As a chief expert at Traders Union, my primary concern is the interests of our website’s readers, and how to help them preserve capital and prevent loss.

Therefore, before you read this article, in which we looked into the best proprietary trading firms, I would like to warn you about the specifics of working with prop firms that promise funding for traders.

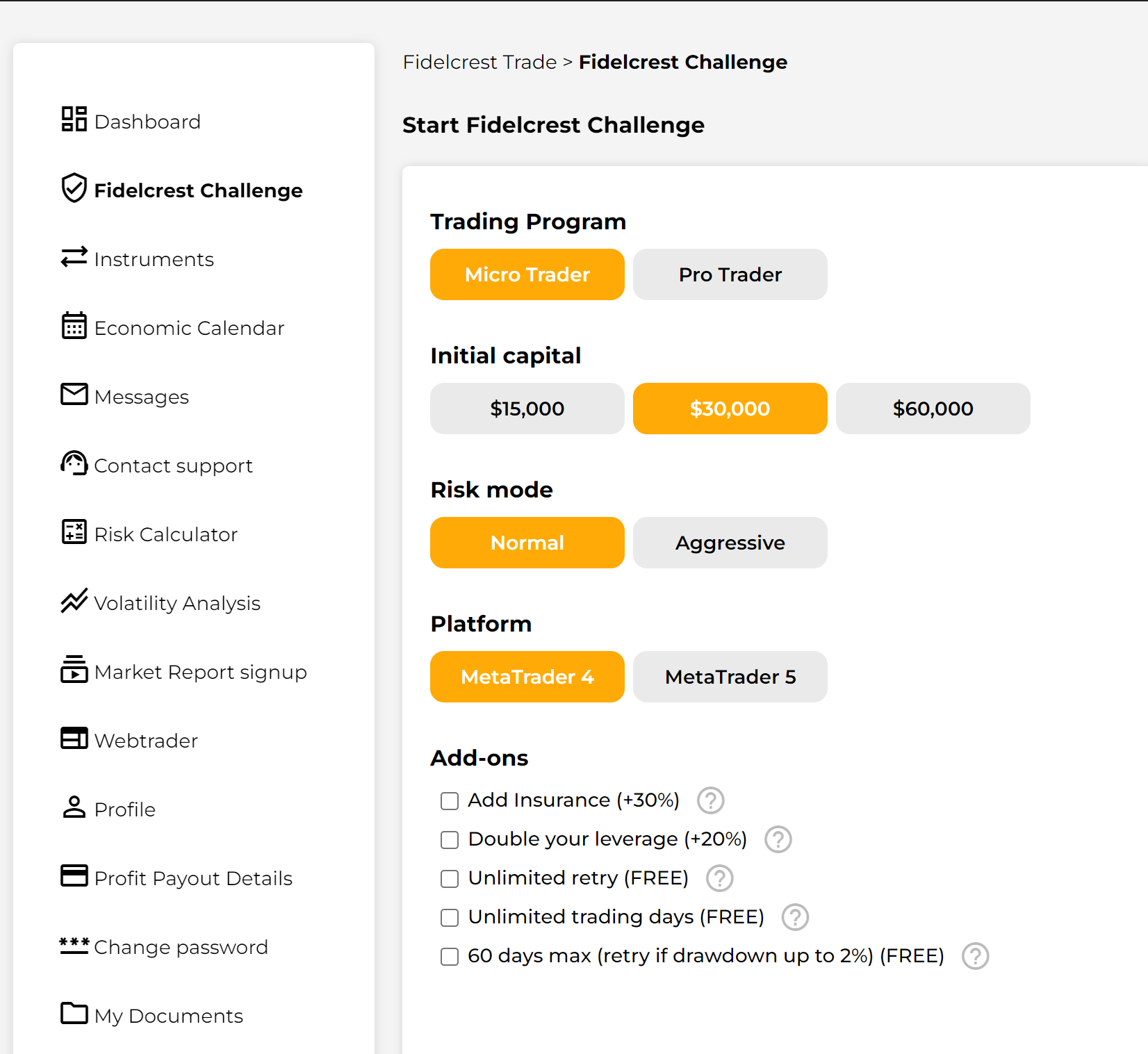

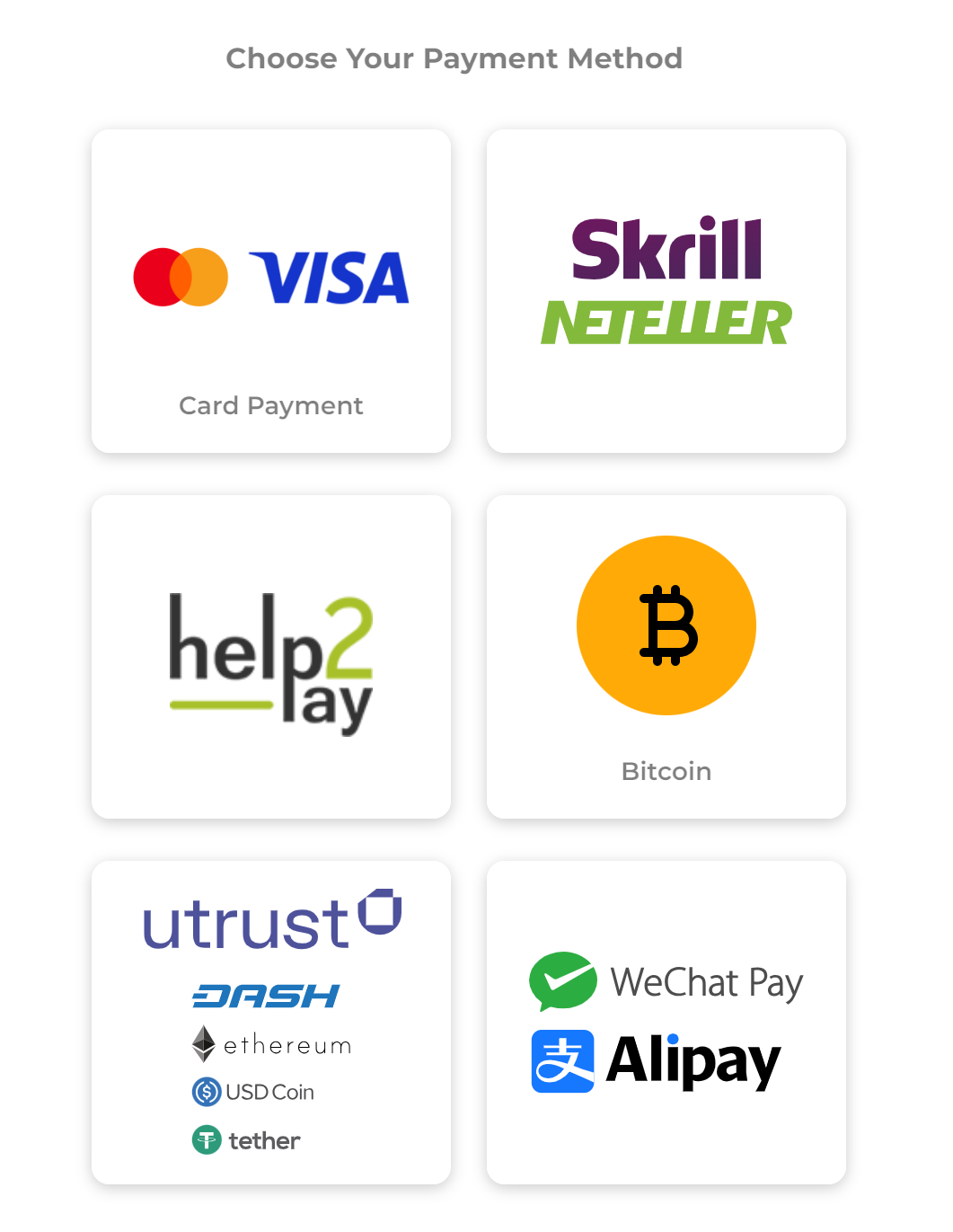

Our research shows that people mostly lose money with these firms, failing to pass the testing stage (challenges). Those who do get the funding are likely to still lose money upon failing to meet certain conditions of the agreement with many hidden clauses. Often, proprietary trading firms make their money not from their share of profits of successful traders, as their websites claim, but from the fees users pay for testing. The funding in itself is essentially nothing more than leverage for you, which licensed brokerages also offer.

This is why I advise against using prop firms, and working with licensed Forex brokers instead. Once you learn to earn stable profit with a real broker, you won’t need to look for a prop firm, because you will be doing well on your own.

Here are several brokerage companies I can recommend: