Note:

a bearish breakout of the first low may be formed too quickly, so when planning a trade, you can use a pending sell stop order.

The “h” pattern may not be widely used by traders, but it is known for its steep decline, reversals, and buyers' capricious sentiments.

Features: It signals bearish reversals and is applicable across multiple financial markets

Pros: It gives clear trading signals and integrates with multiple indicators

Cons: Its signals may need confirmation by indicators. They are subjective and difficult to detect manually

The pattern "h" is considered to be a variant of a strong graphical model of technical analysis Head-and-Shoulders. Due to the fact that one "shoulder" is larger than the scale of the main figure, the pattern resembles the letter "h". The pattern is easily identified on all types of market assets, including stocks and cryptocurrencies. The trading strategy of "h" pattern is similar to the classic H&S figure.

Once identified, a trader can open a position or conduct further analysis to confirm the signal before trading.

The “h” pattern will be explained with examples. We will also look at how it is traded and discuss its merits and demerits.

What is the “h” pattern?

This pattern means that the bear market continues after a technical upward correction. On the price chart, the pattern looks like a small letter "h".

Is the “h” pattern bullish or bearish?

It is a bearish signal pattern because it indicates that the asset price has started declining and the bearish trend may continue.

What is the H&S pattern?

“Head and Shoulders” (H&S) is a popular chart pattern that shows 3 peak prices on a baseline, where the middle peak is the highest. It signifies a trend reversal from a bullish run to a bearish market.

What is the most powerful pattern in trading?

The efficiency of a pattern largely depends on market conditions, as well as experience and trading skills of the trader. So, there is nothing like the most powerful pattern in trading because all patterns can fail. However, the “Head and Shoulders” pattern is one of the most widely used and the most accurate price action patterns in the stock market.

An “h” pattern is formed when price action makes a steep decline, then bounces back to retest recent lows and finally drops beyond the initial lows. The explanation is that bullish market participants move in and start buying a declining asset, but then discover that the demand is not sustainable. As a result, many of them exit their positions. The trading volume decreases and the price also declines until it reaches new lows.

“h” pattern

Follow the steps below to manually identify an “h” pattern on a chart:

Identify a steep bearish trend that reaches a support level

The price recovers at the support and starts a bullish rebound

But then it hits a resistance level and reverses

The bearish run resumes and crosses the support level. This confirms the “h” pattern

Indicators like Moving Averages (MAs), Moving Average Convergence/Divergence (MACD), Aroon, and many others can also help to recognize “h” patterns.

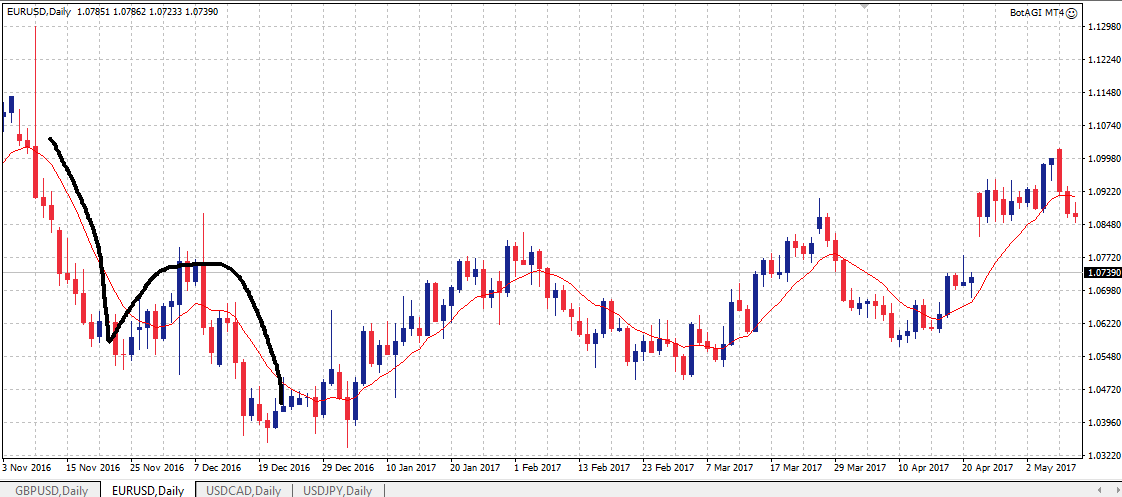

An “h” pattern identified by an MA on a EURUSD chart

Generally, “h” patterns work better in bearish markets. Some traders short the market right from the bearish reversal at the top of the “h” curve, for example, use an entry point at the Fibo level of 50%. But the most popular way to trade the “h” pattern is to open a sell position after the pattern is confirmed.

