Forex Trading Industry Statistics and Facts

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Currencies of different countries increase or decrease in value in relation to each other. These relative upward and downward movements give traders an opportunity to make profits, and that is what forex trading is about. Unlike how other securities such as stocks operate, forex trading involves the use of currency pairs like JPY/GBP (which represents the Japanese Yen against the British Pound) and EUR/USD (which represents the euro against the US dollar).

So, forex trading simply has to do with selling one currency for another so you can make profits if the currency you sold goes down against the one you bought. If you’re interested in trading in the foreign exchange market, then it’s important to know some key facts about forex.

The global forex market size was $2.4 quadrillion in 2022. The forex market has a daily turnover of $7.5 trillion according to data pulled from sources in 2022.

Forex trading in facts and figures

If you are currently doing research on the financial markets, then consider these 15 important facts and figures about forex.

The biggest financial market in the world is the forex market which is currently worth about $2.4 quadrillion.

The forex market has a daily turnover of $7.5 trillion according to data pulled from sources in 2022.

There are currently 170 different currencies being traded in the forex market.

85% of traders use MT4, making it the biggest trading platform. MT5 is the second-ranking platform that has 6% of traders using it.

The most popular currency in the forex market is the US dollar which powers more than 88% of trades worldwide. The Euro is the second-ranking currency, followed by the Japanese Yen, British Pound, Australian Dollar, Canadian Dollar, and Swiss Franc in that order.

The forex market is always open 24/7 from 5 PM EST on Sunday to 4 PM EST on Friday. But the trading occurs across different marketplaces at different time zones in four major sessions (also called segments).

Currency pairs that get traded the most are classified as Majors. These currency pairs are 7 in number and all have the US dollar as a quote or a base. They include AUD/USD, USD/CAD, NZD/USD, USD/JPY EUR/USD, GBP/USD, USD/CHF.

More than 67% of the daily trading volume in the forex market involves the majors.

Currency pairs without the US dollar either as a quote or a base are classified as Minors. Some include EUR/NZD, EUR/GBP, GBP/JPY, GBP/AUD, CAD/JPY, etc.

The number of online forex traders around the globe is around 13.9 million. 3.1 million traders are based in Europe, with 1.6 million in North America and 4.6 million in Asia.

Every month, 9-20 trades are opened by 41% of traders on average.

14% of traders spend at least 6 hours on forex trading, while 45% spend anywhere from 1 to 2 hours trading online.

The biggest forex broker in the world is IC Markets based out of Australia. This broker records $18.9 billion in average trading volume every day.

Of all the forex traders, only 7% have actively traded for more than 10 years. 23% have traded for 4 to 9 years, 39% have traded for 1 to 3 years, and 31% have traded for less than 12 months.

No single exchange market controls the international forex trading scene. Rather, the forex market has brokers and exchanges interacting, and the active trading hours for the markets depend on the time zone. These timezones are always overlapping, so each region has its official trading session as follows: New York from 8 AM EST to 5 PM EST, Tokyo from 7 PM EST to 4 AM EST, Sydney from 4 PM EST to 1 AM EST, and London from 2 AM EST to 11 AM EST.

What is Forex and how does it work?

Forex refers to the trading of global currencies in an exchange market. The forex market is known to be the world’s most liquid financial market. As a trader, you will not only be dealing with currencies in pairs. It's important to know some other terminologies and their meanings.

Currency pairs are made up of a quote and a base currency which are separated by a forward slash (/) and displayed in abbreviated forms such as GBP/USD. In this case, the base currency is the British Pound and the quote currency is the US dollar.

The major currencies are those which are traded more often and they all have the US dollar as a part of the pair. These currencies include the US dollar, New Zealand dollar, Australian dollar, Japanese Yen, Swiss Franc, Canadian dollar, British Pound Sterling, and Euro.

Minor currencies, also known as cross-currency pairs, are those which don’t have the US dollar. Among the minors, the British Pound (GBP), Japanese Yen (JPY), and Euro (EUR) are the most traded currencies. Maybe, you are also interested in interesting facts about trading Euro in the Forex market.

A pip refers to a small incremental move made by an exchange rate in the forex market.

