Portfolio Diversification Strategies To Know

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

Portfolio diversification strategies involve spreading investments across asset classes, sectors, industries, and geographies to reduce risk. Key strategies include diversification based on:

- Asset class (stocks, bonds, real estate, etc.)

- Sector (finance, technology, healthcare, etc.)

- Geography (developed and developing nations)

- Style (growth, value, income, etc.)

- Market cap (small cap, mid cap, large cap, etc.)

Diversification allows investors to spread risk across various assets, sectors, and regions . By diversifying, you can mitigate the impact of poor performance in a single investment, leading to more stable and potentially higher returns. This article talks about the eight most prominent portfolio diversification strategies that both beginner and advanced traders should know.

Portfolio diversification strategies to know

1. Diversification by asset class

Diversifying by asset class involves spreading investments across different types of assets, such as stocks, bonds, and real estate. Each asset class behaves differently under various economic conditions, reducing overall portfolio risk .

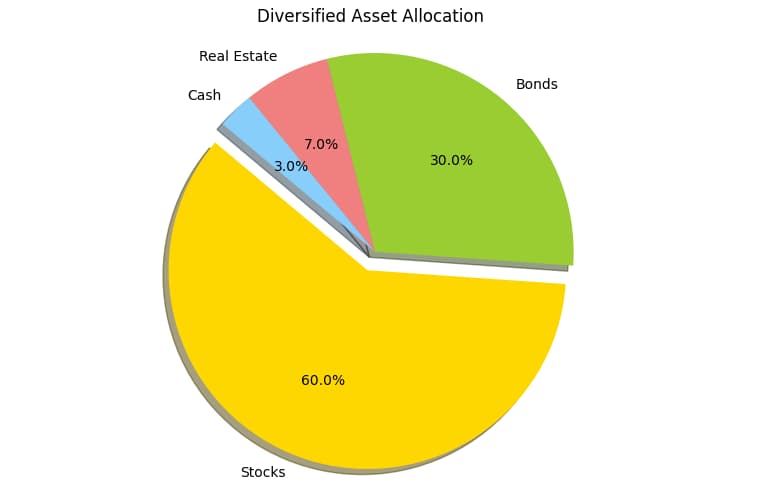

How to Use : Allocate a percentage of your portfolio to each asset class based on your risk tolerance and investment goals. For example, a balanced portfolio might consist of 60% stocks, 30% bonds, and 10% real estate.

During the 2008 financial crisis, while stocks plummeted, high-quality bonds and real estate investment trusts (REITs) provided a cushion, demonstrating the benefits of asset class diversification.

A pie chart illustrating a diversified asset allocation

A pie chart illustrating a diversified asset allocationTo create a diversified portfolio of assets, it is important to choose a reliable broker. We have studied the conditions of top brokers and suggest that you familiarize yourself with the comparative table:

| Broker | Minimum deposit, USD |

Demo | ETFs | Bonds | Stocks | Investor protection | Open an Account |

|---|---|---|---|---|---|---|---|

100 |

Yes |

Yes |

No |

Yes |

€20,000 £85,000 SGD 75,000 |

Open an account Your capital is at risk. |

|

0 |

Yes |

Yes |

No |

Yes |

£85,000 €20,000 €100,000 (DE) |

Open an account Your capital is at risk.

