TD Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- 2015

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- 2015

Our Evaluation of TD Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TD Markets is a high-risk broker with the TU Overall Score of 2.5 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TD Markets clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. TD Markets ranks 360 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

TD Markets offers competitive trading conditions. It has over 100 assets in the pool. Leverage is quite high, the spreads are tight, and the fees are average for the segment (there aren’t any fees on Gold accounts). TD Markets offers standard instruments like the economic calendar. The entry threshold is low with the minimum deposit being $50. Also, there is a demo account. The educational program of the broker, presented by articles and videos, deserves special attention. Unfortunately, trading is carried out only through MT4. The broker does not offer any investment solutions either.

Brief Look at TD Markets

TD Markets is regulated by FSCA (Financial Sector Conduct Authority) and is headquartered in Sandton, South Africa. The broker offers a demo account and two live accounts. It also provides access to the markets of currencies, cryptocurrencies, stocks, indices, energies, precious metals, ETFs (exchange-traded funds), and CFDs (Contracts for Difference). The minimum deposit is $50 and the maximum leverage is 1:500. Margin calls and stop outs for all accounts are 100% and 50%, respectively. TD Markets does not impose trading restrictions on its clients. Thus, you can hedge, scalp, and use advisors and bots. The lowest spread for currency pairs starts from 0.1 pips and it is floating. There are no trading fees on Gold accounts, and a fee of $8 is charged on Pro accounts. Trading is carried out only through the MetaTrader 4 (MT4) platform. The broker offers a number of free instruments like the economic calendar. Also, there is a training system with daily webinars.

- Intuitive interface, popular MT4 trading platform, and a minimum deposit of $50 comprise a low entry level for traders;

- Trader can form a balanced and diversified portfolio with over 100 assets from 8 groups;

- The broker has optimal margin-call and stop-out indicators. In addition, there is a negative balance protection function;

- Registration takes no more than 5 minutes, and the most popular deposit options for South Africa are available;

- The broker is controlled by FSCA, which is a guarantee of its reliability;

- TD Markets offers business partnerships by providing ready infrastructure with rapid integration;

- The training program is represented by video tutorials and webinars; also, the broker publishes news and analytical materials in its blog.

- TD Markets does not have options for passive income, such as partnership programs, copy trading, or investment solutions;

- The broker provides the most demanded assets, however, it does not have a huge number of financial instruments, as compared to its competitors;

- Although MetaTrader 4 is a popular platform, many traders prefer other solutions, but they are not available here.

TU Expert Advice

Financial expert and analyst at Traders Union

The first thing most traders are interested in is security guarantees. TD Markets has only one regulator and it is FSCA. This organization has been operating in Africa for many years, here it is equivalent to FSA (the Financial Services Authority) or any other international regulator. That is why TD Markets clients can have no doubts when working with this company, as it acts transparently and fulfills all its obligations.

Speaking of the trading conditions, TU immediately notes that the broker is focused on active trading. It has neither investment programs nor services for copy trading. There is not even a referral program. Partnerships are possible only for representatives of the business community who also work in the interbank market. Some experts see the absence of passive income options as a disadvantage, but if the company focuses on a particular direction, as a rule, this becomes its constructive advantage. I have no complaints about the work of TD Markets.

The broker offers two account types, they differ in the minimum deposit and some other conditions. For a Gold account, the minimum deposit is $50, for a Pro account it is $1,000. There is no difference in available assets, margin call, stop out, leverage, or lot size. Note that out of 116 assets currently offered by the broker, most are currency pairs. It looks like the company is focused on currencies, including some exotic pairs.

The available currencies are USD and ZAR. Withdrawal of funds is possible by bank transfer or PayFast. It is important that the broker does not charge any withdrawal fees. There is only a fee charged by the third-party withdrawal system. This is a strong advantage, as very few companies allow you to withdraw profits without a fee.

