Note:

CFDs are high-risk investments, especially given the use of leverage, so traders should understand them by carefully weighing their benefits and drawbacks. Again, always trade CFDs with a reputable and licensed broker.

The Best CFD demo account - RoboForex

Top CFD demo accounts:

CFD trading is becoming popular, considering the many advantages it presents. In contrast to traditional trading, CFDs allow traders to avoid paying stamp duty, only put up a small portion of the total trade, and use higher leverage. However, the risks involved in CFD trading make it a good idea to practice with a CFD demo trading account.

For instance, traders need to be aware that leverage has the same potential to increase profits as it does to increase losses. Additional risk factors include the potential for a lack of liquidity and the requirement to keep a sufficient margin. No matter how much you read "how-to" articles on CFD, watch CFD tutorial videos, or attend webinars, trading is best learned through hands-on experience.

So, practicing with CFD demo accounts is the best way to learn how to trade without risking your hard-earned money. In this article, TU experts discuss the top five CFD trading demo accounts and helpful details about the broker firms, the products they provide, their leverage, and the terms of their demo accounts.

| Best For | Trial Period | Supported Assets | $ Virtual Limit | |

|---|---|---|---|---|

Best MetaTrader Demo Account |

30 days |

Forex, Stocks, Indices, Soft Commodities, Crypto, CFDs |

$5000 |

|

Best MT4/MT5 Demo Account |

Unlimited (expires after 21 days of inactivity) |

Forex, Stocks, Indices, Commodities, Crypto, CFDs |

$10,000 |

|

Best MetaTrader Demo Account |

Unlimited (demo accounts expire 14 days after you open a live account) |

CFDs on Bonds, Futures, FX pairs, Metals, Energies, Shares, and indices |

$10,000 |

|

Best MetaTrader and cTrader Demo Accounts |

180 days |

CFDs on Futures, FX pairs, Metals, Energies, Shares, and indices |

Up to $100,000 |

|

Best MT4/MT5 Demo Account |

30 days |

Forex, Stocks, Indices, Bonds, Commodities, Crypto, CFDs, ETFs, Themes |

$10,000 |

|

Best MT5 Demo Account |

Unlimited |

Forex, Stocks, Indices, Commodities, Crypto, CFDs |

$10,000 |

|

Best MetaTrader Demo Account |

30 days |

Forex, Stocks, Indices, Bonds, Commodities, Crypto, CFDs, Futures |

No limit |

|

Best MT4/MT5 Demo Account |

30 days |

Forex, Stocks, Indices, Bonds, Commodities, Crypto, CFDs |

$10,000 |

|

Best Proprietary platform demo account |

Unlimited |

Forex, Stocks, Indices, Soft Commodities, ETFs, crypto-assets, CFDs |

$100,000 |

|

Best MT4 Demo Account |

Unlimited |

Forex, metals, Indices, Soft commodities, CFDs on crypto and indices |

100,000 units |

An excellent way for novice or inexperienced investors to practice trading risk-free is with a CFD demo account. Many of the top online brokers provide CFD demo accounts, which are fictitious profiles that simulate a live trading environment. The amount of virtual money that is accessible and how long demo profiles are active fluctuate.

Additionally, brokers with CFD demo accounts offer a variety of financial assets with varying access to real-time and market data. Below are the best CFD brokers that offer traders the best CFD demo accounts.