|

|

0 |

Yes |

No |

Yes |

Yes |

£85,000 SGD 75,000 $500,000 |

Open an account Your capital is at risk. |

|

100 |

Yes |

Yes |

Yes |

Yes |

£85,000 |

Study review | |

0 |

Yes |

Yes |

Yes |

Yes |

$500,000 £85,000 |

Open an account Your capital is at risk. |

2. Sector Diversification

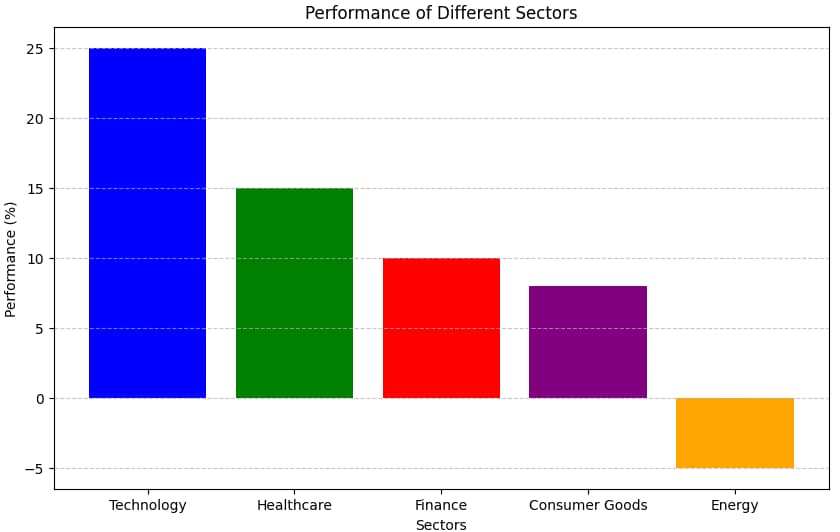

Sector diversification involves investing in various industry sectors such as technology, healthcare, and finance to mitigate sector-specific risks.

How to Use : Choose stocks from different sectors to balance your portfolio. For instance, avoid over-concentration in tech stocks by adding healthcare and financial stocks. That way, if one sector faces turbulence, your portfolio will be safeguarded from volatility to an extent.

In 2020, while the technology sector soared due to increased digital adoption during the pandemic, the energy sector faced significant challenges. A diversified portfolio across sectors would have balanced these opposing trends.

A bar chart comparing the performance of different sectors

A bar chart comparing the performance of different sectors3. Geographic Diversification

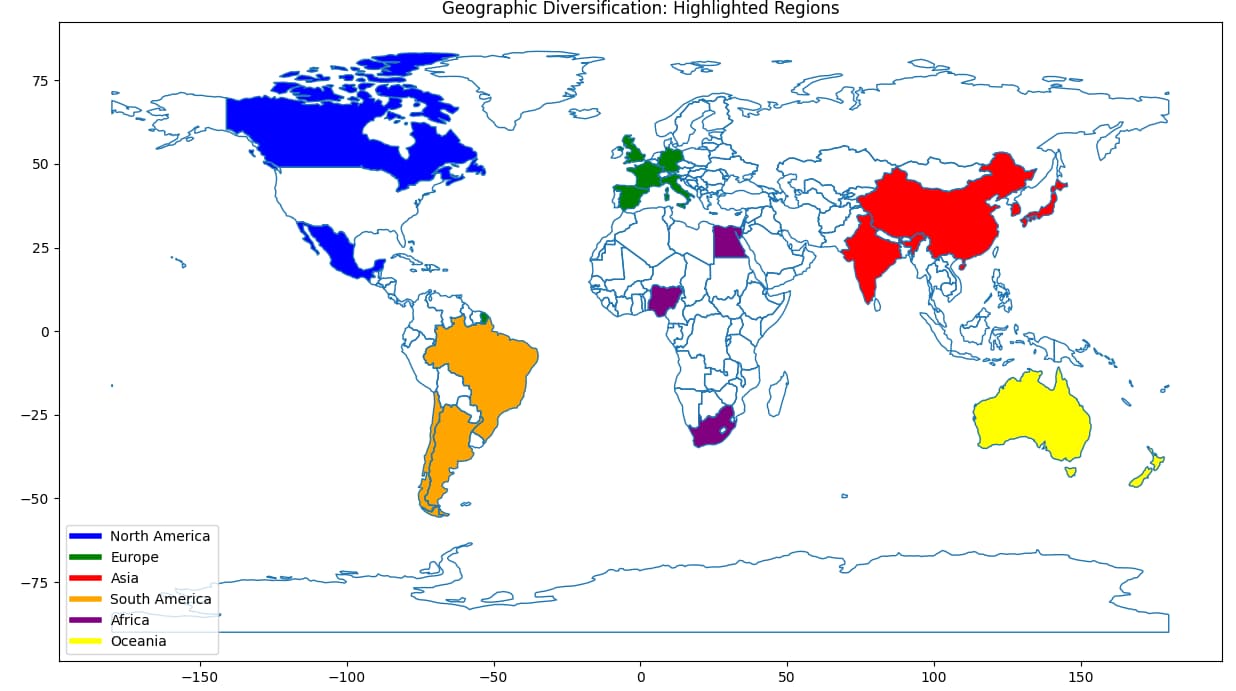

Geographic diversification includes international investments in a portfolio to benefit from global growth and reduce country-specific risks.

