FXDD Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- WebTrader

- 2002

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- WebTrader

- 2002

Our Evaluation of FXDD

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXDD is a high-risk broker with the TU Overall Score of 2.6 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXDD clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. FXDD ranks 350 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

FXDD is a broker for professional trading and investing with a focus on clients from the Eurozone countries.

Brief Look at FXDD

The FXDD (pronounced "Efex-didi") brokerage is an STP broker that has been providing services since 2002. The company offers trading in 6 asset classes — currency pairs, cryptocurrencies, and contracts for difference (CFDs). It has offices in Malta and New York. The broker's services are used by more than 400 thousand clients around the world. The regulators are the MFSA (Malta Financial Services Authority, C48817) and the FSC (Mauritius Financial Services Commission, C117017252).

- The only minimum deposit requirement is $1 or more in your account.

- The desktop and mobile platforms are MetaTrader 4 and MetaTrader 5, as well as a web terminal.

- Availability of PAMM and MAM accounts for passive investment.

- High spreads on standard accounts - from 1.9 pips on the EUR/USD pair.

- No cent (micro) accounts.

- Complex and lengthy procedure for opening a trading account.

- Limited choice of payment systems for depositing and withdrawing funds.

- There is no Russian-language website and support.

TU Expert Advice

Financial expert and analyst at Traders Union

The FXDD Broker has been providing services for more than 15 years and works hard to create and maintain a great trading environment. It tries to provide its clients with first-class service. Traders receive two-way quotes for all products in real-time from leading liquidity provider-banks, regulated markets, and multi-party trading platforms (MTFs). According to the company, to ensure that the provider can offer customers the best possible prices, each of them undergoes a thorough and comprehensive review by the risk department.

The FXDD brokerage company offers 2 types of accounts: Standard and ECN. The terms of standard accounts can not be called favorable, because the spreads on them start from 1.9 points. In addition, the broker offers low leverage to both retail and professional traders. At the same time, ECN accounts are characterized by more loyal commissions: the spread on them starts from 0.4 points.

Additional information about spreads, commissions, and other costs for each underlying instrument is available on the FXDD website. You can check the detailed terms of your trading accounts with our technical support specialists. Online chat operators respond quickly and informatively, but Russian is not among the languages available for communication.

FXDD Summary

| 💻 Trading platform: | МТ4 (Desktop, Mobile, Web), МТ5 (Desktop, Mobile), WebTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, ECN |

