Boursorama Banque Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- Proprietary platform

- Not specified

- Ability to trade securities of local French companies

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- Proprietary platform

- Not specified

- Ability to trade securities of local French companies

Our Evaluation of Boursorama Banque

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Boursorama Banque is a broker with higher-than-average risk and the TU Overall Score of 4.36 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Boursorama Banque clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

This company offers a wide selection of trading assets and a secure entry into the global financial market.

Brief Look at Boursorama Banque

Boursorama Banque (pronounced "Boorsohramah Bank") is a popular French bank that offers clients the opportunity to trade on the stock market. Its official website provides valuable information relevant to both professional traders and beginners. The company began its operations in 1995 and started providing brokerage services in 2002. The bank's operations are regulated by European Union legislation. Boursorama Banque enables trading on the stock exchange without limitations, offering a wide range of popular international assets. Currently, within the French segment of companies providing banking services, boursorama-banque.com holds a leading position.

- Approximately 4,000 different assets available for trading;

- A high level of security for trading accounts;

- The option to choose one of four investor profiles based on traders’ acceptable risk levels.

- The primary focus of the broker is on the French market;

- The gradual reduction of the company's activities in other countries;

- The absence of the opportunity for clients to profit from cryptocurrencies and fiat currencies;

- Some account types (portfolios) are not suitable for novice traders;

- The main focus of boursorama-banque.com is banking, with services for trading on the stock market as an additional option.

TU Expert Advice

Financial expert and analyst at Traders Union

For over 15 years, Boursorama Banque (boursorama-banque.com) has provided financial services, establishing itself as a reliable partner. The bank's lack of high initial deposit requirements makes it a popular intermediary for investing in the stock market. Clients can review the trading fees even before activating their trading accounts, and all service fees are outlined on the bank's website.

Boursorama Banque deserves attention for its personalized approach to each trader. The availability of portfolios with different risk levels offers investors an excellent opportunity to choose an optimal trading strategy. The broker offers the following profile types for clients: protective (suitable for beginners aiming to limit risk and potential capital loss), balanced, dynamic, and aggressive.

The Boursorama Banque website is available only in French, limiting its potential investor base. However, among the French populace, the bank is popular, prompting many traders to choose it as an intermediary for investing in stock market instruments.

Boursorama Banque Summary

| 💻 Trading platform: | Boursorama Banque's proprietary platform |

|---|---|

| 📊 Accounts: | Ordinary securities account, FIP-FCPI, PEA, managed savings account |

| 💰 Account currency: | EUR |

| 💵 Replenishment / Withdrawal: | Debit and credit cards, bank transfers to an account at Boursorama Banque or to an account at another bank, payments by check |

| 🚀 Minimum deposit: | From EUR 100 |

| ⚖️ Leverage: | Not specified |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | Unavailable |

| 🔧 Instruments: | Assets from stock and commodity markets, stocks, and bonds |

| 💹 Margin Call / Stop Out: | Not specified |

| 🏛 Liquidity provider: | Euronext Paris |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Not specified |

| ⭐ Trading features: | Ability to trade securities of local French companies |

| 🎁 Contests and bonuses: | Welcome bonus when applying for a cardBonuses in the form of rebates from Traders Union |

Boursorama Banque's banking product rates are among the most advantageous in the French market. The conditions of broker accounts might interest investors trading on the stock market. The company does not provide accounts and platforms for accessing Forex. Additionally, there are no copy trading services or partner and bonus programs for regular clients. The currency for deposits and withdrawals is exclusively EUR.

Boursorama Banque Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

The process of opening an account with Boursorama Banque is as follows:

