Your capital is at risk.

LYNX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- CZK 75,000

- TWS Trader

- LYNX proprietary platform

- LYNX Basic web terminal

- Českou národní banku

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- CZK 75,000

- TWS Trader

- LYNX proprietary platform

- LYNX Basic web terminal

- Českou národní banku

Our Evaluation of LYNX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

LYNX is a broker with higher-than-average risk and the TU Overall Score of 3.25 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by LYNX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

LYNX has many constructive advantages over its competitors. It offers many base account currencies, a wide choice of trading instruments, acceptable leverage, and a reasonable fee policy. Also, there is a demo account and a good welcome bonus. Among its disadvantages are the limited choice of deposit and withdrawal methods, lack of popular trading platforms, and no possibility to contact technical support on weekends.

Brief Look at LYNX

LYNX clients trade currency pairs, stocks, futures, options, ETFs, and CFDs. There are over 10,000 positions. Also, there are 24 base account currencies. The minimum deposit is CZK 75,000 (~3,218 USD). Currently, there is a promotion that offers new users a EUR 500 loan. Trading parameters depend on the chosen asset. For example, when trading USD, traders can use leverage up to 1:40, and fees for this asset start at $5. The LYNX+ web and the TWS desktop platforms are available. Also, the broker has a mobile app. Its website contains many educational materials and specialized tools.

- Simple registration, a EUR 500 loan, and no trading restrictions;

- Wide choice of financial instruments and leverage up to 1:40 for currency pairs;

- Transparent fee policy, and no hidden markups or additional fees;

- Demo account, educational materials, regular webinars, podcasts, and newsfeeds;

- Web, desktop, and mobile versions of trading platforms are available;

- Useful tools for technical and fundamental analyses;

- Technical support is available via several communication channels.

- The minimum deposit is high;

- No passive income options, such as MAM or PAMM accounts, or copy trading;

- Deposits and withdrawals are made only by bank transfers.

TU Expert Advice

Financial expert and analyst at Traders Union

LYNX is a representative broker for Interactive Brokers and uses its trading infrastructure. The company itself ensures the operation of its website and its internal services. Also, it sets fees. User reviews of the broker are mostly positive and experts confirm its high level.

The minimum deposit is CZK 75,000. Traders can start working on a demo account to study the offered conditions before real trading. The asset pool is extensive and includes currency pairs, stocks, futures, options, ETFs, and CFDs. Leverage depends on the asset, and the maximum for currency pairs is 1:40. Sometimes, leverage also differs for different base account currencies.

LYNX’s trading fees are market average. For example, when working with stocks of Czech companies, the fee is 0.25% of the trade amount but not less than CZK 150. Note that deposits and withdrawals are available in most European currencies, USD, AUD, and CNY. However, these transactions are made only by bank transfers, including international.

Unfortunately, LYNX doesn’t offer passive income options, since the broker focuses only on active trading. It provides its clients with everything necessary regardless of their experience. For example, the company has a high-quality education system that includes conveniently structured articles, and regular podcasts and webinars. Also, there are many tools for technical and fundamental analyses, such as newsfeeds, expert advice, economic calendars, exchange working hours, bank interest rates, etc.

LYNX doesn’t provide its services to residents of certain countries, the list of which is available with technical support. Note that support works for a limited time on weekdays. TU experts conclude that the broker has certain disadvantages, but its advantages prevail. Thus the broker is recommended for traders.

LYNX Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. LYNX and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | LYNX+ (desktop and mobile) and TWS |

|---|---|

| 📊 Accounts: | Demo, Individual, and Joint |

| 💰 Account currency: | EUR, CZK, CHF, GBP, CNY, USD, etc. In total, 24 currencies |

| 💵 Replenishment / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | CZK 75,000 |

| ⚖️ Leverage: | Up to 1:40 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.1 pips |

| 🔧 Instruments: | Currency pairs, stocks, futures, options, ETFs, and CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Rather high minimum deposit; Free demo account; Thousands of financial instruments from 6 groups; Average fees; Moderate leverage; Convenient trading platform and mobile app. |

| 🎁 Contests and bonuses: | Yes |

To open a live account, a minimum deposit of CZK 75,000 is required. Note that most brokers have lower requirements. Leverage differs subject to the traded asset. For example, the maximum leverage for trading USD is 1:40, and for trading CZK, it is 1:20. Detailed information on leverage is provided in the corresponding section of the LYNX website. Technical support is available via telephone, email, and live chat. If necessary, the broker’s experts can use TeamViewer for remote assistance. However, they work only from 8:00 to 18:00 on weekdays.

