Most Important Order Types For Beginners

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The 5 most important order types for beginners:

- Market orders: buy or sell immediately at the current market price

- Limit orders: buy or sell at a specified price or better

- Stop loss orders: become market orders once a specified price (the "stop price") is reached or passed

- Stop limit orders: turn into limit orders to buy or sell at a specified limit price or better when the stop price is reached

- Trailing stop orders: set a stop price at a fixed amount or percentage below (for a long position) or above (for a short position) the market price

There are various types of orders at disposal for traders. In this guide, we cover the key order types every new trader should know: market, limit, stop-loss, stop-limit, trailing-stop, and advanced order types. We'll explain how they work, their benefits, and their risks.

By using these tools, you can reduce risk, increase your chances of success, and execute trades more precisely, avoiding emotional decisions and potential losses. Further, with these order types, you can trade with discipline across various markets and assets, including Forex, stocks, and commodities.

What are the different order types in trading?

Let’s take a look at the different order types in trading.

Market orders

A market order is a quick and simple way to buy or sell an asset immediately at the current market price. It ensures fast execution but can sometimes result in less favorable prices due to market fluctuations. Use market orders when speed is more important than precision.

Market buy order: it is assumed that the price will grow, so enter the market at the current price, set StopLoss below the market price, TakeProfit - above. The order immediately becomes active and its result affects the current deposit balance.

Market sell order: it is assumed that the price will decrease, we enter the market at the current price, StopLoss is set above the market price, TakeProfit - below. The order immediately becomes active and its result affects the current deposit balance.

Use Case: Use market orders when you want to enter or exit a position immediately. They are best used in highly liquid markets where there is minimal price slippage.

Limit orders

A limit order enables a trader to specify the exact price they are willing to buy or sell an asset, assisting traders to target favorable entry or exit points and maintain control over trade execution.

Limit orders do not guarantee immediate execution, but ensure transaction at a specific chosen price.

