ClickTrades Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1,000

- MT5

- ClickTrades WebTrader

- FSA

- 2014

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1,000

- MT5

- ClickTrades WebTrader

- FSA

- 2014

Our Evaluation of ClickTrades

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ClickTrades is a broker with higher-than-average risk and the TU Overall Score of 3.76 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ClickTrades clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

ClickTrades is a licensed broker that allows you to trade the most popular instruments on favorable terms.

Brief Look at ClickTrades

The ClickTrades broker started operating in 2018 and is registered in Cyprus. It provides services throughout most of the world except Japan, Canada, and several other countries. Trading is available on Forex for stocks and bonds, commodities, indices, ETFs, and cryptocurrencies. Spreads are average for the segment, trading is available through the browser and the MT5 terminal. There are three types of accounts and all the main options for depositing and withdrawing funds. The broker also offers an advantageous referral program.

- 7 categories and over 2,100 instruments, including hundreds of the most popular stocks, commodities, and cryptocurrencies.

- ClickTrades WebTrader trading terminal is available in the browser and as an application for mobile gadgets.

- The terminal displays up to 10 charts simultaneously, and there are stop loss and take profit functions.

- The Trade Center provides third-party tools for technical analysis that can be integrated into the terminal.

- ClickTrades is licensed by the FSA (SD020), the international financial regulator.

- The broker provides an economic calendar, news feed, and up-to-date analytics.

- Each client has a dedicated technical support specialist (availability depends on account type).

- Fairly high minimum deposit of $1,000.

- The broker has a demo account, but no cent (micro) accounts.

- At the start, the leverage is only 1:2, and it is difficult to get the declared 1:300.

TU Expert Advice

Financial expert and analyst at Traders Union

The ClickTrades broker is relatively new, and it has been operating for a little over four years. It is usually difficult to form a comprehensive assessment of the platform in such a short time, but in this case, it is quite realistic. Thanks to competent marketing at the start the broker received a large influx of highly qualified users. Most of them are still on the platform, which is an important indicator.

The key advantages of the broker are a large number of trading instruments, adequate spreads, no hidden fees, and an official license. Also, experts at the Trading Union emphasize the high level of optimization of the web terminal, the availability of useful tools for technical analysis, and fundamental analytics as strengths.

Despite the availability of a demo account, ClickTrades is most likely not suitable for beginners due to the high initial deposit ($1,000). At the same time, it has an excellent referral program, according to which it is possible to receive 40% of the initial funding of the referral. The web terminal is simple and intuitive, and you can trade through MT5 using all its features. It is also worth noting that leverage is up to 1:300.

Based on the sum of factors, the broker can be recommended for cooperation. However, it is important to first study the conditions of each of the three types of accounts.

- You require Islamic accounts. ClickTrades offers Shariah-compliant Islamic trading accounts, catering to traders who follow Islamic finance principles.

- You are looking for a diverse range of instruments. ClickTrades provides 7 categories and over 2,100 instruments, including popular stocks, commodities, and cryptocurrencies, offering a broad selection for trading.

- Low minimum deposits are essential for you. ClickTrades has a fairly high minimum deposit requirement of $1,000, which may not be suitable for traders looking for lower entry barriers.

- High leverage is a priority for you. At the start, ClickTrades offers leverage of only 1:2, and achieving the declared 1:300 can be difficult. If high leverage is a crucial factor in your trading strategy, this broker may not meet your leverage requirements.

ClickTrades Summary

| 💻 Trading platform: | ClickTrades WebTrader and МТ5 |

|---|---|

| 📊 Accounts: | Demo, Essential, Original, Signature |

| 💰 Account currency: | USD and other popular currencies |

| 💵 Replenishment / Withdrawal: | Visa/MC credit cards, bank transfer, Skrill, Neteller |

| 🚀 Minimum deposit: | 1,000 USD |

| ⚖️ Leverage: | up to 1:300 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | from 1000 units for Forex |

| 💱 Spread: | from 0.0001 (depends on the asset) |

| 🔧 Instruments: | Forex, stocks, bonds, commodities, indices, ETFs, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | N/A |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution |

| ⭐ Trading features: | There is stop loss and take profit |

| 🎁 Contests and bonuses: | Yes |

ClickTrades allows you to trade the most popular currency pairs, cryptocurrencies, securities, precious metals, and other resources. At the start, leverage is 1:2, but after passing the “exam”, a trader can get leverage up to 1:300 for any instrument. To personally explore the possibilities of the platform, it is not necessary to register right away. You can open a demo account that is identical to the real one, but the user does not risk his own funds.

