deposit:

- $250

Trading platform:

- MT4

- FCA

- CySEC

ETX Capital Review (OvalX) 2024

Best alternatives for ETX Capital

|

Ranking position |

Overall Score |

Broker | Next Step |

|---|---|---|---|

|

1

|

Score

5.7

/10

|

||

|

2

|

Score

5.28

/10

|

||

|

3

|

Score

6.68

/10

|

Summary of ETX Capital Trading Company

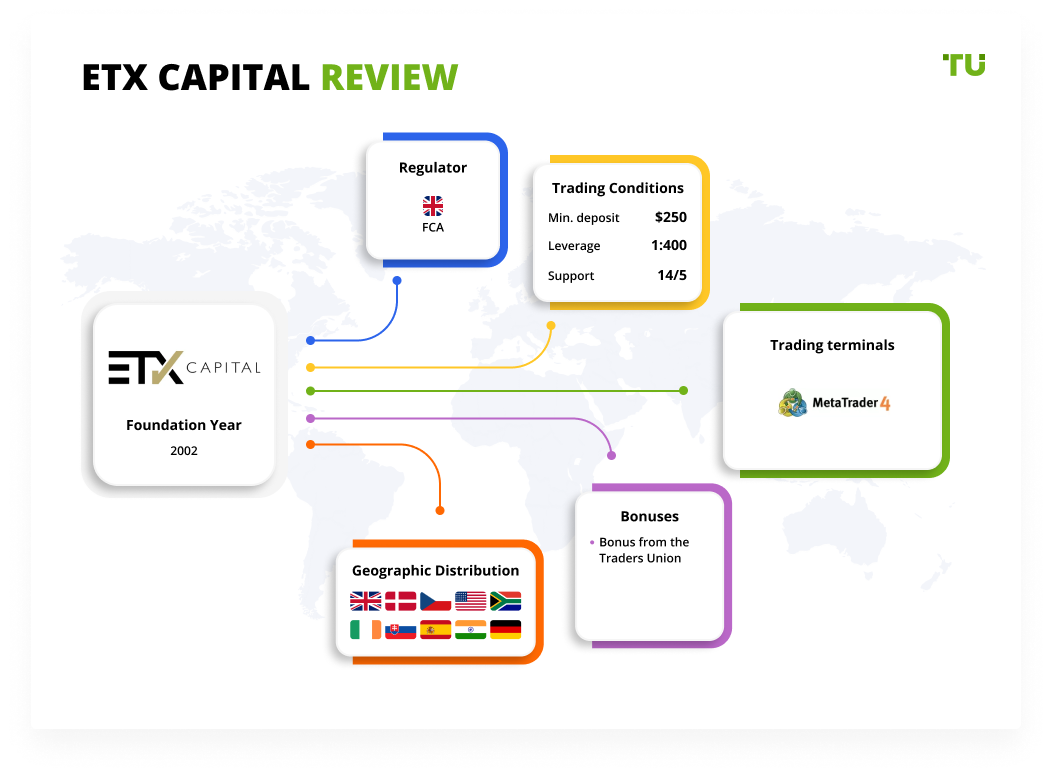

The brokerage company OvalX (aka ETX Capital) was founded in 2002 and belongs to the well-known corporation Monecor Limited, which has been operating since 1965. Headquartered in London, the company is regulated by the FCA (UK Financial Conduct Authority). The broker is aimed at cooperation with traders from EU countries. ETX Capital provides a wide range of trading tools, narrow spreads and quality training materials. In 2018, ETX Capital’s own development TraderPro was recognized as the best trading platform according to the UK Forex Awards and Online Personal Wealth Awards.

👍 Advantages of trading with ETX Capital:

- control of the broker's activities by the FCA;

- typically a narrow spread for popular currency pairs;

- quality training from London’s financial experts.

👎 Disadvantages of ETX Capital:

- high minimum deposit;

- small selection of payment systems and withdrawal commission under certain conditions;

- a complex and lengthy procedure for opening an account, consisting of four stages;

- there are no PAMM accounts or investment programs for generating passive income.

Geographic Distribution of ETX Capital Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

OvalX aims to provide favorable conditions for active trading. For this reason, there are no investment programs, no ready-made diversified portfolios or PAMM accounts in the broker's arsenal. To obtain passive income without independent trading, the company offers clients the use of its automatic copying service and to participate in an affiliate program.

Expert advisor: A service for copying trades using MetaTrader 4

An expert advisor is a mechanical trading system that uses an algorithm set by the proprietor. The program is compatible with MT4, but not available for TraderPro. The trading system allows you to open/close trades automatically. The user independently determines the priority algorithm for opening a trade. The settings allow you to select copying based on support/resistance levels or technical indicators.

