Your capital is at risk.

FlowBank Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- none or 100,000 CHF

- MT4

- MT5

- FlowBank

- FlowBank Pro

- FINMA

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- none or 100,000 CHF

- MT4

- MT5

- FlowBank

- FlowBank Pro

- FINMA

Our Evaluation of FlowBank

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FlowBank is a broker with higher-than-average risk and the TU Overall Score of 3.12 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FlowBank clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

FlowBank brokerage stands out for its low trading costs, extensive asset pool of over 50,000 instruments, and proprietary trading platform, which in many aspects surpasses classical MT4/5 solutions. There is moderate leverage available, and no trading restrictions, thereby allowing scalping, hedging, trading on news, and the use of advisors. There are no additional commissions typical of other brokers (e.g., no withdrawal fees regardless of the channel and withdrawal amount). Relative drawbacks include the lack of passive earning opportunities and regional restrictions.

Brief Look at FlowBank

Swiss broker FlowBank offers two real accounts with access to stocks, bonds, ETFs, CFDs, futures, and options. Among the contracts for difference, there are currency pairs, cryptocurrencies, stocks, indices, and metals. There is no minimum deposit requirement. Trading can be done through MT4, MT5, or the broker's trading platforms. Costs are below average, for instance, spreads for currency pairs start from 0 pips, and the commission for trading stocks is 0.15%. All major funding channels are available, with no withdrawal fees. The broker provides technical and fundamental analysis, and education is presented through a conveniently structured article database and a series of video lectures. The platform periodically conducts open and closed webinars in multiple languages. The company is registered in Switzerland and holds a FINMA (the Swiss Financial Market Supervisory Authority) license. Contact methods for technical support include a call center, email, live chat, and tickets on the website.

- There are no minimum deposit requirements, a user-friendly education system for beginners, and efficient technical support.

- Spreads starting from 0 pips, and more favorable trading commissions compared to most competitors.

- Two real accounts with transparent conditions, a discount system for CFD trading.

- Multiple trading platforms to choose from, the broker's trading platform includes some internet banking features.

- Broker has flexible leverage of up to 1:200 for CFD instruments, allowing increased profit potential.

- Many useful options such as automatic currency conversion and investment insurance.

- The broker offers expert analytics and a well-thought-out education system in various formats.

- No typical alternative earning options such as copy trading, joint accounts, or referral programs.

- The broker does not work with residents of certain countries, including Canada and Belgium, and has special conditions for those from China.

- Technical support, though highly rated by users, is not available 24/7 and is unavailable on Sundays.

TU Expert Advice

Financial expert and analyst at Traders Union

FlowBank Broker is unique because if a trader uses its proprietary application, they get some online banking services, such as commission-free currency conversion. They can also acquire dividend stocks, create individual investment portfolios, and conveniently monitor them. The FlowBank trading platform (including the Pro version) differs from typical solutions like MT4 and MT5, but clients of the broker can also use this software if they wish.

A demo account is not provided, and there are no minimum deposit requirements when opening a Classic account. All 50,000 financial instruments are immediately available for trading with leverage ranging from 1:1 to 1:200. The broker does not limit its clients, allowing the use of advisors. If a trader wants to become a major investor, they can deposit 100,000 CHF and receive reduced commissions (e.g., the commission for bonds will be 0.20%, not 0.35% as on a Classic account). On the other hand, some fees are universal and independent of the account type. For example, for a lot of stock CFDs, the trader pays 2 Swiss francs.

Client funds are insured in case of unforeseen circumstances, with the insurance amount being 100,000 francs under the requirements of the Swiss Financial Market Supervisory Authority (FINMA), which regulates the broker's activities. In terms of transparency and legality, there are no issues with FlowBank. The company fully fulfills its obligations to clients, and a retrospective analysis of its activities has not revealed any unresolved conflicts.

The FlowBank asset pool requires special mention. Assets are divided into two categories – investment and trading. Investment instruments include stocks, bonds, ETFs, futures, and options, while trading instruments include CFDs on currency pairs, cryptocurrencies, stocks, indices, and metals. Unfortunately, typical passive earning options like copy trading are not available. It's also worth noting regional restrictions, which can be thoroughly reviewed in the "Help Center." The platform's client support operates effectively, although it is not available 24/7 and is unavailable on Sundays. Nevertheless, the FlowBank broker is recommended for consideration.

