54.76% of retail investor accounts lose money when trading CFDs / Spread betting with this provider.

ATFX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $250

- MT4

- Desktop MT4

- Mobile MT4

- Web Trader MT4

- FCA

- CySEC

- FSC (Mauritius)

- 2017

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $250

- MT4

- Desktop MT4

- Mobile MT4

- Web Trader MT4

- FCA

- CySEC

- FSC (Mauritius)

- 2017

Our Evaluation of ATFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ATFX is a broker with higher-than-average risk and the TU Overall Score of 4.94 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ATFX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

ATFX is a broker for professional traders, who are prepared to invest at least $5,000.

Brief Look at ATFX

ATFX is a Forex and CFD broker and is a part of AT Global Markets, an international investment holding company. The company is licensed by the FCA (UK) 760555, CySEC (Cyprus) 285/15, FSC (Mauritius) C118023331, and FSA (Saint Vincent and the Grenadines) 333 LLC 2020. The broker offers beneficial trading conditions for active traders as well as passive investors. ATFX service quality has been recognized by the many awards the broker has received, including Fastest Growing Forex Broker in Europe in 2017, and a 2018 Best Forex CFD Broker award from UK Forex Awards.

- Several licenses from international regulators.

- Beneficial trading conditions for professional traders and large investors.

- Possibility to invest in PAMM accounts and copy trades using the broker’s proprietary platform.

- No cent accounts.

- High minimum deposit on standard accounts.

- Bonuses are not available for all customers.

- Wide market spreads on Standard accounts.

- Limited choice of partnership programs.

TU Expert Advice

Financial expert and analyst at Traders Union

ATFX positions itself as a customer-oriented broker that is focused on the trader’s interests. Automation and flexible work are the key components of the successful operation of the company on the Forex market. ATFX provides technical and fundamental analysis, market forecasts, and trading rates from financial experts with vast experience of working both in the retail and institutional environment.

ATFX promptly reacts to the evolving needs of the customers and launches custom-made products to meet them. In particular, recently the company introduced ATFX Connect, a new division that was set up to service institutional professional customers. Also, in 2020, the broker introduced a proprietary social trading platform titled ATFX TeamUp.

The company updated the website, adding new useful sections – Trading Strategies and Market News. The information published in them will help beginners and professionals improve the quality of their trading skills.

ATFX Summary

Your capital is at risk. 54.76% of retail investor accounts lose money when trading CFDs / Spread betting with this provider. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs / Spread betting work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4 (desktop, mobile, WebTrader) |

|---|---|

| 📊 Accounts: | Demo, Standard, Edge, Premium, Professional |

| 💰 Account currency: | EUR, USD |

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, wire transfer, Neteller, Skrill, Perfect Money, Nganluong, CASH, and M-Pesa |

| 🚀 Minimum deposit: | $250 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.1-1.8 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrency, CFDs on indices, stocks, and commodities |

| 💹 Margin Call / Stop Out: | Not specified |

| 🏛 Liquidity provider: | Not specified |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | STP |

| ⭐ Trading features: | Wide range of standard and professional accounts |

| 🎁 Contests and bonuses: | Yes (for customers from specific countries) |

The trading conditions of ATFX are designed for professionals and traders with a sufficient volume of equity. The minimum deposit is $250, which is a rather high entry threshold to the Forex market for novice traders. Also, the broker does not offer cent accounts, which is why the traders cannot test trading conditions while investing a minimum amount. On the standard accounts, the spread is from 1-1.8 pips. For traders who use high-frequency strategies, such a high trading commission is unacceptable.

ATFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

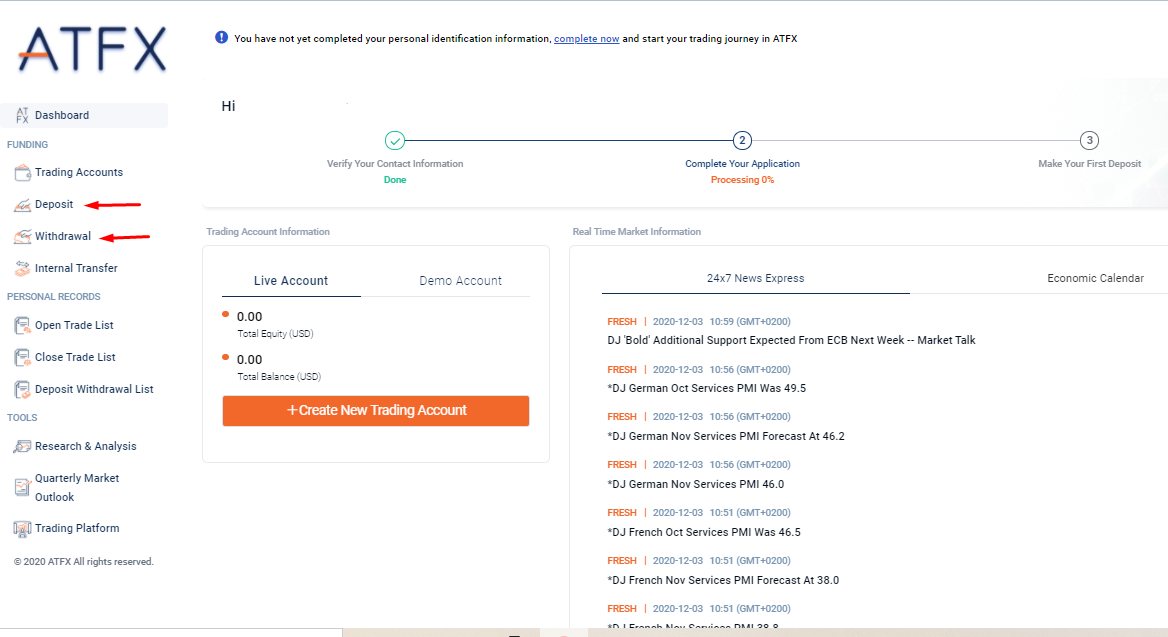

Trading Account Opening

To start trading on ATFX, you need to open a trading account with the broker. For this, you need to:

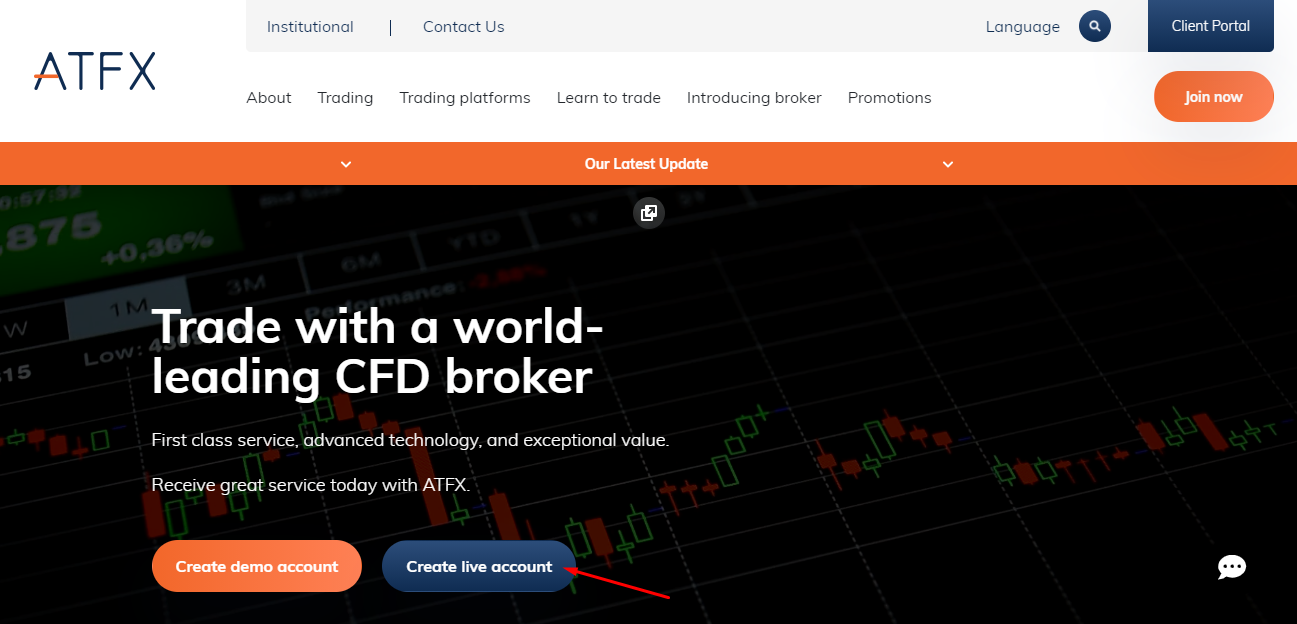

Visit the company’s official website and press Create Live Account on its home page.

