eToro Investment Portfolios: eToro investing in Smartportfolios

Are you a novice investor struggling with portfolio diversification and trading profits? Is it beneficial to follow the investment portfolio of trading experts for your trades?

eToro is a well-known Israeli fintech company. Founded by Ronen Assia, Yoni Assia and David Ring in 2007, today, it is one of the most popular brokers for social trading worldwide. Today we will discuss their recent initiative in the direction of innovative investment methods that benefit both amateur and adept investors- Smart Portfolios.

Smart Portfolios (formerly Copy Portfolios) are catalogued collections targeting investments towards a specific theme or methodology. Smart Portfolios allow investors to swiftly diversify their holdings by investing in various assets and trades they believe in or following the trading strategies of expert traders they are influenced with

Why Invest in eToro Smart Portfolios?

eToro Smart Portfolios

Smart Portfolios combine the benefits of social trading and the industry life cycle.

Novice investors can judge and follow the trading methodology of veteran investors. Match their moves and gain profitability by exploiting their experience.

Smart Portfolios facilitates diversified investment in an established or emerging industry for which investor has high regard and reap benefits from the industry’s collective growth.

Smart Portfolios are the most uncomplicated way to invest in a diverse yet very balanced portfolio for realising long-term investment goals.

Each Smart Portfolio employs a range of tactics to comprehend the long-term implications of the listing's location, industry, asset type, and investment strategy.

Smart Portfolios are regularly rebalanced to get the most out of the thematic trading strategy on which the portfolio is based so the portfolios remain profitable in the long run.

What Smart Portfolios are available on eToro?

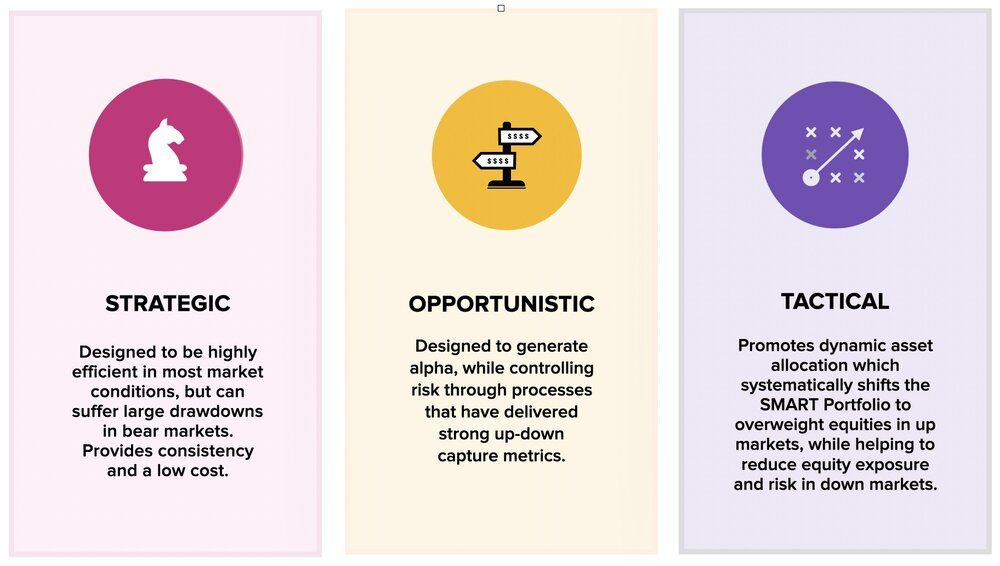

Most Portfolios are designed and managed by the eToro’s in-house investment team. Smart Portfolios are constructed with great care and research, considering various elements like balance, exposure, yield potential, risk, and more. eToro has three types of Smart Portfolios:

Top Trader Portfolios

Thematic Market Portfolios

Partner Portfolios

Top Trader Portfolios

eToro uses the billions of metrics collected by millions of users to develop cutting-edge, data-driven investment methods. For Instance-

Portfolio: Sharp Traders

Thematic Market Portfolios

eToro provides investors with diversified exposure to the most influential sectors of the global economy. For Instance-

Portfolio: Oil World Wide

Partner Portfolios

eToro is partnered with both contemporary and established investment startups worldwide, enabling them to create their portfolios on its channel for users to subscribe. For Instance,

Portfolio: Warren Buffet-CF

Pros and Cons of Investment Portfolios on eToro:

👍 Pros:

• Each portfolio is backed by professional research and development.

• The eToro investment team has an in-depth understanding of markets.

• eToro uses Cutting-edge technologies to create and manage portfolios to stay ahead in exploring new, groundbreaking investment strategies.

• Each portfolio has risk considerations and management tools to enable investors to make informed decisions.

• All portfolios are created and managed using specific and distinct methods.

•Investors can begin with a minimum investment of $500 without paying management fees.

• eToro provides advanced trading features in its mobile app.

• Every eToro account gets a $100,000 virtual trading account, so new investors can practice trading with play money.

• Being regulated by the top-tier FCA and ASIC signifies eToro's safety.

👎 Cons:

• eToro's services are not available worldwide.

• eToro does not allow for crypto-to-crypto pairs.

•Chat and phone support are available for eToro Club members only. Non-club members have to resort to email and ticket support.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

"Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more"

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQs

Are Smart Portfolios based on short-term or long-term profitable strategies?

The creation of Smart Portfolios considers a long-term plan, making them appropriate for investors seeking a more passive strategy.

When are Smart Portfolios rebalanced?

Rebalancing periods change from one Smart Portfolio to another. The rebalancing process is automated and does not require any action from your side. Visit individual portfolio pages on eToro to determine your portfolio's specific rebalancing methodology.

What is the minimum amount I can invest in a Smart Portfolio?

For investing in Thematic Market and Partner portfolios, you will need a minimum investment of $500. For Top Trader Portfolios, the minimum investment required is $5,000.

How can I withdraw funds from a Smart Portfolio?

It is not possible to withdraw funds from an open Smart Portfolio. However, you can close your Smart Portfolio anytime, and your funds will return to your available balance immediately upon liquidation.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).