Your capital is at risk.

EnviFx Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- 2020

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- 2020

Our Evaluation of EnviFx

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

EnviFx is a high-risk broker with the TU Overall Score of 2.7 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by EnviFx clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. EnviFx ranks 340 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

EnviFx broker is a universal platform on which traders can work almost without restrictions with a large number of assets. Leverage of up to 1:500 is available to increase profit potential. However, spreads are at or above average market levels, plus significant commission fees (except for Var accounts). A trader can become an investor or manager of a joint or PAMM account. There is also a multi-level affiliate program. If a trader has no capital, the platform offers a proprietary service with favorable conditions and a very simple challenge. EnviFx does not have its own call center. Also, be sure to note the regional restrictions.

Brief Look at EnviFx

The EnviFx broker offers cooperation to private traders. Four account types allow you to choose optimal trading conditions, there are also demo accounts and PAMM accounts for investment. Available asset groups on currency pairs, indices, stocks, metals, and energies. The broker uses ECN (Electronic Communication Network) technology. Trading is conducted through MT4 and MT5 trading platforms. There are no restrictions on trading strategies and methods. Scalping, hedging, and news trading are available. Spreads are floating, ranging from 0.6-1.3 pips for major currency pairs. Commission fees depend on the asset and account type, ranging from $0 to $9 per lot. The minimum trade is 0.01 lots. There is a multi-level referral program available. EnviFx also offers proprietary financing that traders can get a balance of up to $200,000 with a profit distribution of 80/20 or 90/10, with a fee of $250 which is refundable. Deposits and withdrawals are available using a bank card and cryptocurrency wallet.

- Low entry barrier, no minimum deposit; and registration takes just a few minutes.

- The broker offers four account types and two trading platforms, with no restrictions on strategies.

- The passive earning options are PAMM accounts and a five-level referral program.

- Hundreds of assets form five groups, with leverage of up to 1:500 regardless of account type.

- The broker has its own proprietary trading service with a profit-sharing of up to 90/10.

- Funds can be deposited and withdrawn in both currencies and cryptocurrencies such as BTC, ETH, LTC, XRP, and USDT.

- The company cannot work with residents of the Russian Federation, Japan, and some other countries.

- Spreads on some assets are higher-than-average market spreads, and trading commissions are also quite high.

- Technical support is available 24/7, but only via LiveChat and email.

TU Expert Advice

Financial expert and analyst at Traders Union

EnviFx started its operations in 2020. The company is registered in Kingstown (Saint Vincent and the Grenadines) and is regulated by the FSA (Financial Services Authority). EnviFx operates steadily and constantly adds new features. Traders and experts have no questions about the platform’s ability to fulfill their obligations. Currently, there are no unresolved conflicts.

EnviFx can be characterized as a versatile platform. For clients invested in active trading, the broker offers several hundred assets from five categories: currency pairs, indices, metals, and energies. The maximum leverage is 1:500, which increases the potential profits (although it also increases risk). The broker does not limit its clients in any way and even encourages the use of bots by organizing special competitions.

There are four account types to choose from, which differ in the number of financial instruments, spreads, and commissions. Perhaps it is the spreads and commissions that are the broker’s weak point. A comparative analysis showed that trading costs for traders are at least at the average market level, and sometimes exceed the indicators of most competitors. In contrast to this disadvantage, the trader receives maximum freedom, they can choose between MT4 or MT5 trading platforms, which can be perfectly customized. In addition, the broker provides several useful options, including an interest calculator and a service that displays market hours.

EnviFx also offers proprietary trading with funded balances ranging from $25,000 to $200,000. The conditions here are more than competitive, fees are partially rebated by Traders Union, and the challenge is relatively simple. However, leverage is reduced to 1:100, and there are some other restrictions in addition to the maximum daily and overall drawdown. Also, the broker offers its clients joint accounts. An experienced trader may apply to become the manager of his own PAMM account. Traders may also become investors if they focus on passive income. Finally, there is a profitable referral program, which increases the overall rating and attractiveness of the company.