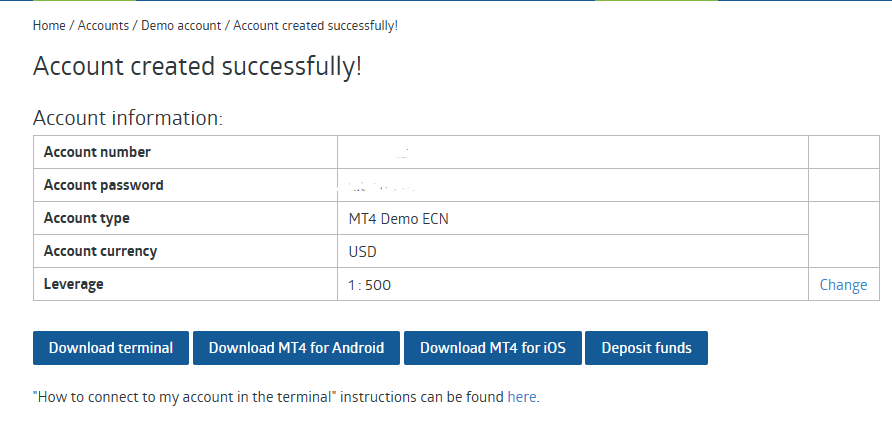

The RoboForex CFD demo trading platform is the best way for users to practice CFD trading, as the account mimics features and tools on actual accounts. Although the RoboForex demo accounts expire after 30 days, they are compatible with all trading platforms and allow traders to select from different asset types.

