How To Choose Stocks For Day Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to choose stocks for day trading:

Step 1. Identify market trends.

Step 2. Screen for high volume stocks.

Step 3. Evaluate volatility.

Step 4. Assess news impact.

Step 5. Analyze sector and industry performance.

Step 6. Evaluate financial health.

Step 7. Use advanced technical tools.

Step 8. Assess market sentiment.

Step 9. Consider economic indicators.

Step 10. Monitor pre-market and after-hours trading.

Step 11. Set entry and exit points.

Day trading involves buying and selling stocks within the same trading day, aiming to take advantage of price changes. Unlike long-term investors, day traders do not keep their stocks overnight, which helps avoid risks from overnight news and events. This trading method needs a strong grasp of market behavior, quick thinking, and a good plan to handle risks.

In this article, you will learn how to find the best stocks for day trading, understand important factors to consider, and explore strategies for both new and experienced traders. By the end, you'll have the knowledge to make smart trading choices and increase your chances of success in day trading.

How to choose stocks for day trading

Selecting the right stocks is crucial for success in day trading. The right choices can significantly impact your profitability and risk management. Stocks with high liquidity, volatility, and clear trends provide the best opportunities for making quick profits. Conversely, choosing the wrong stocks can lead to substantial losses, emphasizing the need for careful analysis and selection.

Identify market trends

Use technical analysis to identify prevailing market trends and monitor economic indicators to understand broader market movements.

