Is Copy Trading Halal In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Copy trading may be halal when it aligns with Islamic finance values such as avoiding riba (interest), steering clear of gharar (uncertainty), and prioritizing ethical investing. Some brokers offer swap-free Islamic accounts with terms that match Shariah guidelines. Still, if trades involve non-permissible elements like interest-linked instruments or excessive risk, they can be haram. Many scholars advise confirming the trading methods of the lead trader and selecting brokers with verified halal credentials to ensure compliance with Shariah principles.

There is no single answer to the question “Is copy trading halal or not in Islam?” as much depends on how responsibly and intentionally the individual engages in the process. When the purpose is education or managing investments within ethical boundaries, and the trades themselves are free from prohibited activity, copy trading can fall within accepted limits.

Further, copy trading is halal or haram depending on whether the trades include interest or rely heavily on risk and speculation. Religious scholars continue to discuss and refine these rules across various cultures and contexts. In this article, we have taken a detailed look into the permissibility of copy trading as per Islamic finance, along with other important aspects that must be taken care of.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Is copy trading halal or haram?

Copy trading is a process where you mirror the trades of experienced investors, aiming to benefit if their strategies continue to perform well. When you copy someone’s trades, your account reflects the same investments, meaning you buy and sell the same assets they do. This lets you earn similar returns, but it also means you share the same risk. At the same time, following other traders can help you observe how professionals make decisions and improve your own approach over time. Here are key considerations to help you understand the Islamic perspective on copy trading. Also find out the answer to the question, is paper trading halal or haram in Islam?

Check if the copied trades involve leverage. A lot of traders use margin without knowing it, and you could end up earning through contracts built on interest.

Look into the contract between you and the platform. If the deal is unclear or one-sided, that’s a red flag for Islamic finance.

Avoid traders who use swaps or hold overnight Forex positions. You’re still part of it, even if you didn’t click the button yourself.

Make sure the earnings aren't guaranteed. If fixed returns are being promised, it starts sounding too much like guaranteed profit, which Islam does not allow.

Check how the profit-sharing is structured. If the platform charges you based on trading volume instead of results, the setup might not be fair.

Some scholars say automation removes intention. If you’re copying trades without thinking, it starts looking more like gambling than trading.

Ask if the trader being copied is trading halal assets. You might be earning from stuff you’d never touch directly, like banks or alcohol-related stocks.

When is copy trading halal?

Is copy trading halal in Islam? It can be, if certain conditions are met, especially those that align with Shariah principles. The discussion then broadens to whether it is permitted to undertake spot copy trading, and its halal status depends on transparency, ownership, and avoiding interest-based elements, which are essential in determining its permissibility.

Intention and purpose. When copy trading is used to help you learn how to trade, it can be considered halal. If the primary intention is to learn from experienced traders, manage a halal portfolio, or improve trading knowledge, then copy trading is halal under certain interpretations.

Platform choice. Some trading platforms actively comply with Islamic finance principles, such as avoiding transactions based on interest or investments in industries prohibited by Islamic law. Ensure that the platform you trade with adheres to Islamic law.

Active engagement. You should combine copy trading with personal research and seek knowledge about the strategies used by the trader you are copying. Passive investing can be problematic. However, copy trading halal status is also likely if the trader is actively monitoring and reviewing the strategies being followed. Traders should research and understand who they are copying and how they trade.

Ethical trading. You can ensure that copy trading is halal by making sure that the trades engaged in by the person being copied are ethical and comply with Islamic principles. Their strategies should be transparent and not involve any deception or manipulation.

Giving to charity. An important aspect of Islamic finance is sharing a portion of profits with charitable causes, so consider giving some of your profits from copy trading to charity.

