Advanced Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader5

- FCA

- ASIC

- 2019

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader5

- FCA

- ASIC

- 2019

Our Evaluation of Advanced Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Advanced Markets is a broker with higher-than-average risk and the TU Overall Score of 4.32 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Advanced Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Advanced Markets is a broker for both institutional clients and retail traders that aims at trading currencies and various types of CFDs.

Brief Look at Advanced Markets

Advanced Markets was incorporated in 2006. It uses DMA (Direct Market Access) technology to provide direct access to the inter-market market without the participation of dealers. Traders can trade Forex, cryptocurrencies, and CFDs on metals, commodities, and stock indices. Various account types on MetaTrader 5, including Islamic, are available. Advanced Markets offers its own copy trading platform where novice traders can earn passive income by copying the trades of professionals.

- Long existence on the market;

- Access to margin trading;

- Wide range of trading assets;

- Availability of investment solutions;

- Trading accounts for traders with varied experience;

- Direct access to the inter-bank market (DMA technology);

- 8-level partnership program.

- Spreads are higher than those of well-known international brokers;

- The Advanced Markets office for retail traders is not licensed;

- Clients cannot invest in PAMM or MAM accounts.

TU Expert Advice

Financial expert and analyst at Traders Union

Advanced Markets has been operating since 2006 and it provides Direct Market Access. The company's directors include professional traders, investors, and financial analysts who understand what retail and institutional clients need for effective trading. Advanced Markets' regular partners are leading technology and liquidity providers, such as Liquidity Finder, Centroid Solutions, Tradefora, Tradesocio, and Pelican.

The broker offers account types for both novice traders and professionals. They differ in trading fees (spreads) and maximum leverage. Account types can be selected according to the available capital, however, the range of trading platforms is limited, and only MetaTrader 5 is available.

A representative office providing services for non-professional retail traders is not licensed. However, other companies in the Advanced Markets group are regulated by the Financial Conduct Authority (FCA) and the Australian Securities and Investment Commission (ASIC), which are some of the most reliable financial commissions in the world. The company offers such useful tools as analytics, real-time currency quotes, an economic calendar, Autochartist, etc.

Advanced Markets Summary

| 💻 Trading platform: | MetaTrader 5 (desktop, Android app, and iOS app) |

|---|---|

| 📊 Accounts: | Demo МТ5, Advanced Plus, Advanced Prime, and Advanced Infinite |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfers (Swift), e-wallets, bank cards, and cryptocurrencies |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Forex, indices, commodities, metals, and cryptocurrencies |

| 💹 Margin Call / Stop Out: |

Advanced Plus: 100%/0% Advanced Prime: 100%/20% Advanced Infinite: 100%/30% |

| 🏛 Liquidity provider: | Liquidity Finder |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | DMA |

| 🎁 Contests and bonuses: | No |

Advanced Markets provides more than 80 financial instruments, including currencies (fiat and digital), CFDs Trading on indices, metals, and commodities. To have access to the above, a minimum deposit of $100 is necessary. The account currency is USD only. Deposits in other currencies are converted according to rates of Advanced Markets’ liquidity providers. Clients who deposit less than $20,000 and select an account with no fee per lot can request an Islamic account, where no swap fees are charged.

