How To Choose Promising Stocks To Invest In

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Step-by-step guide how to choose promising stocks to invest in:

Step 1: Identify growth sectors

Step 2: Monitor economic indicators

Step 4: Analyze company fundamentals

Step 5: Assess management quality

Step 6: Conduct a competitive analysis

Step 7: Use valuation metrics

Step 8: Review analyst opinions

Step 9: Diversify your portfolio

Step 10: Keep learning and adapting

Promising stocks are those that show potential for significant growth and strong performance based on various financial and market factors.

As an investor, selecting the right stocks for your portfolio can make or break your investment plans. Ideally, you would want to choose stocks that have a strong market position and high growth potential. But finding such stocks often becomes difficult. So, to help you out, this guide provides comprehensive insights into choosing the right stocks, highlighting key factors, expert advice, and practical steps.

Choosing promising stocks - a step-by-step guide

Step 1: Identify growth sectors

Focus on sectors that are expected to grow significantly. Here are three sectors to consider:

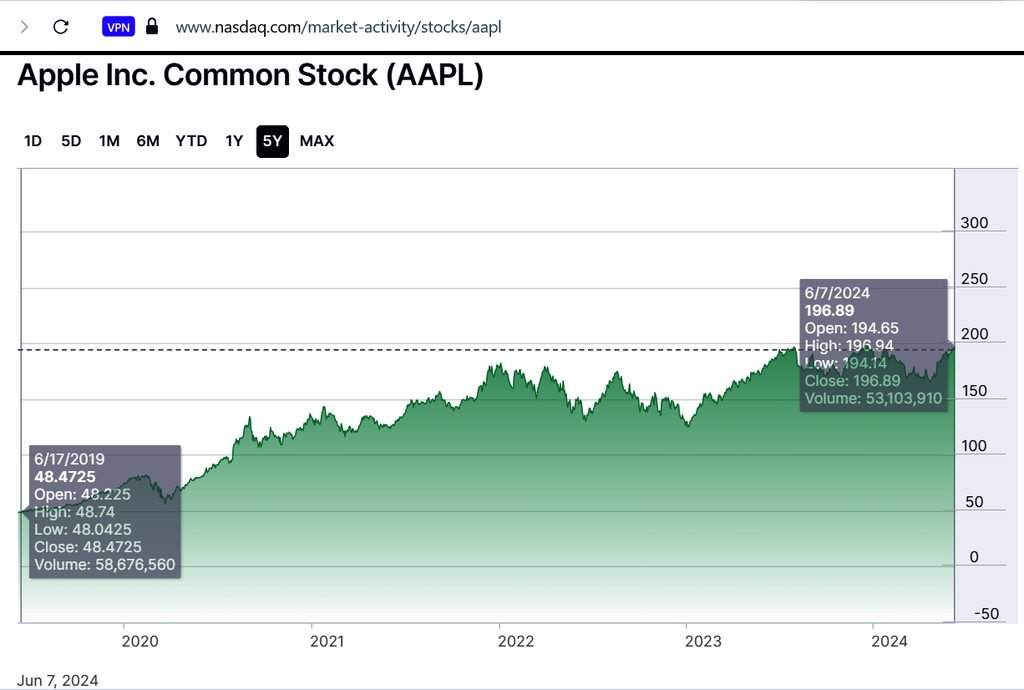

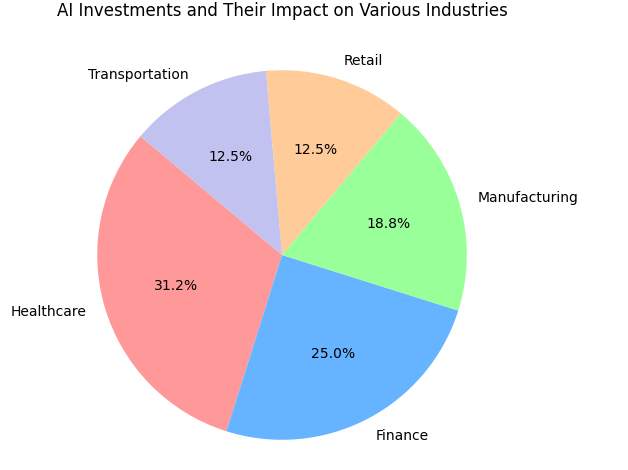

Technology

Companies like Apple (AAPL) and NVIDIA (NVDA) are continuously innovating with new products and services.

Healthcare

Moderna (MRNA) and Pfizer (PFE) have been at the forefront of developing COVID-19 vaccines.

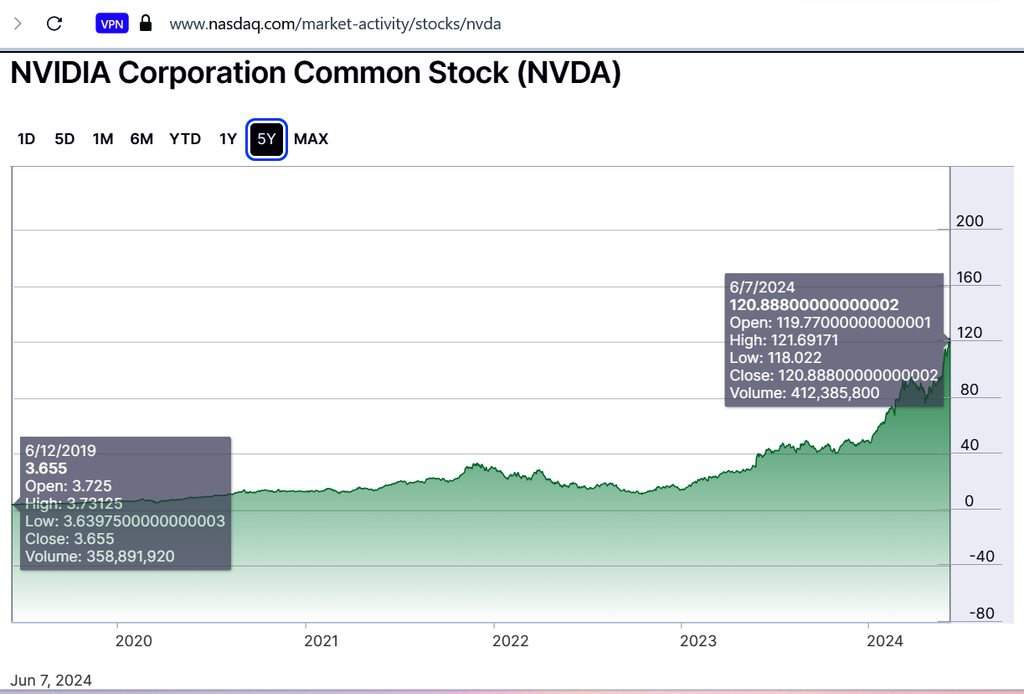

Renewable Energy

Companies like Tesla (TSLA) and NextEra Energy (NEE) are leading the shift to sustainable energy.

Step 2: Monitor economic indicators

Keep an eye on key economic indicators to understand the broader market environment. For example:

GDP growth. When GDP growth is strong, it often leads to higher corporate profits, which can boost stock prices;

Inflation Rates. High inflation can reduce consumer purchasing power and corporate profits, potentially impacting stock prices negatively;

Employment Data. High employment levels generally lead to increased consumer spending, benefiting retail and consumer goods stocks.

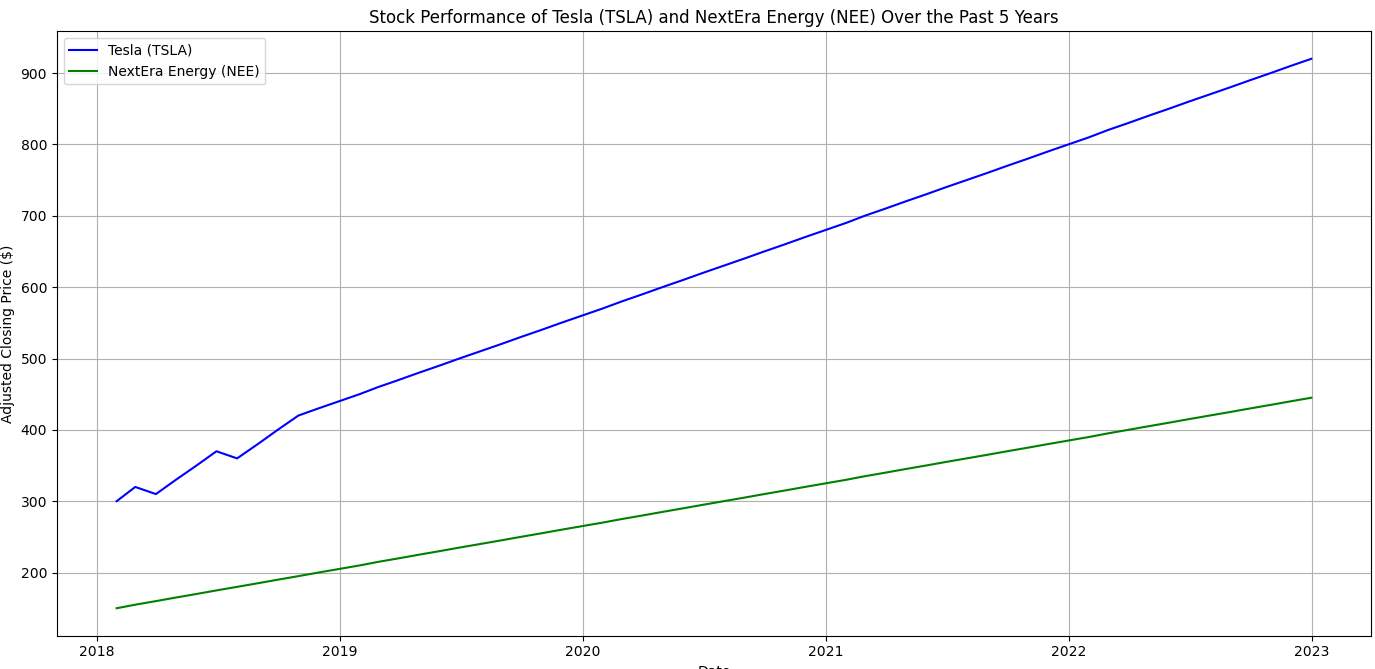

Step 3: Evaluate Technological Innovations

Stay updated on technological advancements that could drive industry growth:

Artificial Intelligence. Example: Alphabet (GOOGL) and Microsoft (MSFT) are heavily investing in AI technologies.

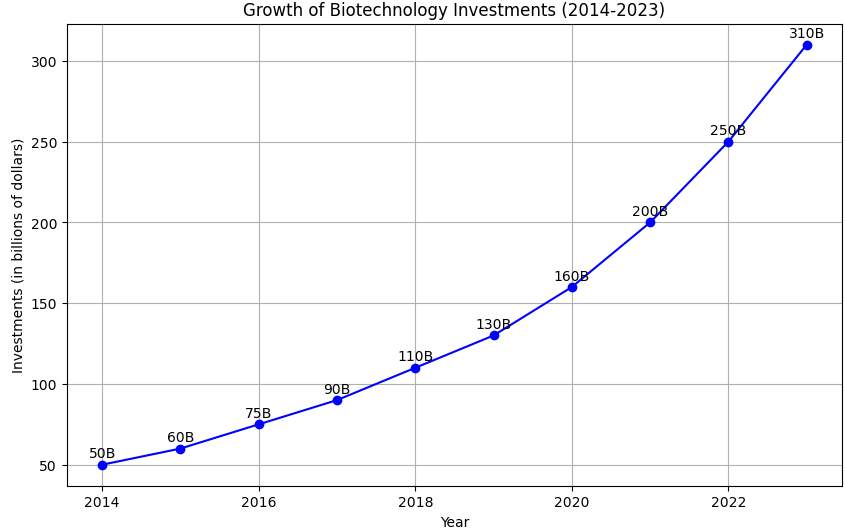

Biotechnology. Example: CRISPR Therapeutics (CRSP) is pioneering gene-editing technology.

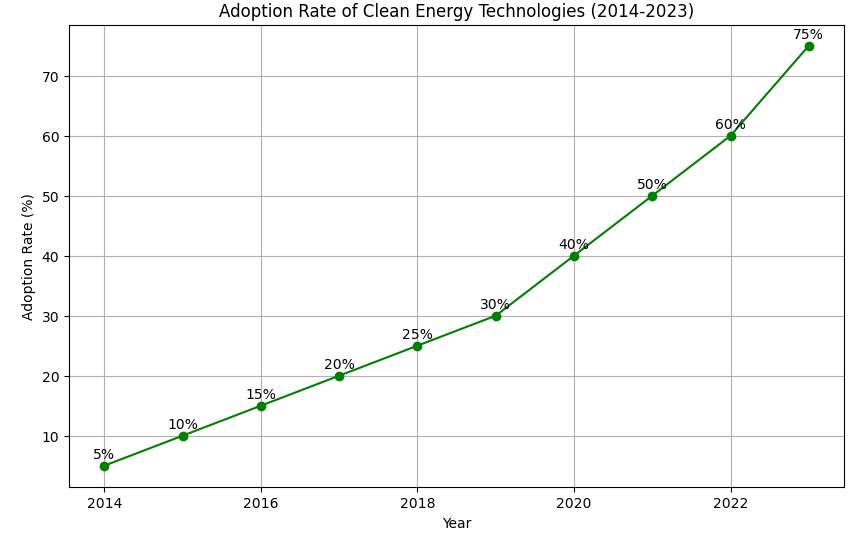

Clean energy. For example, First Solar (FSLR) and Enphase Energy (ENPH) are leading solar technology advancements.