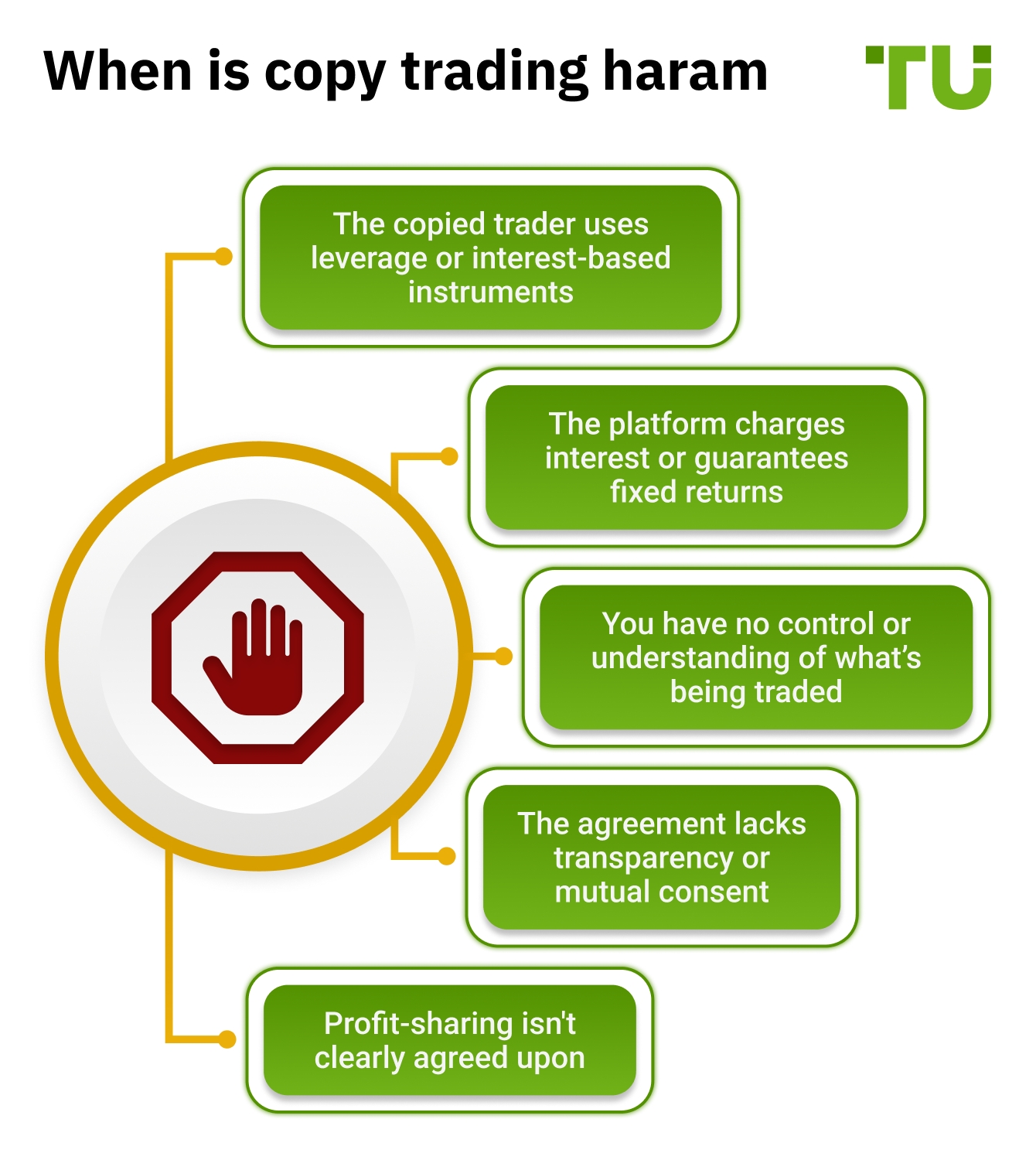

Most traders ask whether copy trading is halal or haram, but the answer lies in specific conditions.

The copied trader uses leverage or interest-based instruments. If the person you're following trades on margin or uses swaps, you're also exposed to riba through their actions.

The platform charges interest or guarantees fixed returns. Promising profits without risk or using interest in the payout system goes against how Islamic finance is supposed to work.

You have no control or understanding of what’s being traded. Copying trades blindly adds a level of risk Islam doesn’t allow, especially if you don’t know what’s in your portfolio.

The agreement lacks transparency or mutual consent. If the platform auto-copies without you actively agreeing to every term, it makes the whole setup questionable from an Islamic point of view.