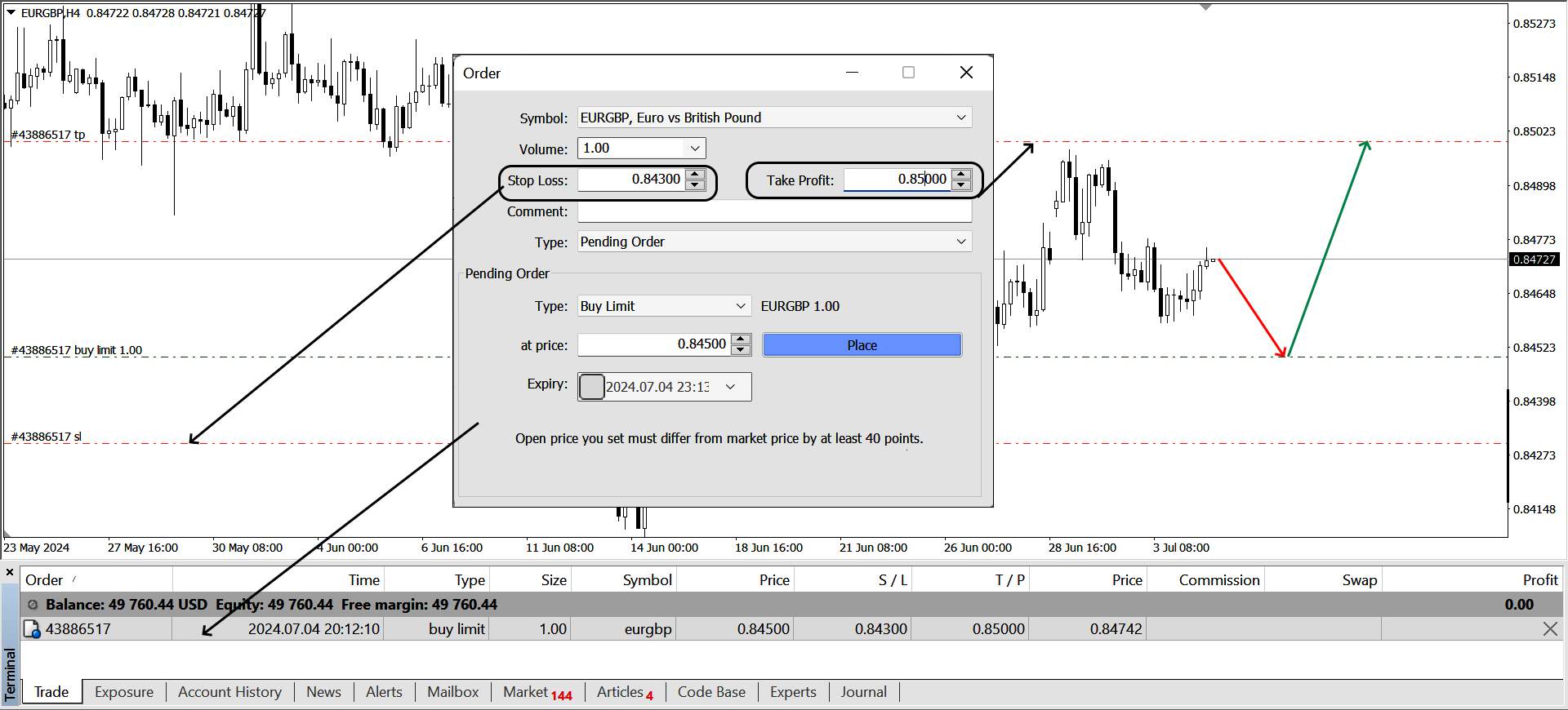

Limit pending buy order: it is assumed that the price will fall to a certain level, after which it will reverse and go up. Place a pending order at the level of potential reversal, set StopLoss below the market price, TakeProfit - above. If the price reverses before the BuyLimit order is activated, it is recommended to delete it.