How to Use : Invest in international funds or stocks from different regions such as North America, Europe, and Asia to gain exposure to different geographic risks and mitigate concentration risk of a single region.

Currency exchange rates, political stability, and economic growth vary by region. For example, investing in emerging markets can offer high growth potential but comes with higher risks compared to developed markets.

A world map highlighting diversified regions

A world map highlighting diversified regions4. Diversification by Investment Style

Investment styles can be growth, value, income, and others. Combining them can balance potential returns and risks.

How to Use : Allocate portions of your portfolio to growth stocks, value stocks, and dividend-paying stocks. For example, include high-growth tech stocks, undervalued industrial stocks, and stable dividend-paying utility stocks. This will help you create a balanced portfolio.

Growth stocks tend to perform well in a booming economy, while value stocks may offer better stability during downturns. Dividend stocks provide regular income regardless of market conditions. Having all three in your portfolio can make you better-off in almost all market conditions.

5. Market Capitalization Diversification

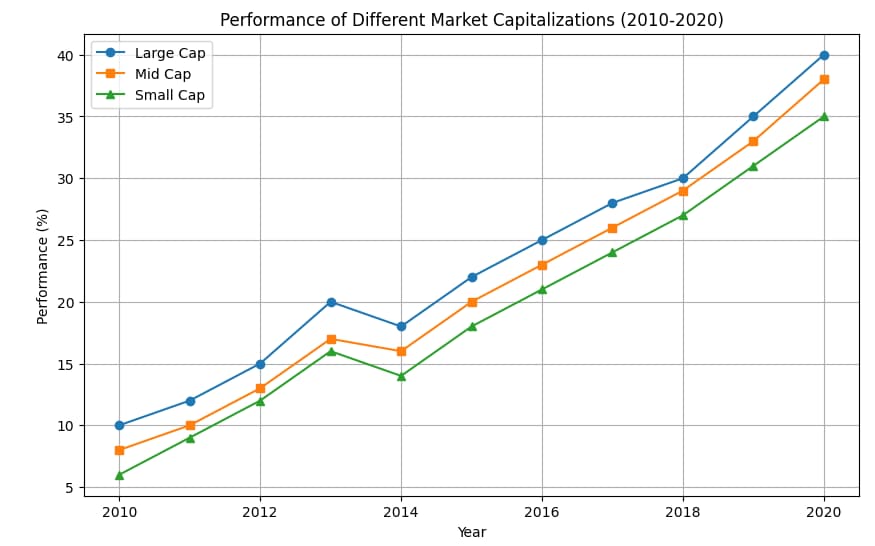

Investing in companies of various sizes (large-cap, mid-cap, small-cap) offers different growth potentials and stability levels.

How to Use : Include stocks of different market caps in your portfolio. For example, large-cap companies like Apple provide stability, while small-cap companies offer high growth potential.

Small-cap stocks often outperform large-cap stocks during economic recoveries due to their growth potential, while large-cap stocks tend to be more resilient during economic downturns.

A line chart showing the performance of different market capitalizations

A line chart showing the performance of different market capitalizations6. Diversification through Mutual Funds and ETFs

Mutual funds and ETFs provide exposure to a diversified set of assets without picking individual stocks or bonds.

How to Use : Select funds that align with your investment strategy and goals. For example, choose a broad-market ETF for general exposure or a sector-specific mutual fund for targeted diversification.

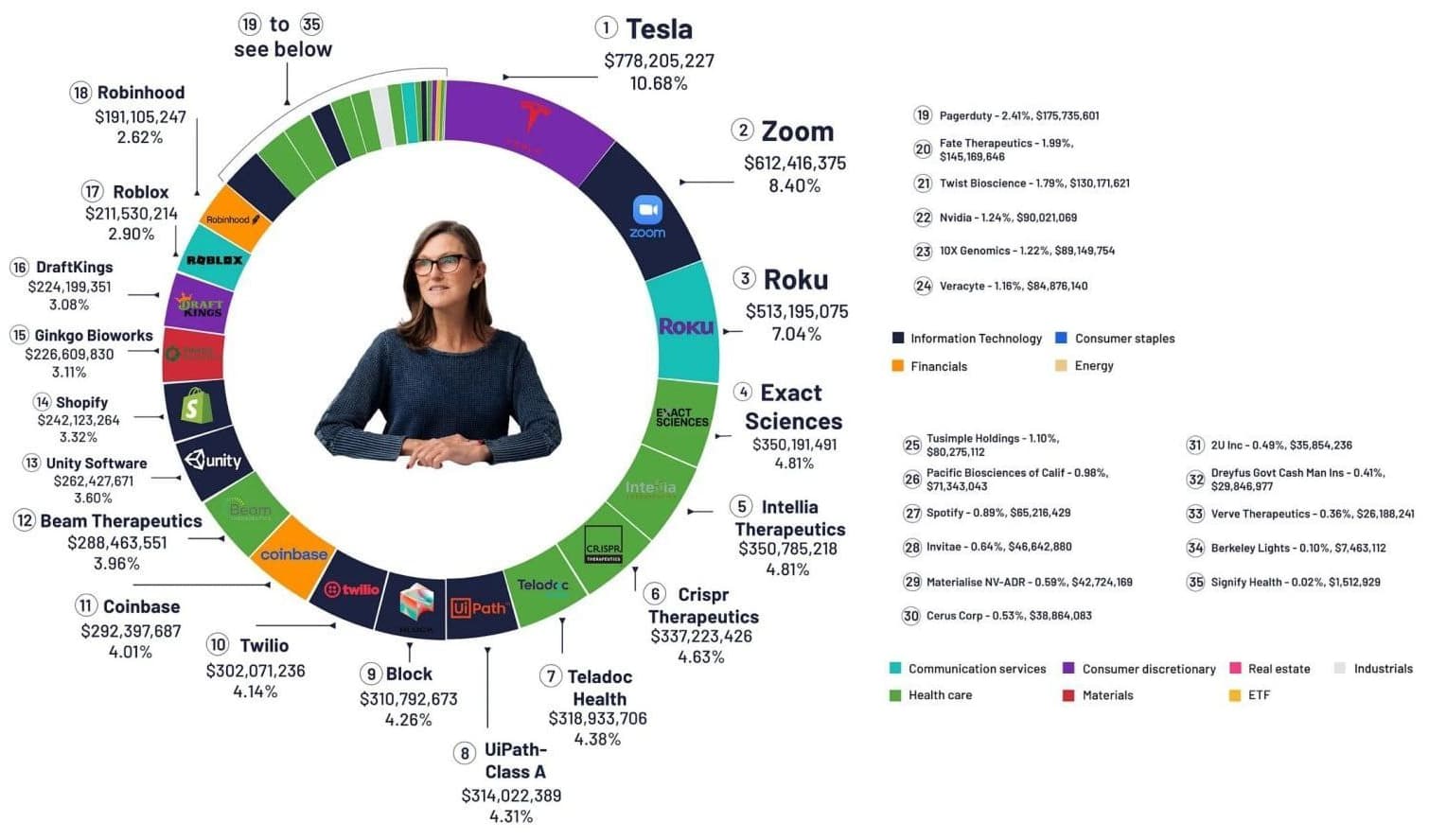

ARK Invest Cathie Wood: current portfolio

ARK Invest Cathie Wood: current portfolio Index funds, a type of ETF, have gained popularity due to their low fees and broad market exposure. Vanguard's Total Stock Market ETF (VTI) is a prime example, offering exposure to the entire U.S. stock market.

7. Alternative Investments

Alternative investments such as commodities, real estate, and hedge funds offer diversification beyond traditional stocks and bonds.

How to Use : Allocate a small percentage of your portfolio to alternative investments. For example, invest in gold ETFs, real estate funds, or hedge funds to diversify further.

During periods of stock market volatility, alternative investments like gold often act as a safe haven, preserving capital.