TD Markets Summary

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Gold, Pro, and demo |

| 💰 Account currency: | USD and ZAR |

| 💵 Replenishment / Withdrawal: | Bank transfer and wire transfer |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:500 subject to the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.1 pips |

| 🔧 Instruments: | Currencies, cryptocurrencies, stocks, indices, energies, precious metals, ETFs, and CFDs |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

Demo account and two live accounts; Moderate choice of financial instruments (mostly currency pairs); High leverage; Tight spreads; Competitive fees; No withdrawal fees; Qualitative optimization; Strong educational system; Fast technical support |

| 🎁 Contests and bonuses: | No |

The minimum deposit with most brokers depends on the account type. Clients of TD Markets must deposit at least $50 for a Gold account and at least $1,000 for a Pro account. The available leverage is not affected by the account type, it is determined by the group of assets with which the trader works. The largest leverage of 1:500 is available only for currency pairs, while for most other instruments the leverage does not exceed 1:200. Technical support can be reached via call center, email, and tickets on the website. Support works 24/7, which is an important advantage of the broker.

TD Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with the broker, register on its website, open an account, and make a deposit. Also, verify your user account, that is confirm your personal information. Traders Union has compiled the below guide on how to open an account with TD Markets.

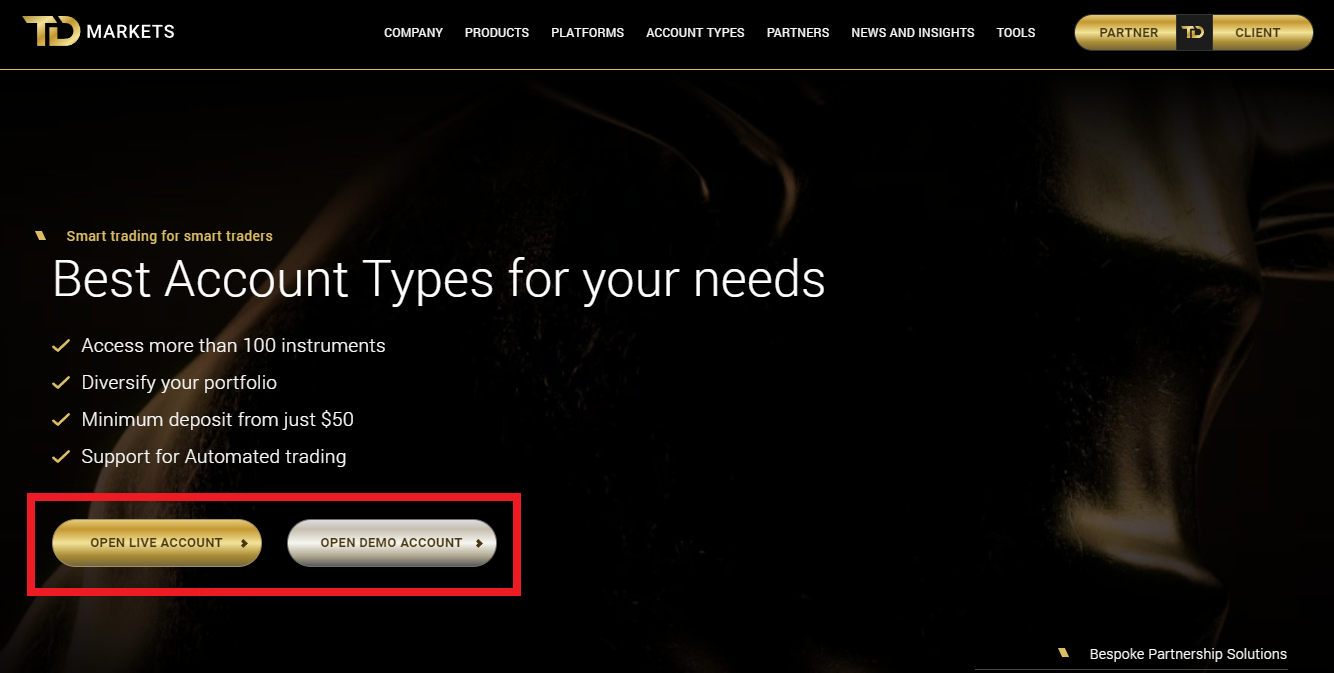

Go to the broker's website. In the main block there are the "Open Demo Account" and "Open Live Account" buttons. Click either of them. In TU’s example a live account will be registered.

