Fundamental Analysis | Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Fundamental analysis is a method of evaluating the intrinsic value of an asset by examining related economic, financial, and other qualitative and quantitative factors. This approach involves analyzing a company's financial statements, management, competitive advantages, industry conditions, and broader economic indicators to determine its fair value.

Investors use fundamental analysis to make informed decisions about whether an asset is undervalued or overvalued, guiding long-term investment strategies. It involves analyzing key indicators such as a company's revenue growth, profit margins, debt levels, and cash flow. According to a study by the CFA Institute, fundamental analysis is a critical tool for predicting long-term performance , helping traders identify whether a security is overvalued or undervalued and make informed decisions, particularly in Forex and cryptocurrency markets where economic data and news events significantly influence price movements.

What is fundamental analysis?

Fundamental analysis evaluates a security's intrinsic value by examining economic, financial, and qualitative factors . It helps determine if a security is overvalued or undervalued, guiding traders in their investment decisions.

In Forex trading, fundamental analysis involves examining economic indicators such as interest rates, inflation, and GDP growth of different countries. For example, if the U.S. Federal Reserve raises interest rates, the U.S. dollar typically appreciates due to higher returns on investments denominated in dollars.

In cryptocurrency markets , traders look at factors like network activity, regulatory news, and technological advancements . For instance, a significant upgrade to the Ethereum network, such as the transition to Ethereum 2.0, can increase its value by improving scalability and security.

Basic terminologies in fundamental analysis

Income Statement : A financial report showing the company's revenues, expenses, and profits over a specific period.

Balance Sheet : A snapshot of the company's financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity.

Price-to-Earnings (P/E) Ratio : A valuation ratio calculated by dividing the current share price by EPS. It indicates how much investors are willing to pay for a dollar of earnings.

Price-to-Book (P/B) Ratio : A valuation ratio comparing the market value of a company’s stock to its book value.

Return on Equity (ROE) : A profitability ratio calculated by dividing net income by shareholders' equity, indicating how efficiently a company is using its equity to generate profit.

Return on Assets (ROA) : A profitability ratio calculated by dividing net income by total assets, showing how efficiently a company is using its assets to generate profit.

Current Ratio : A liquidity ratio calculated by dividing current assets by current liabilities, measuring the company's ability to pay short-term obligations.

Comparable Company Analysis : A valuation method comparing the target company's valuation ratios to those of similar companies.

Intrinsic Value : The perceived true value of a company or asset, based on fundamental analysis rather than current market price.

Market Capitalization : The total market value of a company's outstanding shares, calculated by multiplying the share price by the number of shares outstanding.

Dividend Yield : The annual dividend payment divided by the current share price, indicating the return on investment from dividends.

Earnings Call : A conference call held by a company to discuss its financial results and outlook with investors and analysts.

Corporate Governance : The system of rules, practices, and processes by which a company is directed and controlled, affecting transparency and accountability.

By understanding these fundamental analysis terms, investors can better evaluate the financial health and value of companies, aiding in informed investment decisions in Forex trading.

How fundamental analysis works

Here is a detailed guide on performing fundamental analysis:

Data Collection

Sources include financial reports, industry analysis, and economic data . First of all this includes reports from regulators and companies that publish annual reports and investor presentations that provide insights into their operations, financial performance, and future strategies. For example, you can access Microsoft’s annual reports directly from their investor relations page. Also obtain industry reports and market analyses from financial news websites and research firms.Data Analysis

Interpret financial metrics and ratios to assess company performance. Analyzing financial statements, using financial ratios, evaluating trends and projections based on industry trends and economic conditions.Investment Decisions

Use the insights gained from analysis to make informed investment decisions: buy, hold or sell .

Tools and Resources

"The Intelligent Investor" by Benjamin Graham: This classic book is a must-read for anyone interested in fundamental analysis. It provides timeless advice on value investing and protecting oneself from substantial errors.

"Security Analysis" by Benjamin Graham and David Dodd: Another foundational text that delves deeper into analyzing financial statements and valuing securities.

TradingView - provides a mix of technical and fundamental analysis tools. Offers financial statements, earnings reports, and user-generated content such as analysis and ideas.

MacroTrends - offers long-term financial data and macroeconomic trends. Provides historical financial data, ratios, and industry comparisons.

