Best Stock Brokers For Intraday Deals In 2024

Best Stock Broker For Day Trading - eToro

Top stock brokers for day trading are:

-

eToro: Social trading network with CopyTrader feature

-

Saxo Bank: Multi-asset broker offering extensive trading assets

-

Interactive Brokers: Wide range of markets and financial instruments available

-

Charles Schwab: Full-service approach with extensive educational content

-

Fidelity: Top choice for low costs and ETFs

Day trading, the practice of buying and selling stocks within a single trading day, requires a robust and reliable platform with advanced features. Choosing the right stock broker is crucial for success in this dynamic market. This analysis will delve into the key factors to consider when selecting the best day trading brokers for 2024, exploring their commission structures, trading platforms, research tools, and customer service offerings.

Best stock brokers for day trading

| Name | Minimum deposit | Demo | Day trading features | Available stocks |

|---|---|---|---|---|

$10 |

Yes |

Copy trader feature, social newsfeed |

US-listed stocks |

|

$0 |

Yes |

Advanced trading tools, API access |

US-listed stocks plus IPOs and ADRs |

|

$100 |

Yes |

Proprietary platform, advanced features |

All US-listed stocks |

|

$100 |

Yes |

Access to research, customer support |

All US-listed stocks plus IPOs and ADRs |

|

$0 |

Yes |

Advanced trading tools, customer support |

US-listed stocks |

eToro

eToro offers a variety of investment options, including stocks, ETFs, and other securities, with availability depending on your location. For U.S. citizens, eToro provides access to trading 21 digital currencies and tokens, over 3,000 stocks, more than 270 ETFs, and options contracts on various assets. The platform holds licenses from regulatory authorities such as ASIC, CySEC, EFSA, FCA, FSCA, and MiFID, emphasizing its commitment to maintaining regulatory standards for client safety.

eToro has a social trading network through its News Feed, resembling a social media platform where users share insights on market trends. This feature enables users to understand the strategies of successful traders, aiding in decision-making when selecting traders to emulate. For traders with significant balances, eToro offers a VIP club known as eToro Club, with membership tiers ranging from Silver to Diamond. Each tier offers different benefits, such as access to Trading Central, discounted fees, and dedicated account managers.

| CLUB | SILVER | GOLD | PLATINUM | PLATINUM+ | DIAMOND |

|---|---|---|---|---|---|

|

Tier balance required |

$5K |

$10K |

$25K |

$50K |

$250K |

|

Club Dashboard |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Dedicated Account Manager |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Live Webinars |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Exclusive data-based Smart Portfolios |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Exclusive eToro Money Visa Debit Card |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Crypto Staking |

85% |

85% |

85% |

90% |

90% |

|

eToro Tax Report |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Discounted Tax Return |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Delta PRO Investment Tracker |

Yes |

Yes |

Yes |

Yes |

Yes |

|

WhatsApp – Direct Service Channel with Account Managers |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Weekly Market Analysis Email |

Yes |

Yes |

Yes |

Yes |

Yes |

|

eToro Club Trading Academy |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Discount or exemption on Exchange Fees |

25% |

25% |

50% | 50% |

100% |

|

Interest on Cash Balance |

No |

2% |

2.40% |

5% |

5.30% |

|

No Withdrawal Fees |

No |

No |

Yes |

Yes |

Yes |

|

The Wall Street Journal Subscription |

No |

No |

Yes |

Yes |

Yes |

|

Free Insurance up to 1 million EURO or AUD |

No |

No |

Yes |

Yes |

Yes |

|

Invitations to Top Tier Industry Events |

No |

No |

No |

Yes |

Yes |

|

Tickets to Handpicked Sporting Events |

No |

No |

No |

Yes |

Yes |

|

Access to leading digital financial publications |

No |

No |

No |

Yes |

Yes |

|

Crypto Cashback Program |

No |

No |

No |

Yes |

Yes |

|

Invitation to a Diamond Member Event |

No |

No |

No |

No |

Yes |

|

Airport Priority Pass |

No |

No |

No |

No |

Yes |

Additionally, eToro's Popular Investor program allows traders to qualify for perks based on their trading activity and the number of assets they attract to the platform. With four levels ranging from Cadet to Elite, traders can receive benefits like spread rebates, monthly payments, and management fees.

