If you're a forex trader, then you already know that trading the forex market is a very challenging task. Setting clear trading goals, understanding the forex market, and previous experience are undoubtedly some important factors to help you make informed decisions. But the most important factor that can make or break your entire trading experience is using forex indicators. Not only does using indicators enable you to implement successful forex trading strategies, it also helps you to make profitable returns consistently.

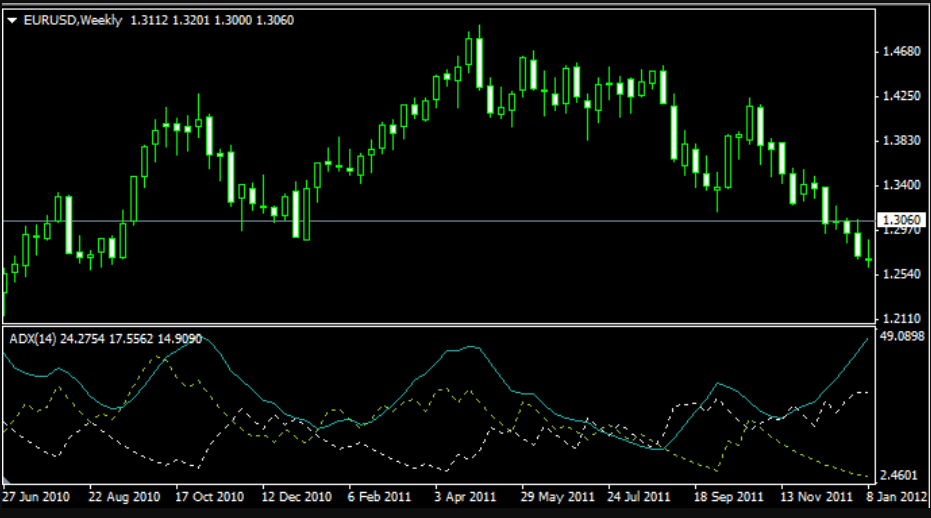

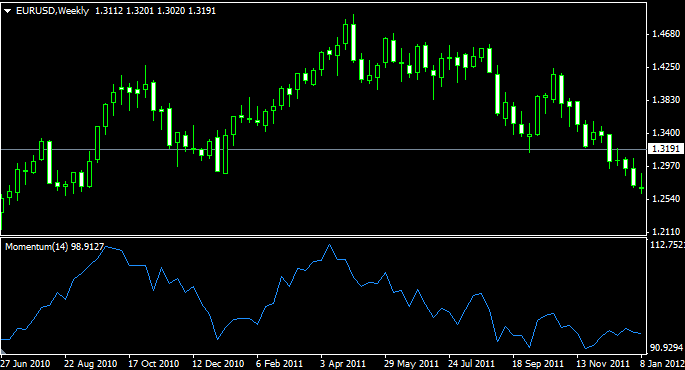

It’s important to note that the forex market behaves differently under different conditions. Forex indicators enable you to identify and take advantage of certain patterns and behaviors of the financial market that occur time and again. This article will discuss the trading indicators' role in the forex market and how you can utilize them to improve your forex trading. So, let’s jump into it.