In Which Month Should You Buy EUR?

The best month for trading EUR/USD, according to historical data, is November to December, or in February when it's cheapest. Based on average prices and price movements from 2002 to 2024, the biggest increase in price tends to be from November going into December, and the highest average price is in December. The lowest price is in February, and the biggest price decrease is from January to February.

When you’re trading Forex, one of the most influential factors in whether your trades will succeed is timing. The exact time and day you enter a trade will see varying liquidity, volatility, and market conditions. As timing is so important, Forex traders may wonder if there is a specific time of year that’s preferable for buying certain currency pairs, such as the EUR/USD.

In this article, I’ll be investigating that question. I use historical price data and some basic analysis to look at which month EUR/USD price is highest, and which month has the biggest EUR/USD price increase.

-

What is the highest EUR to USD ever?

The highest euro to US dollar rate ever was achieved in July 2008, when it hit 1.6038. That means the price of buying one euro was, for a very short time, $1.6038, due in part to the US dollar sinking during the 2008 financial crisis, and the European Central Bank raising interest rates.

-

Which is the best time to trade in EUR/USD?

EUR/USD trading should be done during the New York and London Forex market session hours, which are from 7:30 AM to 3:30 PM (GMT) and 1 PM to 9 PM (GMT), respectively. The ideal time is during the overlap of the two market sessions, which occurs from 1 PM to 3:30 PM. Read about the ideal times in more detail here: The best time to trade EUR/USD on Forex.

-

What happens when you buy EUR/USD?

When you buy EUR/USD, you are essentially going long on the euro and short on the US dollar. This means you believe that the euro will appreciate in value relative to the US dollar. If the value of the euro increases compared to the dollar after you’ve made the purchase, you’ll make a profit. Conversely, if the euro depreciates relative to the dollar, you’ll incur a loss.

-

Which month EUR/USD rate is low?

There isn’t really a specific month where the EUR/USD is ‘low’. To calculate the average EUR/USD price each month, we collected the average price of the pair for each month from 2002 to 2024. As the analysis shows, the price of the euro usually goes down in January, August and October. But the actions of the past do not necessarily have to be repeated in the future.

What Is the best time of the year to buy Euro?

Figuring out when the best time of the year is to buy the EUR/USD pairing is no easy undertaking. If you’re knowledgeable about Forex, you’ll know that an almost uncountable number of factors can influence prices, from inflation rates to Central Bank policies. This makes it almost impossible to predict how markets will behave month to month.

Nevertheless, we can use past historical data and take a mathematical approach to calculating when is the best month of the year to trade EUR/USD. We can look at the average price of the currency pair each month since the euro first started trading, and then calculate the percentage price change from month to month. That’s exactly what I’ve done here.

This approach provides an objective method to analyze historical data without relying solely on subjective interpretations or opinions. It should help to identify recurring patterns or trends in the EUR/USD exchange rate over the years, and identify the months with historically higher or lower average price changes. This can lead to better-timed trades.

Here’s how I did the calculations:

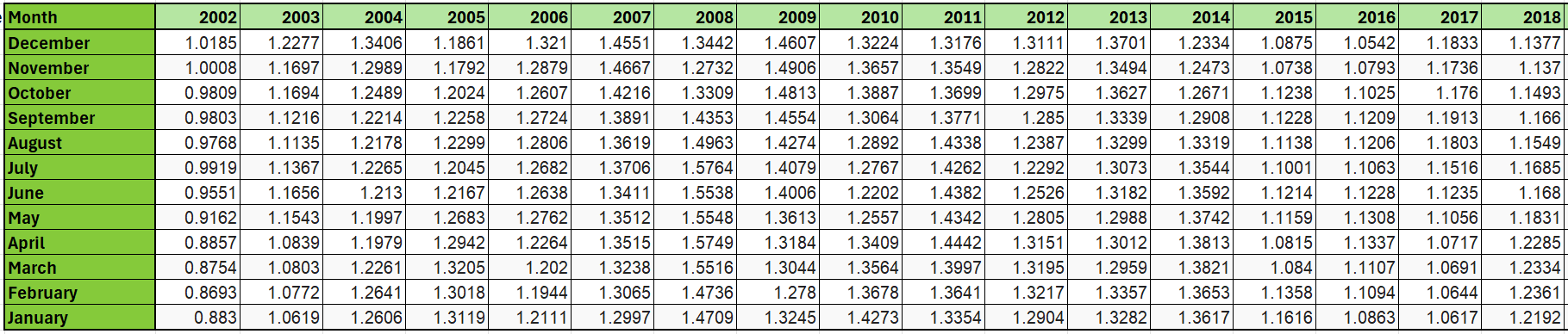

First, I gathered data on EUR/USD prices for each month from 2002 to 2024. I took the average price for each individual month and put them into a spreadsheet.

Calculation of the average monthly % change in EUR/USD. Step 1.

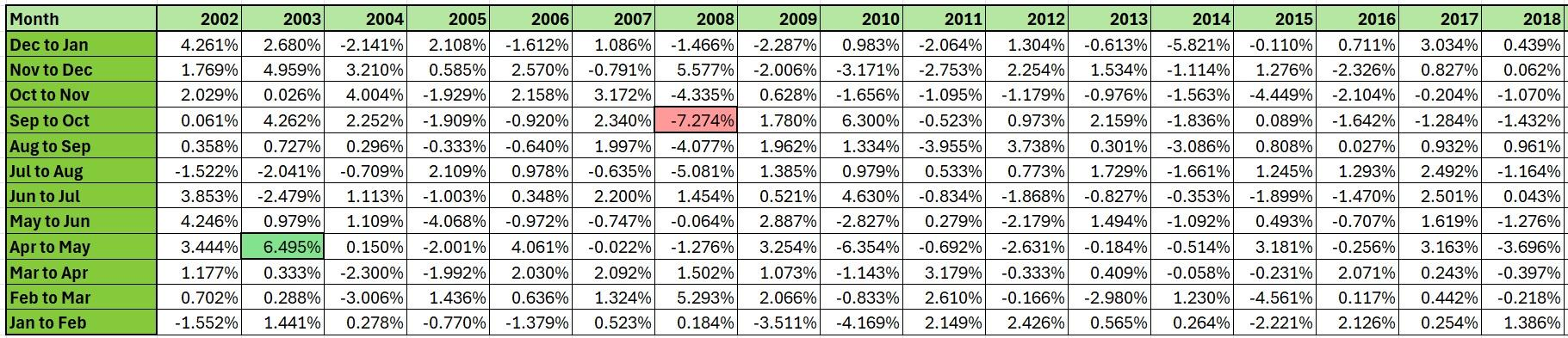

After that, I calculated the price change as a percentage from month to month. As you’ll see from the table, price changes each month ranged from decreases of as much as -7.274% and increases of up to 6.495%. These price changes occurred from April to May, and September to October. We can see that average monthly price changes can fluctuate significantly.

Calculation of the average monthly % change in EUR/USD. Step 1.

Lastly, I calculated the average price change across the same month from 2002 through to 2024. The results can be seen in the chart below.