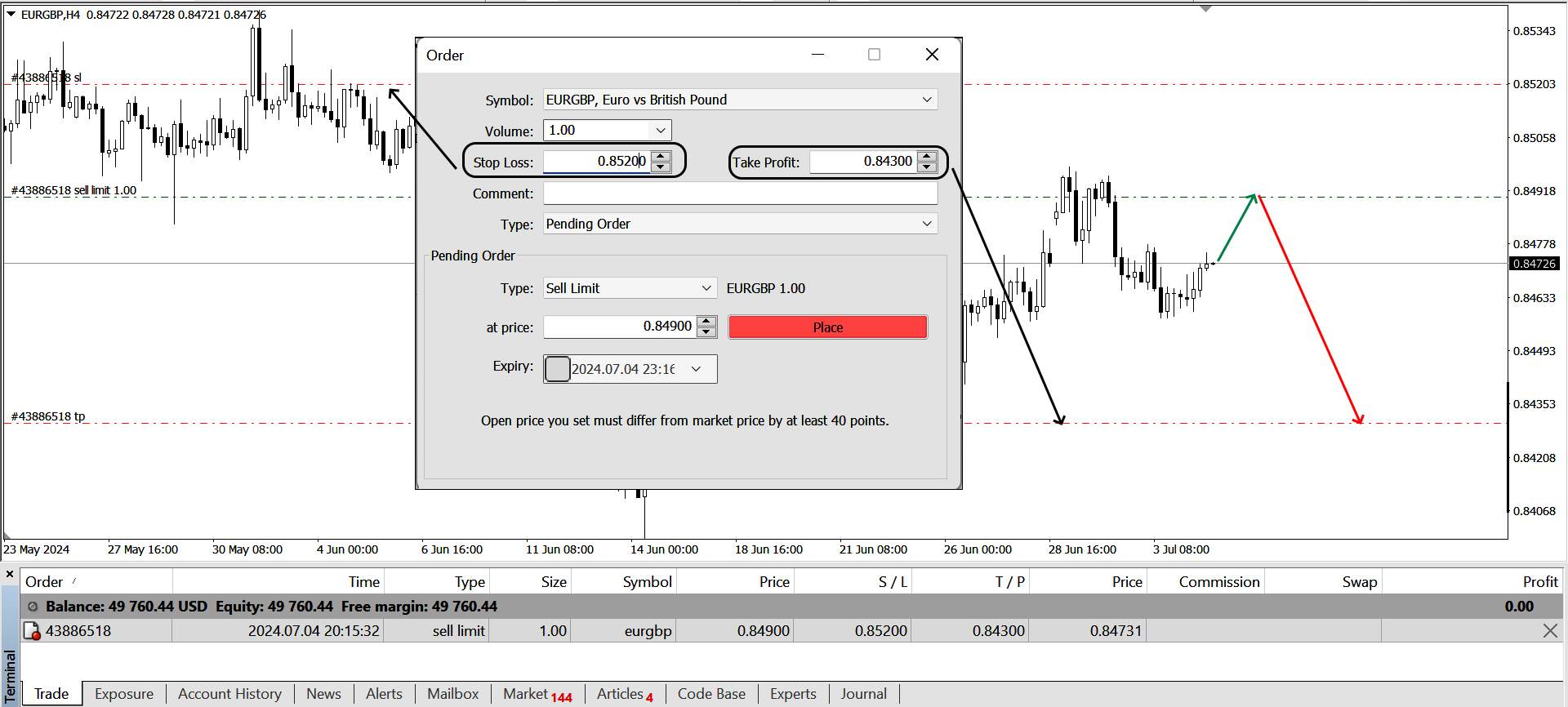

Limit pending sell order: it is assumed that the price will grow to a certain level, after which it will reverse and go down. Place a pending order at the level of potential reversal, place StopLoss above the market price, TakeProfit - below. If the price reverses before the SellLimit order is activated, it should be deleted.

Use Case: Use limit orders when you have a specific entry or exit price in mind. They are ideal for trading strategies that rely on precise price levels and for entering trades in less liquid markets.

Stop-loss orders

A stop-loss order helps manage risk by setting a predetermined price to sell, limiting potential future losses. It acts as a safety net, automatically executing a sell order if the market moves against your position, helping to protect your capital and maintain trading discipline.

Use Case: Use these to protect against large losses. They are triggered when the market moves against your position to a predefined level.

Stop-limit orders

A stop-limit order helps manage risk by combining precision and control. It has two prices: a stop price that triggers the order and a limit price that sets the execution range. Once the stop price is reached, it becomes a limit order to ensure it executes near your chosen price.