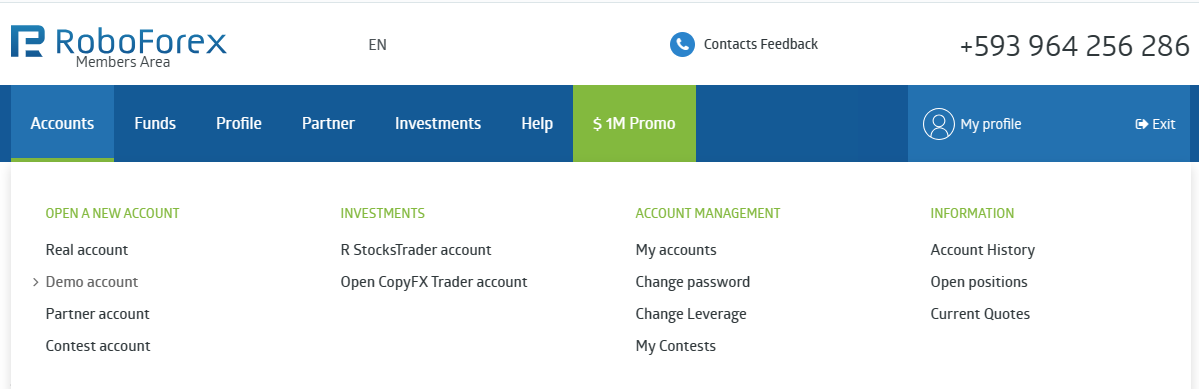

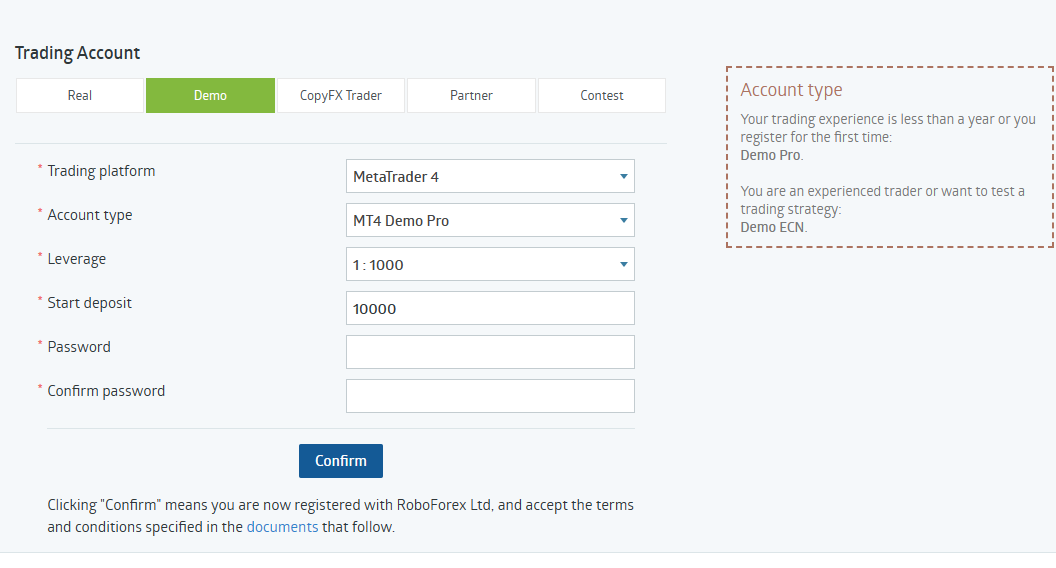

RoboForex does offer multiple free demo trading accounts for beginners to practice Forex trading in a 100% risk-free environment. Traders have access to three different kinds of CFD demo accounts, just as they do when they want to open a real account; this gives them more choices. These three accounts consist of:

Demo Pro - Pro

Demo ECN (MT4) - Prime

Demo (MT5) - ECN

While the ECN demo account allows trading CFD on the energy market with a maximum leverage of 1:500 and spread floating from 0 points, the demo R StocksTrader account gives users access to the largest global markets through the R StocksTrader platform. Traders can trade CFDs on stocks, ETFs, indices, and currencies with spreads that start at 0 points and a maximum leverage of 1:200.

An Exness CFD demo account is a practice account that both novice and experienced traders can use to learn how to trade CFDs and test out or alter current money management and risk management strategies. Due to its flexibility and lack of time constraints, the Exness demo account is among the best. It provides access to the same functionalities and trading tools as the real account.

Similar to real accounts, demo accounts are available for Mini, Classic, and ECN accounts. Leverage is 1:unlimited for mini and classic accounts but 1:200 for ECN accounts. Additionally, the mini's spreads started at 0.3, 0.1 for traditional spreads, and 0.0 for ECN spreads. The CFD demo accounts support a wide range of CFD assets and algorithmic trading, and traders can trade these CFDs on MT4, MT5, and Exness Terminal.

The Exness demo account starts with $10,000 in virtual funds for investors, and that sum may be increased at any time in $1,000 increments. Account expiration does not apply to Exness CFD demo account regular users; otherwise, accounts expire after 21 days of inactivity.

The Tickmill CFD demo account allows traders of all levels to trade CFDs on Forex, Bonds, Commodities, Stocks, Indices, and Cryptocurrencies without committing real money. Using a demo account, which functions almost like a live account, new traders can practice trading CFDs without taking any risks. Seasoned traders take breaks from CFD trading with real money and return to demo trading to improve their trading skills.

The CFD demo account from Tickmill offers traders the same features, options, and choices.

Tickmill offers three different kinds of demo accounts.

The Pro

Classic

Vip accounts

The CFD demo account incorporates the MT4 and MT5 trading platforms, and leverage options for the CFD demo account range from 1:100 to 1:500. However, if you do not log in to either your MT4 Demo account or your MT5 Demo account within 7 days, they both expire. The Tickmill CFD demo account allows for real-time trading and includes all of the programmable tools and features available on the MetaTrader platforms to improve trading efficiency.

FXPro CFD demo accounts are a useful tool that lets new and seasoned traders practice their trades without risking their funds. The platform's tools, including watchlists, news, charting software, and other order types, are available on the CFd demo account. Tickmill CFD demo accounts come with real-time pricing, up to $100,000 in fictitious money, and are accessible on all platforms.

The demo account lasts for 180 days, and you can use premium content and trader tools to enhance your trading there, such as:

Economic Calendar

Educational Material

Calculators

FxPro.News

The trading platform for the FxPro demo account is simple to use and intuitive. Additionally, it works with a few well-known third-party trading platforms, such as MT4, MT5, and cTrader. The maximum leverage for CFDs is strictly regulated in the majority of legal systems, including those in the EU, the UK, and Australia. According to the underlying product, FxPro's current CFD leverage limits range from 30:1 to 2:1.