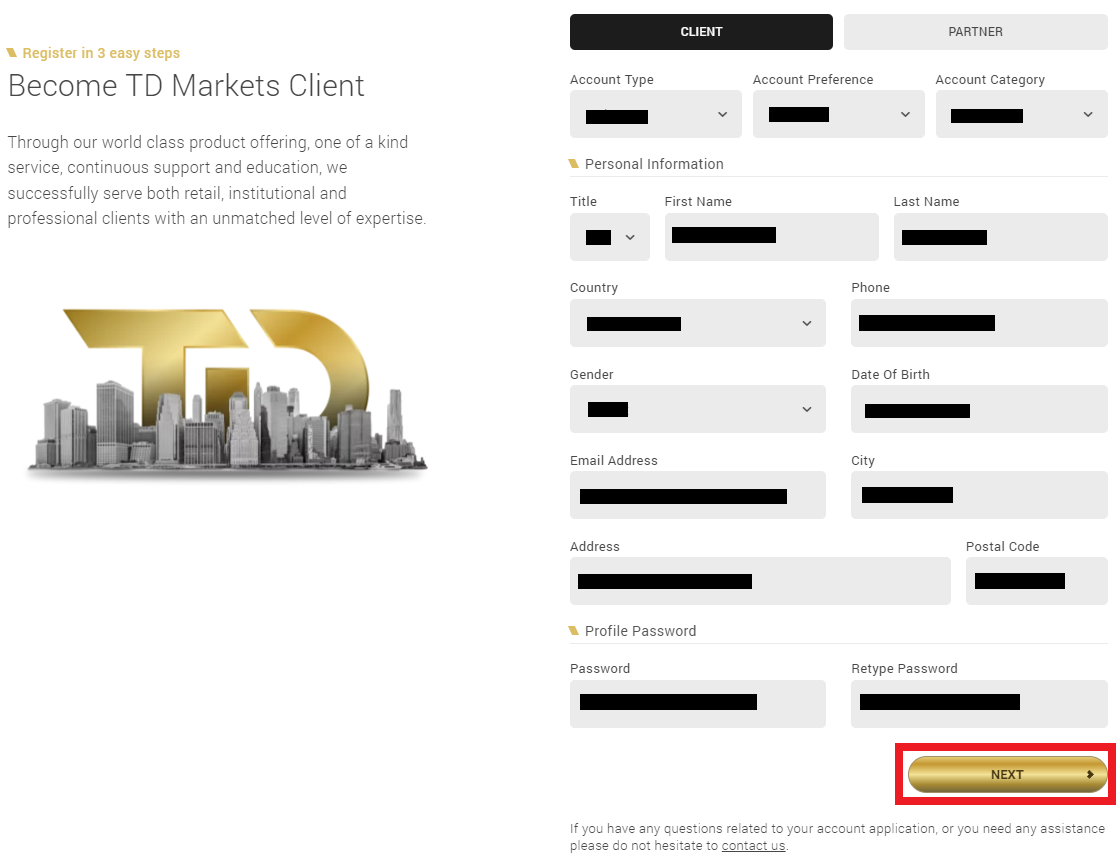

Select the type of registration. You can register as a client or partner (this is a business option). Next, specify the type of account. You can choose Gold or Pro accounts (note that you need a Pro Crypto account to trade cryptocurrency). Then enter the account category, for individuals it can only be the "Trading" category. Select your title, indicate your first and last names, gender, and date of birth. Next, enter your email, registration address, and generate a password. Click the “Next” button.

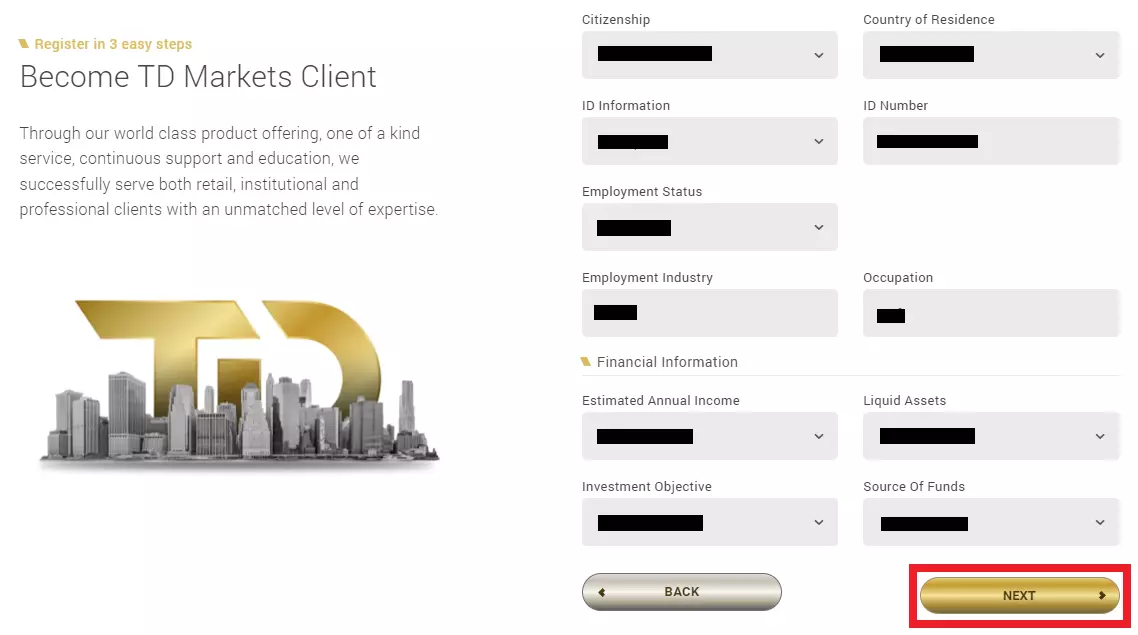

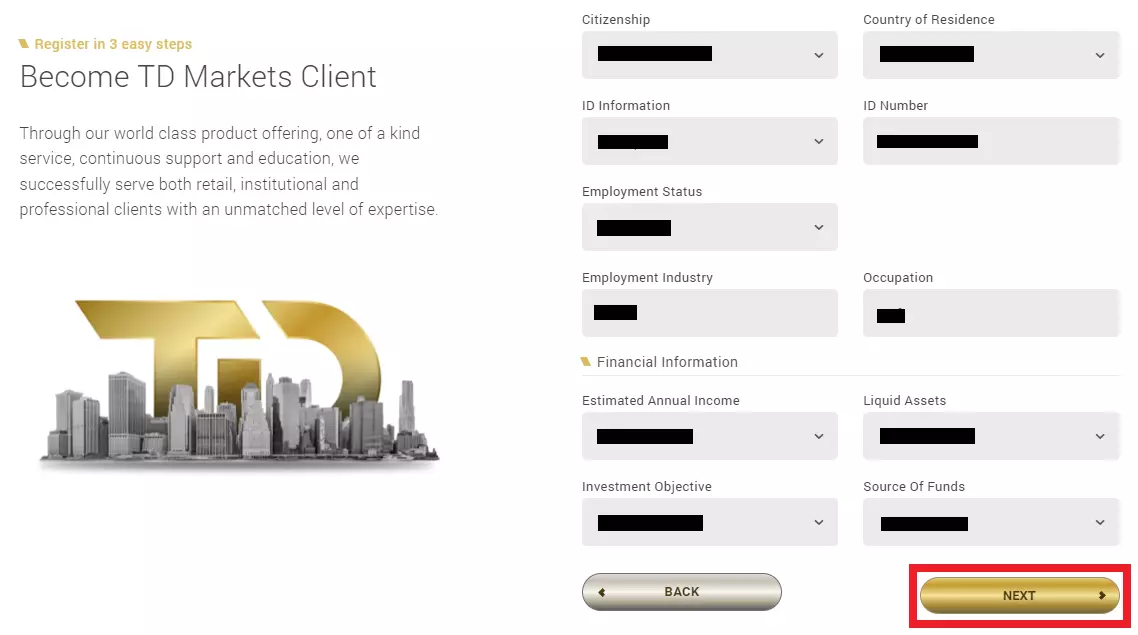

Indicate your citizenship and your country of residence. Enter data from your ID in the corresponding field. Indicate your status and required financial information. Click the “Next” button.