Lots are the specific amounts of a currency pair being traded. They refer to the number of units of a currency a trader either buys or sells.

The ask price is the lowest price at which a seller is willing to buy a currency pair.

A bid refers to the highest price at which a buyer is willing to sell a currency pair.

The spread means the difference between the bid price and the ask price.

To open a long position means that the trader buys the base currency in a trade.

To open a short position means that the trader sells the base currency in a trade.

A margin is the amount of trading capital used to open and maintain trading positions.

Leverage allows traders to use very little money to get access to a relatively larger amount of trading funds which increases their potential of getting higher returns or making higher losses.

A swap is an interest paid to keep your trade running overnight.

The changes in currency prices are influenced by a wide range of political and economic factors such as the political situation of the country, inflation, interest rates, economic growth, government policy, etc.

Volatility measures how prices fluctuate within the specified timeframe. It is one tool used by traders to spot potential opportunities and manage their risk.

What is a trading platform and why is it needed?

The financial markets today have totally evolved from the way they used to be. Traders can now take part in the market using forex trading platforms. These are platforms that allow you to enjoy easy access to the financial markets around the world. The most popular platforms for forex trading are MetaTrader 4 and MetaTrader 5, also known as MT4 and MT5 respectively.

MT4 and MT5 allow you to do your trading from any device such that opening, closing, and managing trades is seamless. These trading platforms come with a wide range of valuable charts, indicators, and tools that help forex traders in monitoring and analyzing the markets on the go.

What are the options for earning on Forex?

To make money in the forex market, you need to understand the basics of trading. When carrying out a trade, you buy something at a cheaper price and then sell it at a much higher price in order to make profit. This is not any different from what happens when buying and selling currency pairs. Some ways to earn in forex trading include:

Open a long position by buying a currency pair (say EUR/USD) at a lower price and then selling at a higher price.

You can also open a short position by selling a currency pair at a higher price and then buying it back when the price plummets.

Another way to earn in forex is by trading CFDs, also known as contracts for difference.

An additional way to make money in forex is by trading binary options.

You may also have heard of leverage trading. Forex brokers allow you to trade using leverage so you can open positions bigger than your margin. Some brokers will offer leverages of up to 1:100 and more. This can help to maximize your returns, but keep in mind that it will also increase your risk of losing your money if the market goes against you.

What is technical and fundamental analysis?

Technical analysis in forex trading is a method that traders employ to predict and determine what the possible future price movement will be by analyzing trends and patterns. This kind of analysis is mostly used by short-term and swing traders to ascertain entry or exit points in the market. Technical analysis takes only past data into consideration and is carried out using indicators and charts.

Fundamental analysis on the other hand is a trading method employed by long-term position traders. This kind of analysis involves looking at the intrinsic value of currencies, evaluated stats, and available information in order to determine price movement and take trading decisions. Such analysis is mostly based on industry statistics, news events, and economic reports.

Foreign exchange market participants

Different kinds of players come together to make up the forex market. Consider the key traders and institutions and the individual roles they perform in the market:

| Participant | Role |

|---|---|

| Broker | Ensures easy accessibility to trading platforms where forex traders can buy and sell. You can liken a forex broker to the middleman between the trader and the markets |

| Trader | engages in buying and selling currencies in the forex market. The trader tries to make profits by taking advantage of exchange rate fluctuations. |

| Liquidity provider | Performs the role of a market maker in the forex market. |

| ECN-system | An electronic communication network refers to an automated system designed to match orders from buyers and sellers in the forex market. |

| Marketmaker | Facilitates liquidity and makes sure that the market runs smoothly by buying and selling currency pairs in large amounts. They are a financial intermediary. |

Can you make money on Forex?

While it’s possible to make money trading Forex, more than 85% of beginners end up on the losing side. And that's because they trade the markets without having a proven system. They also do not dedicate sufficient time to learn and master the techniques of risk management. If you want to become a successful trader, you must take time to get trained and come up with a strategy that works for you. The best way to do that is to spend time using a demo account to trade the forex market until you hone your skills. Only then can you succeed and make money in forex trading.

Forex market cap and forex market daily turnover

Since April 2022, the forex market daily turnover has reached up to $7.5 trillion. The forex market cap also sits around $2409 trillion, that is, $2.4 quadrillion.