Average Monthly % Change of EUR/USD

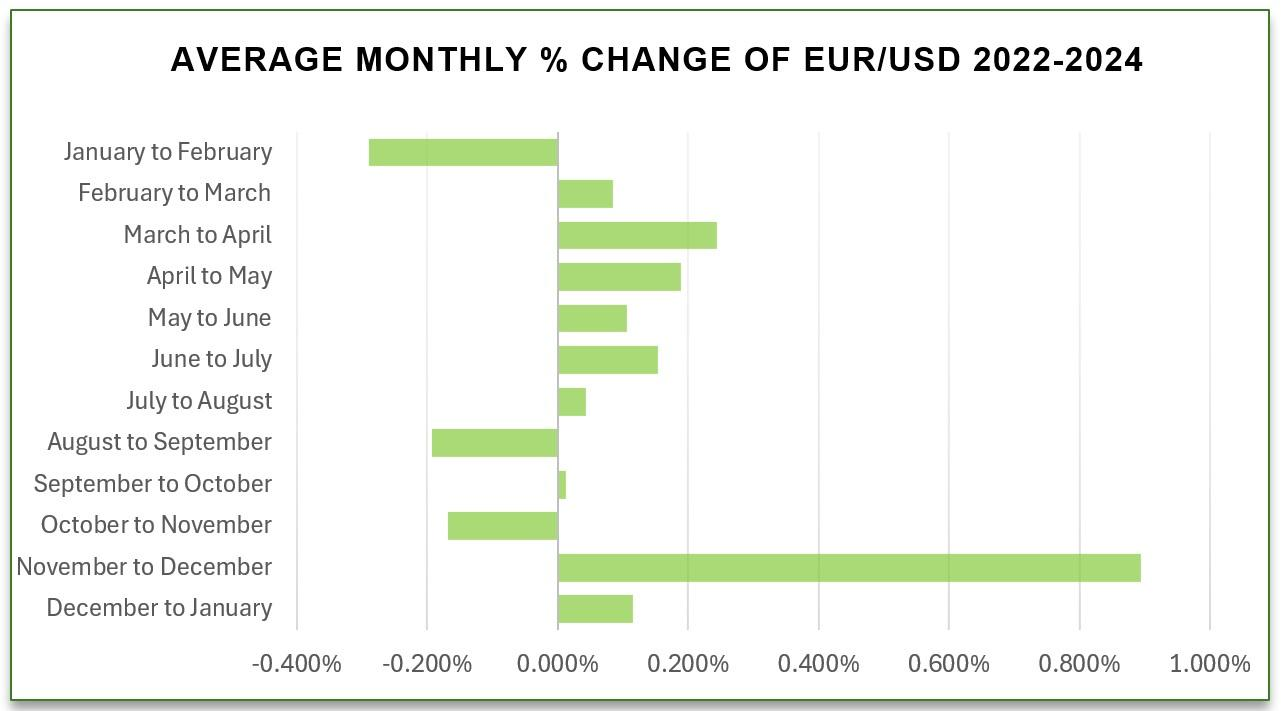

So, what information can we glean from the data above? Because of how averages work, the chart doesn’t represent the larger price changes from month to month, so all price changes are in the range of -0.29% to +0.894%. We can see that on average, from 2002 to 2024, November into December saw the biggest price increases. January going into February saw the biggest price decrease overall.

Based on this data, the best time of year to buy the EUR/USD currency pair would be in November, going into December. Bear in mind that these numbers are based on averages. That means that the price could be low in early November, then high in late November, then drop in early December but rise again in late December, and still lead to a higher price change based on the price averages for each month. This chart does not guarantee a price increase from November to December.

According to TU expert Oleg Pylypenko traders could also buy EUR/USD when it reaches its lowest, which tends to be in February. Past data shows an average price of 1.2080 for February, the cheapest price of the year. This could be an optimal time to buy the pair.

There are several possible explanations for the data we see here:

-

Year-end trading: Many traders and investors close their positions or adjust their portfolios as the end of the year approaches. This can result in higher demand for euros relative to the dollar, driving up the EUR/USD price.

-

Holiday season: The holiday season in November and December often sees increased consumer spending and economic activity in the Eurozone, which can boost the euro's value against the dollar.

-

Seasonal factors: Seasonal trends or patterns can influence currency markets, although these are often not consistent or predictable. Factors such as year-end corporate transactions, repatriation of profits, or portfolio rebalancing by institutional investors can contribute to the upward movement of the EUR/USD price during this period.

In summary, the tendency for the EUR/USD price to increase on average toward the end of the year, yet decrease at the start of the new year, is likely attributable to seasonal factors and changes in end-of-year supply and demand.

