How Do You Invest Using AI?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

OKX - Best crypto exchange for 2025 (United States)

AI can be used in investment in seven ways:

- Algorithmic trading: User-programmed AI algorithm for automatically executing trades

- Personal consultant: Gives personalized advice tailored to your needs

- Robo-advisors: AI-powered financial advisors that can execute trades for you

- Sentiment analysis: Assesses market trends based on information from wide range of sources

- Stock picking: AI tool for selecting stocks based on hundreds of signals and indicators

- Risk management: AI used for managing risk according to pre-set parameters

- Portfolio optimization: Portfolio management conducted by AI

Though the excitement around artificial intelligence feels like a new phenomenon, AI has been around for a long time and used in the investment sector for algorithmic trading and quantitative data analysis for decades. However, the introduction of generative AI and new AI models in recent years has begun to transform financial markets and given rise to new investment opportunities for both institutional and retail investors. With its ability to analyze massive amounts of data from a wide range of sources, and recognize patterns or trends, all at previously unimaginable speeds, 24/7, AI outpaces humans in most areas.

With all of the buzz surrounding AI, many traders and investors are either already using AI for investing, or wondering how AI can be utilized to its maximum potential. In this article, we discuss 7 ways that you can use AI to improve your trading and investing, while also looking at the advantages and disadvantages of doing so.

Can I use AI for investing?

AI has emerged as an incredible tool for increasing productivity, learning about almost anything, and streamlining almost any digital work process. Today, AI is being utilized across almost every industry. Who could’ve predicted that one of the first AI uses would be writing and making art?

Due to AI’s ability to rapidly process quantities of data incomprehensible to the human brain and generate outputs based on those inputs, it seems perfectly suited to analyzing historical market data and predicting future movements. A lot of what traders do involves analyzing past market data and trying to strategically place trades based on their interpretations, so why not optimize that process with AI?

There are of course drawbacks to using AI for investing, and AI should not be relied on as a complete substitute for human input. It functions more as a pattern recognition system, and is limited in its ability to understand context and adapt to changing market conditions. It can make mistakes, and it can’t predict the future. It does not guarantee profitability.

Nevertheless, AI has multiple uses for improving your trading and investing. We’ll be looking at seven of those uses:

Algorithmic trading

Personal consultant

Robo-advisors

Sentiment analysis

Stock picking

Risk management

Portfolio optimization

How to Use AI for algo-trading

Algorithmic trading, or algo trading, involves using computer-programmed instructions to execute trades. The advent and integration of AI has allowed algo trading to evolve significantly. AI can trawl through huge amounts of data, look for patterns, and then make predictions. And this can all be done much faster than by a human.

The instructions given to the algo trading program are usually based on quantity, timing, price, or any mathematical model. The program takes a systematic approach to trades, executing them based on a set of parameters defined by the user, using whichever form of technical analysis is coded into it. As it’s automated, it can be done rapidly with little to no slippage and no human error, at the best possible prices, and with no emotional or psychological influence.

Setting up an algo trading program using AI can be pretty complex, and usually requires at least some coding knowledge. Users creating their own AI algo trading program would need to collect data, develop the model, backtest, design an algorithm, run simulations, and implement risk management.

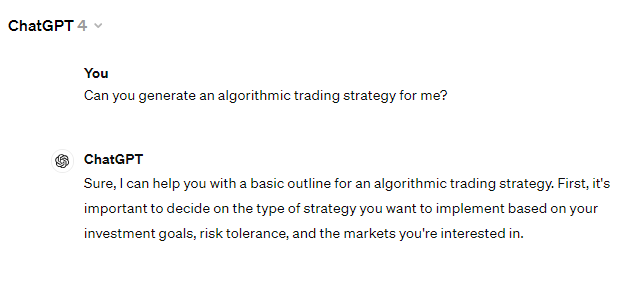

Using ChatGPT to create an algorithmic trading strategy

Using ChatGPT to create an algorithmic trading strategyPersonal consultant

One of the first uses to emerge from AI, and probably the most prominent, is as a language model. AI can answer just about any question a person can think of, and elaborate on it, giving extensive information based on the billions of pages of human knowledge across the internet. This ability makes it an unparalleled tool for learning and getting advice tailored to your needs.

