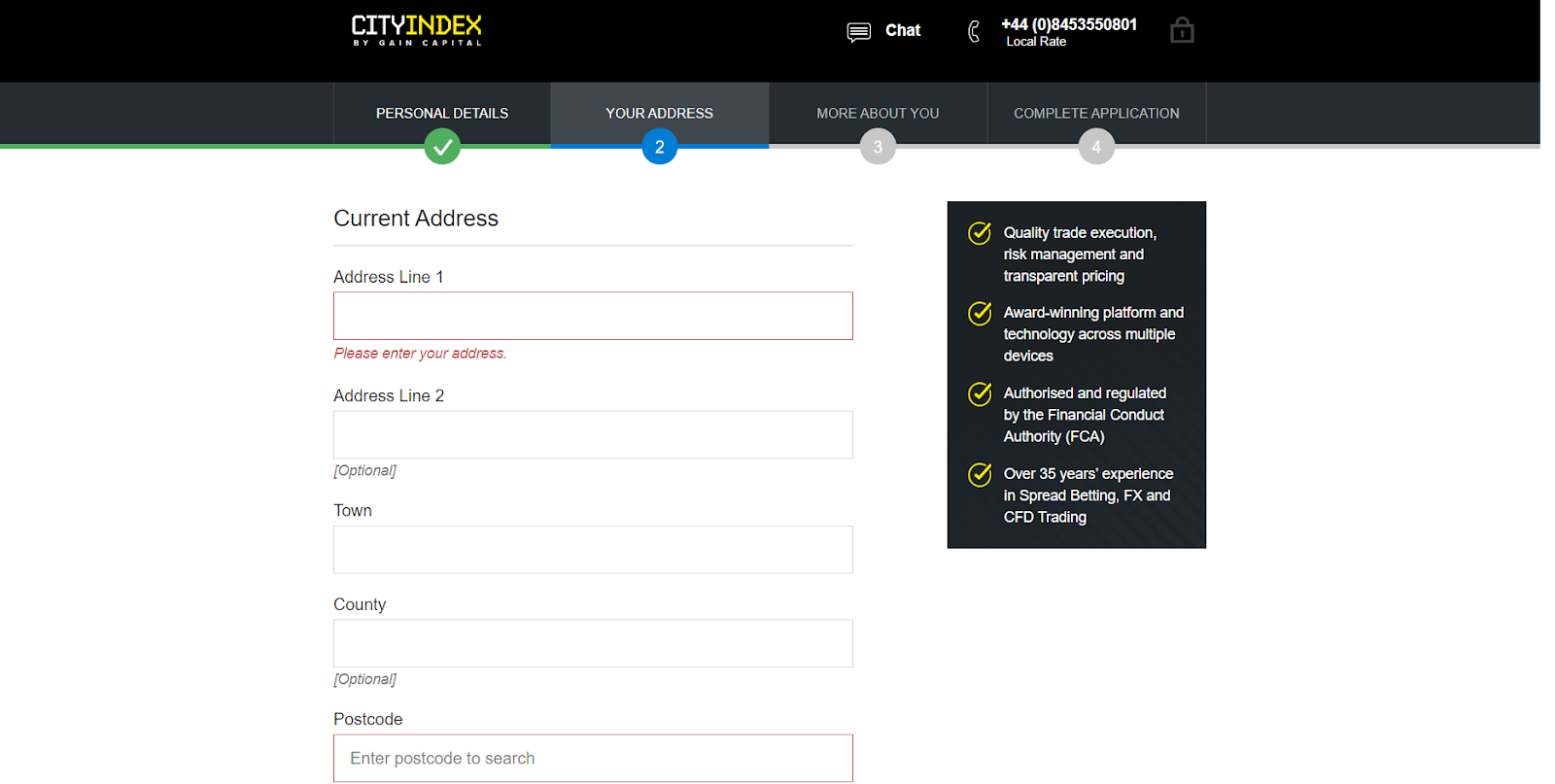

The next step is to indicate your current address of residence, city, postal code, citizenship, and TIN.

Now you need to specify information about the status of employment, trading experience in foreign exchange and other markets, and financial data: currency, annual income, other sources of income, the amount that you are willing to spend on the initial deposit).

