5 Types of Strategies for Trading EUR/USD Binary Options

When choosing a strategy for binary options trading, a trader should consider his strengths and weaknesses. Here are 5 strategies for trading EUR/USD (as well as for other competitive markets):

If you are trading a binary options strategy that gives you a competitive advantage - then you are running a business. Otherwise, you are gambling, and this is the path to disappointment.

This article tells you what strategies there are and how to use them wisely when trading such popular binary options as EUR/USD.

5 Types of EUR/USD Binary Options Trading Strategies

What is Binary Options?

Binary options are financial instruments that simplify trading by providing a Call/Put proposition on the direction of an asset's price movement within a specified time frame, offering a fixed payout if the prediction is correct.

What is EUR/USD?

EUR/USD is a major currency pair in the foreign exchange market, representing the exchange rate between the Euro and the U.S. Dollar. It's widely traded and influenced by economic factors from both the Eurozone and the United States.

Why is the trading strategy important?

EUR/USD is a major currency pair in the foreign exchange market, representing the exchange rate between the Euro and the U.S. Dollar. It's widely traded and influenced by economic factors from both the Eurozone and the United States.

The 5 Types of EUR/USD Binary Options Trading Strategies:

News Trading

Candlestick patterns

Trading using chart patterns

Trading using indicators

Sentiment trading

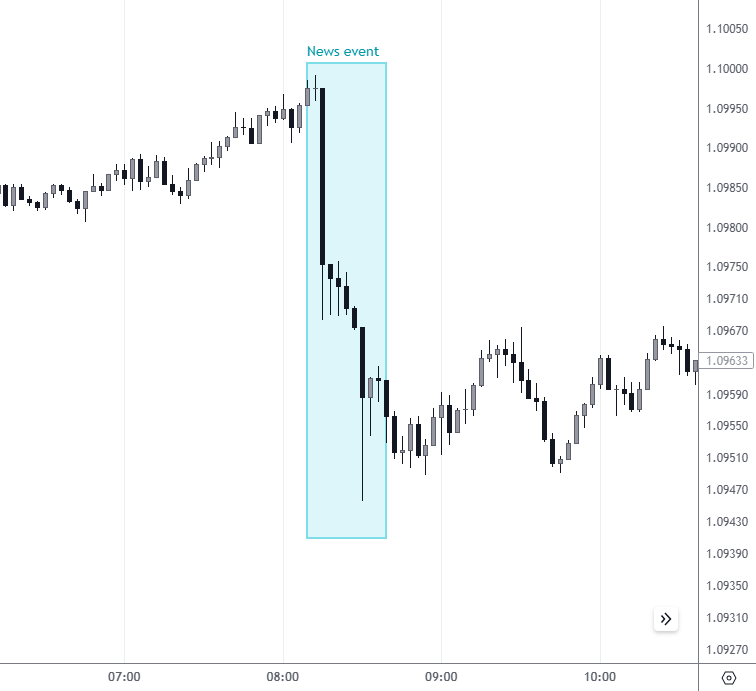

EUR/USD News Trading Strategy

The EUR/USD news trading strategy involves capitalizing on significant economic events and announcements that impact the Euro/US Dollar currency pair.

News is an important driver for EUR/USD momentum

News is an important driver for EUR/USD momentumTraders focus on interpreting and reacting to these news releases to make informed decisions in the binary options market.

For making stable decisions with news trading strategy, we recommend reading How to Trade Forex News?

- Pros

- Cons

- Opportunities for rapid market movements and substantial profits during major news events.

- Traders can save time by trading according to events on the economic calendar

- High volatility can lead to increased risk and potential losses if the market reacts unfavorably.

- Timing is crucial, and delays in execution may result in missed opportunities or unfavorable entry points.

Trading EUR/USD with candlestick patterns

Candlestick patterns are visual representations of price movements on charts, providing insights into market sentiment.

Shooting Star Candlestick Bearish Pattern

Shooting Star Candlestick Bearish PatternTraders analyze these patterns to predict potential reversals or continuations in the EUR/USD binary options market.

- Pros

- Cons

- Candlestick patterns offer a visual and intuitive way to interpret market sentiment and potential price movements.

- Traders can use these patterns to identify entry and exit points, enhancing decision-making in EUR/USD binary options trading.

- Interpretation can be subjective, requiring a learning curve to accurately recognize and respond to various candlestick patterns.

- Reliance solely on candlestick patterns without considering other factors may lead to occasional false signals.

