What Is The PDT Trading Rule For Dummies?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

eOption - Best stock broker for 2025 (United States)

Pattern Day Trading (PDT) is regulated by FINRA and the SEC. PDT rules only apply to either US residents or non-US residents trading through a US-registered brokerage. The rules come into effect if you execute four or more day trades (opening and closing a position within the same trading day) on a margin account within a rolling five-day period. PDT traders are required to have $25,000 in their account to cover any margin trades.

For any trader who has heard of pattern day trading, whereby eligible day traders must have a minimum of $25,000 equity in their trading account, the rules can cause some worry – particularly if you don’t know who they apply to. However, pattern day trading rules only apply to traders who meet specific criteria, which we’ll explain in this article. We will cover what a pattern day trader is, what the rules are and who regulates pattern day trading, and who must follow the PDT rules.

What is considered pattern day trading?

The term Pattern Day Trader (PDT) is a designation given by regulatory bodies such as the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) to traders and investors who engage in this type of day trading.

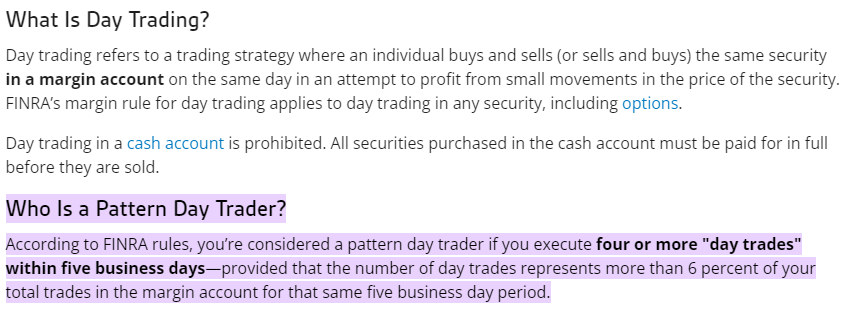

What is day trading?

What is day trading?Pattern day trading refers to a pattern of trading that involves executing four or more day trades within a period of five consecutive business days. PDT traders must have a minimum amount in their balance at all times to cover any margin deals.

Traders with PDT classification are subject to special rules to reduce the risks of frequent day trading, ensure traders have sufficient capital to cover potential losses, and promote market stability. Compliance with PDT rules is monitored closely by FINRA to uphold fair and transparent trading practices within the securities markets.

Best Stock Brokers

What are the SEC and FINRA rules for PDT?

PDT rules are primarily established and enforced by FINRA with oversight from the SEC. Here's a breakdown of the PDT rules:

Classification: If you execute four or more day trades within a rolling five-business-day period, you are classified as a pattern day trader. The PDT regulations define day trading as buying and then selling the same security on the same day, using a margin account. This applies to multiple types of securities, including but not limited to stock options and short sales. Once you meet this threshold, you are designated as a pattern day trader.

$25,000 Minimum Equity Requirement: As a PDT you’re required to maintain a minimum equity of $25,000 in your margin account at all times. This equity must be in the account before engaging in day trading activities and must be maintained to continue day trading. If the account equity falls below this threshold, you’ll be prohibited from any further trading by your brokerage firm. The $25,000 amount isn’t required to be cash holdings, it can be in eligible securities too.

Day Trading Buying Power: If designated as a PDT, you may trade in equtity securities up to four times your maintenance margin excess as of the close of business of the previous day. Exceeding the purchasing power limit will result in the broker issuing a margin call, which you have five business days to comply with.

During that period, your trading is limited to two times the maintenance margin excess, based on your daily total trading commitment. Failure to meet the margin requirement will result in the account being limited to trading with available funds for 90 days or until the margin call is met.

The 6% Rule: A key PDT regulation is the 6% rule, which limits the amount of day trading buying power available based on the account's net liquidation value from the previous trading day. If as a PDT your account falls below the required $25,000, you can still day trade, but the total number of day trades you can make within a five-business-day period is limited to 6% of your account's total trading activity for that period.

You can read more about the somewhat complex regulations surrounding pattern day trading on the SEC’s official website.

Does the PDT rule apply to non-US citizens?

The rules and regulations regarding day pattern trading come from US-based financial regulators, the SEC and FINRA. They only apply to US brokerage firms, accounts, and traders or investors. Therefore, whether PDT rules apply to you depends on your trading activities and which jurisdiction your brokerage account operates under.