Screen for high volume stocks

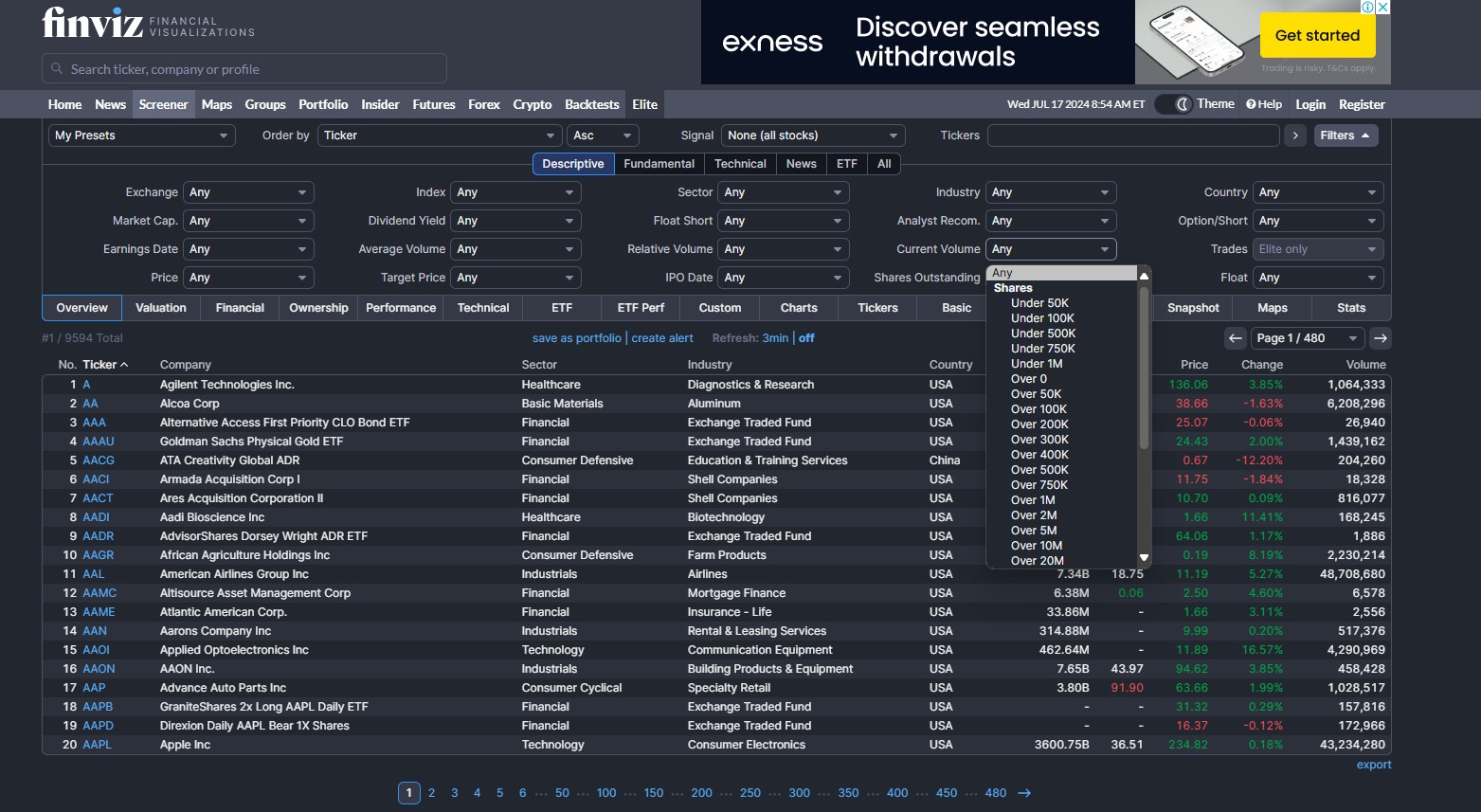

Utilize stock screeners to find stocks with high trading volumes and analyze their liquidity.

Evaluate volatility

Look for stocks with significant price movements and check their beta values to assess volatility. Beta is a measure of a stock's volatility in relation to the overall market. A beta value greater than 1 indicates the stock is more volatile than the market, while a beta less than 1 suggests lower volatility. It helps investors assess how a stock might move in relation to broader market swings, influencing risk assessment and portfolio diversification strategies.