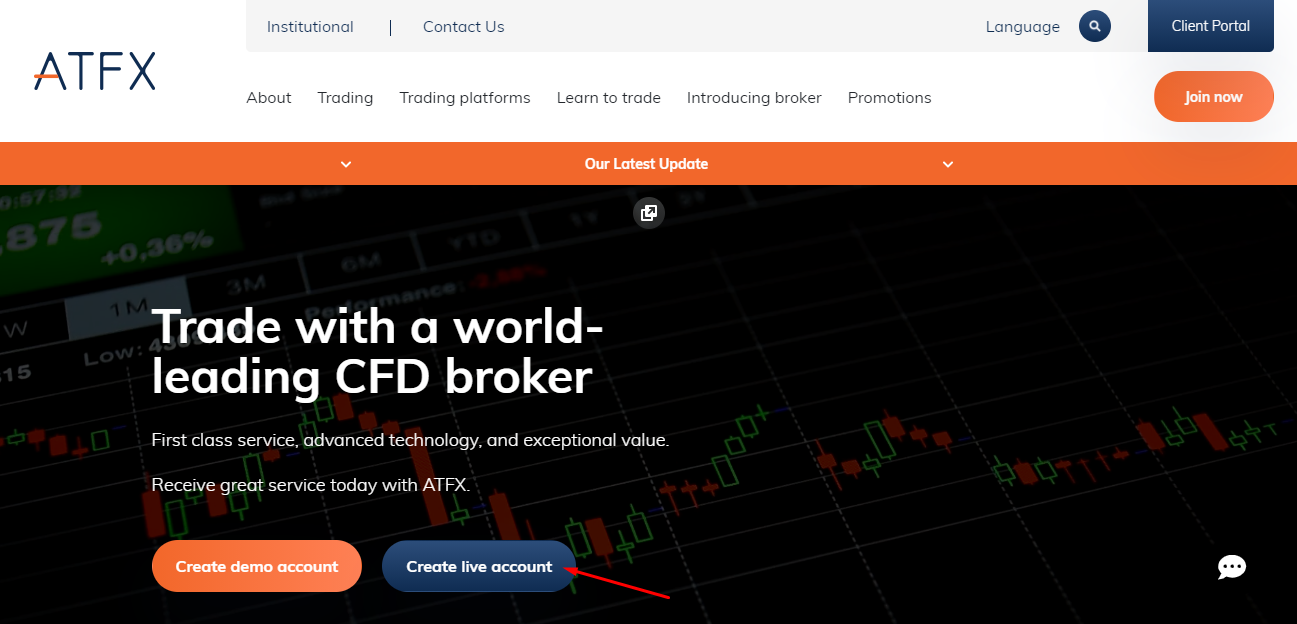

Fill out the registration form, provide first and last name, country of residence, phone number, email. Come up with a secure password, enter the captcha code and accept conditions. Confirm email and phone number by entering the codes that were sent by the broker in the pop-down window in the personal account.

The following features are available in ATFX personal account:

In the personal account, a trader can also perform the following actions:

-

Download MT4 platform or gain access to the web version of the platform.

-

Read quarterly market reviews.

-

Trace the number of open and closed orders.

-

View withdrawal transaction history.

-

Transfer funds between the internal accounts.

-

Contact the broker’s representatives in online mode.

Regulation and safety

ATFX is a part of AT Global Markets holding. Its daughter companies operate on four licenses: FCA (UK), CySEC (Cyprus), FSC (Mauritius), and FSA (Saint Vincent and the Grenadines).

