Your capital is at risk.

FOREXimf Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 350,000

- MetaTrader4

- QuickPro

- BAPPEBTI

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 350,000

- MetaTrader4

- QuickPro

- BAPPEBTI

Our Evaluation of FOREXimf

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FOREXimf is a broker with higher-than-average risk and the TU Overall Score of 3.23 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FOREXimf clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

FOREXimf doesn’t have an extensive pool of financial instruments. However, it wins the attention and respect of traders with attractive fees and the universality of its offer. Both novice traders and professionals can find an appropriate account type for themselves. They can use MT4 and QuickPro with almost no restrictions on methods and strategies. Also, the broker provides comprehensive training and daily analytics.

Brief Look at FOREXimf

FOREXimf is an Indonesian broker that offers trading futures on currency pairs, metals, and energies. There are four live account types — Ultra Lite, Low Spread, Lite Pro, and Low Spread Pro that differ significantly. A free demo account with virtual $10,000 is available for 14 days. The minimum deposit is IDR 350,000 (~ USD 22) or IDR 3,500,000 (~ USD 222). The minimum spread is 0.3 pips and the minimum fee is $1. Leverage is up to 1:100 or 1:500. Traders work through MetaTrader 4 or the QuickPro mobile app. Deposits and withdrawals are made only by bank transfers without brokerage fees.

- Demo account and a low deposit on two of four live account types provide an easy start for novice traders;

- Spreads and fees are market average or lower; traders can choose their preferred working conditions;

- Flexible leverage is enough for any trading style;

- MetaTrader 4 and the proprietary QuickPro mobile app are provided;

- Education ranges from webinars and YouTube videos to eBooks and other text materials;

- Wide analytics that includes reviews of technical issues, forecasts from leading experts, and regularly updated newsfeeds;

- Technical support is highly competent and is available via four communication channels;

- The broker is regulated by BAPPEBTI (the Commodity Futures Trading Supervisory Agency, or CoFTRA).

- There are not many assets and the broker is mostly focused on currency pairs, not metals or energies;

- Alternative income options include a raw copy trading service with a small number of signal providers;

- Traders outside Indonesia are hardly comfortable working with the broker.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker is registered in Indonesia and is regulated by BAPPEBTI. It’s been in the financial market for over 19 years and is well-established among local traders. The company provides competitive and comfortable trading conditions.

FOREXimf focuses on placing its clients' trades on the ICDX (Indonesia Commodity and Derivatives Exchange) and JFX (Jakarta Futures Exchange). In addition to a free demo account, there are four live account types with their peculiarities and advantages. For example, Ultra Lite and Low Spread accounts require a low initial deposit of IDR 350,000 and offer leverage up to 1:500. Lite Pro and Low Spread Pro accounts are distinguished by a high allowable trade volume of 50 lots and 20% stop out.

The asset pool includes futures on currency pairs, metals, and energies. In total, there are just over 20 positions. Minimum spreads are 0.3 pips or 1.8 pips, and trading fees are $1 or $10, subject to the account type. Desktop and mobile versions of MetaTrader 4, as well as the proprietary QuickPro app are available.

There are not many passive income options. The broker offers a copy trading service, but investors and signal providers are not very interested in it. Also, there are nuances with deposits and withdrawals. These transactions are conducted without fees, but bank transfers are not fast. Moreover, bank transfers are inconvenient for many traders. Technical support is professional and assists clients via the main channels. Support’s only disadvantage is that it is not available 24/7.

Based on the results of studying the broker’s offer, TU recommends it for review. For Indonesian traders, FOREXimf might be a real gem.

FOREXimf Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. FOREXimf and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MetaTrader 4 and QuickPro |

|---|---|

| 📊 Accounts: | Demo, Ultra Lite, Low Spread, Lite Pro, and Low Spread Pro |

| 💰 Account currency: | IDR and USD |

| 💵 Replenishment / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | IDR 350,000 |

| ⚖️ Leverage: | Up to 1:100 or up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 0.3 pips |

| 🔧 Instruments: | Futures on currency pairs, metals, and energies |

| 💹 Margin Call / Stop Out: | Margin call - no; stop out 20% or 100% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Free demo account; Four live account types; Little pool of diverse assets; Reasonable trading expenses; Significant leverage; Many analytical and educational materials. |

| 🎁 Contests and bonuses: | Rebates from Traders Union |

FOREXimf offers four account types with different parameters. The minimum deposit for Ultra Lite and Low Spread accounts is IDR 350,000, and it is IDR 3,500,000 for Lite Pro and Low Spread Pro. Also, account types differ in leverage. It is up to 1:500 for Ultra Lite and Low Spread, and up to 1:100 for Lite Pro and Low Spread Pro. It is possible to choose any leverage within the available range or trade without it. Technical support is available from 8:00 to 24:00 (UTC) on weekdays via email, call center, tickets on the website, and live chat.