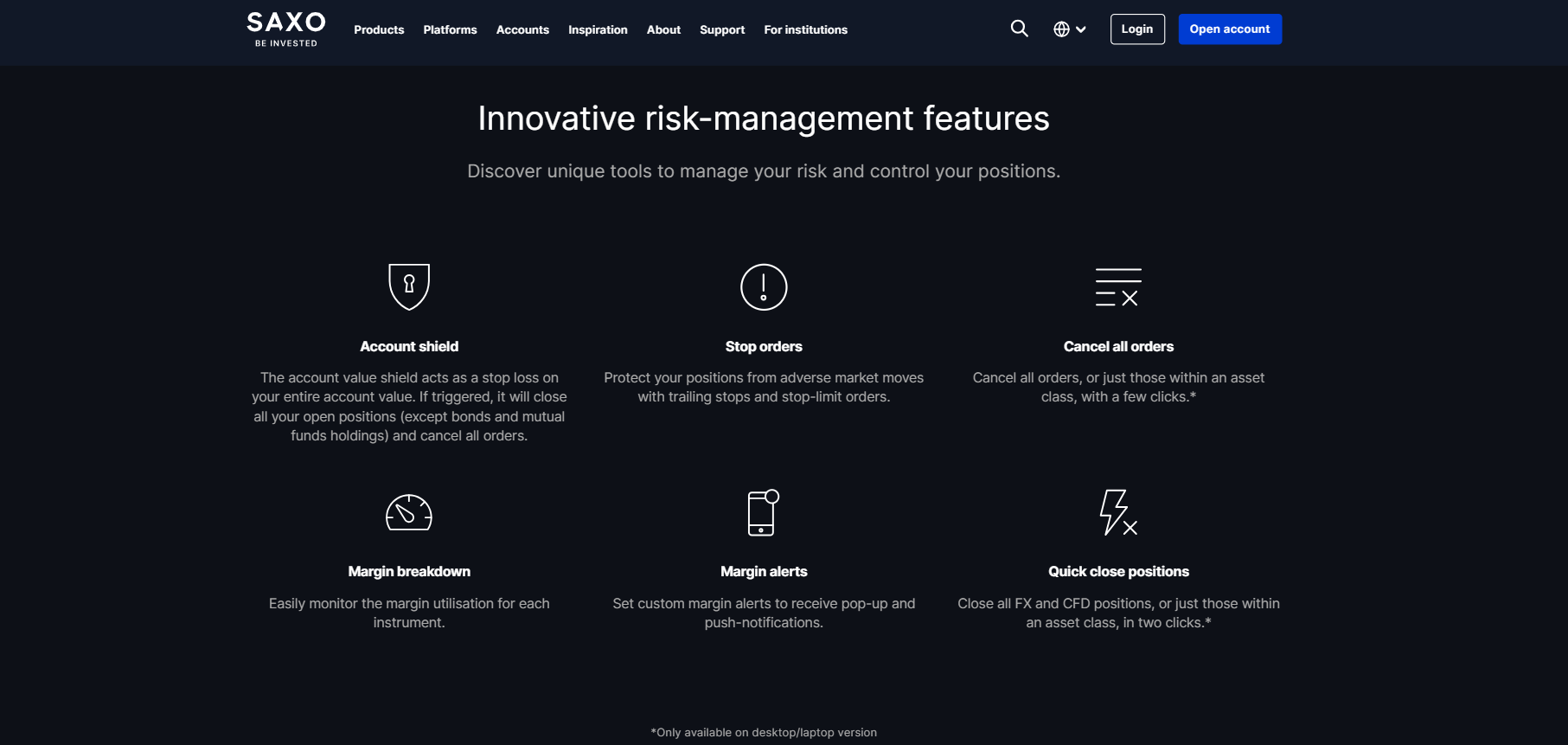

Saxo Bank

Saxo Bank is a multi-asset broker providing access to over 70,000 trading assets - spot forex, FX options, CFDs, stocks, ETFs, bonds, and more. The flagship platforms, SaxoTraderPRO and SaxoTraderGO, cater to both advanced and beginner traders with their diverse features and user-friendly interfaces. However, unlike many other brokers, Saxo does not offer the MT4 platform.