- You appreciate a low entry barrier with no minimum deposit requirement. This can be beneficial for traders with various budget sizes, providing accessibility to a wide range of individuals.

- You want a choice between account variety and platform options. This broker offers four account types and two trading platforms, providing flexibility to choose an account that suits your trading style. The absence of restrictions on strategies allows you to implement various trading approaches.

- You belong to one of the restricted countries. This broker cannot work with residents of the Russian Federation, Japan, and some other countries. If you are located in these regions, you may need to explore alternative brokers that accommodate residents from your country.

- You prefer lower spreads and commissions. For this broker, spreads on some assets are higher-than-average market spreads, and trading commissions are also quite high.

- Lack of clear regulatory oversight is an issue for you. Traders prioritize regulatory compliance as the lack of clear regulatory oversight raises concerns about transparency, security, and potential scams. For this broker, this aspect is a key red flag.

EnviFx Summary

Your capital is at risk. Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, MT5 |

|---|---|

| 📊 Accounts: | Demo, Standard, Pro, Var, Mini, Prop |

| 💰 Account currency: | USD, EUR, GBP, CAD, AUD, BTC |

| 💵 Replenishment / Withdrawal: | Visa/MC debit and credit cards, cryptocurrency wallets (BTC, LTC, ETH, XRP, and USDT) |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | up to 1:500 (up to 1:100 for prop accounts) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, depending on the asset and market conditions |

| 🔧 Instruments: | Currency pairs, shares, indices, metals, energies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant Execution |

| ⭐ Trading features: | Four real account types, proprietary trading accounts, MAM and PAMM accounts, no minimum deposit, hundreds of assets from five groups, high leverage, almost no restrictions, and two trading platforms to choose from |

| 🎁 Contests and bonuses: | Yes |

Usually, if a broker offers several account types, the minimum deposit depends on which account the trader chooses. On the EnviFx website, you can open four accounts for individuals, but none of them requires a minimum deposit. In other words, the trader can deposit as much money as they want to open a new account. An alternative to regular accounts is prop trading, where the broker funds the trader's balance after receiving the initial deposit and successfully completing the start-up challenge. The leverage depends only on the asset, with the highest leverage for currency pairs being 1:500 for standard accounts and 1:100 for prop accounts. Customer support has standard contact options like LiveChat on the website, email, and tickets. There is no call center.

EnviFx Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with the broker, you need to register on their website, complete the verification (confirm your identity), and open a real account. Traders Union has prepared the below step-by-step guide to eliminate any questions.