FOREXimf Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

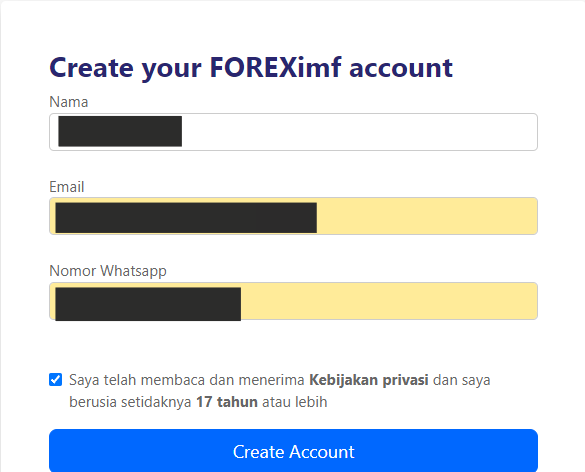

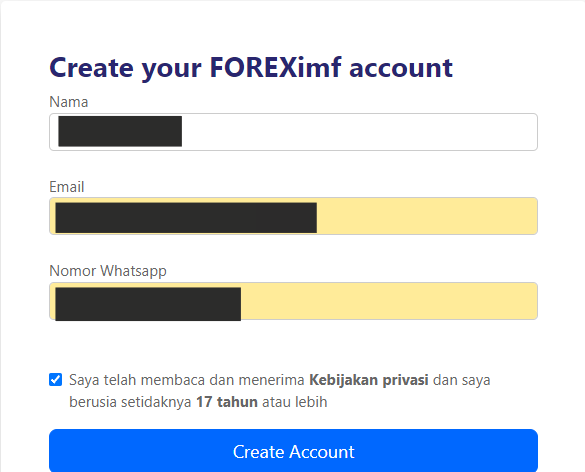

Trading Account Opening

The registration process comprises several stages. It is simple and causes no difficulties.

Click the “Register” button in the upper right corner. Also, you can click the “Open Live Account” button.

Provide your name, email, and WhatsApp number. Agree to the Privacy policy by ticking the box and click the “Create Account” button.

An SMS with a 6-digit code is sent to your WhatsApp number. Enter it in the corresponding field.

Next, provide more information about yourself and pass verification. Upon logging into your user account, register an Ultra Lite, Low Spread, Lite Pro, or Low Spread Pro account and make a deposit. Download the appropriate version of MetaTrader 4 or the QuickPro mobile app, and start trading.

Regulation and safety

How not to lose your capital when stumbling upon a scammer or Forex bucket shop? Before trading with a broker, do a little research and check its registration and regulation. These confirm its legal activities and ensure the protection of the trader’s interests in case of conflicts or disputes. Also, study traders’ reviews of a company. FOREXimf is registered in Indonesia and is regulated by BAPPEBTI. Reviews of the broker are mostly positive.

Advantages

- A veteran in the market

- Official registration

- The broker is supervised by BAPPEBTI

Disadvantages

- The regulator supervises the broker’s activities only in Indonesia

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Ultra Lite | Spread is $18, fee is $1 per lot | No |

| Low Spread | Spread is $3, fee is $10 per lot | No |

| Lite Pro | Spread is $18, fee is $1 per lot | No |

| Low Spread Pro | Spread is $3, fee is $10 per lot | No |

Withdrawals are made only by bank transfers, which can be inconvenient for some clients. However, there are no brokerage fees. If banks that participate in transactions don’t charge fees either, traders receive the exact amounts they have requested.

Below is a comparative table of the average fees of FOREXimf and two leaders of the industry. It shows how competitive the broker’s offer is.

| Broker | Average commission | Level |

|---|---|---|

|

$10.5 | |

|

$1 | |

|

$8.5 |

Account types

Choosing an account type is a priority at the start. The best account types for small capital are Ultra Lite and Low Spread. Also, they are the best option for novice traders. Lite Pro and Low Spread Pro are designed for experienced market participants aimed at large trades. The broker offers the popular MetaTrader 4 platform and its proprietary QuickPro app. Traders decide what is more convenient for them by comparing the solutions. Leverage is another parameter to choose. It’s up to you to set a moderate value up to 1:10 and trade without enormous risks or go all-in by setting 1:50, 1:100, or even 1:500.

Account types:

Deposit and Withdrawal

-

If traders are successful in most trades, profits are accumulated on their accounts.

-

To withdraw profits partially or in full, submit a withdrawal request in your user account on the brokers’ website.

-

Withdrawals are made to bank accounts indicated during registration.