Also, ATFX operates in compliance with ESMA (European Securities and Markets Authority) standards. The independent EU authority and regulators strictly control the operation of the broker and its stability, which guarantees the protection of funds for the retail traders.

Advantages

- Customer funds are kept on separate bank accounts

- Negative balance protection

- The regulator settles disputes between the broker and its customers

Disadvantages

- The regulators only consider claims involving large amounts

- Verification is a mandatory procedure

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard 1:400 | from $18 | Charged in certain situations |

| Standard 1:200 | from $18 | Charged in certain situations |

| Standard 1:100 | from $18 | Charged in certain situations |

| Standard 1:30 | from $10 | Charged in certain situations |

| Edge | from $6 | Charged in certain situations |

| Premium | from $1 | Charged in certain situations |

| Edge (Professional) | from $6 | Charged in certain situations |

| Premium (Professional) | from $1 | Charged in certain situations |

| Professional | from $1 | Charged in certain situations |

Swaps are charged (a commission for rollover of the position to the following day). Our experts also compared ATFX trading commissions with those of its competitors. The results of the comparison are in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$8.77 | |

|

$1 | |

|

$8.5 |

Account types

ATFX offers standard and professional accounts. To be given the Professional status, a trader must close at least 10 trades with large amounts quarterly for the past year and own equity of over EUR 500,000.

Account types:

The company provides an opportunity to test trading conditions and the platform features using a free demo account with identical conditions to the live accounts.

ATFX offers a wide choice of accounts for traders with any level of trading skills. Customers can open standard and professional accounts with conditions that are best suited for their strategy.

Deposit and Withdrawal

-

ATFX does not charge a withdrawal fee on withdrawals from EUR/USD 100 and more to debit/credit cards and electronic payment systems. If the customer withdraws a lower amount, the broker’s fee is EUR/USD 5. Zero fee withdrawals via a wire transfer are available for amounts over EUR/USD 1,000. Payment systems may charge additional withdrawal fees.

-

ATFX allows withdrawals via a wire transfer, to Visa and Mastercard cards. The available electronic systems include Skrill, Neteller, Perfect Money, Nganluong, M-Pesa, and CASH.

-

Withdrawals to a debit/credit card depend on the bank that issued it. Withdrawals to electronic payment systems take from 1 minute to 1 business day. Wire transfers take 3-7 business days.

-

Via a wire transfer, you can withdraw funds in EUR and USD, NganLuong payment system – in VDN. Withdrawals to debit/credit cards and electronic wallets are performed in US dollars.

-

There is no limit on the maximum per day amount for debit/credit cards, wire transfers, or electronic wallets.

Investment Options

Investment Programs, Available Markets and Products of the Broker

ATFX is a broker with conditions designed for active traders. The company also provides an opportunity to earn passive income without being personally involved in trading. The number of investment programs of ATFX is limited: the customers can invest in a PAMM account and earn a partnership reward under the Introducing Broker program. In 2020, the broker launched TeamUp, a proprietary social trading platform, which allows investors to copy trades of successful traders.

PAMM is a managed accounts system from ATFX

PAMM accounts from ATFX are managed accounts that provide an investor with an opportunity to earn profit without trading independently. All financial transactions are performed by the chosen manager. The investor pays the managing trader a fee for successful trades. All conditions are discussed and agreed upon in advance, and profit distribution is automatic.

Key features of PAMM accounts on ATFX:

-

The customer receives daily reports on the actions taken on the account.

-

An investor can choose the manager from the ratings based on the information about the managed funds, the trader’s equity, level of strategy’s aggressiveness, and age of the account.

-

The minimum investment amount, manager’s reward, investment period, and also a penalty for early withdrawal of funds are specified in the contract upon the offer of managing services.

Using PAMM accounts, a trader, who does not have the skills of trading on financial markets, can earn passive income. All trades on the managed accounts are performed by professional traders, which is why an investor does not need to perform analysis and trade. Placement of equity on several PAMM accounts with different managers provides an opportunity for a passive investor to diversify investments.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ATFX affiliate program:

-

Introducing Broker (IB) is a program with a partnership reward of up to $19 per lot of the connected customer.

ATFX offers only one type of partnership. The company gives up a part of its commission to the introducing broker for introducing ATFX services to the traders and urging them to become active customers.