Traders Union - our site offers a wide range of educational articles, real-time quotes, charts, and news. It’s a great resource for gathering data and performing technical and fundamental analysis.

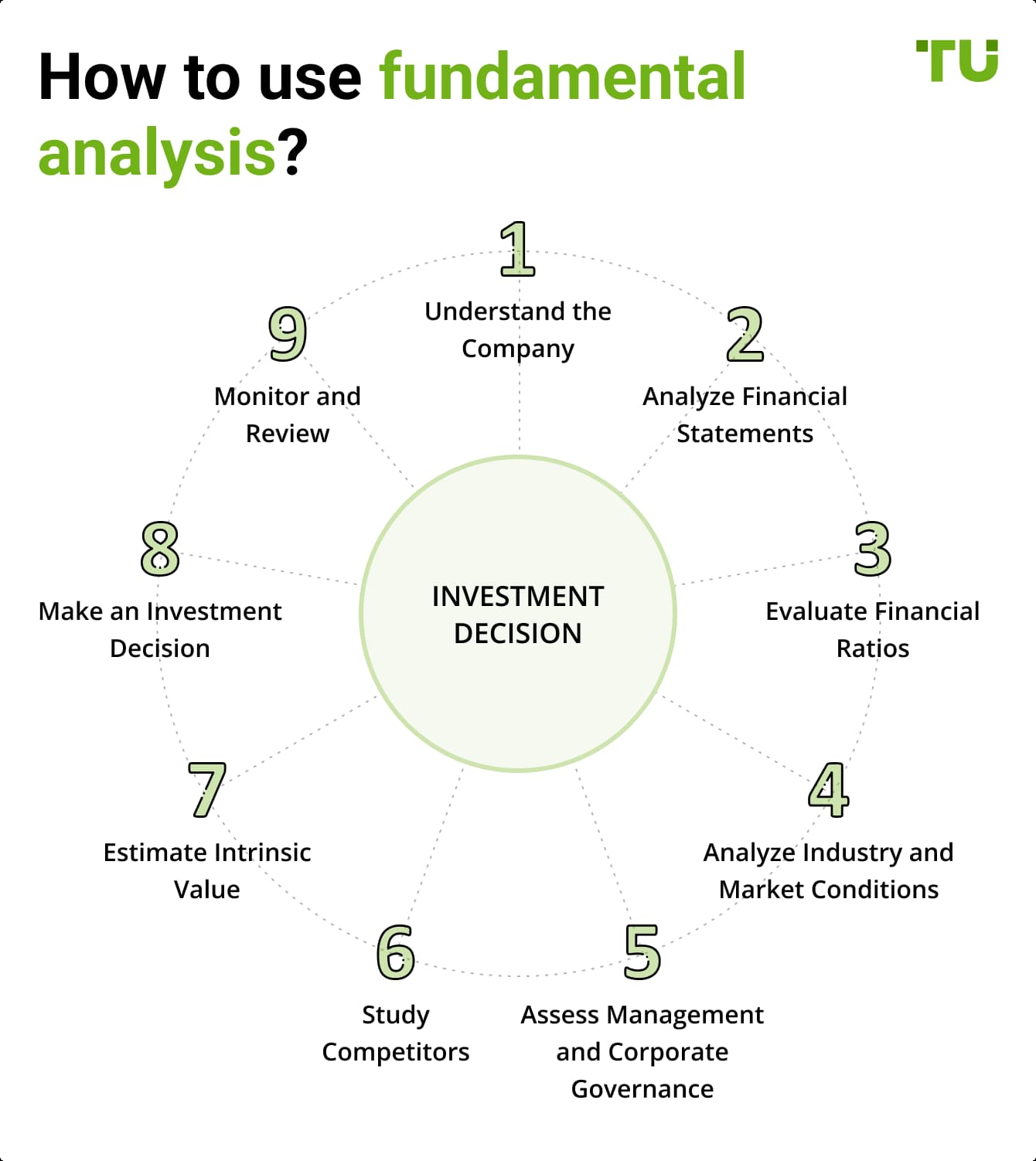

How to use fundamental analysis?

How to use fundamental analysis?