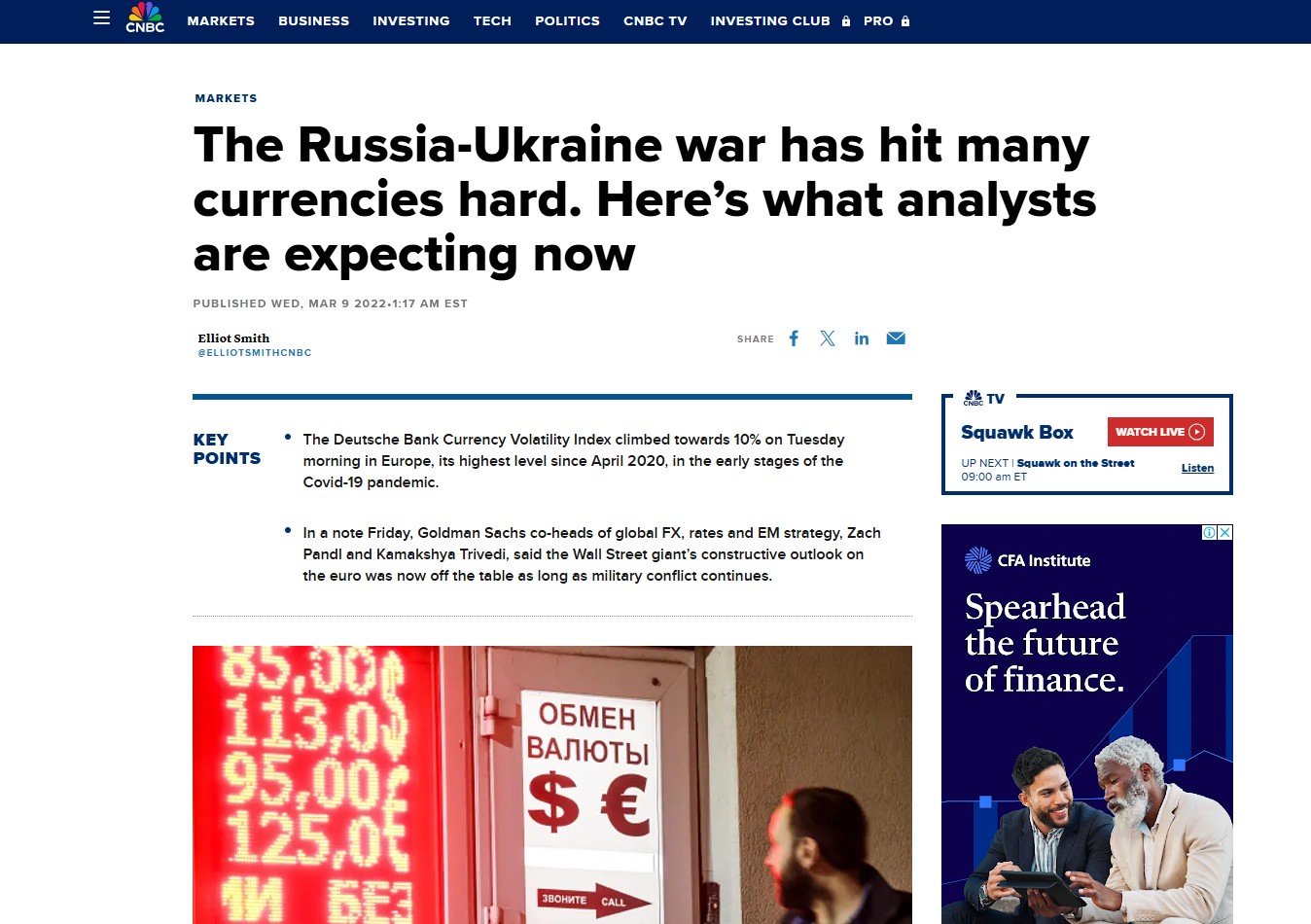

Assess news impact

Follow market news and analyze earnings reports and company announcements to gauge their impact on stock prices. For example, In July 2024, Disney reported its first-quarter earnings, which included several significant announcements. Disney's CEO Bob Iger highlighted the company's strategy to expand its streaming services and revealed plans for ESPN's standalone digital platform. Additionally, the announcement that Taylor Swift's "The Eras Tour" concert film would debut exclusively on Disney+ generated substantial media buzz. These announcements had a notable impact on Disney's stock price.

Analyze sector and industry performance

Identify high-performing sectors and consider sector rotation strategies to find new opportunities. For example recently the technology sector has shown significant growth, driven by advancements in artificial intelligence and increased consumer demand for digital services. Companies in this sector are expected to continue benefiting from technological innovations and strong market demand

Evaluate financial health

Review earnings reports and check financial ratios to evaluate a company's financial health.

Use advanced technical tools

Apply technical indicators like RSI, MACD, and Bollinger Bands to analyze price patterns and identify trade setups.

Assess market sentiment

Assess market sentiment using sentiment analysis tools and monitor news and social media.

Consider economic indicators

Consider economic indicators by tracking key metrics such as GDP growth, inflation rates, and employment figures. These indicators offer insights into economic health, influencing stock market trends and investor sentiment. Monitoring them helps traders anticipate market movements and adjust trading strategies accordingly for better informed decision-making.

Monitor pre-market and after-hours trading

Use pre-market data to identify early opportunities and understand the risks and benefits of after-hours trading. In July 2024, monitoring pre-market and after-hours trading sessions provided insights into market dynamics:

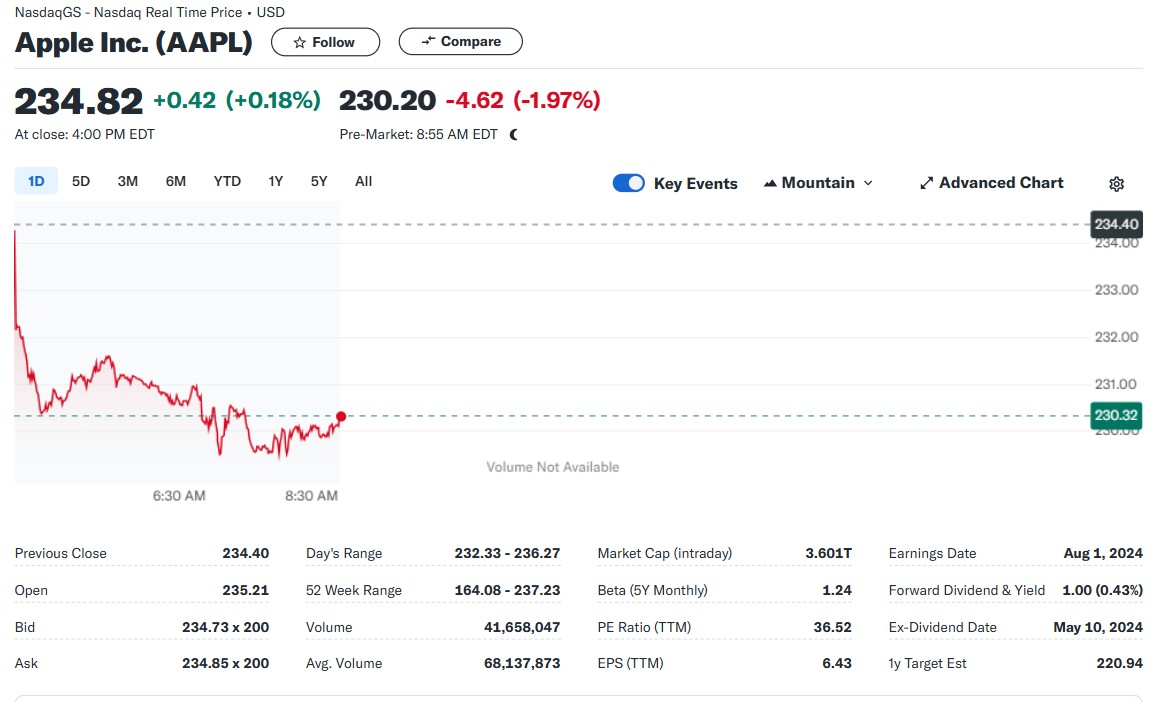

Pre-Market Activity: Stocks in the technology sector showed strong pre-market gains following positive earnings reports from major companies like Apple and Microsoft. Early price movements indicated investor optimism, influencing trading strategies for the day ahead.

After-Hours Reactions: After-hours trading saw increased volatility in pharmaceutical stocks after FDA approval news. Traders monitored price movements to gauge market sentiment and potential trading opportunities for the next trading day.