An infographic showing types of alternative investments

An infographic showing types of alternative investments

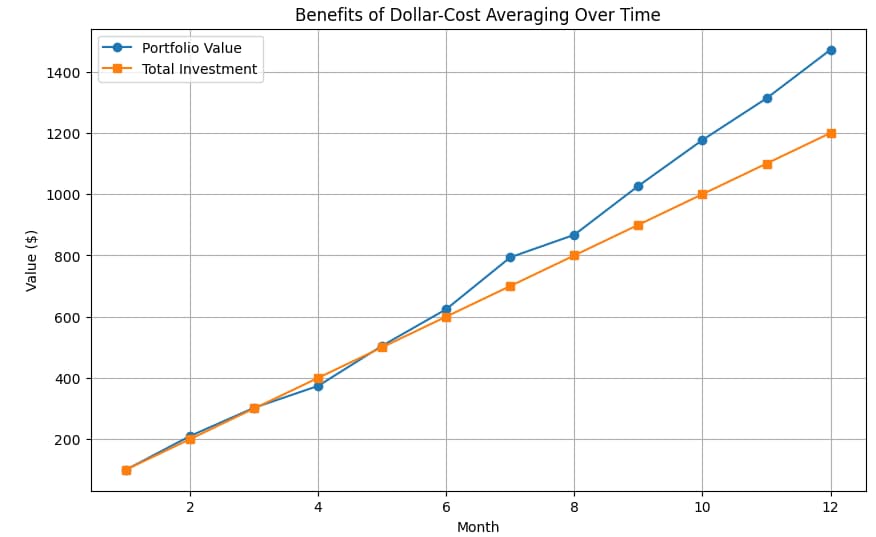

8. Time Diversification (Dollar-Cost Averaging)

Investing a fixed amount regularly over time can reduce the impact of market volatility.

How to Use : Set up automatic investments at regular intervals, such as monthly or quarterly, regardless of market conditions.

Dollar-cost averaging helps investors avoid the pitfalls of market timing. For instance, investing consistently during market downturns can lower the average cost per share over time.

A line graph illustrating the benefits of dollar-cost averaging over time.

A line graph illustrating the benefits of dollar-cost averaging over time.Integration of multiple strategies

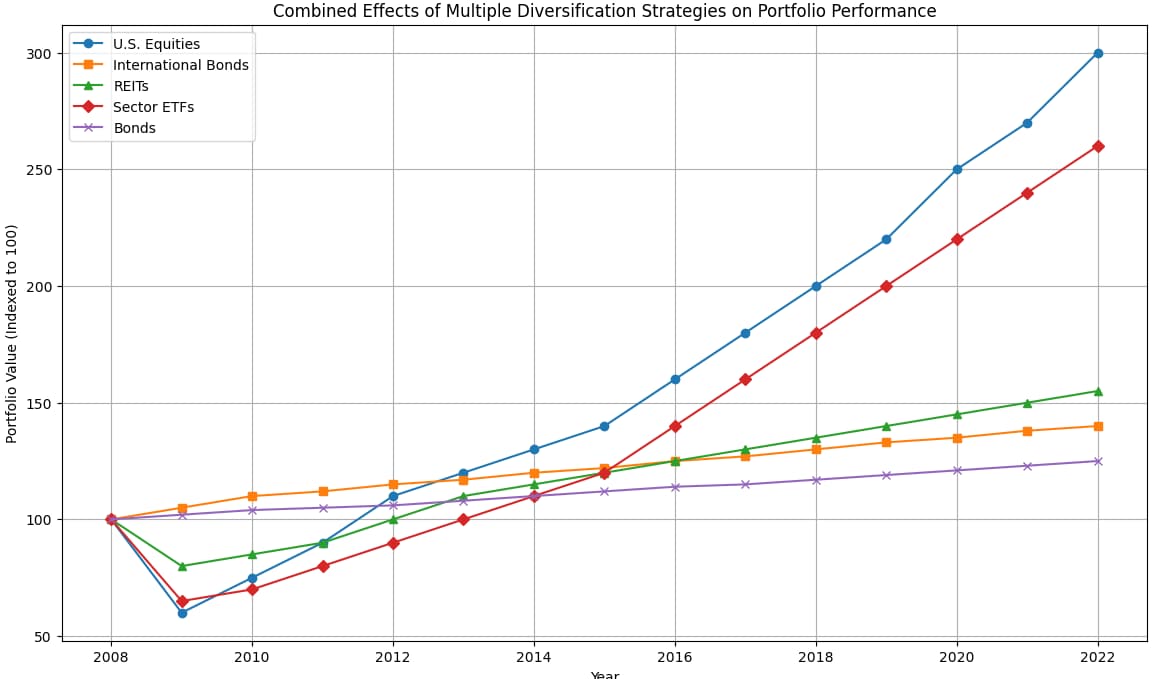

Combining multiple diversification strategies, if done correctly, can improve the performance of your investment portfolio. We have explored some tried-and-tested combinations below:

-

Combining asset class and geographic diversification. By investing in various asset classes (e.g., stocks, bonds, real estate) across different geographic regions (e.g., North America, Europe, Asia), you can gain global exposure and reduce the impact of localized economic downturns.

-

Using mutual funds and ETFs alongside individual stock selections . Incorporate mutual funds and ETFs to achieve broad market exposure while also selecting individual stocks to capitalize on specific growth opportunities.

A graph depicting the effect of multiple diversification strategies on portfolio performance

A graph depicting the effect of multiple diversification strategies on portfolio performanceWhat should be considered for beginners

As a beginner, you should focus on the importance of education, creating a solid trading plan, and managing risk. It is important to have patience and to keep realistic expectations for long-term success.

-

Education . Invest time in learning about market dynamics, trading strategies, and risk management through online courses, trading books, and webinars;

-

Trading Plan . Develop a comprehensive trading plan that outlines strategies and risk management rules;

-

Risk Management . Start with small positions and gradually increase exposure as confidence grows.

What should be considered for advanced traders

Advanced traders should refine and test their strategies, use advanced tools, and manage larger portfolios. Further, they must focus on continuous learning and adaptation.

-

Refining Strategies . Continuously backtest and forward-test trading strategies;

-

Advanced Tools . Use sophisticated trading platforms with advanced charting tools and algorithmic trading capabilities;

-

Portfolio Management . Implement complex risk management strategies like hedging and diversification across asset classes.

Risks and warnings

While diversification is a key strategy to manage risk, it is not without its own set of challenges and pitfalls. This section highlights the risks associated with different diversification strategies and provides warnings about common mistakes investors might make.

-

Over-Diversification. Spreading investments too thin can dilute potential returns. When investors hold too many assets, each with a small proportion of the portfolio, the potential impact of high-performing investments is minimized. Over-diversification can lead to a portfolio that closely mimics the overall market performance, reducing the benefits of carefully selected high-growth investments;

-

Market Risk. Even well-diversified portfolios are subject to market risks. Diversification cannot eliminate systemic risks, such as economic recessions, political instability, or global pandemics, which affect almost all asset classes. During major market downturns, correlations between different asset classes can increase, meaning they move in the same direction, which reduces the effectiveness of diversification.

Expert Advice

I have tested many diversification strategies on my portfolio. While some performed better than the others, one thing was common across all: better risk-adjusted returns. Through my experience, I have the followings insights to share for beginners and seasoned investors alike:

-

For instance, allocating assets among stocks, bonds, and real estate can mitigate the impact of poor performance in any single investment , leading to more stable returns. Sector diversification, which includes investments in technology, healthcare, and finance, helps balance risks associated with specific industries;

-

Geographic diversification reduces country-specific risks by including investments in different regions, such as North America, Europe, and Asia. Combining different investment styles, like growth, value, and income, provides a balanced approach to risk and return;

-

Investing in companies of various market capitalizations —large-cap, mid-cap, and small-cap— offers different growth potentials and stability levels;

-

Mutual funds and ETFs facilitate broad diversification without the need to select individual securities. Additionally, incorporating alternative investments, such as commodities and real estate, can protect against market volatility. Regularly investing fixed amounts through dollar-cost averaging further reduces the impact of market fluctuations.

Conclusion

Diversification is a fundamental strategy in portfolio management that helps mitigate risk and enhance potential returns . Diversification strategies involve spreading investments across asset classes, sectors, industries, and geographies to reduce risk. Remember, the key to successful diversification lies in balancing risk and reward, staying disciplined, and continuously adapting to market changes.

FAQs

What is portfolio diversification?

Diversification is an investment strategy that spreads investments across various asset classes, sectors, and regions to reduce risk and enhance returns.

Why is diversification important?

Diversification mitigates risk by reducing the impact of poor performance in any single investment, leading to more stable returns over time.

What is over-diversification?

Over-diversification occurs when investments are spread too thin, diluting potential returns and making the portfolio mimic the overall market.

Can diversification eliminate all risks?

No, diversification reduces specific risks but cannot protect against systemic risks like economic recessions or global events affecting all asset classes.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.