How to use fundamental analysis?Using fundamental analysis involves several key steps to evaluate the intrinsic value of an asset. Here’s a structured approach to performing fundamental analysis:

Understand the Company - how the company makes money, its products or services, and its market position. Analyze the company’s role within its industry, including its competitive advantages and market share.

Analyze Financial Statements - examine revenue, expenses, and profit to assess the company's profitability. Use key metrics: revenue growth, net income, EPS.

Evaluate Financial Ratios - assess how efficiently a company is generating profit. Also evaluate the company’s long-term financial health.

Analyze Industry and Market Conditions - research trends, challenges, and growth opportunities within the industry. Consider broader economic factors such as interest rates, inflation, and GDP growth.

Assess Management and Corporate Governance - evaluate the experience and track record of the company’s leadership team. Analyze the company's governance practices, board structure, and shareholder rights.

Study Competitors - compare the company’s performance and financial metrics with its main competitors. Use industry averages to benchmark the company’s performance.

Estimate Intrinsic Value - calculate the present value of expected future cash flows. Use valuation multiples (P/E, P/B) of similar companies to estimate fair value.

Make an Investment Decision - compare the intrinsic value with the current market price to determine if the stock is undervalued or overvalued. Develop a clear investment thesis based on your analysis, outlining why you believe the stock is a good investment.

Monitor and Review - keep track of the company’s financial performance, industry trends, and economic conditions. Periodically review your analysis and adjust your investment thesis as needed.

Pros and cons of fundamental analysis

- Advantages

- Disadvantages

Long-term Insights

Provides a deep understanding of a company’s long-term potential.

Comprehensive Evaluation

Considers both qualitative and quantitative factors, offering a well-rounded view of a company’s health and prospects.

Identifies Undervalued Stocks

Helps investors find undervalued stocks that have growth potential.

Time-consuming

Requires extensive research and analysis.

Knowledge-intensive

Needs a strong understanding of financial and economic concepts.

Market Conditions

Can be less effective during extreme market conditions where prices may not reflect true value.

How I uncovered hidden investment opportunities with fundamental analysis

In my years of investing, I've found that fundamental analysis is an invaluable tool for identifying stocks with strong growth potential that are often overlooked by the market.

Case Study: Apple Inc.