To know which chart candlestick pattern suits you the best, you need to know about the top 20 charts. Check now: Top 20 Chart Candlestick Patterns.

Trading EUR/USD with chart patterns

Chart patterns are recognizable formations on price charts that traders use to predict potential market movements. When trading EUR/USD binary options, understanding and identifying these patterns can guide informed decision-making.

Bearish wedge near resistance level

Bearish wedge near resistance levelTo know the top 10 forex chart patterns to help you make the best trading decisions, here is the article you can read: Top 10 Forex Chart Patterns

- Pros

- Cons

- Chart patterns, such as triangles or head and shoulders, provide visual cues for anticipating future price movements in the EUR/USD market.

- Traders can use these patterns to set up well-defined entry and exit points, enhancing the precision of their binary options trades.

- Recognition of chart patterns requires practice and experience, and misinterpretation may lead to inaccurate predictions.

- Chart patterns alone may not be foolproof; combining them with other indicators and analysis is advisable for a comprehensive trading strategy.

Trading using indicators

Trading using indicators involves employing various technical tools to interpret historical price data and generate trading signals.

Here's a breakdown of the indicators traders can use:

Moving Averages (MA) - This indicator refreshes the price data by creating a constantly updated average price. Traders often use two MAs, such as a short-term (e.g., 50-day) and a long-term (e.g., 200-day) MA. Crossovers between these MAs can signal potential trend changes. For example, a bullish crossover (short-term MA crossing above long-term MA) might indicate a potential uptrend in EUR/USD.

Relative Strength Index (RSI) - RSI measures the magnitude of recent price changes to evaluate whether an asset is overbought or oversold. It ranges from 0 to 100, with readings above 70 suggesting overbought conditions and readings below 30 suggesting oversold conditions. How to use the RSI indicator effectively?

Moving Average Convergence Divergence (MACD - MACD comprises two lines- the MACD line (the difference between two exponential moving averages) and the signal line (a moving average of the MACD line). Traders observe the crossovers between these lines and use them as buy or sell signals. Don’t miss: Best MACD Indicator Strategies to Learn

A commonly used tool is the Bollinger Bands indicator, based on the amount of deviation from the mean. In periods of calm market traders can open sales if the price rises above the value of the average deviation, or vice versa - buy if the price falls below the lower Bollinger Bands.

Bollinger Bands Indicator in action

Bollinger Bands Indicator in action- Pros of trading EUR/USD Binary Options using indicators:

- Cons of trading Binary Options using indicators:

- Provides objectivity and removes emotion: Indicators can help remove emotional biases from your trading decisions. Their calculations are based on data and predetermined rules, providing a more objective view of the market compared to solely relying on intuition or gut feeling.

- Identifies trends and opportunities: Many indicators highlight trends, overbought/oversold zones, and potential entry/exit points, giving you valuable insights and trading opportunities you might miss on a bare chart.

- False signals and lagging information: Indicators can generate false signals, leading to incorrect trades and losses. They often lag behind price action, meaning they might confirm a trend or opportunity after it has already begun, potentially reducing your profit potential.

- Overreliance and ignoring fundamentals: EUR/USD traders may become overly reliant on indicators, neglecting fundamental analysis of the underlying asset or market conditions. This can lead to missed opportunities or poor decisions based solely on technical signals.

