Your capital is at risk.

Vital Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- TradeLocker

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- TradeLocker

Our Evaluation of Vital Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Vital Markets is a high-risk broker with the TU Overall Score of 1.9 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Vital Markets clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. Vital Markets ranks 407 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Vital Markets caters to both novice and experienced traders with its array of account options. However, it's important to acknowledge the risks associated with trading through an unregulated broker situated in an offshore zone.

Brief Look at Vital Markets

Vital Markets operates as an STP/ECN broker, providing the TradeLocker platform for trading various assets like currency pairs, cryptocurrencies, stocks, commodities, and stock indices. Clients can access accounts with varied spreads (fixed/floating), fee structures, and trading volumes. The broker deals with cryptocurrency deposits and withdrawals, uses advanced encryption techniques, and offers two-factor authentication for account security.

- Low minimum deposit of $10;

- Cent accounts designed for beginners and potential clients;

- Accounts without additional trading fees;

- Flexibility to trade using fixed or variable spreads;

- No charges for deposits or withdrawals;

- Leverage up to 1:500;

- 24/7 professional support.

- Operating without a regulatory license and registration offshore;

- Higher spreads on classic accounts;

- Insufficient training tools.

TU Expert Advice

Financial expert and analyst at Traders Union

Vital Markets presents an extensive array of financial tools suitable for both beginners and seasoned traders, capable of generating profits given the right approach. Specializing primarily in Forex, the broker not only handles the major 7 currency pairs but also provides options for trading with 20 cross pairs and nearly 30 exotic pairs. Furthermore, it offers dealings in 20 cryptocurrencies against the USD, along with CFDs spanning stocks, indices, and commodities, and covering energy sources and metals.

Preferring sophisticated solutions, the broker avoids involvement with traditional fiat currencies. Instead, it accepts deposits in various cryptocurrencies like Bitcoin, Ethereum, Litecoin, USDT (ERC20, TRC20), Ripple, Dogecoin, USD Coin, and through bank cards, facilitated by third-party currency exchange services. Thanks to the nature of cryptocurrency transactions, funds are swiftly credited within 1-3 hours, enabling faster deposits compared to the usual 5-day wait with bank transfers.

As of the review's writing, Islamic accounts were not available with Vital Markets, but plans are underway to introduce them soon. Additionally, the company pledges to enhance its offerings by introducing a MAM service and enabling the connection of trading advisors within its platform. Clients can use functions like One-Click Trading, scalping, hedging, and trading during regular news events.

Vital Markets Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Vital Markets and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | TradeLocker |

|---|---|

| 📊 Accounts: | Demo, Micro, $0 Commission, Fixed Spread, ECN/STP, VIP |

| 💰 Account currency: | USD, EUR, GBP, CAD, AUD, BTC |

| 💵 Replenishment / Withdrawal: | Cryptocurrency transactions, debit/credit card via third party providers |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:20-1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: |

Micro, Fixed Spread, ECN/STP — from 0.5 pips $0 Commission — from 0.7 pips VIP — from 0.1 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, commodities, metals |

| 💹 Margin Call / Stop Out: | N/A |

| 🏛 Liquidity provider: | Partner banks and financial organizations |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant and Market |

| ⭐ Trading features: | Accounts with variable and fixed spreads are available; trading on news, hedging, and scalping are allowed |

| 🎁 Contests and bonuses: | No |

The company doesn't deal with fiat currencies. It accepts BTC, ETH, DOGE, LTC, XRP, USDT (ERC20/TRC20), and USD Coin (TRC20) but only withdraws funds in Bitcoins. If a trader doesn't have a crypto wallet, they can buy Bitcoins on an external platform using a debit or credit card. The minimum deposit amount using a direct transfer from a crypto wallet is $10, through an external provider, it ranges from $25 to $50. Traders have the option to trade with floating or fixed spreads, with or without a commission per lot.