If you’re a non-US citizen who has brokerage accounts with US-based firms, and you trade in US securities, the PDT rule will apply if you meet the criteria for pattern day trading. You’d be subject to the same regulatory requirements, including the $25,000 minimum equity. However, if you’re a non-US citizen trading with a brokerage account with firms outside the US, you would generally not be subject to the PDT rule.

Is there a PDT rule in Europe?

The short answer is no, there are no rules similar to the PDT rule in Europe. However, if you’re a European citizen trading on a US-based brokerage firm, such as Interactive Brokers, your trading would be subject to US laws. Even if your broker is a subsidiary of a US broker, you would in most cases be subject to US regulation. Make sure to check where your broker is registered before engaging in day trading with margin.

Does PDT apply to options / Forex / crypto?

Currently, PDT rules do not apply to the Forex market, as Forex operates quite differently from the stock market. Forex is an over-the-counter market with no centralized exchange, so Forex traders aren’t subject to the same rules as stock traders.

The crypto market is also not subject to PDT regulation, as cryptocurrencies are not legally considered securities – a subject of much ongoing debate. You can trade crypto free from the worry of PDT regulations.

For options trading, the PDT rules still apply if they’re stock options. Essentially, US securities, including stocks, bonds, options, and ETFs, are regulated by FINRA and the SEC. When you trade these securities within the same day, your brokerage will automatically register that you’re day trading, and if done more than 4 times in the same day, you’ll be subject to PDT rules.

What is the Difference Between Day Trader and Pattern Day Trader?

The difference between a day trader and a pattern day trader (PDT) lies in the frequency and volume of their trading activity, under US financial regulations. Because PDT is a US regulation, a non-US day trader trading through a non-US brokerage would not be a PDT even if they executed more than four trades in one trading day.

A day trader is someone who buys and sells securities in one trading day to make a profit. They might execute multiple trades in a day but do not necessarily meet the criteria to be classified as a pattern day trader.

A pattern day trader is someone who is designated as such by FINRA and the SEC, because they’ve executed four or more day trades within a rolling five-business-day period using a margin account.

How to comply with Pattern Day Trading regulations?

To comply with PDT regulations while still maximizing your profit opportunities, follow these tips:

Maintain Sufficient Account Equity: To avoid PDT restrictions, ensure your margin account maintains a minimum equity of $25,000 at all times.

Strategic Trade Planning: Plan your trades strategically to minimize the number of day trades executed within a rolling five-day period.

Use Swing Trading Strategies: Instead of day trading, consider implementing swing trading strategies where positions are held for multiple days to reduce the frequency of day trades.

Focus on Quality Over Quantity: Prioritize quality trades over quantity. Look for strong technical or fundamental setups that offer favorable risk-to-reward ratios.

Complying with regulations surrounding pattern day trading requires first understanding what actually constitutes day trading. You can learn all about that here: Is Day Trading Legal? Day Trading Rules and Limitations.

Summary

If you’re not a US resident or trading through a brokerage firm registered in the US, you needn’t worry about pattern day trading regulations. However, if you are, then it’s crucial that you’re aware of the rules. If you conduct more than three day trades within the same five-day rolling period, you’ll be subject to FINRA and SEC pattern day trading regulations, and required to have a minimum of $25,000 in your account. Check which jurisdiction your broker operates under before engaging in day trading.

FAQs

Why the need for the PDT rule?

After the dot-com crash, the SEC and FINRA concluded that previous rules did not adequately address the inherent risks inherent in day trading. The PDT Rule is used to limit potential losses and protect the consumer.

What is the 6% rule for pattern day traders?

According to the Financial Industry Regulatory Authority (FINRA), you’re a pattern day trader if you day trade more than four times in the space of five business days, and those day trades make up more than 6% of the total trades executed in your margin account for those same five days.

Why do you need $25,000 to day trade?

Day trading is extremely risky, so FINRA enforces the $25,000 minimum requirement to protect firms from a trader not being able to settle their trades. Usually, margin requirements are determined based on a trader’s positions at the end of the trading day – a day trader doesn’t maintain positions past that point. The $25,000 rule addresses this risk, by imposing a minimum amount to cover any deficiencies in a trader's account at the end of the trading day.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

A margin call is a demand made by a broker or a financial institution to a trader or investor who is using margin (borrowed funds) to cover potential losses in a trading account. It occurs when the value of the securities or assets held in the account falls below a certain threshold, known as the maintenance margin or margin requirement, as specified by the broker.