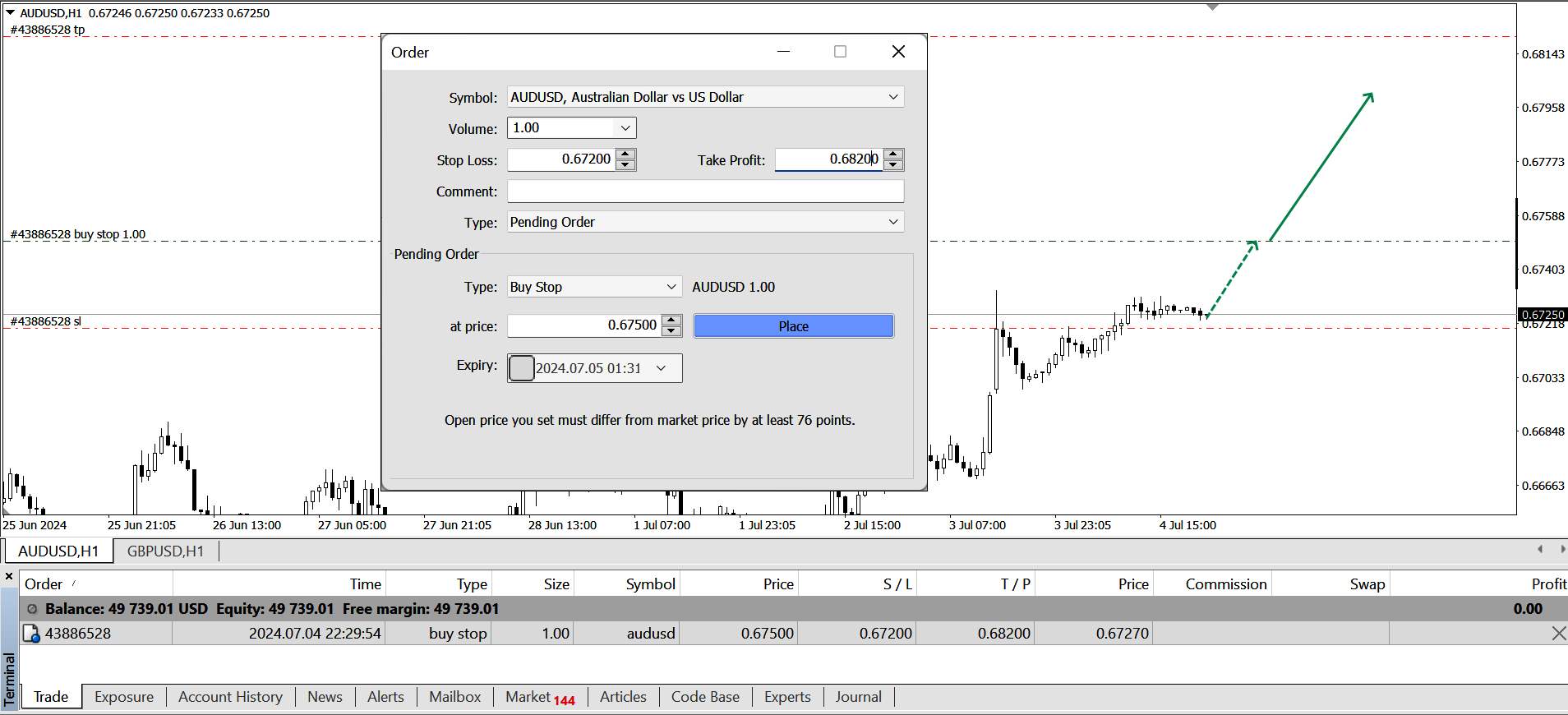

Pending Buy Stop order: the current bullish trend is expected to develop. The order is placed above the current price, if the forecast is not realized and the market turns down, the BuyStop order should be deleted.

