How To Day Trade Forex

Forex day trading refers to a trading approach in which traders engage in the buying and selling of currency pairs within a single trading day to take advantage of short-term price movements. The primary objective is to leverage intraday fluctuations, avoiding overnight positions.

Forex day trading can be interesting for many beginner-traders due to its fast-paced nature, offering the potential for quick profits and dynamic market opportunities within a single trading day.

This article serves as a comprehensive guide for potential Forex day traders, offering valuable insights to help them understand the market better and avoid typical mistakes. Geared towards those stepping into the dynamic world of Forex day trading, TU expert emphasizes the importance of risk management, starting with liquid currency pairs, and considering trading costs.

Do you want to start trading Forex? Open an account on Roboforex!What is Forex day trading?

Forex day trading is a trading style where traders buy and sell currency pairs within the same trading day to profit from short-term price movements. It aims to capitalize on intraday fluctuations, not holding positions overnight. Day traders usually rely on technical analysis to make trading decisions.

Commonly used time frames are 1-minute, 5-minute, 15-minute, and 1-hour charts. Traders focus on these shorter intervals for quick entries and exits. Day traders can make multiple trades in a day, ranging from 1 to several of trades.

The key Forex day trading benefit is that it offers potential for quick profits due to frequent trades and leveraged positions.

On the flip side, the main risk of day trading lies in the higher exposure to market volatility. The short-term price movements can be unpredictable, making effective risk management essential for traders to navigate these increased risks successfully.

Overall, Forex day trading requires expertise, effective strategies, and strict discipline. It offers the potential for significant gains in a short time but demands careful analysis and control to manage the associated risks effectively.

Is day trading a good idea for me?

Forex day trading can be a rewarding venture for certain individuals, particularly those possessing specific qualities and abilities. It is a good idea for traders who are willing to dedicate most of their working day to monitor charts, as day trading requires constant attention and quick decision-making. Additionally, successful day traders are capable of controlling their emotions and maintaining a rational mindset during volatile market conditions. Other essential qualities include discipline, as day trading demands adherence to strict trading plans and risk management strategies, and the ability to learn continuously and practice to improve trading skills.

Forex day trading may not be advisable for those who struggle with discipline, as impulsive or emotional decisions can lead to substantial losses. Moreover, day trading is not a viable option for individuals who lack the time and commitment to learn the complexities of the Forex market and practice trading consistently.

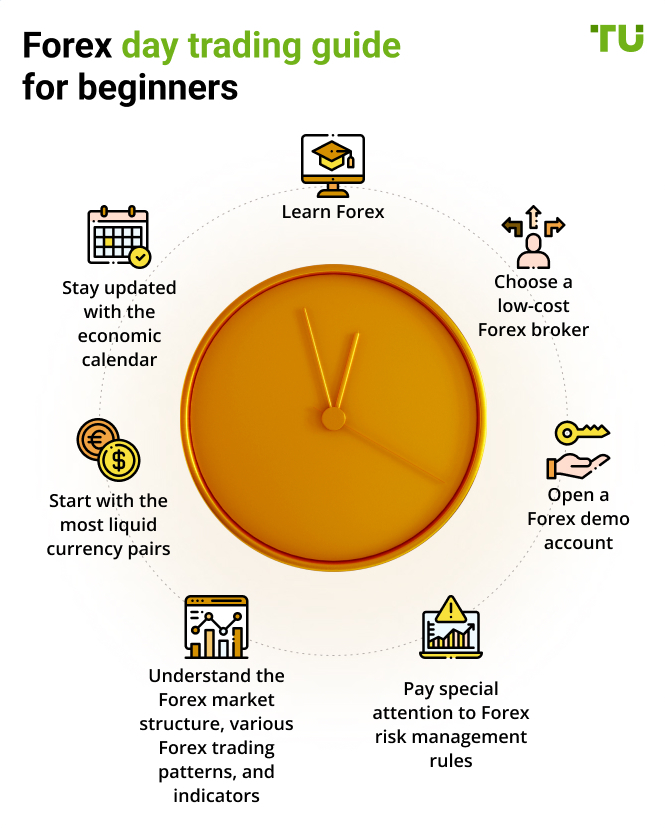

Forex day trading guide for beginners

Starting with this TU guide will help you to get started well-prepared in Forex day trading, equipping you with essential knowledge and strategies to navigate the market confidently and effectively.