Advanced Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

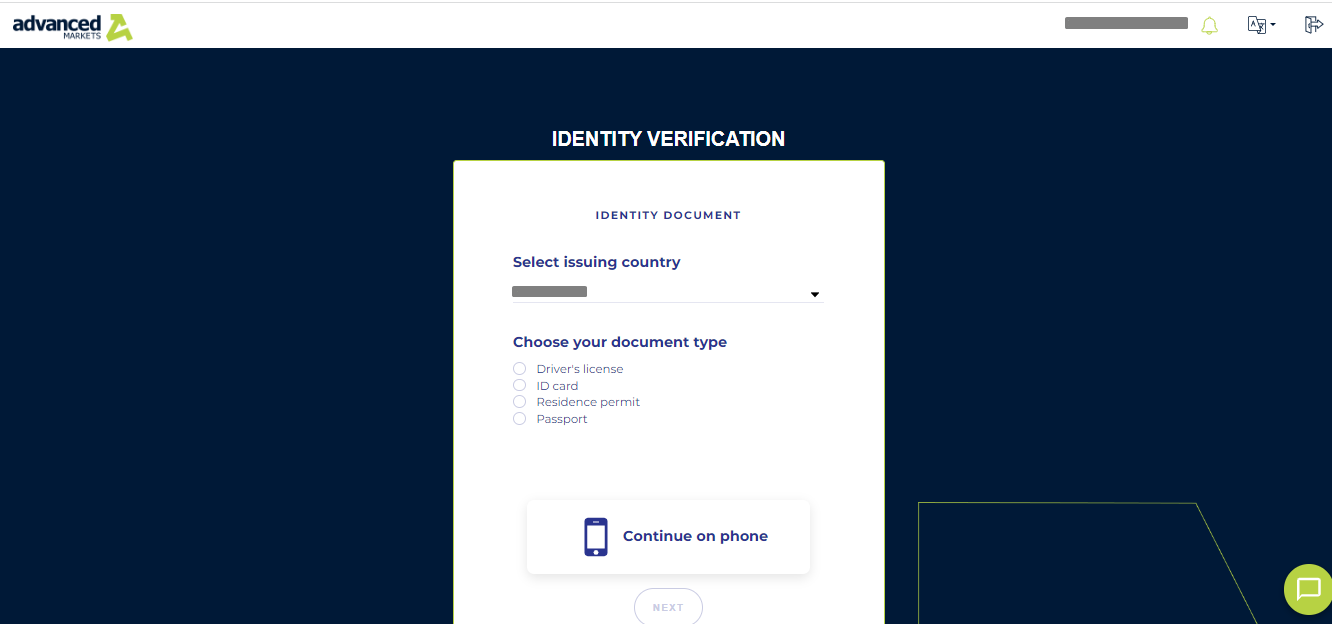

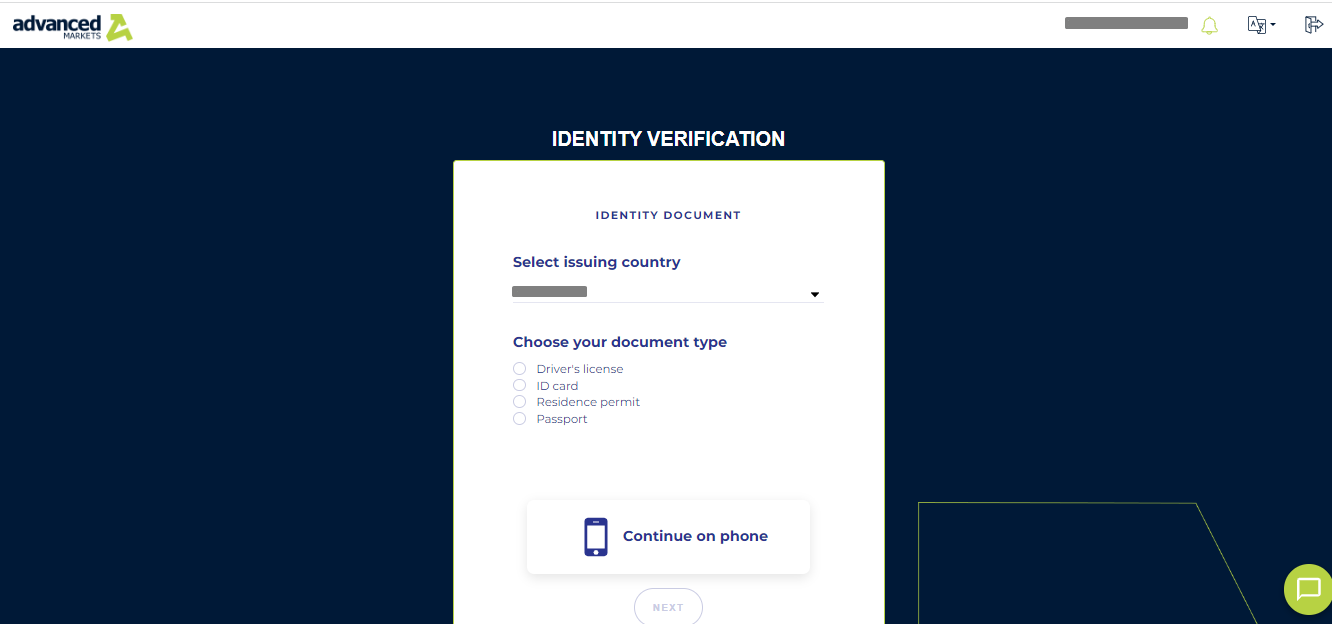

Trading Account Opening

A user account on the Advanced Markets website allows for managing accounts and funds, downloading software for executing trades, etc. To create it, do the following:

Click the “Start Trading” button on the Advanced Markets official website.

Fill out the form for creating a user account, indicating your first and last names, phone number, email, and country. A mandatory step is an automatic or manual generation of a reliable password. After that, the company will send a pin code by email, enter it in the form. To access your user account, specify your email address and password.

Features of the Advanced Markets’ user account:

Additional features of the user account:

Buttons for opening demo accounts;

Statistics on active trading accounts;

Deposits, withdrawals, and internal transfers of funds;

Auxiliary tools for traders such as an economic calendar, trading calculator, and news feed;

Copy trading platforms;

Tab for partners;

Menu to change account settings and enable two-factor authentication.

Regulation and safety

Advanced Markets is the brand name used by three companies that provide brokerage services. The UK office, licensed by FCA, and the Australian office, licensed by ASIC, provide their services exclusively to professional traders.

Access to Forex for retail traders worldwide is offered by Advanced Markets (Bermuda) Ltd. It is registered in Bermuda and is not required to be licensed to provide brokerage services.

Advantages

- Professional clients trade through brokers licensed by reputable regulators

- Retail traders work with the company that is part of a reliable investment holding

- Traders can secure their accounts with Two-Factor Authentication

Disadvantages

- Compensation fund covers losses of clients from the UK and Australia only

- Trading accounts can be opened only after confirmation of identity and residential address

- Prior to the withdrawal of funds, additional checks by the broker are possible

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Advanced Plus | $12 | Withheld by the broker and/or payment systems |

| Advanced Prime | $8 | Withheld by the broker and/or payment systems |

| Advanced Infinite | $0 | Withheld by the broker and/or payment systems |

Swaps are charged for positions transferred overnight. They can be not only negative, that is, cause losses for traders, but, on the contrary, positive. The comparative table below shows the average fees of Advanced Markets, RoboForex, and Pocket Option.

| Broker | Average commission | Level |

|---|---|---|

|

$6.7 | |

|

$1 | |

|

$8.5 |

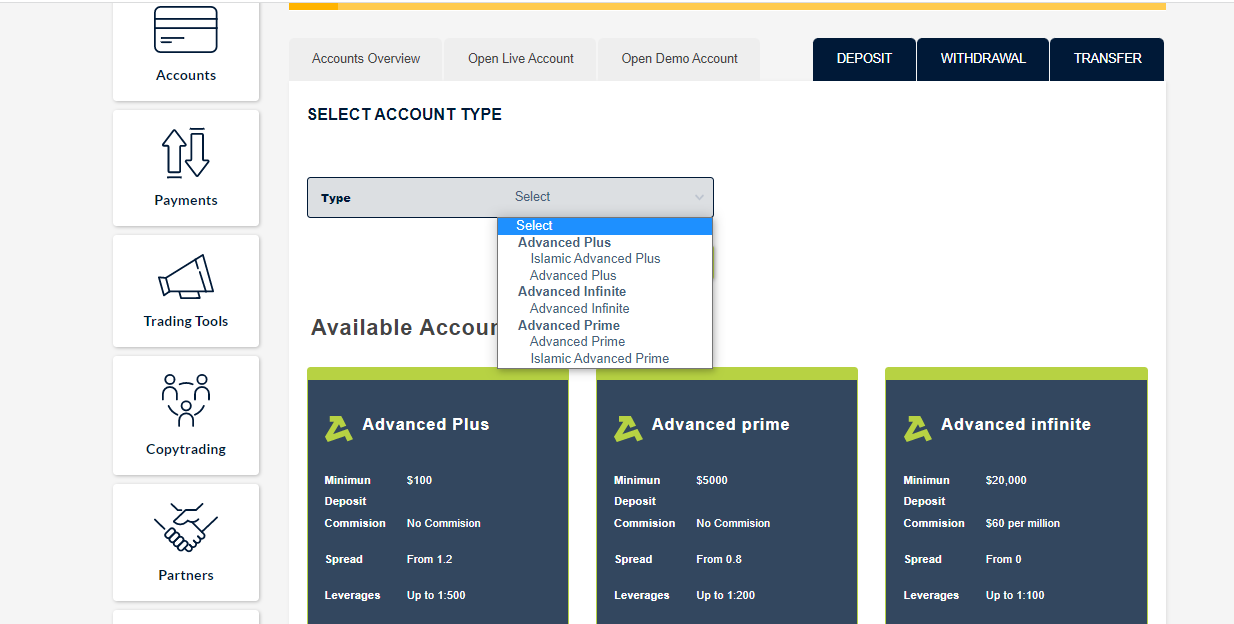

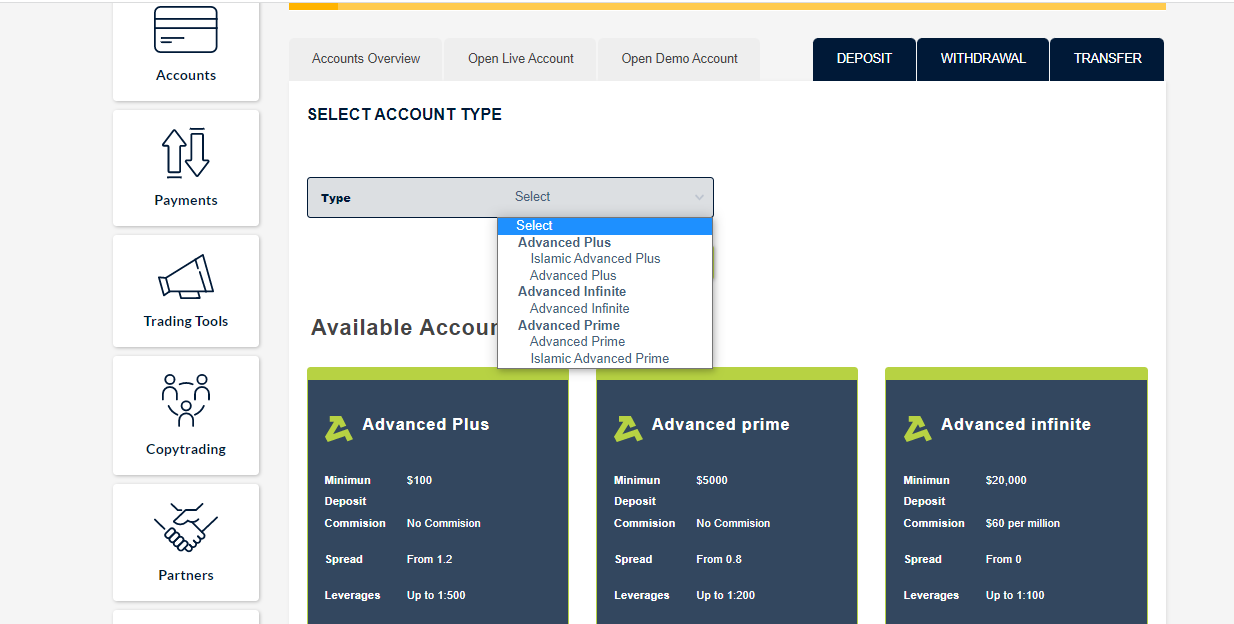

Account types

Real money can only be received from trades executed on trading accounts. Advanced Markets offers 3 types. On all accounts, the minimum order is 0.01 lots. Account types differ in the deposit amount, available leverage, fees, and swap-free trading options.

Account types:

Advanced Markets also offers demo accounts. They can be opened in mobile or desktop versions of MT5, do not require deposits, and allow choosing the size of the virtual deposit and leverage. Account conditions are adapted to different trading strategies and styles so that novice traders and professionals can choose the most suitable option for themselves.

Deposit and Withdrawal

-

Withdrawal requests are submitted to the trader's user account. The company has the right to approve requests immediately or to require additional information and documents to ensure their legitimacy;

-

Withdrawals are made by the same method used by a client when making a deposit;

-

Money is transferred only to bank accounts, bank cards, or e-wallets. Withdrawal to third-party systems is not allowed;

-

The broker, payment systems, or banks may charge fees for transferring money.

Investment Options

After creating an account with Advanced Markets, each of its clients can choose an active or passive type of income, or combine both of these options. They can also receive additional income on referrals, if, after registering through a partner link, these referrals start trading on live accounts.

Copy trading is a solution for traders interested in passive income

Copy trading enables traders to copy trades placed by other traders. The one who copies orders is an investor. The one whose trades and is copied is a signals or strategy provider. Trades of the selected provider are copied to the investor's account automatically. Part of the investor's profit for successful positions is used to pay for the services of the signals provider. Advanced Markets offers two types of copy trading:

Signals from the MQL5.community website. You can copy signals of traders worldwide who trade on MT5 and broadcast their strategy for $30-$100. Subscription to traders is issued directly in the trading platform and is valid for one month. Signals providers can be selected according to different criteria, such as the amount of profit or leverage, strategy type, number of subscribers, etc.;

The broker’s proprietary (own) copy trading platform. In the clients’ user accounts, there is a rating of strategy providers that are approved by Advanced Markets for a variety of parameters. These include the amount of profit (total and for the past month), the amount of investors' funds, the percentage of drawdown, etc. For successful trades of providers, investors pay 20%, 30%, or 35% of their profit. Payments are made monthly.