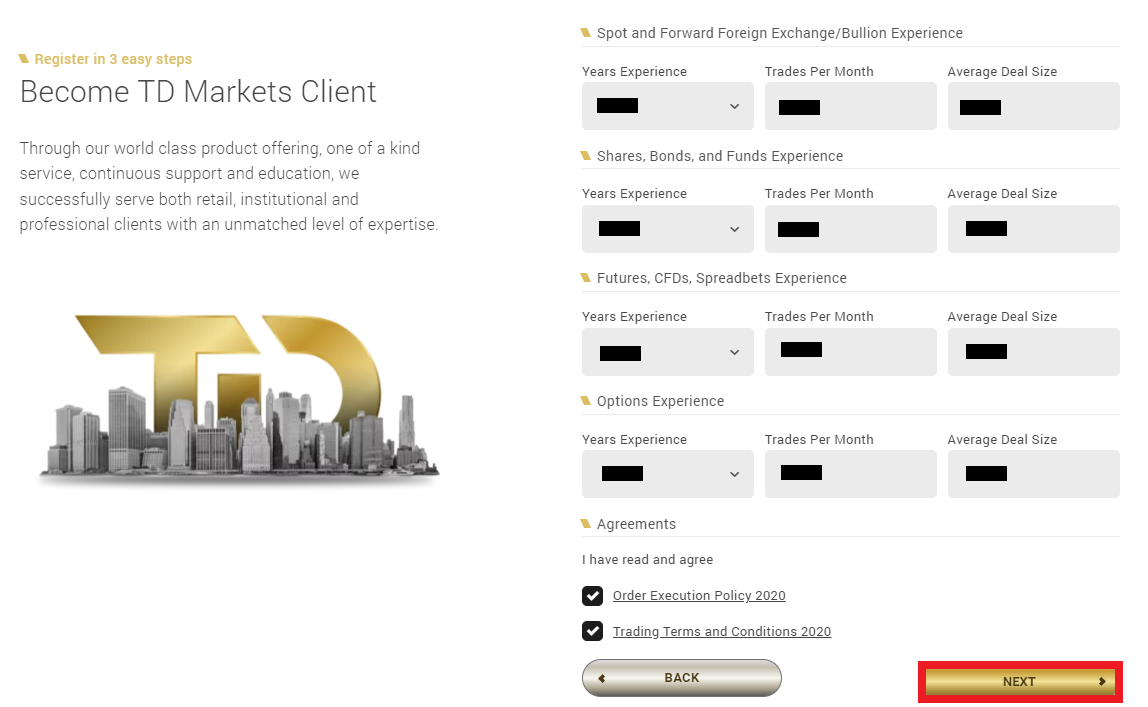

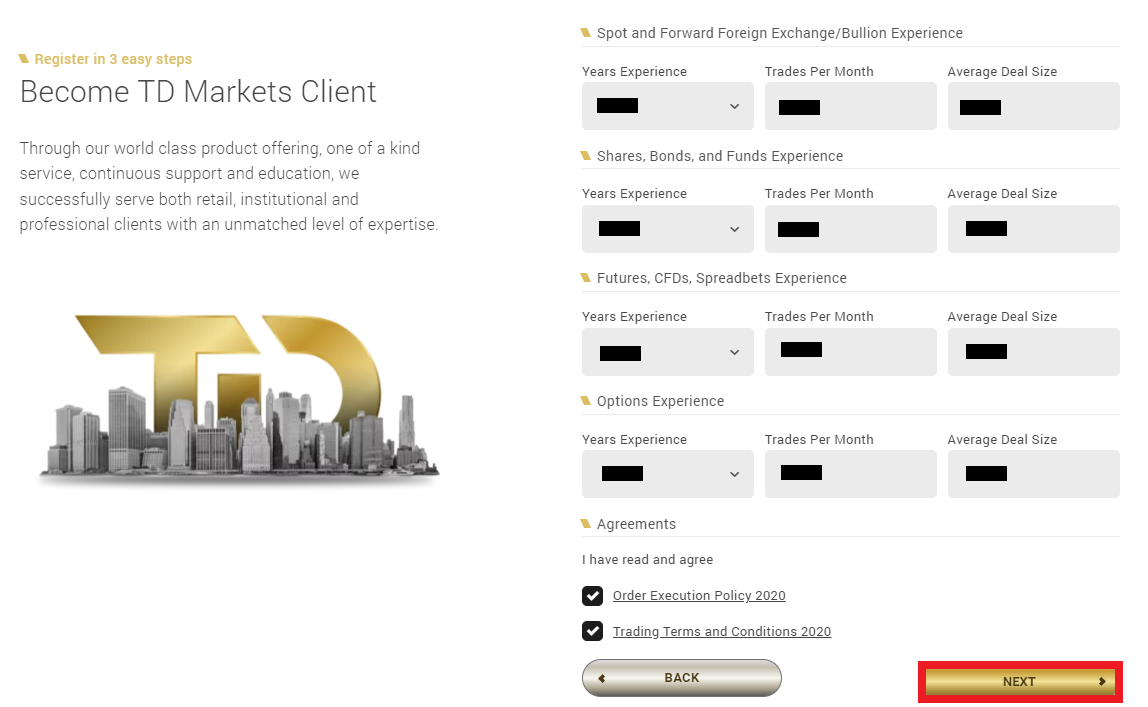

Indicate your experience in trading certain financial instruments and agree to the terms of service by ticking the appropriate checkboxes. Click the “Next” button.