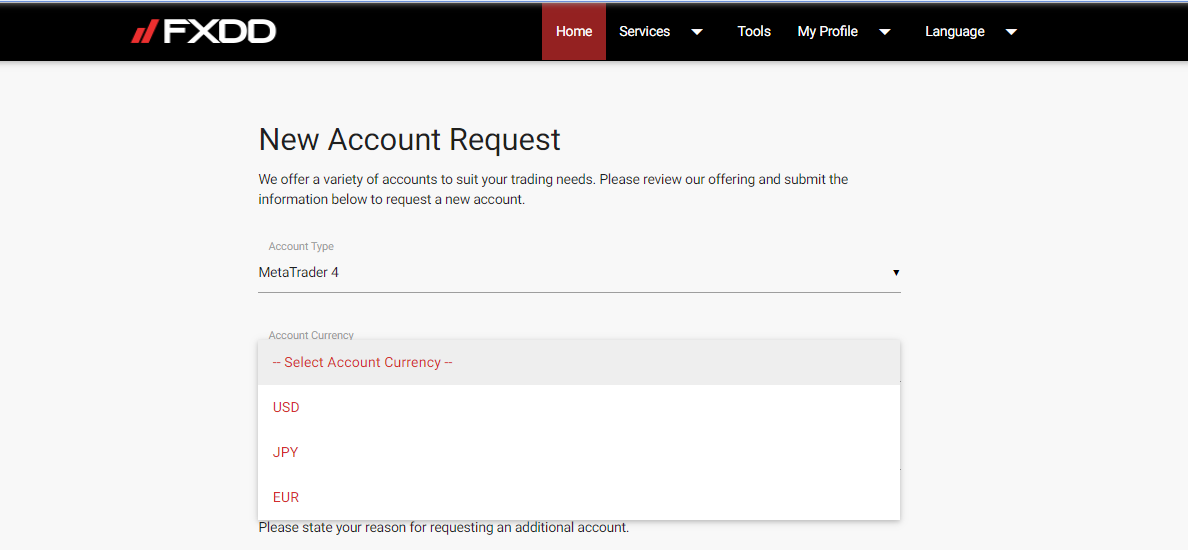

| 💰 Account currency: | USD, EUR, GBP, JPY |

| 💵 Replenishment / Withdrawal: | Credit cards, Bank transfer, Neteller, UnionPay |

| 🚀 Minimum deposit: | Starting from $1 |

| ⚖️ Leverage: | Up to 1:30 (for retail), up to 1:100 (for professional traders) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0,01 |

| 💱 Spread: | From 1.9 points (Standard), from 0.4 points (ECN) |

| 🔧 Instruments: | Currency pairs (67), CFDs on stocks (20), indices (13), metals (7), energy resources (4), cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | More than 20 major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution, Market execution |

| ⭐ Trading features: | There is a fee for inactivity on the account |

| 🎁 Contests and bonuses: | No |

The FXDD broker offers its clients more than 100 trading tools, classic MetaTrader terminals, and the ability to trade from standard and ECN accounts. Traders get leverage from 1:30 to 1:100, depending on the asset and platform selected for trading. Potential customers can test trading conditions on demo accounts. Muslim traders can work on Islamic accounts without charging for swaps.

