eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

eToro Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- From $100

- WebTrader

- Mobile application

- 1:30

- Portfolio management and copying trades

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- From $100

- WebTrader

- Mobile application

- 1:30

- Portfolio management and copying trades

Our Evaluation of eToro

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

eToro is a reliable broker with the TU Overall Score of 7.75 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by eToro clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

eToro is an international broker for trading and investing in assets, copying trades of experienced market players and earning income on offering your own successful strategy. The activities of eToro are controlled by European financial regulators: CySEC and FCA. The broker offers its clients the opportunity to trade indices with a maximum leverage of 1:20 and ETF instruments with a leverage of 1:5. Size of leverage in eToro can also vary depending on the regulation of the division of the broker you work with.

Brief Look at eToro

The eToro broker was founded in 2007. The company promotes itself as a social trading platform working with traders from over 140 countries. The broker has several divisions operating under different jurisdictions and licensed by different regulators. For example, eToro (Europe) is licensed by the Cypriot regulator CySEC (109/10) and eToro (UK) is licensed by the British regulator FCA (583263). The broker also has a representative office in Australia and the USA.

- High level of reliability ensured by the licenses of respected regulatory authorities and participation in the compensation funds.

- Wide selection of assets quoted at stock exchanges in the UK, U.S., Australia and Asia.

- An opportunity to combine active trading with social trading and passive investing.

- Zero-fee trading of a number of stocks.

- Access to ready-made diversified asset portfolios with various risk levels.

- Provision of leverage, educational materials on various markets and user-friendly trading platforms that can run on any device.

- Zero fees for portfolio management, depositing funds and account maintenance.

- High minimum deposit for users of a number of countries.

- No live chat on the website for quick connection to customer support.

TU Expert Advice

Financial expert and analyst at Traders Union

eToro is an international brokerage company offering services all across the world. Every registered office adjusts the conditions to suit local traders to enable them to trade on beneficial conditions. The minimum deposit depends on the country of residence of a trader. In particular, the minimum deposit for residents of the US is $10 and UK is $50, Europe – $50, Israel – $10,000. The minimum deposit for overseas territories of the UK and France is $1000, for all other countries – $200.

The broker provides retail clients with a negative balance protection and restrictions on opening positions with insufficient margin. The clients can also contact the Financial Ombudsman Service. Investments of traders from a number of European countries are protected by compensation funds.

The leverage on eToro varies depending on the type of asset and the registered office chosen for trading. In particular, traders, who chose the office regulated by CySEC or FCA can trade indices with a leverage of 1:10-1:20, ETFs – 1:5. The company with a license of the Seychelles regulator offers a leverage of 1:100 for the most traded indices and 1:10 for non-major indices and ETFs.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk

eToro Summary

Your capital is at risk. eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

| 💻 Trading platform: | Mobile apps (iOS, Android) |

|---|---|

| 📊 Accounts: | Demo, Standard, PRO |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank Transfer, Skrill, Neteller, Revolut, Sofort (Klarna) |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | $1 for copying trades$10 for investing in stocks |

| 💱 Spread: | From 2 pips |

| 🔧 Instruments: | Stocks, ETFs, stock indices |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Portfolio management and copying trades |

| 🎁 Contests and bonuses: | No |

You can use eToro to invest in more than 3,000 stock assets, including at zero fee. The minimum deposit and leverage vary depending on the country of registration of a trader. Trading is available in mobile apps and on the web platform on any device. You can deposit and withdraw money via bank transfer and electronic payment systems. The broker offers margin trading, various bonuses and partner rewards.

eToro Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Matei

Matei  RO Sector 6

RO Sector 6

Low commissions for investers

Not yet found

Albert

Albert  PL Krakow

PL Krakow

A good broker for trading stocks

Quotes can slip sometimes

CA Beauharnois

CA Beauharnois Trading Account Opening

eToro is a Traders Union partner under the rebate program. Therefore you can save on fees, if you open an account using the Traders Union website. Follow the referral link on the TU website to the official website of eToro and then take the following steps:

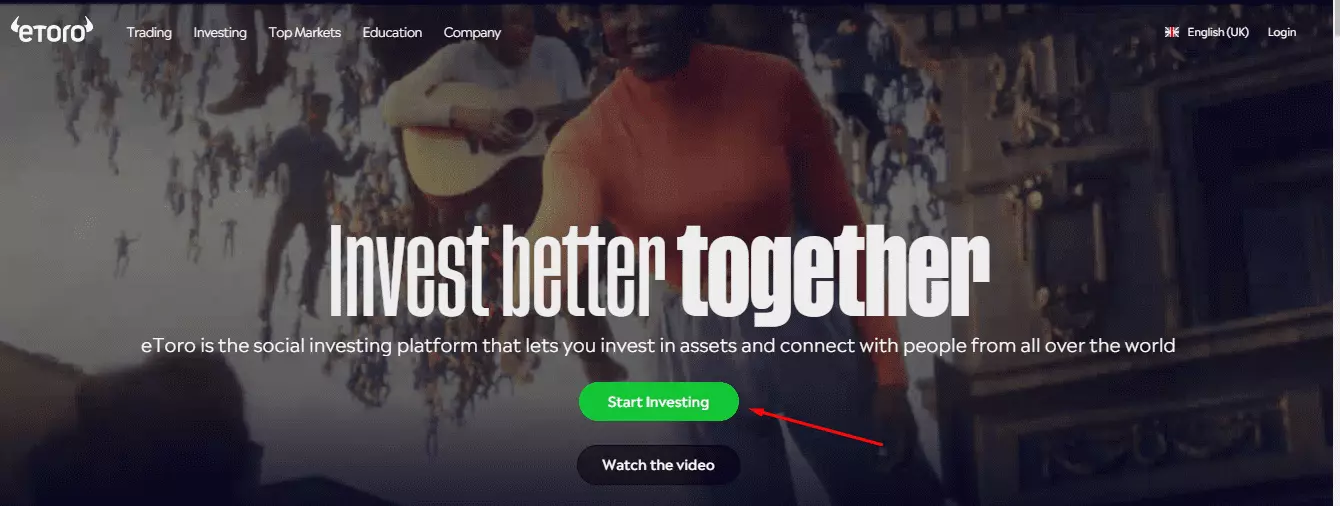

Choose your language on the homepage and click Start Investing.

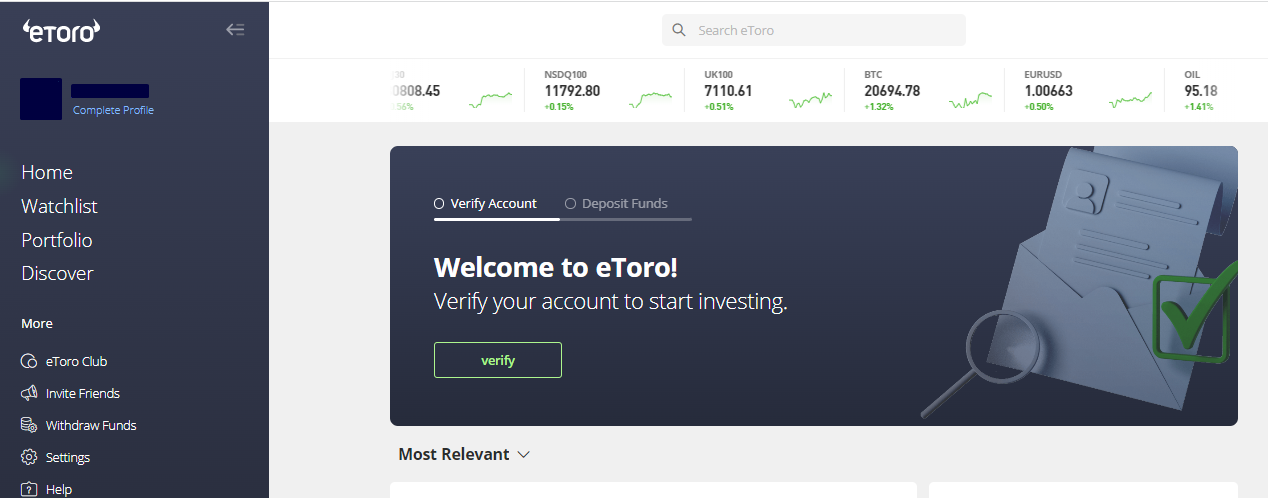

A registration form will open. Provide your email and come up with a username and password. You can also link your eToro account with Google or Facebook. Next, the company will send a confirmation link to your email. Follow the link and sign in to your Personal Account with the username and password that you provided earlier.