ClickTrades Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

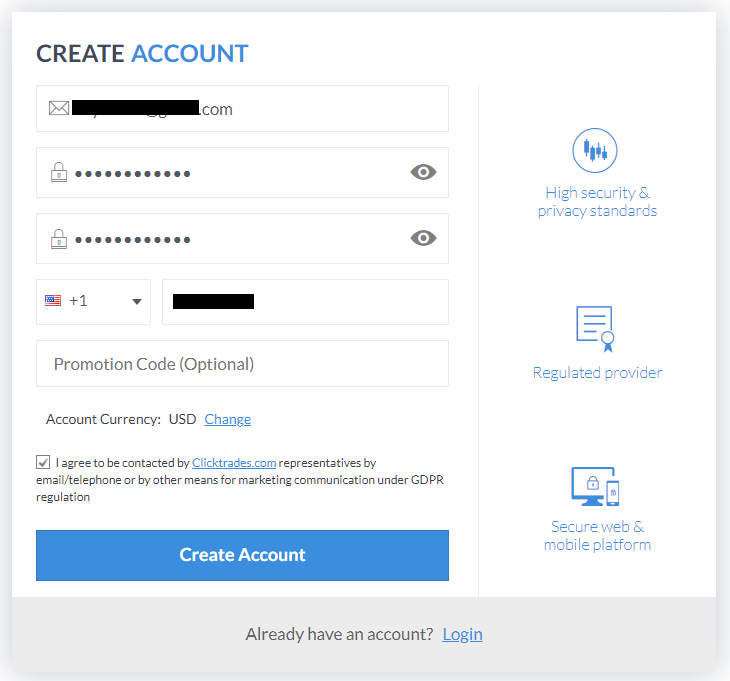

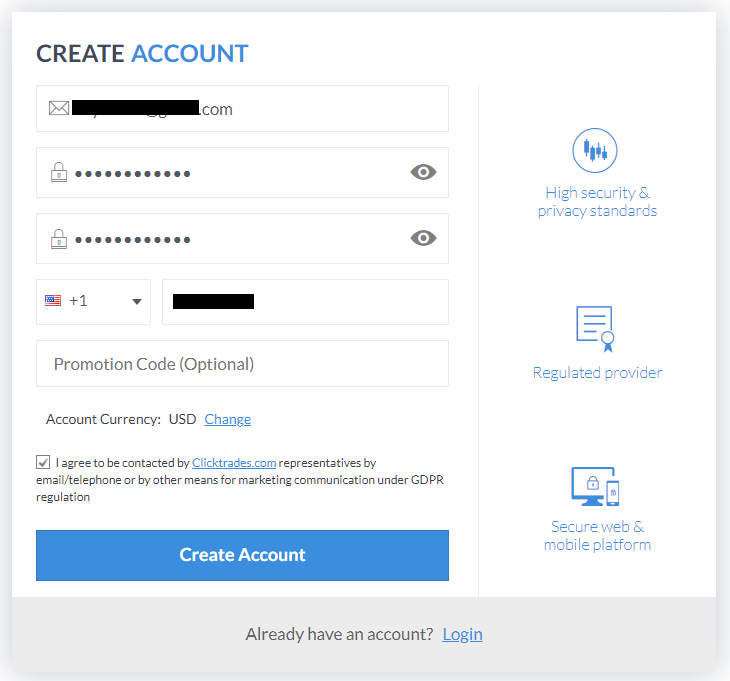

To trade through this broker, you need to register with its official website by following the below instructions:

Go to the official website clicktrades.com and click on the “Register now” button in the upper right corner of the screen. A standard registration form will appear.

In the registration form, you must specify an email address, generate a password, repeat it, enter a phone number, agree to the terms of service and click on the “Create an account” button.

ou will get an email with the link to confirm the registration. However, the user will not receive full access to the platform’s capabilities until he is verified. To do this, click on the warning in the upper left corner of the screen. Then follow the instructions (you will need to provide scans of identification documents).