FXDD Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

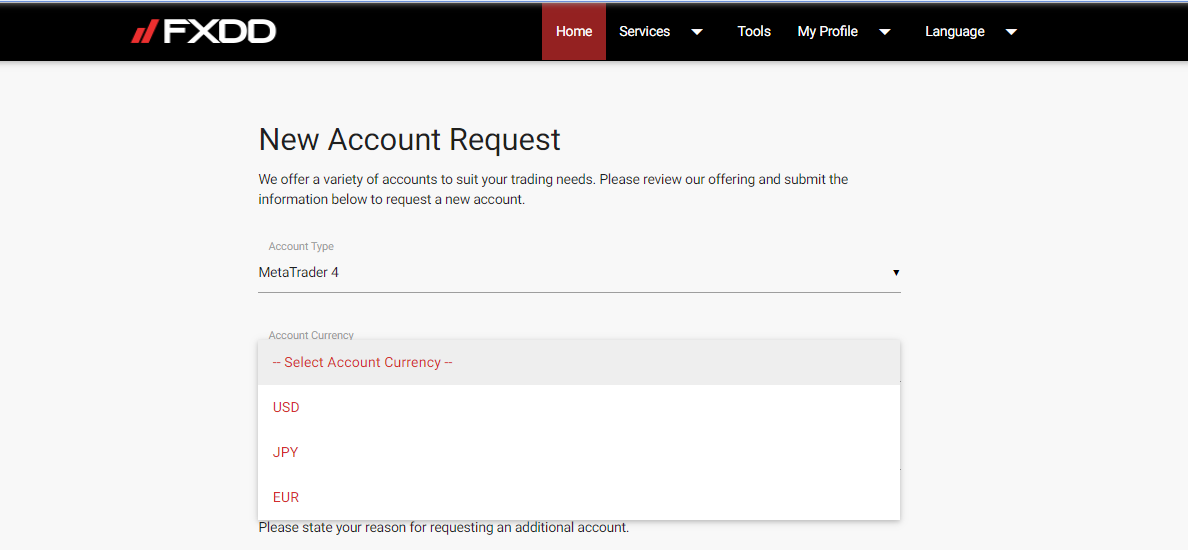

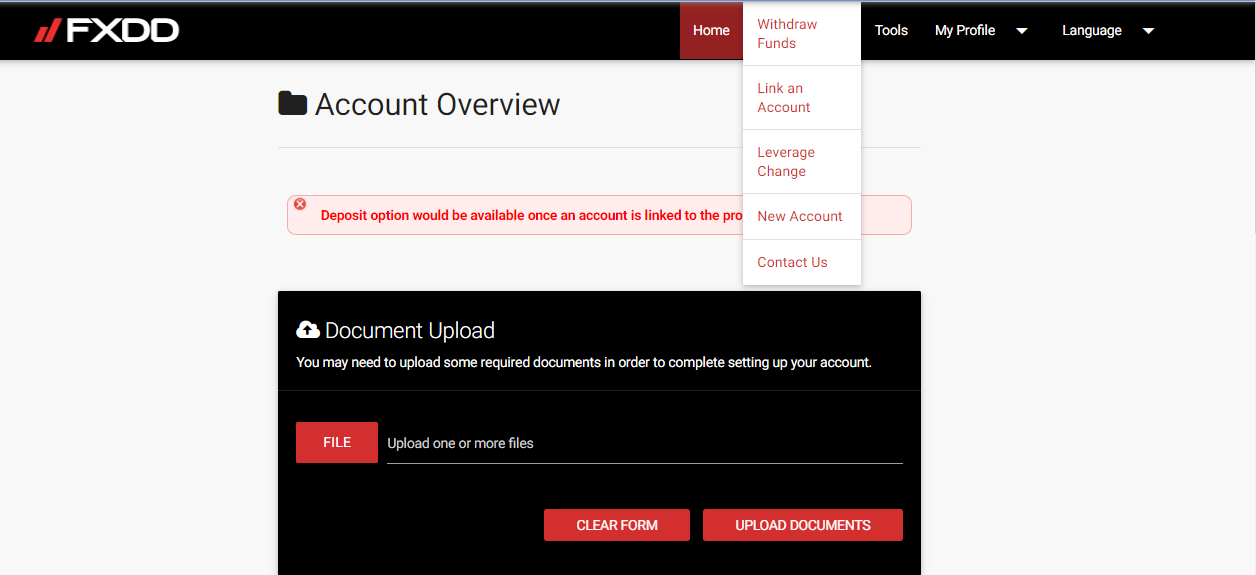

Trading Account Opening

To start trading with FXDD, you need to become a client of the broker by creating a trading account. Follow these steps:

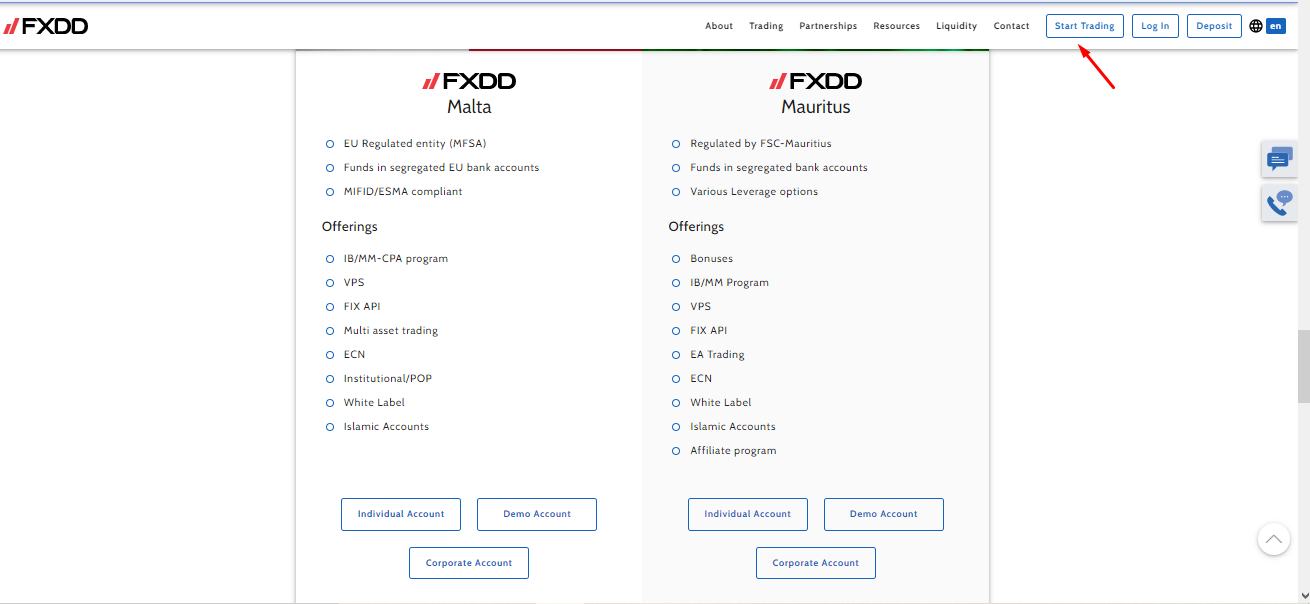

On the FXDD website, click Start Trading. After that, the system will ask you to choose one of the divisions to create an account — Maltese or Mauritian.

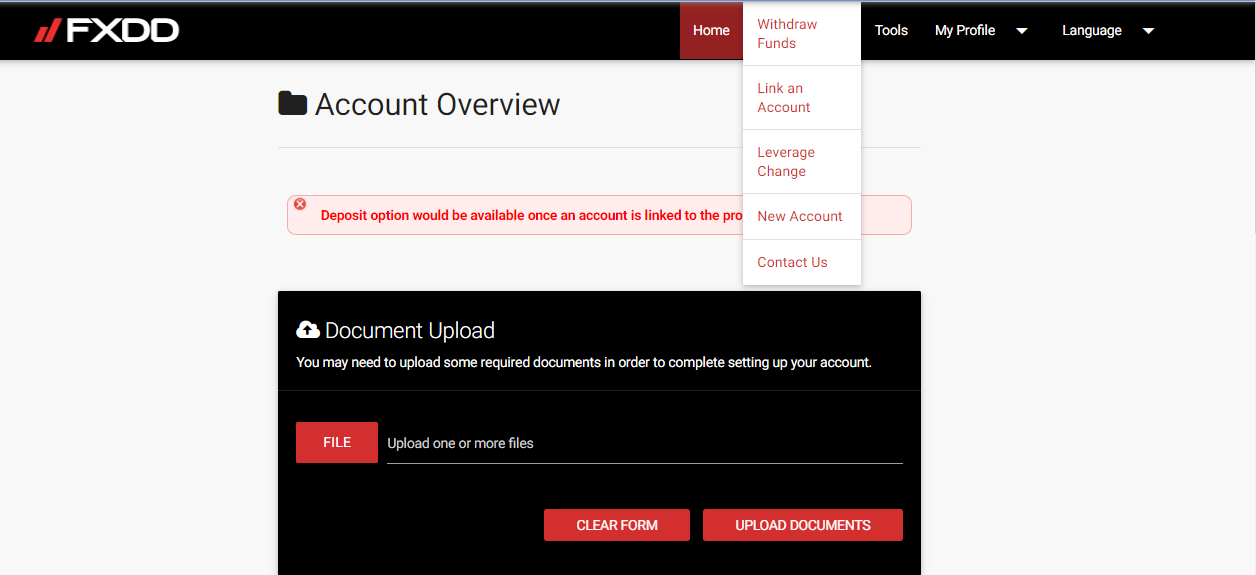

After selecting the company's division, fill out the registration form. The broker asks you to specify not only personal data (last name, patronymic, date of birth, address, and phone number), but also the amount of available capital, the origin of income, as well as trading experience. After that, you need to answer a series of questions about trading: what is Stop Loss, margin trading, etc. To deposit money to a trading account, you need to pass verification.