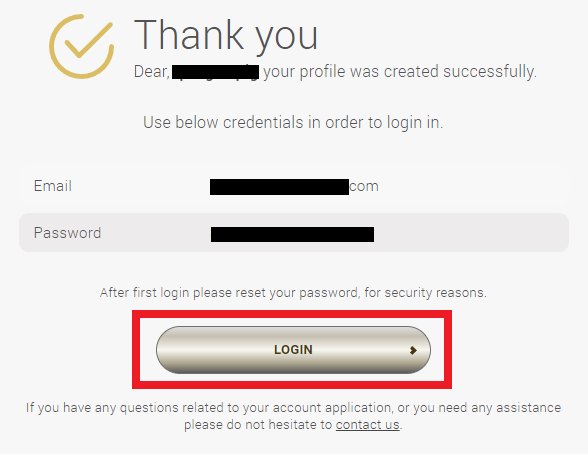

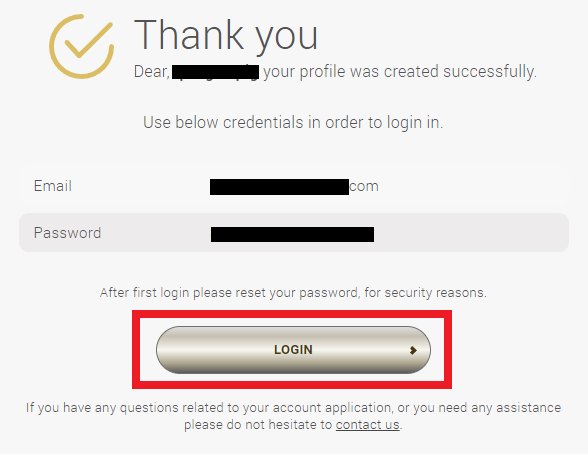

The system will notify you when the review of your registration is complete. Click the “Login” button. Use your email as your login. Enter the password you provided during registration. Click the "Login" button again.