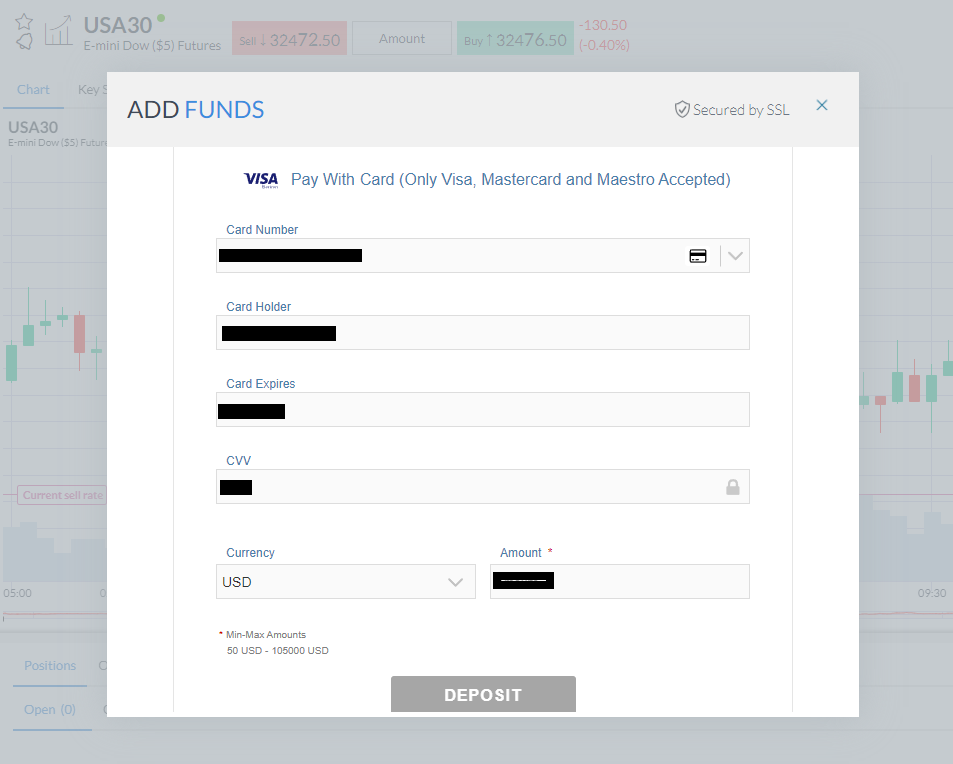

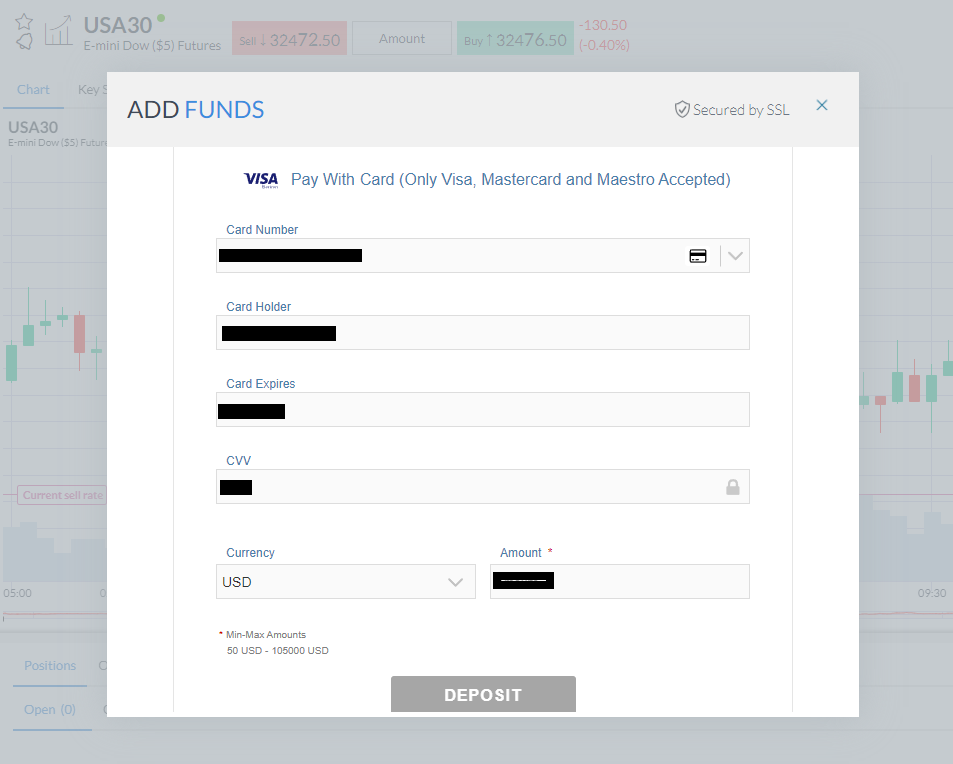

You can deposit funds into the account before passing the verification, but it is better to wait for your data to be verified. After that, in your user account, click on the “Add Funds” menu button in the upper right corner. Enter your personal data (if you have not entered it yet during verification), select a funding channel, fill in the details and click “Deposit”. Wait for the receipt of funds and start trading.

In a trader’s user account, he can:

-

Select a trading instrument from the list.

-

View current quotes.

-

View the order book.

-

Modernize the chart with indicators.

-

Open up to 10 charts in one window.

-

Create an order to buy or sell an asset.

-

Switch to a demo account at any time.

-

Go to the news feed.

-

Check out the Trade Center for analytics.

-

Use special trading opportunities.

Regulation and safety

The official website of the broker and its web terminal are owned by KW Investments Limited. The company is officially registered in Cyprus and authorized and regulated by the Seychelles Financial Services Authority (FSA), license number SD020. The business is operated by Key Way Solutions Ltd, located in Cyprus, and its license number is НЕ 388418. Thus, the broker has the right to officially provide targeted financial services to users from most countries of the world. At the moment, the company does not work with residents of Japan and Canada.

Advantages

- Client funds are stored in specialized accounts and are protected by modern cryptographic methods

- There is negative balance protection, which greatly reduces the risk

- A trader can file a complaint with the regulator if the broker violates the terms of service

Disadvantages

- To open an account and verify, you must provide personal information

- Access to the main functionality is impossible without full verification

- Limited choice of funding channels through electronic payment systems such as Skrill, Neteller, and a few others

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Essential | from $12 | Yes |

| Original | from $7 | Yes |

| Signature | from $4 | Yes |

For clarity, the Traders Union’s experts compared the average commission of ClickTrades and two leading brokers that provide services at a similar level. The comparative results are shown in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$11.5 | |

|

$1 | |

|

$8.5 |

Account types