-

Expert advisors provide signals around the clock, 7 days a week.

-

The expert advisor operates in two modes: informational (notification of signals for entering and exiting the market) and automatic (execution of trades without the personal intervention of a trader).

-

Trades are copied instantly.

-

The system is equipped with its risk assessment system.

The use of an automated program in the work eliminates psychological factors when making decisions. Mechanical trading systems allow you to receive additional income without conducting independent analysis and with minimal trading experience.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

OvalX’s affiliate program:

-

Affiliate programs - allow the owners of Forex-themed websites to receive a reward for placing a text link or company banner on their page.

-

IBs allow profits from the trade turnover of new clients and for participation in training courses or seminars of the company.

-

Regulated Brokers are for dealers who offer traders to trade CFDs.

The amount of remuneration is negotiated with each partner individually and depends on the country of residence, the type of trading account opened with the company, and the status of a private person or organization.

Trading Conditions for ETX Capital Users

The trading conditions of OvalX (aka ETX Capital) are designed for professional traders. The deposit starts from £250 on a standard account and £1,000 on the premium and professional accounts. Clients who prefer to trade stocks and options can take advantage of individual conditions for deposits of over £10,000. The broker does not provide cent accounts. The maximum leverage is 1:400.

$250

Minimum

deposit

1:400

Leverage

14/5

Support

| 💻 Trading platform: | МТ4, OvalX platform |

|---|---|

| 📊 Accounts: | Demo, Standard, Premium, Professional |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Neteller, Skrill, UnionPay, cards Visa, Mastercard, Maestro, bank transfer |

| 🚀 Minimum deposit: | From £250 or equivalent |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0,01 lots |

| 💱 Spread: | From 0.6 pips |

| 🔧 Instruments: | Currencies, indices, stocks, energies, commodities, metals, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100% - 20% |

| 🏛 Liquidity provider: | No data on the site |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Any trading style allowed |

| 🎁 Contests and bonuses: | No |

ETX Capital Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $6 | Yes, under certain conditions |

| Premium | From $6 | Yes, under certain conditions |

| Professional | From $6 | Yes, under certain conditions |

There are swaps (commission for transferring a position to the next day). A comparative analysis of the trading commissions of the OvalX broker and its competitors was also carried out. After this comparison, we assigned each broker an appropriate level: low, medium, or high.

| Broker | Average commission | Level |

| ETX Capital | $6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of OvalX (aka ETX Capital)

The OvalX brokerage provides high-quality personal services to each client through the implementation of a proprietary platform with an intuitive interface. It allows you to analyze the markets using advanced technical indicators and instantly execute trades in one click. The broker offers clients over 5000 markets for trading and a wide range of instruments. Training courses from OvalX are recognized by many traders as one of the best on Forex.

The main figures that characterize the OvalX broker are:

-

it is part of the London corporation Monecor Limited, founded in 1965;

-

it has more than 55 thousand clients worldwide;

-

it has garnered 5 international awards for educational courses and its proprietary trading platform.

OvalX (aka ETX Capital) is a reliable broker for professional trading

The OvalX broker, which belongs to the corporation Monecor Ltd., began providing services in 2002. In 2018, the management executed a complete rebranding with a new name. Since then, OvalX has been constantly improving service and introducing innovative technologies to attract new clients. The first step was to develop a proprietary trading platform with 60 indicators, a risk management function, and the ability to adjust settings at the user's request. Low spreads, access to 5000 markets and high-quality educational materials have brought OvalX recognition in the EU market and increased its popularity among Western traders.

Clients use ETX’s proprietary terminal—TraderPro—or the popular MetaTrader4 for trading. Both platforms are available in desktop and mobile versions. There are no web terminals. The list of available trading instruments on the two platforms is different: there are more assets for trading on TraderPro.

Useful services of OvalX (aka ETX Capital) investments:

-

internal calculator. The tool is integrated into the TraderPro trading platform and it allows you to quickly calculate the price of an asset;

-

fresh analytics. This section contains comments and analyses from the company's experts;

-

Market News. Contains important economic news.

Advantages:

narrow spreads from 0.6 pips for popular currency pairs;

wide range of assets;

self-developed platform with convenient functionality;

control by the international regulator FCA that is headquartered in London;

access to free training webinars and fresh analytics.

The broker does not prohibit the use of robots or advisors during trading. Any strategy is allowed, including scalping and hedging.