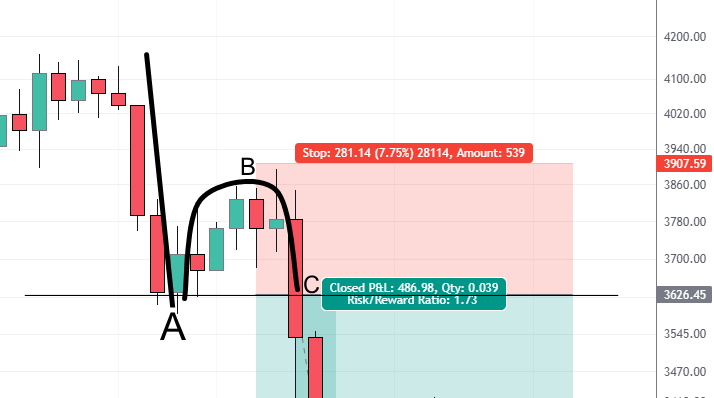

Below is a daily ETH/USD chart. An “h” pattern has been identified and sketched into the chart.

An “h” pattern on an ETH/USD chart

The chart segment below displays 3 major points of the “h” pattern:

The base of the “h”, which is the lowest price before the reversal to an uptrend

The highest point of the arc made by the “h” before a bearish reversal

The point where the price hits the base again

An “h” pattern on an ETH/USD chart

On the chart, the “h” pattern is confirmed when the price hits the support level again at 3626.45, completing the “h” shape. This should be the entry price for a short position.

The stop loss should be close to the top of the curve (B) depending on the trader’s strategy. We chose a little above it, at a price level of 3907.59.

Risk = 3907.59 – 3626.45 = 281.14

Next, we set the take profit to reflect the price target or risk/reward. Remember that cryptos are volatile and we are using a daily timeframe. So, we can go a little below 1:2

Reward = 3626.45 – 3139.47 = 486.96

So, the risk/reward ratio = 281.14/486.96 = 1:1.73

Of course, we could have set the stop loss at a lower price and risked less than 281.14, thereby increasing the risk/reward ratio. But the problem here is that prices fluctuate a lot and the stop loss might be triggered earlier than expected. If this happens, we end up with a loss. So, setting a wide stop loss increases the chance of success.

Use indicators: For example, MACD or the Relative Strength Index (RSI). Apart from helping to confirm “h” patterns, they can also help confirm sell signals

Check the fundamentals: Make sure there are no relevant news releases or events before trading

Timeframe: If you use smaller timeframes like M15, H1, or 4-hourly, the signals might easily fail compared to when you trade on daily or weekly timeframes.

Oleg Pylypenko says that a true ‘h’ pattern refers to a situation where price is moving in a bear market and meets a support level. And this support is sufficient for the price to form a rebound, but not enough for the market to become bullish. To confirm the pattern, pay attention to the volumes - when the price rises on a bounce, the volumes should decrease, indicating weakness in demand, and when it falls, the volumes should increase, because then the volumes indicate the strength of the sellers' pressure. In my opinion, the ‘h’ pattern can also be compared to the ‘dead cat bounce’ pattern.

Stop loss is an order type that triggers a close order when a preset price is reached. It is a risk management tool used by traders to automatically exit a losing position. For an “h” pattern, a stop loss is used to cut off losses in case the market reverses against the trader’s position.

The trader specifies his risk tolerance by inputting the stop-loss price when placing the order. It can also be modified after the order is placed.

