What is a Day Trader? Definition, Deposit Requirements, Potential Return, and Risks

Day traders use active buying and selling strategies to capitalize on volatility that occurs throughout the day. So, what is a day trader, and how can you become one? Our experts will answer these questions and more – keep reading to learn how to be a day trader and the risks and opportunities associated with the profession.

What is a Day Trader?

A day trader executes a large volume of trades to profit from intraday market fluctuations. By opening and closing positions as the market moves, they can make a profit. Day traders can choose to amplify their returns by using leverage but note that this can also increase the risk of loss.

Day traders employ various strategies, but the overall goal is to take advantage of temporary inefficiencies in supply and demand caused by other orders in the market. They may hold these positions for a couple of hours or as short as a few seconds – in general, though, they are closed out before the end of the trading day.

Why Day Trading is Difficult

Why Do Day Traders Lose Money? Common MistakesDay trading does not come without its difficulties – if not everyone would do it.

For starters, it requires significant self-discipline. You must be able to remain objective in a high-stress and often emotional environment so that you can execute your day trading strategy. Similarly, you must be constantly following the market and adjusting your efforts accordingly since the trading environment can shift very quickly.

The effectiveness of your strategy can also be limited by commissions, the bid-ask spread, and other expenses like the cost of real-time quotes and news. Day traders must also have a vast amount of knowledge and experience to calculate favorable probabilities.

Another reason day trading can be difficult is that you must consider tax implications. If you are not trading in an IRA or other tax-sheltered account, you will be responsible for paying short-term at your marginal tax rate.

When is Day Trading a Good Idea?

Even though day trading can be difficult and risky, there are times when it is a great strategy to earn a profit. If you are willing to commit the time and capital needed to day trade successfully, you can experience significant gains. In short, day trading can be more profitable than other strategies.

Likewise, day traders need to learn new things constantly, have enough money to avoid trading with too much leverage, and stick to a specific risk management strategy.

Day Trading Rules and Limitations

According to FINRA, the Financial Industry Regulatory Authority, a day trader is someone that executes four or more trades during five days. The trades must account for over 6% of their total activity during that timeframe, and when this occurs, the broker will label that customer as a day trader.

FINRA has specific rules for day traders who use margin accounts. Individuals that day trade in margin accounts are called pattern day traders and must follow specific guidelines set by regulators.

Pattern day traders are required to have $25,000 in cash or equity in the account to continue to place intraday trades. If the account value falls below this minimum, it will be restricted from day trading. These restrictions are designed to discourage excessive trading without sufficient capital.

It is essential to note that these restrictions do not apply if you are day trading in the forex or cryptocurrency markets.

Basic Day Trading Strategies

As you learn how to become a day trader, you must understand basic day trading strategies. They can vary in intensity, style, and potential earnings, so you must find the option that works best for your goals and experience level.

Scalping

Scalping is a strategy that involves identifying short-term arbitrage opportunities. The goal is to make small profits throughout the day so they multiply and lead to further gains.

This strategy requires extensive technical analysis and the use of tools like candlestick charts. By taking advantage of subtle price changes, day traders can buy and sell to turn a profit. However, they must have a clear exit strategy to farm these gains and mitigate losses.

News-Based Trading

Another basic day trading strategy involves opening and closing positions based on news events and headlines. Earnings releases, acquisitions, spinoffs, and other major developments can lead to heightened volatility in the share price, and day traders can take advantage of this.

The impact of news tends to fade rather quickly, so users that engage in news-based trading close out positions very quickly. Using this strategy requires an understanding of the psychology behind what drives the market and historical events.

Swing Trading

Swing trading strategies rely on support and resistance levels to help day traders decide when to buy or sell a stock. This method is sometimes called range trading, as the day traders may leave these positions open for several hours, days, or even weeks.

Investors will need to analyze the history of a particular investment to anticipate where and when the price will move. Unlike day traders, swing traders will move from one stock to the next instead of opening and closing positions with the same security.

Unlike the other basic day trading strategies, this method can expose investors to overnight or weekend risk. The price could open at a different price than anticipated, so this must be factored into the risk management strategy.

Fading

Fading the market is a method day traders use to trade against a current trend. If a stock price is growing at a rapid pace, they will engage in short sales. The thought is that the shares are overbought, and the price is inflated – so early buyers will start taking profits and the price will fade back down.

Once investors start buying back into the security, day traders that employ fading will cash out their profits. This strategy can be particularly risky if you are shorting uncovered positions. However, it can be very profitable if the stock price behaves as expected.