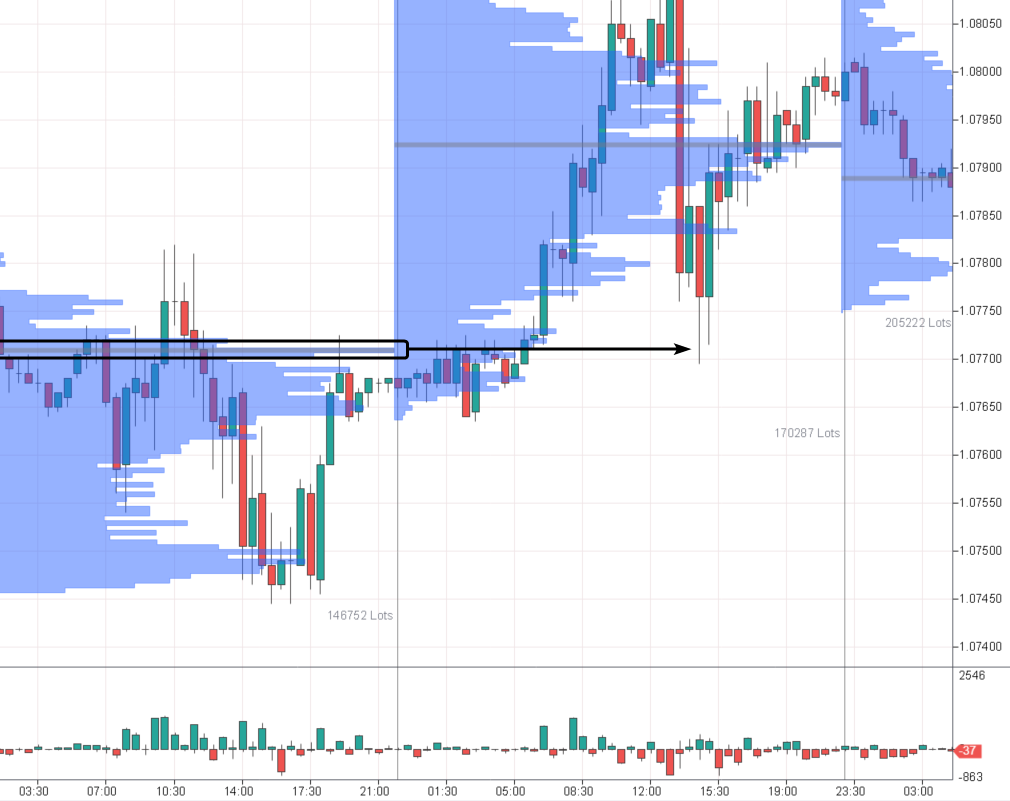

EUR/USD sentiment trading

By incorporating volume analysis and examining the open positions of other traders, you gain valuable insights for trading EUR/USD binary options.

Bouncing from the high volume level

Bouncing from the high volume levelUse advanced platforms to analyze trading volumes and Level II levels to find strong blocks of support and resistance.

- Pros

- Cons

- Volume analysis provides a deeper understanding of market strength, validating price movements and potential trends.

- Monitoring the open positions of other traders helps identify potential market reversals, providing a contrarian perspective for more nuanced trading decisions.

- Analyzing volumes and open positions requires a level of sophistication, and misinterpretation may lead to inaccurate conclusions.

- You will probably need additional professional-level software to analyze volumes

Best binary options brokers

Tips for EUR/USD binary options traders

Mix Different Types of Strategies - Diversify your approach by combining strategies like news trading, candlestick patterns, and indicators to adapt to various market conditions for trading EUR/USD binary options.

Control Risks - Prioritize risk management to protect your capital. Do not risk more than 5% of your capital in a single trade.

Try Demo First - Before venturing into live trading, practice your strategies and refine your skills using a demo account.

Do Not Expect to Get Rich Quickly - Manage expectations and understand that binary options trading requires patience and discipline.

Develop a Strategy and Trading Plan - Craft a well-defined trading strategy and plan, outlining entry and exit points, risk tolerance, and overall objectives.

Here is the article we recommend you read if you want to start trading as it will help you grasp the basic understanding and steps of starting binary trading How to start binary trading.

Summary

Whichever strategy you choose to trade EUR/USD binary options, the important thing is that you realize how it gives you a trading advantage. This way, over the long haul, you can withstand drawdowns and keep the odds in your favor.

FAQs

What is the EUR/USD scalping strategy?

The EUR/USD scalping strategy involves making short-term trades to capitalize on small price fluctuations, typically utilizing tight stop-loss orders.

What is the best time to trade EUR/USD?

The best time to trade EUR/USD is during the overlap of the European and U.S. trading sessions, specifically when liquidity is high, typically between 8:00 AM and 12:00 PM (EST).

How to trade forex binary options successfully?

Successful trading of forex binary options involves thorough market analysis, risk management, and strategic execution based on a well-defined trading plan.

How much can you earn trading EUR/USD binary options?

Theoretically, in the binary options market, the amount of profit is not limited. For example, if your total capital is $500, the payout rate is 90%, you risk $50 in a trade, make 10 trades per day, of which 7 are profitable → your profit will be 7*50*0.9 - 3*50 = $315 - $150 = $165 per day (excluding taxes and commissions).

Related Articles

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

MFSA was established on 23 July 2002. MFSA comprises a group of government and non-government regulators that license and control brokers and their financial activities.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.

Social trading is a form of online trading that allows individual traders to observe and replicate the trading strategies of more experienced and successful traders. It combines elements of social networking and financial trading, enabling traders to connect, share, and follow each other's trades on trading platforms.