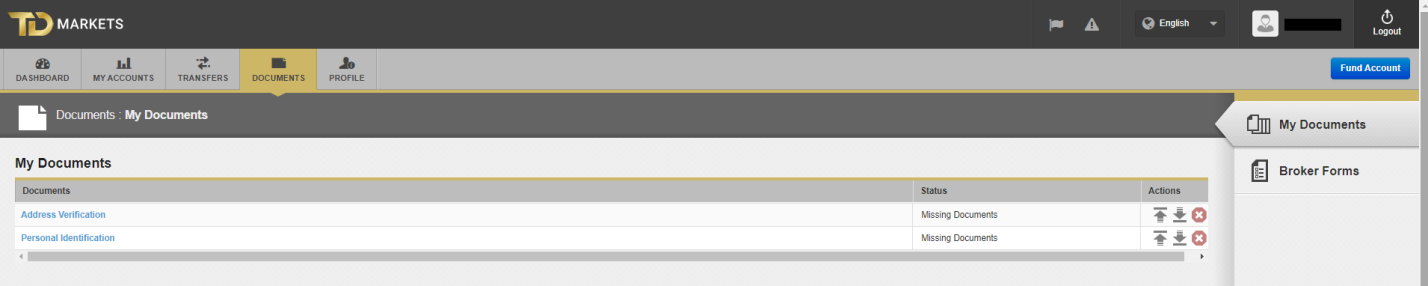

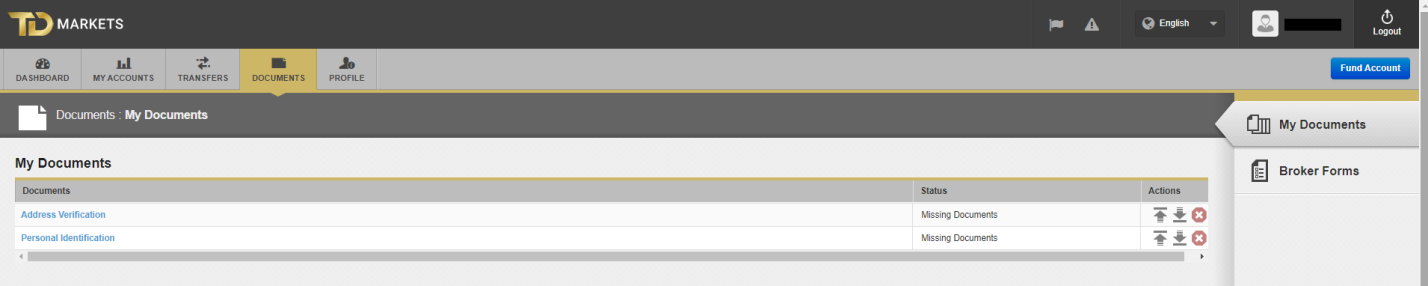

You now have access to your user account, but you cannot open a live account yet. To do this, verification is required, that is, confirmation of your personal information. Go to the "Documents" section. Upload photos/scans of required documents.

You can find out which documents are needed for verification by hovering over the section name; a hint will appear in a pop-up message. Verification of documents takes several days, and after its completion, you will be able to open a trading account.

Functions of TD Markets’ user account:

Dashboard. It displays up-to-date information about all accounts and trades of a client;

My accounts. Contains a list of accounts with their type, platform, floating PnL (Profit and Loss), and other parameters is provided;

Transactions. In this section, a trader can deposit or withdraw funds from the platform by selecting a convenient channel;

Documents. Here the documents used for verification (confirmation of personal information) are uploaded;

Profile. This section contains the registration data of users, as well as the newsletters they receive.

Regulation and safety

A trader can only be confident in a broker when it is regulated. Note that registration as a financial institution is not regulation. All brokers are registered in jurisdictions where they have their headquarters or registered offices. Regulation is the control by one of the state-authorized organizations that monitor the transparency and legitimacy of a financial company. TD Markets is regulated by FSCA under license number FSP49128.

Advantages

- Traders can apply to the broker’s technical support

- Clients can contact the broker’s regulator FSCA

Disadvantages

- Traders cannot contact regional regulatory authorities

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Gold | $18 | No |

| Pro | $1 | No |

A Gold account only has a floating spread, while a Pro account has floating and raw market spreads. The analysis above shows that spread is much higher on Gold accounts intended for novice traders. Although the exact figures always depend on the transaction parameters, such as the instruments traded, a specific asset, lot size, and market conditions. The comparative table below shows the average trading fees of TD Markets and its closest competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$9.5 | |

|

$1 | |

|

$8.5 |

Account types

The first thing to decide is a suitable account type. TD Markets offers one demo account and two live accounts, so it's quite simple. A demo account does not require a deposit, it uses current quotes, so traders work with virtual currency. To get a live account, you need to make an appropriate deposit. Transactions on live accounts are displayed on the interbank market and make a profit if successful. The Gold account is designed for novice traders. It offers extremely low minimum deposits, high leverage, and access to all asset types. The Pro account, as its name suggests, is suitable for advanced players. Its minimum deposit is much higher, the leverage is lower, but the conditions are more flexible.

Account types:

On a demo account, clients can trade any asset with maximum leverage.

Deposit and Withdrawal

-

If clients trade on live accounts, the profit goes to their balance subject to successfully closed positions;

-

The broker's client can at any time submit a withdrawal application. The minimum withdrawal amount is specified in the user account;

-

The application is sometimes considered within a few days, but usually it is processed on the day of submission;

-

Traders can withdraw funds in two ways, by bank transfer and through the PayFast electronic transfer system;

-

The broker does not charge fees for withdrawal of funds, regardless of the withdrawal channel.

Investment Options

This broker does not offer options for passive income. Some of its competitors provide the opportunity to buy dividend stocks, invest in cryptocurrency staking, or use the services of signal providers in an integrated copy trading service. The absence of these attributes for passive income is a disadvantage of this broker. However, most traders come here to actively trade on their own. Sometimes a referral program is considered as an option for passive income, but TD Markets does not have that either (do not confuse it with a partnership program, which is designed for business representatives, not ordinary traders).

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Why TD Markets doesn't have a referral program:

The essence of a referral program is that a trader invites another trader to the platform using a personal link. If new users register and open accounts, they bring the owner of the link a percentage of their trading fees or a one-time bonus, which is less common. The referral program was created in order to stimulate the influx of users. According to open information, TD Markets has more than 80,000 clients. Experts believe that the company does not need an additional increase in the trading pool, as users come in large numbers themselves. This indicates that TD Markets offers favorable trading conditions and client-oriented service.