Advanced Markets does not offer PAMM or MAM accounts. In addition to copy trading, passive investors can earn on automated trading using expert advisors (EAs) written in MQL5. They can be purchased from the shop on the MQL5.community website, but free trading robots are also available.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from Advanced Markets:

The company invites retail traders and companies that want to become Introducing Brokers (IBs). IBs receive individual trading conditions that allow earning up to 60% of spreads on each position placed by referred clients.

The Advanced Markets partnership program has 8 levels. Each IB can establish a whole network of sub-partners and receive income from trading their referrals.

Customer support

Support is available on weekdays when the market is open. On Saturdays and Sundays, there is no real-time contact with a live chat operator, but you can send an email and receive a response during the broker’s business hours.

Advantages

- 24-hour support on weekdays

- No delays when using live chat

Disadvantages

- Support works 5 days a week

- You must specify your email and phone number each time you use live chat

You can contact the brokerage company by:

-

live chat;

-

WhatsApp;

-

Telegram;

-

email.

Institutional clients can use phone support during trading sessions.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | Advanced Markets (Bermuda) Ltd, Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda |

| Regulation | FCA, ASIC |

| Official site | https://advancedmarkets.com/ |

| Contacts |

+1-704-544-9446

|

Education

Although Advanced Markets works with retail traders, it does not provide education in Forex and CFD trading. Neither articles nor videos for Forex novice traders are available on the broker’s website.

Traders can study theory on third-party resources, and then open a free demo account with Advanced Markets to put their knowledge into practice. Trading with virtual money allows traders not to lose their own funds.

Comparison of Advanced Markets with other Brokers

| Advanced Markets | RoboForex | Pocket Option | Exness | XM Group | AMarkets | |

| Trading platform |

MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, MobileTrading, XM App | MT4, MT5, AMarkets App |

| Min deposit | $100 | $10 | $5 | $10 | $5 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

100% / No | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 50% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of Advanced Markets

Advanced Markets is a wholesale provider of liquidity from the largest international banks. Its services are available to retail traders and experienced market participants worldwide. The company offers such account types for trading on MT5 as demos, classic, Islamic, and accounts with near-zero spreads for professional trading. Moreover, Advanced Markets provides its services to institutional clients offering them the FIX API [Financial Information Exchange (FIX) API] messaging protocol, advanced analytics, and liquidity from over 100 banks and large investment funds.

Advanced Markets by the numbers:

-

More than 17 years of providing brokerage services;

-

3 representative offices in different parts of the world;

-

3 account types for retail traders;

-

Leverage for currency pairs is up to 1:500.

Advanced Markets is a broker for retail and professional trading

Advanced Markets’ retail clients can trade with leverage up to 1:500, however, the maximum allowable value depends not only on the financial instrument but also on the account type. For example, major currency pairs with trading leverage up to 1:500 on the Advanced Plus account, up to 1:200 on the Advanced Prime account, and up to 1:100 on the Advanced Infinite account. Cryptocurrencies are traded with leverage up to 1:20, which is the same for all account types. Available assets are also the same for all account types. Professional clients work with representative offices registered in the UK and Australia. Financial regulators of these countries prohibit leverage over 1:30.

The Advanced Markets website states that the company offers a choice of MetaTrader 4 and MetaTrader 5, however, currently only MT5 is available. This trading platform cannot be used without installation like WebTrader. To trade, you need to download the MetaTrader desktop or mobile app to your smartphone.

Useful services offered by Advanced Markets:

-

Economic calendar. This tool broadcasts important data that can be used for fundamental analysis;

-

Market news. The main emphasis is on coverage of events that may affect the value of currencies and stocks. You can filter news by a specific financial instrument or by the market type;

-

Trading calculator. It can be used to calculate spreads, swaps, margins, and pip value for a specific position;

-

Analysis of volatility of the selected instrument. It provides a comprehensive view of the expected change in the price of a particular asset. It is displayed in the user account and is updated in real-time.

Advantages:

Opportunity to use paid and free expert advisors for analysis and trading;

Fast technical support available 24 hours on weekdays;

To deposit and withdraw funds, you can use both classic payment methods (cards, bank transfers, or e-wallets) and cryptocurrency transactions;

Any interested person, as well as brokerage companies, can become partners of Advanced Markets;

The broker offers account types with no additional trading fees.

All clients of Advanced Markets have access to professional technical analysis, financial news from leading news agencies, copy trading, and a fully customizable trading platform.

User Satisfaction