In the Personal Account, eToro clients do the following:

Main functionality of Personal Account:

-

Setting up and viewing the list of selected assets.

-

Information on your investment portfolio – the amount of invested funds, total equity, yield for the selected period.

-

Switching to virtual (demo) mode.

-

Access to Help Center and educational materials.

-

A button for generating a referral link.

-

Checking your eToro Club Membership status.

Regulation and safety

eToro is a financial holding company, each registered office of which is regulated at the place of location of the headquarters. The European office operates on the license No. 109/10 issued by CySEC, the British office – license No. 583263 issued by FCA, the Australia office — license AFSL No.491139 issued by ASIC. eToro is also supervised by the regulators of Malta and the Seychelles.

Accounts opened on eToro UK Ltd. are subject to the Financial Services Compensation Scheme (FSCS). Under its terms, each customer of the company's UK office can receive up to 85,000 British pounds in compensation in the event of eToro's bankruptcy. The CySEC regulator guarantees investment protection in the amount of up to EUR 20,000 euros to all clients of eToro (Europe) Ltd.

Advantages

- The broker operates on the licenses of respected international regulators

- Retail traders are provided with negative balance protection

- Brokerage services are provided in compliance with the MiFID.

Disadvantages

- The compensation schemes apply only to the clients of European and British offices of eToro.

