Best Place To Set A Stop Loss Order

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

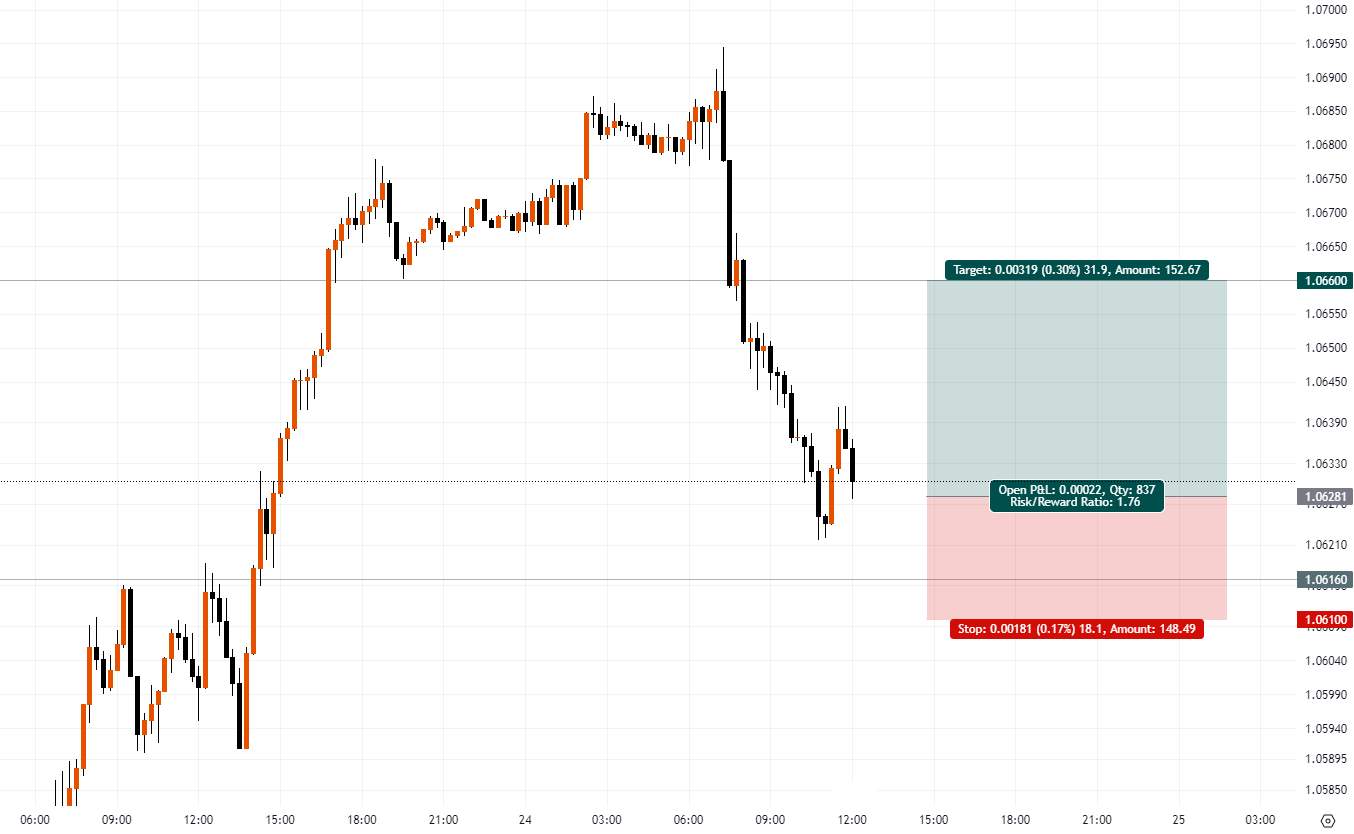

A stop-loss order should be placed at a strategic point where it allows for normal market fluctuations but protects you from significant losses. The best place to set your stop-loss depends on various factors such as market conditions, trading strategy, and risk tolerance.

Understanding where to set your stop-loss can significantly impact your trading success. A correctly and timely set StopLoss is 50% of success in any deal.

