Myths vs. Reality: Why Do Forex Trading Robots Fail?

| Metric | Low Risk | Medium Risk | High Risk |

|---|---|---|---|

|

Drawdown |

Up to 10% |

10% - 20% |

20%+ |

|

Sharpe Ratio |

Above 1 |

0.5 - 1 |

Below 0.5 |

|

Recovery Factor |

Above 5 |

2 - 5 |

1 - 2 |

|

Profit Factor |

Above 2 |

1.5 - 2 |

1 - 1.5 |

In Forex and crypto trading, trading bots are often seen as a golden ticket to effortless profits. Yet, reality tells a different story, with many traders facing disappointments. This discrepancy stems from various factors, including market volatility, strategy flaws, and a lack of user knowledge.

This article aims to shed light on the reasons behind the failures of trading bots and how to navigate these challenges for better outcomes. By exploring the pitfalls and offering guidance on making informed choices, we seek to help traders harness the true potential of trading bots, moving beyond myths to achieve practical success.

-

What are Forex robots?

Forex robots are automated trading systems that execute trades in the foreign exchange market based on predefined criteria or algorithms. For more details, read our article on What are Forex Trading Bots? Do they really work?

Why do trading bots fail?

Trading bots have revolutionized the way we approach the markets, offering a blend of efficiency and consistency that is hard to match with human trading. However, the path to automated trading success is fraught with pitfalls that can lead to the downfall of trading bots.

Understanding why these tools fail is crucial for any trader looking to integrate automation into their strategy.

Strategies that are too simple

Forex is an extremely complex and highly competitive market. If you want to survive in this market, don't rely on strategies that look too simple.

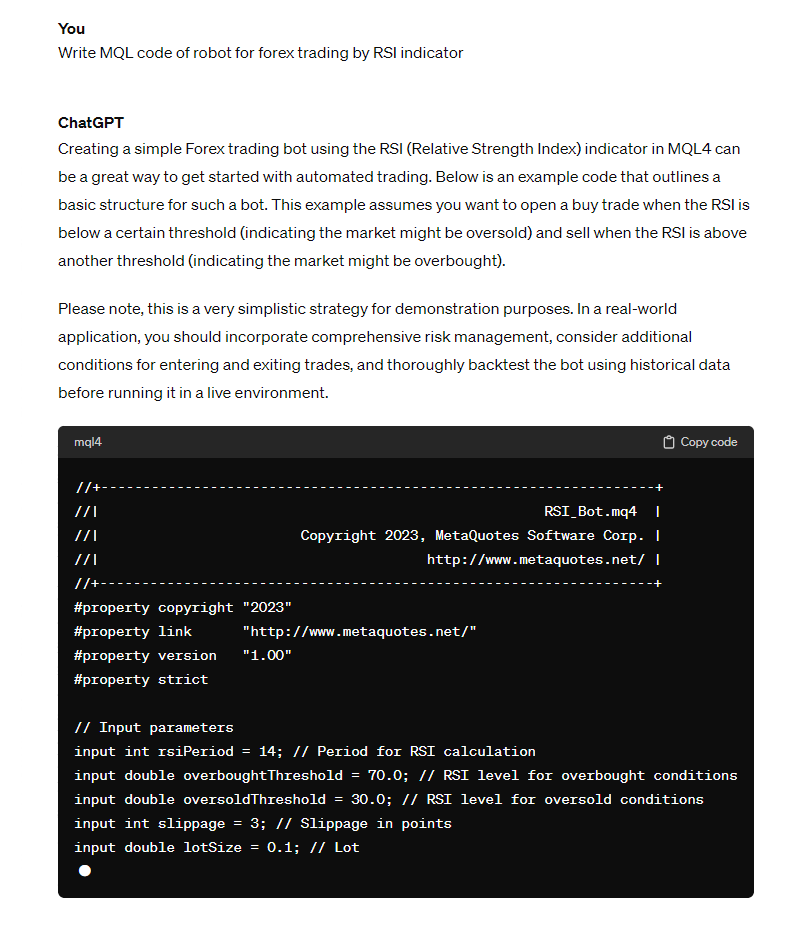

ChatGPT writes code for a Forex trading bot

With ChatGPT you can quickly create a trading bot, for example, to trade the RSI indicator. But this will not give you a trading advantage, because any of the market participants can also make such a bot.