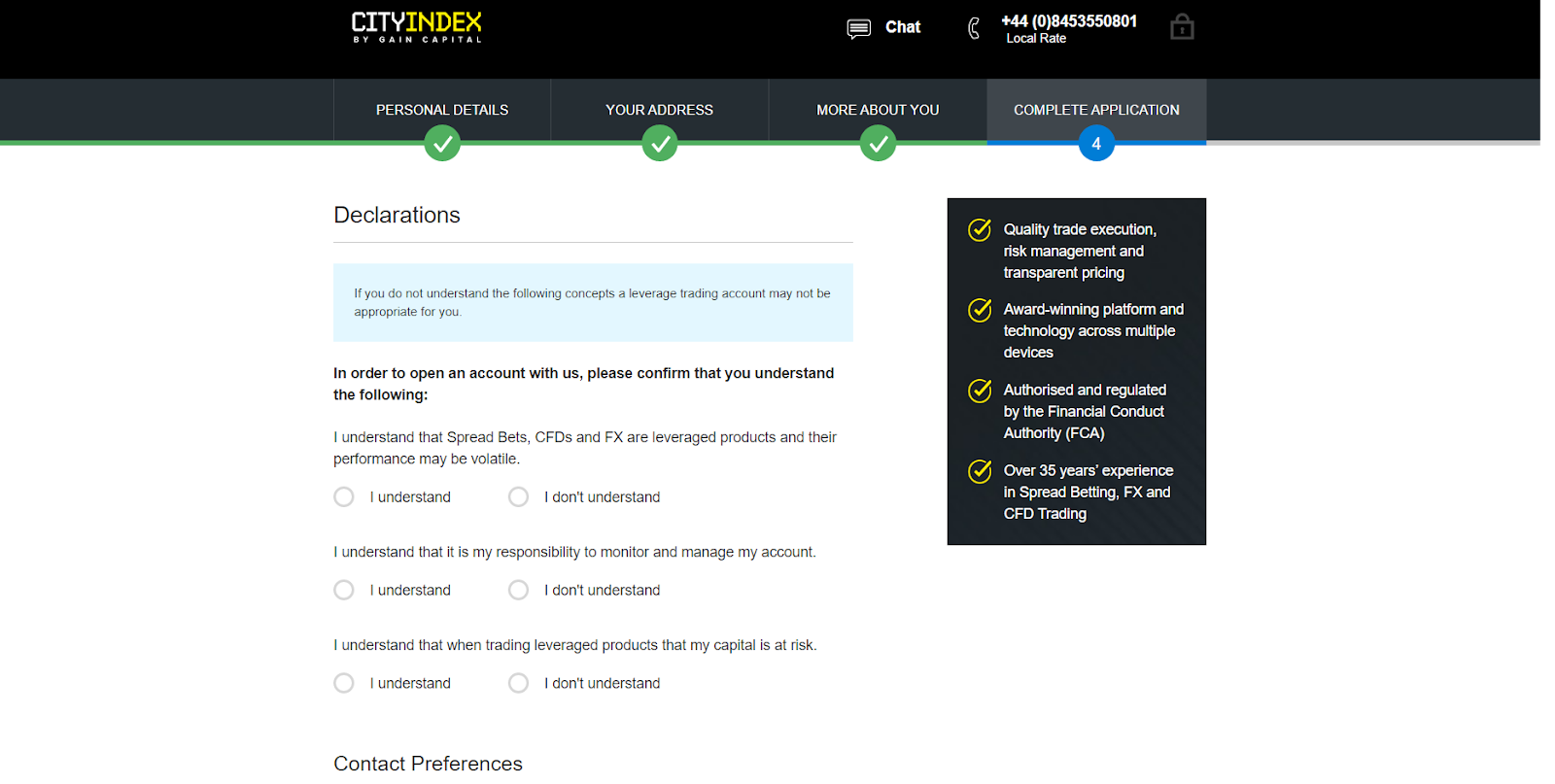

After specifying all personal data, you need to confirm your application for opening an account. At this stage, the trader needs to confirm that he accepts responsibility for his account and understands that trading the markets involves risks. Here you can also set up notifications in the form of letters to email, SMS, or calls on a mobile phone.

After your application is approved, you can go to your personal account, where these functions will be available:

-

personal account settings;

-

replenishment of the trading account.

All information must be indicated exclusively in English and all specified fields are required when registering. Also note that if you do not have the necessary trading skills, your application for opening an account may be rejected.

Regulation and safety

The City Index broker is regulated by the British FCA — Financial Conduct Authority. The same authority issued the company license number 113942, which allows it to safely provide financial services internationally.

The FCA is a regulator that puts forward several requirements for a broker. In case of failure to fulfill obligations to the regulator, the company is deprived of its license. City Index also uses segregated accounts to securely store customer funds, and the FSCS (Financial Services Compensation Scheme) guarantees traders up to £85,000 in compensation in the case of violations.

Advantages

- Protecting client funds with segregated accounts

- Guaranteed compensation

- Availability of a license and a regulator

Disadvantages

- Documents are not in the public domain

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Real | From $5 | None |

A fixed commission (for swaps) is charged for transferring a position to the next day. The spread indicators in City Index were analyzed and compared with those of other similarly situated brokers that are also popular among traders. Based on the results obtained, we can say whether the broker's commission level is low, medium, or high.

| Broker | Average commission | Level |

|---|---|---|

|

$5 | |

|

$1 | |

|

$8.5 |

Account types

The City Index broker provides only two types of accounts, one of which is real and the other is the demo. The difference lies in the presence of financial risk in a real account.

Account types:

Deposit and Withdrawal

-

To withdraw funds from the City Index broker, you must apply. The company does not charge a commission for this operation, as well as payment systems.