Where is the best place to set your stop loss?

A stop-loss order is an instruction to close a trade at a predetermined price level to prevent further losses.

| Type | Description |

|---|---|

| Fixed Stop-Loss | Set at a specific price or distance from entry. |

| Trailing Stop-Loss | Moves with the price to lock in profits. |

To find the best place to set your stop loss, use the following methods:

Fixed pip stop-loss. Setting a stop-loss based on a fixed number of pips from the entry price is straightforward and easy to implement. For example, setting a stop-loss 20 pips away from your entry point.

Support and resistance levels. Placing stop-loss orders just beyond key support or resistance levels helps avoid premature exits caused by minor price movements. For example, if you are trading the EUR/USD pair and identify a support level at 1.18 and a resistance level at 1.22, you can place your stop-loss order just below the support level (e.g., 1.17) if you are in a long position or just above the resistance level (e.g., 1.23) if you are in a short position. This strategy helps protect your position against false breakouts and normal market fluctuations.

Moving averages. Using moving averages to determine stop-loss placements helps avoid stop-loss runs. For example, setting a stop-loss slightly below a 50-day moving average.

ATR (Average True Range). The ATR indicator measures market volatility. A higher ATR suggests setting a wider stop-loss, while a lower ATR indicates a tighter stop-loss.

Price patterns and formations. Setting stop-loss orders based on price patterns, such as pin bars or head & shoulders, helps align your stops with natural market movements.

Time-based stops. Implementing time stops involves closing trades after a set period if the price does not move as expected.

Tips for beginners

For beginners, it's important to focus on simple strategies and foundational knowledge. Use:

Simple strategies. You should start with fixed pip and support/resistance strategies as they are straightforward and easy to understand.

Risk management basics. Basic risk management techniques, such as setting appropriate stop-loss levels and understanding market volatility, are essential for beginners.

Educational resources. Learning from demo accounts and educational materials is crucial for beginners to build confidence and knowledge.

Here you could find a comparison table of brokers offering demo accounts for risk-free training and other useful options.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

PAMM |

No | 1 | No | No | No |

|

Cent |

No | No | No | No | No |

|

Investor protection |

€20,000 £85,000 SGD 75,000 | £85,000 €20,000 €100,000 (DE) | £85,000 SGD 75,000 $500,000 | £85,000 | $500,000 £85,000 |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Risks and warnings

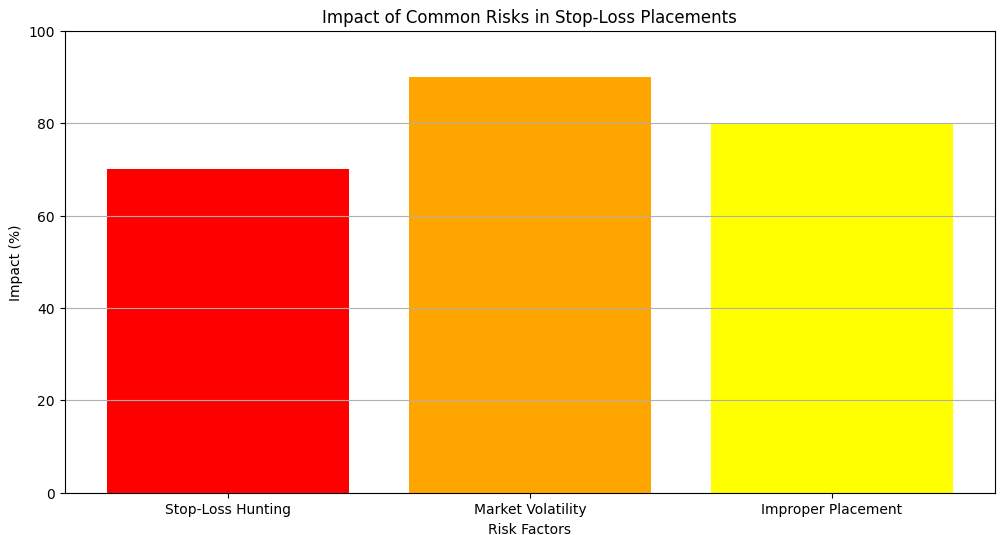

Stop-loss hunting

One of the common risks associated with stop-loss orders is stop-loss hunting. This occurs when large traders or institutions manipulate the market to trigger stop-loss orders set by retail traders. For example, if many traders have placed their stop-loss orders just below a key support level, large traders might push the price down to that level to trigger these stop-losses, allowing them to buy at a lower price.