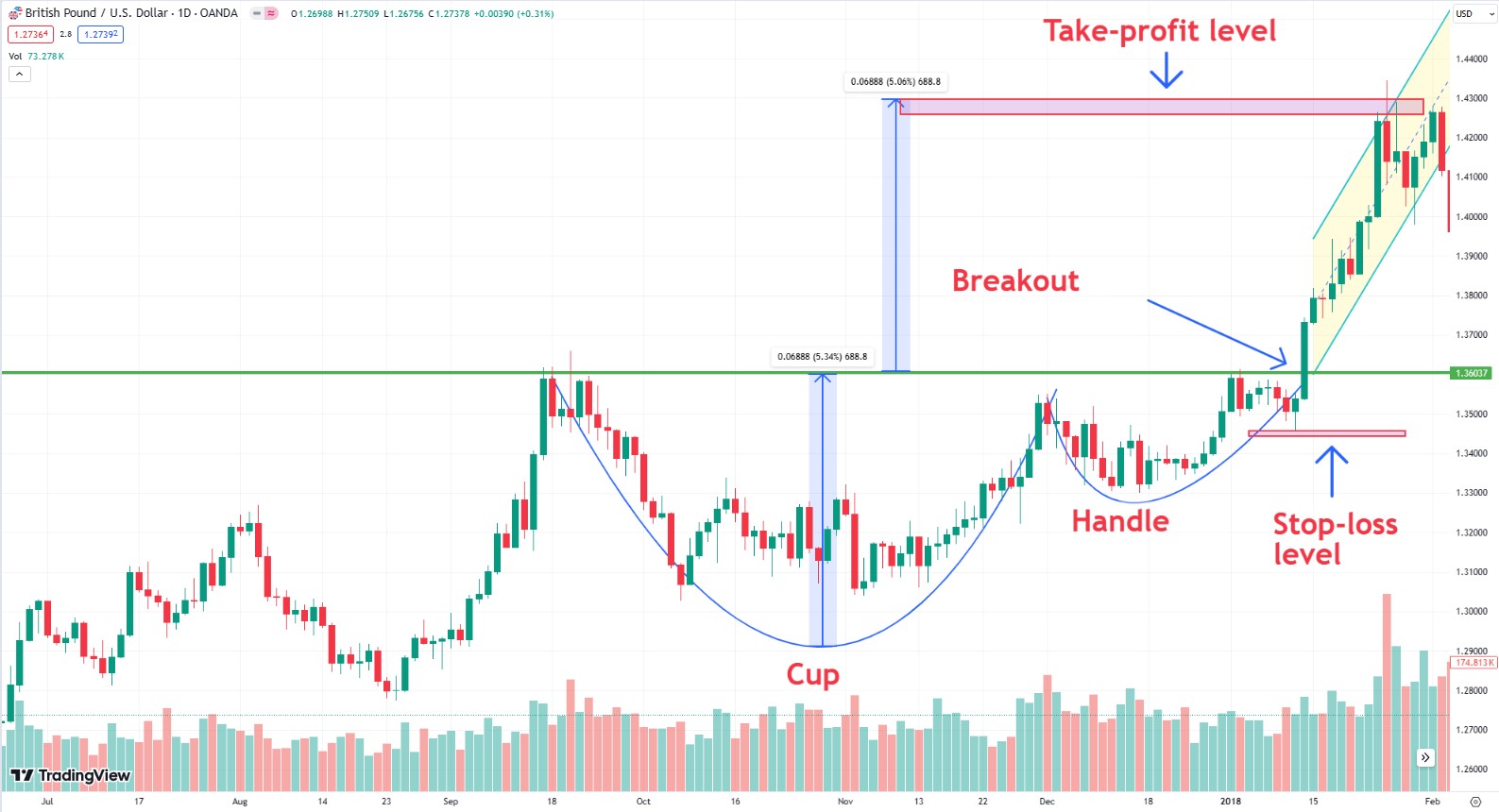

Set entry and exit points

Define your trading strategy, including entry and exit points, and use stop-loss and take-profit levels to manage risk.

Here you can find the best stocks brokers for comfortable day trading:

| Demo | Account min. | Interest rate | Basic stock/ETF fee | Min. stock/ETF fee | Regulation level | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | No | No | Zero Fees | Zero Fees | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | No | No | $3 per trade | $3 per trade | Tier-1 | Open an account Via eOption's secure website. |

|

| No | No | No | €2,00 + €0,038 per share for US stocks | €2,00 for US stocks | Tier-1 | Study review | |

| Yes | 2,000 | 3,8 | US: $0.01 per share; min $2. EU: 0.1% of trade value with a min €4. | US Stocks $2, EU Stocks €4 | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | £500 | 4,56 | U.S. Stocks: start from $1. European Stocks: start from €3. UK Stocks: start from £5. | $1/£5/€3 | Tier-1 | Open an account Your capital is at risk. |

Advanced strategies and insights for day trading

Trading psychology

In 2022, market volatility due to inflation fears and geopolitical tensions tested traders' psychological resilience. Successful traders managed their emotions by sticking to their strategies and avoiding panic selling during market dips. For instance, traders who maintained their positions in energy stocks like ExxonMobil (XOM) despite market jitters benefited from the subsequent recovery as oil prices rebounded.

Backtesting strategies

A trader might backtest a moving average crossover strategy using historical data from Apple (AAPL) stock. By simulating trades where a buy signal is generated when the 50-day moving average crosses above the 200-day moving average, and a sell signal when it crosses below, the trader can evaluate the strategy's performance over the past five years. This process helps refine the strategy before applying it to live trading.

Correlation analysis

During the COVID-19 pandemic, traders observed a high correlation between airline stocks and oil prices. For example, the performance of Delta Airlines (DAL) and United Airlines (UAL) was closely linked to fluctuations in crude oil prices. By understanding this correlation, traders could hedge their positions in airline stocks with trades in oil futures or ETFs, reducing overall risk.