LYNX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

No entries yet.

Trading Account Opening

To start working with LYNX, register and pass verification on its official website. Also, open an account, make a deposit, and install a trading platform. TU experts have prepared a step-by-step guide on the process. Also, they have described the main features of the user account.

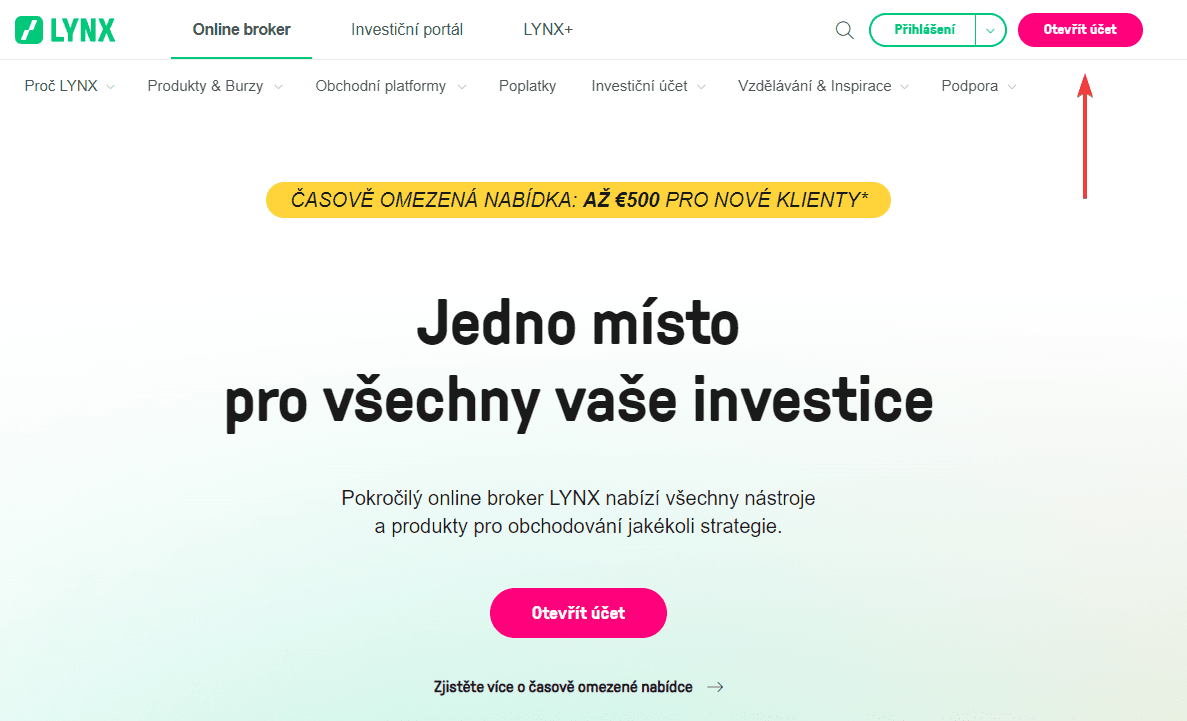

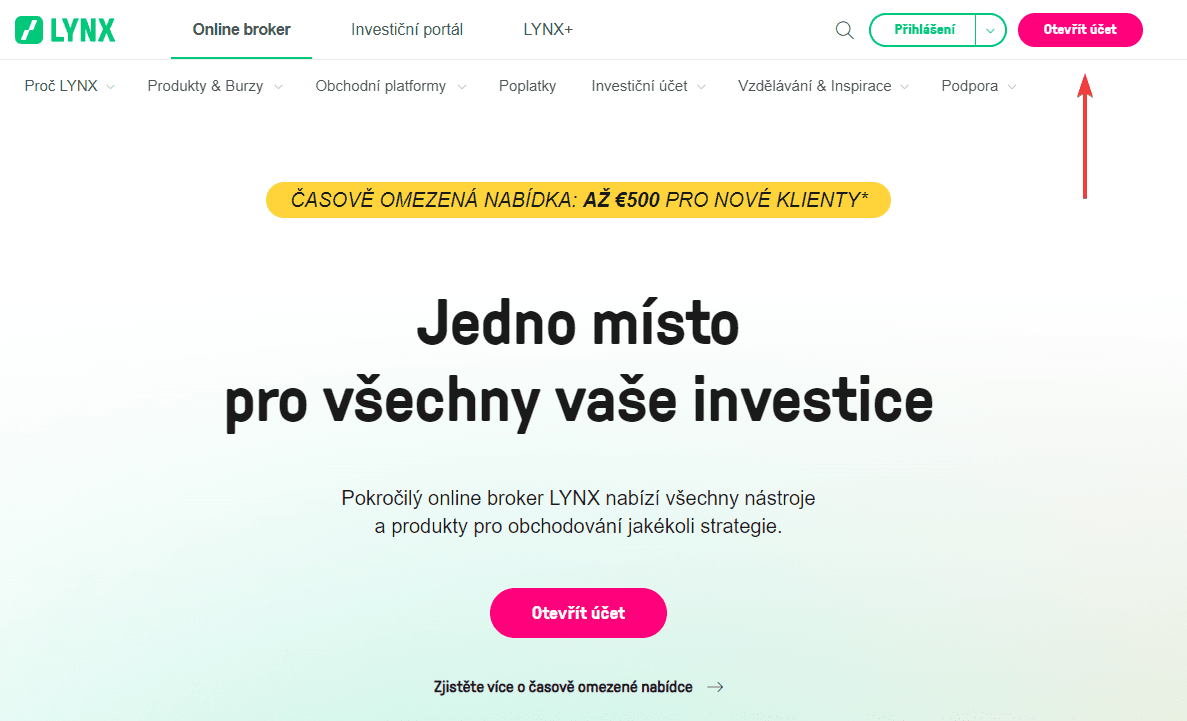

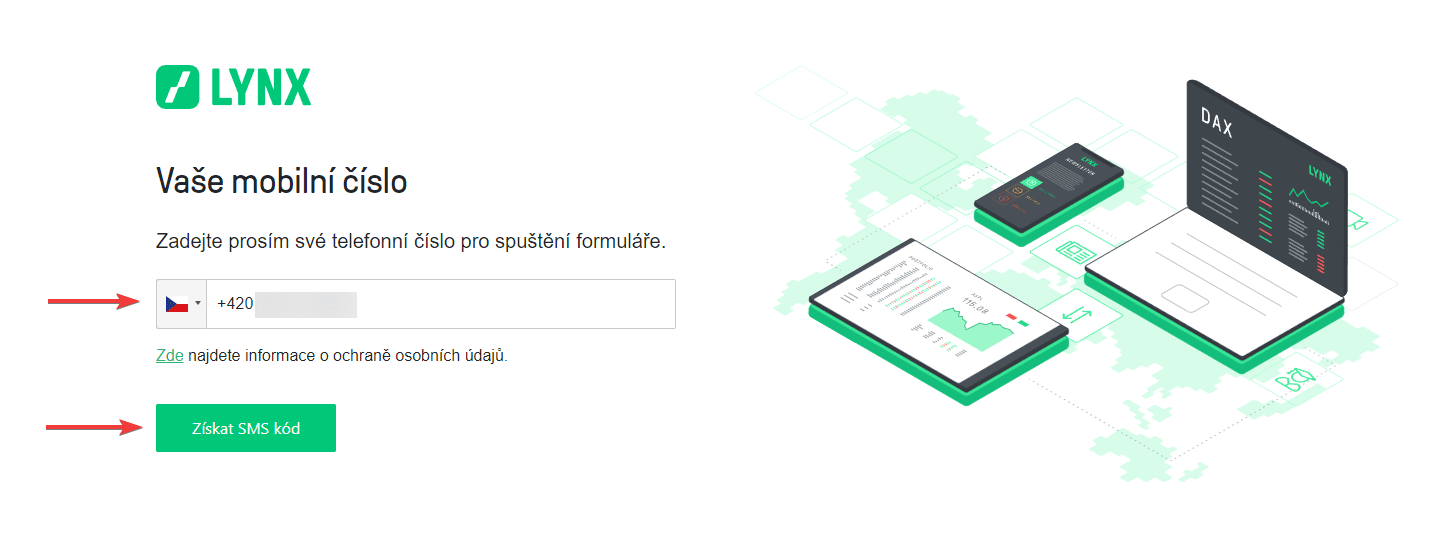

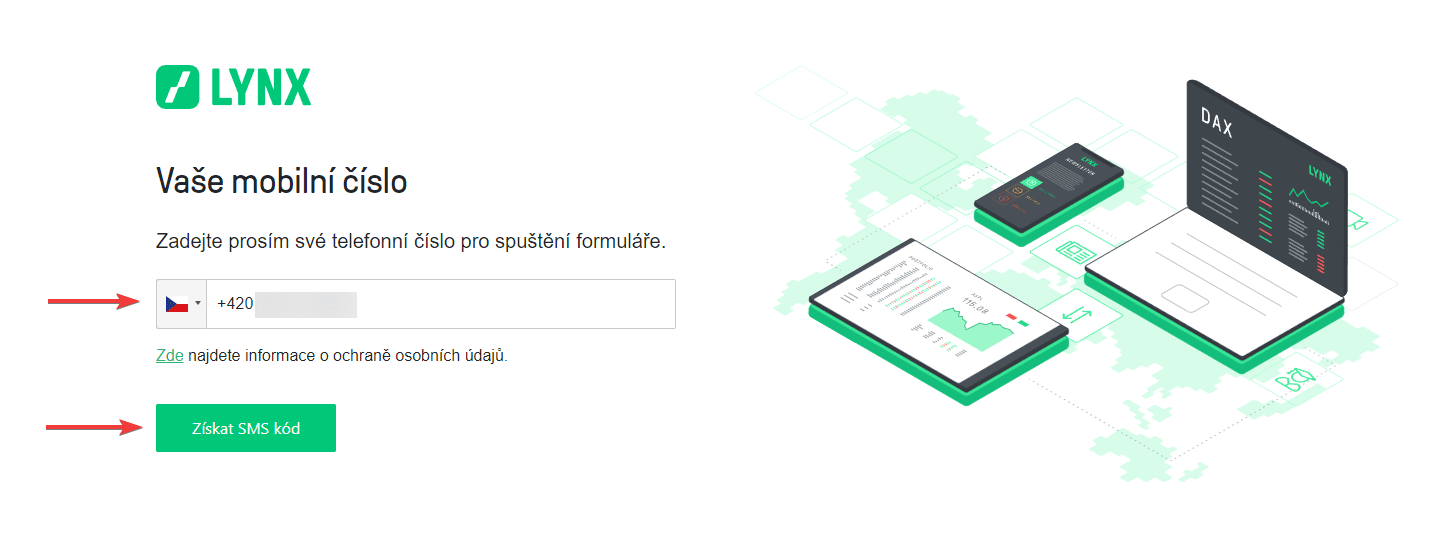

Go to the broker’s official website and click the “Open account” button in the right upper corner.