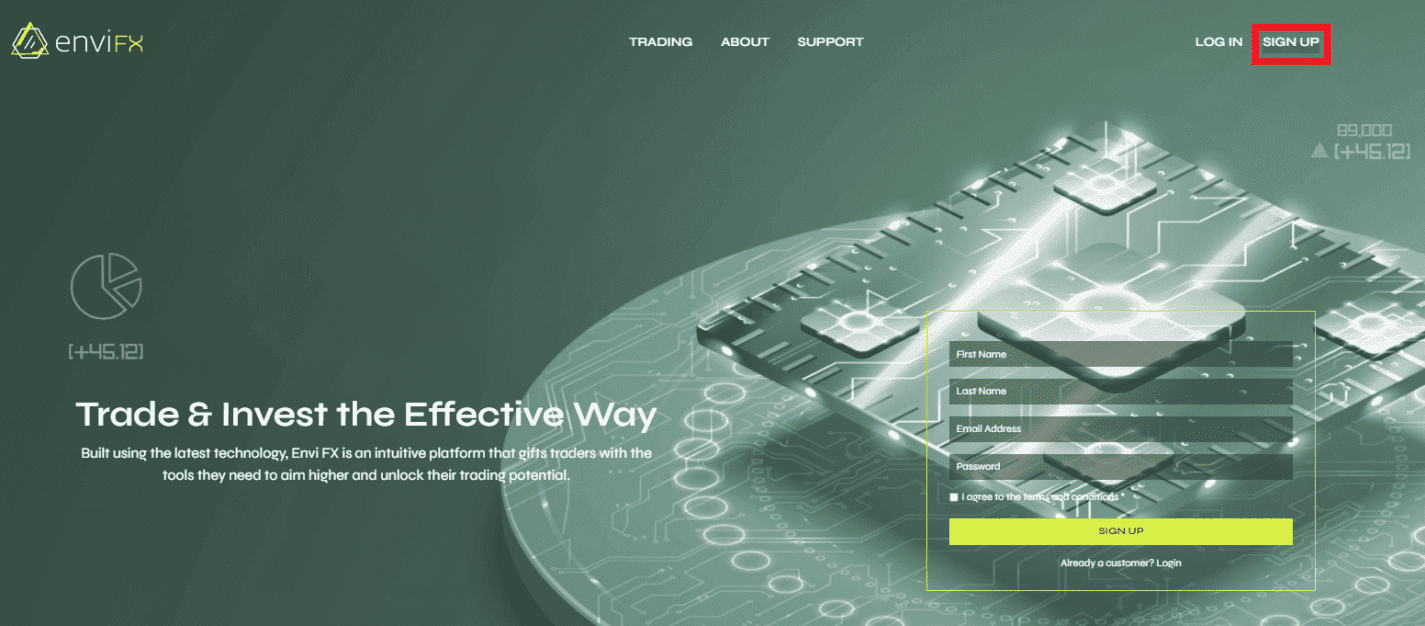

Go to the broker's official website. In the top right corner, click the "Sign Up" button. You can also click "Start Trading" or "Unlock Your Options.”

