ATC Brokers Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $3,000

- MT4

- FCA

- CIMA

- 2013

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $3,000

- MT4

- FCA

- CIMA

- 2013

Our Evaluation of ATC BROKERS

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ATC BROKERS is a moderate-risk broker with the TU Overall Score of 5.14 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ATC BROKERS clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

ATC Brokers is an STP and ECN broker targeted at clients looking for a US and UK regulated Forex broker.

Brief Look at ATC BROKERS

The ATC Brokers is an ECN and STP broker that has been operating since 2005. The company provides services for both individual traders and institutional investors. ATC is headquartered in the United States and operates under licenses issued by regulators such as FCA 591361(UK) and CIMA , 1448274(Cayman Islands).

- Spreads for EUR/USD from 0.3 pips.

- The ability to invest using the Trade Copier and PAMM accounts;

- Support for 38 Forex currency pairs.

- Availability of licenses for financial activities from reputable regulators in the USA and Great Britain.

- Direct access to liquidity providers thanks to the support of ECN and STP technologies.

- There are only two groups of trading instruments.

- There are commissions for account replenishment, withdrawal of funds, and an inactivity fee.

- Lack of bonuses.

TU Expert Advice

Financial expert and analyst at Traders Union

ATC Brokers has been providing brokerage services to clients for over 16 years. During this time, there were no high-profile scandals, data manipulations, or other problems with this broker. Reliability is also confirmed by licenses issued by US and UK regulators, which have strict requirements and issue documents only to worthy financial companies. The existence of permits for financial activities from FCA is a positive factor.

In general, this broker is not universal, but very good in its niche. ATC Brokers specializes in providing services in the Forex market and has succeeded in this due to its attractive commission policy, convenient trading terminal, and high-quality support.

This broker is not suitable for beginners as it has high minimum deposit requirements and limited training. However, for experienced people who are eager to find a reliable Forex broker with low fees, ATC Brokers is a good choice.

ATC BROKERS Summary

| 💻 Trading platform: | МТ4 (desktop, mobile, web) |

|---|---|

| 📊 Accounts: | Individual, Joint, and Corporate |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer, Skrill, debit/credit card |

| 🚀 Minimum deposit: | From USD 3,000 |

| ⚖️ Leverage: | Up to 1:100 with a trading account balance of less than USD 100,000, Up to 1:200 with an account balance of more than USD 100,000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.3 pips |

| 🔧 Instruments: | Currency pairs (38), CFDs on metals (2) |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | There is an inactivity fee on the account |

| 🎁 Contests and bonuses: | No |

The broker specializes in providing clients with trading services in the Forex market. In particular, 38 currency pairs are available here, including the most popular pairs, cross rates, as well as some types of exotic currencies. On a standard trading account, traders are provided with leverage of up to 1:200. Clients can test the trading conditions of the company using a demo account, access to which is provided without restrictions.

ATC BROKERS Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with ATC Brokers, you need to go through the registration and verification procedure. The document verification procedure takes 1-2 business days for private traders and 3-5 business days for corporate clients. The registration procedure for private traders includes several stages.

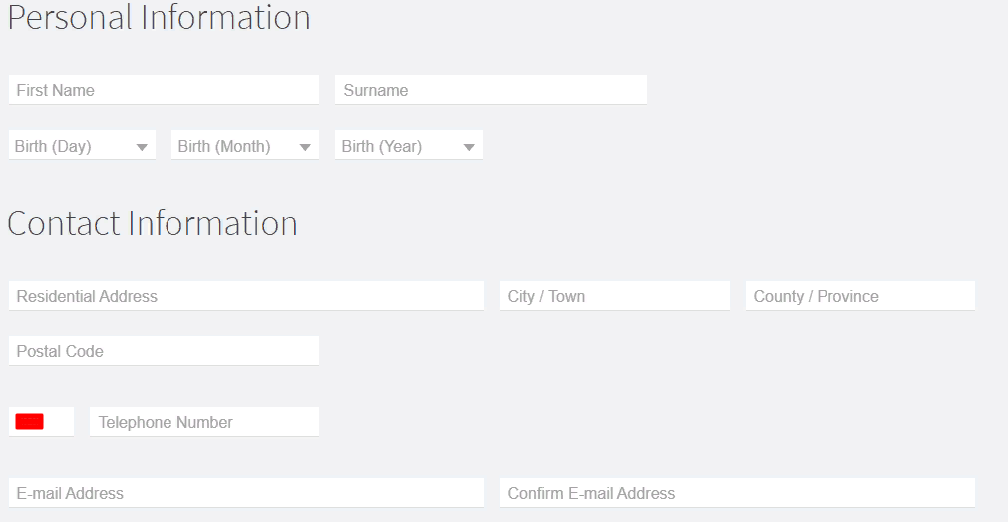

First, you need to fill out a basic registration form. It includes the following fields: country of residence, account type, account currency, type of trading terminal (online, desktop, mobile), planned investment amount.