Profit-sharing isn't clearly agreed upon. If the copied trader earns from your money but there’s no formal Mudarabah-like deal in place, it doesn’t really fit with the kind of agreement Islam supports.

This is why it’s important to ask not just is copy trading halal in Islam, but also how it’s being done.

"Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity... But Allah has permitted trade and has forbidden interest." — Surah Al-Baqarah (2:275)

Which brokers are best suited for copy trading?

We reviewed the offerings of brokers that provide strong conditions for copy trading while also supporting Islamic accounts, catering to traders who wish to follow their faith when making investment choices. This apart, these brokers also offer similar services, such as trading signals and trading bots.

| Swap Free | Copy trading | Signals (alerts) | Trading bots (EAs) | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | No | Yes | Yes | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | Yes | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | No | Yes | 200 | No | 1.96 | Study review |

These platforms help ensure that copy trading is halal for observant Muslim traders, provided the assets and strategies involved are compliant.

Copy trading vs. social trading vs mirror trading: key differences and halal status

Although often grouped together under the umbrella of automated or community-based investing, copy trading, social trading, and mirror trading have distinct mechanisms. Each presents unique challenges and opportunities for Muslim traders concerned about Islamic finance compliance.

Below is a comparative table outlining their features, user control, popularity, and halal status considerations:

| Trading Type | Key Features | User Control | Estimated Usage* | Halal Status Evaluation |

|---|---|---|---|---|

| Copy Trading | Automatically replicates individual trades from selected traders in real time | Medium | ~60% of social traders | Potentially halal if platform and trader are Shariah-compliant |

| Mirror Trading | Replicates an entire algorithmic strategy or system, often pre-programmed | Low | ~20% of auto traders | Debated, may involve gharar (uncertainty) or hidden riba |

| Social Trading | Sharing strategies, trade ideas, analytics; users decide which to act on | High (manual) | ~80 million users globally | Generally halal, especially for educational purposes |

Copy trading

In copy trading, you select a trader whose positions are automatically replicated in your own account. The system typically allows you to set stop-loss limits, risk thresholds, and capital allocations. Copy trading is halal when done carefully, and remains the most popular form of passive investing, especially on platforms like eToro and RoboForex, which have millions of active users that work in the spot markets.

Halal status. Permissible, if:

You use a swap-free (Islamic) account.

The trader’s actions do not involve interest or unethical instruments.

You actively monitor and review the copied strategies.

Mirror trading

Mirror trading is a more automated version of copy trading. In this model, you follow a fixed strategy, usually developed by third parties or professional algorithmic traders. These strategies are often tested on historical data before being offered for subscription.

Halal status. Questionable, due to:

Lack of transparency (you may not know which assets are being traded).

Higher risk of riba or gharar, especially if derivatives or leveraged instruments are involved.

Passive nature, which may conflict with Islamic finance’s emphasis on informed, responsible investing.

Social trading

Social trading is more community-oriented. These platforms offer access to feeds, charts, performance data, and insights from skilled traders. You can then choose which strategies to manually implement in your own account.

Halal status. Generally halal, especially when:

Used for educational purposes.

Traders avoid prohibited asset classes (e.g., alcohol, pork, gambling).

You execute trades through a halal account structure.

How copy trading compares to other trading methods in Islamic finance

Like day trading, copy trading often involves short-term strategies, which can border on speculation (maysir). If the trader being copied uses interest-based leverage or engages in high-risk behavior, the entire setup could become non-compliant. That’s why investors must be selective and screen who they follow.

Compared to proprietary trading, which can be halal if structured around shared risk and transparency, copy trading lacks direct control, making ethical oversight more difficult. You’re essentially outsourcing decisions without always knowing the compliance behind them.

When placed next to swing trading, copy trading shares some similarities, especially in holding periods. But swing trading can be done in a halal way if the trader avoids leverage, speculative assets, and sticks to asset-backed trades.

Short selling is largely considered haram due to the sale of unowned assets and speculation on price drops. Copy trading could cross into similar territory if the trader you follow engages in short selling without Shariah safeguards.

Finally, scalping, with its rapid-fire trades and reliance on split-second price moves, is often viewed as borderline haram due to its speculative nature. Copy trading that mimics scalping bots or strategies can carry the same concerns.