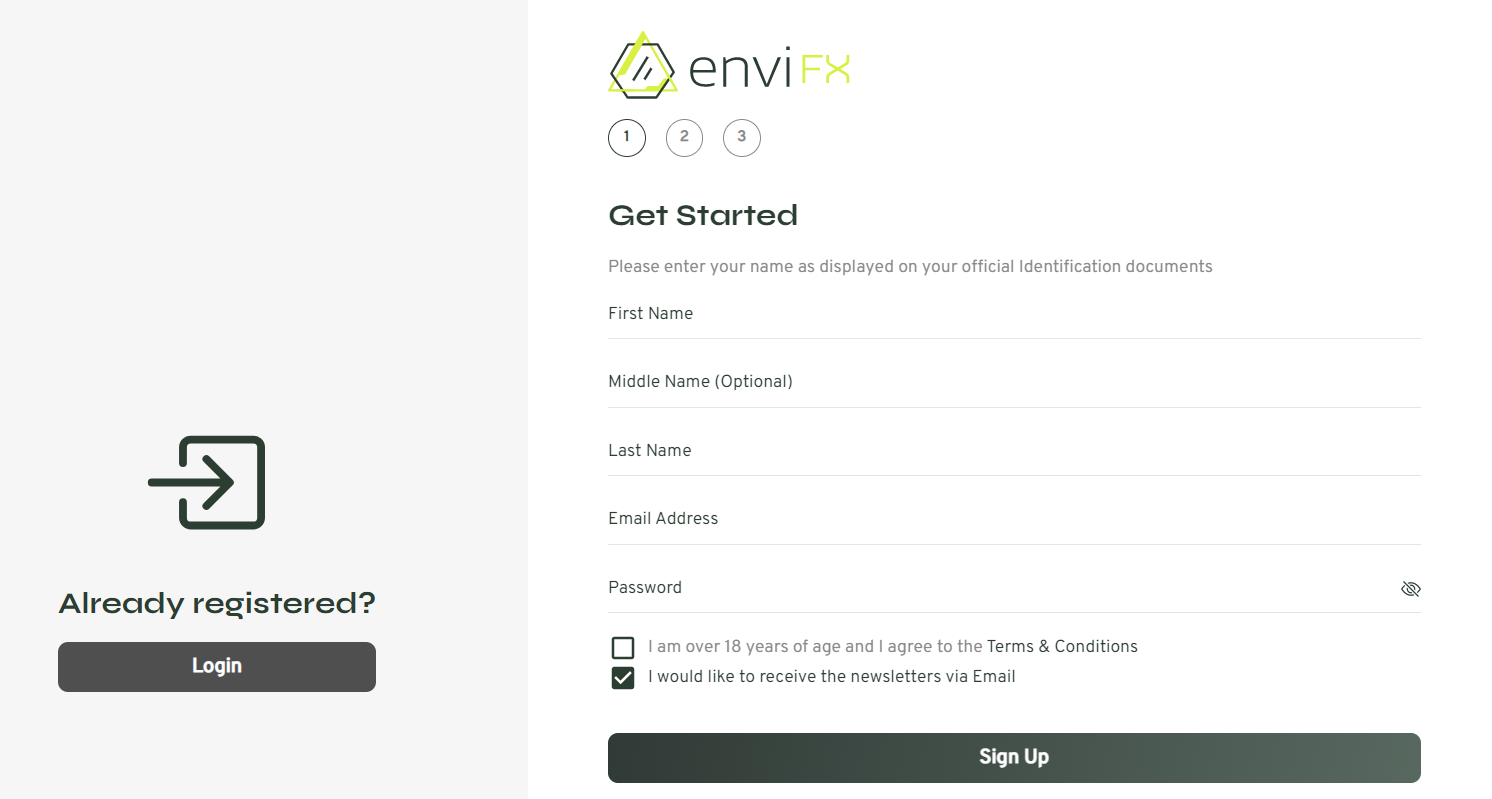

Enter your first name, patronymic or middle name as you wish. Enter your email address and create a password. Confirm that you are 18 years old by checking the appropriate box. The second checkbox confirms that you want to receive the broker's newsletter, which is optional. Click "Sign Up”.

Open your email inbox. You will find an email from the broker with a link to confirm your registration. Click on the link to proceed to the next step.

Provide your phone number and registration address with the postal code. Select the account currency – USD, EUR, GBP, CAD, AUD, or BTC. Click the "Sign Up" button.

Click the "Start" button. Then enter your login (email) and password. Now click "Login". You will be taken to the user account, but you cannot open an account without verification.

On your first login to the user account, you will see a message about the need for verification. Click the "Verify My Identity" button. Follow the on-screen instructions and select the country of your residence, then upload a photo/scan of the required document (choose from the list). Wait for the managers to verify your details. After that, you will have full access to the user account.

Click on the icon in the upper right corner and select "Accounts". Then click "New Account:”. Choose the account type and follow the on-screen instructions.

Click the icon in the upper right corner again, but this time select "Funding". Now click the "Deposit" button. Choose the payment method that suits you, enter the amount, and pay the bill, following the on-screen instructions. Once the funds have arrived on your balance, you can start trading through your chosen trading platform.

Your EnviFx user account also provides access to:

Dashboard. A block with summary data on accounts, trades, and transactions.

Funding. Here you can deposit to your account.

Withdrawals. Menu for withdrawing profits from the balance of the selected account.

Transfer Money. Separate functionality for internal transfers.

Accounts. Here, you can open and close an account, and view details.

Identity Verification. Menu for completing trader verification.

Affiliates. This block is dedicated to the broker's referral program.

Documents. All documents about the broker's work are displayed here.

Notifications. A block with notifications and messages.

Settings. Here you can change the profile settings.

Sign Out. Clicking this button ends the current session.

Regulation and safety

For a trader, two things are important. The broker must be registered as a financial company and have a license from a regulator (local or international). Registration indicates the official nature of its work, and regulation indicates its transparency and accountability to supervisory organizations. EnviFx is registered in Kingstown (Saint Vincent and the Grenadines) and operates under the auspices of the local FSA (Financial Services Authority) regulator. This means that the broker regularly provides financial reporting on its activities, and in the event of a dispute, the regulator can protect the trader's interests

Where can you go for help?