News-based trading strategies

In 2023, the announcement of new regulations for the semiconductor industry in China had an immediate impact on stocks like Intel (INTC) and TSMC (TSM). Traders who quickly reacted to this news by shorting these stocks or buying put options could capitalize on the ensuing price drop. Staying updated with real-time news feeds allowed these traders to act swiftly and profit from the market reaction.

Scalping

Scalping was evident during the GameStop (GME) trading frenzy in early 2021. High-frequency traders took advantage of the extreme volatility and rapid price changes by executing numerous small trades throughout the day. By buying and selling GME shares within minutes or even seconds, scalpers captured small profits that added up to significant gains over time.

Pairs trading

An example of pairs trading could involve Coca-Cola (KO) and PepsiCo (PEP). These two stocks are historically correlated due to their presence in the same industry. If a trader notices a divergence where Coca-Cola's stock price increases significantly while PepsiCo's remains stable, they might sell short Coca-Cola and buy PepsiCo, betting that the prices will eventually converge.

Pros and cons of day trading stocks

This layout clearly distinguishes the advantages and disadvantages of day trading, making it easy for traders to understand the key points.

- Pros

- Cons

High profit potential. Day trading offers the opportunity to make significant profits in a short period.

Flexibility and independence. Day trading offers flexibility and independence compared to traditional jobs.

Variety of trading opportunities. Day trading provides access to a wide range of trading opportunities across different markets.

High risk and volatility. Day trading is associated with high risk and volatility, leading to the potential for significant losses.

Time-consuming and stressful. Day trading requires a significant time commitment and can be very stressful.

Requires significant knowledge and skills. Day trading requires extensive knowledge and skills to be successful.

Risk and warning section

Potential risks in day trading. Outline the main risks associated with day trading, including market volatility, leverage, and liquidity risks.

Psychological factors and emotional control. Discuss the importance of maintaining emotional control and the psychological challenges of day trading.

Regulatory and legal considerations. Highlight regulatory and legal aspects that traders need to be aware of, such as pattern day trading rules and tax implications.

Warning signs of market manipulation. Educate readers on how to spot and avoid market manipulation schemes, such as pump-and-dump tactics.

Precision and speed: key elements for day trading success

As an experienced trader who has navigated the markets for many years, I can tell you that choosing the right broker for day trading is as crucial as selecting the right stocks. The exchange you choose can significantly impact your trading efficiency and profitability. Here’s my advice based on years of trial, error, and success.

Speed is a critical factor too. In day trading, milliseconds can make a difference. Opt for an exchange known for quick trade executions and minimal delays. This ensures your trades are executed at the prices you expect.

High trading activity is essential. Active markets ensure that you can buy and sell stocks quickly without significant price changes. High activity means narrower price gaps, which reduces your trading costs and enhances your potential profits.

Security is non-negotiable. Choose an exchange with a strong reputation for security and compliance with regulatory standards. Your funds and personal information must be protected, so look for robust security features.

Conclusion

Choosing the right stocks for day trading is key to making profits and avoiding losses. It involves understanding factors like volume, volatility, trends, news, and financial health. Beginners should start with simple strategies and manage risks carefully. Advanced traders can use more sophisticated tools and techniques to refine their stock picks.

Remember, day trading is risky and requires emotional control and quick decision-making. Always stay informed with the latest news and economic indicators, and be aware of the risks involved. Use expert advice and recommended resources to continue learning and improving your skills.

FAQs

How do I find high volatility stocks for day trading?

Use stock screeners and filters to identify stocks with large daily price movements and high trading volumes.

What time of day is best for day trading stocks?

The best times are typically the first and last hours of the trading day due to high volatility and trading volume.

Should I use leverage when day trading stocks?

While leverage can amplify profits, it also increases risk. Use it cautiously and understand the potential for significant losses.

How much capital do I need to start day trading?

The minimum required varies, but many recommend at least $25,000 to comply with the pattern day trader rule and manage risk effectively.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

In the Forex market, a “trend” is the label used to describe the general direction that the prices of currency pairs are moving in, over a specific period of time. Trends are basically the pattern that a currency pair appears to be following and can help traders determine when to enter and exit a trade.

After-hours trading occurs outside of regular market hours, allowing investors to react to news and events that arise after the official market close.