How Call And Put Options Work In Binary Trading

Binary options allow traders to receive fixed payouts at fixed risk:

-

Call options: if the trader assumes that the price of the underlying asset will be higher after a certain time.

-

Put options: if the trader assumes that the price of the underlying asset will be lower after a certain period.

In Binary trading, Call Options give you profit if an asset's price goes above a set level, signaling optimism. Binary Put Options pay when the price falls below, reflecting a bearish view.

Traders choose call options when anticipating price increases and put options for expected decreases. The simplicity of binary options lies in predicting whether the asset's price will be above or below the specified level at the option's expiration.

This article explores the fundamental concepts of Binary Call and Put Options, their characteristics, differences, and how they function in the world of binary trading.

Start trading binary options right now with Pocket Option!-

What is a call put in binary options?

In binary options, a call is a prediction that an asset's price will rise, while a put anticipates a price drop.

Binary Call Options

Binary Call Options are financial derivatives that provide traders with the opportunity to speculate on the upward movement of asset prices. In binary trading, a Call Option pays out a fixed amount if, at the option's expiration, the underlying asset's price is above a predetermined strike price. This indicates a bullish outlook, where the trader expects the asset's value to rise.

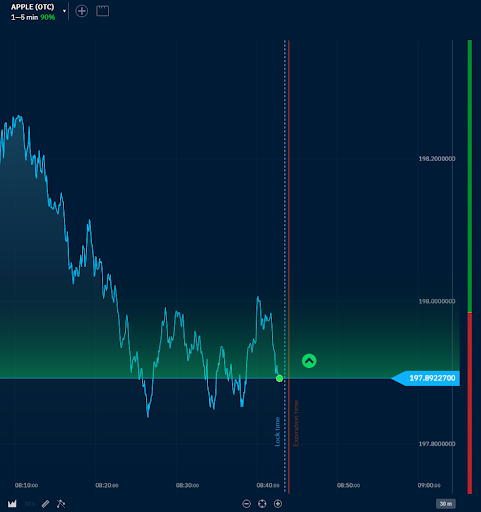

An example of how a call option works in binary trading

Example: Let's consider a binary call option on AAPL (Apple) stock with a strike price of $197.89 and an expiration time of one minute. If, at the end of the minute, the AAPL stock price is above $197.89, the binary call option would pay a fixed predetermined percentage on your investment amount, (which is usually 70-85% of the option cost). However, if the stock price remains below $197.89, the option would expire worthless, and the trader would incur a loss equal to the initial cost of purchasing the option.

Binary Put Options

Binary Put Options are financial instruments in binary trading that allow traders to speculate on the downward movement of asset prices. A Binary Put Option pays out a fixed predetermined amount if, at the option's expiration, the underlying asset's price is below a specified strike price. This reflects a bearish outlook, indicating the trader's expectation of a decline in the asset's value.

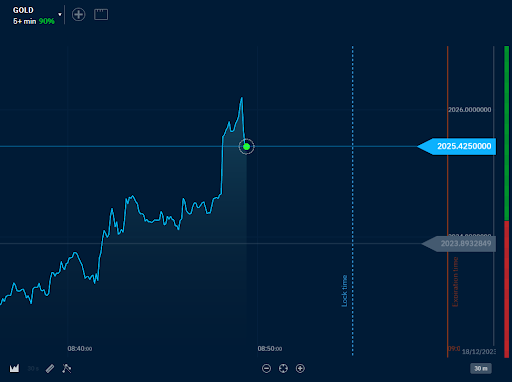

Example - Consider a binary put option on Gold with a strike price of $2025.42 and an expiration time of 10 minutes.

An example of how a put option works in binary trading

Let's say you buy a call option worth $100 and payout ratio = 90%.

If the price of gold is below $2025.42 in 10 minutes, you will be paid a fixed amount of $90 on the binary put option. However, if the price of gold is above $2025.42, the option will be worthless, resulting in a loss equivalent to the cost of buying the option ($100).

Best binary options brokers

Comparison of call and put options

Similarities

Binary Nature: Both Call and Put Options in binary trading have a binary outcome. They either result in a fixed payout if the condition is met or expire worthless if it is not.

Expiration Time: Both options have a predetermined expiration time, and the outcome is based on the asset's price at that specific moment.

Fixed Payout: In successful scenarios, both options offer a fixed predetermined payout, providing clarity on potential profits. Similarly, both put options and call options offer a fixed risk that is equal to the value of the option.

Extra fast earning opportunities: Since in binary options, the expiry time can be as short as one minute, you can quickly increase your capital. Of course, if you can predict the price accurately enough for the near future. For understanding effective binary trading strategies, we recommend reading: Best Binary Option Strategies.

Differences

| Aspect | Call Options | Put Options |

|---|---|---|

Market Outlook |

Signal a bullish outlook, anticipating that the asset's price will rise above the predetermined level. |

Reflect a bearish outlook, expecting the asset's price to fall below the predetermined level. |

Profit Direction |

Profit when the asset's price increases. |

Profit when the asset's price decreases. |

Strike Price Relation |

Succeed when the asset's price is above the strike price. |

Succeed when the asset's price is below the strike price. |

Decision Criteria |

Chosen when anticipating price appreciation. |

Selected when expecting price depreciation. |

Risk/Reward Ratio |

Limited risk, limited reward. |

Limited risk, limited reward. |

Tips for novice put and call option traders

-

Understand Risk-Reward Ratio: Assess the potential reward against the risk before entering a trade.

-

Limit Investment Percentage: Avoid investing a significant portion of your capital in a single trade.

-

Stay Disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotions.

-

Use Hedging Strategies: Consider using options to hedge against potential losses in your portfolio.

Want to try to start a career as a binary options trader? Here's what you need to know for a successful start: How to start binary trading for beginners

Summary

A binary options trader buys a Call option if he has a bullish view of the near future (1 minute to 1 hour or more) of the market. If the vision is bearish, he buys a Put option. If the time shows that the trader is right, he receives a predetermined profit, which is usually from 70 to 95% of the option value.

Glossary for novice traders

-

1

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

2

Binary options trading

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.

-

3

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

Extra

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).