Next, the broker will ask you to provide personal data: name, surname, and date of birth. In addition, the trader will need to provide contact information such as residence address, email, and phone number.

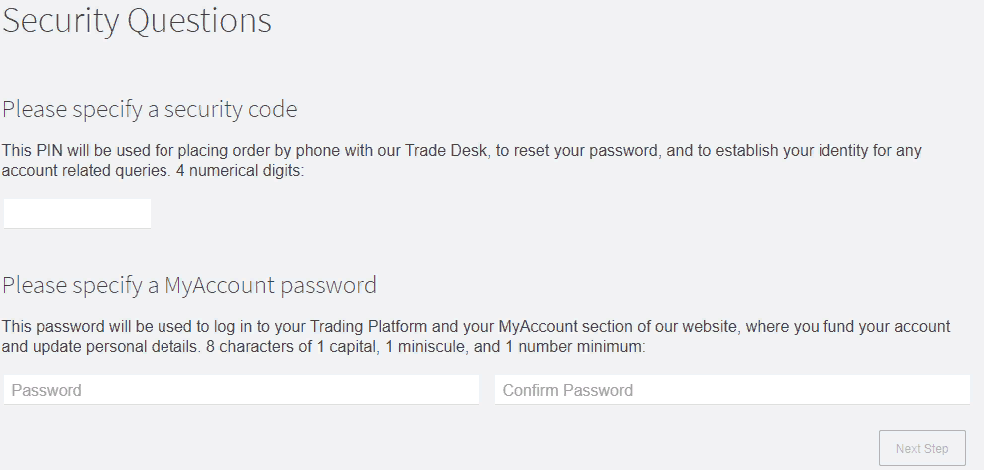

After that, the broker will ask you to set a password for your account and a four-digit pin code. The PIN code is used to reset the password, to contact the customer with technical support, etc.

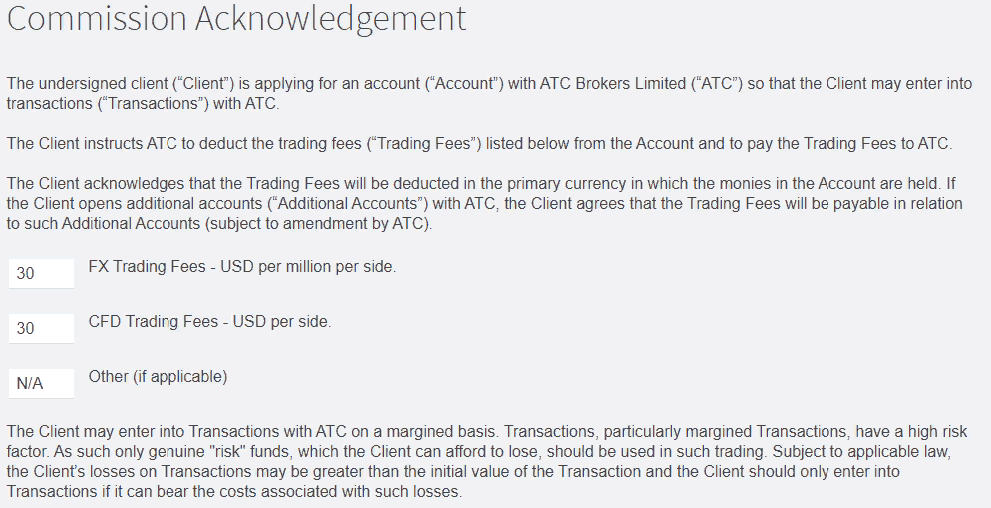

Next, the company will warn the client about the fees charged. You must confirm that you have read this information.

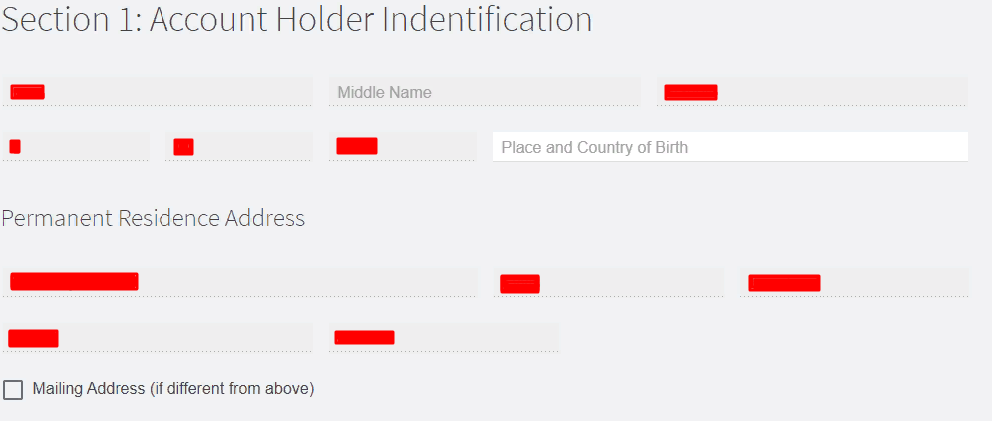

Next, you will be asked to fill out a large identification form. The specified data will need to be confirmed during verification. The first part includes the personal data and address of the resident.