- To the broker’s client support

- To the FSA regulator

There is no point in contacting

- The regional financial control authorities

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | 8$ | No |

| Pro | 4$ | No |

| Var | 12$ | No |

| Mini | 10$ | No |

| Prop | 8$ | No |

The commission policy is not the only important element that should be under consideration. The number of available assets, leverage, investment opportunities, and additional features are also critical. Only the sum of all factors will give an objective assessment. Traders Union experts compared the commission data on EnviFx with two leaders in the industry. The information is presented in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$8.4 | |

|

$1 | |

|

$8.5 |

Account types

The first and most crucial step is to choose the right account. The broker offers four main account types for private traders (individuals). They do not differ in available asset groups and leverage, and all of them have STP execution with second-level pricing. The difference lies in the number of financial instruments, spreads, and trading commissions. For example, the Mini account is designed for beginners, offering only 29 assets, but the commission is $4 per lot, and the spreads are on average 1 pips. The highest spread is on the Var account, but there is no commission. Thus, the trader needs to carefully study the conditions for each of the proposed accounts. If there is not enough capital, it makes more sense to open a prop account, where the broker will provide its own funds for active trading (the trader first needs to prove his competence by successfully passing a challenge).

Account types:

It is optimal to start by opening a demo account to learn about the platform's capabilities and working conditions. Additionally, on the demo account, you can safely test various trading strategies. Then, considering the information obtained, open a real account and trade under comfortable conditions for yourself.

Deposit and Withdrawal

-

When a trader opens a demo account, he trades with virtual currency, so his balance is not replenished.

-

When a trader starts trading on a real account, if their trades are successful, they receive financial profit.

-

Profits accumulate on the balance and can be withdrawn at any time through a special feature in the user account.

-

Funds can be withdrawn in the account currency to a Visa or MasterCard debit or credit card.

-

The trader can also withdraw funds to cryptocurrency wallets (BTC, ETH, XRP, LTC, and USDT).

-

The minimum amount for most channels is $50, and there is no maximum limit for withdrawal.

-

The request is processed in a minimum amount of time, and its status is displayed in the trader's user account.

Investment Options

Many brokers offer their clients various investment solutions. Although most traders come to such platforms to trade independently, the opportunity for additional earnings is always a significant advantage. Sometimes innovative solutions like cryptocurrency staking are discussed, but more often it's MAM and PAMM accounts. EnviFx is rightly recognized as a versatile platform because the broker offers two options for passive income. Although the second option − a referral program − is only relatively passive. To obtain a significant profit through referrals, it is necessary to demonstrate high activity on the internet, preferably with a popular blog and an extensive network of contacts.

EnviFx provides PAMM and MAM accounts for passive income:

This account type combines the funds of the manager and the investors. The manager conducts trades using the shared capital, while each investor decides how much they are willing to allocate. If the trade is successful, the profits are distributed according to the investments, and the manager collects a small percentage from each investor. If the trade is unsuccessful, everyone (including the manager) loses their trade. The advantage for the investor is that they entrust a portion of their capital to an experienced player and earn passively at 100%. The advantage for the manager is that he trades according to his own rules and at his own pace, but his earnings are higher due to the amount they take from the investors.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program for additional income:

All affiliate programs work on the same principle: a trader receives a referral link and places it on the internet. Each user who clicks on the link and registers becomes the owner's referee. The referee brings the owner a cash bonus. In the case of EnviFx, it's even more interesting because the program includes five levels. That means, when a trader's referee invites someone to the platform, the new user also becomes their referee but brings in less profit. This way, a colossal network of referees can be formed, earning bonuses for each of them. Bonuses are accumulated in a separate account and transferred to the main balance once a week if the total amount exceeds $10. If the amount is less, it remains in a separate account until the next week. The broker offers ready-made advertising materials so that traders can promote the platform more effectively.

Customer support

Technical support is necessary for a company to assist customers in resolving issues they cannot handle on their own. The quality of the FAQs section is not particularly important in this case, as traders often encounter problems that require qualified support due to carelessness or other reasons. If platform managers respond slowly or incompetently, traders may become disappointed in the broker and go to a competitor. Most industry leaders understand this very well. EnviFx offers 24/7 customer support that operates seven days a week, responding via the main communication channels such as email and LiveChat. There are also tickets on the website (the answer still comes by email) and a callback option.

Advantages

- Support specialist work even at night

- Traders can ask for help at weekends

- There is an option to request a callback

Disadvantages

- The broker does not have a call center

- Only registered users can write to LiveChat.