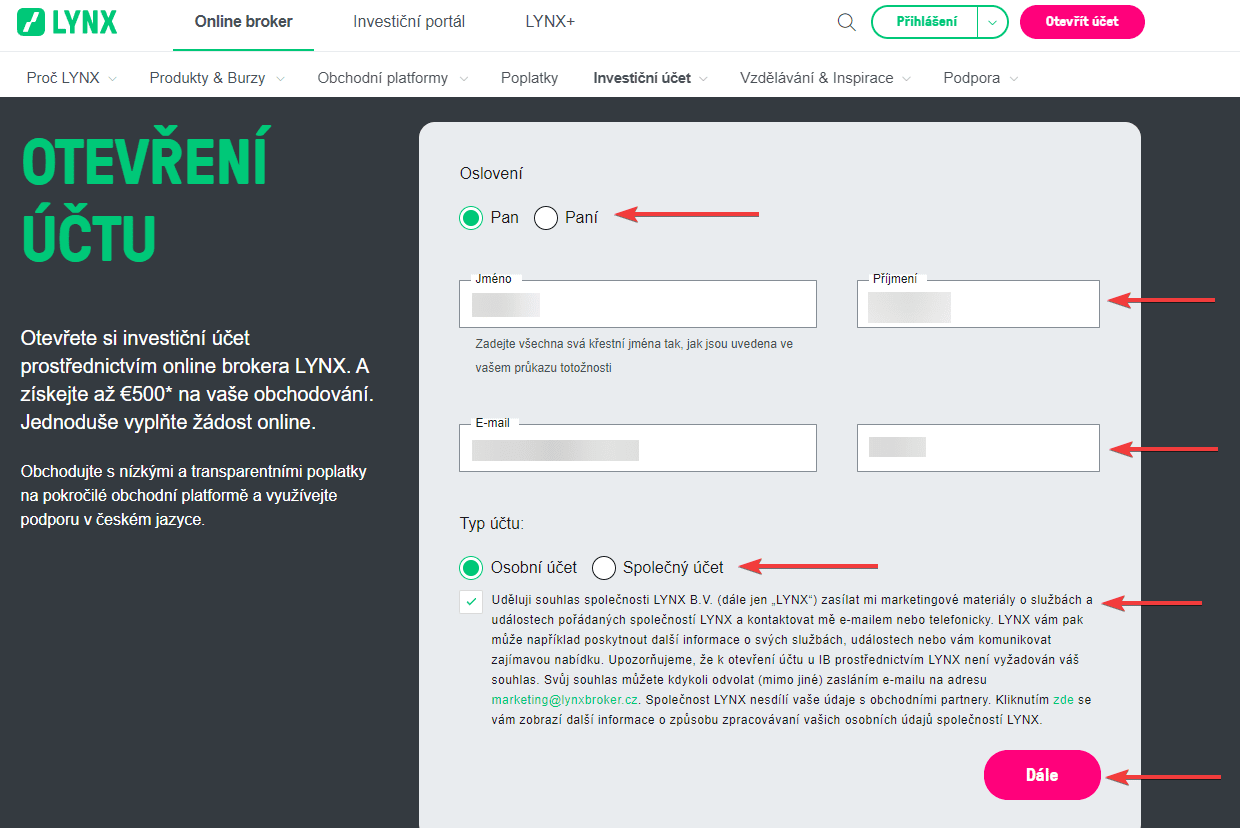

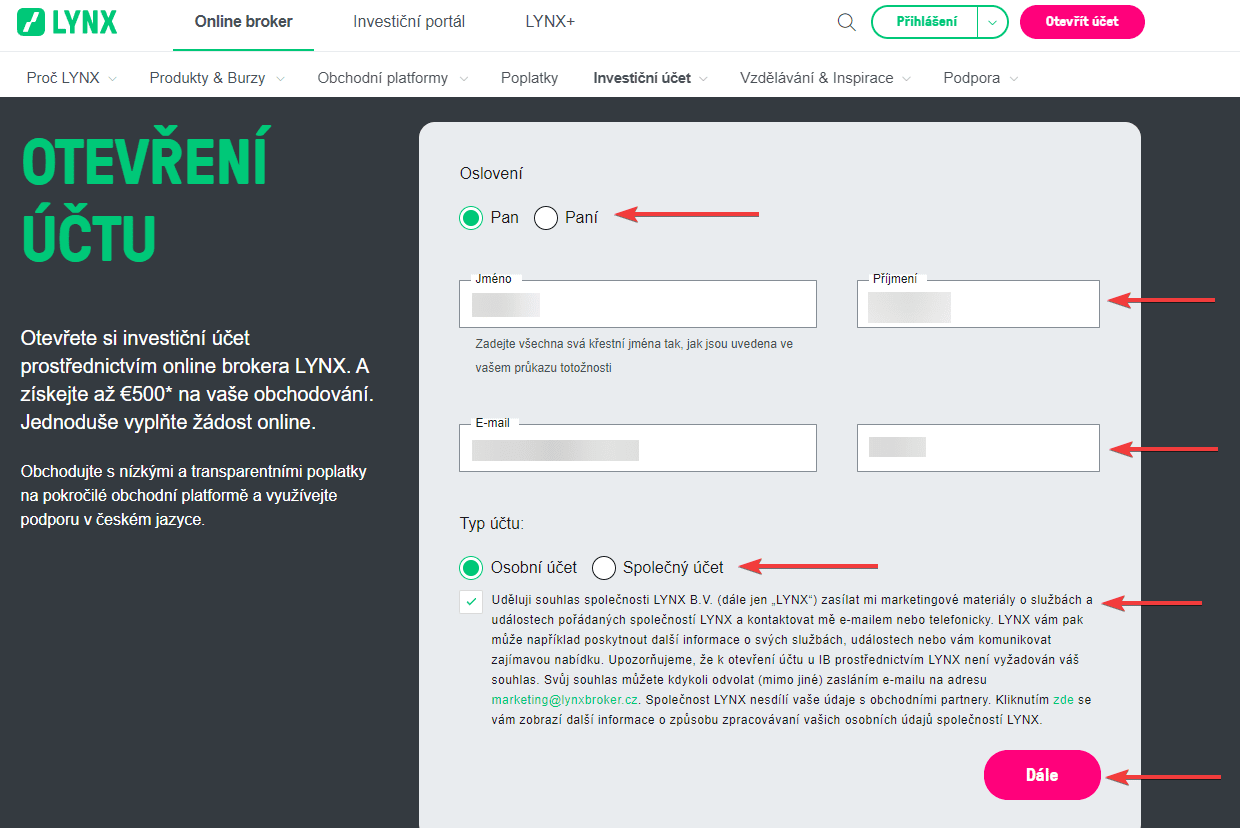

Indicate your title, first and last names, email, and a special code if any. Choose the account type. Agree to the terms and conditions by ticking the box and clicking the “Continue” button.

Provide your phone number. Request a code and wait for an SMS. Enter the code in the corresponding field.

Provide your address, information from an ID, and bank details. Attach scans/photos of the documents and follow the instructions. Wait for verification to complete. This process may take up to several days.

Go to the corresponding section of your user account and make a deposit.

You can work in the browser or download the LYNX+ app to your mobile device. Also, the broker offers the TWS desktop platform. Upon installation, enter your registration data and start trading.

Features of LYNX’s user account that allow traders to:

-

Monitor the account status, make deposits, and request withdrawals;

-

Study detailed statistics on trades and transactions, including current and archived;

-

Use charts, newsfeeds, and special analysis tools;

-

View educational materials, webinars, and podcasts;

-

Contact technical support;

-

Change personal data and authentication details.

Regulation and safety

Never work with an unregistered broker — it is the first rule for a trader. Regulation is also very important since it confirms transparency of the broker’s conditions and ensures the protection of client interests in conflict situations. LYNX is registered in the Netherlands and its activities are supervised by reputable organizations from many countries. Moreover, Interactive Brokers is responsible for order processing. This company is one of the market leaders.

Advantages

- Official registration