-

1

Learn Forex. Be sure you understand the Forex market's mechanics, technical and fundamental analysis, risk management, and trading psychology. Learning Forex terms, strategies, and concepts is crucial for beginners. Continuous learning and practice are key to gaining experience and confidence as a Forex day trader. Review TU free Forex trading library

-

2

Choose a low-cost Forex broker. Consider your trading costs. Opt for brokers offering tight spread accounts with good liquidity and low commissions, especially those with ECN (Electronic Communication Network) accounts, which provide direct access to the interbank market and transparent pricing

-

3

Open a Forex demo account. It allows traders to practice in a risk-free environment using virtual funds. Forex demo trading provides an opportunity to familiarize yourself with the trading platform, test different strategies, and gain practical experience without risking real money

-

4

Pay special attention to Forex risk management rules. It is a crucial skill for Forex day traders because day trading involves higher risks due to the volatile nature of short-term price movements. Implementing proper risk management strategies, such as setting stop-loss and take-profit levels, can help protect your capital and limit potential lossesy

-

5

Understand the Forex market structure, various Forex trading patterns, and indicators. Knowledge of support and resistance levels, chart patterns, and technical indicators can help you identify potential entry and exit points more effectively

-

6

Start with the most liquid currency pairs, like EUR/USD, GBP/USD, and USD/JPY. These pairs have higher trading volumes, tighter spreads, and better price stability, making them more suitable for day trading

-

7

7 Stay updated with the economic calendar. Economic announcements, central bank decisions, and other macroeconomic data can significantly impact currency prices, and being aware of these events helps in making informed trading decisions

Top 5 Forex day trading strategies for beginners

Even the simplest strategies can be effective if mastered thoroughly, with a keen understanding of market structure and clear take profit and stop-loss points. TU has prepared top 5 popular Forex day trading strategies to consider.

Remember, mastering any Forex strategies requires practice, discipline, and risk management. It's essential for beginners to start with demo accounts and gradually transition to live trading as they gain confidence in their abilities. Continuous learning and researching different strategies are essential aspects of successful Forex day trading.

Breakout Forex strategy

Breakout Forex trading involves identifying key support and resistance levels and executing trades when the price breaks out of these levels. Beginners should focus on strong breakout signals and use proper risk management to avoid false breakouts.

Entry point:

Look for significant price levels where the market has repeatedly tested and failed to break through (support or resistance levels). Enter a trade when the price breaks decisively above resistance or below support.

Stop Loss:

Set the stop loss just below the breakout point for a long trade (above for short trade) to limit potential losses if the breakout is false.

Breakout Forex strategy

Forex pattern trading

Recognizing Forex chart patterns like triangles, head and shoulders, and double tops/bottoms can provide trading signals. Novice traders should confirm patterns with other technical indicators and wait for valid breakout or breakdown signals.

Entry point:

Identify chart patterns (e.g., head and shoulders, triangles) forming on the charts and enter a trade when the pattern is confirmed by a breakout or breakdown.

Stop Loss:

Place the stop loss below the pattern's breakout point for a long trade (above for short trade) to protect against false patterns.

Forex chart patterns

Trend following strategy

Forex trend following involves riding the market trends and entering trades in the direction of the prevailing trend. Beginners should use trend lines, trend-following indicators like Moving Averages and ADX to identify trends and avoid counter-trend trades.

Entry point:

Enter trades in the direction of the prevailing trend. For an uptrend, enter long trades on pullbacks to support or when a new higher high is formed. For a downtrend, enter short trades on rallies to resistance or when a new lower low is formed.

Stop Loss:

Set the stop loss below the recent swing low for a long trade (above for short trade) to guard against trend reversals.

