FXPIG Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- MT4

- MT5

- cTrader

- 2014

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- MT4

- MT5

- cTrader

- 2014

Our Evaluation of FXPIG

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXPIG is a high-risk broker with the TU Overall Score of 2.59 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXPIG clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. FXPIG ranks 355 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The FXPIG broker offers different account types, all of which, except for Pro, are represented in two variations, which are “Raw+Commission” or “All-in”. Demo accounts can be funded without limitations upon request. The platform allows for the trading of hundreds of assets, all strategies and methods are permitted, and users can work using MT4, MT5, and cTrader. The platform supports 6 currencies, with deposit/withdrawal options that include a bank card, bank account, Skrill, Neteller, BTC wallet, and Uphold. The company implements an advanced technology stack, including the FIX API protocol (the Financial Information Exchange (FIX) algorithm speeds the flow of financial data over the networks), STP algorithm, and high-performance virtual servers. Investors can operate MAM and PAMM accounts, and there is a deposit bonus.

Brief Look at FXPIG

This broker offers three account types plus a demo. The following trading instruments are available: currency pairs, stocks, metals, energies, CFDs on cryptocurrencies, and indices. The minimum deposit is $200. Spreads start from 0 pips, and commissions start from $0. Available account currencies are USD, EUR, GBP, CAD, AUD, and JPY, and there are no fees for deposits or withdrawals. Trading is available 24/7, and all trading styles and strategies are allowed. Traders can choose to work using MT4, MT5, and cTrader platforms. The broker offers flexible income distribution for MAM and PAMM accounts.

Kevin Murcko, CEO at FXPIG, reported that he wanted to create a playful company name that is easy to remember, easily brandable, and takes some of the seriousness out of Forex trading. He deliberately chose “PIG”, which stands now for Premier Interchange Gateway, before later adding the “FX” for Forex.

FXPIG uses data from 20 liquidity providers, operates on an STP (straight through processing) algorithm, and has its own VPS hosting with a virtual dedicated server. The website offers a wide range of technical tools, from popular analytic tools like MACD (Moving Average Convergence/Divergence) and Parabolic SAR (stop and reverse) indicators that are used to draw attention to alert traders to when the price direction is changing.

- Hundreds of assets across six trading groups with leverage of up to 1:500.

- Spreads from 0 pips with competitive trading commissions.

- Low entry threshold, with a deposit of $200 and a user-friendly interface.

- Trading is available at night and on weekends, and bots and advisors are welcome.

- Traders can work with the most convenient and functional platforms.

- Managed accounts with fine-tuning for successful investing.

- 100% transparent broker operations with prompt technical support.

- Affiliate program is only available for corporate clients.

- The broker is unavailable to residents of the U.S., Canada, and certain other countries.

- The broker’s technical support is not provided through a call center.

TU Expert Advice

Financial expert and analyst at Traders Union

FXPIG started its operations in 2011. It is a regulated broker that operates transparently in accordance with the Vanuatu Financial Service Commission. A retrospective analysis has shown that the platform fulfills its obligations to its clients and there are no unresolved conflicts or legal disputes. In addition to being properly regulated and the broker’s flawless reputation, modern security methods are a guarantee of reliability from SSL certificates to the separate storage of funds.

The broker offers a demo account and three live account types. The spread is floating and starts at 0 pips. Commissions depend on the trader’s choice of account and assets. They can either pay a “Raw+Commisson” or an all-in fee (for All-in account types). In the second case, the spread is higher, but the broker does not charge a trading fee for most instruments (commission is taken for stocks and cryptocurrencies in any case). This is a fairly flexible approach that allows traders to choose the optimal option for cooperation based on their own preferences.

Trading conditions are average or better. The undeniable advantage of the platform is that its pool of assets includes hundreds of instruments from six groups, and this list is constantly growing. The leverage is flexible and depends on the traded asset, with a maximum value of 1:500. There are very few verified brokers with the same leverage. Also, the fees are 100% transparent. Even without being a client of the broker, the trader knows everything about its commission policy and can calculate the cost of any transaction in advance.

There is no referral program for private traders, but there is an affiliate program for companies. As for investment options, there are MAM and PAMM accounts with standard conditions and flexible management settings. To attract new users, the broker offers deposit bonuses. Plus, there is a bonus from Traders Union, which makes trading even more profitable. There are no restrictions, scalping and hedging are available, and traders can use advisory bots. Trading is conducted continuously. The broker's drawbacks are not significant, so considering all relevant factors, FXPIG can be recommended for cooperation.

- You seek high leverage. FXPIG offers leverage of up to 1:500.

- Trading costs are a key consideration for you. This broker offers spreads from 0 pips and competitive trading commissions.

- You are an individual trader looking for an affiliate program. FXPIG's affiliate program is only available for corporate clients.

- You reside in the U. S., Canada, or certain other countries where the broker is unavailable.

- You are concerned about regulations. FXPIG is regulated by the Vanuatu Financial Services Commission (VFSC), which has less stringent regulations compared to some other jurisdictions. Consider your comfort level with this regulatory environment.

FXPIG Summary

| 💻 Trading platform: | МТ4, МТ5, cTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, Premier, Pro |

| 💰 Account currency: | USD, EUR, GBP, CAD, AUD, JPY |

| 💵 Replenishment / Withdrawal: | Visa/MC bank card, bank transfer, Skrill, Neteller, Uphold, BTC cryptocurrency wallet |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | Up to 1:500, depending on the asset |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs, stocks, metals, oil/energies, Index of CFDs,other indices |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | 20 top-tier liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Demo and three live accounts, narrow floating spreads, the option to choose a trading commission, execution up to 50 ms, many assets from 6 asset groups, high leverage, joint accounts available, three trading platforms to choose from, 24/5 technical support |

| 🎁 Contests and bonuses: | Yes (deposit bonus and rebates from Traders Union) |

As a rule, if the broker offers several types of accounts, the minimum deposit for them differs. FXPIG is no exception. To open a Standard account, traders need to deposit at least $200; whereas, to open a Premier account, they need at least $5,000. The most expensive option is the Pro account, which requires $50,000 or more to open. Note that it is not necessary to deposit exactly the minimum amount. When opening a Standard account, a trader can fund their balance, for example, with $500 or $100. As for leverage, it depends on both the platform’s conditions and the asset selected. At FXPIG, the highest leverage is available for currency pairs, which is 1:500. The platform’s technical support operates 24/5, which means that you cannot contact managers on weekend days.

FXPIG Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

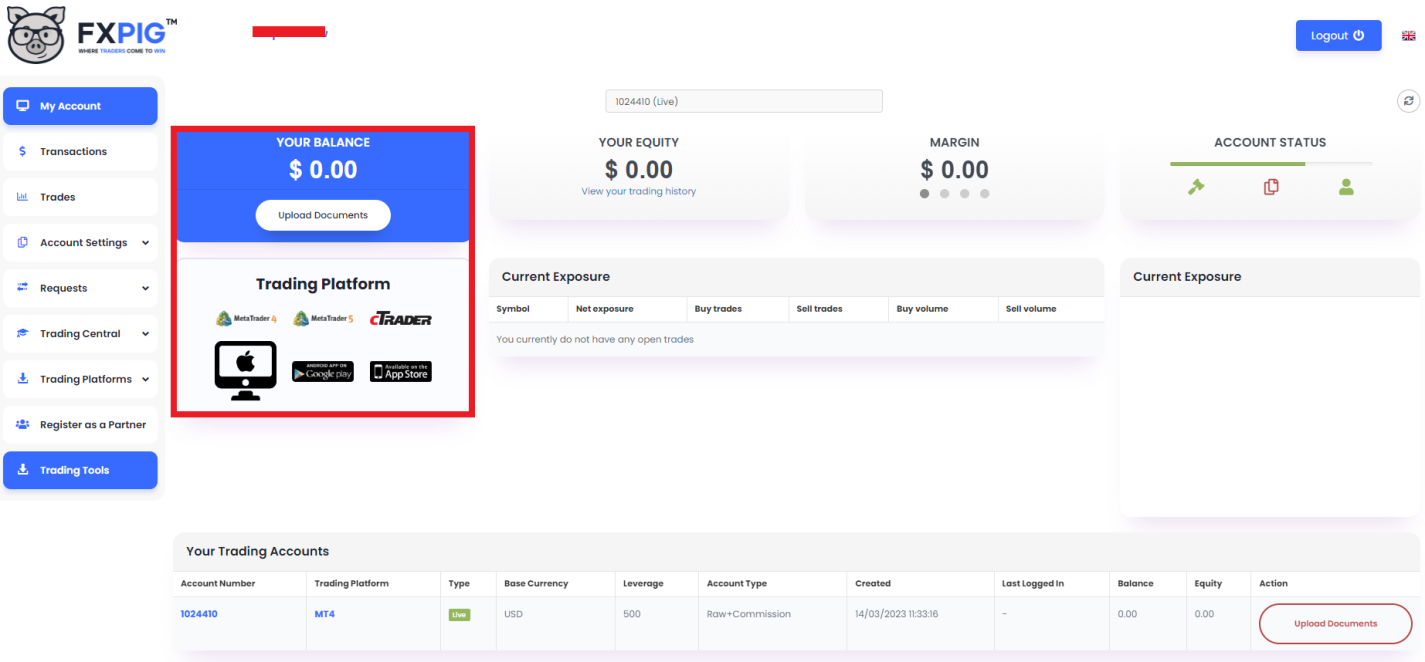

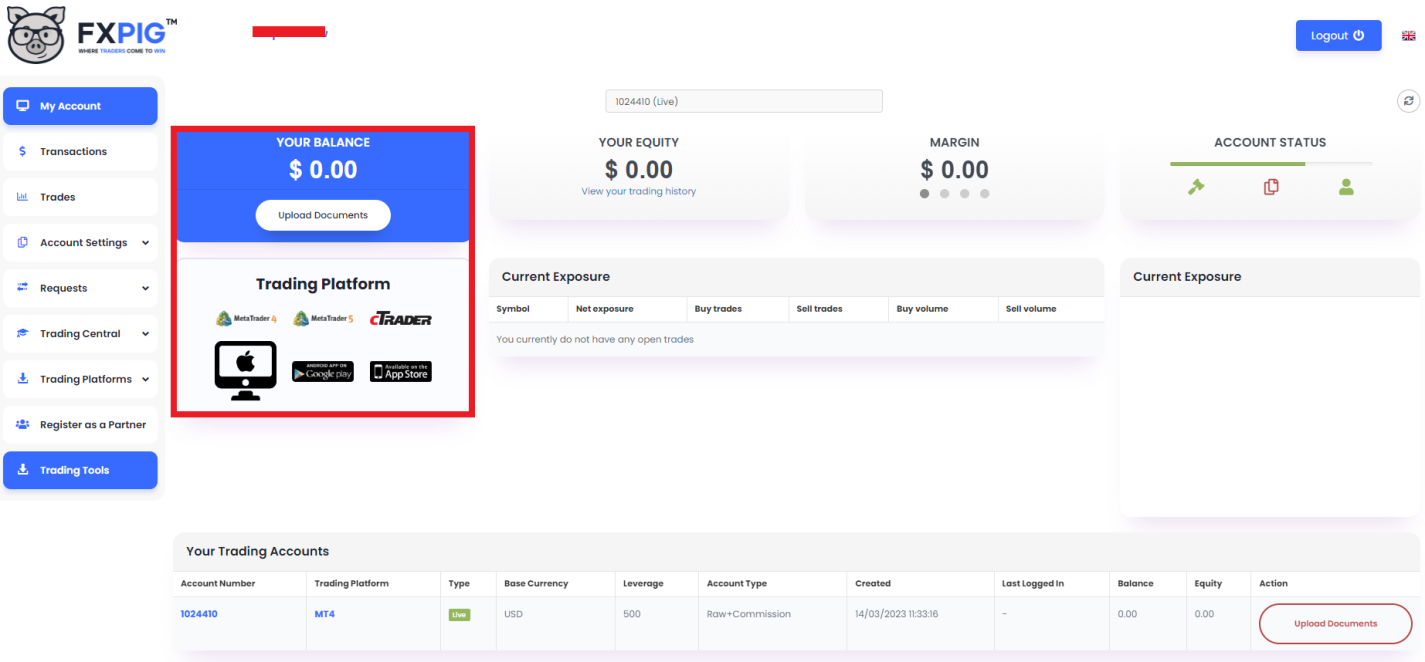

Trading Account Opening

To start working with a broker, sign up on its official website, complete verification, and make a deposit. Usually, this is not difficult. However, the TU experts have prepared this detailed guide for your convenience.

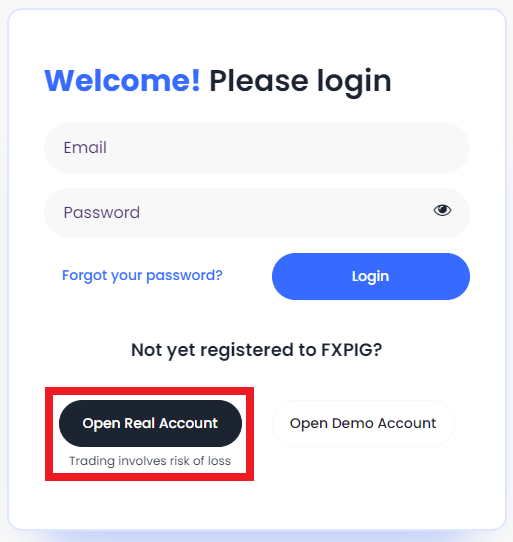

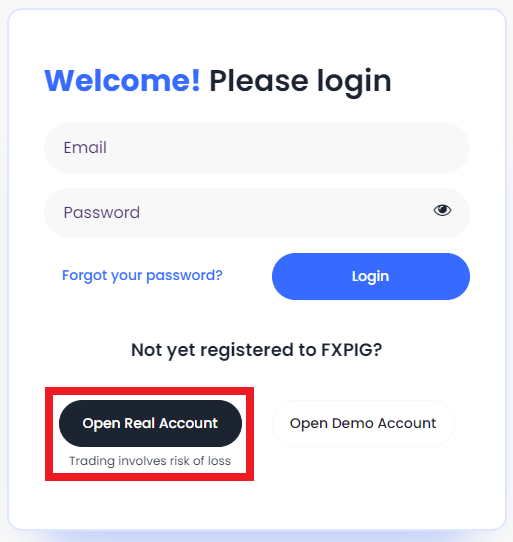

Go to the broker's website, select the interface language in the top right corner, then click the “Sign up/ Sign in” button. You can also click the “Open Live Account” button.

If you already have an account, enter your registration data and click “Sign in”. If you don't have an account yet, click “Open Live Account” or “Open Demo Account” at the bottom. In this example, TU will register a live account.

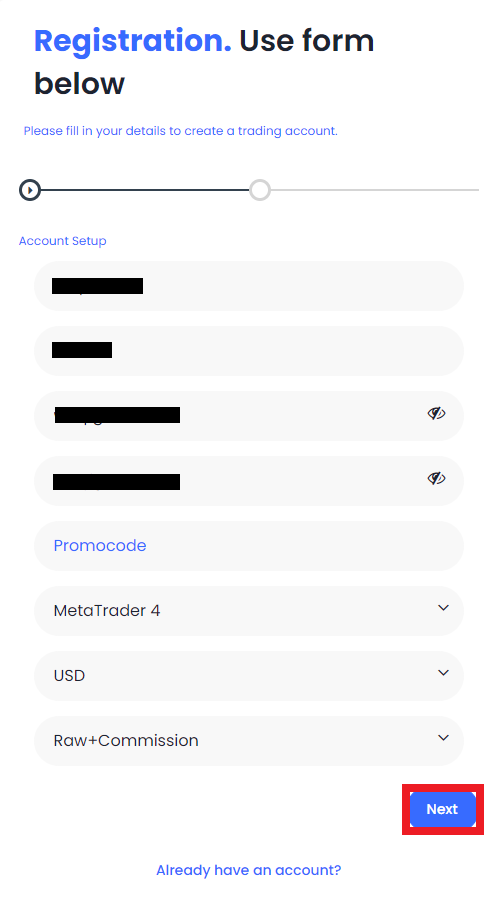

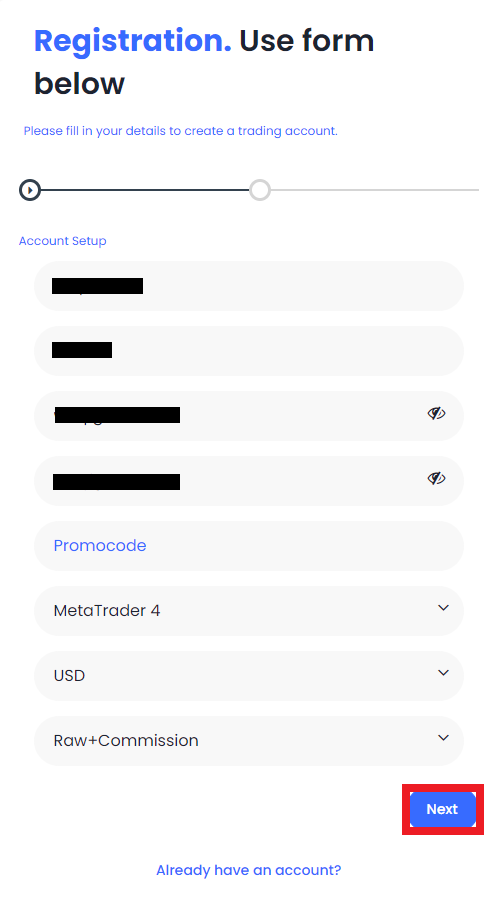

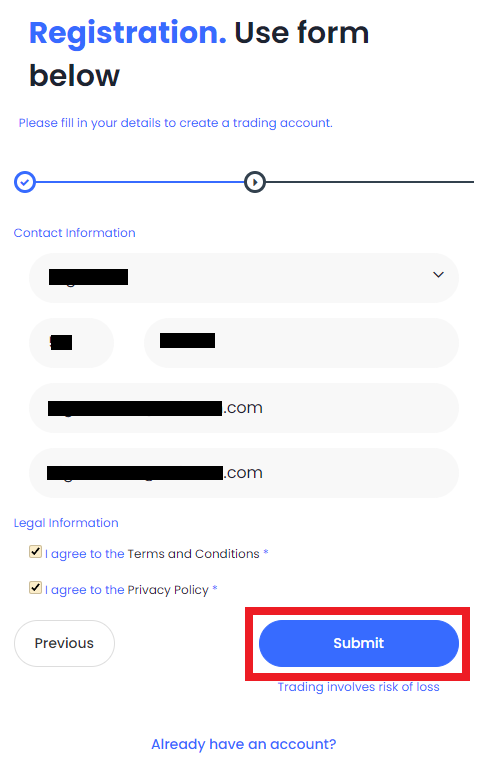

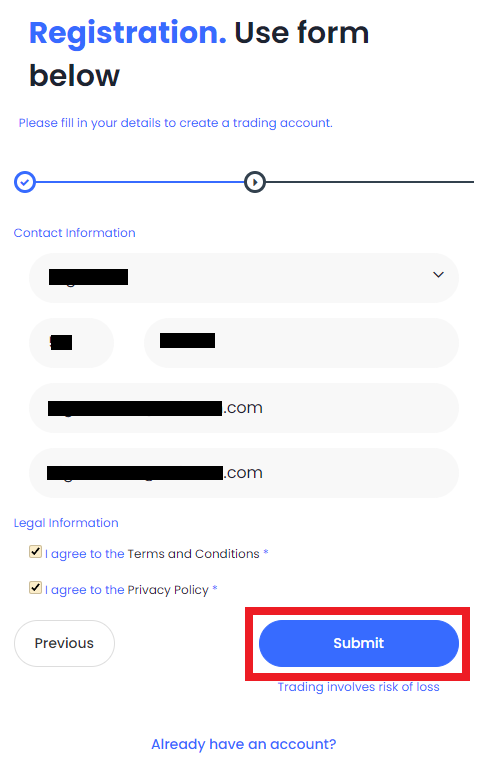

Enter your first and last name, create a password, and enter it twice. Enter a promo code (if you have one), and select a preferred trading platform, currency, and account type. Click “Next”.

On the next stage of registration, select the country of your residence, enter your phone number, and email address. Agree to the platform's terms and conditions by checking the boxes and click “Submit”.

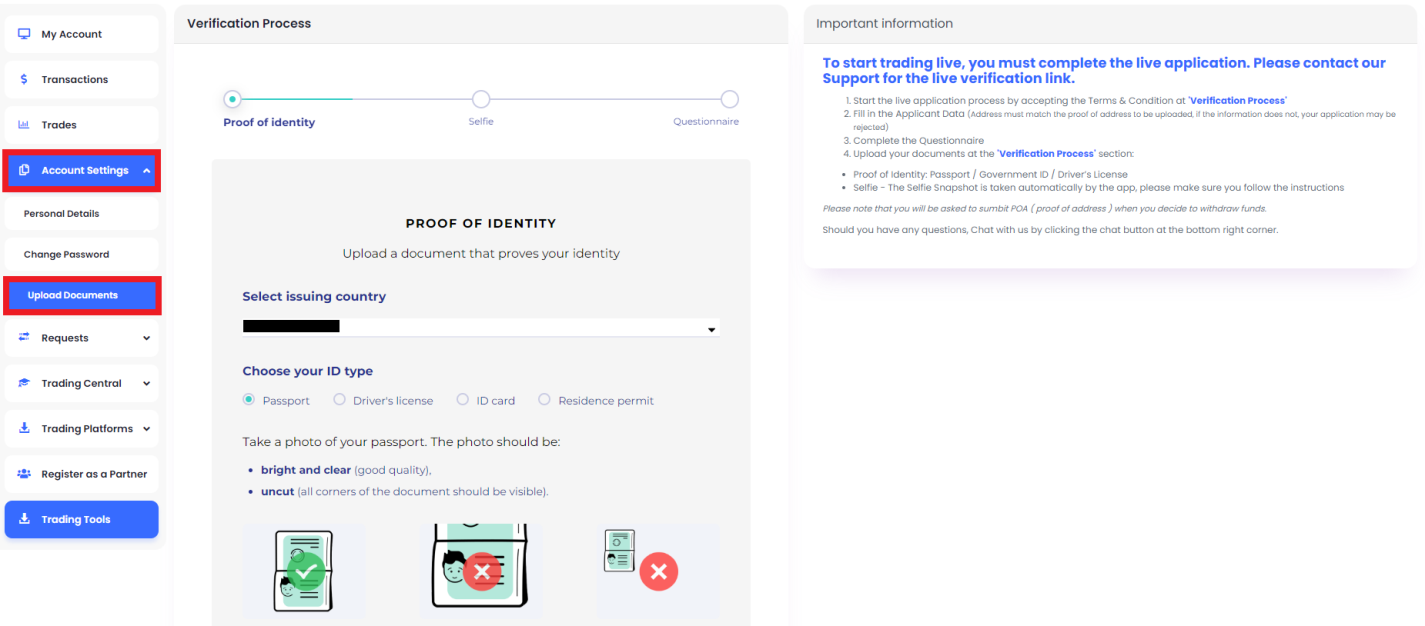

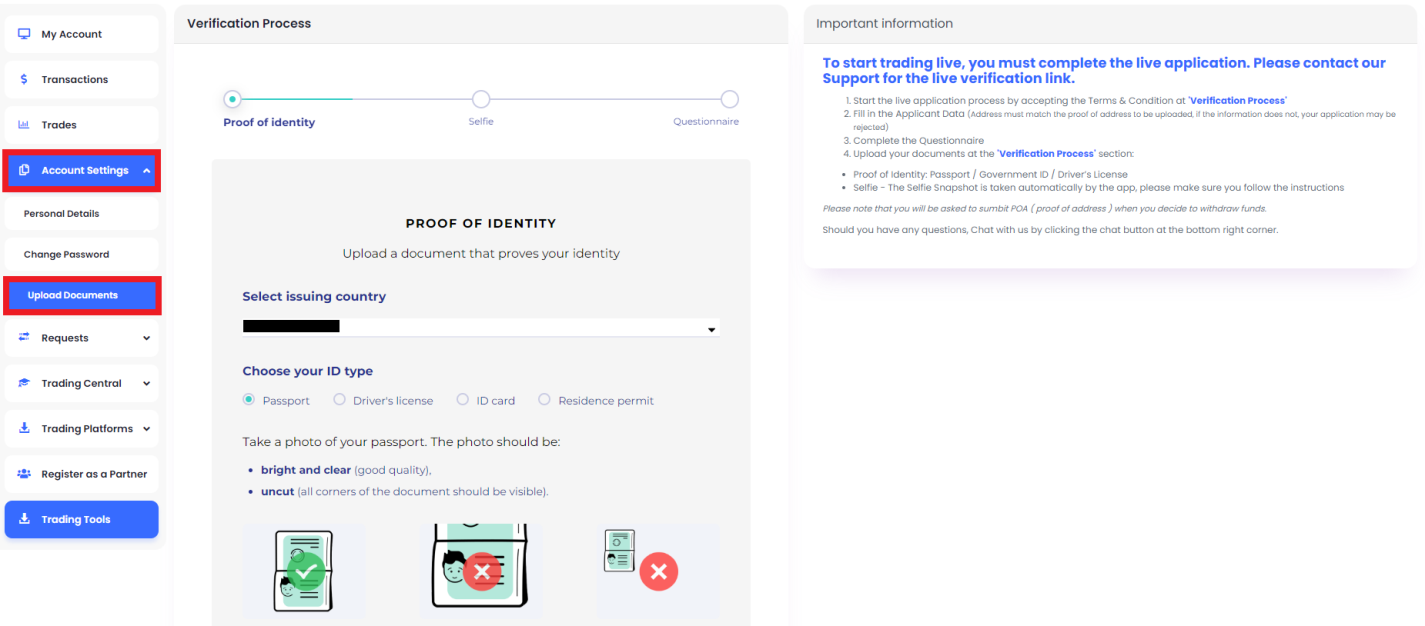

You have received your user account but cannot open a live account yet. To do so, you need to go through the verification process and confirm your identity. In the left menu, click on “Account Settings” and then select “Upload Documents”. Read the comments and upload a scan/photo of your passport or driver's license. Follow the instructions on the screen.

Once your documents pass verification, you will gain access to the full functionality of your user account. Download the selected trading platform via the link from your dashboard. Make a deposit by following the instructions on the screen. Start trading.

Your FXPIG user account also provides access to:

-

My Account. A dashboard for managing live accounts with detailed statistics for each.

-

Transactions. This section displays operations for depositing funds and withdrawing profits.

-

Trades. As the name suggests, this block shows current and completed trades.

-

Account settings. Here, the trader uploads documents and adjusts security settings.

-

Requests. Here, the broker offers several useful features, including fund withdrawals, international transfers, etc.

-

Trading Central. This block is dedicated to basic analytics and displays market status data.

-

Trading Platforms. In this section, the trader can download the installer for the MT4, MT5, or cTrader trading platforms.

-

Register as a Partner. This block is relevant only for legal entities wishing to become broker partners.

Regulation and safety

A trader can ensure that they are not dealing with a fraudster by verifying the registration and regulation of the broker. The main entity of FXPIG is registered in Tbilisi, Georgia. Group Asia Pacific Ltd, operating as FXPIG, is registered in the Republic of Vanuatu and is subject to the Vanuatu Financial Services Commission (VFSC). Its license No.14578 is confirmed.

Where can you go for help?

- To the broker's customer support

- To the legal department of Group Asia Pacific

- To the Vanuatu Financial Services Commission (VFSC)

There is no point in contacting

- The regional financial authorities

- Any other regulator

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | 0 or 0.9 pips | No |

| Premier | 0 or 0.7 pips | No |

| Pro | 0 pips | No |

Therefore, traders must choose whether they are satisfied with the low spread and small commission or pay an All-in fee. FXPIG does not charge any fees for withdrawals, regardless of the account type. The same goes for deposits, they are free through all channels. The following table shows the data with the average fee (spread + commission) for the Standard FXPIG account and its two closest competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$3 | |

|

$1 | |

|

$8.5 |

Account types

At the start, it is important to choose the best account for you. FXPIG offers three types of accounts. All tradable assets are available immediately, with maximum leverage, minimum trade size, and a single currency for all accounts. The differences are in the minimum deposit, spread, and trading commissions. Note that a Pro account is not necessarily better than a Standard in a specific case. Yes, it has zero spread and a commission of only $2 per lot, but you will need to deposit at least $50,000. In contrast, Premier account holders receive priority technical support and only need to deposit $5,000. With this account, you can get a minimum spread of 0-0.7 pips and a commission of $0-3 per lot. The highest commission is on Standard accounts, where the spread starts at 0 pips too.

Account types:

Most traders start by opening a demo account. It is very similar to a live account, with all the same functions, options, and mechanisms. The difference is that trading is done with real quotes, but with virtual funds. If the funds on the account run out, the trader can contact technical support and request replenishment, which is free.

Deposit and Withdrawal

-

When a trader operates on a demo account, they trade with virtual funds and therefore do not earn profits;

-

Live accounts under the condition of successful transactions bring real money, which forms the balance of the account.

-

All information about profits can be found in the corresponding section of the trader's user account on the broker's official website;

-

In the user account, traders also can create a withdrawal request at any time, with no minimum limit;

-

For withdrawals, traders can use Visa or MasterCard bank cards, as well as bank transfers;

-

Traders also have access to the following online transfer systems: Skrill, Neteller, and Uphold, plus withdrawals to BTC wallets;

-

The processing of the request is prompt, and its status is displayed in the trader's user account;

Investment Options

Some brokers offer their clients various investment solutions such as cryptocurrency staking and classic options like dividend stocks. And while most traders come to a broker to trade independently and passively or relatively passive, income is always an important advantage. By relatively passive income, TU means referral programs. Many traders forget that significant referral bonuses require active networking and preferably having a popular blog. FXPIG offers a simpler and more universal way to earn, which is also completely passive (if you set the parameters correctly).

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FXPIG’s MAM and PAMM accounts:

These tools are triggered in the MetaTrader 4 trading platform; they allow the manager to control not only their own account but also investors’ sub-accounts . Managers don’t have full access to the sub-accounts, they only use the combined capital to conduct larger trades. If the trade is successful, the main account and sub-accounts receive their profits according to predetermined settings (for example, the investor may choose the upper limit of the rate). And the manager then charges investors a small percentage for his work. If the trade is unsuccessful, everyone suffers a loss. At FXPIG, the specificity of PAMM accounts is that the number of sub-accounts is unlimited, and there are flexible settings for the maximum drawdown, individualized fee setting, automatic calculation of rewards for efficiency, and many other useful options. The key advantage for investors is the complete transparency of the manager's work and a strong incentive to be successful on every bid because his money is at stake.

Customer support

Technical support plays a crucial role for companies that provide financial services. A broker may offer the simplest and most intuitive interface, a detailed FAQs, section and comments on the website, but a trader will sooner or later encounter a question that he cannot solve on his own. In this case, he may turn to customer support. If support is unavailable, responds slowly, or offers an unintelligible response, the user may become disappointed with the platform and switch to a competitor. FXPIG understands this very well, so it provides 24/5 support via email, live chat, and tickets on the website.

Advantages

- You can contact support even if you're not registered

- Live chat managers respond promptly

- Users note the high quality of the broker's technical support and give it high ratings

Disadvantages

- Customer support is unavailable on weekends and holidays

- The broker does not have a call center

If you intend to work with FXPIG or are already a client of this broker, you can contact support using the following methods:

-

Email;

-

Online chat on the website and in the user account;

-

Ticket on the page.

FXPIG is one of the few brokers that assist via Skype; just access the manager's account named chat.fxpig. The company also has official pages on Facebook, Twitter, Instagram, and LinkedIn. You can subscribe to them to not miss the latest news from the broker.

Contacts

| Foundation date | 2014 |

|---|---|

| Registration address | Lisi Veranda, Phase 3, Building B4, Tbilisi, Georgia, 0159 |

| Official site | https://fxpig.com/ |

| Contacts |

Education

Traders will only be successful if they continuously improve their trading skills and knowledge. This requires not only regular trading, but also studying theoretical materials, communicating with experts, participating in webinars, and corresponding with colleagues. Brokers often offer clients educational systems of varying depth and coverage. FXPIG takes a different approach, the website only has a basic FAQs section and a blog with articles that can be grouped by tags.

FXPIG provides little information about money management and trading psychology. The articles posted on the blog are useful, but are not sufficient for comprehensive development of trading skills and acumen. The broker assumes that its clients study the market independently.

Comparison of FXPIG with other Brokers

| FXPIG | RoboForex | Pocket Option | Exness | XM Group | Tickmill | |

| Trading platform |

cTrader, MT5, MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, MobileTrading, XM App | MT4, MT5, Tickmill Mobile App |

| Min deposit | $200 | $10 | $5 | $10 | $5 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 100% / 30% |

| Execution of orders | No | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of FXPIG

FXPIG is the brand of the Prime Intermarket Group Asia Pacific (which also has a subdivision, Prime Intermarket Group Eurasia). The payment agent is Alchemy Prime. These structures are all jointly owned but operate independently. Each subdivision has official registration and regulation. FXPIG is a technologically advanced broker that implements modern algorithms (such as STP), uses virtual servers to increase performance, and introduces innovative solutions (including the latest version of FIX API protocol). Additionally, clients can be confident in the protection of their funds and data because FXPIG has Implemented multi-factor authentication and AML standard verification. The website is protected by an SSL certificate, and trader funds are stored separately from company funds. Also, it is necessary to note that the broker is client-oriented and supports three trading platforms, including their mobile versions.

FXPIG by the numbers:

-

Minimum deposit is $200.

-

Spread starts from 0 pips.

-

6 groups of financial instruments.

-

Maximum leverage is 1:500.

-

Trading is available 24/7.

FXPIG is a convenient broker for the diversification of risks

Many platforms focus on a specific group of assets, such as CFDs or currencies. Others offer several options, including stocks, indices, and ETFs. FXPIG clients have access to currency pairs, stocks, metals, energies, CFDs on cryptocurrencies, and indices. Why is this an advantage? Because a trader can diversify risks with relative ease by investing in different types of assets, he can offset the decline of one with stable and growing positions in others. In addition, the more assets a trader has, the more freely he can trade, and he doesn’t have to limit himself in methods and strategies.

FXPIG’s analytical services:

-

MAM and PAMM accounts. Joint accounts allow investors to earn passively. These special accounts provide investors partial control over their funds while allowing the fund manager to make discretionary trades based on his expertise and market conditions. If the trade is successful, profits are distributed in proportion to investments, and a small commission is paid to the manager.

-

Trading indicators. This is the simplest, yet most effective method of technical analysis of charts. Bollinger Bands, Ichimoku Kinko Hyo, MACD, Parabolic SAR, Stochastic Indicator, RSI, and other indicators can be integrated into any of the platform terminals. Each system is used to gauge momentum along with future areas of support and resistance.

-

Market and alert managers. The first shows a list of asset prices, basic information about it, and open tickets. It also provides a brief overview of recent activity. The second allows you to create personalized notifications about price changes, and when to enter and exit from trades. The alert manager can be connected to a news feed and any number of accounts.

Advantages:

There are several account options with maximum personalization of spread and commission payment conditions from which to choose.

Intuitive website and user account interface, and you can use one of three trading platforms.

A large number of assets from different asset groups and high leverage increase profit potential.

The broker offers dozens of various instruments, including a mini-terminal, session map, and tick charts.

There are no additional fees, only spread/commission, and withdrawals are free through all channels.

User Satisfaction