Market volatility

Market volatility can significantly impact stop-loss orders. In highly volatile markets, prices can fluctuate wildly, triggering stop-loss orders unnecessarily. For instance, during economic announcements or geopolitical events, the market might experience sharp price movements that hit your stop-loss levels, resulting in premature exits from your trades.

Improper placement

Improper placement of stop-loss orders can lead to frequent losses. If your stop-loss is set too tight, minor fluctuations can trigger the stop-loss, leading to unnecessary losses. Conversely, if it's set too wide, it may not protect against significant losses. For example, setting a stop-loss 5 pips away in a market with high average true range (ATR) is likely too tight.

Relying solely on one method for setting stop-losses is risky. It’s essential to diversify your strategies and continuously learn and adapt to changing market conditions. For example, combining technical analysis with fundamental analysis and market sentiment can provide a more comprehensive approach to setting stop-losses.

Setting your stop-loss, consider key technical levels such as support and resistance

Setting stop-loss orders is not just about avoiding losses but also about maintaining discipline and sticking to your trading plan. Here’s my professional advice on best practices for setting stop-loss orders based on current market conditions and trading goals.

When setting your stop-loss, consider key technical levels such as support and resistance. Placing your stop-loss just beyond these levels helps avoid premature exits due to minor price fluctuations.

It's essential to align your stop-loss strategy with your overall trading goals. If you’re a short-term trader, you might use tighter stop-loss levels to quickly exit losing trades and preserve capital for other opportunities. On the other hand, long-term traders might set wider stop-losses, giving their trades more room to develop and avoid being stopped out by short-term market noise.

Remember, setting stop-loss orders should be a part of your risk management strategy. Never trade without stop-loss, as it’s essential to limit your potential losses and protect your trading account from significant drawdowns. It’s also important to review and adjust your stop-loss levels regularly based on market conditions and your evolving trading strategy.

Conclusion

Setting the best place for your stop-loss is essential for effective Forex trading. It helps you manage risk, protect your capital, and avoid emotional trading decisions. By understanding various methods such as fixed pip stop-loss, support and resistance levels, moving averages, and ATR, you can tailor your strategy to fit market conditions and your risk tolerance.

For beginners, simple strategies like fixed pips and using support/resistance levels are a good start. As you gain more experience, advanced techniques such as using ATR or algorithmic trading can enhance your stop-loss strategy. Remember, regular review and adjustment of your stop-loss settings based on market research and performance is important. Stay disciplined, avoid common mistakes, and always be prepared to adapt your strategy as market conditions change.

FAQs

Should I use automated stop-loss tools as a beginner?

Yes, automated stop-loss tools can be very helpful for beginners as they help manage trades without the emotional bias. They ensure that your trades are closed at the predetermined levels, protecting your capital and helping you stick to your trading plan.

Can I change my stop-loss after placing a trade?

Yes, you can adjust your stop-loss order as the trade progresses. Traders often move their stop-loss to break even or to lock in profits as the market moves in their favor.

How do moving averages help in setting stop-loss orders?

Moving averages help smooth out price data to identify the trend direction. You can place your stop-loss just below a moving average in an uptrend or above it in a downtrend, which helps avoid stop-loss runs due to short-term market noise.

Can stop-loss orders be used in all types of trading markets?

Yes, stop-loss orders can be used in various markets, including Forex, stocks, commodities, and cryptocurrencies. The principles remain the same, though specific strategies may vary.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Stop loss hunting is an unethical strategy used by notorious traders to gain from the market at the cost of retail traders. They achieve this by driving the asset's price to a point where most traders have set their stop losses.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.