Step 4: Analyze company fundamentals

Examine the financial health of potential investments:

Revenue Growth. Amazon (AMZN) has shown consistent revenue growth, indicating strong market demand;

Profit margins. Visa (V) has high profit margins, showcasing its efficiency;

Debt levels. For instance, Johnson & Johnson (JNJ) maintains manageable debt levels, indicating financial stability;

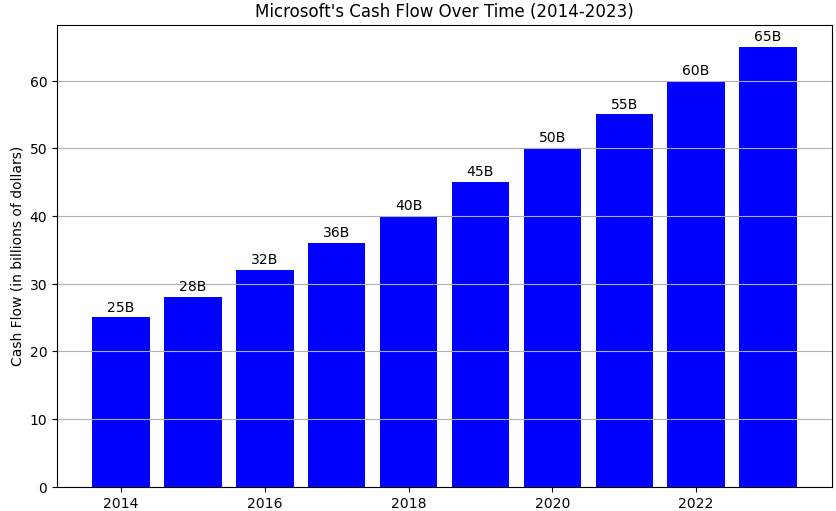

Cash flow. Microsoft (MSFT) consistently generates positive cash flow, ensuring it can meet its financial obligations.

Step 5: Assess management quality

Evaluate the leadership team:

Experience. Example: Warren Buffett at Berkshire Hathaway (BRK.A) has decades of successful investment experience;

Vision. Example: Elon Musk at Tesla (TSLA) is known for his visionary approach to sustainable energy and space exploration;

Decision-Making. Example: Satya Nadella at Microsoft (MSFT) has made strategic decisions that led to the company’s growth in cloud computing.

Step 6: Conduct a competitive analysis

Research the company’s position within its industry:

Market share. Example: Coca-Cola (KO) has a significant market share in the beverage industry.

Competitive Edge. For instance, Nike (NKE) has a strong brand and innovative product line that sets it apart from competitors.

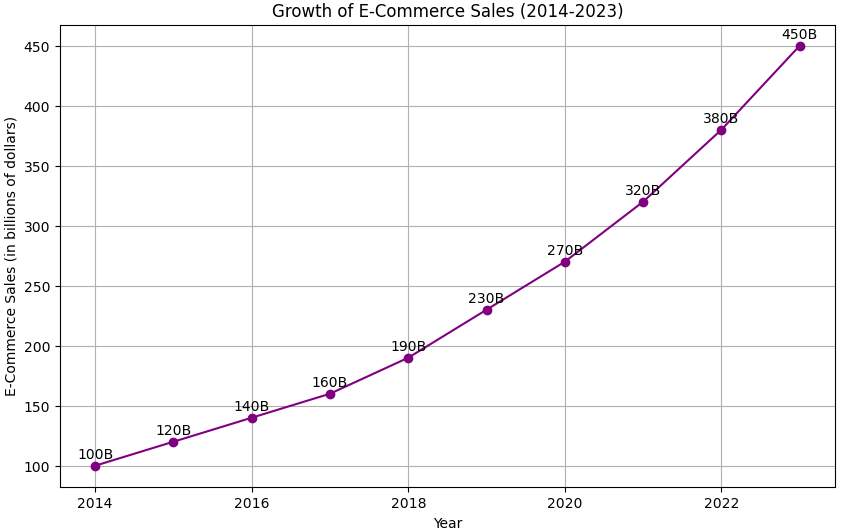

Industry Trends. For example, Shopify (SHOP) benefits from the trend towards e-commerce.