ClickTrades offers three types of accounts, all are available on the company’s terminal and the MT5 terminal. Accounts do not differ in leverage, which is up to 1:300. There is also no difference in spreads, commissions, and other trading indicators. But there are differences in the available functionality.

Account types:

Demo accounts are relevant for accounts of all types. The user can switch to the demo at any time from the web terminal or MT5.

Deposit and Withdrawal

-

Funds can be withdrawn to a Visa or MasterCard bank card.

-

Withdrawal to bank accounts is available (except for bank accounts in Japan and Canada).

-

A trader can use accounts in Skrill, Neteller, and other payment providers for withdrawal.

-

Withdrawal of funds takes some time (the maximum terms will be specified when completing the application).

-

The broker charges a floating commission (it is also indicated at the time of application).

-

The broker does not provide traders with preferential conditions with the possibility of reducing the commission for withdrawal.

Investment Options

The ClickTrades broker does not have investment programs. It does not have PAMM, MAM, or other types of joint accounts, nor a trade copy service. However, it provides users with access to up-to-date IPO programs, constantly updating its list. Investments in IPO are recognized by experts as one of the most profitable and promising investment options for individuals. For example, an initial public offering from Discord, Reddit, and Instacar is expected soon. Each of these programs can be joined using a ClickTrades account.

An IPO is an advantageous investment solution

An initial public offering is the company’s first listing on the stock exchange with the possibility of individuals purchasing its shares. The initial offer is considered especially valuable because at that moment the shares of the company can be purchased at the lowest price. If we are talking about a giant company or a promising startup, their assets are guaranteed to grow in value over time. The owner of the shares goes into profit even without taking into account dividends (their availability and size depend on the shares themselves). A typical pattern of actions looks like this:

-

An individual registers with a broker who publishes information about upcoming IPOs.

-

As soon as the company makes an initial offer, the investor purchases a block of shares through a broker.

-

Availability of shares (allocation) depends on their number and demand for the initial offer.

-

In the future, the investor monitors the market and can sell shares at any convenient time for a profit.