-

A trader can use Visa or MasterCard bank cards or select the bank transfer option to withdraw money.

-

The time for crediting funds to a client's card is on average 24 hours.

-

The following fiat currencies are available for withdrawing funds and replenishing the deposit: EUR, USD, GBP.

Investment Options

Investment Programs, Available Markets and Products of the Broker

City Index is focused on cooperation with traders who prefer active trading. City Index does not provide programs that allow clients to receive passive income using various investment offers and services for copying transactions.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

City Index’s affiliate program:

-

Affiliates. The bonus is credited to the partner for each referral client through an individual referral link.

-

Representing Broker. A program for brokerage companies that allows you to receive commissions for each transaction of an attracted referral.

-

White Labels. Companies that want to provide customers with access to more markets under a personal brand are considered as partners.

-

Exchange-traded futures. Providing clients of partner companies with access to more than 30 derivative exchanges in the United States, Europe, Asia, and the Middle East.

Customer support

If a trader in the process of work encounters difficulties or needs help, he can contact the support service. The company's employees work around the clock from Monday to Friday or 24/5.

Advantages

- 24-hour support, Monday-Friday

Disadvantages

- Customer support speaks exclusively in English

- You cannot get in touch with support on weekends

You can contact support using:

-

a call to a local phone number;

-

a call to an international number;

-

letters via email;

-

messages to the online chat on the broker's website.

You can apply for help directly from the broker's website or your personal account.

Contacts

| Foundation date | 1983 |

|---|---|

| Registration address | Devon House, 58 St Katharine's Way, London, E1W 1JP |

| Regulation |

FCA

Licence number: 113942 |

| Official site | cityindex.co.uk |

| Contacts |

0845 355 0801 (local rate, +44 203 194 1801

|

Education

Broker City Index provides its clients with access to free training materials that will help beginners to understand the peculiarities of foreign exchange trading, and more experienced market participants to improve their qualifications. Please note that all information in the "Training" section is presented exclusively in English.

We recommend using a demo account that excludes financial risks to practice and consolidate the knowledge gained.

Comparison of City Index with other Brokers

| City Index | RoboForex | Pocket Option | Exness | FBS | XM Group | |

| Trading platform |

MT4, MobileTrading, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MT5, MobileTrading, XM App |

| Min deposit | $100 | $10 | $5 | $10 | $1 | $5 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.3 points | From 0 points | From 1.2 point | From 1 point | From 0.2 points | From 0.6 points |

| Level of margin call / stop out |

80% / 50% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | $5 | No |

| Cent accounts | No | Yes | No | No | Yes | Yes |

Detailed Review of City Index

City Index is one of the most experienced in the Forex and CFD markets, providing financial services worldwide since 1983. The company's priority is to allow traders to trade from anywhere in the world from any device, without losing quality indicators. The broker provides clients with access to 12,000 markets, which significantly increases their trading opportunities. In addition to trading CFDs and currency pairs, the company offers traders cryptocurrency and spread betting.

Here are some numbers regarding City Index that may be essential for traders when choosing a broker:

-

the company has been providing services around the world for over 35 years;

-

over 120 thousand accounts have been opened during the operation of the broker;

-

the broker's clients have access to over 12,000 markets.

City Index is a broker for active trading at a professional level

City Index is a company that offers high-quality services and has optimal working conditions for traders. The broker offers one live trading account that will satisfy the needs of experienced market participants. Trading conditions vary depending on which of the trading assets the client uses. A distinctive feature of the City Index broker is its access to 12,000 trading instruments, which significantly expands the trading arsenal of its clients.

The company offers several trading platforms: from the familiar MetaTrader 4 to Web-Trader AT Pro, and mobile applications for iOS and Android. Such a wide range of terminals allows customers to choose the most suitable option for themselves and trade from anywhere in the world.

Useful services of City Index:

-

portal of technical and fundamental analysis. With its help, the trader reduces the time for independent analysis of the market and sees the most profitable points for opening a buy or sell order;

-

has a professional trading platform, AT Pro. More than 100 trading signals are available to help a trader adjust his trading strategy;

-

real-time news from Reuters. Cooperation with a news agency allows the company's clients to always be the first to keep abreast of financial news and receive financial reports;

-

economic calendar. Using this tool gives the trader an understanding of how various events affect the market situation, and use this data when building a trading strategy;

-

expert analysis of the market. The data is supplied by the broker's research team and helps clients predict the most likely price movement in the market.

Advantages:

the company has 35 years of experience in trading Forex assets, CFDs, and spread betting;

the most common and secure payment systems are used to replenish the account and to withdraw money;

the broker's activities are licensed and regulated by the British Financial Conduct Authority - FCA;

the company provides clients with tools so they can manage risks and mitigate the risk of loss on already open orders;

a vast range of trading platforms designed for both personal computers and mobile devices.

There are no trading restrictions in the company, and you can familiarize yourself with all available trading strategies on the broker's website.

User Satisfaction