In the second part of the identification form, you must indicate whether you are a citizen of the United States, where you were born. The third part of the identification form will require tax information. In particular, it is necessary to indicate the country of tax residence, the type of tax identification document, and its number. Finally, you need to confirm that all the information provided in the form is correct and true.

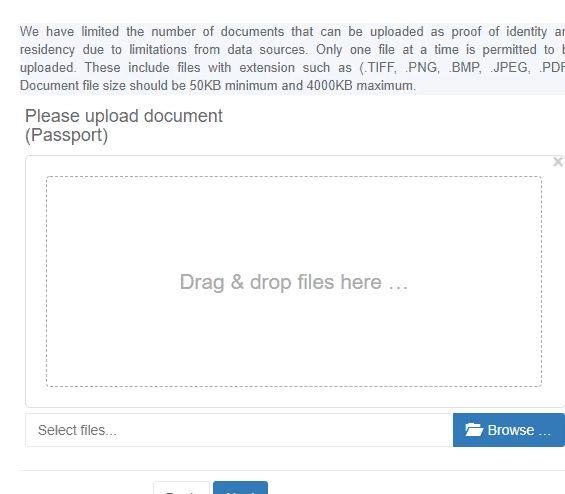

The last stage of the procedure is verification. To verify your identity, you need to upload your ID and proof of residential address.

After the approval of your documents, you will get full access to your account, you will be able to replenish your account and start trading.

Also in the personal account, the trader has access to:

-

Reports - information about the trades made by the user during the trading activity.

-

Portfolio - reports on the trader's activity for various trading instruments.

-

Swap history - information about accrued or withheld swaps during trading.

Regulation and safety

ATC Brokers is a secure and regulated broker. The company operates under the following licenses: Financial Conduct Authority (Great Britain) - FCA No. 591361, and Cayman Islands Monetary Authority - CIMA No. 1448274.

Advantages

- Client funds are segregated from ATC Brokers capital and held in segregated bank accounts

- Negative balance protection active

- In case of violation by the broker of the obligations prescribed in the offer, the client can file a complaint with the regulator

Disadvantages

- You cannot access your account without verification.

- Limited choice of electronic payment systems for making deposits and withdrawals of money

Commissions and fees

The broker also has non-trading commissions. In particular, the company requires mandatory payments for account replenishment and withdrawal of funds. The following commissions are charged for account funding: bank transfer - 0%; bank cards - 2.9%; and Skrill - 2.9%. When withdrawing funds, the broker withholds commissions in the following amount: bank transfer - USD 40; EUR 30; GBP 25; bank cards - 0%; and Skrill - 1%. There is also a commission for account inactivity. It is held at 50 units of the base currency after 6 months of inactivity. If there are not enough funds in the account, the account will be automatically blocked

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Individual | From $3 | Yes |

The Traders Union also compared the size of the average trading commission of ATC Brokers, Admiral Markets, and FxPro. The comparison results are presented in the form of a table.

| Broker | Average commission | Level |

|---|---|---|

|

$3 | |

|

$1 | |

|

$8.5 |

Account types

ATC Brokers provides clients with three types of accounts: Individual, Joint, and Corporate. There are no differences in trading conditions for these types of trading accounts. Commissions depend on the type of trading instruments the trader deals with.

Account types:

A demo account is offered for the company's clients, which is available without any restrictions. To open it, you must submit an appropriate application.

ATC Brokers is an STP/ECN broker that provides profitable trading conditions for professional traders who prefer to work with liquidity providers.

Deposit and Withdrawal

-

The processing time for applications for withdrawal of funds at ATC Brokers is up to 48 hours.

-

The company withdraws funds by bank transfer, to Visa and Mastercard bank cards, as well as to Skrill wallets.

-

A bank transfer in a company takes up to two business days.

-

The broker charges a commission for withdrawing funds. The amount of payment for withdrawal by bank transfer is GBP 20; EUR 30; or USD 40 depending on the base currency of the account. Withdrawals to Skrill are subject to a 1% commission. There are no commission fees for transactions using bank cards.

-

Deposit and withdrawal of funds at ATC Brokers are possible only after passing the verification.