Risks and warnings

Engaging in copy trading as a Muslim investor requires not just financial awareness but religious mindfulness too. While a strategy may appear profitable, it could still breach Islamic ethics if not properly vetted. When in doubt, consult a qualified scholar who is learned enough to advise whether copy trading is halal in Islam in your case. Relying only on community feedback or platform claims may lead to non-compliance and ethical risks.

Below are key risks to consider before starting:

Riba (Interest) exposure

Many brokers apply overnight swap charges or offer interest-based leverage. Even if the trader you're copying avoids direct riba, the platform might still be involved in it through its underlying structures. Confirm that your account is truly swap-free and aligned with Islamic finance.

Gharar and speculation

Following traders who use high-risk or unclear strategies may lead to excessive uncertainty (gharar). Islamic finance discourages actions that resemble gambling or blind speculation. Not knowing why a trade is made increases this risk.

Passive dependence

Islamic values highlight personal accountability and mindful financial behavior. Fully passive models, where the user does not engage in decision-making, may conflict with the concept of amanah and lead to a disregard for financial stewardship.

Unscreened asset classes

Some copied strategies may invest in haram sectors like alcohol, gambling, pork, or interest-based banking. If you do not thoroughly examine the trader’s portfolio, you could unknowingly benefit from non-permissible sources.

Misleading “Islamic” labels

Not all platforms claiming to offer Islamic accounts follow full Shariah compliance. Some simply remove swap charges while still permitting margin trading or speculation. Always choose services that offer transparency, ethical standards, and ideally certification from a Shariah board.

Choosing halal copy trading strategies by tracking trader behavior patterns

Most beginners don’t look at how the trader behaves when things go wrong. It’s not enough to check if the assets are halal. You’ve also got to see how that trader reacts to bad news or market shocks. If they start throwing money into risky trades just to recover losses, that could cross the line into speculation. Many platforms let you review trade history, so take a few minutes to see how they perform under stress. That pattern says more about their strategy than just their returns.

Also, just having a swap-free account isn’t enough. You need to make sure the trader you’re copying isn’t using margin or interest-based positions to build their trades. Even if your account avoids riba, their strategy might be full of it. Some platforms give you details about the broker and account type the trader is using. That’s where the real transparency is. Pick traders who work in spot markets or who clearly state they’re shariah-compliant. It’s a small step that protects both your faith and your finances.

Summary

Determining whether copy trading is halal or haram remains a nuanced issue in Islamic finance. While some scholars consider it permissible under specific conditions, others advise caution or even classify it as haram due to the risks of riba and gharar. Ultimately, the permissibility of copy trading depends on several factors: the intention behind trading, the ethical nature of the trades being copied, the transparency of strategies, and the compliance of the platform with Islamic financial principles.

Traders who aim to stay within the boundaries of Shariah law must be proactive — choosing halal-compliant platforms, avoiding interest-based transactions, and verifying the ethical integrity of the traders they copy. Consulting with qualified Islamic scholars, conducting due diligence, and investing in halal assets all contribute to ensuring that one’s trading practices align with religious values. In this way, copy trading can be approached as a halal activity, provided all necessary precautions are observed.

FAQs

What makes a copy trading platform Shariah-compliant?

A Shariah-compliant copy trading platform offers swap-free accounts, avoids interest, and does not support prohibited asset classes.

Can Muslims earn passive income through copy trading?

Yes, if the passive income is generated ethically, without interest or speculation, and with oversight, it may be permissible.

Is spot copy trading halal?

Yes, spot copy trading can be halal, provided it involves real asset ownership without leverage or interest (riba), and both the platform and the copied trader follow Shariah-compliant practices. For full assurance, it's recommended to check the broker’s Islamic account terms and consult with a qualified scholar.

How do I verify if a trader I’m copying follows halal practices?

Check their trading history, asset types, and whether they engage in riba-based or speculative strategies. Use verified platforms with ethical filters.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Paper trading, also known as virtual trading or simulated trading, is a practice where individuals or traders simulate real-life trading scenarios without using real money. Instead of placing actual trades with real capital, participants use a simulated trading platform or keep track of their trades on paper or electronically to record their buying and selling decisions.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.