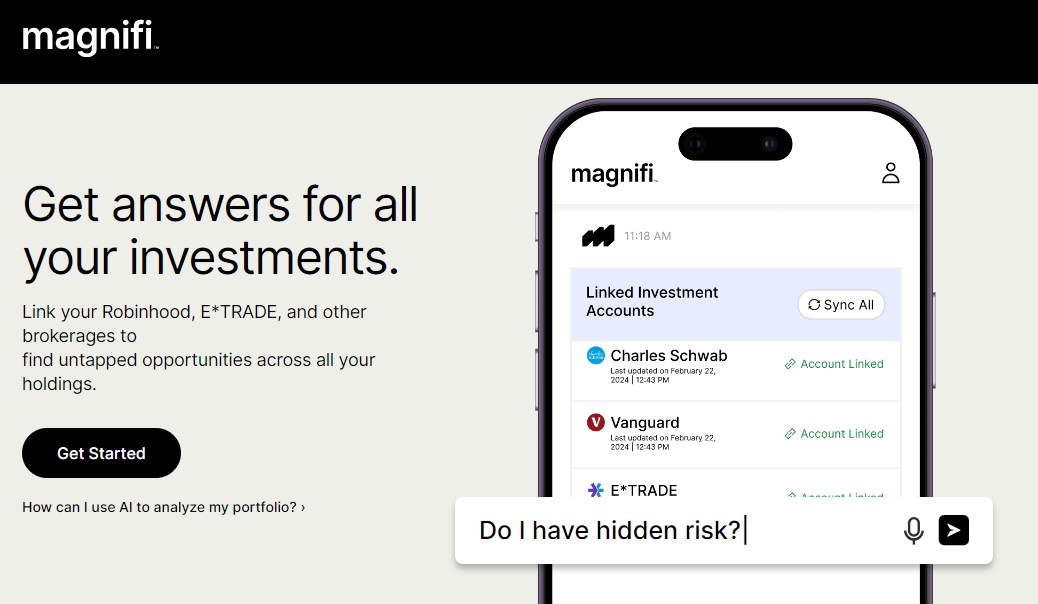

Certain AI tools have emerged that specialize in offering personalized investment advice based on a user’s needs and questions. One such tool, for example, is Magnifi. Magnifi is an AI tool designed to help you invest, by giving advice on decision-making, planning for investment goals, managing your portfolio, and learning while you invest. Drawing from its large database of over 15,000 stocks, it uses conversational AI to guide your investments. It can understand your investing personality, help to build a plan, and recommend an investment path. It can even track and analyze your investments across multiple brokerages.

Magnifi is an AI-powered financial platform designed to make investment research and execution easier

Magnifi is an AI-powered financial platform designed to make investment research and execution easierTools like Magnifi should not be confused with robo-advisors however, as they don’t automatically manage your portfolio for you.

Robo-advisors

Robo-advisors are digital AI platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Typically, when you sign up with a robo-advisor, it collects information from you about your financial situation and future goals through an online survey, and then uses the data to offer advice and automatically invest your capital.

Unlike personal AI consultants, robo-advisors can actually invest for you. The primary advantage of a robo-advisor is its ability to provide cheap and comprehensive investment management. They can analyze millions of data points and execute trades at the optimal price, manage complex investment portfolios, and monitor your account 24/7.

Robo advisors utilize AI to learn from vast amounts of financial data and improve their algorithms over time. AI has vastly improved robo-advisors’ capabilities in predicting market trends, managing risk, and building personalized portfolios based on your risk tolerance and time horizon. Best of all, AI allows robo-advisors to adapt to changes in market conditions or personal circumstances, making it a truly flexible and personally tailored tool.

We’ve put together a list of the best robo-advisors available today. You can find it here: 12 Best Robo-Advisors in 2024.

Sentiment analysis

The ability of AI to rapidly trawl through billions of sources of data and analyze text, makes it perfectly suited for assessing market sentiment. AI can analyze vast amounts of financial data, market trends, news articles, social media posts, and more, to find valuable insights that a human user might not. It can then continuously learn and adapt in real-time when these conditions change, and then forecast future movements, detect risks, and recommend optimal strategies for investing.

You can program an AI to follow specific company fundamentals and track sentiment surrounding it through social media. You could use AI to look for trending topics across multiple news sources to gauge market sentiment regarding specific industries or stocks. Being able to quickly analyze a massive range of information can help you make more informed investment decisions more effectively than if you simply followed social media and news feeds manually.