Trend following strategy

Moving average crossover strategy

Utilizing different moving averages can help traders spot trend direction and potential entry/exit points. Beginners should combine moving averages with other indicators to confirm signals and avoid whipsaw movements.

Entry point:

Look for crossovers of different moving averages (e.g., 50 ma and 100 ma). Enter a long trade when the shorter moving average crosses above the longer moving average and a short trade when it crosses below.

Stop Loss:

Set the stop loss below the recent swing low for a long trade (above for short trade) to minimize losses if the trade moves against the trend.

MA crossover strategy

50 pips a day strategy

The 50 pips a day Forex strategy is designed to achieve a daily gain of 50 pips by leveraging technical indicators to spot high-probability trades. Applicable to any currency pair, this approach relies on a 15-minute chart for precise entry and exit signals. Traders are advised to focus on currency pairs with tight spreads and clear trends, and then confirm the trend's validity using technical indicators like Moving Average and Relative Strength Index (RSI) to pinpoint opportune entry and exit points.

How much money do I need to day trade Forex?

The amount of money needed to start day trading Forex can vary depending on individual circumstances and trading goals. Technically, one could start with as little as $100, but it's crucial to understand that the more funds you have, the more flexibility you'll have in implementing conservative strategies with lower risks. Additionally, it's essential to consider living costs during the learning phase, as day trading requires time and dedication.

Experts generally recommend starting day trading with at least $500. This amount allows for a more comfortable trading experience and enables traders to better manage risks and potential losses. However, the specific amount can vary based on personal financial situations, living expenses, and the chosen trading style.

If you have limited capital but feel confident in your trading skills, considering Forex prop companies can be a viable option, as they provide traders with access to higher leverage and trading capital to potentially enhance their trading opportunities.

Is Forex day trading profitable?

Day trading in Forex presents significant earning potential, as it doesn't require substantial capital to start and leverage from brokerages can lead to substantial profits, but it's crucial to be aware of the inherent risks, as the market can be highly volatile, and inexperienced traders may suffer significant losses.

A well-developed strategy with proper risk management can help day traders achieve consistent profits, with potential gains ranging from 5 to 15 percent per month, making it possible to start with as little as $500 to $1000.

Forex day trading offers the potential for skilled traders to earn substantial profits and even become millionaires, it's essential to acknowledge that the reality is that a significant portion of traders (up to 80%) end up losing money due to the complexities of the market and the challenges of day trading. Success in day trading requires a high level of skill, experience, discipline, and continuous learning to navigate the risks and capitalize on market opportunities effectively. Learn also the richest Forex traders in the world trading lessons to understand their secrets better.

What are the best day trading brokers?

The best Forex day trading brokers typically offer ECN (Electronic Communication Network) accounts, which provide direct access to the interbank market. This grants traders access to liquidity providers, leading to better pricing and faster execution of trades.

Moreover, these brokers often offer free virtual private network (VPN) services, which ensure a secure and stable internet connection for uninterrupted trading. Additionally, they provide ultra-tight spreads (from 0.1 pips), which means the difference between the buying and selling price is minimal, reducing trading costs. Low commissions (from $2 to $3.5 per lot).

Top 3 Forex brokers in 2024

FAQs

Is forex good for day trading?

Yes, forex can be a good option for day trading due to its high liquidity, round-the-clock trading hours, and frequent price movements, offering potential opportunities for short-term profits.

Can you be a day trader in Forex?

Yes, individuals can become forex day traders by actively buying and selling currency pairs within the same trading day, aiming to capitalize on short-term price movements.

How much do forex day traders make?

The income of Forex day traders varies widely, depending on their skills, experience, trading strategies, and risk management. Successful day traders can make substantial profits, while others may experience losses.

Can you day trade forex with $100?

Technically, you can start day trading forex with as little as $100 and even $10, but it is essential to be aware that lower capital may limit trading opportunities, and proper risk management is crucial to protect against potential losses. Experts usually recommend starting with $500 or more.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

-

4

Day trader

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

-

5

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).