AMarket’s CFD demo account is another top advantage for beginning and professional traders. This broker demo account offers a way to learn and master a trading platform without having to open and fund a live account first, with over $10,000 in fictitious funds. While professionals use it to test trading strategies before executing a live trade, beginners can use this account to get acquainted with trading on a live market.

Users of the MT4/MT5 and xStation trading platforms have access to different instruments by trading CFDs on bonds, soft commodities, futures, ETFs, and futures. The CFD demo account's interface is very user-friendly and gives traders access to the same functions, features, and options they would typically find on a live trading account. The CFD demo account should be accessible for 30 days after activation, even though the exact length of the demo account's validity is not specified.

The AMarkets CFD demo account offers a wide range of electronically traded products, direct access to international markets, algorithmic trading, and cutting-edge trading tools, with leverage up to 1:3000.

Even though they also offer binary options trading, Pocket Option is a CFD broker that provides the best CFD demo account. The demo account supports trading on both the MT5 and proprietary trading platforms. This free CFD account combines current market data and an excellent trading interface. As an alternative, seasoned traders can experiment with different strategies without risking real money.

Every trader using the platform has access to the standard account that Pocket Option offers. However, only clients who have an open live trading account with Pocket Option are permitted access to the MT4 demo account. You have access to $10,000 in fictitious funds and their online trading platform with a Pocket Option CFD demo account. Social trading is the only distinction between the standard and MT4 CFD demo accounts.

Maximum leverage of 1:1000 allows traders to experience the best CFD trading without risking their money. You can use Windows and Mac to access the services of the Pocket Option platform.

The IC markets CFD demo account ranks as one of the top demo trading accounts thanks to its unique features. The platform's extremely user-friendly interface makes it easy to navigate for new and experienced traders. Users have access to several trading instruments through its demo account, allowing them to familiarize themselves with a range of markets.

The CFD demo account from IC Markets closely reflects the actual market by offering live quotes and utilizing a realistic trading environment.

The features of our live trading accounts, such as ultra-low latency execution and connectivity with raw spread pricing without requotes, are also available on our demo trading accounts. When you open a CFD demo account on this platform, you can choose from MetaTrader 4, cTrader, and MetaTrader 5 for trading.

Although the IC Markets demo account is unlimited, it might expire if it is inactive for 30 days. It is highly customizable, and traders can create up to 20 demo accounts. For traders using the CFD demo account, the maximum leverage is 1:500.

Admiral Markets provides a risk-free demo account that enables you to test your trading strategies under actual market conditions while getting your first taste of trading Forex and CFDs. Even though traders can open a demo account on any device (Windows, Mac, Android, iOS, etc.), doing so gives traders access to free market data and real-time news in addition to a fully immersive live market experience.

The CFD demo account is available for 30 days of access but is accessible for a lifetime when opening a live trading account. For the demo account to remain active, investors must log in at least once every 30 days.

The investment services available through this CFD and Forex Broker demo account include trading in Forex and CFDs on indices, metals, energies, agriculture, stocks, ETFs, and bonds. The CFD demo account complies with an FCA-regulated broker's maximum leverage ratios. Forex pairs offer traders up to 1:30 leverage, indices like the FTSE100 up to 1:20 leverage, and stock, ETF, and bond CFDs up to 1:5.

The demo account gives traders a place to start when trading CFDs, even though eToro is the best CFD trading platform available for copy-trading. With the best CFD products, you can practice more than 3,000 assets, both long and short, using a demo account and leverage that ranges from 1:1 to 1:30 for some products.

Practice on an eToro demo account or virtual portfolio carries absolutely no risk. You will receive a $100,000 virtual value that you can use to trade any of the platform's available assets. You can use actual trading scenarios to hone your technical analysis, portfolio management, and risk management skills.