Vital Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

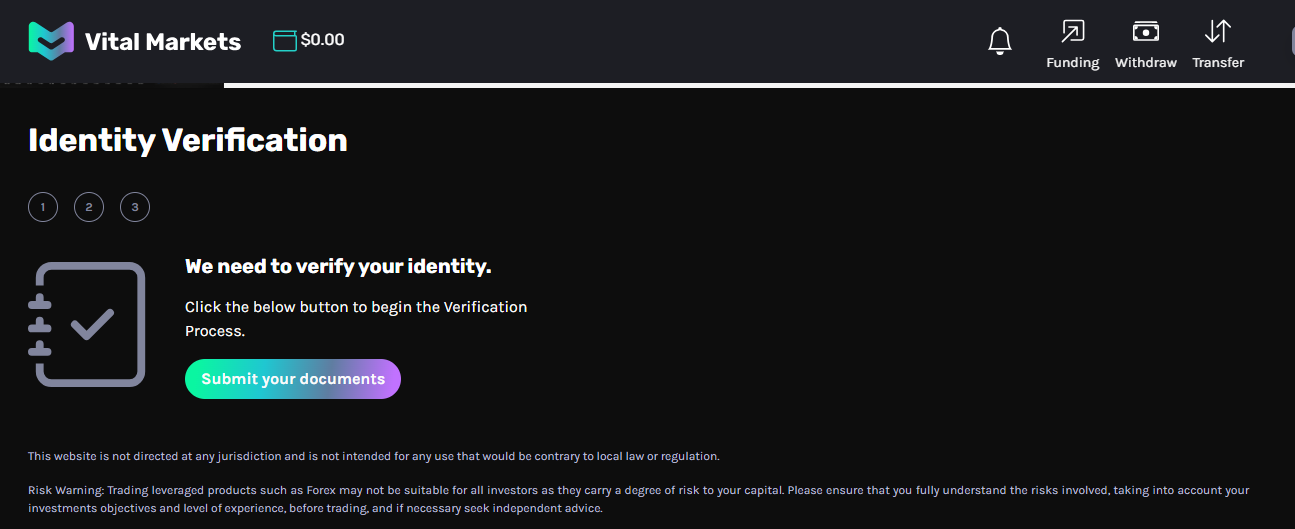

Trading Account Opening

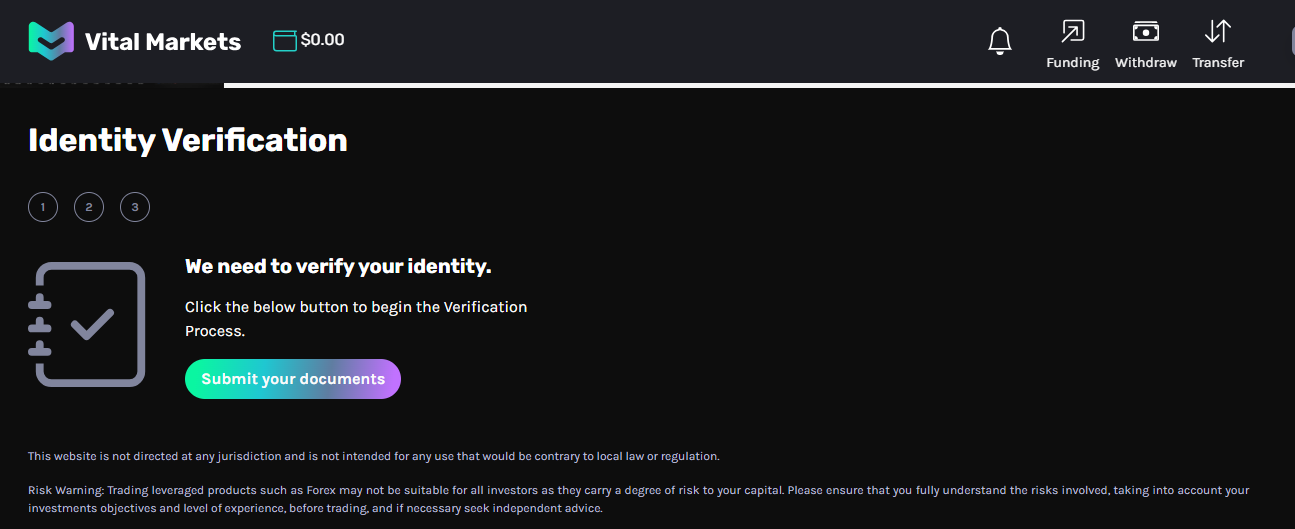

Creating a user account on the Vital Markets company website is done according to the instructions provided below:

To initiate the registration process with the broker, click on the Sign Up button.

Next, provide your name, surname, email, confirm adulthood, and create a secure password. To access the user account, a password and email address are used.

Functions of the Vital Markets user account:

In the user account, you can perform the following actions:

-

Fund your trading account;

-

Place withdrawal requests;

-

Transfer funds between your accounts;

-

View notifications about company news and the trading system's status;

-

Manage 2FA settings;

-

Register as a partner, track the number of active referrals, and the lots closed by them.

Regulation and safety

The main office of Vital Markets is located in Roseau, the capital of the Commonwealth of Dominica. There is no information about an active license on the company's official website.

As security guarantees, the company uses the segregation of client funds in separate accounts and fully complies with the terms of the user agreement and privacy policy. The account is protected against intrusion through two-factor authentication.