Investors can choose from a wide array of investments, including stocks, bonds, ETFs, and funds. Saxo also offers ready-made portfolios designed for various risk appetites, managed by its in-house team in collaboration with asset managers like BlackRock and Morningstar. Educational resources, including market analysis and investment commentary, are available to help investors make informed decisions.

Saxo innovative features

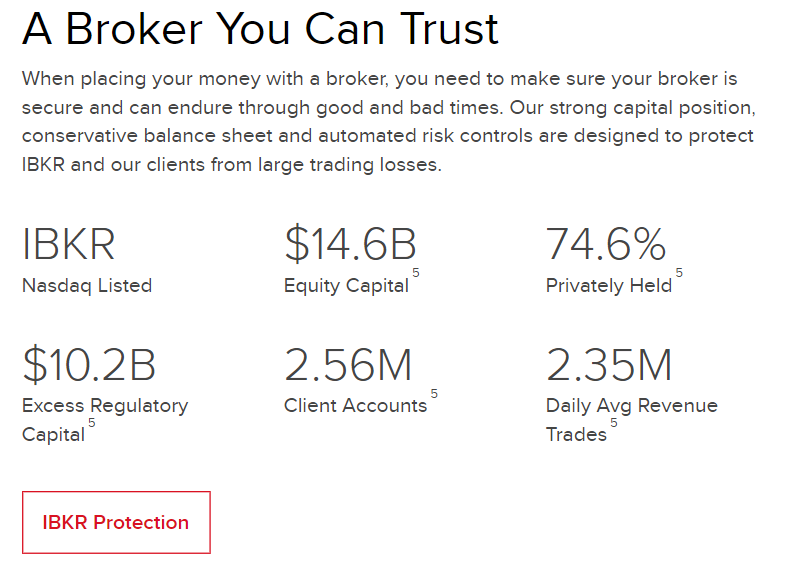

Interactive Brokers

Interactive Brokers is a pioneer in utilizing technology for financial markets. Interactive Brokers stands out for its extensive market access and technological innovations.

IBKR Platform

The platform caters to both regular investors and advanced traders, offering commission-free trades through IBKR Lite and low commission rates for high-volume traders through IBKR Pro. Interactive Brokers provides various apps for different trading purposes, including IMPACT for stocks and crypto, and IBKR for Forex and CFD trading, available on both iOS and Android devices.

Interactive Brokers' mobile app features advanced charting capabilities, allowing users to execute trades directly from the charts. With 127 available indicators and an intuitive interface, traders can analyze market trends efficiently. Additionally, the app offers an Impact dashboard for assessing portfolio metrics related to Environmental Social Governance (ESG) factors, enhancing the trading experience.

Charles Schwab

Charles Schwab serves a wide range of investors, employers, and independent advisors. With $8.56 trillion in client assets as of January 2024, Schwab's acquisition of TD Ameritrade in October 2020 has contributed to its growth. The broker offers extensive educational resources for investors and has integrated TD Ameritrade's thinkorswim® trading platform. Trading commissions are competitive, with options for free online trades across various investment types.

SCHWAB Platform

Flexible trading platform options include a simple web platform accessible directly through the website, offering real-time market data and basic research tools. For day trading and advanced research, Charles Schwab StreetSmart Edge provides sophisticated capabilities like advanced charting and options trading modules. There is no account minimum, and access to over 200 funds is available with minimum investment requirements as low as $100.

Fidelity

Fidelity stands out as a top choice for online brokerage, particularly for low costs and ETFs. It also excels in cash management services. The platform offers diverse investment platforms for active traders and investors, including mobile, desktop, and Active Trader Pro. Fees are minimal, and many services and products are fee-free, covering assets like ETFs, mutual funds, options, cryptocurrency, and fixed-income products.