- Low leverage in compliance with the regulators’ requirements

- Identity and bank account verification is mandatory

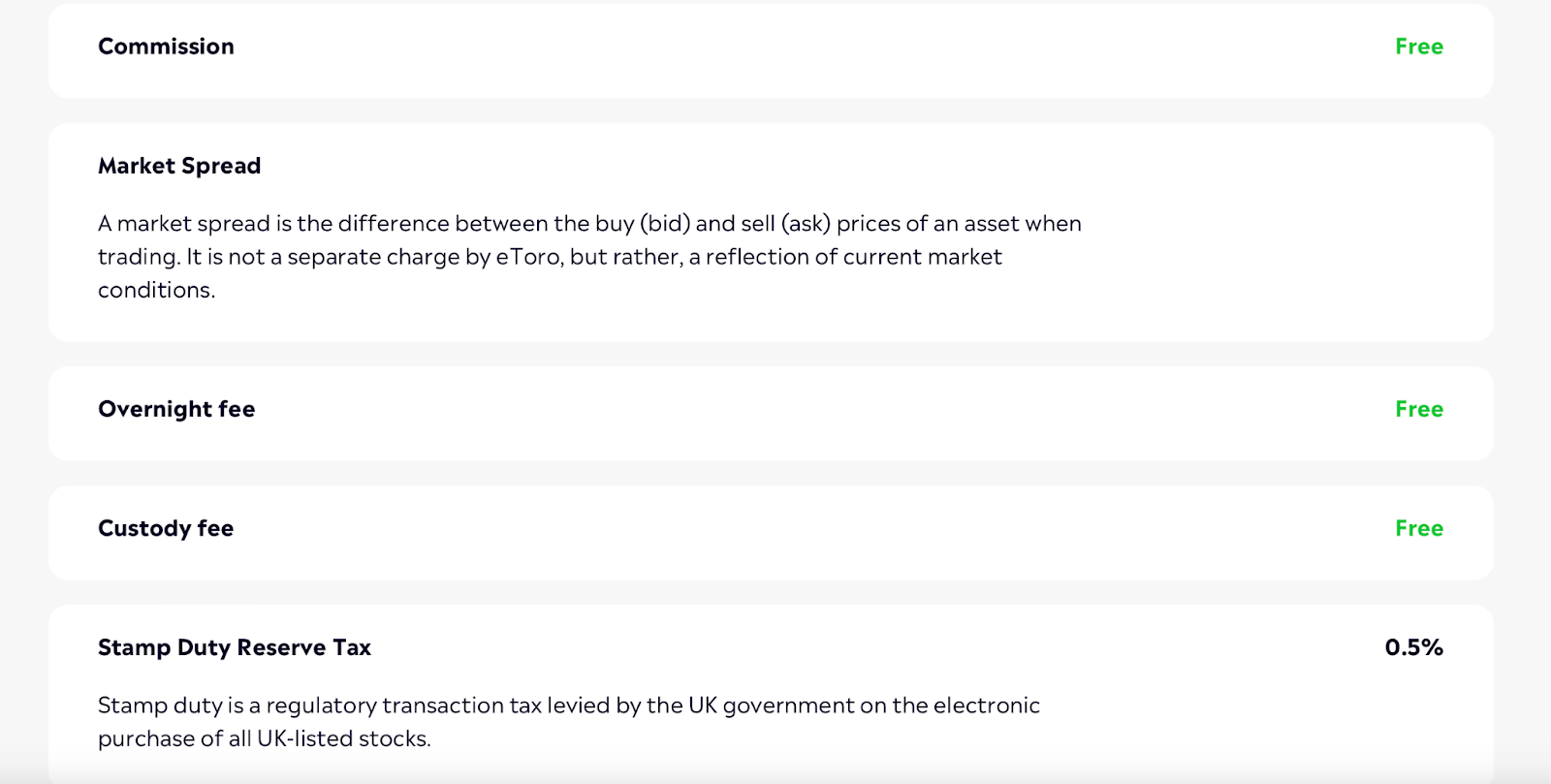

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | $5 | Yes |

| Pro | from $1.1 | $5 eToro’s fee + the fees of payment systems |

The broker charges the overnight fee for the rollover of the position to the following trading day. The formula for its calculation depends on the currency and the type of transaction (buy/sell).

We also calculated the average commission for standard and professional eToro accounts and compared it to the fees of other stock brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$1.1 | |

|

$11 | |

|

$4 |

Account types

In order to start trading on eToro, you need to open an account. The company offers a standard account to all clients by default. However, professional traders can submit an application for a Pro Account.

Account types:

Before opening a real account, every visitor to the eToro website can open a demo account to test the service. A demo account can be accessed in the trader’s Personal Account upon completion of registration.

Deposit and Withdrawal

-

The money from eToro account balance can be withdrawn to a debit card, and also to a bank account via SWIFT or IBAN. Also Neteller, Skrill and Sofort electronic payment systems are available.

-

The processing time depends on the chosen withdrawal option and can range from several minutes to 7 working days.

-

Minimum withdrawal amount for bank transfers is $500, all other methods - $30.

-

eToro charges a fixed $5 fee on each withdrawal. In addition, payment systems also charge their fees.

-

The company allows withdrawals only in US dollars. Other currencies are converted to USD with the corresponding fees.

Investment Options

With investment offers of eToro, the broker’s clients can earn passive income without trading financial instruments on their own. It is also possible to earn additional income on the partnership program.

Smart Portfolio, CopyTrader and Popular Investor

eToro specializes in social trading, which means it offers the best conditions for comfortable work of trading signal providers and their subscribers. Not only successful traders, but also novice investors with this broker. At the moment, the following investment solutions are available on eToro:

Smart Portfolio. These are long-term investment portfolios that consist of various assets. The portfolios are built by investment experts, who are also involved in their management and rebalancing.

CopyTrader. This is a service for copying trades of successful traders. An investor who subscribed to a strategy pays the standard trading fee. There are no additional fees. The minimum amount for copying a position is $1.

Popular Investor. This is an offer for traders who have traded financial instruments successfully for at least 2 months and are prepared to offer their strategy for copying by other eToro clients. There are 4 levels available: Cadet, Champion, Elite and Elite Pro with different percentages of profit.