Customer support

Technical (or client) support is needed for traders to address a competent specialist in a situation that they cannot handle on their own. It doesn’t matter how intuitive the interface and detailed FAQs of the website are, traders still need assistance from managers from time to time. In the case of TD Markets, they can contact the call center, use email or live chat, or leave tickets on the website. The broker’s tech support is available 24/7.

Advantages

- Technical support will answer your questions, even if you are not registered with the broker

- Managers are online 24/7

- Experts assess the high speed and quality of technical support

Disadvantages

- Technical support is not available in most major languages

- Reply speed of managers can be lower during rush hours

If you have questions or need assistance, use one of the following communication channels:

-

call center;

-

email;

-

live chat on the website and in the user account;

-

contact form.

The broker has its official profiles on Instagram, Twitter, Facebook, and LinkedIn. It is recommended to subscribe to the broker and not miss news and important newsletters.

Contacts

| Foundation date | 2015 |

|---|---|

| Registration address | Floor 12 Green Park Corner, 3 Lower Rd, Sandton, 219 |

| Official site | https://www.tdmarkets.com/ |

| Contacts |

010 3000 001

|

Education

It is in the interests of traders to constantly improve, learn new methods and techniques, and learn from the experience of their colleagues. TD Markets helps its clients by holding regular webinars and training programs. They are presented in two forms, such as blog articles and videos in a special section.

It is important that all this information is available to traders, even if they are not registered on the platform and have not opened an account with TD Markets.

In general, TD Markets offers significant information, however, there is no materials for experienced traders. But they can receive news and life hacks in the blog of the platform, where short and interesting articles are constantly published.

Comparison of TD Markets with other Brokers

| TD Markets | RoboForex | Pocket Option | Exness | FreshForex | XM Group | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4, MT5, MobileTrading, XM App |

| Min deposit | $50 | $10 | $5 | $10 | No | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.6 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 50% |

| Execution of orders | No | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | $30 | No |

| Cent accounts | No | Yes | No | No | Yes | Yes |

Detailed review of TD Markets

TD Markets differs from many of its competitors in its transparent conditions, as the company directly states which assets can be traded, what is the average spread, and which accounts are charged trading fees. A big advantage is the FSCA license. This is one of the largest regulators on the African continent. Also, the evidence of reliability of the broker is the fact that it has been operating for 8 years and over the past years there has not been a single conflict with traders that has not been amicably resolved. A comprehensive analysis of the operation of the platform in terms of static and dynamic indicators demonstrates the high client-oriented service, which for the end user is expressed, among other things, in the efficiency of its 24/7 technical support.

TD Markets by the numbers:

-

Average spread on Pro accounts is 0.1 pips;

-

The minimum deposit is $50;

-

116 instruments from 8 groups;

-

Leverage is up to 1:500;

-

Withdrawal fee is $0.

TD Markets is a broker that offers comfortable trading conditions

Although the company does not provide passive income options, this is more than offset by favorable conditions for active trading. At the moment, there are over 100 financial instruments in the broker's pool. The number is constantly growing in response to the wishes of traders. Currencies, cryptocurrencies, metals, energies, and other groups, including CFDs are presented. This diversity is a conceptual advantage, because it allows traders to work within any strategy and style, without restrictions. At the same time, when you have a greater choice of assets, you can prepare a balanced and diversified risk portfolio.

Useful services offered by TD Markets:

-

Economic calendar. It includes all the most important political and economic events that may affect the movement of quotes for a particular asset;

-

Newsfeed. This section publishes the latest financial news, as well as analytical notes from professional traders that help forecast the market;

-

Educational portal. The broker implements educational programs in the form of articles and videos for traders with small and medium experience, and also it regularly holds webinars.

Advantages:

The broker offers financial instruments from 8 groups so that traders are not forced to limit themselves in trading and can diversify risks;

Leverage ranges from 1:200 to 1:500 depending on the selected asset; it significantly increases the profit (and loss) potential;

Traders can use any version of MetaTrader 4, including its mobile version, which removes technical and local restrictions;

The broker offers a tight floating spread, as well as low (compared to its competitors) trading fees. There is no withdrawal fee;

Technical support works 24/7, and managers can be contacted via any of the presented communication channels.

User Satisfaction