Customer support

Online chat operators provide support 24 hours a day, 7 days a week.

Advantages

- 24-h online chat

- Possibility to contact your personal manager

Disadvantages

- Only general questions can be asked in the online chat

- Detailed information about trading conditions is not provided to unregistered users.

The following methods of contacting customer support are available:

-

via phone at the numbers specified in the Contact Us section;

-

email;

-

online chat on the broker’s website;

-

Messenger Facebook.

Online chat for contacting the broker’s representatives can be found both on the website and in the personal account.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines |

| Regulation |

FCA, CySEC, FSC (Mauritius)

Licence number: 760555, 285/15, C118023331 |

| Official site | atfx.com |

| Contacts |

+44 203 957 7777, 0800 279 6219

|

Education

There is a rather extensive Learn to Trade section on the broker’s website, featuring instruments for analysis and also useful information on trading on the financial markets for beginners and experienced traders.

Using a demo account will help consolidate the acquired knowledge and test it.

Comparison of ATFX with other Brokers

| ATFX | RoboForex | Pocket Option | Exness | FxPro | FxGlory | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MobileTrading, MT5 |

| Min deposit | $500 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 2 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 20% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of ATFX

ATFX is a reliable Forex and CFD broker, introducing the latest technologies and offers solutions for retail and institutional investors. The company provides services globally, although, at the moment, the broker is working on expanding its presence in Europe. For this purpose, AT Global Markets developers have created ATFX Connect, a unique product for institutional investors. Simplicity, speed, security, and adaptability make ATFX one of the top platforms in the industry.

Several figures about ATFX published on the broker’s official website:

-

The broker employs 450 people.

-

The broker has branches and offices in 14 countries.

-

Over 100 trading instruments are available to customers.

ATFX is a broker for active traders of all levels of trading experience

ATFX is a reliable institutional platform, providing access to first-level bank and non-bank liquidity. The broker offers competitive spreads, high order execution, and access to the most popular trading platform. The company uses HTML5 protocols to make the user interface as efficient as it can be. A functional client portal allows ATFX customers to manage their risks, view opened positions and trades, and also control their equity in real-time.

ATFX provides the MT4 platform for Forex trading. The broker’s customers can work from any device – PC, laptop, tablet, or smartphone. A web version that does not require the installation of additional software is also available. All versions of the platform offer a wide range of analytical instruments, including over 30 indicators.