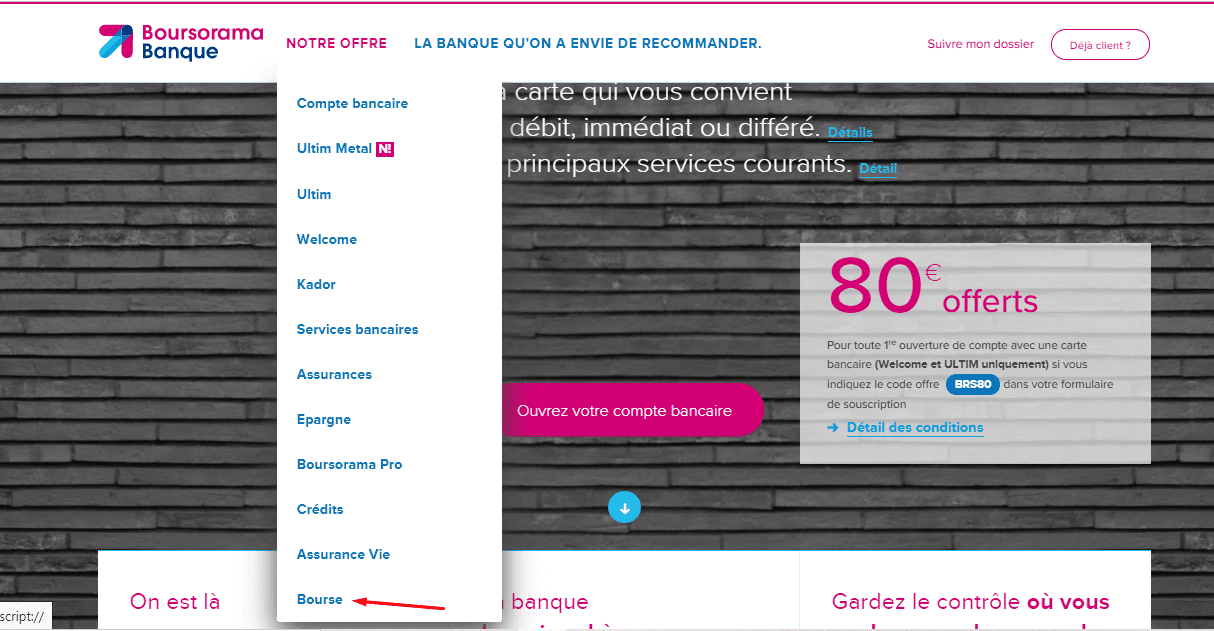

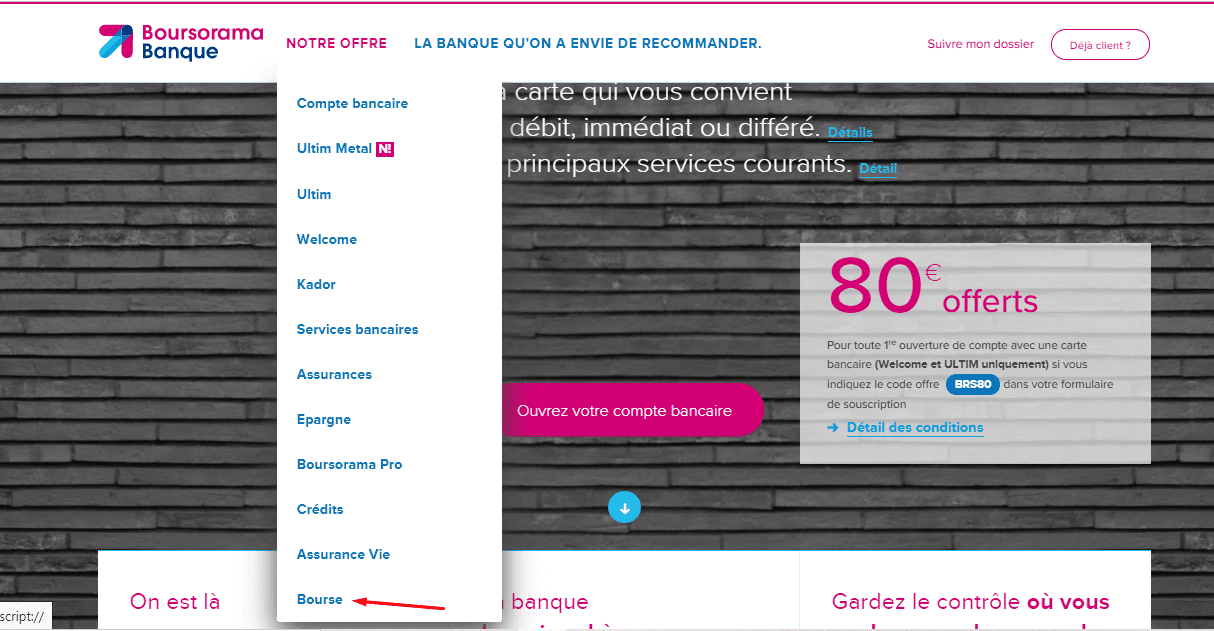

Go to the official website boursorama-banque.com and click on the "Our Offer" button. In the list of available services that appears, select "Stock Exchange”.

To open an account for investing in the stock market, you first need to open a bank account. In the registration form, provide personal information as well as the financial information requested by the bank. After filling out the application, it's essential to undergo verification.

In the Boursorama Banque user account clients can:

-

Deposit and withdraw funds;

-

Work with a full range of assets;

-

Explore detailed trading statistics;

-

Receive up-to-date analytical data from financial experts at Société Générale holding company.

Regulation and safety

Boursorama Banque is a subsidiary of the Société Générale group, a licensed credit institution supervised by the French government and independent authorities. The company is regulated by the ACPR — Prudential Supervision and Resolution Authority. Additionally, the group holds an AMF license from the Financial Markets Authority, an independent administrative body. Oversight of the corporation's activities is also conducted by the supervisory service of the European Central Bank (ECB).

Advantages

- Client funds are held in segregated accounts

- Investors have the option to lodge complaints with regulators

Disadvantages

- Brokerage services become available after opening a bank account and complying with regulatory requirements

- Does not support transactions with electronic wallets

Opening a bank or brokerage account requires an official agreement with the bank.