Best time to trade forex

Our team of experts at Traders Union carried out a survey on members of our community using the computer-assisted web interviewing (CAWI) method. Based on our survey, the respondents chose Wednesday as the most favorable trading day of the week.

They also chose the periods between 6.00-12.00 GMT and 18.00-0.00 GMT as the best time to trade because that is when they’ve made the most profits. For the traders, Thursday is also the next best day to trade in the short term. For long-term traders, however, Mondays and Wednesdays are the best days to trade.

Best Forex Currency Pairs

Our TU experts also surveyed traders from our community who are 18 years and older and affiliated with brokers from our top-rated list. Of the 2,500 respondents, most traders prefer the major currency pairs and like to trade currency pairs with high liquidity.

Five facts about Forex Trading, that will help you succeed in trading

As a beginner trader, these five facts about forex trading will help you succeed in your journey:

Have a trading system

Develop a trading system that allows you to detect market signals. Your system should also include some validated instruments that help you take advantage of these signals. You should be able to determine when to enter and exit the market. Build a system that allows you to calculate transaction volume before opening a position.

Use risk management

Learn risk management because that is the number one strategy to preserve your capital and reduce losses. Use a risk management system that controls how much you risk in a single trade, as well as how much risk you are exposed to when you open a number of positions. Master how to calculate the length of your stop loss.

Control your emotions

The fastest way to lose money in forex trading is to allow your emotions to influence your trading decisions. Never trade based on emotions and don’t jump into new trades after making a loss. Set limits for yourself every day and stick to them.

Test your strategies continuously

Learn to suppress your emotions by developing different strategies and testing them to decide what works best for you. Backtest your strategy on a demo account and make sure it covers the right mathematical parameters in terms of risk and reward.

Keep your losses small

No matter how good your strategy is, you are bound to lose some trades in the forex market. So don't jump into a trade with more than you can afford to lose. Always remember that your money is at risk as soon as you fund your account. Prepare yourself psychologically to get used to small losses so long as you manage your risk. Resist the urge to always count your equity but focus on perfecting your trading skills and keeping your losses small. This will help you succeed in the long run.

TOP-10 fun facts about Forex Trading and Investment

Most of the candlestick chart terminologies used today relate to the military as they were drawn from a period in Japan when there were nonstop wars between feudal lords.

Nearly 90% of all forex transactions involve the US dollar.

Most people think of the forex market as a traditional trading floor. But most of the trading is done on the web.

The top three largest foreign exchange hubs on the globe are London, New York, and Singapore.

The reason why the US dollar is also referred to as Greenback is because of the unique green color it had during the civil war in America.

If you heard the term “spot trading”, it comes from the act of quickly exchanging foreign currencies on the spot.

In the past, only institutions and banks could trade forex because they met the liquidity requirements. But all that has changed today as virtually anyone can trade forex with smaller amounts

There are two categories of traders – BULLS and BEARS. The bulls expect the market to move upward while the bears expect it to fall.

Forex trading is mostly about speculation because most traders are not necessarily exchanging real currencies.

The GBP/USD pair is popularly referred to as the CABLE because the markets in London and New York used to be connected by a large transatlantic cable. That was before fiber-optic and satellite communications were invented.

Richest Forex Traders - Trading Secrets & Life Stories

The forex market has created lots of billionaires and millionaires who succeeded by employing different strategies and techniques. Let's talk about the top 3:

George Soros

Currently worth around $8 billion, George Soros comes from Hungary and started trading while at school. He built his own strategy which he created by observing currency rate movements. He then used that strategy to open a short leveraged position in 1992 against the Pound Sterling and made $1 billion in profits.

Paul Tudor Jones

Now worth nearly $5 billion, Paul Tudor Jones turned down many opportunities after graduating from the University of Virginia in 1976 to get into commodity trading. Paul shorted the market during the crash in 1987 and went on to make over $100 million in gains.