You can interact with the community directly on eToro's platform that trades the CFDs you are interested in since the demo account gives you full access to all of the platform's features. The EToro demo account offers limitless practice time in actual market circumstances. With no time restrictions, traders can freely experiment and improve their trading strategies with EToro's demo account's unlimited virtual funds.

Demo accounts work similarly to OANDA live accounts for trading CFDs on Bitcoin Cash, Litecoin, or Ethereum. The CFD demo account's user-friendly interface rounds out its extensive features by providing an approachable and intuitive environment, especially for beginners. Because the broker provides alluring demo accounts that allow traders to simulate trading, trading in a demo account makes trading in real accounts easier.

You can select your virtual balance in the Oanda demo account, which is limitless and simple to open. The CFD demo account allows for customization and provides access to more than 120 tradable markets, including MT4, a proprietary desktop, mobile, and WebTrader trading platform. In contrast to other brokers' CFD demo accounts, Oanda does not use a protocol that closes an account after a certain period of inactivity.

While trading on an Oanda CFD demo account, traders can go long or short on more than 120 CFD instruments and over 70 Forex pairs.

Choosing the best CFD demo account starts with a trader choosing the best CFD broker, but finding the best CFD broker is the first step in locating the best CFD demo account. So, the first thing a trader should do when looking for a reliable CFD broker is to make sure the broker is overseen by an established financial institution.

Traders should always assess the broker’s trading platform's dependability and functionality and the variety of CFD instruments the broker offers once more. Next, the traders should verify if the broker offers a CFD demo account.

If the broker provides a demo account for CFD trading, the trader can register for an account. However, the trader should make sure the demo account replicates trading on the exact platform they later plan to use with real money. Then go ahead and verify the following:

Ensure the account enables you to tailor indicators and other tools to your trading strategies. Real-time market data, available chart types, and technical indicators are all important considerations

Examine the wide range of financial markets that are accessible and be aware of the broker's leverage and margin requirements. Examine the different types of demo accounts provided and the maximum number of demo accounts that can be opened using the same email

Check to see if the broker offers accommodating customer support to answer your queries and educational tools and resources to help you improve your trading skills. You should be able to contact the broker's support team through active channels, and they should be open to your inquiries

Verify if the broker has mobile trading options available via a mobile app or a mobile-friendly website. Consider the broker's turnaround time for trade execution and whether they provide risk-management tools like guaranteed stop-loss orders

Using a CFD demo account, traders can become familiar with the trading platform and gain experience in trading without risking any real money. This can boost your confidence and lower the likelihood that you will make costly errors. The following reasons are further justifications for traders to use CFD trading accounts:

Using a CFD demo account, traders can evaluate the performance of their strategies on the live market

Managing your overall risk exposures and establishing stop-loss orders, take-profit levels, and stop-loss levels can all be practiced using a demo account

You can test out various market conditions, price swings, and market movements using a demo account without having to take any financial risks. You can learn how events and news affect CFD prices

A CFD demo account can help you find the instruments that suit your trading preferences and interests

Using a demo account will help you better understand how emotions like fear, greed, and impatience affect your trading

Opening a CFD demo account on Robo Forex is simple and you can get started by following the steps below.

Note:

CFDs are high-risk investments, especially given the use of leverage, so traders should understand them by carefully weighing their benefits and drawbacks. Again, always trade CFDs with a reputable and licensed broker.

Poor knowledge of the CFD market and a lack of a solid trading strategy are the main causes of CFD account losses. Again, insufficient risk management, excessive trading, trading without adequate analysis, and the requirement to maintain a sufficient margin due to leveraged losses are also contributing factors.

Yes. You can trade with a demo account, but note that you cannot withdraw any profits from a demo account.

The fact that CFDs are over-the-counter (OTC) products and do not pass through regulated exchanges makes them illegal in the US.

No. A demo account uses what is known as virtual or fake money.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).