The functionality of the FXDD personal account:

Also, in the trader's personal account, the following options are available:

-

An economic calendar that displays the forecast of news and events happening in the market in real-time.

-

Rollovers — current rates for Forex positions held until their value date, and interest on unrealized profit/loss.

-

Data from Trading Central: market analysis and a brief overview of the daily news.

-

Real-time currency quotes and spread sizes from leading banks and financial institutions.

Regulation and safety

The FXDD has two representative offices, each of which operates under the requirements of the regulators of the country of its jurisdiction.

Triton Capital Markets Ltd. operates under the license of the Malta Financial Services Authority (MFSA) under number 48817. Under the EU Markets in Financial Instruments Directive (MiFID II), the company is allowed to provide brokerage services in the European Economic Area. The FXDD Mauritius Ltd. division is authorized and regulated by the FSC, Mauritius Financial Services Commission, license number C117017252.

Advantages

- Customer funds are separated from FXDD capital and held in segregated bank accounts

- Negative balance protection is in effect

- If the broker violates the obligations specified in the offer, the client can file a complaint with the regulator

Disadvantages

- To create an account, you must provide detailed financial information

- You cannot make a deposit and withdraw funds without passing verification

- Limited choice of electronic payment systems for making money deposit and withdrawal operations

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $19 | Exists |

| ECN | From $4 | Exists |

There are swaps (commission for transferring a position to the next day). Analysts at TU also compared the size of the average trading commission of FXDD, RoboForex and EXNESS. The results of the comparison are presented in the form of a table.

| Broker | Average commission | Level |

|---|---|---|

|

$11.5 | |

|

$1 | |

|

$8.5 |

Account types

The FXDD offers 2 types of accounts. For the MetaTrader platforms, standard accounts and ECN are available; for WebTrader, only ECN. The maximum leverage for retail clients is 1:30, for professionals, it’s 1:100. There are no minimum deposit requirements for any accounts.

Account types:

Demo accounts are available for all terminals.

The FXDD is an STP broker that provides favorable trading conditions to professional traders who prefer to work with ECN technology.

Deposit and Withdrawal

-

The FXDD processes withdrawal request within 24-48 hours.

-

Money can be withdrawn to Visa and Mastercard cards (debit and credit), by bank transfer, using the electronic payment systems Neteller and UnionPay.

-

A bank transfer takes from 1 to 2 business days. The money is credited to the EPS within a few minutes after the broker approves the withdrawal request.

-

FXDD compensates each client for the first withdrawal of funds in a calendar month. Starting from the second withdrawal, the company charges the trader a commission of $40 dollars per transaction. An additional fee of $25 is charged if the customer withdraws less than $100.

-

To be able to make a deposit, you must pass verification.

Investment Options

Investment Programs, Available Markets and Products of the Broker

The FXDD broker cooperates with active traders and passive investors. The company provides clients with the opportunity to invest in PAMM and MAM trust management accounts. Investors who prefer to copy the trades of experienced market participants, rather than trade independently, can connect to the popular social trading platform ZuluTrade. The broker also offers the IB program - a partner offer to generate additional income by introducing brokers to the platform.

PAMM and MAM accounts are money management solutions

The FXDD broker offers MAM (multi-account management) and PAMM (Percent Allocation Management Module). trust management accounts. They are available through the MT4 terminal. Financial managers get highly competitive spreads, first-class liquidity from major banks, and the ability to manage multiple accounts on a single trading platform.

Features of solutions for managing investors' funds:

-

The accounts are provided to the manager free of charge and without any opening fees.

-

The investor chooses the method of distribution of funds — by lot, percentage, or proportionately. The minimum order is 0.01 lots.

-

Real-time profit tracking is available.

-

There are no restrictions on the number of investors who can connect to a PAMM or MAM account.