Every investment program of eToro implies a deposit of a certain amount to the trader's account. In order to start working with Smart Portfolio, you need to deposit at least $500. The minimum account balance for the Popular Investor program is $1,000. In order to connect to the CopyTrader platform, you need $200 or more.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

eToro Partnership Program:

eToro shares with partners a part of its income from the new users who opened an account with the broker using a referral link. The rewards depend on the CPA indicators. There are three commission plans with monthly rewards of $100, $200 and $250.

The broker starts paying the rewards only after receiving at least $10 in fees from the referred users. A partner can use various methods of promotion – publish direct links and banners, send newsletters and ads by email, etc.

Customer support

The operators of customer support are available 24h from Monday till Friday.

Advantages

- Not only company clients, but also unregistered traders can ask a question

Disadvantages

- Support via a live chat is not available

- Responses by email are sent within 3 working days

There are several ways to contact eToro customer support:

-

email;

-

feedback form;

The company has pages on Facebook, Instagram, Twitter and LinkedIn.

Contacts

| Foundation date | 2007 |

|---|---|

| Registration address | eToro (UK) Ltd. 24th floor, One Canada Square Canary Wharf London, E14 5AB, United Kingdom |

| Official site | https://www.etoro.com/ |

| Contacts |

Education

eToro pays special attention to the education of traders. The broker’s website features information about what copy trading, leverage and margin are. There are also descriptions of how to buy and sell various types of financial instruments.

Upon completion of registration, any trader can create a free demo account with a virtual deposit of $100,000 and practice trading in an entirely risk-free environment.

Detailed Review of eToro

eToro specializes in social trading and also portfolio investing. The company is regulated in six jurisdictions; the broker has registered offices in different countries, including the UK, US, Cyprus and Australia. The number of active users on eToro is more than 6 million. Since 2019, the broker has been offering zero-fee stocks and in 2022, an opportunity was introduced to invest in fractional shares of over 1,000.

eToro in figures:

-

The company has been operating for over 15 years.

-

Around 10 million users have downloaded the mobile apps of eToro.

-

Traders from more than 140 countries use the services of the broker.

eToro is a broker for trading, investing and social trading

eToro provides access to investing in assets of various markets. The list of available stock instruments includes nearly 3,000 stocks, 15 indices, 15 exchange commodities and over 250 ETFs. The broker regularly expands the choice of ready-made investment portfolios that are balanced by the risk score and yield percentage. Theme portfolios with stocks (NVDA) and penny stocks of various industries, including energy, electronics, hardware, etc., are available.

eToro clients can also buy and sell stocks of companies that pay dividends. For passive investors, the broker has formed a portfolio of securities of international companies that have been paying dividends to their shareholders for at least 20 years straight. In addition, each eToro client can build his own portfolio or copy one from more experienced traders using the CopyPortfolios service.

Useful services by eToro:

-

Market hours and events. This is a section on the official website of the broker featuring the trading hours for various instruments and also the dates of important market events.

-

Dividend calendar. The calendar shows a list of companies that pay dividends to the holders of their shares. It also specifies the payment dates for different types of dividends – annual and periodic.

-

Earnings reports. In this special calendar, you can find information about the expected reporting dates of companies with the highest market cap and the expected earnings per share (EPS).

-

Demo account. You can use it to build a virtual asset portfolio, test the trading platform and the services of the company.

-

eToro Club. There are five membership tiers: Silver, Gold, Platinum, Platinum+ and Diamond. Each tier provides members with certain privileges, such as withdrawal fee and exchange fee discounts, a dedicated Customer Success Agent, etc.

-

ESG. The ESG scores help investors consider social, environmental and governance indicators and risks, which are not taken into account in the fundamental analysis. Depending on the level of company leadership in its sector, its stocks on the trading platform are lit with one of three colors – green, yellow or red.

Advantages:

A wide variety of assets are available: stocks, ETFs and stock indices.

Traders from the majority of European countries can start trading on eToro with USD 50.

The broker offers a user-friendly web platform and also Android and iOS mobile apps for market analysis and trading.

Margin trading and trading with leverage 1:30 are available on eToro.

The broker is regulated by respected financial commissions and participates in investor compensation funds.

Zero fee is applied exclusively for opening long positions on the US stocks. Other trading and non-trading fees charged by eToro are comparable to the indicators of other international stock brokers.

User Satisfaction