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Securities accounts | From EUR 1.99 | Yes |

There are no swap fees for carrying over positions to the next trading day.

TU analysts also compared the main trading fees of boursorama-banque.com with the fees of others brokers. The results are displayed in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$1.99 | |

|

$2.99 | |

|

$1.1 |

Account types

The international broker operates in line with French state regulators' requirements, allowing stock exchange trading exclusively for bank clients. Account top-ups are solely permitted for active Boursorama Banque account holders. Furthermore, complete access to fee details is exclusively granted to active bank clients.

Accounts Types:

The broker doesn't provide demo accounts, making trading without financial investments impossible.

Boursorama Banque's focus is on providing banking services and fostering comfortable conditions for clients entering the stock market.

Deposit and Withdrawal

The broker enables clients to withdraw funds whenever they prefer. Funds become available upon the client's initial request right after the bank's financial experts process the withdrawal request;

Withdrawals can be executed through various methods: transferring funds to debit or credit cards, depositing into the client's account within Boursorama Banque or another bank, and conducting transactions via client checks;

All account funding and withdrawals are carried out in EUR, with processing time and payment fees contingent upon the chosen withdrawal method;

Verification is obligatory, depositing or withdrawing funds without providing personal and financial details is not possible.

Investment Options

Controlled Savings Account is an investment service from Boursorama Banque

It is designed for clients who aim to benefit from stock market dynamics by relying on the expertise of ODDO Asset Management. Trades are based on reports from a leading analytical firm. Clients can choose from 4 investor profiles. The aggressive account type is particularly noteworthy, allowing for a rapid balance increase, albeit with a high degree of risk. Key advantages of the controlled savings account include:

Transparent management of client funds in partnership with ODDO Asset Management;

Investment starting from EUR 100;

No withdrawal fees;

Transparent profitability statistics available even to unregistered users, enabling clients to choose an investment solution with an acceptable risk level.

Thus, controlled savings accounts help compensate for the lack of experience and knowledge among novice traders. Potential investors can determine the best strategy in advance by reviewing profitability data and studying the user agreement.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program of Boursorama Banque

Boursorama Banque does not offer a partnership program. Instead, the company allows clients to earn income from investing in securities rather than from recruiting new traders.

Customer support

Clients have support available from Monday to Friday, from 8:00 to 22:00, and on Saturdays from 8:45 to 16:30 (Paris time).

Advantages

- Accessible to all bank clients

Disadvantages

- Not available on Sundays

- Questions can only be asked in French

- No option for individuals who are not bank clients to contact company representatives

- No live chat available

Support can be reached through two methods:

Using contact phone numbers;

Using a specific form (only for active clients).

To submit an inquiry or question, it's necessary to log in to the client's user account.

Contacts

| Foundation date | 1998 |

|---|---|

| Registration address | 44 Rue Traversière, 92772 Boulogne-Billancourt, France |

| Regulation | l’ACPR, l’AMF, BCE |

| Official site | https://www.boursorama-banque.com/ |

| Contacts |

0800 09 20 09

|

Education

Detailed information about the availability of various educational tools is only accessible to active bank clients. The educational section is absent on the website itself.

As for technical analysis tools, the broker doesn't offer the opportunity to test its services on a demo account.

Detailed review of Boursorama Banque

Boursorama Banque operates under an international license, ensuring its reliability. With extensive experience in the global market, the bank guarantees the quality of its services. Clients opening brokerage accounts with Boursorama Banque can trade stocks and bonds, with the added benefit of technical and analytical support for novice traders.

Key figures about Boursorama Banque that showcase its service quality include:

Access to over 4,000 different assets for clients;

More than 19 years of stock market experience as a broker;

A client base of over 3 million French citizens using the bank's services.

Boursorama Banque is a broker that serves as a regulated entity, offering a safe investment environment for traders.

Boursorama-banque.com provides clients with an optimal suite of services and analytical tools. While it lacks support for currency or cryptocurrency trading, this is compensated by a diverse range of other available assets. Additionally, the service stands out for offering various types of savings accounts. For instance, the "Protective" account is ideal for beginners aiming to grow their capital in a secure manner.

Clients can execute trades using the web platform in their user accounts, and the mobile platform facilitates trading from anywhere. Smartphone users have access to the same essential tools as the web platform.

Useful functions of Boursorama Banque:

ProRealTime. Professional trading tool for technical and real-time chart analysis;

Trading Board. A unique system for swift position viewing and order placement;

Investment Analysis Tools. Access to comprehensive value tables and detailed analytical reports.

Advantages:

Client and company funds are maintained in segregated accounts;

More than 4,000 assets are available;

The brokerage firm is a part of France's largest bank;

There are no high trading fees for dealing in stock market instruments;

Access to analysts who customize optimal trading strategies is available.

The company streams quotes from the Euronext Paris stock exchange (France) and real-time data from the U.S. markets.

User Satisfaction