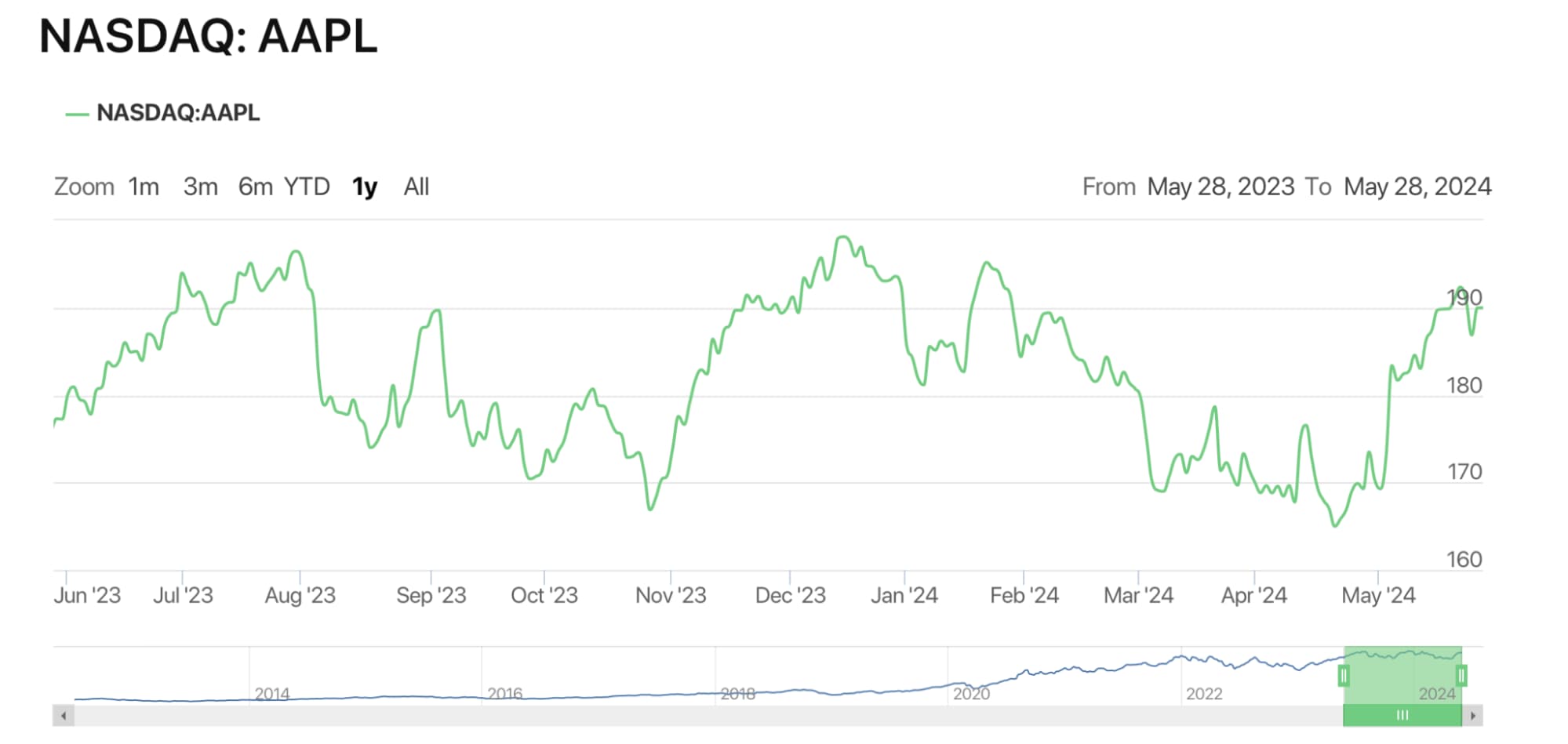

One illustrative case is my early investment in

Apple Inc. back in 2003. At that time, Apple was trading at about $14 per share. Despite being relatively low-priced, my thorough fundamental analysis revealed several promising indicators.

Key Financial Indicators:

Revenue Growth: By examining Apple’s financial statements, I noticed a consistent increase in revenue, which had grown by 36% from the previous year.

R&D Investment: Apple’s commitment to innovation was evident in their investment in research and development, which was 6% of their revenue.

Qualitative Factors:

Leadership: Under the leadership of Steve Jobs, Apple demonstrated strong management.

Brand Strength: Apple’s brand and loyal customer base set it apart from competitors.

Industry Trends:

Market Demand: There was a growing demand for consumer electronics, particularly personal computing devices.

Valuation: Comparing Apple’s Price-to-Earnings (P/E) ratio to industry averages, it was clear that Apple was undervalued relative to its peers.

Today, Apple’s stock trades well above $180 per share, illustrating how fundamental analysis can uncover valuable investment opportunities that yield substantial long-term returns. This approach, involving a detailed examination of financial health, management quality, and market conditions, remains a cornerstone of my investment strategy.

Apple’s stock trades

Apple’s stock tradesFundamental analysis not only helps in making informed decisions but also in understanding the underlying value of companies, ensuring that investments are based on solid financial footing.

Conclusion

Fundamental analysis evaluates a security's intrinsic value by examining economic, financial, and qualitative factors . This method helps identify whether a security is overvalued or undervalued, guiding investment decisions. It is particularly useful for long-term investments as it provides a comprehensive assessment of a company's health and potential.

FAQs

What is fundamental analysis?

Fundamental analysis evaluates an asset's intrinsic value by examining economic, financial, and qualitative factors. It helps determine if an asset is overvalued or undervalued, guiding traders in their investment decisions.

How does fundamental analysis differ from technical analysis?

Fundamental analysis focuses on intrinsic value using economic and financial data, while technical analysis relies on historical price and volume data to predict future price movements.

What are key indicators in fundamental analysis for Forex?

Key indicators include GDP growth, employment rates, inflation, trade balances, and interest rates. These factors provide insights into a country’s economic health and its currency value.

How can I apply fundamental analysis to cryptocurrency trading?

For cryptocurrencies, focus on adoption rates, technological developments, regulatory news, transaction volumes, and network activity. These factors help evaluate the intrinsic value and future potential of a cryptocurrency.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.