Stock picking

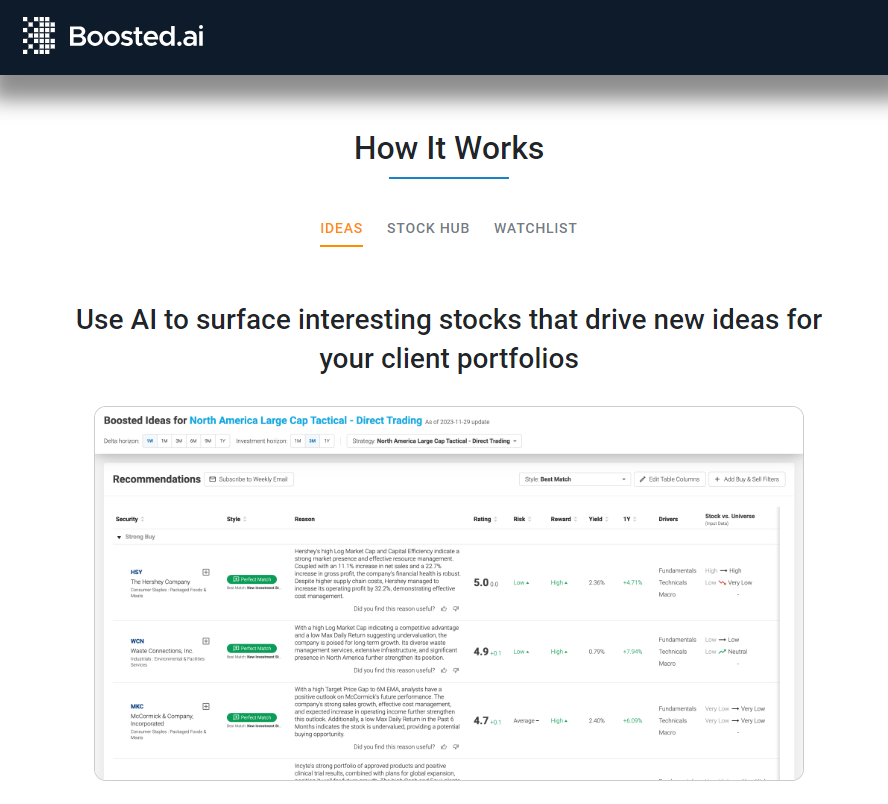

AI’s mass data analysis can also be used for picking the best stocks to invest in out of a selection of tens of thousands. Although this use case for AI is still relatively new, it’s being marketed to both retail and institutional investors by companies like Danelfin and Boosted.ai. They claim their AI tools are capable of outperforming the S&P 500, despite even stock experts not being able to do so.

AI can be used to find stocks for your portfolio

AI can be used to find stocks for your portfolioThe way their tools work is by choosing and rating stocks and ETFs. Danelfin’s mission is to “democratize the use of artificial intelligence to help everyone make better investment decisions.” Their platform uses analytics to give users scores out of 10 for stocks and ETFs that are generated by AI, even offering a free option. It uses 600 technical indicators, 150 fundamental indicators, and 150 sentiment indicators, and rates each asset based on the analysis.

However, financial experts have cast doubt on the abilities of tools like Danelfin’s AI stock picker. They say AI stock pickers will naturally perform well during preferable market conditions, but the real test will come when there’s a market downturn. Due to the recent successes seen across the world’s stock markets, that observation holds weight. Onlookers might have to wait until the global economy suffers a change in direction to really be able to gauge the success rates of AI stock pickers.

Risk management

Firms have increasingly been turning toward AI as a means to manage risk when investing. By analyzing vast amounts of data to identify patterns and trends, AI can execute trades automatically based on predefined risk parameters, such as stop-loss orders, to minimize losses. Additionally, AI algorithms can continuously monitor market conditions in real time and adjust trading strategies accordingly to mitigate risk.

AI for risk management can be implemented into many of the other AI tools mentioned in this list. For example, an algo-trading tool might use AI to determine the optimal stop-loss limit order, while a market sentiment AI model could give indicators telling you when to sell.

Portfolio Optimization

Optimizing your portfolio for diversification and risk is crucial when investing. AI has helped portfolio management to significantly evolve with the use of new AI-driven technologies. AI tools trained on historical data can use machine learning to forecast asset prices, analyze market trends, and optimize your portfolio. Natural Language Processing models can interpret human language to extract key information, understand sentiment, and allocate your portfolio accordingly. Deep learning models, such as “recurrent neural networks”, can be used for predictive analysis or pattern recognition to help achieve ideal portfolio allocation.

Best Stock Brokers

How is AI used in investment decision-making?