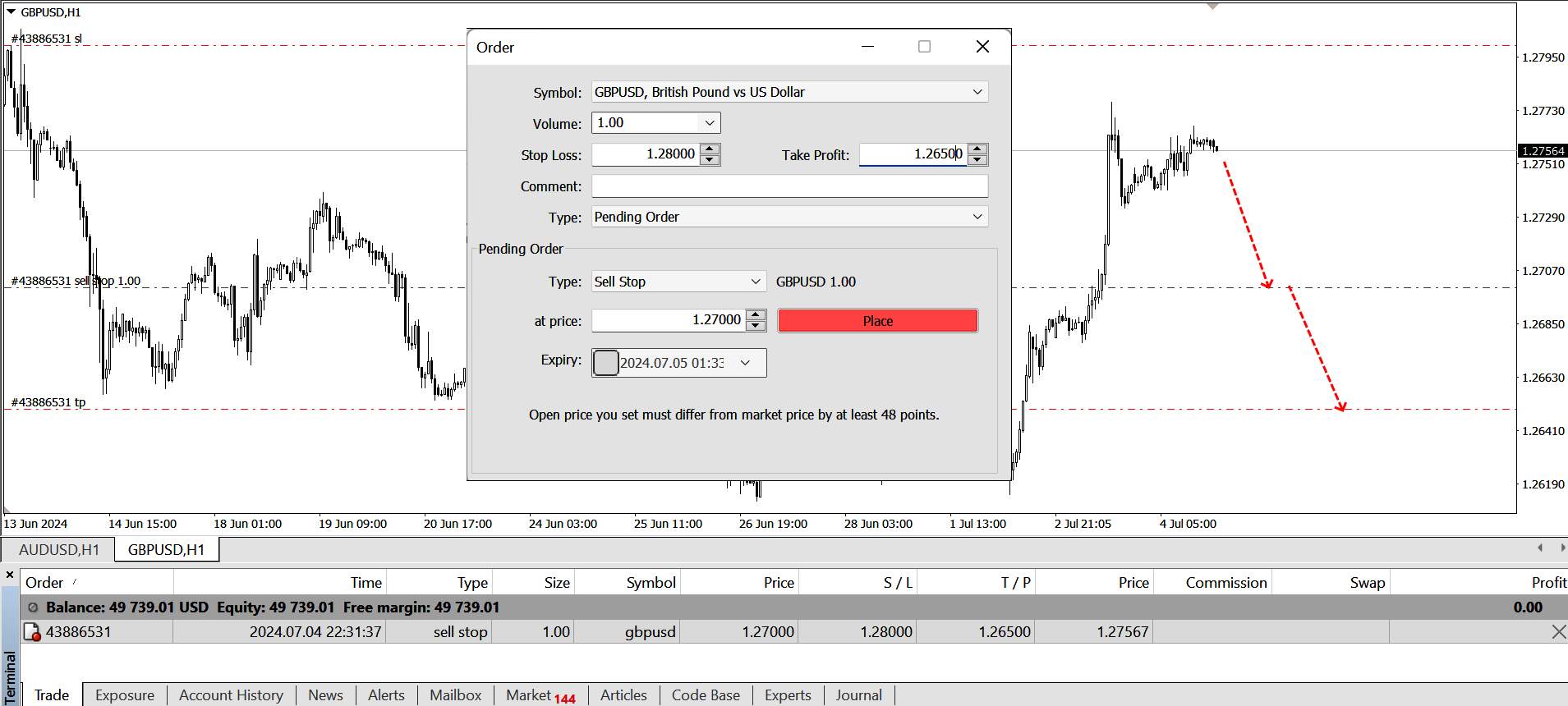

Pending stop order to sell: the current downtrend is expected to develop. The order is located below the current price, if the forecast is not realized and the market turns up, it is recommended to delete the SellStop order.

Use Case: Use stop-limit orders to control the price at which your stop order is executed. This is particularly useful in volatile markets where price slippage is a concern.

Trailing stop orders

A trailing stop order automatically adjusts to lock in profits as prices move in your favor and remains fixed if the market reverses, offering both protection and flexibility for beginners in trading.

Use Case: Use trailing stops to lock in profits as the market moves in your favor while protecting against downside risk. This type of order is beneficial for capturing gains in trending markets.

Apart from order types, certain other aspects can also impact your trading outcomes. One such aspect is the broker you choose. Based on this idea, we have studied the conditions of leading brokers and prepared the following comparison:

| Trading platform | Orders execution | Min. deposit, $ | Min Order | Mobile trading | Accounts | Open account | |

|---|---|---|---|---|---|---|---|

| Mobile, Web, Desktop | Market Execution | 100 | 0,01 | Yes | Demo, User | Open an account Your capital is at risk. |

|

| MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | Instant (30 ms) | No | 0.01 lot | Yes | Razor, Standard | Open an account Your capital is at risk.

|

|

| WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 | Market Execution | No | 0,01 lot | Yes | Standard, Core, Swap-free, Premium, Premium Core | Open an account Your capital is at risk. |

|

| FOREX.com, MT4, MT5 | Market Execution, Instant Execution | 100 | 0.01 | Yes | Standard account, Commission account, Direct Market Access account (DMA) | Study review | |

| Trader Workstation, IBKR Mobile, APIs | Instant Execution | No | 0.1 lot | Yes | Real, Demo | Open an account Your capital is at risk. |

How to choose the right order type?