Every FXDD client can become an investor, and only a professional trader can become a manager. The broker provides account managers with full control over the distribution of trading operations, access to multiple accounts to implement various strategies, and compensation for non-trading fees for making a deposit through the Bank of America.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FXDD’s affiliate program:

-

Introducing Broker"(IB) – is an activity that provides brokerage services. Partners get discounts on spreads, and their clients get the opportunity to work using proven FXDD technologies.

Introducing brokers can control the margin on their spreads themselves. Payments are made daily to the partner account. FXDD acts as an intermediary between partners and their clients, providing traders with the highest level of aggregated liquidity, and working with advanced software.

Customer support

Support service operators are available 24 hours a day Mon-Fri and from 17: 00 Sunday and 16: 55 on Fridays, EST).

Advantages

- In an online chat, you can ask a question without being a customer of the company

- Support is available in 6 languages

Disadvantages

- Works in 24/5 mode

- You can't ask a question in Russian

The broker provides the following communication channels:

-

phone number (specified in the section Contact);

-

email;

-

online chat on the website and in your personal account;

-

feedback form;

-

callback request.

Not only can a registered client ask a broker's representative a question, but also a trader without an active account.

Contacts

| Foundation date | 2002 |

|---|---|

| Registration address | Triton Capital Markets Ltd., K2, First Floor, Forni Complex, Valletta Waterfront Floriana, FRN 1913, Malta |

| Official site | fxdd.com |

Education

There is no separate training section on the FXDD website. The only way for novice traders to gain knowledge is to study short guides on trading various Forex assets.

The broker does not have cent accounts, so the only option to consolidate the acquired knowledge in practice will be training on a demo account.

Comparison of FXDD with other Brokers

| FXDD | RoboForex | Pocket Option | Exness | Vantage Markets | Forex4you | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, WebTrader, Mobile Apps | MT4, MobileTrading, MT5 |

| Min deposit | $1 | $10 | $5 | $10 | $50 | No |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:10 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.9 point | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 100% / 20% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed Review of FXDD

The FXDD broker builds its business on compliance with three rules: providing the best prices, the ability to apply any trading strategies, and ensuring the fastest execution. Clients can choose the type of execution (instant execution or market execution), conduct automated trading and use free analytics from the company's experts and the Trading Central service. Standard, Islamic, ECN, and demo accounts are available to traders.

About the FXDD broker in numbers:

-

More than 400 thousand open trading accounts.

-

More than 19 years in the field of brokerage services.

-

The total volume of operations is about 8 trillion US dollars.

FXDD is the broker for active trading and passive investing

In addition to standard accounts, STP broker FXDD offers ECN technology (Electronic Communication Network), which allows private traders to trade directly with the broker's liquidity providers such as banks and top-level financial institutions. This allows users to get the lowest possible trading spreads. The company's clients can trade currency pairs, cryptocurrencies, as well as CFDs on stocks, indices, metals, and energy. For passive investors, the broker offers the ZuluTrade social trading platform and Money Manager accounts for money management.

FXDD clients trade through the desktop and mobile terminals of MetaTrader 4/5, as well as using the broker's own web platform. One-click trading is available to traders, and automated expert advisors and scripts are allowed.

Useful FXDD services:

-

Custom Price Ticker. On the site, the user can create a ticker to track prices and spreads for interesting assets. The data is updated in real-time.

-

Trading calculators. They allow you to calculate the size of profit and loss, margin, pivot point, and Fibonacci levels.

-

Display of market data. Traders can access the economic calendar, historical data for MetaTrader, the prices of all assets, and the size of spreads and swaps.

-

VPS for MetaTrader 4. Hosting for the round-the-clock operation of automated systems.

Advantages:

There are 6 asset classes available for trading.

To ensure the security of client funds, the company stores them in segregated accounts.

Negative balance protection is in effect.

Narrow spreads from 0.4 pips on ECN accounts.

ZuluTrade, a popular social trading platform, is available to investors.

The broker provides free analytics and online tools to improve the quality of trading.

The VPS, FIX API, and Islamic accounts are available to all customers, regardless of the size of the deposit.

User Satisfaction