Fidelity Platform

Fidelity provides zero-commission trading for stocks, ETFs, and over-the-counter (OTC) stocks, with options trading at a low per-contract charge. Mutual fund options include zero expense ratio index funds and fee-free trading for certain Fidelity mutual funds held for at least 60 days. However, non-Fidelity mutual funds may be subject to commissions, with a significant fee at purchase.

Additionally, Fidelity offers a fractional share purchase program called Stocks by the Slice, allowing investors to buy partial shares for as little as $1 and reinvest dividends into fractional shares.

How to choose the best stock broker for day trading?

Define your trading needs

The initial step in selecting the best stock broker for day trading is to understand your specific trading requirements. Consider factors such as:

-

Trading volume: If you trade frequently, look for brokers with low commissions and fast execution.

-

Trading strategy: For systematic strategies, prioritize brokers offering backtesting and advanced charting tools.

-

Trading capital: If your funds are limited, seek brokers with low minimum deposits and fees.

-

Trading platform: Choose brokers that support your preferred trading platform.

Reputation and reliability

Selecting a reputable and reliable broker is crucial since you'll entrust them with your funds. Evaluate the following aspects:

-

Regulatory compliance: Ensure the broker is registered with relevant regulatory bodies and follows industry standards.

-

Financial stability: Assess the broker's financial health through financial statements and independent ratings.

-

User reviews: Read feedback from other traders to gauge the broker's performance and customer service.

Compare fees

Visit broker websites to compare fees, including trading commissions, account fees, and other costs that may affect your profits.

Test trading platforms

Evaluate trading platforms to ensure they align with your needs. Look for features like real-time data, customizable charts, and diverse order types.

Evaluate customer service

Assess customer service quality by considering response times, availability, and overall support. Prefer brokers offering 24/7 support and multiple contact channels.

Consider additional services and support

Day trading can be complex, so access to quality support and educational resources is vital. Look for brokers offering:

-

Research and analysis: Access to market analysis and research reports.

-

Trading education: Educational resources like webinars and tutorials.

Can I make money in stock day trading?

Yes, it is possible to make money in stock day trading, but it's important to understand the risks involved. Day trading involves buying and selling stocks within the same day, aiming for small profits. However, there are challenges and limitations to consider:

Transaction costs

Day trading comes with high transaction costs, including taxes and fees. Short-term capital gains tax applies to day trading profits, which is higher than long-term capital gains tax. Additionally, traders may face fees for each trade, reducing their profits.

High risk

Day trading is inherently risky and requires a deep understanding of markets, products, and strategies. Professional day traders are experienced and knowledgeable. Before starting day trading, it's essential to grasp the significant risks involved.

Market monitoring

Successful day trading demands constant market and news monitoring. It's fast-paced and speculative, requiring intense focus and emotional resilience.

Minute-to-minute decision-making

Day trading involves rapid decision-making, which can result in substantial losses. Market volatility poses a challenge, even for experienced traders, as prices fluctuate throughout the day.

Basic stock day trading strategies

Day trading is the practice of buying and selling stocks within the same trading day to benefit from short-term price movements. There are three main strategies used in stock day trading:

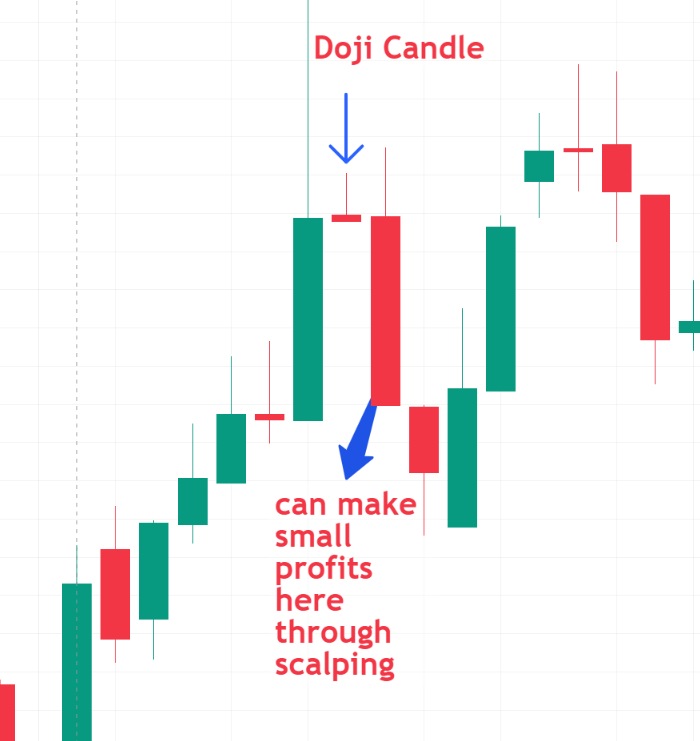

Scalping

Scalping involves making small profits from quick price changes. Traders enter and exit positions rapidly throughout the day, aiming to accumulate profits over time. Successful scalping requires intense focus, swift decision-making, and the ability to manage multiple trades simultaneously.

Scalping strategy

Momentum trading

Momentum trading focuses on stocks with strong upward or downward trends. Traders capitalize on the continuation of these trends, riding the momentum to profit. Technical analysis indicators are used to identify robust trends and guide trading decisions.

Upward momentum

Breakout trading

Breakout trading involves entering positions when a stock breaks out of a defined trading range or pattern. Traders look for stocks consolidating within a range and enter trades when they anticipate a breakout. Volume and volatility indicators help confirm potential breakouts, allowing traders to capitalize on subsequent price movements.

Breakout trading

Stock day trading example

Let's assume you're a day trader interested in trading shares of Apple Inc. (AAPL). Your trading day begins with thorough market analysis and preparation. You review the latest news and announcements related to Apple, as well as broader market trends and economic indicators that could potentially impact the stock's performance.

Pre-market analysis

-

You analyze Apple's pre-market trading activity, paying close attention to the bid-ask spread, volume, and any significant price movements.

-

You study the previous day's closing price, support and resistance levels, and key technical indicators like moving averages, relative strength index (RSI), and MACD.

-

You also review analyst ratings, price targets, and any upcoming events or earnings reports that could influence the stock's price action.

Trading plan and entry

-

Based on your analysis, you develop a trading plan with well-defined entry and exit points, as well as risk management strategies like stop-loss orders.

-

Let's say your analysis suggests a potential breakout above a key resistance level at $135 per share. You decide to enter a long position at $135.10 with a stop-loss order at $134.50, limiting your potential loss.

Intraday trading and position management

-

Shortly after your entry, Apple's stock price begins to rally, and you observe significant buying volume. You decide to trail your stop-loss order to protect potential profits as the stock moves in your favor.

-

As the stock approaches your initial profit target, you consider implementing a scaling-out strategy, where you gradually exit your position in multiple tranches to lock in gains while allowing a portion of your position to remain open in case the rally continues.

-

Throughout the trading day, you closely monitor the stock's price action, volume, and any potential catalysts or news that could impact your position. You may adjust your stop-loss levels, take partial profits, or even add to your position based on your real-time analysis and risk management strategies.

Exit and post-trade analysis

-

Assuming the stock reaches your final profit target, you exit your position completely, securing your gains for the day.

-

After the market closes, you conduct a thorough post-trade analysis, reviewing your entry and exit points, risk management strategies, and overall trade performance.

-

You analyze any potential mistakes or areas for improvement, and document your findings to refine your trading strategies for future trades.

Do I have to pay taxes when day trading stocks?

In day trading, you're obligated to pay taxes on your trading profits. Day trading is classified as short-term capital gains, subject to ordinary income tax rates.