Step 7: Use valuation metrics

Utilize financial metrics to assess whether a stock is fairly priced:

Price-to-Earnings (P/E) Ratio. Example: Apple (AAPL) has a P/E ratio that can be compared with industry averages to determine its valuation.

Price-to-Book (P/B) Ratio. Example: Bank of America (BAC) uses the P/B ratio to assess its valuation.

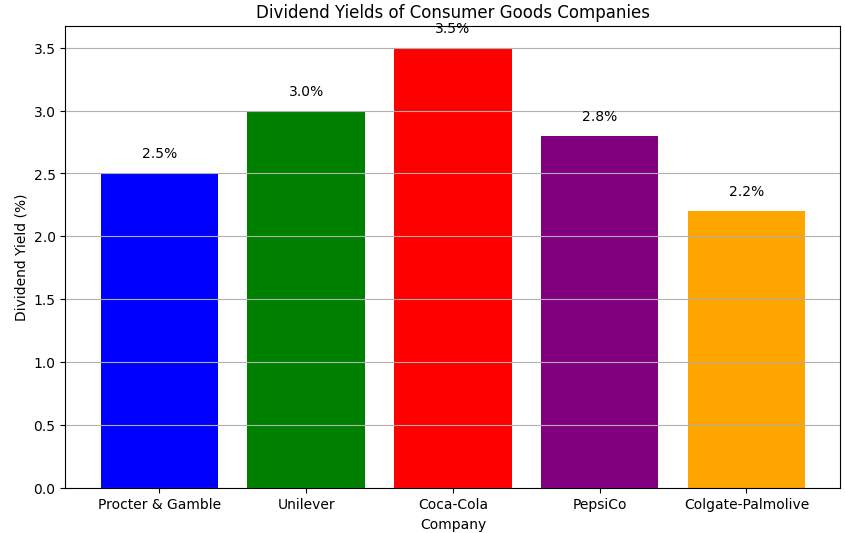

Dividend yield. Example: Procter & Gamble (PG) offers a stable dividend yield that attracts income-focused investors.

Step 8: Review analyst opinions

Consider insights and recommendations from financial analysts:

Research reports. Analyst reports on Alphabet (GOOGL) provide in-depth analysis and future projections.

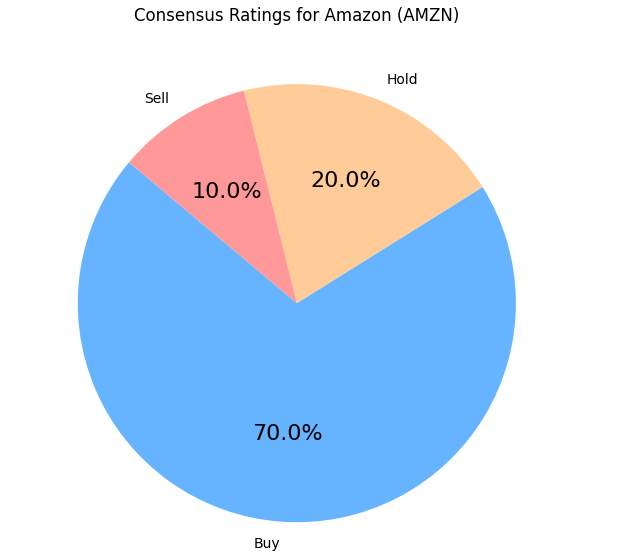

Consensus Ratings. The consensus rating for Amazon (AMZN) helps gauge overall analyst sentiment.

Step 9: Diversify your portfolio

Spread your investments across different sectors and asset classes to minimize risk:

Sector diversification. Invest in a mix of technology, healthcare, and financial stocks;

Asset class diversification. Include stocks, bonds, and real estate in your portfolio.

Step 10: Keep learning and adapting

Continuously update your knowledge and adapt your strategies:

Market trends. Follow trends in e-commerce, renewable energy, and fintech;

Visual: Line graph showing emerging market trends;

Webinars and courses. Attend webinars hosted by financial experts and take online courses on investing;

Financial news. Regularly read publications like The Wall Street Journal and Bloomberg.