- Regulation by AFM, DNB, CySEC, CNB, and BaFIN

Disadvantages

- Regulators’ authority doesn’t cover all regions

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Individual | $1 | No |

| Joint | $1 | No |

The broker doesn't charge withdrawal fees. However, traders’ banks can withhold their fees, especially when it comes to international transfers.

The comparative table below shows the average trading expenses for traders who work with LYNX and two other top brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$1 | |

|

$1 | |

|

$8.5 |

Account types

In addition to a demo account, LYNX clients open only a standard account that can be Individual or Joint. The Joint account implies that several traders with equal rights trade on it. Otherwise, it is similar to the Individual account. Also, at the start traders should decide on priority asset types and study detailed information on them. Many peculiarities are described on the broker’s website. Choosing the trading platform is another important moment. LYNX+ and TWS are very different, so it is better to work on both of them and to choose the one that suits you best.

Account types:

Traders don’t have to open a demo account and can immediately start trading on a live one. However, if you haven’t worked with this company before and you don’t have enough experience, start with a demo to explore the broker and to improve your trading strategy in conditions as close to real as possible.

Deposit and Withdrawal

-

Successful trading on a live account brings profits to traders.

-

Profits can be withdrawn in full or partially at any time.

-

Submit a request in the app or the corresponding section of the user account. Withdrawal requests are processed quickly.

-

Withdrawals are made by bank transfers.