FlowBank Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. FlowBank and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4, MT5, FlowBank, FlowBank Pro |

|---|---|

| 📊 Accounts: | Classic, Platinum |

| 💰 Account currency: | CHF, and 19 more currencies |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, electronic systems, and crypto wallets |

| 🚀 Minimum deposit: | None or 100,000 CHF |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 0 pips |

| 🔧 Instruments: | Stocks, bonds, ETFs, futures, options, CFDs (on currency pairs, cryptocurrencies, stocks, indices, metals) |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

There is no demo account, No minimum deposit requirements for a Classic account, For a Platinum account it is necessary to deposit at least 100,000 CHF, More than 50 thousand assets, A proprietary trading platform in two versions, Low trading costs and no withdrawal fees, A lot of analytics, and High-quality training |

| 🎁 Contests and bonuses: | Yes, plus rebates from TU |

If a broker offers multiple real accounts, the minimum deposit for each may differ due to varying trading conditions. Traders opting to collaborate with FlowBank can deposit any amount when opening a classic account. There is also a Platinum account with lower commissions, but to activate it, a minimum deposit of at least 100,000 CHF (or its equivalent in another supported currency) is required. For most users, especially novice traders, the classic account is sufficient, characterized by a low entry threshold due to the absence of minimum deposit requirements.

Leverage on all accounts is flexible and depends solely on the traded asset. The highest leverage is available for currency pairs, reaching 1:200. Regarding technical support, it is available through all major communication channels, but managers respond only during weekdays around the clock. On Sundays, a response to a query will be received on Monday.

FlowBank Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To initiate collaboration with FlowBank, register through the official company website. Subsequently, verification (confirmation of personal data) will be required. Traders can operate through the MT trading platforms or in the broker's application, which can be downloaded from the website or directly from digital stores. Traders Union experts have prepared a step-by-step guide to minimize registration-related questions. They will also familiarize you with the functions of the user account.

Go to the broker's website. Select your preferred language at the top right, then click "Open an Account."

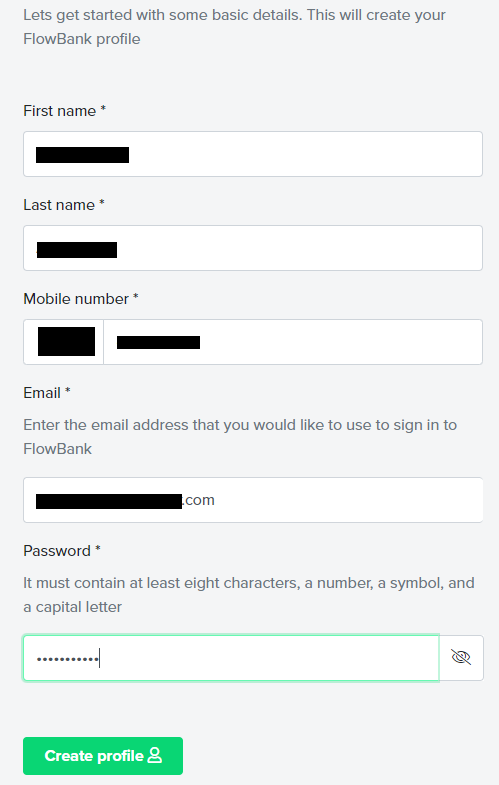

Enter your name, email, and phone number, and create a password. Click "Create Profile."

A temporary password will be sent to the provided email. Enter the code and click "Confirm." Read the comment, then click "Next."

Specify your gender, date of birth, nationality, document number, and its expiration date. Click “Next.”

Enter your residential address with the postal code. Click “Next.”

Answer several questions grouped into thematic blocks. Each time, click "Next" to proceed to the following block.

After providing all required information, read the cooperation documents. Check the box at the bottom and click “Next.”

Verify your identity and confirm your personal information. You can do this, including through your mobile device, by installing the broker's application. Just follow the on-screen instructions.

You can download the broker's trading platform on the official FlowBank website. Alternatively, you can download the MT4 or MT5 trading platforms on their respective websites. Install the suitable platform, enter your registration details, and after depositing funds, start trading.

Your FlowBank user account allows you to:

-

Open and close accounts, receive detailed information, and generate reports.

-

View current trades and trade archives, as well as transactions associated with the account.

-

Deposit funds into the account and submit withdrawal requests using a convenient method.

-

Adjust personal information in the profile, and change account security parameters.

-

Explore available fundamental and technical analysis tools and communicate with support.

Regulation and safety

If one is not careful in choosing a broker, there is a serious risk of encountering a scam or a Forex bucket shop. This entails the potential loss of capital with no means of recovering it. Therefore, traders should always pay attention to the registration and regulation of the company with which they intend to collaborate. FlowBank is officially registered in Switzerland and regulated by FINMA (the Swiss Financial Market Supervisory Authority). This means that the platform operates legally and transparently, committing to fulfill its obligations to its clients, who, in turn, have official legal protection.

Advantages

- The broker is officially registered

- Holds a FINMA license

- Clients' funds are insured

Disadvantages

- There is no regional protection of traders' interests outside Switzerland

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Classic | From $0, and no commission | No |

| Platinum | From $0, and no commission | No |

Many platforms offer low trading costs, but they may impose a substantial withdrawal fee, offsetting other advantages. Additionally, some companies set a minimum withdrawal amount. FlowBank clients have nothing to worry about because the broker does not limit withdrawals, and there are no fees regardless of the chosen withdrawal channel. However, traders should consider that fees are often present on the other side of the transaction, involving banks, cryptocurrency wallets, and electronic transfer systems. The broker has no relation to these fees.

Below is a table presenting data on the average trading fee for FlowBank and two leaders in the industry. This allows for a clear assessment of the competitiveness of the conditions offered by the examined company.

| Broker | Average commission | Level |

|---|---|---|

|

$1.15 | |

|

$1 | |

|

$8.5 |

Account types

If the platform offers multiple trading accounts, traders may find it challenging to choose, as conditions often differ significantly among them. In the case of FlowBank, there is no such problem because the broker has only two accounts – Classic and Platinum. The basic conditions are the same, but while there are no requirements for a minimum deposit for a Classic account, to open a Platinum account, you'll need at least 100,000 CHF (or its equivalent in 20 other supported currencies).

Another difference lies in spreads and trading commissions. On a Classic account, they are slightly higher than on a Platinum one. Thus, a Classic account suits the absolute majority of traders, while a Platinum account makes sense for large investors focused on significant trading volumes. Moreover, trading can be done through any available trading platform — MT4/5 or the broker's proprietary application.

Account types:

While some brokers offer demo accounts, which are a good way to familiarize oneself with the platform without financial risk, FlowBank does not provide demo accounts. On the other hand, considering that there are no minimum deposit requirements for a classic account on the platform, there is no urgent need for a demo. A trader can deposit a hypothetical $20-50 and explore the broker in "real combat conditions".

Deposit and Withdrawal

-

Regardless of the account type, a trader engages in real-market trading from the outset. If they execute successful trades, they accrue profits, replenishing the account balance.

-

Funds from the account balance can be withdrawn at any time by logging into the user account on the website and submitting a withdrawal request. A similar option is available in the broker's app.

-

Currently, funds can be withdrawn to a bank card, bank account, electronic wallet, or cryptocurrency wallet. The broker does not set a minimum withdrawal amount.

-

The platform does not charge its clients a withdrawal fee. However, a fee may be imposed by a third party involved in the transaction, such as a bank.

-

The FlowBank trading account supports 20 currencies. The conversion and auto-conversion features are available. It is recommended to install the broker's app and explore its capabilities.

Investment Options

The primary goal of any broker is to provide clients with access to global financial markets with a wide range of instruments for active trading. Alternative earning options, such as copy trading and joint accounts like MAM or PAMM, can be a pleasant bonus but are not the main focus. The FlowBank broker concentrates on its core mission, so its clients cannot earn in ways other than through active trading.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Customer support

Can I fund my account with a bank card issued in China? What are the spreads on the Classic account for CFDs on indices? What are the conditions for automatic conversion? Often, traders' questions stem from their simple oversight, but sometimes the information is indeed not available on the website. Moreover, real issues during trading or fund transactions cannot be completely ruled out. In any case, FlowBank clients can seek assistance from client support. It is available through email and tickets, with responses provided by a 24/5 support team. The website features a live chat, and the call center operates under the same schedule.

Advantages

- Multiple communication channels

- Prompt response

- High user appreciation

Disadvantages

- Tech support is not available on Sundays

You can contact FlowBank's client support even if you haven't registered yet and don't have a trader's user account.

Here are the current contact methods:

-

Email;

-

Phone;

-

Tickets;

-

Live chat on the website and in the user account.

Also, technical support can be reached through the broker's application.

Contacts

| Registration address |

FlowBank S.A, Esplanade de Pont-Rouge 6, 1211 Geneva 26, Switzerland FlowBank S.A, Seidengasse 20, 8001 Zurich, Switzerland |

|---|---|

| Regulation | FINMA |

| Official site | https://www.flowbank.com/ |

| Contacts |

+41 (0) 22 888 66 00

+41 (0) 22 888 61 30 |

Education

Some traders enter brokerage platforms without prior experience in financial markets. Brokers understand well that everyone starts their trading journey at some point, so they often provide educational materials. FlowBank has comprehensive training offered in two formats — a structured collection of articles and video lectures categorized by topics and skill levels. Beginners will undoubtedly find a lot of useful information here, and some lectures will be interesting for intermediate-level traders. Materials for professionals are not directly available, as interesting information for them is presented only in closed webinars, but those are relatively infrequent.

Many brokerage platforms focus on providing knowledge to clients who have recently entered trading. This is because, for experienced players, theoretical preparation does not hold as much value as regular practice.

Comparison of FlowBank with other Brokers

| FlowBank | RoboForex | Pocket Option | Exness | Deriv | Libertex | |

| Trading platform |

FlowBank, FlowBank Pro, MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader | Libertex, MT5, MT4 |

| Min deposit | No | $10 | $5 | $10 | $5 | 100 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 1.00% | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 50% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of FlowBank

The platform has been operating for several years and enjoys significant popularity in the global market. The reason lies in the transparency and broker’s stability, which employs microservices architecture, virtual servers, and other innovative solutions to ensure 100% protection against system failures, as well as order execution speeds of up to 30 ms. The platform focuses on investing and Forex trading, excluding any third-party services and alternative earning methods. Instead, the FlowBank site has several built-in options for fundamental and technical analysis. The training system, highly praised for its convenient structure and materials presented in various formats, is another notable aspect, although experienced traders may find it less appealing.

FlowBank by the numbers:

-

Minimum deposit is $0.

-

Over 50,000 financial instruments.

-

Maximum leverage is 1:200.

-

Minimum spreads for Forex is 0 pips.

-

4 trading platforms are available.

FlowBank is a versatile broker for investments and active trading

In addition to the platform's commission policy, traders pay attention to the asset pool and available trading platforms. In terms of assets, the FlowBank broker undoubtedly outperforms most of its competitors, as its clients can trade stocks, bonds, ETFs, futures, options, and CFDs on currency pairs, cryptocurrencies, stocks, indices, and metals. Each category features hundreds or even thousands of assets, enabling the implementation of various investment and trading strategies. Additionally, the 1:200 leverage is advantageous, providing significant profit potential without a critical increase in trading risks. Traders can use classic MT4 and MT5 solutions and the broker also offers its proprietary trading platforms in two versions, both highly rated by experts and users.

FlowBank’s analytical services:

-

Market Insights. Presents several categorized newsfeeds, e.g., cryptocurrencies and stocks, with constantly added overview articles featuring expert market analysis and forecasts.

-

Technical analysis. An interactive section providing conclusions made by the platform's intelligent systems, without market assessments. Users can select an asset or asset group and receive forecasts on price movements.

-

Client positioning. An interesting tool displaying the "sentiment" of the broker's clients. It includes two tables — the most popular instruments and the ratio of short and long positions for them. The service helps assess trends.

Advantages:

The broker is officially registered in Switzerland, holds a regulator license, and has predominantly positive reviews.

No requirements for a minimum deposit for a Classic account, and no restrictions on trading strategies and methods.

Over 50,000 financial instruments are in the pool, with the ability to trade with flexible leverage up to 1:200.

Spreads and commissions are below average market levels, and it is especially advantageous for trading on a premium account (although the entry threshold is higher).

Traders can use MT4/5 trading platforms or the broker's application.

User Satisfaction