Advantages

- All client deposits are received into separate bank accounts and kept there

- Forex leverage goes up to 1:500

- Simple account opening without the need for a trading exam or confirmation of existing trading experience

Disadvantages

- Lack of regulation poses a risk of fund loss

- All disputes with clients are resolved within the company

- Government financial oversight fees do not monitor Vital Markets' activities or compliance with obligations to clients

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Micro | From $0.05 | No |

| $0 Commission | From $7 | No |

| Fixed Spread | From $5 | No |

| ECN/STP | From $5 | No |

| VIP | From $1 | No |

If a trade remains open past its opening day and is carried overnight, a swap fee is charged for it. Below is a comparison of fees among Vital Markets, RoboForex, and Pocket Option. TU analysts have compiled it in the form of a table for better clarity.

| Broker | Average commission | Level |

|---|---|---|

|

$3.6 | |

|

$1 | |

|

$8.5 |

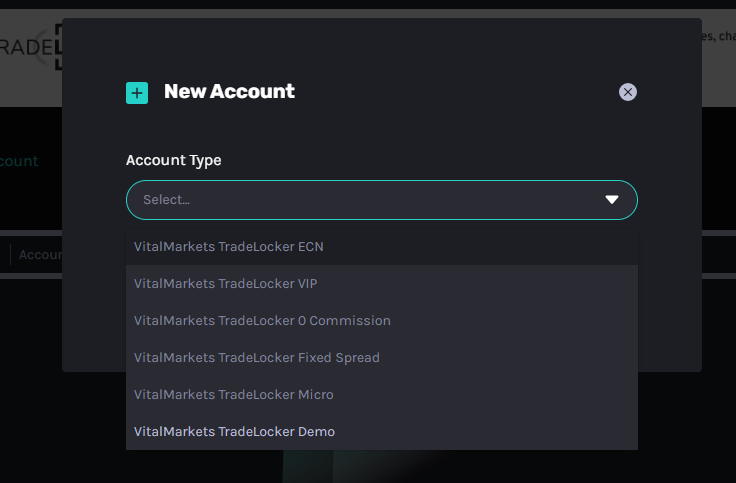

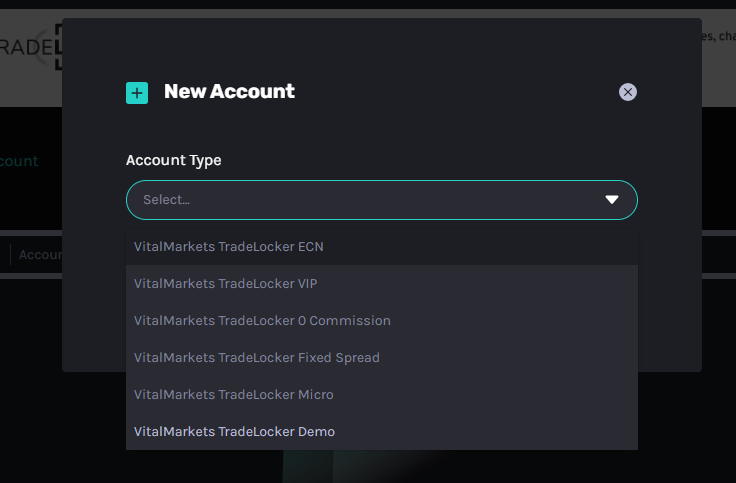

Account types

Vital Markets presents 5 account types. The leverage size is consistent across all accounts, yet there are constraints on larger deposits (starting from $500,000). There are no limitations on the number of active accounts per user, enabling traders to have multiple accounts in different currencies.

Account types:

Each trader also has the option to open a demo account with virtual capital ranging from $100 to $1,000,000.

The range of account options is a key benefit of Vital Markets, allowing traders of any experience, strategy, or deposit size to trade on terms that suit them in a comfortable setting.

Deposit and Withdrawal

-

Before requesting a withdrawal, all active trades need closing, and money must be moved from the trading platform to Vital Markets' internal wallet;

-

Clients can solely withdraw funds in Bitcoins. Fiat currency withdrawals aren't an option. The company transfers funds to the client's Bitcoin wallet. If deposits were made in other cryptocurrencies, they're converted to BTC;

-

The broker doesn't levy charges for Bitcoin withdrawals, but there might be network and currency conversion fees;

-

Withdrawal requests at Vital Markets are processed within 1 business day. Upon confirmation, funds are credited within 1-3 hours. The precise arrival time of Bitcoins depends on blockchain traffic.

Investment Options

Vital Markets is a broker designed for active trading. Their developed trading platform allows users to profit from asset price movements, but the trades must be executed manually. Managed accounts are currently unavailable, but the company plans to introduce the option for investment in a MAM service.

The broker does not provide services related to trade copying, but this type of trading activity is not prohibited. Traders can select an online copy trading platform and use it to duplicate others' trades, ensuring compatibility with the TradeLocker trading platform. Signals from external providers can be tested on a demo account.