Here are some recommendations:

Identify your strategy: Your trading strategy will largely determine the order types you use. Scalpers might rely more on market orders, while swing traders may prefer limit orders.

Risk management: Consider how each order type impacts your ability to manage risk. Stop-loss orders are crucial for protecting against significant losses.

Market conditions: The liquidity and volatility of the market can affect which order type is most effective. In highly volatile markets, limit orders and stop-limit orders can help avoid unfavorable executions.

Execution speed: If speed is critical, market orders are the best choice. For precision, limit and stop-limit orders are more suitable.

By understanding order types you can significantly improve trading performance

I believe that understanding the five essential order types is crucial for any beginner trader. Market orders are invaluable for executing trades swiftly at the current market price, ensuring you don't miss out on immediate opportunities. Limit orders, on the other hand, give you control over your entry and exit points, allowing you to buy or sell at a specified price or better, which is essential for strategic planning.

Stop-loss orders are a fundamental risk management tool. They automatically trigger a market order once a predetermined price is reached, helping to cap potential losses and protect your capital. Stop-limit orders offer even more precision, combining the benefits of stop-loss and limit orders by setting a specific execution price after the stop price is hit, giving you greater control over your trades.

Finally, trailing stop orders are an excellent way to protect your profits. By setting a stop price that adjusts with the market, you can lock in gains while still offering protection against downside risk. These order types not only help in managing risks but also ensure that your trading strategy remains disciplined and effective in various market conditions. Understanding and mastering these order types can significantly improve your trading performance and confidence.

Summary

Understanding the five most essential order types can greatly enhance a beginner trader's success. Market orders allow immediate buying or selling at the current market price, ensuring quick execution. Limit orders enable traders to buy or sell at a specific price or better, offering control over entry and exit points. Stop-loss orders automatically convert to market orders once a set price is reached, helping to limit losses. Stop-limit orders combine the features of stop-loss and limit orders, providing precise control over the execution price after the stop price is triggered. Trailing stop orders set a dynamic stop price that adjusts with the market price, protecting gains while offering downside protection.

Mastering these order types helps traders manage risks, execute trades effectively, and maintain discipline in various market conditions.

FAQs

Can I change my order type after placing a trade?

You can adjust orders after placing them, but only if they still need to be executed. Once a trade is executed, modifications are usually not possible. Check your trading platform's rules for specific policies.

When should I use a stop-loss order vs. a stop-limit order?

Use a stop-loss order for immediate execution at the market price to limit losses quickly. Choose a stop-limit order when you need precise control over the entry or exit price, as it sets both a trigger and a specific execution price. The choice depends on your trading strategy and risk tolerance.

Should I use a regular stop-loss if I prioritize closing the trade?

Yes, if your main goal is to close a trade quickly to limit potential losses, use a regular stop-loss order. It ensures immediate execution at the market price when the stop price is reached.

Should I use a stop limit to gain more control over the execution price?

Yes, if you need more precise control over the execution price, use a stop-limit order. This allows you to set both a trigger price and a specific execution price, providing greater accuracy and control.

Related Articles

Team that worked on the article

Mr. Walsh commenced his career within Interbank Capital markets in Johannesburg in 1990 broking USDDEM as well as USDZAR spot and forward FX with the worlds leading interbank broker M.W. Marshalls of London, now ICAP Pte. Ltd. Shortly after a stint in London, he was offered a role at the same firm in the Singapore office in early 1993, where he was a leading broker in Asia on the USDSDEM desk.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A Trailing Stop Order is a type of order that automatically adjusts the stop-loss level as the market price moves in a favorable direction, helping to protect profits.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.