Investment Options

Investment Programs, Available Markets and Products of the Broker

Investment programs are presented by ATC Brokers with a copy-trading service, as well as PAMM accounts, which allow both beginners and professionals to earn money.

Passive earnings using Copy Trading at ATC Brokers

To invest with ATC Brokers, you can copy trades. The company provides clients with access to the Trade Copier service. It is a platform that is a partner of ATC Brokers. The broker provides access to the free Trade Copier package, which includes some restrictions. Thus, the maximum number of lots per day is 10, and per month, it's 20. The maximum number of trades per day is 20, and per month, it's 50.

Traders can also use the paid services of Trade Copier.

The broker charges a commission for copy trading in the form of a spread. The spread size is identical to standard trades, which are opened manually by traders.

PAMM accounts are the choice for professionals and private investors for passive earnings

The service helps both managers and clients earn money. The company's clients can change subscription settings, set copy rates, and view reports. You can quickly subscribe and unsubscribe from the manager. You can choose a manager by success indicators, by the terms of work on the platform, by the number of accounts and funds under management, and by commissions.

The account holder has access to the subscription statistics, membership level, and risk management settings associated with the account. The client, through his personal account, also may track all the trading activity of the manager, receive reports, request withdrawals, send requests for tickets, and much more.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ATC Brokers’ affiliate program

ATC Brokers offers its clients the Introducing Brokers affiliate program. With its help, institutional investors, account managers, Forex schools, etc. will be able to promote their services. Monitoring of the results of the affiliate program from ATC Brokers is carried out through a special application, as well as through reports that the company sends by email.

To become a member of the ATC Brokers Introducing Brokers (IB) program, clients need to apply using the form on the company's official website.

Customer support

Support operators are available 24 hours a day (Sunday 5 pm to Friday 5 pm EST).

Advantages

- You can ask the support service even without being a client of the company

- There are 4 ways to contact support

Disadvantages

- Works 24/5

Available communication channels with customer support specialists include:

-

phone number (specified in the Contact section);

-

email;

-

feedback form;

-

online chat on the site.

A user can ask the support service a question without registering with the company.

Contacts

| Foundation date | 2013 |

|---|---|

| Registration address | 700 N Brand Blvd, Suite 1180, Glendale, CA 91203, United States |

| Regulation | FCA, CIMA |

| Official site | https://atcbrokers.com/ |

| Contacts |

+44 20 3318 1399

|

Education

Training materials for traders at ATC Brokers are very limited. Training is presented in the form of nine educational articles, which show the peculiarities of trading with various trading instruments, the functions of the MetaTrader 4 terminal, and the features of ECN technology. There is no detailed video course on the website. Educational books, reviews of trading strategies are not provided.

The broker does not have cent accounts, so you can get practice in trading only with the help of a demo account.

Comparison of ATC BROKERS with other Brokers

| ATC BROKERS | RoboForex | Pocket Option | Exness | FxPro | Forex4you | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MobileTrading, MT5 |

| Min deposit | $2000 | $10 | $5 | $10 | $100 | No |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:10 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

120% / 100% | 60% / 40% | 30% / 50% | No / 60% | 25% / 20% | 100% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed Review of ATC Brokers

The ATC Brokers uses STP and ECN technologies. This gives traders direct access to liquidity providers, which helps to reduce trading costs. The company specializes in Forex trading services and offers 38 currency pairs for traders. Users can work on Individual, Joint, and Corporate accounts. A free demo account is also provided.

ATC Brokers in figures:

-

0.3 pips - the average spread in EUR/USD.

-

16 years on the market.

-

1:200 - leverage.

Automation and convenient terminal of ATC Brokers

ATC Brokers provides clients with access to the MetaTrader 4 terminal. This is a proven platform that provides clients with several options, such as the ability to customize the platform interface and charts, connect news resources, quickly open and close trades, 1-click trading, more than 50 technical tools, analyses, and many plug-ins.

The ATC Brokers MetaTrader 4 supports automated trading. Also, the company's clients can use trading advisors. The broker allows you to employ many trading strategies. Also, clients can receive passive income using copy trading. ATC Brokers provides access to Trade Copier, a partnership service for copying trades. Connection to the signal provider you are interested in is carried out through the MetaTrader 4 terminal.

Useful investment services of ATC Brokers:

-

Economic calendar. Allows you to track world economic events and trends. It contains all the events for the next two weeks and you can sort events using filters.

-

VPS for MetaTrader 4. This option allows you to keep trades open even if the trading terminal is closed. The VPS server is provided free of charge.

Advantages:

38 currency pairs for Forex.

Tight spreads, from 0.3 pips.

Negative balance protection.

Investors are allowed to work with the Trade Copier copy-trading platform.

User Satisfaction