At present, the TradeLocker trading platform does not support the use of expert advisors or bots. However, the company actively collaborates with advanced trading software developers, promising to add automated trading capabilities soon.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program of Vital Markets:

-

Partners earn $3 for every closed lot traded by referred clients. Additionally, the company pays fees for second-level referral trades at $1 per lot. IBs (Introducing Brokers) receive $3 per lot and a 10%-15% fee on the second level. Payouts for the first 60 days are increased by 33%.

For the most productive partners, there's an enhanced rate. If the referred traders trade between 50-99 lots, an additional $0.5 per lot is credited to the standard $3, $0.75 for 100-199 lots, and $1 for 200 lots or more. Money can be withdrawn every week once the minimum withdrawal sum of $100 is earned.

Customer support

Technical support at Vital Markets is available to assist traders 24/7.

Advantages

- Support is provided 24/7

- Multi-channel online chat with minimal service delays

Disadvantages

- Cannot contact a company representative via messengers or social networks

- No service in the user account for sending personalized tickets

Available communication channels with Vital Markets support:

-

Live chat;

-

Email;

-

Feedback form in the company's contact section;

-

Call back option.

If necessary, assistance can be requested via phone through the online chat. To do this, one needs to write the question and provide the operator with their name, phone number, and country of residence.

Contacts

| Registration address | Vital Markets Group Ltd, 8, Copthall, Roseau Valley, 00152, Commonwealth of Dominica |

|---|---|

| Official site | https://vitalmarkets.com/ |

| Contacts |

Education

There's very little useful information for beginners on the Vital Markets website. There's a brief overview of essential trading terms in the documentation and FAQs sections.

When learning how to trade, it's advisable to use a demo account as it's the most effective tool for gaining practical trading skills. You don't need to deposit your own money for risk-free learning as the broker provides virtual funds.

Comparison of Vital Markets with other Brokers

| Vital Markets | RoboForex | Pocket Option | Exness | Vantage Markets | Deriv | |

| Trading platform |

TradeLocker | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, WebTrader, Mobile Apps | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader |

| Min deposit | $10 | $10 | $5 | $10 | $50 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 1.00% |

| Spread | From 0.5 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of Vital Markets

Vital Markets switched from traditional trading software to their own platform, aiming to give clients a unique experience with a wide range of assets and account choices. Traders can work with variable or fixed spreads, nearly zero spreads with a commission per lot, or standard accounts without extra fees and with average spreads. They offer demo trading for learning, practicing, testing signals, or getting familiar with Vital Markets’ conditions.

Vital Markets by the numbers:

-

5 types of trading accounts plus a demo option;

-

Spreads starting from 0.1 pips;

-

Leverage is up to 1:500;

-

5 asset classes available for trading.

Vital Markets operates with a unique platform that supports margin trading.

Vital Markets is a broker with a multifunctional proprietary platform supporting margin trading. The available leverage for traders depends on the trading instrument and the account balance. For accounts with capital below $500,000, the maximum leverage for currencies ranges from 1:50 to 1:500 depending on the class. For metals, indices, and energy resources, it's 1:200, and for cryptocurrencies, it's 1:100. If the account balance exceeds $500,000, the Forex leverage does not exceed 1:200. For cryptocurrencies, indices, and commodities, it's 1:50. The maximum leverage for stocks is 1:20 for all accounts regardless of balance. There are two instruments traded under unique conditions: the leverage for pairs with TRY (Turkish Lira) cannot exceed 1:50, and for SHB/USA1000, it cannot exceed 1:30.

The broker provides TradeLocker, a multifunctional trading and analytical platform. It allows setting market and pending orders, selecting lot sizes, and setting stop-loss and take-profit levels. Through a user-friendly interface, traders can manage positions and portfolios, switch chart styles between candles, bars, or lines, as well as integrate their own templates and indicators.

Useful Functions of Vital Markets:

-

Market hours for Forex, metals, stock indices, energy resources, U.S. and EU stocks;

-

A trading calculator that reflects the predicted profit for a selected period according to the compound interest formula;

-

Press kit — a collection of marketing materials (banners, logos, and assistance in social media page design) to boost conversion in affiliate programs;

-

Insights — a website section with the latest market news, overall trading trends, and useful reviews.

Advantages:

Rapid account verification — document validation within 24-48 hours;

Diverse range of trading accounts offering varied conditions;

Lucrative partnership program promoting productivity;

Swift deposit and withdrawal via cryptocurrency wallets;

No limitations on scalping, hedging positions, or news-based trading.

Vital Markets presently focuses on active trading and providing favorable conditions for clients preferring self-directed trading rather than passive strategies.

User Satisfaction