Unsustainable core strategy

At the heart of any trading bot is its core strategy — the algorithm that dictates its trading decisions. A common misconception is that a trading bot is a set-it-and-forget-it solution.

The truth is far from it. Many bots are programmed with strategies that are not robust enough to withstand the test of time. They may perform well under certain market conditions but fail when those conditions change. The result? A strategy that was once profitable becomes a liability.

Unfavorable trading environment, market volatility

The financial markets are notoriously volatile, with conditions that can change rapidly and unpredictably. A bot programmed to follow trends might flounder in a range-bound market, while a bot designed for a quiet market could face disastrous losses when volatility spikes.

When market changes outpace a bot's programming, the bot can generate significant losses before it's manually stopped or adjusted.

Lack of understanding

Many users deploy trading bots without fully understanding how they operate. They may not grasp the strategy behind the bot, the conditions under which it performs best, or how to intervene when things don't go as planned.

This lack of understanding can lead to inappropriate use of the bot, resulting in poor performance and potential losses.

Overreliance on automation

Overreliance on trading bots is another pitfall. While automation can significantly enhance trading, it cannot replace human judgment and oversight. Market conditions often require a nuanced approach that a pre-programmed bot may not be able to provide.

Without human oversight, a bot may continue to execute its strategy inappropriately, leading to compounded losses.

Poor risk / capital management

Risk and capital management are essential components of successful trading. Some trading bots, especially those utilizing high-risk strategies like the Martingale system, can lead to ruin.

The Martingale strategy, for instance, involves doubling down on losing positions in the hope of recovering losses with a single win. While this can lead to impressive-looking gains in the short term, it can also lead to catastrophic drawdowns, exhausting the capital of the trader.

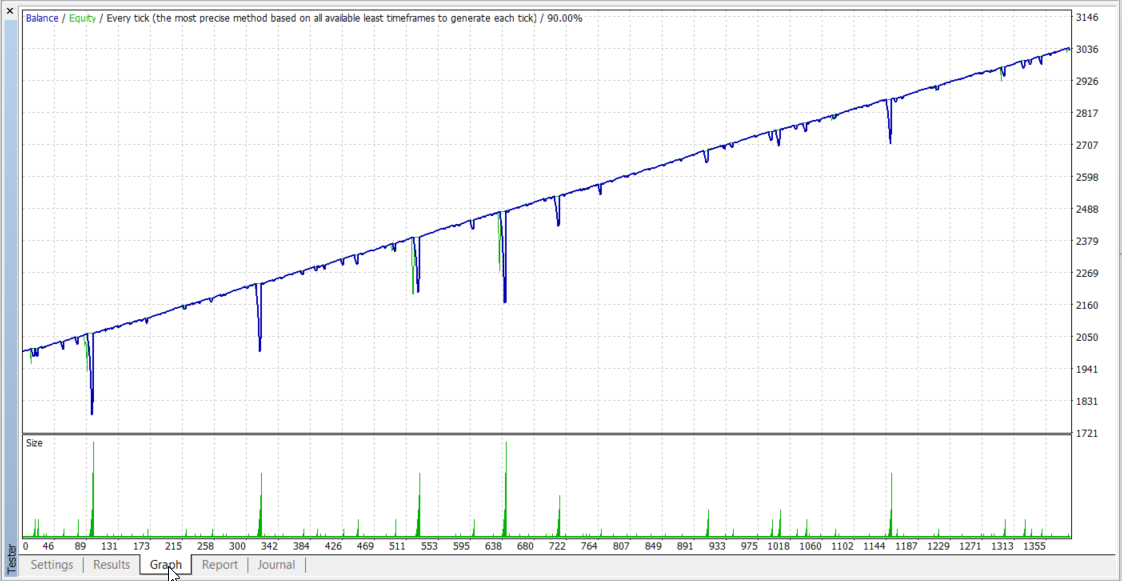

An example of a bot using the Martingale strategy, which is extremely risky and can result in catastrophic losses

Technical failures

Technical issues such as software bugs, connectivity problems, or platform outages can also lead to bot failures. A disconnection at a critical moment can prevent a bot from executing trades or managing positions, potentially leading to uncontrolled losses.