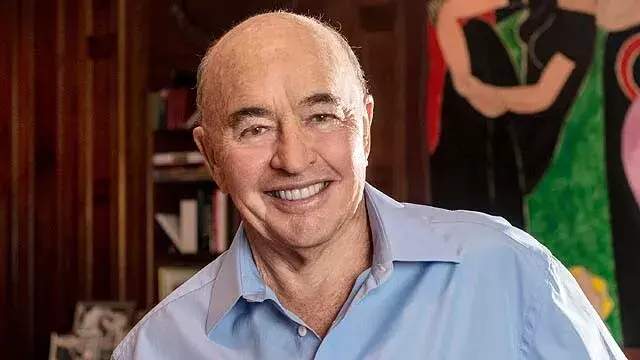

Joe Lewis

Joe Lewis' story is the kind of “went from nothing to something” story you like to read about. This UK trader now worth around $4.33 billion had to start working at the age of 15 in order to support the family business, which he eventually sold off and ventured into forex trading. After meeting up with George Soros, he also went home with $1.8 billion in profits in Market

Best Forex Brokers 2025

Admiral Markets

Starting out in 2001, Admiral Markets is a trusted broker that offers its services in 40+ countries while boasting a cash cycle of around $40 billion. The broker has a Federal Financial Markets Service lifetime license. It also has licenses from ASIC and the FCA. It offers mouthwatering services to clients who only need at least $1 to set up an account. Admiral Markets provides easy withdrawals and deposits, as well as a 1:500 leverage which is very high. You’ll also enjoy 24 hours support every day of the week once you open any of the 5 account types, including Trade.MT5, Invest.MT5, Zero.MT5, Trade.MT4, and Zero.MT4.

FxPro

FxPro has over 80 awards to its name and is licensed by the FSCA in South Africa, FCA, Bahamas SCB, and CySEC. It began operations in 2006 and has expanded its reach to 140 countries. This broker allows you to trade 70+ currency pairs and provides a wide range of tools to guarantee a smooth trading experience. It has a negative balance protection policy to ensure your account never gets into a negative balance, thanks to its risk management system and automated transaction monitor. The account types offered include MT4, MT5, FxPro Markets, and cTrader. Beginners will also trade under the guidance of proven advisors which can be upgraded to include a personal manager and free VPS.

Interactive Brokers

Since 1977, Interactive Brokers has stood out as a US broker and has licenses from the SEC, FCA, FINRA, and a host of other top-tier financial regulatory bodies. Its customers from 33 different countries get access to over 130 markets and a plethora of trading tools. The broker has adaptable stop-out and margin call levels, and opening an account doesn’t depend on any minimum deposit. Its account offerings include a demo account that allows beginners to practice risk-free and a real account for individuals and organizations alike. Interactive Brokers offers leverage as high as 1:1000, as well as around-the-clock support 24 hours a day during business days.

Summary

The forex facts and educational information in this guide show that forex trading is profitable. But you’ll need to build your understanding of currencies and how their values get affected by certain factors. Also, learn fundamental and technical analysis so you can build your forex strategy, and then adopt valuable risk management principles.

FAQs

Who invented forex?

It is believed that the early beginning of Forex is the Babylonian period. In those days, trade was barter.

Why is forex so important?

Forex allows everyone to earn on the difference in rates, from banks, hedge funds and ending with ordinary investors.

Why do most forex fail?

Many traders fail due to lack of experience and knowledge, risky investments of large sums.

Can forex make me rich?

Yes, Forex trading can bring good income, but earnings here are associated with risks.

Can you get rich by trading forex?

AnsPeople like George Soros, Joe Lewis, and Paul Tudor Jones became billionaires by trading forex. So, you can make good money from trading forex but you have to devote time to learning and studying the markets first as a beginner.wer

Can I learn forex on my own?

If you’re a good self-learner, then you can learn forex online by enrolling in paid courses and watching lots of tutorials online. Then get a demo account to practice what you learn and you’ll succeed over time.

How much do forex traders actually make?

Forex trading can earn you anywhere from 5% to 15% monthly if you employ a good risk management system and risk/reward strategy while leveraging. Thankfully, you only need a small capital to start trading currency pairs.

Is forex trading gambling?

No, forex trading isn’t gambling unlike what most beginners think. Spend time learning and developing a strategy that’ll help you become profitable.

Related Articles

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.