Here are some essential points to understand about taxes on day trading stocks in different countries

| Country | Tax Treatment | Tax Rate | Tax Reporting | Tax Benefits |

|---|---|---|---|---|

US |

Short-term capital gains |

10% - 37% + NIIT (3.8%) |

File Form 1040 with Schedule D |

Day traders can deduct trading-related expenses as business expenses, potentially lowering their taxable income. |

|

UK |

Income tax |

20% - 45% (Spread betting may be exempt) |

Self Assessment tax return |

ISA accounts offer tax-sheltered investing |

|

Australia |

Capital gains |

30% (May be income tax if deemed a business) |

Capital Gains Tax return |

CGT Discount for holding assets over 1 year |

|

Canada |

Capital gains |

Effective rate 15% - 33% |

File with regular tax return |

TFSA accounts offer tax-sheltered investing |

|

Singapore |

Exempt (unless resident trader) |

N/A |

Not applicable |

No capital gains tax for most individuals |

|

Spain |

Capital gains |

19% (>€24,000), lower rates for smaller gains |

File with income tax return |

None (Benefits may exist for long-term investments) |

How to choose the best stocks for day trading?

When selecting stocks for day trading, it's essential to consider specific criteria to enhance your chances of success. Here are some highly analytical tips to help you choose the best stocks for day trading:

Liquidity and volume

Look for stocks with high liquidity and trading volume. Liquidity ensures smooth entry and exit from positions without significantly affecting the stock price. High liquidity reduces slippage and enables quick trade execution, crucial for day trading where speed is paramount.

Sector correlation

Consider stocks that move in correlation with their sector or index group. Understanding sector trends helps identify stocks likely to follow broader market movements. Trading stocks aligned with sector trends increases the probability of successful trades and reduces risk exposure.

Utilize advanced technical analysis tools

Incorporate advanced technical analysis tools and indicators to gain a competitive edge. Order flow analytics can identify potential supply and demand zones, while market profile analysis visualizes the dynamic relationship between price and volume.

Backtesting and continuous refinement

Backtest your trading strategies using historical market data to evaluate performance and profitability. Identify weaknesses and refine your approach by testing strategies on different stocks, market conditions, and time periods. Continuously review and adjust strategies based on real-time trading experiences, market changes, and evolving dynamics.

Expert opinion

In my experience, for novice day traders, platforms like eToro and Fidelity offer excellent options. eToro's user-friendly interface and CopyTrader feature simplify the trading process, making it ideal for beginners. Fidelity's comprehensive educational resources and zero-commission trading for stocks and ETFs provide valuable support for those starting out. Additionally, beginners should look for platforms with robust research and analysis tools, educational resources such as tutorials and webinars, and responsive customer support to help navigate the complexities of day trading effectively.

Summary

In conclusion, selecting the best stock brokers for day trading involves considering various factors such as trading volume, platform features, fees, and customer support. Platforms like eToro, Saxo Bank, and Interactive Brokers offer a range of benefits for day traders, including user-friendly interfaces, advanced trading tools, competitive fees, and extensive educational resources. Whether you're a novice or experienced trader, finding a broker that aligns with your trading style and goals is essential for success in day trading.

Methodology for compiling our ratings

Traders Union applies a rigorous methodology to evaluate brokers using over 100 both quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Brokers are evaluated on the breadth and depth of assets/markets available to trade.

-

Fees and commissions. A comprehensive analysis is done of all trading costs to analyze overall cost to clients.

-

Trading platforms. Brokers are assessed based on the variety, quality and features of platforms offered to clients.

-

Other factors like brand popularity, customer support, education resources are also evaluated

FAQs

What stocks are best for day trading?

Stocks with high liquidity and volatility are best for day trading, as they provide ample trading opportunities and quick price movements.

Is day trading very profitable?

Day trading can be profitable, but it also carries significant risks. Success depends on factors like market knowledge, strategy, discipline, and risk management.

What are the risks of day trading?

Risks of day trading include substantial financial losses, emotional stress, rapid market movements, high transaction costs, and regulatory compliance issues.

What should you consider when choosing a day trading platform?

When choosing a day trading platform, consider factors such as usability, trading tools, research resources, fees, customer support, reliability, and compatibility with your trading strategy.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

-

4

Scalping

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

-

5

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).