In this pattern, stop loss is usually placed above the bend, but this rule should be adapted to specific market conditions, for example, find a level for stop loss on the lower timeframe.

The chart below shows the formation of an “h” pattern on a 4-hour chart of the EUR/GBP currency pair. The “h” pattern has been identified and sketched into the chart.

An “h” pattern on a EUR/GBP chart

Initially, the trend was moving upwards until a steep decline, which formed the stroke of the emerging “h” pattern. Then, there was a rebound as the price rallied upwards for a while before declining again. This time, it dropped below the stroke of the “h”, confirming the pattern. So, traders could quickly go short on the currency pair once the pattern was confirmed.

Note:

a bearish breakout of the first low may be formed too quickly, so when planning a trade, you can use a pending sell stop order.

Just as the name sounds, the inverse “h” pattern is formed when price action forms a shape that looks like an inverted “h”. It means that the price rose sharply and hit a high point, forming the first resistance level. The price then reversed moderately before making new highs and breaking the first resistance level.

An inverse “h” pattern on an XAG/USD chart

Trading the inverse “h” pattern is similar to trading the regular “h” pattern, except that the same principles are applied the opposite way.

An inverse “h” pattern on an XAG/USD chart

Once the pattern is confirmed as the bullish trend breaks through the initial resistance, we open a buy position. The stop loss can be placed around the support level. Take profit can be set using the trader's reward/risk ratio. Some traders use Fibonacci levels to determine the stop-loss and take-profit prices.

It is very important to accurately determine the “h” pattern on a chart before trading it. Often, what seemed like an “h” pattern may fail to meet one of the criteria to qualify as the pattern. Note that a failed “h” pattern may result in another price action pattern. So, traders usually learn how to use a lot of patterns, especially as many of them are related.

A failed “h” pattern on a BTC/USD chart

The chart above has a steep decline, but no immediate reversal because there was a little consolidation period. When the price dropped again, it did not clearly break the initial support at the stroke of the “h”. This "failed h pattern" can no longer be traded with this strategy because the price went below the first low, but then recovered - then shorts should think that the sellers have failed to resume the downtrend, and continuing to hold the short may not be a good idea.

Before using the “h” pattern, it is best to rigorously test your strategy on a demo or mini account. This way you will see if the strategy fits your personality, gain firsthand experience, and hone your trading skills.

Avoid trading an asset if you don’t know its current fundamentals. The news can affect market sentiments and cause the “h” pattern to fail.

If you are a manual trader who relies on technical analysis, then adding the “h” pattern to your arsenal is a good idea. However, trading based on signals generated solely from “h” patterns is not recommended. It is best to also use other trading tools or indicators like MACD, RSI, etc.

Benefits of using the “h” pattern:

It does not depend on the type of financial market, consistently effective on both low-liquid and volatile trading assets - the Forex, stocks, futures, cryptos etc, It works with multiple indicators

It generates signals with a high probability of profit

It indicates bearish continuation in financial markets

Downsides of using the “h” pattern:

It can give false signals

Locating it manually on charts can be time-consuming and involve human errors

After identifying a potential “h” pattern, use indicators to confirm the downtrend and patiently wait for the price to hit the support level again before opening a position. You can use a pending order to automate your market entry.

Do not forget that your primary focus is on risk management and preserving your trading capital.

The formation of the "h" pattern on the price chart starts with a sharp decline, followed by a short-term reversal and continuation of the decline. An “h” pattern is confirmed when the price drops below the previous lows. It is commonly traded by entering a short position upon confirmation.

Inverse “h” patterns work the opposite way. They are traded by going long after confirmation. Trading on these patterns requires deep practice and can be useful, but it is not absolutely profitable. The use of additional indicators to confirm "h" pattern signals is mandatory.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

A bear market is a period of time in which an investment asset, such as stocks, bonds, or commodities, experiences a decline in price for an extended period of time.

Kelechi started as an IT personnel, Network Engineer, and Web Designer. His quest for investments and wealth creation led him to the financial markets. Consequently, he began learning the rudiments of investing and financial markets trading. With time, he started experimenting with forex, CFDs, social trading, etc, and began following financial market news and analyses.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).