ClickTrades allowed investors to purchase IPO shares starting with minimum amounts of less than $20. Note that the broker charges its own commission, the size of which you will know only at the moment the company enters the market and the trader gets the opportunity to purchase shares.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

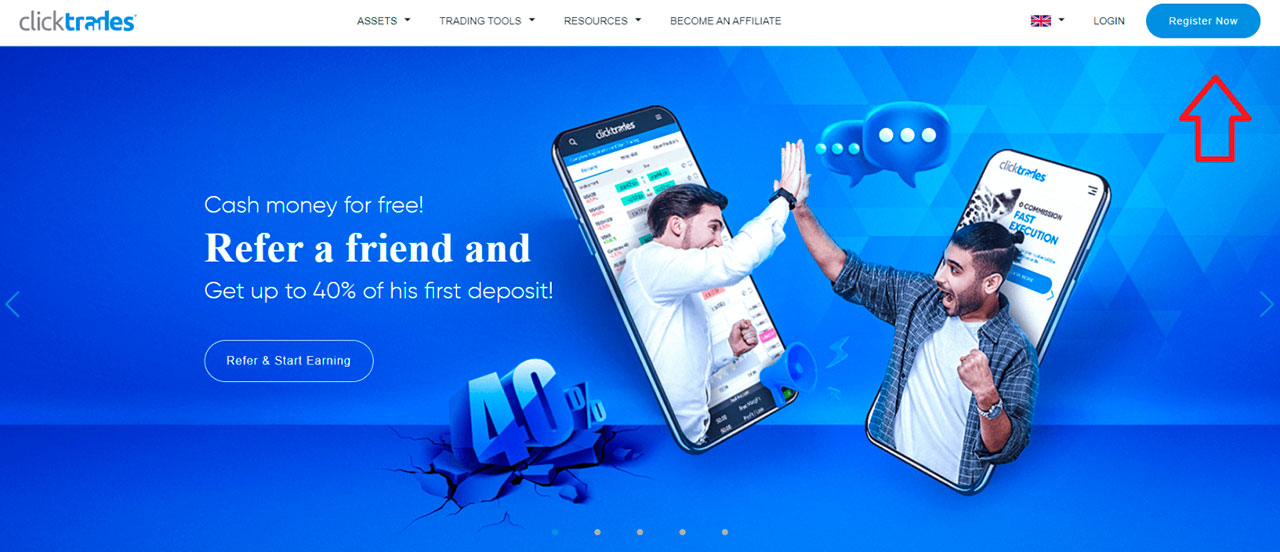

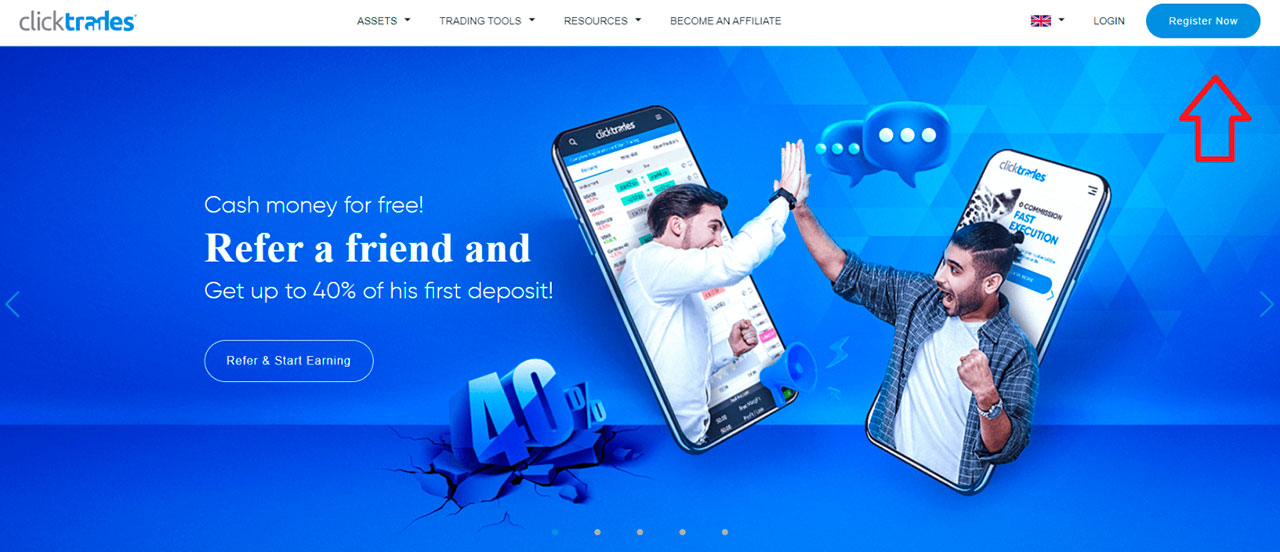

ClickTrades’ affiliate program:

-

The broker offers partnerships with companies that provide brokerage services. There is a ready integration platform, landing pages, banners, tech stack, and user-generated content.