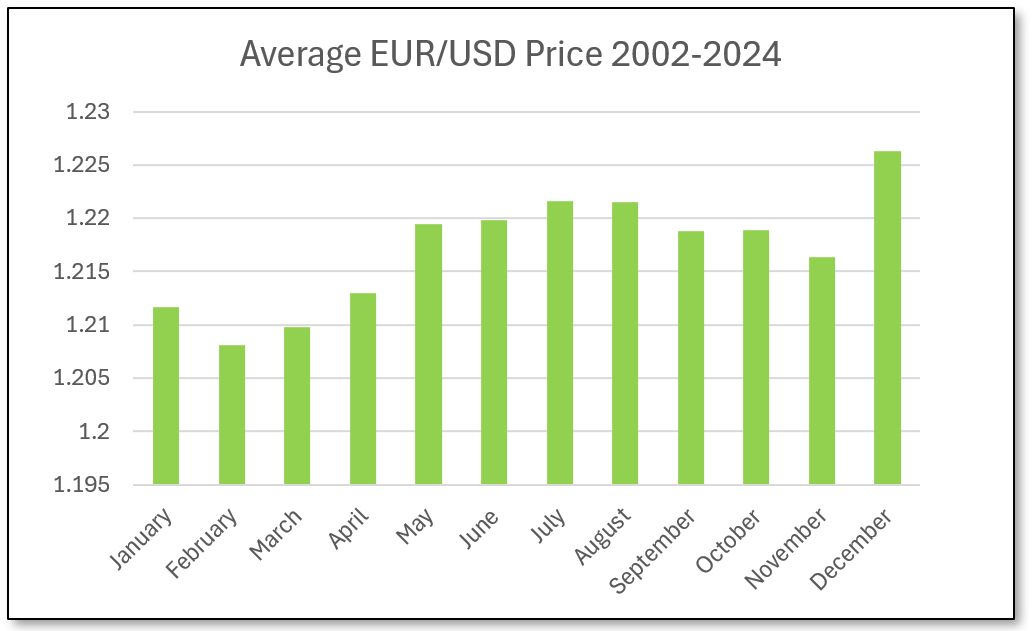

What month is EUR/USD most expensive?

In order to answer this, I calculated the average monthly price of EUR/USD from 2002 to 2024. Though the difference in prices wasn’t significant, there was a clear pattern. Prices tended to be highest in December, and lowest in February. The numbers are consistent with the price change data found in the previous section, and show that EUR/USD is most expensive in December, with an average price of 1.2263. EUR/USD price is usually lowest in February, at an average of 1.2080.

Average EUR/USD rate by months

Best Forex Brokers

Will Euro USD go up or down?

Making accurate predictions on whether EUR/USD will go up or down poses challenges, though there are current influential factors we can look at that could have an impact on price movements.

-

MUFG: Foreign exchange analysts at Mitsubishi UFJ Financial Group predict an end-of-2024 rate of 1.12 due to rate cuts by the Fed.

-

Credit Agricole: The French international banking group expects the price to drop to 1.05 as a result of economic uncertainty in the Euro-Zone.

-

ABN Amro: The Amsterdam-based Dutch bank expects the Fed and European Central Bank to cut interest rates in the coming months, leading EUR/USD rates to stay close to current levels, ending the year at 1.10.

Experts and analysts at Traders Union conduct daily price analyses and forecasts. You can see those here: EUR USD forecast – Analysis, Rate & Chart.

Conclusion

In summary, if you’re looking to time your buying of EUR/USD at the optimal time of year, November to December may be the best time. From 2002 to 2024, on average, the pairing’s price increased 0.894% from November to December. Prices on average were highest in December in the same period. Bear in mind that due to how averages work, buying EUR/USD in November does not guarantee success. The exact timing of your trade should still incorporate technical and fundamental analysis and consider the broader market conditions. Make sure to do your own research before investing your capital.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

5

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).