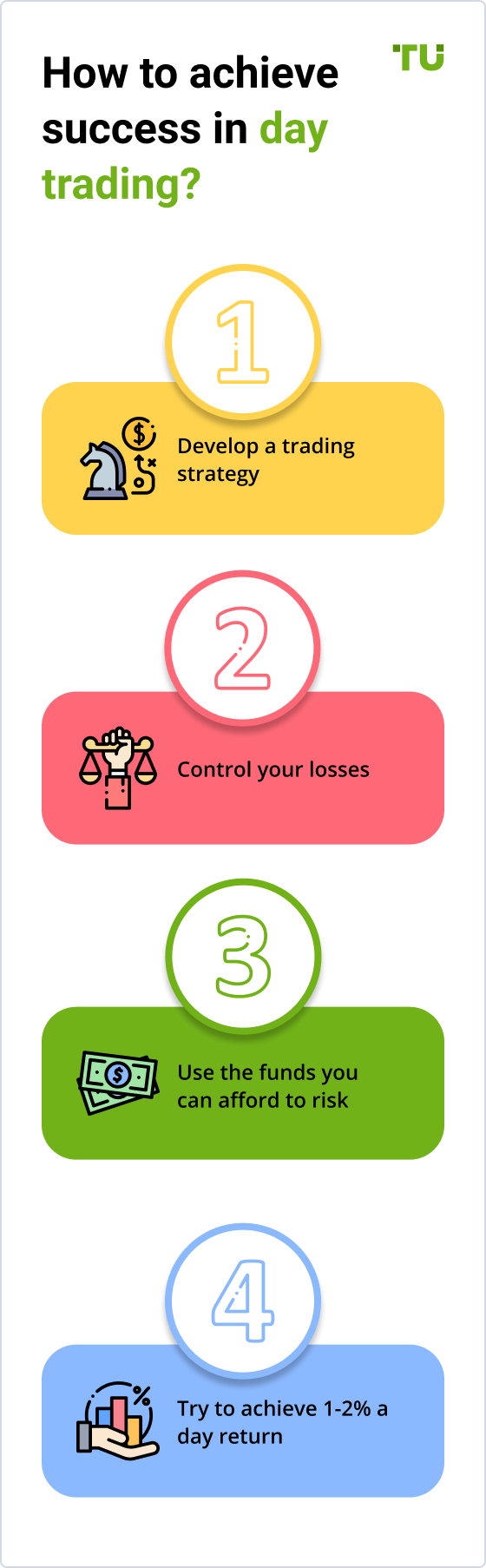

How to Become a Successful Day Trader

Now that you understand what a day trader is – and some of the basic strategies that they employ – let’s review how you can become a successful investor.

Be Consistent

First and foremost, you must recognize that consistency is the key to success. Investors that trade only occasionally or as a hobby will not see the same profits as those that treat it like a business.

Develop a Plan – and Stick to It

There should be a strategy behind every trade you make. It can be easy to let your emotions get the best of you but failing to stick to your plan can cause you to be less successful.

Do your best to make calculated and planned decisions that are not based on emotions, but rather market analysis and your core strategy.

Only Risk the Money You Can Afford to Lose

You should only day trade with funds that you can afford to lose.

There is always a chance that the market will move unexpectedly or that your strategy will be unsuccessful. Sure, you can take steps to minimize these risks, but you can never eliminate them.

Never use money set aside for things like your mortgage, emergency savings, or other necessities. Instead, you will be more successful if you trade with money that you are not afraid to lose.

Make Larger Deposits if Possible

It is no secret that the more money you invest, the more you can make. The profit potential will be higher if you make larger deposits.

In other words, the amount you day trade with is the determining factor in how much you can earn each trading session.

Always Manage Your Risks

Successful day traders always manage their risks. Don't lose sight of the potential downsides of day trading when you are on a hot streak – always follow the basic rules of managing your money.

The general rule of thumb is 2% per trade. You should always have an exit strategy to limit your losses and prevent being stuck in a position that will only continue to deteriorate.

Leverage Technology

Day traders must use technology whenever possible. That includes using online trading platforms to speed up and facilitate trading, as well as technology that allows you to analyze data, review historical trends, and predict price movements.

How Much Can a Day Trader Make?

There is no guarantee of how much a day trader can make. It can be a very lucrative profession, but that comes with a high level of uncertainty and risk.

While you may have heard stories of traders earning millions of dollars in just one day, know that this is not the norm. The average day trader can make anywhere from $50 to $200 per day. This can be even more depending on the strategy and how is invested.

Can You Day Trade for a Living?

Although consistent income is not guaranteed, you can day trade for a living. If you follow the rules, develop a successful strategy, and invest enough capital, you can earn a very decent return.

It is always important to keep in mind that your earning potential is always variable, as it relies on unpredictable market factors and other temporary conditions.

Best Day Trading Platforms

The platform that you choose to day trade on is extremely important. Selecting the right platform is just as essential as developing a strategy – you need technology that allows you to react quickly, make fast trades, and access accurate data. Likewise, it needs to have low fees so that your profits are not eroded by commissions.

When you pick a trading platform, you also need to consider the type of trading you will be doing. The best choice will depend on whether you are trading stocks and options, cryptocurrencies, or forex.

Webull: Best for Stocks and Options

The best platform for trading stocks and options is Webull. They offer no-commission trades and an impressive arsenal of fundamental and technical analysis tools to help you implement your day trading strategy.

Binance: Best for Cryptocurrencies

Binance is the best trading platform for cryptocurrencies. They are the largest crypto exchange and allow you to trade anywhere, with mobile and desktop options to maximize convenience.

FxPro: Best for Forex

The best trading platform for Forex is FxPro. They offer no-commission trades and competitive spreads so that you can optimize your strategy.

Summary

Day trading involves opening and closing investment positions within the same trading session. The goal is to capture profits and multiply them over time.

While day traders can earn significant income if they are successful, positive outcomes are not guaranteed. As a result, you should carefully craft your day trading strategy and ensure that you are only risking funds that you can afford to lose.

FAQs

What is a Day Trader?

A day trader is someone who uses intraday investing strategies to profit from temporary price fluctuations. You are legally considered a day trader if you complete four – or more – day trades within a five-day window.

How Much Money Can You Make Day Trading?

The amount of money you can make while day trading will depend on your strategy, the performance of the market, and how much capital you invest. However, your profits can range anywhere from $50 a day to several thousand – just know there is no guarantee.

What is the Best Platform for Day Trading Stocks?

Webull is the best platform for day trading with stocks, as they offer an impressive selection of charting and research tools, no-commission trades, and access to current quotes and news.

What are the FINRA Requirements for Day Traders?

If you are day trading in a margin account, you must have at least $25,000 in cash and equity – if the minimum is not met, your account will be restricted, and you cannot continue to day trade until you correct the issue.

Glossary for novice traders

-

1

Swing trading

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Day trader

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

-

4

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

5

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Team that worked on the article

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).