Another type of referral program is aimed at traders. Each user who registers with the platform receives a personal referral link, which he can freely distribute through any channel. A new client of the broker, who registers through this link and makes the first deposit, brings the owner of the link up to 40% of the amount of his deposit. You will find more details on the conditions of the program in the corresponding section on the website.

Customer support

The broker’s technical support works 5 days a week, excluding Saturday and Sunday. Hours of operation vary by region.

Advantages

- There is a multi-channel call center and email

- Technical support is multilingual, managers speak the main languages

Disadvantages

- It doesn’t work on weekends

- There is no live chat

The broker provides the following communication channels:

-

call center;

-

email;

-

Cyprus office.

A user who has not passed verification can call the contact number or write an email to the broker. VIP support with a personal manager is received by verified traders on all types of accounts.

Contacts

| Foundation date | 2014 |

|---|---|

| Registration address | Suite 3, Global Village, Jivan’s Complex, Mont Fleuri, Mahe Seychelles |

| Regulation | FSA |

| Official site | https://clicktrades.com/ |

| Contacts |

+507 838 8578

+965 22 06 89 97 |

Education

ClickTrades does not provide comprehensive tutorials. However, the platform has a financial vocabulary and a detailed FAQs section, which contains basic information about trading on the platform.

Comparison of ClickTrades with other Brokers

| ClickTrades | RoboForex | Pocket Option | Exness | Octa | Forex4you | |

| Trading platform |

ClickTrades WebTrader, MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MobileTrading, MT5 |

| Min deposit | $1000 | $10 | $5 | $10 | $25 | No |

| Leverage |

From 1:1 to 1:300 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:10 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0.1 points |

| Level of margin call / stop out |

50% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 100% / 20% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed Review of ClickTrades

ClickTrades focuses more on experienced traders, although it provides a demo account. The minimum deposit of $1,000 objectively acts as a repulsive factor for players with insufficient experience. There is a large number of tools for technical analysis, including third-party solutions that are not initially integrated into the trading terminal of the platform.

ClickTrades’ success by the numbers:

-

2,100 instruments for trading;

-

10 charts simultaneously in the terminal;

-

40% of the first deposit of a referral from the affiliate program.

ClickTrades is a broker for professional trading

ClickTrades offers a versatile and responsive platform for trading through a browser, mobile gadget, or an MT5 desktop option. To reduce risks, there are stop-loss and take-profit functions, and the Trade Center provides technical analysis tools in addition to standard indicators on charts. Integration of tools from other platforms is available, and there is a news feed and up-to-date analytics for fundamental analysis. Leverage up to 1:300 allows you to get impressive profits, while the broker has fairly tight spreads and advantageous commissions.

Users particularly appreciate the ClickTrades mobile app, which can be downloaded for free from the Google Play digital store. The application is easily adapted to a specific user, and there is the possibility of deep customization and setting alerts.

ClickTrades’ useful services are:

-

Trading center. It is available on the website and app. It publishes reviews and analytical articles on key financial issues, including expert forecasts.

-

Economic calendar. It is convenient and visual, it reflects all significant economic events related to different countries and regions. There is a filter system.

-

IPO catalog. The broker monitors the most profitable offers and lets its client know about them in advance, providing the opportunity to make deposits on favorable terms.

-

CFD rollover. Futures contracts have an expiration date, but when the term is over, the contract is automatically switched to a new one with similar conditions.

Advantages:

The broker provides the most popular trading instruments.

The company implements advanced methods of cryptographic protection.

There is a function to protect the user account from a negative balance.

Spreads for all types of assets are narrow and objectively low.

There are detailed analytics and forecasts from experts.

The range of available options depends on the type of account. For example, the trading center is not available on Essential and Original accounts. Open access to economic research is available only to Original and Signature account holders.

User Satisfaction