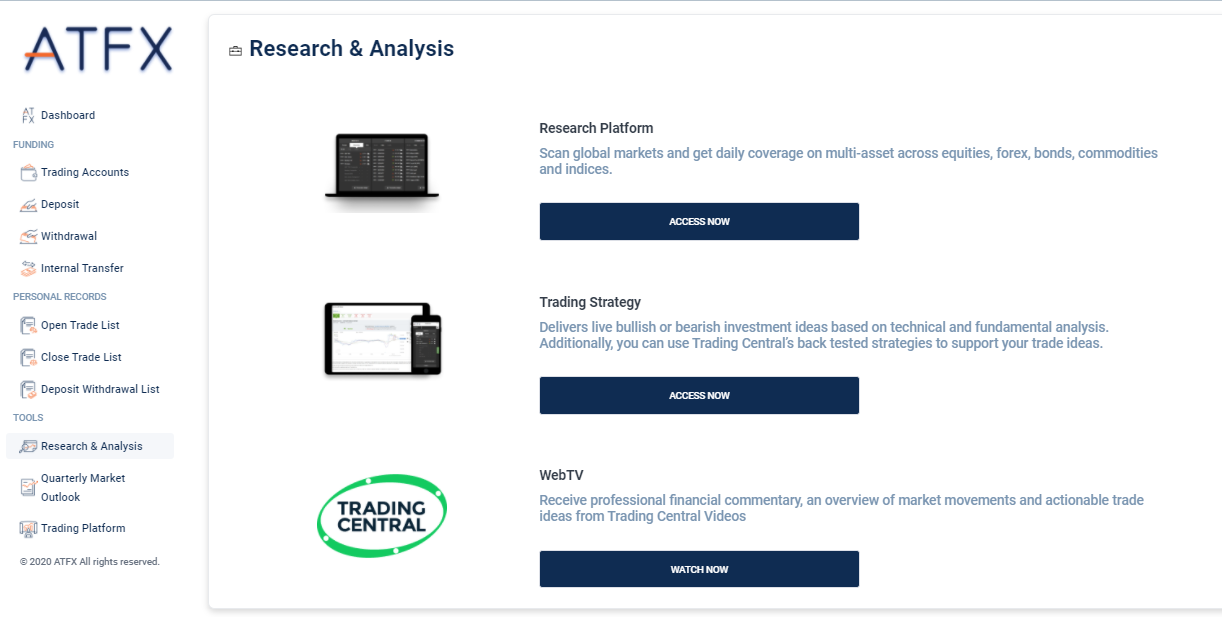

Useful services offered by ATFX:

-

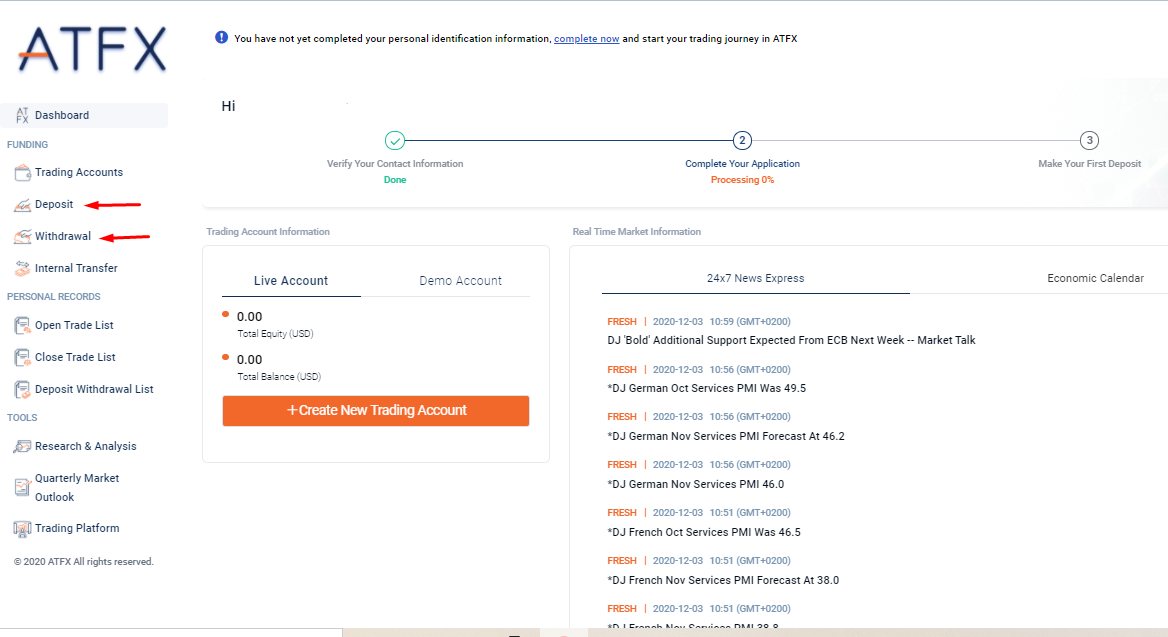

Autochartist is an instrument for market analysis, which builds charts based on trading indicators such as pivot points, moving averages, Bollinger Bands, Fibonacci Retracements, MACD, and others.

-

Trading Central is a customizable review of over 8,000 instruments, including Forex, indices, and commodities.

-

Dow Jones News is a service for receiving financial information, which serves as a fundamental analysis instrument from a top world agency.

Advantages:

There is negative balance protection on all standard and professional accounts.

There are accounts with tight market spreads from 0.1-0.6 pips.

A trader can choose accounts with the best-suited leverage – from 1:30 to 1:400.

The broker provides an opportunity to invest in PAMM accounts.

ATFX is a part of a large holding company, which holds licenses issued by international regulators.

The company provides the latest analytical information, trading signals from Trading Central, and quality educational materials.

Scalping, trading with algorithmic advisors (EAs), creation of user indicators in MQL are allowed.

User Satisfaction