Thus, if you have registered on the EnviFx website and have questions, you can always contact customer support through the following methods:

-

Email.

-

Live chat.

-

Website tickets.

It makes sense for traders who work with EnviFx to subscribe to the broker's official pages on Facebook, Instagram, and Twitter to stay up-to-date on its news.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | Beachmont Business Centre, Suite 141, Kingstown, Saint Vincent and Grenadines |

| Official site | https://envifx.com/ |

| Contacts |

Education

Traders become successful only when they develop comprehensively. Yes, they need to trade constantly, but they also need external sources of experience and information. For example, educational courses, and webinars with experts. Some brokers understand this need of their clients and provide training in various formats − from structured articles in a blog to regular streams. However, many take a different approach. For example, EnviFx has a blog only, and it has not been updated for two years.

As you can see, EnviFx assumes that traders independently explore trading theory, study the market, and practice. There is no external information on the broker's website, only answers to questions about the platform itself. This cannot be considered a conceptual disadvantage as brokers are not obligated to educate traders.

Comparison of EnviFx with other Brokers

| EnviFx | RoboForex | Pocket Option | Exness | Octa | FxPro | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $1 | $10 | $5 | $10 | $25 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 25% / 20% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | Yes | No | No | No | No |

Detailed review of EnviFx

The EnviFx broker has been successfully operating for 3 years. Despite its relative youth, it has established a strong presence in the international market and has already gathered a powerful base of tens of thousands of active traders. The platform comprises technological solutions, uses the STP protocol, and offers access to hundreds of markets with trade execution within 30-50 ms. Standard accounts for individuals, proprietary accounts, and joint accounts such as MAM and PAMM are available. The trading conditions are universal, with the possibility of personalizing the offering. The broker has never been hacked, and it uses SSL certificates, AML-type registration, two-factor authentication, and other methods to protect users’ funds and data. Traders' funds are stored separately from the company's funds. Therefore, thanks to its high-quality technological stack and variety of features, this broker makes an attractive offer for both novice and experienced players.

EnviFx by the numbers:

-

Minimum deposit is $0.

-

An average spread is 0.8 pips (on a Standard account).

-

Trading commission is between $0 to $9.

-

5 groups of financial instruments.

-

$200,000 is a possible balance on a prop account.

EnviFx is a convenient broker for trading on multiple markets

Some platforms focus on one group of assets, such as currency pairs, while others offer several groups. EnviFx is exactly that kind of company, providing access to currencies, stocks, indices, metals, and energies. The pool of trading instruments is regularly updated and expanded. The advantage of a wide selection is that the trader does not need to limit themselves in terms of strategy. Also, through different asset types, they can successfully diversify risks, creating a portfolio in which the drawdown of one instrument will be compensated by stable and progressive positions in others. EnviFx is convenient because it allows you to trade multiple instruments in one trading platform, offers high leverage (up to 1:500), and average market spreads. If a trader does not have capital, the broker will provide its own with a profit distribution of 80/20 or 90/10.

EnviFx’s analytical services:

-

Compound Interest Calculator. This service allows you to calculate the total balance amount for each period based on the increase in deposit percentage.

-

Market Trading Hours. This service provides up-to-date information on how a particular market is performing (e.g., reflects early closure).

-

Competitions. Service includes three contests with real cash prizes Standard Trading Contest, Affiliate Trading Competition, and Battle of the Bots.

Advantages:

An easy start is due to the absence of a minimum deposit, intuitive website interface, the ability to choose MT4/5 trading platforms, and transparent conditions.

The trader can choose the most personalized offer for themselves ̶ five accounts are available for individuals (including a funded account), a demo account, and PAMM accounts.

Spreads and trading commissions are known in advance. The broker updates the information in real time and provides it on the main page of the website, and in the user account.

Traders can deposit funds with a bank credit or debit card, and it is also possible to fund trades with cryptocurrency wallets. Withdrawals are made through the same channels.

The broker allows passive earnings through joint accounts and a five-level referral program.

User Satisfaction