Scammers and low-quality robots

The allure of easy money has attracted numerous scammers to the automated trading space. They sell low-quality trading bots that promise high returns but are often based on over-optimized backtesting results. These bots can give the appearance of profitability for a short period, only to fail spectacularly when exposed to live market conditions.

The most expensive Forex robots

The price of the most expensive Forex robots on the MQL market (embedded in the MT4 terminal) is 30 thousand dollars. But this high figure does not mean that a trading bot is worth this money at all. And check, the seller will not be able to give you a guarantee that the robot will not turn out to be unprofitable.

Best Forex brokers for Trading With Bots in 2024

How to avoid pitfalls with trading robots

Reaping the benefits of automated trading requires more than just a set-and-forget mindset. To sidestep the pitfalls that lead to the failure of trading bots, a strategic approach encompassing research, understanding, and continuous oversight is essential.

Here’s how traders can fortify their automated trading strategies and avoid common traps:

Proper research and selection

The first step to a successful trading bot experience is the selection process. Not all bots are created equal, and thorough research is paramount. Traders should look for bots with a transparent track record, verified by independent platforms.

Trusted forums and financial software communities often rate Expert Advisors (EAs), providing a wealth of user experiences and performance data. Choose a bot with a solid reputation and a strategy that aligns with your trading style and risk tolerance.

Here is an article that will help you reduce the risks of getting a loss from forex trading with a robot: Which Free Forex EAs Are The Best?

Understanding the bot's strategy

A deep dive into the bot’s strategy cannot be overstated. It's crucial to understand the underlying principles that drive the bot's decisions. Whether it's a trend-following, mean-reversion, arbitrage, or any other strategy, knowing how your bot reacts to market conditions will empower you to set it up for success and intervene when necessary.

Continuous monitoring and adjustment

Even the most sophisticated bot requires oversight. Market conditions evolve, and so must your bot’s parameters. Regular monitoring allows for timely adjustments, ensuring the bot continues to operate within the desired risk framework. Discipline in this process helps prevent emotional trading decisions and maintains a level of control over the automated process.

Setting realistic expectations

One of the most common mistakes is expecting too much from a trading bot. It’s vital to align expectations with the bot's realistic capabilities. High-quality bots often come at a premium and for a good reason. They are typically based on more sustainable strategies and receive better support.

Conversely, cheap or free bots are widely accessible, but they may not provide the stability and performance a serious trader requires.

Building your own trading bot

For those with a technical inclination, building a custom trading bot can be an attractive option. It allows for complete customization and control. Educational resources are available that can guide through the process of building an EA from scratch. This might involve a steeper learning curve, but the payoff is a strategy that’s entirely tailored to your specifications.

If this is something that interests you, feel free to go over our article on Best Expert Advisor (EA) Builders Review.

Professional software for testing and optimization

Utilizing professional backtesting software is a must for optimizing trading bot performance. Such software can simulate a range of market conditions using historical data to test the bot’s robustness. This step is critical before going live, as it helps identify and iron out any potential issues.

Ensure technical setup

A reliable technical setup is the backbone of successful bot trading. This includes a stable internet connection, power backup solutions, and possibly a Virtual Private Server (VPS) to ensure the bot runs continuously without interruption.