-

The broker doesn’t charge withdrawal fees, but banks may.

Investment Options

LYNX focuses on active trading. Its clients use a wide range of financial instruments, but can’t make passive income with them. There are no MAM or PAMM accounts or copy trading.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from LYNX:

The company has been on the market for many years and has a sufficient influx of clients. Therefore, it doesn’t need to additionally attract traders with a partnership program.

Customer support

LYNX clients have constant access to the service center, where the most frequent questions are conveniently grouped. If traders can’t solve the problem themselves, they can contact technical support by phone, email, or in live chat. If necessary, the broker’s experts can help remotely using TeamViewer.

Advantages

- Several communication channels

- Phone calls in the Czech Republic are free

- Support managers are highly competent

Disadvantages

- Support is only available from 8:00 to 18:00 on weekdays

Unfortunately, support is not available in the evening and on weekends. But during working hours it quickly solves relevant issues and is friendly.

Current communication channels are as follows:

-

Telephone;

-

Email;

-

Live chat on the website and in the user account.

LYNX has its profiles on Facebook, X (Twitter), YouTube, Instagram, and LinkedIn. Traders can also contact support there, but prompt responses are not guaranteed.

Contacts

| Registration address | Za Hanspaulkou 879/8, 160 00 Praha 6-Dejvice, Česká Republika |

|---|---|

| Regulation | Českou národní banku |

| Official site | https://www.lynxbroker.cz/ |

| Contacts |

800-877-877, +420-234-262-500

|

Education

Clients with minimum experience in global financial markets often come to brokers. Some of them don’t have any experience at all. Therefore, some brokers try to help new users. LYNX is among them. It offers much useful educational information on its website. Also, there are regular webinars and podcasts, as well as analytics and newsfeeds.

A lack of information for professional traders can hardly be called a serious disadvantage. Most brokers that offer education, focus on novice traders, which is logical. Nevertheless, LYNX holds regular webinars with experts that can be of interest even to experienced market participants.

Comparison of LYNX with other Brokers

| LYNX | RoboForex | Pocket Option | Exness | Deriv | FxGlory | |

| Trading platform |

LYNX Basic web terminal, LYNX proprietary platform, TWS Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader | MT4, MobileTrading, MT5 |

| Min deposit | $75000 | $10 | $5 | $10 | $5 | $1 |

| Leverage |

From 1:1 to 1:40 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 1.00% | 8.00% |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 2 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of LYNX

LYNX has a strong infrastructure, an up-to-date technological stack, a deep pool of financial instruments, and a well-established education system. This is a reliable broker with a transparent fee policy that provides compliance with the KYC (Know Your Client) standard, SSL encryption protocols, and two-factor authentication. Traders’ funds are protected and insured.

LYNX by the numbers:

-

65,000+ clients;

-

150 stock exchanges are available for trading;

-

6 groups of financial instruments;

-

10,000+ assets;

-

Maximum leverage is 1:40.

LYNX is a universal broker with attractive conditions

The broker’s universality is determined primarily by its range of available assets. LYNX clients can trade currency pairs, stocks, futures, options, ETFs, and CFDs. The pool of financial instruments is significant and is constantly expanding. Traders work with leverage up to 1:40 and are not limited in strategies and methods. Scalping, hedging, and using advisors are available. Also, LYNX provides newsfeeds, signals, and expert analysis.

Useful services offered by LYNX:

-

Information. It includes such important blocks as an economic calendar, stock market holidays, exchange working hours, current interest rates of the world’s leading banks, and an investment glossary.

-

Analysis. It is divided into three sections. The first one contains the latest global economic and political news. The second section offers analytical articles from the broker’s leading experts. The third section provides recommendations and forecasts for stock trading.

-

Trading. Here numerous educational materials on technical and fundamental analyses, trading strategies, portfolio management, psychology of trading, and other aspects are provided.

Advantages:

Free demo account;

The broker’s trading conditions are convenient for both novice traders and professionals;

Traders work with many financial instruments without restrictions on methods and strategies;

Transparent fee policy that is profitable for most assets;

LYNX+ web and mobile versions, as well as the TWS desktop platform are available;

Technical support can be contacted via several communication channels. Managers respond promptly.

User Satisfaction