Pros and cons of each investment option

The following table summarizes the pros and cons of different categories of stocks. We have also discussed the pros and cons in detail later, along with examples, for your better understanding.

| Investment Option | Pros | Cons |

|---|---|---|

|

| |

Value Stocks |

|

|

|

|

Considerations for beginners

By following these guidelines, you can build a strong foundation for your investment portfolio.

Start with low-risk investments such as index funds or ETFs that provide broad market exposure and reduce individual stock risk;

Diversifying your portfolio helps spread risk across different asset classes and sectors, reducing the impact of any single investment's poor performance;

Robo-advisors can help beginners by providing automated, low-cost investment management based on your risk tolerance and goals;

Minimize fees and expenses by choosing low-cost investment options and being mindful of trading frequency. This can also be taken care of by selecting the right broker that charges lower fees. You also need to pay attention to other trading conditions:

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Stocks |

Yes | Yes | Yes | Yes | Yes |

|

Leverage |

Up to 1:30 or up to 1:300 | Up to $400:1 retail, 500:1 Pro | Up to 1:200 | Up to 1:400 | Depending on the asset |

|

Spread, pips |

From 0.8 pips | from 0.0 pips | From 0 p for currency pairs | From 0.2 pips | From 0 pips |

|

Types accounts |

Demo, User | Razor, Standard | Standard, Core, Swap-free, Premium, Premium Core | Standard account, Commission account, Direct Market Access account (DMA) | Real, Demo |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Technical analysis tools to identify promising stocks

Technical analysis tools use historical price patterns and market data to help traders identify potential investment opportunities:

Identify trends with moving averages: Use moving averages to determine the overall trend direction of a stock. Look for stocks that are in an upward trend, where the price is consistently above the moving averages.

Spot overbought and oversold conditions with RSI: Use the RSI to identify stocks that may be overbought or oversold. Consider buying stocks with an RSI below 30 and selling stocks with an RSI above 70, but always confirm with other indicators.

Generate buy and sell signals with MACD: Use the MACD to identify potential entry and exit points. Look for MACD line crossovers with the signal line as confirmation of buy or sell signals.

Combine multiple indicators: For a more reliable analysis, combine multiple technical indicators. For example, use moving averages to confirm the trend, RSI to identify overbought or oversold conditions, and MACD to time your entry and exit points.

Risk and warning section

This section will highlight key risks associated with stock investments, such as market volatility, economic downturns, and company-specific issues. By being aware of these potential pitfalls, you can better prepare and protect your portfolio from significant losses.

Market volatility. Understand that market volatility is normal and be prepared for fluctuations in stock prices;

Economic downturns. Be aware of the impact of economic downturns on stock performance and have a strategy to mitigate risks;

Company-specific risks. Consider risks specific to individual companies, such as management changes or regulatory issues;

Diversification as a risk management tool. Use diversification to reduce risk by spreading investments across various assets and sectors.

How to choose a promising stocks from expert

Investing in the stock market can be both rewarding and challenging. Through my experience, I can provide the following recommendations and strategies that can help you make better investment decisions, whether you're a beginner or an advanced trader:

Focus on a company's financial health, competitive position, and growth potential when selecting stocks;

Keep up with market news and trends to make informed investment decisions;

Balance long-term and short-term strategies based on your financial goals and risk tolerance;

Be aware of common mistakes like emotional trading and lack of diversification.

Remember, successful investing requires a combination of thorough research, strategic planning, and disciplined execution.

Conclusion

Selecting promising stocks requires thorough research, strategic planning, and ongoing monitoring. By understanding key factors, diversifying your portfolio, and staying updated with market trends, you can make informed investment decisions that align with your financial goals. Apply the strategies and insights discussed in this guide to enhance your stock selection process and build a robust investment portfolio.

FAQs

How important is diversification in an investment portfolio?

Diversification is crucial for managing risk and achieving stable returns. By spreading investments across different asset classes and sectors, you reduce the impact of any single investment's poor performance on your overall portfolio.

What is the difference between growth stocks and value stocks?

Growth stocks are companies expected to grow at an above-average rate compared to other companies. They often reinvest earnings into the business rather than paying dividends. Value stocks are companies that appear undervalued based on fundamental analysis. They often provide steady dividends and are typically less volatile than growth stocks.

How do I assess my risk tolerance?

Risk tolerance can be assessed by considering your financial situation, investment goals, and comfort level with market fluctuations. Tools such as risk tolerance questionnaires can help you evaluate how much risk you are willing to take on.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.