Use demo versions for testing

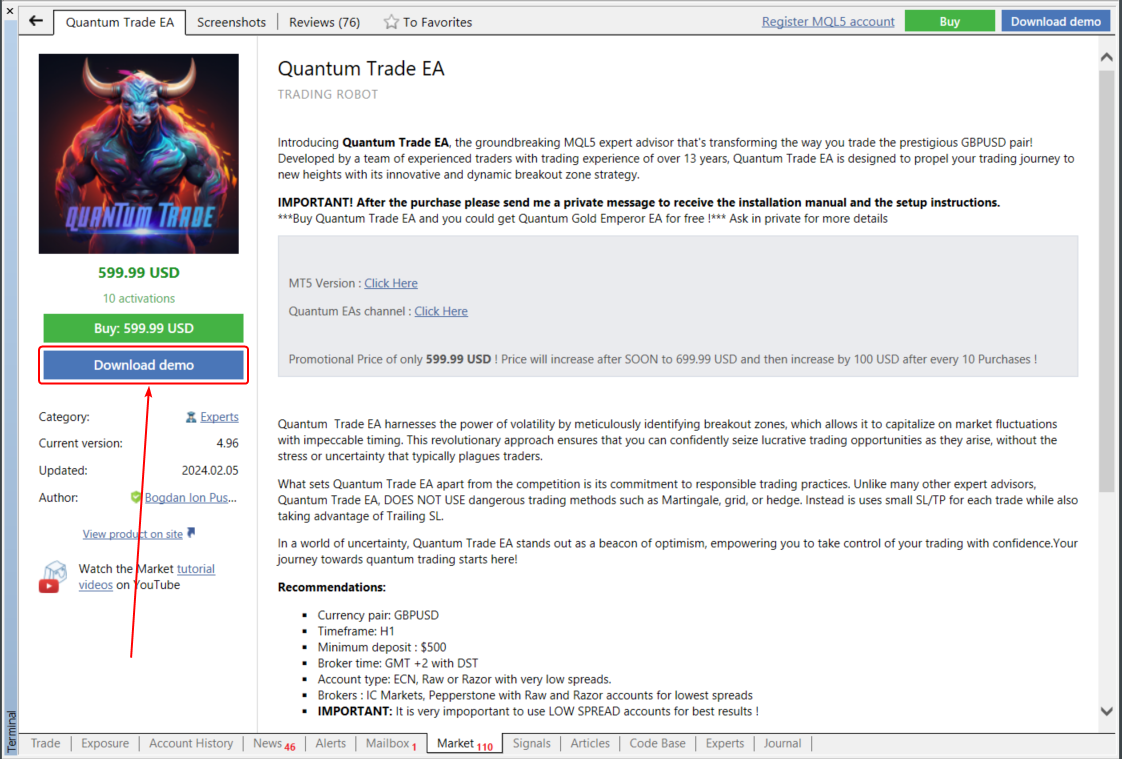

Before deploying a bot on a live account, testing it on a demo version is advisable. Many bots are available for trial on markets like the MQL market. This practice phase helps to familiarize with the bot’s behavior in real-time conditions without risking actual capital.

Use forex bot demo versions to reduce the risk of failure

You should not fully trust the results of tests conducted by other traders using a particular trading bot. Publishing the results without real access to monitoring of the trading account where the test was conducted may be a common advertisement. You need to perform the tests yourself and on the platform of the broker where you intend to use the trading bot.

In the process of testing you will be able to determine the optimal parameters of the trading bot taking into account the technical conditions of the broker and the level of your risk tolerance.

By adhering to these guidelines, traders can significantly reduce the risk of bot failure, turning a potential liability into a potent tool in their trading arsenal.

Conclusion

While trading bots present an opportunity for enhanced trading performance, they require a balanced approach of informed decision-making and cautious operation.

The use of any trading bot on a real account is allowed only after consistently profitable results of testing on a demo account in various trading conditions with high risk management requirements.

Conducting thorough research, understanding strategies, and maintaining diligent oversight allows traders to mitigate risks.

It's important to set realistic expectations and commit to continuous learning and adjustment. With these practices, trading bots can become valuable tools in a trader's arsenal, contributing to a more strategic and disciplined trading experience.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

-

4

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

5

Expert Advisor

An Expert Advisor (EA) is a piece of software or script used in the MetaTrader trading platform to automate trading strategies. EAs are programmed to execute trading decisions based on predefined criteria, rules, and algorithms, allowing for automated and systematic trading without the need for manual intervention.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).