In the past, even before Generative AI’s introduction in recent years, AI played a big role in investment and was used for algorithmic trading and quantitative strategies to guide investor decisions. Today, AI’s role has gone much further, and is used to handle data analysis, predict market trends, assess market sentiment, and tailor investment strategies to investors. The use of AI is democratizing investing, as anyone with some capital and access to AI tools can get professional financial advice and personally tailored portfolio management.

However, AI comes with limitations and does not guarantee a profit, no matter what some firms might tell you. AI for the most part uses quantitative data and pattern analysis, but can’t predict the future and determine events that can influence markets. It can streamline trading and investing, executing trades much faster than a human could, and analyze huge amounts of data that a human couldn’t. But AI is still fallible.

Benefits of using AI in investing

Tailored: Any investment advice that an AI model gives will usually be tailored specifically to the individual investor. Picture an online investment expert that writes articles – they’d be publishing the same advice to all readers. An AI advisor on the other hand, can take into account your risk tolerance, capital, time horizon, and more, to give personalized advice suited to your needs

Speed: AI systems can scan, analyze, and interpret huge amounts of data in seconds, and then recognize patterns or trends instantly. A human could never achieve the speed that an AI could. The speed of AI reduces the risk of missed opportunities and ensures the best possible prices when investing

Emotionless: When trading or investing, it’s easy to give in to emotions like fear and greed. But unlike humans, machines don’t have feelings. When using AI for investing, its decisions are based on market conditions, technical analysis, market sentiment data, and the parameters you program into it. This means AI won’t go “chasing losses” or giving into “FOMO”, and sticks to hard, cold data

Why not use AI in investment decision-making?

Limited flexibility: Many AI models used for investing are machines with programmed instructions. Because of this, they can’t change their operations. For example, robo-advisors follow a set of rules given to them by their users and can’t adapt on their own accord. This can be limiting when compared to working with a human advisor

Lack of regulation: Regulating new technology takes time, and AI is still in its infancy. As regulators are struggling to keep up with the development of AI tech, use of AI in the investment sector could pose risks

Technical vulnerability: Vulnerability to technological glitches or cyberattacks presents a systemic risk in AI-driven investing. Malicious actors could exploit vulnerabilities in AI algorithms or infrastructure, leading to data breaches, manipulation of market data, or disruption of trading operations. Technical failures or glitches in AI systems could also result in unintended consequences or financial losses for investors

Expert Opinion

For individual traders, solutions based on big data and artificial intelligence open up many new opportunities. They can help to uncover many non-obvious trading signals and make more informed investment decisions. While AI-based solutions are not the holy grail of trading and do not guarantee success, they certainly help traders spend less time on market analysis and make it more qualitative.

Summary

AI is transforming the financial world, and with it, how investment decisions are made, both by large institutional investors and retail ones. Thanks to AI, massive troves of historical data can be analyzed, and then predictions and advice given based on market sentiment, trends, market conditions, and more. Tools that use AI can execute trades at a rapid pace with pinpoint accuracy and can do so around the clock. However, AI does come with some risks and it’s crucial to maintain at least some human input in the overall investment process.

FAQs

Is it worth investing in AI?

Yes, the artificial intelligence sector is currently experiencing explosive growth and has been for the past two years or so. The AI market is worth almost $300 billion in 2024, and is expected to grow to almost $2 trillion by 2030. In the past year alone, Nvidia, the largest producer of AI chips with an 80% market share, has seen share prices rise 213%. With the AI market expected to continue expanding, there is still a lot of investment opportunity.

Can you make money with AI trading?

Yes, AI trading bots hold promise for consistent profits, leveraging advanced algorithms and data analysis. However, their success is nuanced, influenced by factors like market volatility, strategy robustness, and regulatory challenges. While they offer potential, navigating their complexities requires strategic knowledge and risk awareness.

Is there an AI that predicts stocks?

Yes, there are AI systems that analyze huge amounts of data to predict stock market trends. These systems use machine learning to identify patterns that might indicate future movements in stock prices. For example, platforms like EquBot, an SEC-registered AI advisor, use AI to forecast returns and automatically allocate portfolios. However, AI bots should be used carefully with human input as they are not infallible.

Is it legal to use AI for stocks?

Yes, it is legal so long as it adheres to regulations surrounding market manipulation, data privacy, and rules specific to algorithmic trading. However, as AI is a relatively young and emerging market, governments around the world have yet to draft proper legislation surrounding its use, something that could change in the future.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.