How to Start Making Profits — Guide for Traders

The OvalX brokerage offers several types of accounts for Forex trading: standard, professional and premium. All accounts are designed for professional traders with free capital. The size and type of spread, type of order execution, and leverage are identical on all accounts.

Account types:

Any trader can test the platform and the broker's trading conditions by opening a free demo account for 14 days.

OvalX's terms and conditions are aimed primarily at professionals. The broker offers narrow spreads and reliable service, but at the same time sets a high entry threshold to start trading.

Bonuses Paid by the Broker

Bonuses for deposit replenishment or compensation for withdrawal fees are not available at OvalX. The company does not hold promotions and contests among traders. The broker aims to cooperate with Western investors who use their own capital to trade in the financial markets.

Investment Education Online

The broker's website has a separate section with quality training modules. Here the trader will find ebooks, video tutorials, as well as links to online seminars where you can directly ask a question to a market expert.

The knowledge gained after studying the training materials can be tested on a demo account.

Security (Protection for Investors)

OvalX (aka ETX Capital) is an FCA licensed, MiFID II compliant member of the Financial Services Compensation Scheme (FSCS).

Disputes or claims will be governed by UK law. All litigation takes place under British jurisdiction. In order to comply with the MiFID II Directive, the company is obliged to provide the client with full transparency regarding the quality of the execution of trades.

👍 Advantages

- Custody of customer funds is held in segregated accounts under the requirements of the regulator

- Negative balance protection

- Participation in a compensation fund with a payment of up to £85,000 per claim

👎 Disadvantages

- The regulator does not consider claims of private traders with insignificant amounts

Withdrawal Options and Fees

-

The processing of a withdrawal request takes 3-5 working days on average. There are restrictions on the number of requests, and the limit is 5 requests per month. Withdrawal fees depend on the chosen electronic payment system.

-

The following withdrawal options are available: Neteller, Skrill and UnionPay wallets, Visa, Mastercard, Maestro cards, and bank transfer.

-

For withdrawals from £100 up to 5 times a month, applications are processed free of charge. If the amount is less or the number of applications has exceeded the limit, a fee of $25 will be charged for each payment.

-

The basic withdrawal currency is the GBP. When withdrawing in EUR and USD, a currency conversion fee is charged.

-

Identity verification is mandatory.

Customer Support Service

The broker's support team is available Monday through Friday from 7:30 am to 9:00 pm London time.

👍 Advantages

- There is online chat and telephone support

- Multilingual support

👎 Disadvantages

- Does not work on weekends

You can contact customer support in the following ways:

-

phone numbers indicated on the website;

-

letter via email;

-

Facebook messenger.

Support is available from the broker's website and your personal account.

Contacts

| Foundation date | 2022 |

| Registration address | 5 Spatharikou Street, 1st floor, Mesa Geitonia, 4004, Limassol, Cyprus. |

| Regulation |

FCA, CySEC Licence number: 124721, 096/08 |

| Official site | ovalx.com |

| Contacts |

Email:

enquiries@ovalx.com,

Phone: +357 25 056 447 |

Review of the Personal Cabinet of OvalX (aka ETX Capital)

To start trading with the OvalX broker, you need to open a trading account. To do this, go to the company's website and follow these steps:

On the main page, click "Create account" or "Open live account". Fill out the registration form: enter your last name, first name, email address and telephone number. Come up with a strong password and click "Continue".

At the second stage, you need to specify your residence address, experience in the Forex market, source of income and other financial information. After that, a letter with 2 passwords will be sent to your email for entering your personal account and for authorization on the mobile terminal. Then you need to complete verification. The broker's financial department verifies the authenticity of the submitted documents within three days.

In the personal account of OvalX, the broker's client can:

1. Download the trading terminal;

2. Apply to watch future webinars;

1. Download the trading terminal;

2. Apply to watch future webinars;

Other useful features of the personal account:

-

access to messages from a personal financial advisor attached during registration;

-

the ability to open another demo or real account;

-

account management and switching between them;

-

quick link to technical support.

Disclaimer:

Your capital is at risk. 77,2 % of retail investor accounts lose money when spread betting or trading CFDs with ETX. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets or CFDs work and whether you can afford to take the high risk of losing your money.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Find out how ETX Capital stacks up against other brokers.

Articles that may help you

FAQs

Why has ETX Capital been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against ETX Capital by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of ETX Capital is down, not updated or operates with clear errors and some features are not available;

• ETX Capital has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if ETX Capital got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why ETX Capital got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from ETX Capital?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if ETX Capital is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.