-

There are no brokerage fees for such transactions, but banks can charge their fees.

-

Withdrawals are available only on weekdays.

Investment Options

Most traders come to brokers to independently trade on financial markets. However, some of them prefer passive income, provided by copy trading and joint accounts. FOREXimf offers only the first option. The copy trading service is still under development and there are not many users.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Copy trading

Traders choose signal providers with conditions and trade rates that suit them. Upon subscription, the signal provider’s trades are automatically copied to the investor’s account. Investors have the right to set certain limits. For example, they can limit funds used for a certain trade or leverage. If signal providers are exact in their forecasts, both parties receive profits. Otherwise, both of them incur losses. Investors should bear in mind that they give a part of their profits to providers when they win.

Customer support

Traders often have questions due to their inattentiveness or insufficient information on the broker’s website. Also, certain problems with trading, deposits, or withdrawals may occur. In any situation, traders contact technical support. If managers give comprehensive and timely responses, the broker’s clients are satisfied and stay with it. Otherwise, they may be disappointed and might leave for another company. FOREXimf’s technical support is of a high level. It is available 16/5 via email, telephone, live chat, and ticket system on the website.

Advantages

- Four main communication channels

- Responses are prompt during working hours

- Traders applaud the competence of managers

Disadvantages

- Technical support is not available 24/7

Whether you are the broker’s client or just intend to become one, you may contact technical support with a relevant question.

The following communication channels are available:

-

Telephone;

-

Email;

-

Live chat on the website and in the user account;

-

Tickets on the website.

The broker has its profiles on TikTok, Facebook, Instagram, YouTube, and X (Twitter). Links to these accounts are available in the footer of its website. There you can also contact the support team. Usually, managers respond within 24 hours.

Contacts

| Registration address | Menara Asia Afrika Lantai 12 Jl. Asia Afrika No.133 - 137, Bandung |

|---|---|

| Regulation | BAPPEBTI |

| Official site | https://www.foreximf.com/ |

| Contacts |

022 - 426 6000

|

Education

Many brokers try to provide various educational materials for novice traders on their websites. These are usually articles, a glossary, and video guides. FOREXimf pays much attention to this.

The training information is sufficient for most novice traders, therefore, they don’t have to search for additional materials on third-party resources. Professional traders can be interested in webinars, and available eBooks provide additional information.

Comparison of FOREXimf with other Brokers

| FOREXimf | RoboForex | Pocket Option | Exness | AMarkets | Tickmill | |

| Trading platform |

QuickPro, MetaTrader4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, AMarkets App | MT4, MT5, Tickmill Mobile App |

| Min deposit | $35000 | $10 | $5 | $10 | $100 | $100 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.3 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

20% / 100% | 60% / 40% | 30% / 50% | No / 60% | 50% / 20% | 100% / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of FOREXimf

FOREXimf keeps up to date applying advanced technologies to provide its users with the best trading opportunities. It offers ultra-fast order execution and no significant slippages. Due to placing its clients’ trades on ICDX and JFX, liquidity is always high. Special attention is paid to the security of client funds and data, which is ensured by SSL encryption protocols, authentication tokens, and other protection methods. Client funds are held in major banks in Indonesia. Technical support is available to assist in any disputable or unclear situations.

FOREXimf by the numbers:

-

Minimum deposit is IDR 350,000;

-

4 live account types plus a demo;

-

20+ financial instruments;

-

Minimum spread on Low Spread and Low Spread Pro accounts is 0.3 pips;

-

Fee per lot on Ultra Lite and Lite Pro accounts is $1.

FOREXimf is one of the most popular Indonesian brokers

Being a member of ICDX and JFX, FOREXimf offers the most popular assets traded there. There are minimum restrictions; only scalping is prohibited. Hedging, trading on news events, and automated advisors are allowed. Leverage up to 1:500 allows traders to increase their profit potential even with small capital. Traders who, for some reason, don’t like MetaTrader 4, can try the broker’s proprietary QuickPro app.

Useful services offered by FOREXimf:

-

Education. Text and video materials available on the website are very valuable for novice traders, yet professionals can find a lot of useful information as well.

-

Analytics. Market research, newsfeeds, forecasts, and economic calendars allow traders to start trading fully prepared.

-

QuickPro. This is an intellectual trading app with extensive functionality that provides for market monitoring, independent analysis, and instant execution.

Advantages:

Wide range of account types with different flexible parameters;

Fees are below market average and correspond to those of top brokers;

No pitfalls or additional fees outside the pre-defined conditions;

Users highly evaluate the competence of technical support that responds very quickly during its working hours;

The broker is officially registered and participates in many reputable financial organizations in Indonesia.

User Satisfaction